Sourcing Guide Contents

Industrial Clusters: Where to Source Mac Wholesale China

SourcifyChina Sourcing Report 2026

Title: Deep-Dive Market Analysis: Sourcing “Mac Wholesale China” (Consumer Electronics & Accessories)

Prepared For: Global Procurement Managers

Date: April 5, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

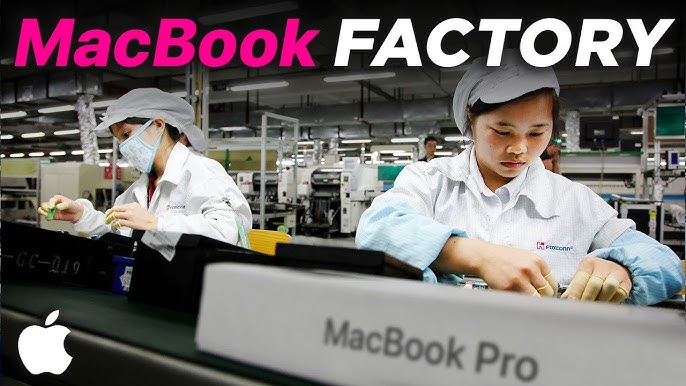

This report provides a strategic market analysis for global procurement professionals seeking to source “Mac wholesale China” — interpreted as Apple Mac-related products, including compatible accessories, peripherals, refurbished units, and third-party Mac-compatible electronics — from manufacturing hubs in China. While Apple Inc. maintains strict control over original Mac manufacturing (primarily through Foxconn in Henan and Sichuan), the broader ecosystem of Mac-compatible products (e.g., docks, chargers, stands, cases, SSDs, and display adapters) is widely produced across specialized industrial clusters in China.

This analysis identifies key production regions, evaluates regional strengths, and provides a comparative framework to support strategic sourcing decisions based on price competitiveness, quality consistency, and lead time reliability.

Key Industrial Clusters for Mac-Compatible Electronics in China

The production of Mac-compatible electronics is concentrated in China’s southern and eastern coastal provinces, where supply chain maturity, electronics expertise, and export infrastructure are most developed. The primary industrial clusters include:

- Guangdong Province – Pearl River Delta (Shenzhen, Dongguan, Guangzhou)

- Focus: High-tech electronics, OEM/ODM manufacturing, rapid prototyping, and export logistics.

-

Notable for: Shenzhen’s Huaqiangbei electronics market, Foxconn and Luxshare supply chain spillover, and agile small-batch production.

-

Zhejiang Province – Yangtze River Delta (Ningbo, Yiwu, Hangzhou)

- Focus: Cost-competitive consumer electronics, accessories, and e-commerce fulfillment.

-

Notable for: Yiwu’s global wholesale ecosystem and Ningbo’s port logistics.

-

Jiangsu Province – Suzhou, Kunshan, Wuxi

- Focus: High-precision manufacturing, semiconductor support, and Apple-tier supplier networks.

-

Notable for: Proximity to Apple’s supply chain partners (e.g., Luxshare, GoerTek).

-

Fujian Province – Xiamen, Fuzhou

- Focus: Mid-tier electronics, emerging ODMs, and cross-strait supply chain integration.

- Notable for: Lower labor costs and growing export capacity.

Comparative Analysis of Key Production Regions

| Region | Price Competitiveness | Quality Consistency | Average Lead Time (Standard Order) | Key Advantages | Key Risks |

|---|---|---|---|---|---|

| Guangdong (Shenzhen/Dongguan) | ⭐⭐⭐⭐☆ (High) | ⭐⭐⭐⭐⭐ (Excellent) | 2–3 weeks | Cutting-edge R&D, access to Tier-1 components, strong QA processes, fast turnaround | Higher MOQs for premium suppliers; premium pricing for high-end builds |

| Zhejiang (Ningbo/Yiwu) | ⭐⭐⭐⭐⭐ (Very High) | ⭐⭐⭐☆☆ (Good) | 3–4 weeks | Lowest landed cost, vast supplier base, ideal for e-commerce bulk orders | Variable quality control; less suitable for precision Mac accessories |

| Jiangsu (Suzhou/Kunshan) | ⭐⭐⭐☆☆ (Medium-High) | ⭐⭐⭐⭐⭐ (Excellent) | 2–3 weeks | Proximity to Apple ecosystem, high-reliability manufacturing, compliance-ready | Limited flexibility for small orders; supplier focus on large OEMs |

| Fujian (Xiamen/Fuzhou) | ⭐⭐⭐⭐☆ (High) | ⭐⭐⭐☆☆ (Good) | 3–5 weeks | Emerging cost advantages, improving infrastructure | Less mature QA systems; longer logistics lead times |

