The global backhoe loader market is experiencing steady growth, driven by rising infrastructure development, urbanization, and investments in construction and agricultural sectors. According to Mordor Intelligence, the backhoe loader market was valued at approximately USD 4.1 billion in 2023 and is projected to grow at a CAGR of over 4.5% through 2029. Increasing demand for compact and versatile construction equipment—especially in emerging economies—has positioned machine backhoes as essential assets across residential, commercial, and public works projects. Technological advancements, such as enhanced fuel efficiency, improved operator ergonomics, and integration of telematics, are further reshaping procurement preferences among contractors and equipment rental firms. In this evolving landscape, manufacturers that combine innovation, durability, and cost-efficiency are gaining competitive advantage. Based on market presence, technological leadership, and global distribution, the following ten manufacturers stand out as the leading players in the machine backhoe industry.

Top 10 Machine Backhoe Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Excavators

Domain Est. 1995

Website: komatsu.com

Key Highlights: Company Logo. Komatsu is a leading manufacturer of construction, mining, forestry, and industrial heavy equipment. Global corporate website….

#2 JCB

Domain Est. 1997

Website: jcb.com

Key Highlights: JCB is one of the world’s top three manufacturers of construction equipment. We employ around 14000 people on four continents and sell our products in 150 ……

#3 MECALAC, Excavators, Loaders, Backhoe Loaders, Dumpers and …

Domain Est. 1999

Website: mecalac.com

Key Highlights: Mecalac is an international manufacturer of wheel excavators, crawler excavators and wheel loaders. So many innovative and compact machines adapted to the wide ……

#4 Construction Equipment

Domain Est. 1990

Website: deere.com

Key Highlights: Explore John Deere’s full line of construction equipment: from small excavators to large ADTs, our machines work hard to help you succeed….

#5 Backhoe Loaders / Backhoe Tractors

Domain Est. 1993

Website: cat.com

Key Highlights: 2-day deliveryCat backhoe loaders provide superior digging, trenching, back-filling and material handling capability and can be used for many applications….

#6 Backhoe loader

Domain Est. 1993

Website: manitou.com

Key Highlights: Discover all Manitou backhoe loaders and all their specs and features….

#7 CASE Backhoe Loaders

Domain Est. 1995 | Founded: 1957

Website: casece.com

Key Highlights: CASE backhoe loaders have been doing it right since 1957, pulling double duty on lots of tough jobsites including utility and emergency underground response….

#8 Gehl

Domain Est. 1995

Website: gehl.com

Key Highlights: We proudly design, build, test and manufacture machines that WORKS LIKE YOU. Dating back to 1859, GEHL has been deeply rooted in agriculture….

#9 Backhoe Loaders

Domain Est. 1997

Website: bobcat.com

Key Highlights: Backhoe loaders from Bobcat are versatile, trusted workhorses for efficient digging, trenching and attachment work in jobsites where high-horsepower strength ……

#10 to KOBELCO USA

Domain Est. 2012

Website: kobelco-usa.com

Key Highlights: At KOBELCO, we build excavators with features you won’t find anywhere else. Features that let you power through the toughest jobs, get more done in less time….

Expert Sourcing Insights for Machine Backhoe

H2: 2026 Market Trends for Machine Backhoe

The global machine backhoe market is expected to undergo significant transformation by 2026, driven by technological advancements, evolving construction demands, and sustainability initiatives. As urbanization continues to accelerate—particularly in emerging economies—the need for versatile, compact, and efficient earthmoving equipment like backhoe loaders remains strong. The following key trends are projected to shape the backhoe market in 2026:

-

Increased Adoption of Smart and Connected Backhoes

By 2026, the integration of IoT (Internet of Things) and telematics into backhoe machines is expected to become standard. Real-time monitoring of machine health, fuel efficiency, location tracking, and remote diagnostics will enhance operational efficiency and reduce downtime. Fleet managers will increasingly rely on data analytics to optimize maintenance schedules and improve job site productivity. -

Shift Toward Electrification and Alternative Fuels

Environmental regulations and corporate sustainability goals are pushing manufacturers to develop electric and hybrid backhoe models. While diesel-powered backhoes still dominate, electric variants are expected to gain market share—especially in urban construction and indoor applications where emissions and noise are critical concerns. Battery technology improvements will support longer operating times and faster charging, making electric backhoes more viable. -

Growth in Emerging Markets

Regions such as Southeast Asia, Africa, and Latin America are anticipated to drive backhoe demand due to infrastructure development, rural electrification projects, and government-led construction initiatives. Localized manufacturing and affordable financing options will make backhoes more accessible to small contractors and rental companies in these regions. -

Focus on Compact and Multi-Functional Machines

Urban construction sites with space constraints will continue to favor compact backhoe loaders that offer high maneuverability and multifunctional capabilities. Attachments such as breakers, augers, and grapples will be increasingly adopted, allowing a single machine to perform multiple tasks and reduce equipment costs. -

Rise of Rental and Shared Equipment Models

The construction industry’s shift toward asset-light models will boost the backhoe rental market. Small and medium-sized enterprises (SMEs) will prefer renting over purchasing, especially for short-term projects. Digital platforms facilitating on-demand equipment leasing are expected to proliferate, improving access and utilization rates. -

Enhanced Operator Safety and Ergonomics

By 2026, machine backhoes will feature advanced safety systems such as rearview cameras, collision avoidance, and rollover protection structures (ROPS). Cab designs will prioritize operator comfort with improved seating, climate control, and intuitive control interfaces, reducing fatigue and increasing productivity. -

Impact of Automation and AI Integration

While fully autonomous backhoes may remain limited to niche applications, semi-automated features—such as auto-digging, bucket leveling, and GPS-guided operation—will become more common. These features will improve precision, reduce operator error, and attract younger, tech-savvy workers to the construction sector.

