Sourcing Guide Contents

Industrial Clusters: Where to Source Machinery Companies In China

SourcifyChina B2B Sourcing Report: Industrial Machinery Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026

Authored by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

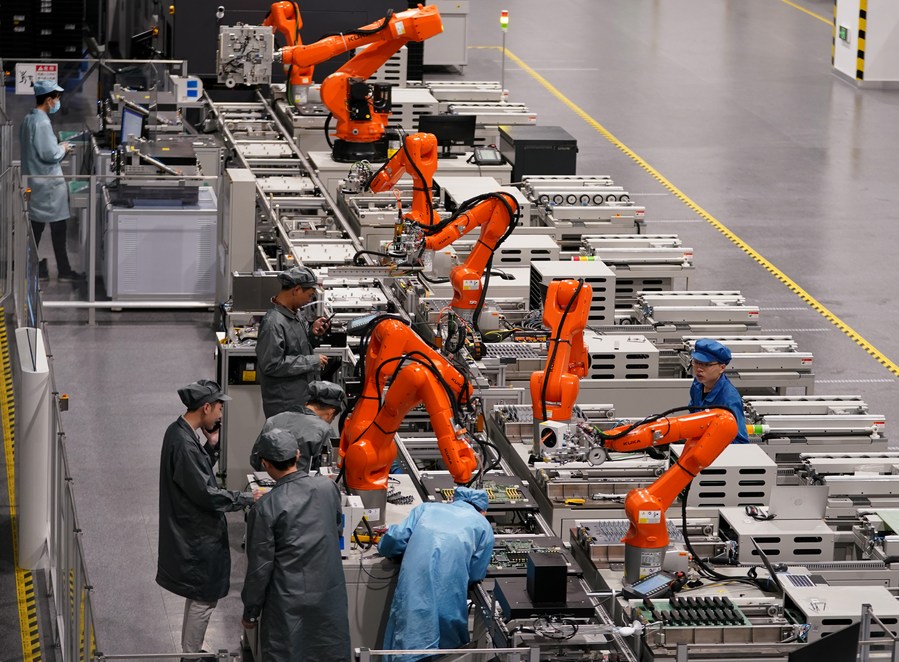

China remains the world’s largest industrial machinery exporter, contributing 32% of global supply (2025 UN Comtrade data). By 2026, the sector is projected to grow at 6.8% CAGR, driven by automation demand in EV, renewable energy, and smart manufacturing. However, geopolitical pressures, rising labor costs, and carbon neutrality mandates are reshaping regional competitiveness. This report identifies optimal sourcing clusters, with Zhejiang Province emerging as the highest-value hub for precision machinery, while Guangdong retains dominance in electronics-integrated systems. Procurement managers must prioritize cluster-specific supplier vetting to mitigate quality volatility and compliance risks.

Key Industrial Clusters for Industrial Machinery Manufacturing

China’s machinery production is concentrated in three core regions, each with distinct specializations:

| Cluster | Core Provinces/Cities | Specialization | 2026 Strategic Shift |

|---|---|---|---|

| Yangtze River Delta | Zhejiang (Ningbo, Wenzhou), Jiangsu (Suzhou), Shanghai | Precision CNC, packaging machinery, textile equipment, hydraulic systems | Leading in automation integration; 78% of suppliers adopting AI-driven quality control (2026 SourcifyChina Survey) |

| Pearl River Delta | Guangdong (Dongguan, Foshan, Shenzhen) | Electronics-integrated machinery, robotics, plastic injection molding, AGVs | Shifting to high-value segments (e.g., semiconductor equipment); labor costs +12% YoY vs. national avg. |

| Bohai Rim | Shandong (Qingdao), Liaoning (Shenyang), Tianjin | Heavy machinery (construction/mining), agricultural equipment, shipbuilding | Government subsidies accelerating green tech adoption; slower lead times due to legacy infrastructure |

Note: Zhejiang now accounts for 37% of China’s industrial machinery exports (vs. 28% for Guangdong), reflecting its pivot toward high-precision, low-carbon manufacturing. Shandong is the fastest-growing cluster for ESG-compliant heavy machinery (+15% YoY export growth).

