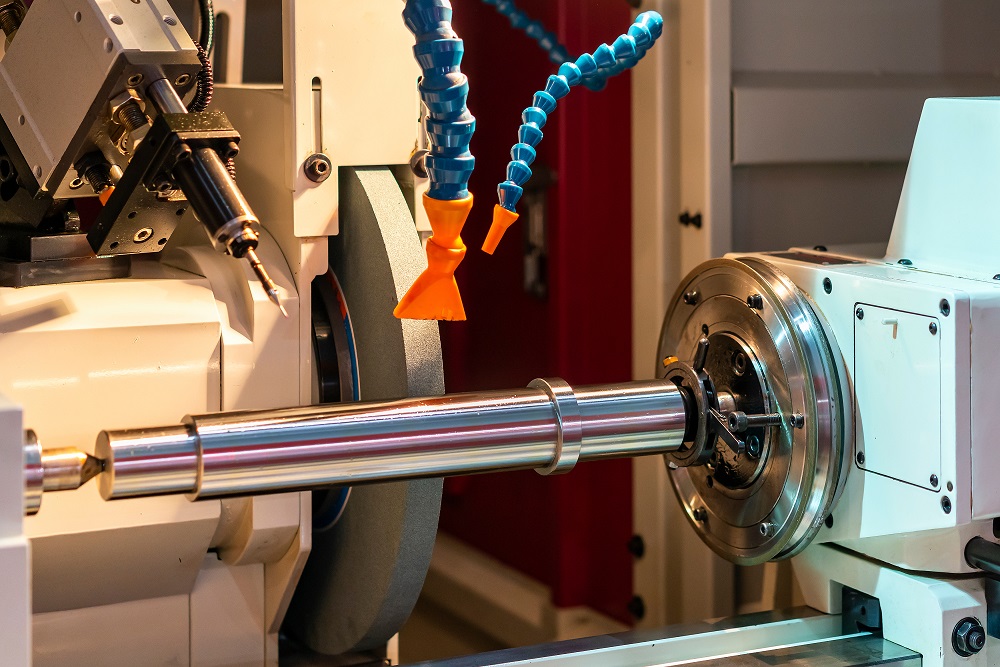

The global market for grinding machines is experiencing robust growth, driven by rising demand for precision machining across industries such as automotive, aerospace, and heavy manufacturing. According to Grand View Research, the global grinding machine market was valued at USD 6.9 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. This growth is fueled by technological advancements, including CNC integration and automation, which enhance accuracy and efficiency in production processes. As manufacturers increasingly prioritize high-tolerance surface finishing and material removal rates, the competitive landscape has intensified. Based on production capacity, innovation, global reach, and customer reviews, here are the top 10 grinding machine manufacturers shaping the industry.

Top 10 Machine For Grinding Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

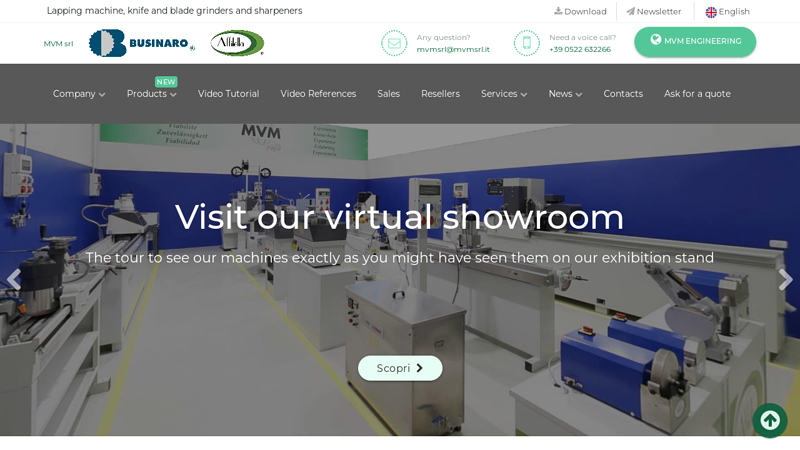

#1 MVM srl, manufacturer of Lapping machine, knife and blade grinders …

Domain Est. 2000

Website: mvmsrl.it

Key Highlights: MVM Srl is a leading manufacturer of grinding machines for industrial blades of all industries, like wood, paper, recycling, food, plastic, metal, ceramic, etc….

