The global lost wax casting market is experiencing robust growth, driven by increasing demand for high-precision metal components in industries such as aerospace, automotive, and medical devices. According to a report by Mordor Intelligence, the global investment casting (lost wax casting) market was valued at USD 13.67 billion in 2023 and is projected to reach USD 19.42 billion by 2029, growing at a CAGR of approximately 6.1% during the forecast period. This expansion is fueled by advancements in ceramic shell technologies, tighter tolerances in component manufacturing, and the growing adoption of near-net-shape casting methods to reduce material waste and post-processing costs. As industries prioritize efficiency and precision, manufacturers specializing in the lost wax casting process are scaling capabilities in automation, material science, and quality control. In this evolving landscape, a select group of companies have emerged as leaders, combining technical expertise, extensive production capacity, and a global footprint to serve critical industrial applications. The following list highlights the top 10 lost wax casting manufacturers shaping the future of precision metal casting.

Top 10 Lost Wax Casting Process Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Lost Wax Casting & Investment Casting OEM Manufacturer

Domain Est. 1998

Website: cscasting.com

Key Highlights: C&S – specialized in lost wax casting & investment casting. C&S Metal Products Co., Ltd is a professional OEM investment casting manufacturer….

#2 LOST WAX CASTING

Website: castem.co.jp

Key Highlights: We have more than 30,000 experiences with lost wax casting, which is the largest number among lost wax manufacturers. We are good at simple to complex 3D shapes ……

#3 Aristo

Domain Est. 2000

Website: aristo-cast.com

Key Highlights: Our original additive manufacturing methods for lost-wax casting includes 3D scanning and in-house tooling for the fastest delivery and highest quality….

#4 Lost Wax Casting, Manufacturer

Domain Est. 2011 | Founded: 1975

Website: silvercloudcasting.com

Key Highlights: Offering quality Gold, Silver & Bronze lost wax casting for jewelers, designers, artists and manufacturers since 1975! Mold making & Finishing available….

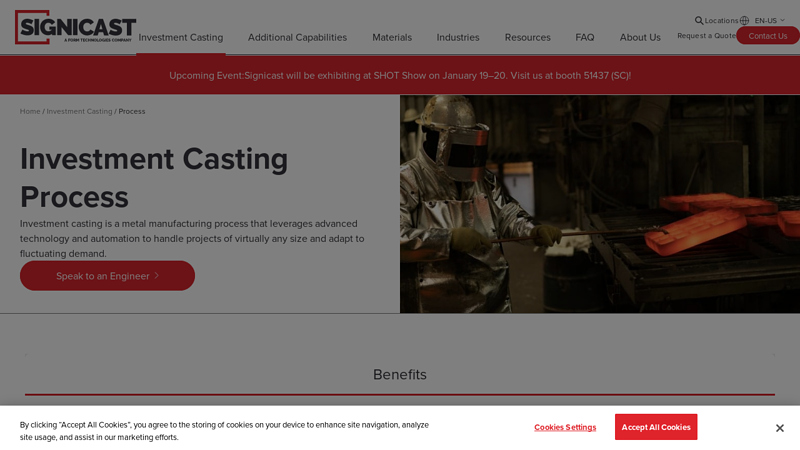

#5 Precision Investment Casting Process

Domain Est. 1998

Website: signicast.com

Key Highlights: Investment casting, or lost wax casting, involves creating a wax pattern, coating it with ceramic to form a mold, melting out the wax, pouring molten metal ……