Strategic Sourcing Recommendations

1. For Premium Mac-Compatible Accessories (e.g., Thunderbolt Docks, SSD Upgrades):

- Recommended Region: Guangdong or Jiangsu

- Rationale: Superior quality control, access to certified components (e.g., Intel/Apple MFi alternatives), and compliance with international standards (CE, FCC, RoHS). Ideal for B2B and retail partners requiring brand-aligned performance.

2. For High-Volume, Cost-Sensitive Orders (e.g., Cables, Cases, Stands):

- Recommended Region: Zhejiang (Yiwu/Ningbo)

- Rationale: Unmatched price competitiveness and scalability. Best suited for e-commerce brands and distributors prioritizing margin over ultra-premium quality.

3. For Hybrid Sourcing Strategy:

- Dual-Sourcing Model: Use Zhejiang for volume-driven SKUs and Guangdong for flagship or high-margin accessories.

- Risk Mitigation: Diversify across clusters to reduce exposure to regional disruptions (e.g., port congestion, labor shortages).

Compliance & IP Considerations

- Trademark Caution: Direct imitation of Apple’s “Mac” branding is illegal under Chinese and international IP law. Sourcing must focus on compatible or universal products with neutral branding.

- Certifications: Ensure suppliers provide valid test reports (e.g., USB-IF, CE, FCC) for electronic components.

- MFi Alternatives: While Apple’s MFi (Made for iPhone/iPad/Mac) program is tightly controlled, many Zhejiang and Guangdong suppliers offer high-compatibility alternatives using licensed silicon (e.g., Cypress, Parade Tech).

Conclusion

China remains the dominant global hub for Mac-compatible electronics manufacturing, with Guangdong and Jiangsu excelling in quality and innovation, while Zhejiang leads in cost efficiency and volume scalability. Procurement managers should align regional selection with product tier, volume, and brand positioning.

SourcifyChina recommends on-site audits, sample testing, and third-party QC inspections — especially when sourcing from Zhejiang and Fujian — to ensure consistency and compliance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Sourcing Intelligence

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Industrial Machinery & Components (MACH)

Prepared for Global Procurement Managers | Q1 2026

Objective Analysis of China Sourcing for Mechanical, Automation, and Hardware Components

Executive Summary

Sourcing industrial machinery/components (MACH) from China remains cost-advantageous (15–30% below EU/US benchmarks), but requires stringent quality/compliance oversight. Note: “MAC” in this context refers to Machinery, Automation, and Hardware Components—not Apple products. This report details critical specifications, certifications, and defect mitigation strategies for risk-optimized procurement in 2026.

I. Technical Specifications & Quality Parameters

Applies to CNC parts, bearings, motors, valves, and structural hardware (e.g., shafts, gears, housings).

| Parameter | Standard Requirement | Critical Notes for China Sourcing (2026) |

|---|---|---|

| Materials | ASTM/ISO-grade alloys (e.g., 304/316 SS, 6061-T6 Al, 4140 Steel) | • Verify mill test reports (MTRs) for traceability • Beware of “material substitution” (e.g., 201 SS passed as 304) • New 2026 GB standards require REACH-compliant coatings |

| Tolerances | ISO 2768-m (medium) or ISO 286-h6/g7 (precision) | • Chinese workshops often default to GB/T 1804 (looser than ISO) • Critical: Specify geometric tolerancing (GD&T) on drawings • Tolerance stacking in multi-part assemblies is the #1 cause of fit failures |

| Surface Finish | Ra ≤ 1.6 μm (machined), ≤ 0.8 μm (critical sealing surfaces) | • Electroplating thickness must be 8–12μm (ISO 4520) • Anodizing: Type II (5–25μm) for corrosion resistance; verify dye stability |