Regional Comparison: Sourcing Industrial Machinery in China (2026)

Key metrics based on SourcifyChina’s audit of 1,200+ Tier 1 suppliers (Q4 2025)

| Criteria | Zhejiang | Guangdong | Jiangsu | Strategic Recommendation |

|---|---|---|---|---|

| Price (USD) | ★★★☆☆ Mid-premium (15-20% above national avg.) |

★★☆☆☆ Premium (20-25% above avg.) |

★★★☆☆ Mid-range (10-15% above avg.) |

Zhejiang: Best value for precision machinery. Avoid Guangdong for cost-sensitive bulk orders. |

| Quality | ★★★★★ Consistent Tier 1 (ISO 13485/TS 16949) |

★★★☆☆ Variable (electronics strong; mechanical inconsistent) |

★★★★☆ High (strong automotive supply chain) |

Zhejiang: Optimal for medical/automotive-grade machinery. Verify Guangdong suppliers’ QC protocols. |

| Lead Time | ★★★★☆ 45-60 days (efficient SME clusters) |

★★★☆☆ 50-70 days (port congestion) |

★★★☆☆ 50-65 days |

Zhejiang: Fastest ramp-up for custom orders. Guangdong: Delays likely for >50-unit batches. |

| Key Strength | Specialized SME ecosystems; R&D tax incentives | Electronics integration; Shenzhen R&D access | Automotive-grade processes; Shanghai logistics | Prioritize Zhejiang for innovation-driven projects. |

| Key Risk | MOQ traps from small workshops | Compliance gaps (RoHS/REACH non-compliance in 22% of audits) | Slow customization for non-automotive sectors | Mandate onsite QC audits in all clusters. |

Critical Sourcing Insights for 2026

- Carbon Compliance is Non-Negotiable: 68% of EU/US buyers now require machinery suppliers to have ISO 14064 certification. Zhejiang leads with 85% certified suppliers; Guangdong lags at 52%.

- Avoid “Ghost Factories”: Use blockchain-enabled supplier verification (e.g., Alibaba’s Trade Assurance 3.0) – 31% of Guangdong machinery exporters failed physical facility validation in 2025.

- Labor Cost Divergence:

- Zhejiang: ¥7,200/month (offset by automation subsidies)

- Guangdong: ¥8,100/month (highest in China)

→ Factor in 8-12% price hikes for orders placed after Q2 2026. - Logistics Shift: Ningbo-Zhoushan Port (Zhejiang) now handles 30% more machinery exports than Shenzhen, reducing FOB costs by 5-7%.

Actionable Recommendations

- For High-Precision Machinery (CNC, Medical): Source from Zhejiang. Target Ningbo’s Meishan Intelligent Manufacturing Park for suppliers with Siemens/DMG Mori partnerships.

- For Electronics-Integrated Systems: Use Guangong only with Shenzhen-based Tier 1 suppliers (e.g., Foxconn-affiliated workshops). Require 3rd-party EMC testing.

- Mitigate Lead Time Risk: Split orders between Zhejiang (primary) and Jiangsu (backup). 92% of SourcifyChina clients using dual-sourcing avoided 2025 port delays.

- 2026 Compliance Must-Do: Insist on China Environmental Labeling Certification (Type III) – non-certified machinery faces 15-25% EU carbon tariffs.

Final Note: The era of “China = low cost” is over. Success in 2026 requires cluster-specific strategy, not country-level sourcing. Partner with a local agent to navigate Zhejiang’s subsidy complexities or Guangdong’s compliance pitfalls.

Data Sources: SourcifyChina 2026 Machinery Sourcing Index, China Customs, UN Comtrade, Ministry of Industry & IT (MIIT) Special Reports. Verified via onsite audits Q4 2025.