#2 Grinding Machines Manufacturer, Grinding Machine

Domain Est. 2004

Website: jainnher.com

Key Highlights: Jainnher Machine Co., Ltd. is a superior grinding machines manufacturer, specializing in different grinding machines including centerless grinders, cylindrical ……

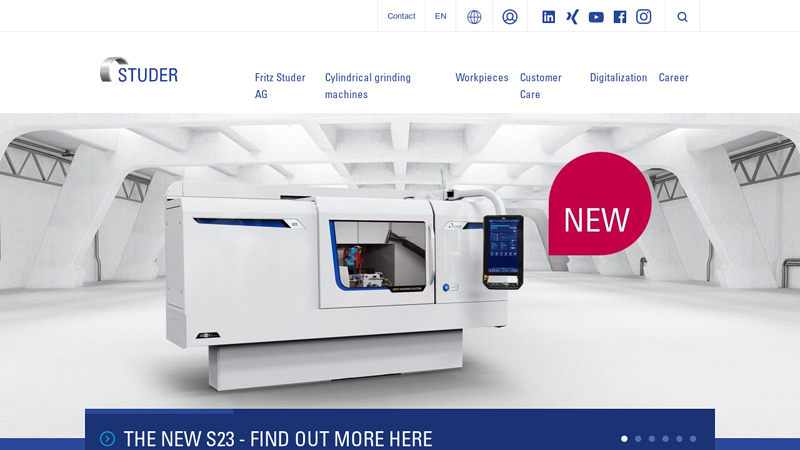

#3 CNC Cylindrical grinding machines

Domain Est. 2001

Website: studer.com

Key Highlights: Fritz Studer AG is a market and technology leader in universal, external and internal cylindrical grinding as well as noncircular grinding….

#4 UVA LIDKÖPING

Domain Est. 2014

Website: uvalidkoping.com

Key Highlights: Worldwide leading global supplier of precision grinding machines for 120 years, more than 10000 machines installed around the world….

#5 Surface Grinding Machines

Domain Est. 1998

Website: chevalierusa.com

Key Highlights: GRINDING. CNC SMART surface grinders: manual, fully automated and semi-automatic. Double column, vertical grinding and 5-axis grinding centers….

#6 Mägerle

Domain Est. 1998

Website: maegerle.com

Key Highlights: Highlights · 5/6 Axis grinding centre · Flat and profile grinding machines · Rotary table grinding machines · Special grinding machines · Vertical grinding machines….

#7 UNITED GRINDING North America

Domain Est. 1999

Website: grinding.com

Key Highlights: UNITED GRINDING is your solutions partner, with products and services designed to assist you throughout the life cycle of your CNC grinding machine….

#8 Cutting Tool Grinding

Domain Est. 2000

Website: rollomaticusa.com

Key Highlights: Rollomatic specializes in designing high-precision CNC machines that are used for manufacturing rotary dental cutting tools and for dental blank preparation….

#9 Ultra Precision

Domain Est. 2007

Website: fivesgroup.com

Key Highlights: Our range of Landis cylindrical grinding machines provide accurate, reliable, flexible and productive solutions for small, medium and large cylindrical ……

#10 Grinding Machine Design and Manufacture

Domain Est. 2017

Website: supertec-grinder.com

Key Highlights: 70 years, Supertec sold over 15000 units of Grinders, As the leader of the CNC grinding machine manufacture in Taiwan, Supertec’s service covers the world….

Expert Sourcing Insights for Machine For Grinding

H2: 2026 Market Trends for Machines Used in Grinding

The global market for grinding machines is poised for significant transformation by 2026, driven by technological innovation, evolving industrial demands, and a growing emphasis on precision manufacturing. As industries such as automotive, aerospace, medical devices, and energy continue to demand tighter tolerances and superior surface finishes, the grinding machine sector is adapting through automation, digital integration, and sustainable practices.