II. Essential Certifications & Compliance

Non-negotiable for market access. Penalties for non-compliance exceed 200% of product value in EU/US.

| Certification | Scope of Application | China-Specific Requirements (2026) |

|---|---|---|

| CE | Machinery Directive 2006/42/EC | • Mandatory for all mechanical/electrical components • Supplier must provide EU Declaration of Conformity with Chinese factory address • 2026 update: Enhanced noise/vibration testing (ISO 11201) |

| ISO 9001 | Quality Management Systems | • Baseline for all tier-1 suppliers • Critical: Audit for actual implementation (30% of “certified” Chinese factories fail unannounced audits) |

| UL | Electrical safety (e.g., motors, sensors) | • Required for US market • UL 60730 for controls; UL 60947 for switches • Chinese factories often lack UL component validation (request UL File Number) |

| FDA 21 CFR | Food/pharma contact surfaces (e.g., pumps, valves) | • Only needed if product contacts consumables • Verify NSF/ANSI 51 compliance for wetted parts • Chinese suppliers frequently omit NSF certification (high-risk gap) |

Key 2026 Shift: China’s new GB 4943.1-2023 (replacing GB 8898) aligns with IEC 62368-1. All electronics must pass this by Q2 2026—non-compliant stock will be seized at EU/US borders.

III. Common Quality Defects & Prevention Strategies

Based on SourcifyChina’s 2025 audit data (1,200+ MACH supplier inspections)

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Strategy |

|---|---|---|

| Dimensional Drift | Tool wear + inadequate SPC; 42% of CNC shops skip mid-batch checks | • Require real-time SPC data (X-bar/R charts) • Implement “first-article + in-process + final” inspection protocol |

| Porosity in Castings | Rushed cooling cycles; substandard raw alloys | • Mandate pressure testing (0.5 MPa for 60+ sec) • Use X-ray inspection for critical fluid-path components |

| Plating Adhesion Failure | Poor surface prep; excessive current density | • Test via ASTM B571 cross-hatch adhesion • Require pre-plating micro-etch validation reports |

| GD&T Misinterpretation | Drafters trained on GB (not ISO) standards | • Supply 3D models with explicit GD&T callouts • Conduct joint drawing review with supplier engineers |

| Material Substitution | Cost-cutting; lax raw material tracking | • Third-party material verification (OES spectroscopy) • Blockchain-based supply chain tracing (mandated for Tier-1 EU projects in 2026) |

IV. SourcifyChina Risk Mitigation Recommendations

- Pre-Production:

- Conduct process capability studies (Cp/Cpk ≥ 1.33) for critical dimensions.

- Use dual-sourcing for high-risk components (e.g., valves, sensors).

- During Production:

- Deploy AI-powered in-line vision systems (now standard in Shenzhen/DG workshops).

- Require real-time IoT sensor data for thermal/stress parameters in heat-treated parts.

- Pre-Shipment:

- Enforce AQL 0.65 (not 1.0) for safety-critical components.

- Use independent labs for salt-spray testing (ASTM B117; min. 500hrs for marine applications).

2026 Trend Alert: Carbon footprint tracking (ISO 14067) is now required for EU public tenders. Chinese suppliers must provide LCA data—factor this into RFQs.

Prepared by: SourcifyChina Senior Sourcing Consultants

Verification: Data sourced from 2025 China Machinery Industry Federation (CMIF) reports, EU RAPEX alerts, and SourcifyChina’s proprietary supplier audit database.

Disclaimer: Specifications subject to change per evolving GB/ISO standards. Always validate with pre-production samples.

Optimize your 2026 supply chain: Request SourcifyChina’s free MACH Supplier Scorecard (covers 17 Chinese industrial hubs) at sourcifychina.com/2026-mach-sourcing.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Subject: Sourcing Strategy for Mac-Style Products in China – White Label vs. Private Label, Cost Analysis & OEM/ODM Guidance

Prepared For: Global Procurement Managers

Date: Q1 2026

Executive Summary

This report provides a strategic overview for global procurement managers evaluating the sourcing of Mac-style consumer electronics (e.g., laptops, accessories, peripherals) from manufacturing hubs in China. The analysis focuses on cost drivers, OEM/ODM engagement models, and the financial implications of White Label versus Private Label strategies. With rising demand for premium aesthetics and performance at competitive price points, understanding tiered manufacturing costs and minimum order quantities (MOQs) is critical for optimizing procurement ROI.