In conclusion, the 2026 backhoe market will be defined by innovation, sustainability, and adaptability. Manufacturers who invest in smart technologies, alternative powertrains, and customer-centric design will be best positioned to capture growing demand across both developed and emerging markets.

Common Pitfalls in Sourcing a Machine Backhoe (Quality, IP)

Sourcing a machine backhoe, whether for procurement, integration, or manufacturing, presents several risks related to both physical quality and intellectual property (IP). Failing to address these pitfalls can lead to operational inefficiencies, legal disputes, and financial losses.

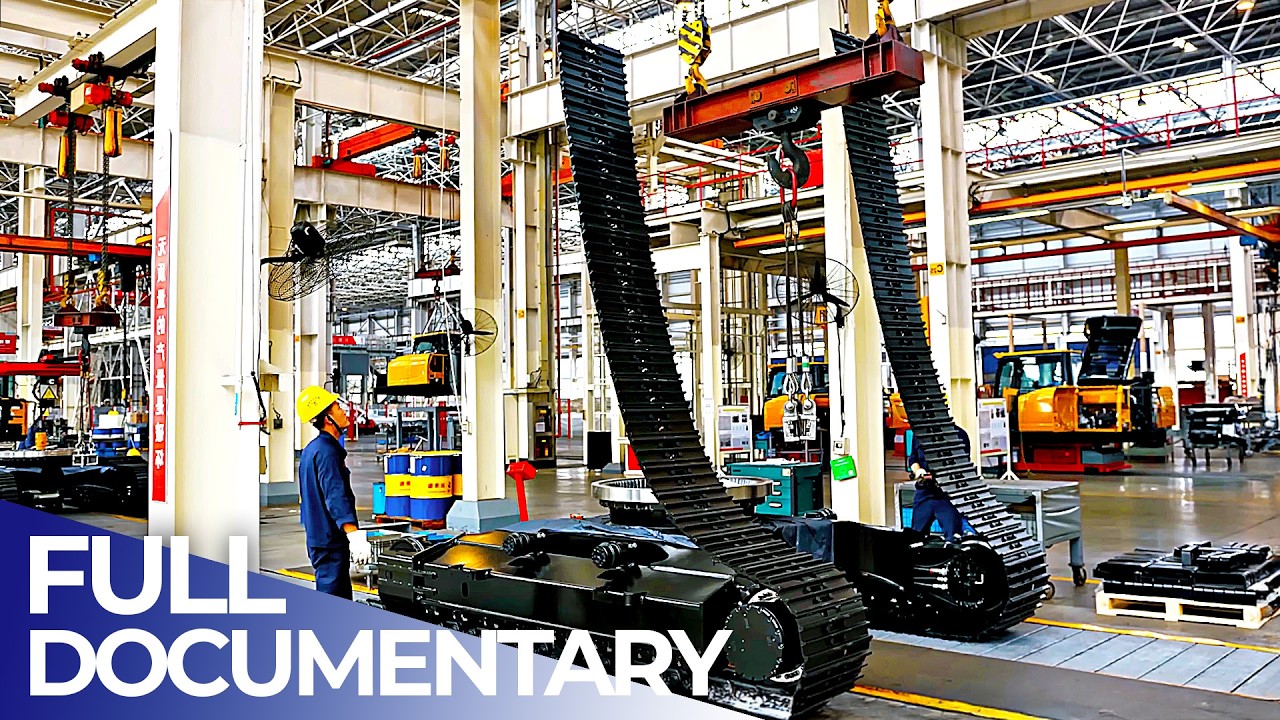

Poor Build Quality and Component Reliability

One of the most frequent issues when sourcing backhoes—especially from less-established manufacturers or low-cost suppliers—is substandard build quality. Components such as hydraulic systems, booms, and undercarriages may use inferior materials or lack proper engineering tolerances, leading to premature wear, frequent breakdowns, and increased maintenance costs. Buyers often discover these flaws only after deployment, resulting in downtime and costly repairs.

Lack of Certification and Compliance

Many suppliers, particularly in emerging markets, may not adhere to international safety and environmental standards (e.g., ISO, CE, or EPA Tier certifications). Sourcing machines without proper certification can lead to non-compliance with local regulations, project delays, or even legal liability in case of accidents. Always verify that the backhoe meets the required industry standards for the region of operation.

