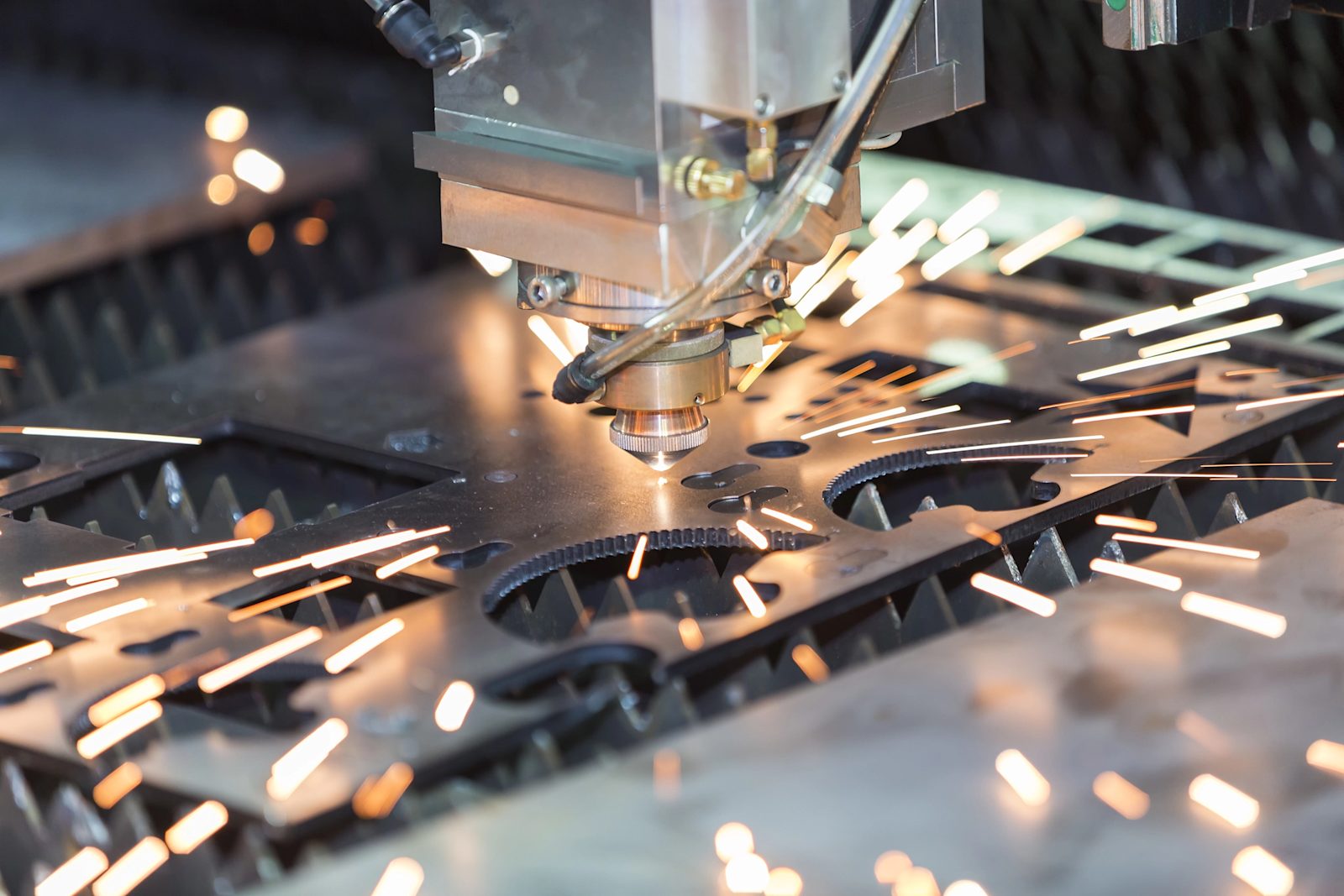

The global machine parts manufacturing industry is experiencing robust expansion, driven by rising demand across key sectors such as automotive, industrial machinery, aerospace, and automation. According to a 2023 report by Grand View Research, the global industrial machinery market size was valued at USD 664.8 billion and is expected to grow at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. This growth is fueled by increasing automation adoption, advancements in precision engineering, and the global push toward smart manufacturing. Similarly, Mordor Intelligence projects steady growth in the machine components segment, citing rapid industrialization in emerging economies and heightened investments in predictive maintenance and Industry 4.0 technologies. As the demand for high-performance, durable, and technologically advanced machine parts intensifies, a select group of manufacturers has emerged as leaders in innovation, quality, and global reach. The following list highlights the top 10 machine parts manufacturers shaping the future of industrial production.