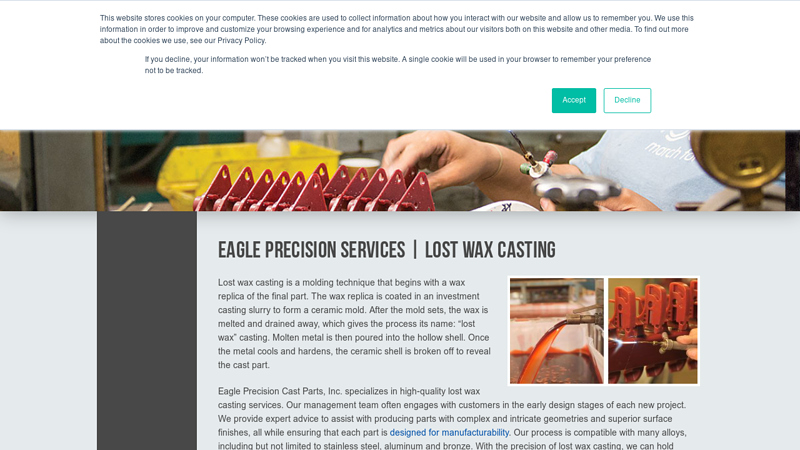

#6 EAGLE PRECISION SERVICES

Domain Est. 2007

Website: eagleprecisioncastparts.com

Key Highlights: Eagle Precision Cast Parts offers high-quality lost wax casting services, producing ferrous and non-ferrous investment castings with tight tolerances and ……

#7 Lost wax investment casting

Domain Est. 2014

Website: cirexfoundry.com

Key Highlights: CIREX is a supplier of precision castings which are cast by using the lost wax technique. These castings are characterized by low surface roughness values and ……

#8 Leading Lost Wax Casting Companies

Domain Est. 2015

Website: investment-castings.net

Key Highlights: ISO certified Lost Wax Casting companies who are able to prototype with and use the newest materials can be found on the company list here on this site….

#9 Daniel Casting

Domain Est. 2016

Website: danielcasting.com

Key Highlights: Our in-house manufacturing services include, lost wax casting in a variety of precious and base metals, expert mold-making….

#10 Lost Wax Casting

Domain Est. 2024

Website: castimize.com

Key Highlights: Online lost wax casting service for jewelry & custom parts. Premium metals & global shipping. Upload your 3D designs today!…

Expert Sourcing Insights for Lost Wax Casting Process

2026 Market Trends for Lost Wax Casting Process

The lost wax casting process, also known as investment casting, is poised for significant evolution by 2026. Driven by advancements in materials, digital technologies, and increasing demand across high-performance industries, the market is expected to witness robust growth and transformation. Below is an analysis of key trends shaping the lost wax casting industry in 2026.

Technological Advancements and Automation

By 2026, automation and digital integration will play a pivotal role in enhancing the efficiency and precision of the lost wax casting process. Foundries are increasingly adopting robotics for tasks such as wax pattern assembly, ceramic shell application, and post-casting finishing. The integration of Industry 4.0 technologies—including IoT-enabled sensors, real-time monitoring, and AI-driven quality control systems—will reduce human error, improve consistency, and lower production costs. Additive manufacturing (3D printing) of wax or thermoplastic patterns is expected to dominate, allowing for complex geometries and rapid prototyping, thereby shortening lead times.

Rising Demand from Aerospace and Defense

The aerospace and defense sectors remain the largest consumers of investment cast components due to the need for high-strength, lightweight, and heat-resistant parts. By 2026, increasing aircraft production rates, modernization of military fleets, and the growth of private space ventures will drive demand for turbine blades, structural components, and engine parts made via lost wax casting. Materials such as superalloys (e.g., Inconel) and titanium will see heightened usage, pushing foundries to refine their capabilities in handling difficult-to-cast alloys.

Growth in Medical and Dental Applications

The medical device and dental industries are emerging as high-growth markets for precision casting. The demand for custom-fabricated surgical instruments, orthopedic implants, and dental crowns/bridges will continue to rise, fueled by aging populations and advances in personalized medicine. Lost wax casting’s ability to produce biocompatible, intricate, and patient-specific components makes it ideal for these applications, with increased adoption of CAD/CAM and 3D scanning technologies streamlining production workflows.

