The global industrial lubricants market is experiencing robust growth, driven by increasing demand from manufacturing and heavy machinery sectors. According to Mordor Intelligence, the market is projected to grow at a CAGR of over 4.2% from 2024 to 2029, fueled by rising industrialization, stricter equipment performance standards, and the need for extended machinery life. As cube manufacturers—producing precision-engineered components across automotive, aerospace, and industrial equipment—rely heavily on consistent production uptime and tool longevity, selecting the right lubricant is critical. These operations demand high-performance lubricants that reduce friction, dissipate heat, and prevent wear in high-pressure forming and machining processes. With the Asia-Pacific region leading market expansion due to rapid manufacturing growth, particularly in China and India, the competition among lubricant providers has intensified. Based on performance benchmarks, thermal stability, viscosity retention, and OEM approvals, the following eight lubricants have emerged as top choices for cube manufacturers seeking reliability, efficiency, and cost savings in their production lines.

Top 8 Lubricant For Cube Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Lube

Domain Est. 2004

Website: thecubicle.com

Key Highlights: 1–2 day deliveryThe Best Cube Lubes in the Business! FZ-Stealth Lube now available. Cubing.GG Courses and Coaching! Free courses available. Cubicle Rewards Program. Earn ……

#2 Cubicle Labs

Domain Est. 2007

Website: speedsolving.com

Key Highlights: Lubicle Silk was developed by Cubicle Labs before they had even officially started. It is a green water-based lubricant and is arguably the most ……

#3 All Lubricant

Domain Est. 2009

#4 Buy Lube for Speedcubes

Domain Est. 2012

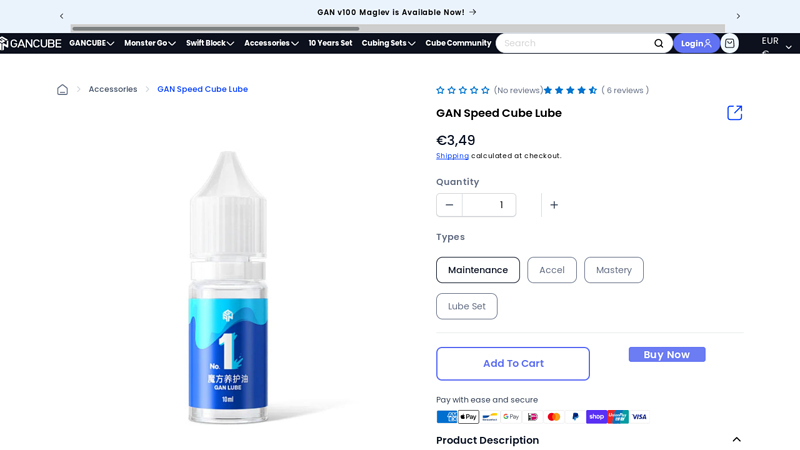

#5 GAN Speed Cube Lube

Domain Est. 2016

#6 Turbo Sauce Silicone Speedcube Lubricant 10ml

Domain Est. 2019

Website: speedcubing.org

Key Highlights: Rating 4.5 (2) · 6–20 day deliveryTurbo Sauce Silicone Speedcube Lubricant 10ml. In Stock. Regular price £5.95….

#7 Speedcube NZ AU: The Speedcube Specialists

Website: speedcube.co.nz

Key Highlights: Cube Sauce Speedcube Lubricant Complete bundle – Speedcube NZ AU. Turbo Sauce Silicone Speedcube Lubricant 10ml · Turbo Sauce Silicone Speedcube Lubricant 10ml….

#8 Cube Lubricants: Types, Uses & Application Guide

Domain Est. 2024

Website: themcubes.in

Key Highlights: These lubricants are specially formulated substances designed to reduce friction between the moving parts of Rubik’s cubes, resulting in smoother and more ……

Expert Sourcing Insights for Lubricant For Cube

H2: 2026 Market Trends for Lubricant for Cube

The global market for lubricants tailored for precision mechanisms—commonly referred to in niche contexts as “Lubricant for Cube”—is poised for significant transformation by 2026. This term typically relates to high-performance lubricants used in engineered cubes such as high-end mechanical puzzles (e.g., speed cubes), miniature robotics, micro-electromechanical systems (MEMS), and compact modular devices. The following analysis outlines key market trends expected to shape this niche lubricant segment through 2026.