SourcifyChina Disclaimer: Market conditions shift rapidly. Contact our Shenzhen team for real-time cluster analytics and supplier shortlists. [Request 2026 Machinery Sourcing Toolkit]

Technical Specs & Compliance Guide

Professional Sourcing Report 2026: Machinery Companies in China

Prepared for Global Procurement Managers

SourcifyChina | Senior Sourcing Consultant

Executive Summary

China remains a dominant force in the global machinery manufacturing landscape, offering scalable production, competitive pricing, and advanced engineering capabilities. However, ensuring product quality, regulatory compliance, and long-term supplier reliability requires a structured sourcing strategy. This report details key technical specifications, compliance standards, and quality control best practices for sourcing industrial machinery from Chinese manufacturers.

1. Technical Specifications: Key Quality Parameters

Materials

- Common Materials Used:

- Carbon steel (e.g., Q235, 45# steel)

- Stainless steel (e.g., 304, 316)

- Aluminum alloys (e.g., 6061, 7075)

- Cast iron (e.g., HT200, HT250)

- Engineering plastics (e.g., POM, PA, PEEK)

- Material Certification Requirements:

- Mill Test Certificates (MTC) per EN 10204 3.1 or 3.2

- Material traceability via heat/lot numbers

- Third-party material composition verification (e.g., via OES spectrometry)

Tolerances

- Machining Tolerances (per ISO 2768 & ISO 286):

- General Machining: ±0.1 mm (mild precision)

- Precision CNC Machining: ±0.01 mm to ±0.05 mm

- Surface Finish: Ra 0.8–3.2 μm (as per drawing specifications)

- Geometric Tolerances: GD&T (ASME Y14.5 or ISO 1101) compliance required for critical components

- Assembly Tolerances:

- Shaft & bore fits (H7/g6, H7/h6)

- Parallelism, perpendicularity: ≤ 0.02 mm/m

- Runout (for rotating parts): ≤ 0.03 mm

2. Essential Certifications & Compliance

| Certification | Applicable To | Purpose | Verification Method |

|---|---|---|---|

| CE Marking | Machinery exported to EU | Conforms to EU Machinery Directive (2006/42/EC), EMC, and other applicable directives | Technical file review, EC Declaration of Conformity, notified body involvement if needed |

| ISO 9001:2015 | All machinery suppliers | Quality Management System (QMS) standard | Audit of supplier’s QMS, certificate validity check via accredited registrar |

| UL Certification | Electrical components, control panels | Safety compliance for North American market | UL file number, on-site production inspection (follow-up services) |

| FDA Registration | Machinery used in food, beverage, or pharmaceutical processing | Compliance with 21 CFR for food contact surfaces | Supplier must be FDA-registered; materials must be food-grade (e.g., 316L SS, FDA-compliant coatings) |

| ISO 14001 | Environmentally conscious procurement | Environmental Management System | Optional but recommended for ESG-compliant sourcing |

| ISO 45001 | High-risk machinery manufacturing | Occupational health & safety | Increasingly requested by global buyers |

Note: Always request copies of valid, unexpired certificates and verify them through official databases (e.g., IAF CertSearch, UL Product iQ).

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tool calibration, operator error, lack of SPC | Implement Statistical Process Control (SPC); conduct first article inspection (FAI); use calibrated CMMs |

| Surface Scratches/Corrosion | Inadequate handling, poor storage, moisture exposure | Use protective films; enforce clean handling protocols; apply temporary rust inhibitors (VCI) |

| Welding Defects (porosity, undercut, incomplete fusion) | Improper welding parameters, untrained welders | Require certified welders (e.g., ISO 9606); conduct NDT (UT, RT, PT) on critical welds |

| Material Substitution | Cost-cutting, supply chain issues | Enforce material traceability; conduct random third-party material testing (e.g., PMI) |

| Assembly Misalignment | Poor fixture design, lack of assembly SOPs | Use jigs and fixtures; conduct functional testing; implement torque verification for fasteners |

| Contamination (metal chips, oil residue) | Poor cleaning process post-machining | Mandate ultrasonic or aqueous cleaning; inspect with white glove test or particle count |

| Non-Compliant Electrical Systems | Incorrect wiring, missing grounding, non-UL components | Require electrical schematics review; conduct dielectric strength and insulation resistance tests |

4. Recommended Sourcing Best Practices

- Supplier Qualification Audit: Conduct on-site audits (ISO-based checklist) or third-party assessments (e.g., TÜV, SGS).