Expansion in Renewable Energy and Electric Vehicles

The global shift toward sustainable energy and electrified transportation is creating new opportunities for investment casting. Components such as turbine housings for wind energy systems and precision gears or housings for electric vehicle (EV) powertrains are increasingly being manufactured using lost wax techniques. As EV manufacturers seek lightweight and durable parts to improve efficiency, investment casting offers a competitive advantage over traditional methods.

Sustainability and Environmental Regulations

Environmental concerns are prompting foundries to adopt greener practices by 2026. The lost wax casting industry is focusing on reducing energy consumption, reusing ceramic shell materials, and minimizing hazardous emissions during dewaxing and pouring stages. Water-based slurries, recyclable wax systems, and closed-loop automation are becoming standard. Compliance with stricter global regulations (e.g., REACH, EPA guidelines) will drive innovation in eco-friendly binders and refractory materials.

Regional Market Dynamics

Asia-Pacific, particularly China and India, will remain the fastest-growing region for lost wax casting due to expanding industrial bases, lower production costs, and government support for advanced manufacturing. North America and Europe will maintain strong positions through high-value, technologically advanced production, especially in aerospace and medical sectors. Regional supply chain resilience post-pandemic will encourage localized production, reducing dependency on global logistics.

Conclusion

By 2026, the lost wax casting market will be characterized by technological sophistication, sustainability, and diversification across industries. While traditional sectors like aerospace will continue to lead, emerging applications in healthcare, renewable energy, and EVs will expand the market’s reach. Foundries that invest in automation, digitalization, and sustainable practices will be best positioned to capitalize on these evolving trends.

Common Pitfalls in Sourcing the Lost Wax Casting Process (Quality, IP)

Sourcing lost wax casting—also known as investment casting—can offer high precision and complex geometries, but it comes with significant risks if not managed carefully. Two major areas where companies often encounter pitfalls are quality consistency and intellectual property (IP) protection.

Quality-Related Pitfalls

Inconsistent Material Properties and Defects

One of the most frequent quality issues in outsourced lost wax casting is variability in material composition and mechanical properties. Poor process control can lead to internal defects such as porosity, shrinkage, and inclusions. These flaws are often not visible during visual inspection and may only surface during performance testing or in-service failure. Sourcing from vendors without strict quality certifications (e.g., ISO 9001, AS9100) or inadequate NDT (non-destructive testing) capabilities increases this risk.

Dimensional Inaccuracy and Surface Finish Issues

Even minor deviations in wax pattern production, shell building, or de-waxing can result in dimensional inaccuracies. Tolerances in lost wax casting are tight, but without proper tooling maintenance and process validation, parts may fall out of spec. Surface roughness is another concern—improper slurry application or mold handling can leave casting surfaces pitted or uneven, requiring costly post-processing or leading to rejection.

Lack of Process Traceability

Many suppliers fail to maintain detailed records of each casting batch, including alloy certifications, heat treatment data, and inspection reports. Without full traceability, it becomes difficult to troubleshoot quality issues or meet regulatory requirements in industries like aerospace or medical devices.

Inadequate Supplier Qualification

Companies sometimes select casting vendors based solely on cost or lead time, overlooking technical capabilities. A supplier may lack experience with specific alloys, post-casting treatments (e.g., HIP—Hot Isostatic Pressing), or finishing processes required for the application. Poor vetting leads to rework, delays, and non-compliant parts.

Intellectual Property (IP)-Related Pitfalls

Unprotected Design and Tooling Ownership

Wax patterns are often created from customer-provided CAD models or physical patterns. If contractual agreements do not explicitly assign ownership of these patterns and tooling to the buyer, the supplier may retain rights or reuse them for other clients. This creates a risk of design duplication or unauthorized production.

Weak Confidentiality and Non-Disclosure Agreements (NDAs)

Many sourcing engagements rely on generic NDAs that lack specificity. Without clear clauses covering reverse engineering, third-party subcontracting, and data handling, sensitive design information can be exposed. Some foundries outsource parts of the process (e.g., pattern making) without client consent, further increasing IP leakage risk.