-

Rising Demand from the Competitive Speedcubing Community

The global popularity of competitive speedcubing continues to drive demand for specialized lubricants that enhance cube performance—reducing friction, improving corner cutting, and prolonging mechanical life. With the World Cube Association (WCA) hosting over 2,000 competitions annually and an estimated 50+ million active cubers worldwide, manufacturers are investing in silicone-based, viscosity-tuned lubricants. By 2026, the market is expected to see increased product differentiation, with brands offering “tension-specific” or “weather-adaptive” formulas to meet the nuanced needs of elite cubers. -

Advancements in Synthetic and Nano-Enhanced Lubricants

Innovation in synthetic base oils and nanotechnology is set to redefine lubricant performance. By 2026, lubricants incorporating nano-additives (e.g., graphene or molybdenum disulfide) are projected to gain traction due to their superior wear resistance and thermal stability. These advanced formulations allow for smoother operation and longer intervals between reapplication—critical for both consumer and industrial “cube-like” mechanisms. -

Expansion into Industrial and Robotics Applications

Beyond recreational use, “cube” mechanisms are increasingly symbolic of modular, compact engineering found in robotics, aerospace actuators, and smart devices. Lubricants designed for such precision cubes are being adapted for micromotors, hinge mechanisms, and miniature gears. The industrial segment is expected to account for over 40% of market growth by 2026, driven by automation and the miniaturization of electronic devices. -

Emphasis on Sustainability and Eco-Friendly Formulations

Environmental regulations and consumer preferences are pushing lubricant manufacturers toward biodegradable, non-toxic formulations. By 2026, leading brands are anticipated to launch water-based or plant-derived lubricants that maintain high performance while reducing environmental impact. Certifications such as ISO 14001 and EU Ecolabel are becoming key differentiators in product marketing. -

Growth of E-Commerce and Direct-to-Consumer (DTC) Channels

The lubricant-for-cube market benefits from a digitally engaged customer base. Online platforms like Amazon, specialized puzzle stores, and brand-owned e-commerce sites dominate distribution. By 2026, DTC models will enable faster iteration of product lines, personalized kits (e.g., “Beginner,” “Pro,” “All-Weather”), and subscription services for regular lubricant replenishment. -

Regional Market Dynamics

Asia-Pacific, particularly China and India, is expected to lead market growth due to high consumer adoption of speed cubes and robust manufacturing of related devices. North America and Europe will remain strong in premium and industrial-grade lubricant segments, supported by R&D investments and stringent quality standards.

Conclusion

By 2026, the lubricant for cube market will evolve beyond a niche hobbyist product into a technologically advanced segment intersecting consumer, industrial, and sustainability trends. Innovation in formulation, expanding application scopes, and digital distribution will drive a compound annual growth rate (CAGR) estimated at 7.2% from 2023 to 2026, positioning the market for sustained expansion and diversification.

Common Pitfalls When Sourcing Lubricant for Cube (Quality, IP)

Sourcing the right lubricant for precision mechanisms like Rubik’s Cubes or similar puzzle cubes requires careful attention to both quality and intellectual property (IP) considerations. Overlooking these aspects can lead to poor performance, reputational damage, or legal issues. Below are key pitfalls to avoid.

Poor Lubricant Quality and Inconsistent Performance

One of the most frequent issues is selecting lubricants that degrade cube performance over time. Low-quality lubes may be too thick, too thin, or chemically unstable, leading to inconsistent turning, stickiness, or residue buildup. Some cheap formulations contain solvents that degrade plastic components, especially the ABS commonly used in cubes. Always verify the lubricant’s viscosity, base oil type (e.g., silicone, PTFE), and compatibility with plastics through independent testing or trusted supplier data sheets.

Lack of Batch-to-Batch Consistency

Inferior manufacturers may lack rigorous quality control, resulting in significant variation between lubricant batches. This inconsistency affects cube tuning reliability and frustrates end users who expect uniform results. To mitigate this, source from suppliers with documented quality assurance processes, such as ISO certifications, and request batch-specific test reports when possible.

Misrepresentation of Lubricant Composition

Some suppliers falsely advertise their lubricants as “premium” or “competition-grade” without transparent ingredient disclosure. This makes it difficult to assess actual performance or safety. Avoid vendors who don’t provide Material Safety Data Sheets (MSDS) or detailed technical specifications. Prioritize suppliers who openly communicate their formulations and testing methodologies.

Intellectual Property (IP) Infringement Risks

A major but often overlooked pitfall is sourcing lubricants that violate intellectual property rights. Some third-party lubes mimic the branding, packaging, or performance claims of well-known proprietary formulations (e.g., those from Gan, MoYu, or TheCubicle), potentially infringing on trademarks or trade dress. Using such products can expose your business to legal liability, especially in regulated markets or during customs inspections.

Failure to Verify IP Ownership and Licensing

When developing a branded lubricant or private label product, ensure that names, logos, and formulation claims do not infringe existing trademarks. Conduct thorough IP searches and consider registering your own trademarks. If licensing a formulation, confirm the agreement includes clear rights to manufacture, distribute, and market the product without infringement.

Overlooking Regulatory Compliance

Lubricants may fall under chemical regulations such as REACH (EU) or TSCA (USA). Non-compliant products—especially those containing restricted substances—can be blocked from import or sale. Always confirm that your lubricant meets relevant regional safety and environmental standards, and request compliance documentation from your supplier.

Relying on Unverified Supplier Claims

Many lubricant suppliers, particularly on global e-commerce platforms, make exaggerated performance claims without supporting data. Due diligence is essential: request samples, conduct real-world testing, and verify supplier credentials. Engage only with manufacturers or distributors who provide traceable sourcing and responsive technical support.