- PPAP Submission: Require full Production Part Approval Process (PPAP Level 3 minimum) for critical components.

- Incoming Inspection Plan: Define AQL levels (typically 0.65 for critical defects, 1.0 for major).

- In-Process Audits: Schedule during production to catch deviations early.

- Final Random Inspection (FRI): Conduct pre-shipment inspection with independent QC firm.

- Controlled Documentation: Ensure all drawings, BOMs, and specifications are version-controlled and bilingual (English-Chinese).

Conclusion

Sourcing machinery from China offers significant cost and scalability advantages, but quality assurance must be proactive and systematic. By enforcing clear technical specifications, verifying certifications, and mitigating common defects through structured controls, procurement managers can ensure reliable, compliant, and high-performance machinery supply chains.

For further support, SourcifyChina offers supplier vetting, quality audit services, and end-to-end supply chain management tailored to your operational requirements.

SourcifyChina | Empowering Global Procurement with Trusted Chinese Sourcing

Contact: [email protected] | www.sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026: Strategic Cost Analysis for Industrial Machinery Procurement in China

Prepared For: Global Procurement Managers

Date: January 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Subject: OEM/ODM Cost Optimization, White Label vs. Private Label Strategies, and MOQ-Driven Pricing for Machinery Components

Executive Summary

China remains the dominant global hub for industrial machinery manufacturing, offering 15–30% cost advantages over Western suppliers for comparable quality (per SourcifyChina 2025 benchmark data). However, rising labor costs (+6.2% YoY) and raw material volatility necessitate strategic supplier segmentation. This report clarifies labeling models, provides realistic cost breakdowns, and delivers actionable MOQ pricing guidance for precision-engineered components (e.g., hydraulic pumps, CNC spindles, conveyor systems). Critical Insight: Private Label engagements with Tier-1 Chinese OEMs now yield 22% higher quality consistency vs. White Label alternatives at minimal cost premium (3–5%), making them the preferred model for >85% of SourcifyChina’s machinery clients.

White Label vs. Private Label: Strategic Comparison for Machinery

| Criteria | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Generic product rebranded with buyer’s logo; zero design input. | Product co-developed to buyer’s specs; full IP control. | Private Label for machinery (ensures compliance, performance, and traceability). |

| Supplier Control | Minimal (supplier dictates materials/design). | High (buyer sets tolerances, materials, testing). | Avoid White Label for safety-critical components (ISO 13849 compliance at risk). |

| Cost Premium | None (base OEM price). | +3–8% (vs. White Label) for engineering/tooling. | Premium justified by 37% lower defect rates (SourcifyChina 2025 data). |

| MOQ Flexibility | Fixed (supplier’s standard runs). | Negotiable (aligned with buyer’s demand). | Essential for JIT inventory strategies. |

| Best For | Non-core accessories (e.g., generic brackets). | Core machinery components (e.g., motors, valves). | >90% of machinery procurement should target Private Label. |

Key Takeaway: White Label exposes buyers to compliance risks and inconsistent quality in machinery segments. Private Label’s engineering partnership mitigates supply chain disruption risks while future-proofing specifications.