Top 10 Machines Parts Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 MAG Automotive OEM Parts Store

Domain Est. 2005

Website: service.mag-ias.com

Key Highlights: Welcome to the official store for genuine MAG Automotive OEM Parts. This site is where you can get new OEM parts, OEM Rebuild Services, Paid Service and ……

#2 Precision Manufacturing Machine Parts

Domain Est. 1997 | Founded: 1927

Website: famcomachine.com

Key Highlights: Empowering industries with precision machine parts since 1927. Famco: leading manufacturer of mechanical shears, squaring shears, presses, cutters, ……

#3 #1 Machining Parts Manufacturers in the US

Domain Est. 1998

Website: jrmachine.com

Key Highlights: We’re the machining parts manufacturers that deliver extraordinary value by streamlining contract machining through automation and process control….

#4 Parts

Domain Est. 2004

Website: pacmachinery.com

Key Highlights: Machine Parts. As a large manufacturer with hundreds of machines and machine options, our packaging equipment is made with thousand’s of parts!…

#5 OEM spare parts for high precision machines

Domain Est. 2007

Website: fivesgroup.com

Key Highlights: Our dedicated inventory contains over one million spare parts for Fives high precision machines. With such a wide range of spare parts immediately available,…

#6 PartsForMachines

Domain Est. 2019

Website: partsformachines.com

Key Highlights: Partsformachines is the largest online spare parts store in UK for all construction, agriculture, and industrial machinery. Get hassle-free delivery at the ……

#7 Metal Fabrication Machinery

Domain Est. 1998

Website: mcmachinery.com

Key Highlights: MC Machinery Systems, a supplier of metal fabrication machines, provides EDM, milling, laser, press brake, finishing, and automation solutions….

#8 All World Machinery

Domain Est. 2002

Website: allworldmachinery.com

Key Highlights: All World is your one-stop shop solutions provider for aftermarket machine tool spare parts, services, repairs, and custom-engineered applications….

#9 SEM Parts

Domain Est. 2008

Website: semmachinery.com

Key Highlights: More than 200 kinds of parts in eight categories, including not only high-grade and super wear-resis-tant blades, but also differentiated products….

#10 Machinery

Domain Est. 2017

Website: machinery-parts.com

Key Highlights: Your reliable partner in spare parts, attachments and ground engaging tools. Logistic services & worldwide shipping. +90 years sector experience….

Expert Sourcing Insights for Machines Parts

2026 Market Trends for Machine Parts: Key Developments Shaping the Industry

The global machine parts market is poised for significant transformation by 2026, driven by technological innovation, sustainability mandates, and evolving industrial demands. Here are the critical trends set to define the landscape:

Advancements in Smart and Connected Components

By 2026, the integration of sensors, IoT connectivity, and embedded intelligence into machine parts will become standard across industrial sectors. Smart bearings, predictive maintenance-enabled gears, and condition-monitoring actuators will allow real-time performance tracking and preemptive failure detection. This shift toward Industry 4.0 will boost demand for parts that support data-driven operations, enhancing equipment uptime and reducing unplanned maintenance costs.

Accelerated Adoption of Additive Manufacturing

Additive manufacturing (3D printing) will revolutionize machine part production by enabling rapid prototyping, complex geometries, and on-demand spare part creation. By 2026, more manufacturers will leverage metal 3D printing to produce high-performance components—especially for aerospace, automotive, and medical equipment—reducing material waste and lead times. Distributed manufacturing models will gain traction, minimizing global supply chain dependencies.