Insecure Digital and Physical Asset Management

CAD files, 3D prints for master patterns, and physical tooling may be stored or handled insecurely by the supplier. Without access controls, encryption, or audit trails, there is a heightened risk of digital theft or physical copying. Foundries in regions with weaker IP enforcement frameworks pose additional legal challenges.

Lack of Audit Rights and Compliance Monitoring

Without contractual rights to audit supplier facilities or processes, buyers cannot verify IP protection measures or quality controls. This lack of oversight makes it difficult to ensure that proprietary designs are not being misused or that production adheres to agreed standards.

Conclusion

To avoid these pitfalls, companies must conduct thorough supplier due diligence, enforce robust contracts with clear IP clauses, and implement ongoing quality and compliance monitoring. Partnering with reputable, certified foundries and maintaining ownership of critical tooling and digital assets are essential steps in safeguarding both quality and intellectual property in the lost wax casting supply chain.

Logistics & Compliance Guide for Lost Wax Casting Process

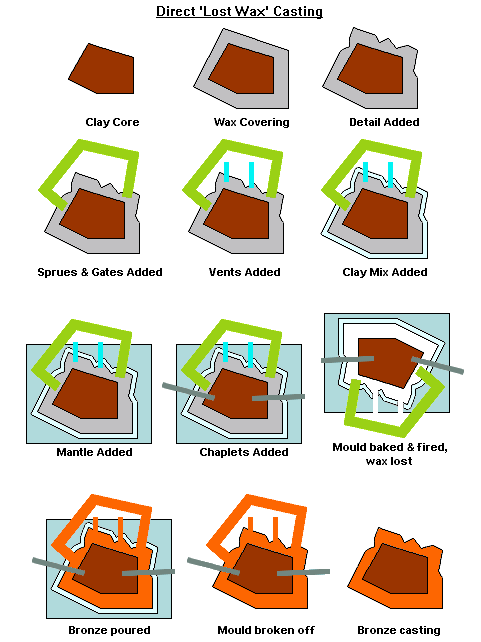

Overview of the Lost Wax Casting Process

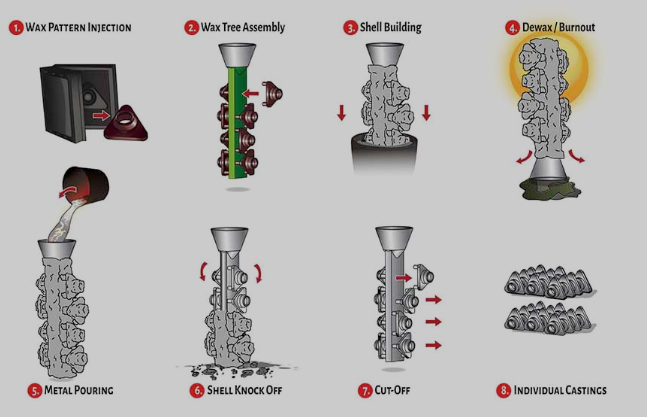

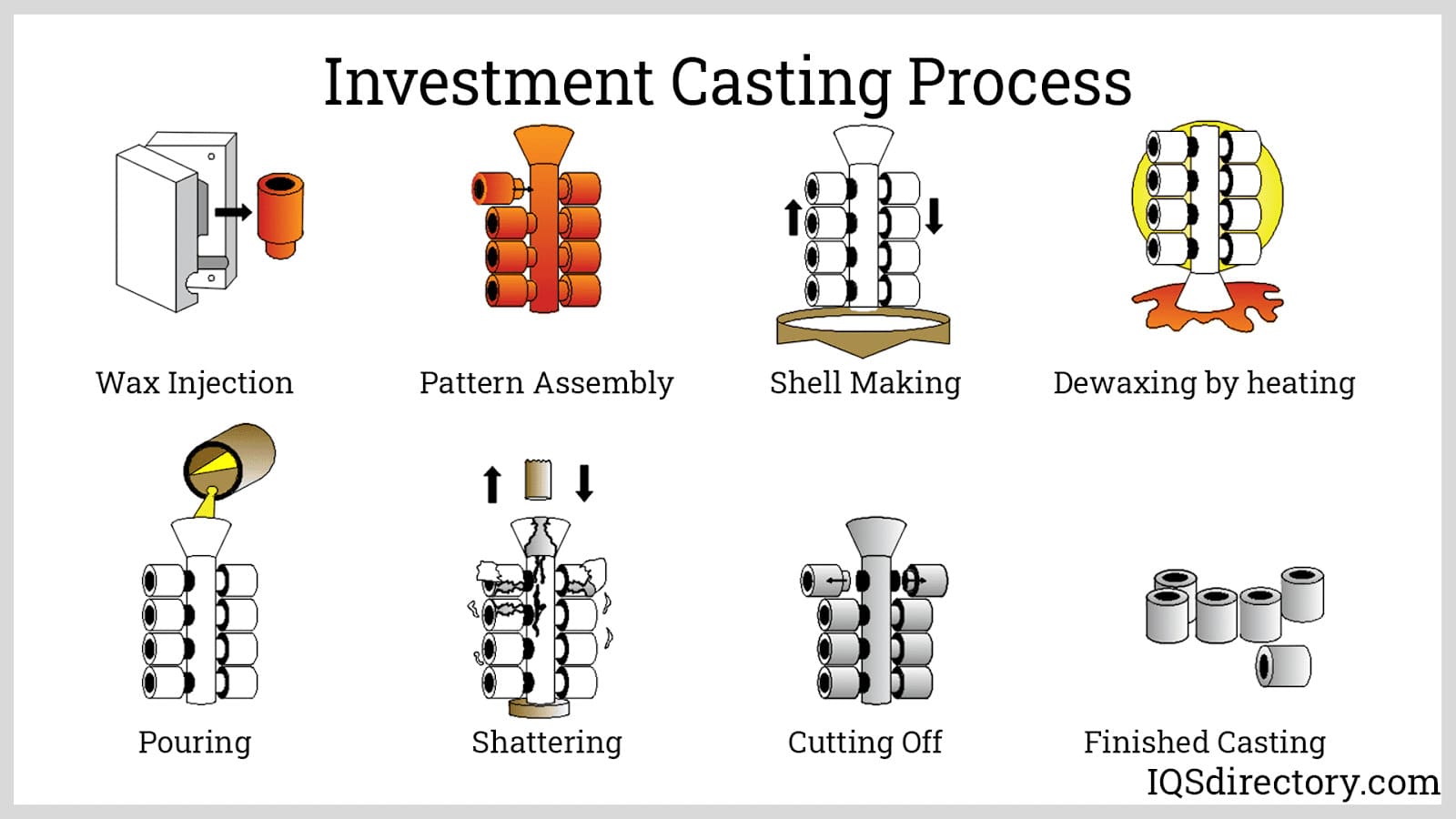

Lost wax casting, also known as investment casting, is a precision manufacturing method used to produce complex metal components with high accuracy and fine surface detail. The process involves creating a wax pattern, coating it with a ceramic shell, melting out the wax, and pouring molten metal into the resulting cavity. Effective logistics and strict compliance with industry standards are essential to ensure product quality, safety, and regulatory adherence.

Raw Material Sourcing and Handling

Procure high-purity wax, refractory slurries, stucco materials, and approved alloys from certified suppliers. Maintain documented supplier qualifications and material certifications (e.g., ISO 9001, ASTM standards). Store materials in controlled environments: wax at stable temperatures (typically 20–25°C), refractory materials in dry conditions to prevent moisture absorption. Implement FIFO (First In, First Out) inventory management to ensure material freshness.