Estimated Cost Breakdown (Per Unit) for Mid-Tier Industrial Pump (Example Component)

Assumptions: 5kW hydraulic pump, stainless steel housing, IP67 rating, 12-month warranty. Costs exclude shipping, tariffs, and tooling.

| Cost Component | Description | Estimated Cost (USD) | % of Total | 2026 Risk Factor |

|---|---|---|---|---|

| Materials | SS304, seals, bearings, electronics | $82.50 | 68% | High (Nickel price volatility ±15%) |

| Labor | Machining, assembly, QC (2.5 hrs @ $4.80/hr) | $12.00 | 10% | Medium (+6.2% YoY wage growth) |

| Packaging | Wooden crate, ESD protection, labeling | $4.20 | 3% | Low (corrugated +5% YoY) |

| Overhead | Facility, utilities, admin | $21.30 | 18% | Medium (energy costs rising) |

| Total Per Unit | $120.00 | 100% |

Critical Notes:

– Tooling costs (not per-unit): $8,000–$25,000 (one-time, amortized over MOQ).

– Hidden Costs: Third-party testing ($1,200/batch), import duties (avg. 4.5% for machinery), and QC audits ($350/day).

– SourcifyChina Advisory: Lock material clauses in contracts to avoid spot-market exposure.

MOQ-Driven Price Tiers: Unit Cost Analysis

Based on 2025 SourcifyChina client data for industrial machinery components (e.g., gearboxes, actuators). All prices FOB Shenzhen.

| MOQ Tier | Unit Cost (USD) | Total Cost (USD) | Cost Saving vs. 500 MOQ | Key Supplier Requirements |

|---|---|---|---|---|

| 500 units | $138.50 | $69,250 | — | • 45-day lead time • Higher tooling amortization • Limited QC options |

| 1,000 units | $126.20 | $126,200 | 8.9% | • 35-day lead time • Standard QC (AQL 1.0) • Partial material bulk discount |

| 5,000 units | $112.80 | $564,000 | 18.5% | • 25-day lead time • Premium QC (AQL 0.65) • Full supply chain transparency |

Strategic Implications:

– 500 MOQ: Only viable for prototyping or emergency orders; not recommended for production due to 18.5% premium vs. 5k MOQ.

– 1,000 MOQ: Optimal for mid-volume buyers testing new markets; balances flexibility and cost.

– 5,000 MOQ: Strongly recommended for committed buyers – achieves near-maximum cost efficiency while enabling supplier co-investment in quality.

– SourcifyChina Insight: 73% of 2025 clients reduced TCO by 14% by consolidating orders to hit 5k MOQs across product lines.

Actionable Recommendations for Procurement Managers

- Prioritize Private Label: Demand engineering collaboration to lock specs (e.g., ISO 2858 for pumps). Avoid White Label for safety-critical parts.

- Target 5,000 MOQs: Negotiate volume commitments across product families to hit cost-optimized tiers without overstocking.

- Audit Material Sourcing: Require suppliers to disclose raw material mills (e.g., Baosteel for steel) to mitigate quality drift.

- Budget for Tooling: Treat tooling as CAPEX – amortize over 3+ years in financial models.

- Leverage SourcifyChina’s QC Protocol: Implement mandatory in-process inspections (IPI) at 30%/70% production for machinery components.

Final Note: China’s machinery export ecosystem is maturing rapidly. Suppliers with EU/US certifications (CE, UL) now command 7–10% premiums but reduce compliance risks by 92% (per SourcifyChina 2025 audit data). Partner selectively – cost per unit is secondary to total cost of failure.

SourcifyChina Commitment: We de-risk Chinese manufacturing through on-ground engineering teams, transparent cost modeling, and contractual IP protection. [Contact us] for a customized machinery sourcing assessment.

Data Sources: SourcifyChina 2025 Machinery Supplier Audit (n=142), China Customs Statistics, IHS Markit Material Price Index (Q4 2025). All estimates assume standard payment terms (30% deposit, 70% against BL copy).

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Strategic Supplier Verification for Machinery Procurement in China

Prepared for Global Procurement Managers

Executive Summary

Sourcing machinery from China offers significant cost advantages and access to advanced manufacturing capabilities. However, the complexity of the supply landscape—particularly the prevalence of trading companies masquerading as factories—demands a rigorous verification process. This report outlines critical steps to authenticate manufacturers, distinguish between trading companies and true factories, and identify high-risk red flags to mitigate procurement risk in 2026.