Increased Focus on Sustainability and Circular Economy

Environmental regulations and corporate ESG goals will push machine part manufacturers toward sustainable materials and processes. Recycled metals, biodegradable lubricants, and energy-efficient designs will see rising demand. Additionally, remanufacturing and refurbishment of machine components will grow as companies seek cost-effective, eco-friendly alternatives. By 2026, lifecycle analysis and carbon footprint transparency will become key purchasing criteria.

Rising Demand for Customization and Modular Design

As industrial applications diversify, the need for customized and modular machine parts will intensify. Modular components that can be easily reconfigured or upgraded will support flexible manufacturing systems, particularly in automation and robotics. OEMs will increasingly offer configurable part solutions, allowing end-users to adapt machinery for specific tasks without full replacements.

Supply Chain Resilience and Regionalization

Geopolitical uncertainties and past disruptions have prompted a strategic shift toward localized production and nearshoring. By 2026, machine part manufacturers will invest in regional supply chains to improve delivery times and mitigate risks. Digital twins and AI-driven logistics will enhance inventory management and demand forecasting, ensuring just-in-time availability without overstocking.

Growth in High-Performance and Lightweight Materials

The demand for machine parts made from advanced materials—such as high-strength alloys, composites, and ceramics—will grow, driven by sectors like electric vehicles, renewable energy, and aerospace. These materials offer improved durability, reduced weight, and better thermal resistance, contributing to overall system efficiency. R&D in material science will continue to unlock new applications and performance benchmarks.

Integration of AI and Predictive Analytics

Artificial intelligence will play a crucial role in optimizing machine part performance and lifecycle management. AI-powered design tools will accelerate product development, while predictive analytics will enhance quality control and failure prediction. By 2026, machine learning models will be embedded in supply and service platforms, enabling smarter inventory decisions and targeted maintenance.

In summary, the 2026 machine parts market will be defined by digital integration, sustainability, customization, and resilience. Companies that embrace these trends will gain competitive advantage through innovation, efficiency, and responsiveness to global industrial shifts.

Common Pitfalls Sourcing Machine Parts (Quality, IP)

Sourcing machine parts, especially from global suppliers, involves significant risks related to both quality consistency and intellectual property (IP) protection. Failing to address these pitfalls can lead to production delays, safety hazards, legal disputes, and reputational damage. Below are key challenges to watch for:

Quality Inconsistencies

One of the most frequent issues when sourcing machine parts is inconsistent quality. Parts may meet specifications in initial samples but degrade in later production batches due to cost-cutting, lack of process control, or inadequate quality assurance at the supplier’s facility. This can result in machine downtime, increased maintenance costs, and compromised product performance.

Lack of Traceability and Certification

Many suppliers, particularly in low-cost regions, may not provide proper documentation such as material certifications, heat treatment reports, or inspection records. Without traceability, verifying compliance with industry standards (e.g., ISO, ASTM) becomes difficult, increasing the risk of using substandard or non-compliant components.

Counterfeit or Substandard Materials

Some suppliers substitute specified materials (e.g., using lower-grade steel or aluminum) to reduce costs. These counterfeit or off-spec materials may not withstand operational stresses, leading to premature part failure. This is especially problematic in high-load or safety-critical applications.

Inadequate Tolerances and Dimensional Accuracy

Machine parts often require tight tolerances to ensure proper fit and function. Poor manufacturing capabilities or lack of precision equipment can result in parts that deviate from engineering drawings. Even minor dimensional inaccuracies can cause assembly issues or affect machine performance.

Intellectual Property Theft

Sharing technical drawings, CAD files, or proprietary designs with external suppliers exposes companies to IP theft. Unscrupulous manufacturers may duplicate designs and sell them to competitors or produce counterfeit parts independently. This is particularly prevalent in regions with weak IP enforcement.

Unauthorized Production and Diversion

Suppliers may overproduce parts beyond the agreed order volume and sell the excess on the gray market. This not only undermines pricing and market exclusivity but also introduces uncontrolled, potentially defective parts into the supply chain.