One of the most prominent trends shaping the 2026 landscape is the integration of Industry 4.0 technologies. Smart grinding machines equipped with IoT sensors, real-time monitoring systems, and AI-driven process optimization are becoming standard. These capabilities enable predictive maintenance, reduced downtime, and consistent quality control—critical factors in high-mix, low-volume production environments. Manufacturers are increasingly investing in connected grinding solutions that allow remote diagnostics and data analytics to enhance overall equipment effectiveness (OEE).

Another key trend is the rising demand for ultra-precision and micro-grinding machines. With advancements in materials such as ceramics, composites, and superalloys used in aerospace and medical applications, traditional grinding methods are being pushed to their limits. As a result, machine builders are focusing on developing high-accuracy grinders with sub-micron tolerances and vibration-damping technologies. Electrochemical grinding (ECG) and laser-assisted grinding are also gaining traction for their ability to process hard-to-machine materials efficiently.

Automation and robotics are playing a pivotal role in reshaping the grinding sector. By 2026, fully automated grinding cells with robotic loading/unloading systems are expected to dominate high-volume production lines. This shift not only improves throughput but also addresses labor shortages and enhances workplace safety. Collaborative robots (cobots) are being integrated into grinding setups to handle delicate workpieces, particularly in the dental and precision tool-making industries.

Sustainability is emerging as a critical market driver. Manufacturers are prioritizing energy-efficient motors, regenerative drives, and closed-loop coolant systems to reduce environmental impact. Governments and industry consortia are introducing stricter regulations on emissions and energy consumption, prompting OEMs to redesign machines with a focus on eco-efficiency. Additionally, the circular economy concept is influencing the refurbishment and remanufacturing of grinding machines, offering cost-effective alternatives without compromising performance.

Geographically, the Asia-Pacific region is expected to lead market growth by 2026, fueled by rapid industrialization in China, India, and Southeast Asia. Local production of electric vehicles (EVs) and advancements in semiconductor manufacturing are increasing demand for high-precision grinding equipment. Meanwhile, North America and Europe are focusing on upgrading legacy systems and adopting hybrid manufacturing solutions that combine grinding with additive processes.

In summary, the 2026 grinding machine market will be defined by intelligence, precision, automation, and sustainability. Companies that embrace digital transformation, invest in R&D for advanced materials processing, and align with green manufacturing principles are likely to gain a competitive edge in this evolving landscape.

Common Pitfalls When Sourcing a Machine for Grinding: Quality and Intellectual Property Concerns

Logistics & Compliance Guide for Machines for Grinding

This guide outlines key logistics considerations and compliance requirements for the transportation, import/export, and operation of industrial grinding machines. Adherence to these guidelines ensures safe, legal, and efficient handling throughout the supply chain.

Shipping & Transportation

Proper packaging and transport planning are essential to prevent damage and ensure on-time delivery of grinding machines, which are often heavy and sensitive equipment.

- Secure Packaging: Use robust wooden crates or steel-reinforced pallets with adequate shock-absorbing materials (e.g., foam, rubber mounts) to protect moving parts and precision components.

- Weight & Dimensions: Accurately measure and declare machine dimensions and gross weight. Coordinate with carriers to ensure appropriate handling equipment (forklifts, cranes) is available at origin and destination.

- Handling Instructions: Clearly label crates with “Fragile,” “This Side Up,” and “Do Not Stack” as applicable. Include center of gravity markings for heavy units.

- Mode of Transport: Choose transport mode (road, sea, air) based on urgency, cost, and machine size. For international shipments, sea freight is typically preferred for large grinding machines due to cost and capacity.

- Insurance: Secure comprehensive cargo insurance covering physical damage, theft, and transit delays.

Import & Export Regulations

Grinding machines may be subject to international trade controls, especially if they have high precision or potential dual-use applications.

- HS Code Classification: Identify the correct Harmonized System (HS) code. Common codes include 8460.20 (grinding machines for metal) or 8460.90 (other grinding machines). Accuracy prevents customs delays and incorrect duties.