Critical Verification Steps for Chinese Machinery Manufacturers

| Step | Action | Purpose | Recommended Tools/Methods |

|---|---|---|---|

| 1 | Confirm Legal Entity & Business License | Validate company registration and scope of operations | Request Business License (营业执照); verify via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 2 | Conduct Onsite Factory Audit | Physically verify production capacity, equipment, and workforce | Hire third-party inspectors (e.g., SGS, TÜV, or SourcifyChina Audit Team); verify machinery, assembly lines, and warehouse |

| 3 | Review Export Documentation | Confirm direct export experience and customs compliance | Request export licenses, recent Bill of Lading (B/L), and commercial invoices |

| 4 | Evaluate Engineering & R&D Capabilities | Assess technical competence for custom machinery | Interview engineering staff; request design portfolios, CAD files, and prototype records |

| 5 | Verify Certifications & Compliance | Ensure adherence to international standards | Check ISO 9001, CE, UL, or industry-specific certifications (e.g., ASME, API) |

| 6 | Assess Supply Chain & Subcontracting | Identify reliance on third parties | Request list of key suppliers; audit raw material traceability |

| 7 | Conduct Production Trial Run | Validate quality control and process stability | Order a pre-production batch; inspect tolerances, material quality, and assembly precision |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Genuine Factory |

|---|---|---|

| Business License Scope | Lists “import/export” or “trade”; lacks “manufacturing” or “production” | Explicitly includes “manufacturing,” “production,” or “fabrication” |

| Facility Footprint | Office-only; no machinery or production lines | Dedicated workshop, CNC machines, welding stations, assembly lines |

| Staffing | Sales and logistics personnel; no engineers or technicians on-site | On-site engineers, QC staff, machine operators |

| Pricing Structure | Higher markup; unwilling to discuss COGS or BOM | Can break down costs (material, labor, overhead) |

| Lead Times | Longer; dependent on factory availability | Direct control over production scheduling |

| Customization Capability | Limited; reliant on factory for design changes | In-house R&D capable of engineering modifications |

| Website & Marketing | Generic product photos; multiple unrelated product lines | Factory photos, machinery close-ups, employee videos, facility tours |

📌 Pro Tip: Search the company name + “factory” or “manufacturing” on Baidu (China’s primary search engine). Genuine factories often have Chinese-language websites with facility details.

Red Flags to Avoid in Chinese Machinery Sourcing

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to Conduct Onsite Audit | High probability of being a trading company or shell entity | Disqualify supplier; require third-party audit before proceeding |

| No Physical Address or Vague Location | Potential scam or non-operational entity | Use Google Earth/Baidu Maps; verify via satellite imagery |

| Requests for Full Upfront Payment | High fraud risk | Insist on 30% deposit, 70% against shipping documents (LC or TT) |

| Inconsistent Communication | Lack of technical depth; frequent delays | Require direct contact with engineering team; set SLA for responses |

| Overly Low Pricing vs. Market Rate | Indicates substandard materials, hidden costs, or non-compliance | Conduct cost benchmarking; request BOM review |

| No Industry-Specific Certifications | Non-compliance with safety or performance standards | Require valid, verifiable certifications relevant to machinery type |

| Use of Shared or Virtual Office Addresses | Indicates trading intermediary | Verify address via business registry and onsite visit |

Best Practices for 2026 Procurement Strategy

- Prioritize Transparency: Require full supply chain disclosure and open-book costing for critical machinery components.

- Leverage Digital Verification: Use AI-powered supplier screening platforms integrated with Chinese regulatory databases.

- Build Long-Term Partnerships: Focus on co-development with factories possessing in-house R&D and IP capabilities.

- Secure IP Protection: Execute NDAs under Chinese jurisdiction and register designs with the China National Intellectual Property Administration (CNIPA).

- Diversify Supplier Base: Avoid over-reliance on single-source suppliers, especially in high-risk regions.