By addressing these common pitfalls—emphasizing quality verification, consistency, transparency, and IP compliance—businesses can source lubricants that enhance cube performance while minimizing legal and operational risks.

Logistics & Compliance Guide for Lubricant for Cube

This guide outlines key logistics and compliance considerations for handling, transporting, storing, and disposing of lubricant used for maintenance of Cubes (e.g., puzzles, mechanical devices). Always consult the specific product’s Safety Data Sheet (SDS) and local regulations.

Product Identification and Classification

Identify the lubricant by its full chemical name, CAS number, and manufacturer. Determine its hazard classification under systems like GHS (Globally Harmonized System). Most lubricants are classified as flammable liquids, skin/eye irritants, or may contain substances of very high concern (SVHC). Confirm whether it is petroleum-based, silicone-based, or synthetic, as this affects handling and regulatory requirements.

Packaging and Labeling Requirements

Use UN-certified packaging suitable for the lubricant’s classification. Ensure containers are leak-proof, chemically compatible, and properly sealed. Labels must include GHS pictograms, signal words (e.g., “Warning”), hazard statements, precautionary statements, and supplier information. Include supplementary labels such as “Flammable” or “Keep Away from Heat” as needed. For international shipments, comply with IATA (air), IMDG (sea), or ADR (road) labeling standards.

Storage Guidelines

Store lubricant in a well-ventilated, cool, and dry area away from direct sunlight and ignition sources. Maintain storage temperature within the manufacturer’s recommended range (typically 5°C to 40°C). Use flammable storage cabinets if applicable, and segregate from oxidizers and incompatible materials. Ensure spill containment measures (e.g., bunds or drip trays) are in place. Limit quantities stored onsite in accordance with local fire codes.

Transportation Regulations

Transport only in approved containers with secure closures. For domestic and international shipping, classify the lubricant according to its UN number (e.g., UN1993 for flammable liquids, n.o.s.). Complete required shipping documents, including dangerous goods declaration if applicable. Ensure drivers and handlers are trained in hazardous materials transport (e.g., DOT HAZMAT training in the U.S.). Follow mode-specific regulations: 49 CFR (U.S. ground), IATA DGR (air), or IMDG Code (sea).

Handling Procedures

Use appropriate personal protective equipment (PPE), including nitrile gloves, safety goggles, and protective clothing. Avoid skin contact and inhalation of vapors. Use in well-ventilated areas or with local exhaust ventilation. Prevent static discharge during transfer. Never use near open flames or hot surfaces. Train personnel on safe handling and emergency response procedures.

Spill Response and Emergency Measures

In case of spill, contain immediately using absorbent materials (e.g., spill pads or vermiculite). Avoid washing into drains or waterways. Collect contaminated material in a labeled, sealed container for proper disposal. For large spills, evacuate area and contact emergency services. In case of fire, use foam, dry chemical, or CO2 extinguishers—do not use water jets. Refer to the SDS for first aid measures in case of exposure.

Waste Disposal and Environmental Compliance

Dispose of used lubricant and contaminated materials as hazardous waste in accordance with local, state, and federal regulations (e.g., EPA in the U.S., EA in the UK). Never pour down drains or dispose of in regular trash. Use licensed waste contractors for collection and treatment. Maintain records of waste disposal for audit and compliance purposes. Consider recycling options for used lubricants where available.

Regulatory Documentation and Recordkeeping

Maintain accessible copies of the Safety Data Sheet (SDS), transport documents, training records, and waste manifests. Ensure SDS is up to date (revised within the last 5 years). Conduct regular compliance audits and employee training sessions. Keep records for a minimum of 3–5 years, or as required by jurisdiction.

International Trade and Customs Compliance

For cross-border shipments, verify import/export restrictions and required permits. Classify the lubricant under the correct HS Code (e.g., 3403.99 for other lubricants). Comply with REACH (EU), TSCA (U.S.), or other chemical inventories. Declare hazardous properties accurately on customs forms to avoid delays or penalties.

By adhering to this guide and staying updated on regulatory changes, organizations can ensure safe, compliant, and efficient logistics for lubricants used with Cubes.

Conclusion for Sourcing Lubricant for Cube:

After evaluating various lubricant options for cube (e.g., Rubik’s Cube or speed cubes), it is clear that selecting the right lubricant significantly impacts performance, speed, smoothness, and longevity of the puzzle. Silicone-based lubricants, particularly those specifically designed for cubes (such as DNM-37, Weight 3, or Lubicle), offer the best balance of viscosity, durability, and non-damaging properties. Avoiding petroleum-based lubricants is crucial, as they can degrade plastic components over time.

Sourcing lubricants from reputable brands and suppliers ensures product quality and consistency. Whether purchasing from specialized cube stores, online marketplaces, or directly from manufacturers, prioritizing purpose-built, high-purity silicone lubes will enhance solve quality and cube lifespan. Ultimately, a well-lubricated cube contributes to improved speedcubing performance and a more enjoyable solving experience. Therefore, investing time and resources into sourcing the right lubricant is a critical step for both casual users and competitive cubers.