- Export Controls: Check for dual-use or technology control regulations (e.g., EAR in the U.S., EU Dual-Use Regulation). High-accuracy CNC grinders may require export licenses.

- Import Duties & Taxes: Research applicable tariffs, VAT, or GST in the destination country. Duty rates vary by country and machine specifications.

- Documentation: Prepare a complete shipping package including commercial invoice, packing list, bill of lading/air waybill, certificate of origin, and any required export licenses or permits.

- Restricted Destinations: Verify that the destination country is not under trade sanctions or embargoes.

Safety Compliance

Grinding machines pose significant operational hazards. Compliance with safety standards is mandatory to protect personnel and meet regulatory requirements.

- Machinery Directive (EU): Ensure CE marking per Directive 2006/42/EC. This includes risk assessment, adherence to EN standards (e.g., EN 13218 for woodworking machinery), and provision of a Declaration of Conformity.

- OSHA Standards (USA): Comply with OSHA 29 CFR 1910.215 (Machinery and Machine Guarding) and other relevant regulations. Machines must have proper guarding, emergency stops, and safety interlocks.

- ISO Standards: Follow ISO 16090 (Safety of grinding machines) for design and safety integration.

- Local Regulations: Adhere to national and regional safety codes (e.g., CSA in Canada, AS/NZS in Australia/NZ).

Environmental & Noise Regulations

Grinding operations generate dust, coolant mist, and noise, requiring environmental and workplace exposure controls.

- Dust Emission Control: Equip machines with dust collection systems compliant with local air quality regulations (e.g., EPA NESHAP in the U.S. for metalworking).

- Coolant Management: Follow proper handling, recycling, and disposal procedures for grinding fluids to prevent water and soil contamination.

- Noise Levels: Ensure machine noise emissions comply with occupational exposure limits (e.g., EU Directive 2000/14/EC for outdoor equipment, OSHA PELs for workplaces).

- Waste Disposal: Classify and dispose of grinding sludge and used filters as hazardous or non-hazardous waste per local environmental laws.

Installation & Operational Certification

Before commissioning, verify that the machine meets all operational and compliance requirements at the destination.

- Site Preparation: Ensure facility has adequate power supply, floor load capacity, ventilation, and space for safe operation and maintenance.

- Commissioning & Training: Use qualified technicians for installation. Provide operator training on safe use, emergency procedures, and maintenance.

- Inspection & Certification: Conduct post-installation safety inspections. In some regions, third-party certification (e.g., TÜV, UL) may be required for operation.

- Maintenance Records: Maintain logs of inspections, repairs, and safety checks to demonstrate ongoing compliance.

Documentation & Record Keeping

Retain all compliance and logistics documents for audits, warranty claims, and regulatory inspections.

- Store copies of: CE/UKCA/UL certifications, risk assessments, operating manuals, shipping documents, import/export licenses, and maintenance logs.

- Retention period: Typically 5–10 years, depending on local regulations and company policy.

By following this guide, businesses can ensure the smooth, lawful, and safe logistics and operation of grinding machinery across domestic and international markets.

Conclusion for Sourcing a Grinding Machine:

After a thorough evaluation of technical specifications, production requirements, supplier credibility, cost implications, and long-term operational needs, sourcing a grinding machine requires a balanced approach that ensures both quality and efficiency. The selected machine should align with the precision, capacity, and material compatibility demands of the intended applications, while also offering reliability, ease of maintenance, and energy efficiency.

Supplier reputation, after-sales support, warranty terms, and delivery timelines are equally critical in minimizing downtime and ensuring smooth integration into existing manufacturing processes. Additionally, considering future scalability and technological advancements, investing in a versatile and automated grinding machine may provide long-term cost savings and improved competitiveness.

In conclusion, the optimal sourcing decision involves not only selecting the most technically suitable grinding machine but also partnering with a reliable supplier who can support sustained operations. A well-informed procurement strategy will ultimately enhance manufacturing precision, productivity, and overall product quality.