Facility Layout and Workflow Logistics

Design the production area to support a linear workflow: pattern assembly → shell building → dewaxing → firing → casting → finishing. Segregate clean zones (wax and slurry areas) from high-temperature and high-dust zones (furnaces, shot blasting). Ensure adequate ventilation, explosion-proof lighting in flammable areas, and fire suppression systems near wax storage and dewaxing autoclaves.

Equipment Calibration and Maintenance

Maintain a scheduled calibration program for critical equipment: viscometers (slurry control), autoclaves (dewaxing), furnaces (temperature uniformity), and dimensional inspection tools. Document all maintenance and calibration activities in accordance with ISO 13485 or AS9100 where applicable. Use preventive maintenance software to track service intervals and equipment performance.

Environmental, Health, and Safety (EHS) Compliance

Comply with OSHA, REACH, and local environmental regulations. Conduct regular air quality monitoring in shell drying and dewaxing areas to manage exposure to VOCs and particulates. Provide PPE including respirators, gloves, and heat-resistant clothing. Install emergency showers and eyewash stations near chemical handling zones. Properly label and dispose of hazardous waste (spent shells, slurry runoff) per EPA or equivalent guidelines.

Quality Control and Inspection Protocols

Implement in-process inspections at key stages: wax pattern dimensional checks (CMM or optical comparators), shell thickness verification, pre-cast visual inspection. Perform final inspections per customer specifications, including NDT methods such as X-ray, MPI, or ultrasonic testing. Maintain full traceability using batch/lot numbers for materials and castings, in compliance with AS9102 or equivalent aerospace standards.

Packaging, Labeling, and Shipping

Package finished castings to prevent damage during transit—use anti-corrosion wraps, foam inserts, and rigid containers. Label each package with part number, heat/lot number, quantity, and handling instructions (e.g., “Fragile,” “Protect from Moisture”). Ensure shipping documentation includes certificates of conformance (CoC), material test reports (MTRs), and compliance statements (e.g., RoHS, DFARS) as required.

Regulatory and Industry Standards Compliance

Adhere to relevant standards such as ASTM A297 (high-temperature casting alloys), ISO 7183 (investment casting quality), and Nadcap accreditation for non-destructive testing and heat treatment. Maintain a documented quality management system (QMS) aligned with ISO 9001. Conduct internal audits and management reviews quarterly to ensure continuous compliance.

Training and Personnel Certification

Provide comprehensive training for all personnel on process steps, EHS protocols, and quality requirements. Certify operators in critical tasks such as shell dipping, furnace operation, and NDT. Maintain training records and ensure refresher courses are conducted annually or as process changes occur.

Documentation and Traceability Management

Use a digital or paper-based system to track each casting from wax pattern creation to final shipment. Archive process parameter records: slurry batch numbers, dewax cycle data, melt chemistry reports, and inspection results. Ensure traceability supports full product history for recalls or audits, in line with customer and regulatory demands.

Conclusion for Sourcing the Lost Wax Casting Process:

Sourcing the lost wax casting process offers a highly effective solution for producing complex, high-precision metal components with excellent surface finish and dimensional accuracy. This traditional yet advanced manufacturing method is particularly well-suited for industries such as aerospace, automotive, medical, and art, where intricate geometries and material integrity are critical. When sourcing lost wax casting, selecting a reliable supplier with expertise in alloy selection, pattern making, and quality control is essential to ensure consistent product quality and performance.

Advantages such as design flexibility, minimal need for secondary machining, and the ability to work with a wide range of metals make lost wax casting a cost-effective option for both prototyping and low-to-medium volume production. However, considerations such as lead times, tooling costs, and material wastage should be carefully evaluated during the sourcing process.

In conclusion, by partnering with experienced casting providers and leveraging advancements in automation and inspection technologies, businesses can successfully integrate lost wax casting into their supply chain, achieving superior part quality and competitive advantage in their respective markets.