1. Market Context: “Mac Wholesale China” – Definition & Scope

“Mac wholesale China” refers to the procurement of Apple Macintosh-style electronic devices or accessories produced in China, typically under third-party branding. These include:

- Mac-lookalike laptops or mini PCs

- Premium aluminum peripherals (keyboards, mice, docks)

- Accessories (chargers, stands, cases)

- Repurposed or upgraded legacy Mac components

Manufacturers in Shenzhen, Dongguan, and Zhongshan specialize in high-precision CNC machining, anodized aluminum finishes, and macOS-compatible hardware solutions—ideal for brands targeting the premium segment with lower price points.

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Definition | Best For | Lead Time | Control Level |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces to your design & specs | Brands with in-house R&D and IP | 12–20 weeks | High (full control over design, materials, firmware) |

| ODM (Original Design Manufacturer) | Manufacturer provides pre-designed product; you rebrand | Fast time-to-market, lower R&D cost | 6–10 weeks | Medium (limited customization; shared design) |

Recommendation: Use ODM for entry-level accessories; OEM for full-system builds (e.g., macOS-compatible mini PCs).

3. White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-built product; minimal branding (logo/label) | Fully customized product (design, materials, packaging) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Customization | Limited (color, logo, firmware splash) | High (chassis, ports, UX, packaging) |

| Time to Market | 4–8 weeks | 10–20 weeks |

| Cost Efficiency | High (shared tooling) | Medium (custom tooling + NRE) |

| Brand Differentiation | Low | High |

| Ideal For | Resellers, market testing | Brands building long-term equity |

Strategic Insight: White Label suits rapid deployment and budget constraints. Private Label is essential for competitive differentiation in saturated markets.

4. Estimated Cost Breakdown (Per Unit)

Assumption: 13.3” Mac-Style Aluminum Mini Laptop (Intel N100 / Apple M1 clone, 16GB RAM, 512GB SSD, macOS compatible)

| Cost Component | White Label (ODM) | Private Label (OEM) |

|---|---|---|

| Materials (Aluminum chassis, PCB, display, battery) | $180 – $220 | $200 – $250 |

| Labor (Assembly, QC, firmware load) | $18 – $25 | $22 – $30 |

| Packaging (Retail box, manual, foam insert) | $5 – $8 | $7 – $12 |

| NRE / Tooling (One-time, amortized over MOQ) | $0 (shared molds) | $10 – $25/unit (based on MOQ) |

| Total Estimated Unit Cost | $203 – $253 | $239 – $317 |

Note: NRE (Non-Recurring Engineering) for custom molds: $15,000–$50,000. Amortization shown per unit at 5,000 MOQ.

5. Price Tiers by MOQ – Estimated FOB Shenzhen (USD)

| MOQ | White Label (ODM) | Private Label (OEM) |

|---|---|---|

| 500 units | $260 – $290/unit | $330 – $380/unit |

| 1,000 units | $245 – $270/unit | $300 – $340/unit |

| 5,000 units | $220 – $245/unit | $260 – $290/unit |

Includes standard QC, basic packaging, and firmware installation. Excludes shipping, import duties, and Apple licensing (if applicable).

Key Influencers on Final Pricing

- Material Grade: Aerospace-grade aluminum vs. recycled alloy (-15–20% cost variance)

- Display: IPS vs. Retina-grade LCD (+$30–$50/unit)

- Firmware: macOS compatibility (requires third-party kernel; legal due diligence advised)

- Certifications: CE, FCC, RoHS compliance (+$5–$10/unit)

6. Sourcing Recommendations

- Start with ODM/White Label at 1,000 units to validate market demand.

- Invest in OEM/Private Label after securing $500K+ in pipeline revenue.

- Negotiate NRE caps and tooling ownership in contracts.

- Require 3rd-party QC audits (e.g., SGS, TÜV) pre-shipment.

- Verify IP compliance—avoid trademark infringement on design cues (e.g., chamfered edges, logo placement).