Weak Contractual Protections

Many procurement agreements lack robust clauses covering IP ownership, confidentiality, audit rights, and liability for IP infringement. Without clear contracts, companies have limited recourse if a supplier breaches IP terms or supplies non-conforming parts.

Insufficient Supplier Vetting and Audits

Relying solely on quotes and samples without conducting on-site audits or due diligence increases the risk of partnering with unreliable or non-compliant suppliers. A lack of transparency in a supplier’s manufacturing processes can hide quality and IP risks.

Language and Communication Barriers

Miscommunication due to language differences or cultural gaps can lead to misunderstandings about specifications, quality expectations, or IP restrictions. This increases the likelihood of errors and non-compliance.

Long-Term Supply Chain Vulnerability

Dependence on a single supplier for critical parts—especially in regions with unstable IP protections—creates long-term vulnerability. If the supplier becomes untrustworthy or starts producing competing products, transitioning to a new source can be costly and time-consuming.

By proactively addressing these pitfalls through rigorous supplier qualification, strong contracts, regular audits, and secure IP practices, companies can mitigate risks and ensure reliable, high-quality machine part sourcing.

Logistics & Compliance Guide for Machine Parts

Overview

This guide outlines key logistics and compliance considerations when shipping machine parts globally or domestically. Proper planning ensures timely delivery, regulatory adherence, and cost efficiency.

Classification and Documentation

Accurately classify machine parts using the Harmonized System (HS) Code to determine tariffs, import restrictions, and documentation requirements. Maintain detailed commercial invoices, packing lists, and certificates of origin. Include part numbers, descriptions, weights, and values for customs clearance.

Packaging and Handling

Use durable, industry-standard packaging to protect machine parts from shock, moisture, and corrosion. Label packages with handling instructions (e.g., “Fragile,” “This Side Up”) and include barcodes or RFID tags for tracking. Secure loose components and use anti-static materials when necessary.

Transportation Modes

Choose the appropriate transport mode—air, sea, rail, or road—based on part size, urgency, and destination. Air freight is ideal for high-value or time-sensitive parts; sea freight suits bulk or heavy components. Coordinate multimodal logistics when needed.

Import/Export Regulations

Comply with export control laws such as ITAR (International Traffic in Arms Regulations) or EAR (Export Administration Regulations) if parts have dual-use or strategic applications. Obtain necessary licenses or authorizations before shipment. Verify import restrictions, quotas, or certification requirements (e.g., CE, UL, RoHS) in the destination country.

Customs Clearance

Partner with licensed customs brokers to ensure smooth clearance. Provide accurate Harmonized Tariff Schedule (HTS) codes, complete documentation, and any required permits. Pre-clear shipments when possible to reduce delays at borders.

Insurance and Risk Management

Insure machine parts against loss, damage, or theft during transit. Assess risks based on route, value, and mode of transport. Include contingency plans for delays or regulatory hold-ups.

Environmental and Safety Compliance

Adhere to environmental regulations for hazardous materials (e.g., lubricants, batteries). Comply with REACH, WEEE, and other directives governing chemical use and end-of-life disposal. Train staff on safe handling and emergency procedures.

Recordkeeping and Audits

Maintain shipment records, compliance certifications, and transaction logs for at least five years. Conduct regular internal audits to verify adherence to logistics protocols and regulatory standards.

Conclusion

Effective logistics and compliance management for machine parts minimizes delays, avoids penalties, and supports reliable supply chain operations. Stay updated on regulatory changes and work closely with freight forwarders and compliance experts.

Conclusion:

In conclusion, sourcing machine parts effectively requires a strategic approach that balances quality, cost, reliability, and lead times. By carefully evaluating suppliers, considering both local and global options, and leveraging tools such as supplier audits, performance metrics, and procurement software, organizations can ensure a consistent supply of high-quality components. Establishing strong supplier relationships, maintaining clear communication, and staying informed about market trends further enhance supply chain resilience. Ultimately, a well-structured sourcing strategy not only supports efficient machine operation and maintenance but also contributes to overall productivity, cost savings, and long-term operational success.