Inadequate After-Sales Support and Spare Parts Availability

Even if the initial machine quality is acceptable, long-term reliability depends heavily on the availability of spare parts and technical support. Some suppliers offer attractive upfront pricing but lack a robust service network. This can result in extended downtime when repairs are needed, undermining productivity and increasing total cost of ownership.

Intellectual Property Infringement Risks

Sourcing backhoes from unauthorized or counterfeit manufacturers poses significant IP risks. Some suppliers may replicate patented designs, control systems, or branding from major OEMs (e.g., Caterpillar, John Deere) without licensing. Purchasing such machines may expose the buyer to legal action, especially if the equipment is used in regulated environments or imported across borders where IP laws are strictly enforced.

Use of Proprietary Software Without Licensing

Modern backhoes increasingly rely on embedded software for diagnostics, performance optimization, and telematics. Sourcing machines with unlicensed or pirated software not only violates copyright laws but can also compromise machine functionality and cybersecurity. Unauthorized software may lack updates, contain malware, or fail during critical operations.

Insufficient Due Diligence on Supplier Authenticity

Failing to verify the legitimacy of a supplier increases the risk of fraud or receiving misrepresented products. Fake dealers, cloned websites, and shell companies are common in the heavy equipment market. Always conduct thorough background checks, request references, and, if possible, perform on-site audits before finalizing procurement.

Hidden Design or Manufacturing Defects

Some backhoes may pass initial inspections but harbor latent defects—such as weak welds, undersized hydraulic lines, or poor weight distribution—that only manifest under load or over time. These flaws can lead to catastrophic failures and safety hazards. Independent third-party inspections and performance testing are crucial before accepting delivery.

Conclusion

To mitigate these pitfalls, implement a rigorous sourcing strategy that includes quality audits, IP verification, supplier vetting, and contractual safeguards. Prioritize suppliers with transparent manufacturing processes, valid certifications, and a history of compliance. Protecting both machine integrity and intellectual property is essential for long-term operational success and legal security.

Logistics & Compliance Guide for Machine Backhoe

This guide outlines the essential logistics and compliance considerations for transporting and operating a machine backhoe, ensuring safety, regulatory adherence, and operational efficiency.

Transportation Planning

Develop a comprehensive transportation strategy that accounts for the backhoe’s dimensions, weight, and route requirements. Use a suitable low-bed or flatbed trailer with proper securing points. Confirm road weight limits, bridge restrictions, and permitted travel times, especially for oversized loads. Notify relevant authorities if permits are required for oversize/overweight transport.

Permits and Documentation

Obtain all necessary permits prior to transport, including oversize/overweight load permits where applicable. Ensure the backhoe has valid registration, proof of ownership, and insurance documentation. Maintain a copy of the equipment’s specification sheet and bill of lading during transit.

Load Securing and Safety

Secure the backhoe to the trailer using rated tie-down straps or chains attached to designated anchor points. Engage the parking brake, lower the bucket to the transport position, and lock hydraulics if available. Conduct a pre-trip inspection of securing equipment and perform periodic checks during transit to ensure stability.

Import/Export Compliance (if applicable)

For international movement, comply with customs regulations, including accurate classification under the Harmonized System (HS Code — typically 8429.52 for backhoe loaders), duty assessments, and documentation such as commercial invoices, packing lists, and certificates of origin. Adhere to import restrictions or emissions standards in the destination country (e.g., EPA, CE, or NRCS regulations).

Environmental and Emissions Regulations

Ensure the backhoe meets applicable emissions standards (e.g., EPA Tier 4 Final or EU Stage V) for operation in the target region. Confirm compliance with local noise, fuel, and environmental protection rules. Properly manage and dispose of any fluids during maintenance or decommissioning in accordance with environmental laws.

Operator Certification and Training

Verify that operators hold valid certifications or licenses as required by local regulations (e.g., OSHA in the U.S. or equivalent). Provide site-specific training covering safe operating procedures, hazard awareness, and emergency protocols prior to deployment.

Site Compliance and Inspections

Conduct daily pre-operation equipment inspections to verify safety systems, fluid levels, and structural integrity. Maintain logs for maintenance and inspections to demonstrate compliance during audits. Adhere to worksite safety standards, including marking underground utilities and establishing exclusion zones.

Return and Decommissioning Logistics

Plan for return transport or end-of-life disposal in accordance with local waste and recycling regulations. If decommissioning, follow environmentally responsible procedures for dismantling, fluid recovery, and metal recycling. Retain documentation for asset disposal or transfer.

Conclusion for Sourcing a Backhoe Loader:

Sourcing a backhoe loader is a strategic investment that significantly enhances operational efficiency, productivity, and versatility in construction, landscaping, and infrastructure projects. After evaluating key factors such as machine specifications, brand reliability, budget, new vs. used options, and after-sales support, it is clear that selecting the right backhoe requires thorough research and due diligence. Opting for reputable suppliers or manufacturers ensures quality, warranty coverage, and access to spare parts and technical assistance. Additionally, considering total cost of ownership—beyond the initial purchase price—leads to better long-term value. By aligning the machine’s capabilities with project requirements and future needs, businesses can maximize return on investment, improve job site performance, and maintain a competitive advantage in the industry.