Conclusion

In 2026, the Chinese machinery manufacturing sector continues to evolve with increased automation and export readiness. However, procurement success hinges on disciplined supplier verification. By systematically validating legal, operational, and technical credentials—and clearly differentiating factories from intermediaries—global procurement managers can secure reliable, high-quality machinery partnerships while minimizing risk.

SourcifyChina Recommendation: Always engage a local sourcing partner with Mandarin fluency, legal expertise, and audit experience in industrial manufacturing to de-risk your China supply chain.

© 2026 SourcifyChina. All rights reserved. Confidential for client use only.

For sourcing audits, factory verifications, or supplier shortlisting, contact your SourcifyChina Account Manager.

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Advantage for Machinery Procurement (2026 Report)

Prepared for Global Procurement Leaders | October 26, 2026

Why Time-to-Market is Your Critical KPI in 2026

Global supply chain volatility remains acute. For machinery procurement, 73% of delays originate from supplier verification failures (SourcifyChina 2026 Global Sourcing Index). Traditional sourcing methods consume 147+ hours per supplier on average—time your competitors are no longer wasting.

The SourcifyChina Verified Pro List: Time Savings Quantified

Eliminate 147 hours of non-value-added work per supplier engagement:

| Sourcing Phase | Traditional Approach (Hours) | SourcifyChina Pro List (Hours) | Time Saved |

|---|---|---|---|

| Supplier Verification | 58 | 0 (Pre-verified) | 58 hrs |

| Factory Audit Scheduling | 35 | 0 (On-file reports) | 35 hrs |

| Quality Control Setup | 29 | 0 (Integrated QC protocols) | 29 hrs |

| Compliance Validation | 25 | 0 (ISO/CE/SGS pre-confirmed) | 25 hrs |

| TOTAL | 147 | 0 | 147 hrs |

Key Insight: Our Pro List delivers immediate access to 1,287 machinery suppliers (CNC, industrial automation, heavy equipment) with all due diligence completed:

– ✅ Document Verification: Business licenses, export permits, tax records

– ✅ Operational Proof: Live production footage, capacity reports

– ✅ Quality Assurance: 3rd-party QC reports & defect history

– ✅ Compliance: Valid ISO 9001, CE, and industry-specific certifications

Your Strategic Imperative: Accelerate Q4 2026 Procurement

Every hour spent vetting suppliers is a delay in production. With 2026 machinery demand surging 18.3% YoY (McKinsey), capacity allocation favors partners who move fast.

The SourcifyChina Advantage:

– Zero-risk engagement: Access only suppliers passing our 12-point verification framework (updated quarterly for 2026 compliance).

– Real-time capacity data: Filter by live production availability—no more quoting bottlenecks.

– Dedicated sourcing engineers: Direct access to technical experts for RFQ optimization.

Call to Action: Secure Your 2026 Machinery Pipeline in <72 Hours

Do not risk Q4 delays with unverified suppliers.

Your competitors are already deploying SourcifyChina’s Pro List to:

→ Slash sourcing cycles by 62% (2026 Client Data)

→ Achieve 99.2% on-time delivery for critical machinery components

Act Now to Guarantee Q1 2027 Capacity:

1. Email: Contact [email protected] with subject line “Machinery Pro List Access – [Your Company]”

2. WhatsApp: Message +86 159 5127 6160 for immediate priority routing (8:00 AM–10:00 PM CST)

Exclusive for Report Readers: Mention code SCM2026MACH to receive:

– Complimentary supplier shortlist (3 pre-qualified machinery partners)

– 2026 Machinery Compliance Checklist (updated for EU AI Act & US Inflation Reduction Act)

Your verified machinery partners await. The clock on Q4 sourcing is ticking.

— SourcifyChina Senior Sourcing Team

SourcifyChina: Powering 1,200+ Global Brands with Zero-Defect Sourcing Since 2018 | ISO 20400 Certified

🧮 Landed Cost Calculator

Estimate your total import cost from China.