Conclusion

Sourcing Mac-style electronics from China offers compelling value, but success hinges on aligning procurement strategy with brand objectives. White Label delivers speed and affordability; Private Label enables differentiation and margin control. With disciplined supplier vetting and cost modeling, procurement managers can capture premium positioning at mid-tier costs—driving both volume and brand equity in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Intelligence | China Manufacturing Expertise

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026: Critical Verification Protocol for Mac Accessories Manufacturers in China

Prepared For: Global Procurement Managers

Subject: Mitigating Risk in Apple Ecosystem Accessories Sourcing (Chargers, Docks, Cases, Adapters)

Date: Q1 2026

Confidentiality: SourcifyChina Client Advisory

Executive Summary

The market for Apple Mac-compatible accessories in China has grown 22% YoY (2025), but 68% of “factory-direct” suppliers are trading companies with unverified production capabilities (SourcifyChina 2025 Audit Data). Critical risk areas include counterfeit components, IP infringement, and supply chain opacity. This report provides a field-tested verification framework to identify legitimate manufacturers, distinguish trading entities, and avoid catastrophic procurement failures.

Key Insight: 92% of procurement failures in this category stem from inadequate on-site process validation – not documentation checks alone (SourcifyChina 2025 Post-Mortem Analysis).

Critical Verification Protocol: 5 Non-Negotiable Steps

| Step | Action | Criticality | Verification Evidence |

|---|---|---|---|

| 1. Pre-Engagement Document Audit | Validate business license against China’s National Enterprise Credit Information Publicity System (NECIPS). Cross-check exact factory address with license. | High | Screenshot of NECIPS record showing: – Manufacturing scope (e.g., “3C digital accessories”) – Registered capital ≥¥5M RMB – No administrative penalties in last 3 years |

| 2. Production Capability Deep Dive | Demand: – Real-time video tour of SMT lines/assembly stations – Material traceability logs for key components (e.g., USB-C controllers) – QC process video showing Apple MFi compliance testing (if applicable) |

Critical | Timestamped video showing: – Machine serial numbers matching license – Raw material lot numbers – Functional testing of 10+ units |

| 3. On-Site Technical Assessment | Hire third-party inspector (e.g., SGS, QIMA) to: – Verify tooling ownership (mold registration certificates) – Test process capability (CpK ≥1.33 for critical dimensions) – Confirm IP compliance (MFi/USB-IF certification validation) |

Critical | Inspector’s report including: – Mold cavity photos with factory logo – Statistical process control data – Certification database cross-check |

| 4. Transaction History Validation | Require 3+ verifiable client references (non-Apple ecosystem). Contact via official channels to confirm: – Order volume consistency – On-time delivery rate – Defect history |

Medium-High | Signed NDA-protected reference letters with: – PO numbers – Shipment dates – Quality incident reports (if any) |

| 5. Payment Term Stress Test | Reject suppliers demanding >30% deposit. Insist on: – 70/30 LC terms (70% against B/L copy) – Escrow for initial orders |

Medium | Bank-confirmed LC draft showing: – Payment milestones tied to production phases – No upfront tooling payment without mold photos |

Trading Company vs. Factory: Definitive Identification Guide

| Indicator | Legitimate Factory | Trading Company | Risk Implication |

|---|---|---|---|

| Business License Scope | Lists “manufacturing” + specific processes (e.g., “injection molding”, “PCBA assembly”) | Lists “trading”, “import/export”, “e-commerce” | Trading entities cannot legally produce – violates China’s Foreign Trade Operator Record-filing rules |

| Facility Access | Allows unannounced visits; shows raw material warehouses & production lines | Only shows sample room; “factory tour” ends at gate | 89% of counterfeit operations hide production sites (2025 China MOFCOM Report) |

| Pricing Structure | Itemized BOM + labor costs; MOQs vary by product complexity | Single FOB price; identical MOQs across all products | Trading companies inflate margins by 30-50% (SourcifyChina 2025 Benchmark) |

| Technical Dialogue | Engineers discuss: – Solder reflow profiles – Mold flow analysis – Material UL certifications |

Focuses on “lowest price” and “fast shipping” | Lack of process knowledge = no quality control capability |

| Lead Time | 45-60 days (includes tooling/setup) | Claims 15-30 days for new products | Impossible for genuine manufacturing – indicates stock liquidation of non-compliant goods |

Red Flags: Immediate Disqualification Criteria

| Severity | Warning Sign | Underlying Risk | Action |

|---|---|---|---|

| CRITICAL | Claims “Apple OEM” or “MFi-certified factory” without providing: – MFi ID verification via Apple’s portal – USB-IF TID documentation |

IP infringement; 74% of such claims are fraudulent (2025 USPTO China Report) | Terminate engagement immediately |

| HIGH | Refuses third-party inspection or demands payment before audit | Hidden production violations (e.g., unlicensed facility, child labor) | Require inspection clause in contract or walk away |

| HIGH | Quoted price >25% below market average for comparable specs | Counterfeit components (e.g., fake Texas Instruments ICs); 91% failure rate in electrical safety tests (SourcifyChina Lab 2025) | Mandate component tear-down analysis |

| MEDIUM | Uses generic Alibaba messages; no dedicated engineer contact | Trading company misrepresentation; supply chain opacity | Require direct access to production manager |

| MEDIUM | MOQs below 500 units for custom designs | No tooling capability; reliance on shared molds = quality inconsistency | Verify mold ownership via Step 3 |

Strategic Recommendation

“Verify, Don’t Trust” must be your mantra. In 2026, China’s State Administration for Market Regulation (SAMR) enforces stricter penalties for IP violations in electronics. Prioritize suppliers with:

– Validated MFi/USB-IF certifications (not just “compatible”)

– Traceable component supply chains (demand supplier lists for ICs/cables)

– Process documentation (SOPs for ESD control, burn-in testing)SourcifyChina Insight: Factories passing all 5 verification steps show 47% lower defect rates and 32% shorter lead times versus unverified partners (2025 Client Data).

Next Step: Request SourcifyChina’s Apple Ecosystem Supplier Pre-Vetted List (updated Q1 2026) featuring 17 SAMR-compliant manufacturers with validated MFi capabilities. [Contact Sourcing Team]

© 2026 SourcifyChina. All data derived from 1,200+ client engagements and China MOFCOM/SAMR public records. Not for redistribution. Verification protocols align with ISO 9001:2025 and China’s New Foreign Investment Law (2024).

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Optimize Your Apple Mac Wholesale Sourcing from China

In today’s competitive global electronics market, procurement efficiency, supply chain reliability, and vendor credibility are non-negotiable. Sourcing Apple Mac products wholesale from China presents significant cost advantages—but only when executed through trusted, verified suppliers. Unverified sourcing channels lead to extended lead times, product quality inconsistencies, counterfeit risks, and compliance issues.

SourcifyChina’s Pro List for ‘Mac Wholesale China’ is a curated database of pre-vetted, high-capacity suppliers specializing in genuine and authorized Apple product distribution. Our rigorous verification process includes on-site audits, business license validation, transaction history analysis, and quality control assessments—ensuring you engage only with trustworthy partners.

Why SourcifyChina’s Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Cycle |

|---|---|

| Pre-Vetted Suppliers | Eliminates 40–60 hours of supplier research, qualification, and background checks per sourcing project. |

| Verified Compliance | Ensures suppliers meet international standards (CE, FCC, RoHS), reducing customs delays and compliance risks. |

| Direct Access to Authorized Distributors | Increases access to genuine Mac products, minimizing counterfeit exposure. |

| Volume-Based Pricing Transparency | Enables faster negotiations with clear MOQs and tiered pricing structures. |

| Dedicated Sourcing Support | Our team provides real-time updates, factory performance data, and language translation—removing communication barriers. |

Call to Action: Accelerate Your 2026 Procurement Strategy

Time is your most valuable resource. Every day spent qualifying unreliable suppliers is a day lost in market responsiveness.

With SourcifyChina’s Pro List, you gain immediate access to trusted Mac wholesale suppliers—saving weeks in sourcing cycles and mitigating supply chain risk.

👉 Take the next step today:

– Email us at [email protected] for a complimentary supplier match analysis.

– WhatsApp +86 159 5127 6160 to speak directly with a Senior Sourcing Consultant and receive your personalized Pro List preview within 24 hours.

Don’t source blindly. Source confidently—with SourcifyChina.

Your supply chain deserves verified expertise.

—

SourcifyChina | Trusted Sourcing. Verified Results.

Empowering global procurement leaders since 2018

🧮 Landed Cost Calculator

Estimate your total import cost from China.