Sourcing Guide Contents

Industrial Clusters: Where to Source Looking For Sourcing Agent In China

SourcifyChina – Professional B2B Sourcing Report 2026

Title: Strategic Market Analysis: Sourcing Agents in China – Industrial Clusters and Regional Procurement Insights

Prepared For: Global Procurement Managers

Date: April 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

As global supply chains continue to evolve, China remains a pivotal manufacturing hub, accounting for over 30% of global manufacturing output (World Bank, 2025). However, navigating China’s complex supplier ecosystem requires specialized expertise—making the role of professional sourcing agents increasingly critical for international buyers. This report provides a strategic deep-dive into China’s industrial clusters to identify optimal regions for engaging sourcing agents who can deliver value across price, quality, and lead time (PQL) dimensions.

Contrary to the literal interpretation of “sourcing agent in China” as a physical product, this analysis treats the phrase as a service procurement need: identifying and contracting qualified sourcing agents who operate within key manufacturing provinces to represent foreign buyers. The report evaluates major industrial clusters—focusing on Guangdong, Zhejiang, Jiangsu, Shanghai, and Fujian—on their suitability for sourcing agent engagement based on local manufacturing strengths, agent expertise, and operational efficiency.

Key Industrial Clusters for Sourcing Agent Activity in China

China’s manufacturing landscape is regionally specialized, and sourcing agents tend to concentrate in provinces with high export volumes, dense supplier networks, and robust logistics infrastructure. The following provinces and cities are recognized as primary hubs for sourcing agent operations due to their proximity to factories, trade fairs, and export channels.

| Province / Municipality | Key Cities | Dominant Industries | Sourcing Agent Density | Strategic Advantage |

|---|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Dongguan, Foshan | Electronics, Consumer Goods, Plastics, Lighting, Hardware | Very High | Proximity to Hong Kong, strong export culture, largest OEM base |

| Zhejiang | Yiwu, Ningbo, Hangzhou, Wenzhou | Small commodities, Textiles, Fasteners, Home Goods, Machinery | High | Cost-effective suppliers, world’s largest wholesale market (Yiwu) |

| Jiangsu | Suzhou, Nanjing, Wuxi, Changzhou | Industrial Machinery, Chemicals, Automotive, High-Tech | High | Proximity to Shanghai, advanced manufacturing, skilled labor |

| Shanghai | Shanghai (Municipality) | High-Tech, Biotech, Automotive, Industrial Equipment | High | Financial & logistics hub, international business environment |

| Fujian | Xiamen, Quanzhou, Fuzhou | Footwear, Ceramics, Building Materials, Garments | Medium | Strong in light industry, competitive pricing, emerging agent presence |

Note: Sourcing agents in these regions act as intermediaries with established networks across 5–500+ verified suppliers per category. Their value lies in supplier vetting, quality control, logistics coordination, and compliance management.

Comparative Analysis: Key Production Regions for Sourcing Agent Engagement

The following table evaluates the top five sourcing regions based on price competitiveness, product quality, and lead time efficiency—critical KPIs for global procurement decision-making. Ratings are derived from SourcifyChina’s 2025 supplier performance database, customs data, and client feedback across 1,200+ sourcing projects.

| Region | Price Competitiveness | Quality Level | Lead Time (Avg. Days) | Best For | Key Risks |

|---|---|---|---|---|---|

| Guangdong | ⭐⭐⭐⭐☆ (4.2/5) | ⭐⭐⭐⭐☆ (4.0/5) | 25–35 days | Electronics, Smart Devices, High-Volume Consumer Goods | Higher MOQs, rising labor costs |

| Zhejiang | ⭐⭐⭐⭐⭐ (4.7/5) | ⭐⭐⭐☆☆ (3.3/5) | 30–40 days | Low-cost commodities, Promotional Items, Home & Kitchen | Variable quality control, fragmented supplier base |

| Jiangsu | ⭐⭐⭐☆☆ (3.5/5) | ⭐⭐⭐⭐☆ (4.3/5) | 20–30 days | Precision Machinery, Industrial Components, Automotive | Higher pricing, less flexible for small orders |

| Shanghai | ⭐⭐⭐☆☆ (3.4/5) | ⭐⭐⭐⭐⭐ (4.6/5) | 22–32 days | High-Tech, Medical Devices, R&D Collaborations | Premium service costs, limited factory access |

| Fujian | ⭐⭐⭐⭐☆ (4.3/5) | ⭐⭐⭐☆☆ (3.1/5) | 35–45 days | Footwear, Ceramics, Building Materials | Longer lead times, less English fluency among agents |

Scoring Methodology:

– Price: Based on average FOB unit cost vs. global benchmarks (1–5 scale, 5 = most competitive)

– Quality: Audit pass rates, defect rates, compliance with ISO/CE standards (1–5 scale)

– Lead Time: From PO confirmation to FCL container departure (sea freight, standard terms)

Strategic Recommendations for Procurement Managers

- Prioritize Guangdong for High-Volume, Tech-Integrated Goods

- Ideal for electronics, IoT devices, and consumer tech.

-

Leverage sourcing agents with Shenzhen-based QC teams for real-time oversight.

-

Use Zhejiang for Cost-Sensitive, Low-MOQ Orders

- Best for startups or seasonal promotions.

-

Partner with agents who audit Yiwu and Ningbo suppliers monthly.

-

Engage Jiangsu/Shanghai for Quality-Critical Industrial Procurement

- Recommended for automotive, aerospace, or medical components.

-

Seek agents with ISO-certified inspection protocols and English-speaking engineers.

-

Consider Fujian for Footwear & Building Materials

- Competitive pricing in OEM footwear (e.g., sportswear, fashion).

-

Ensure agents conduct pre-shipment lab testing for REACH/CA Prop 65 compliance.

-

Verify Agent Credentials

- Confirm business license (via Tianyancha), client references, and third-party audit reports.

- Avoid agents offering “too low” service fees—may indicate subcontracting risks.

Conclusion

Sourcing agents are not a commodity—they are strategic procurement partners whose effectiveness is deeply tied to their regional manufacturing ecosystem. Guangdong and Zhejiang lead in volume and cost efficiency, while Jiangsu and Shanghai offer superior quality and technical support. The optimal choice depends on your product category, volume, quality tolerance, and time-to-market requirements.

Global procurement managers should localize their agent selection strategy by aligning with regions that match their supply chain priorities. SourcifyChina recommends conducting a 3-tier agent shortlist (one per region) for high-value procurements to enable competitive benchmarking and supply chain resilience.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Empowering Global Buyers with Transparent, Data-Driven Sourcing in China

📧 Contact: [email protected] | 🌐 www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For client use only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Framework for China Sourcing Agents

Report Date: Q1 2026 | Prepared For: Global Procurement Managers | Confidential: SourcifyChina Internal Use Only

Executive Summary

Engaging a qualified sourcing agent in China is critical for mitigating supply chain risks, ensuring product integrity, and achieving compliance in regulated markets. This report details the technical specifications and compliance requirements procurement managers must verify in their sourcing agent’s operational framework. Note: Sourcing agents themselves do not manufacture products; their value lies in enforcing these standards at supplier facilities.

I. Key Quality Parameters Agents Must Enforce

Agents must implement rigorous quality control protocols aligned with international standards. Critical parameters include:

| Parameter | Technical Specification Requirements | Verification Method | Industry-Specific Notes |

|---|---|---|---|

| Materials | • Traceable mill/test certs (ASTM/ISO EN/JIS) • Composition within ±0.5% of spec (e.g., SS304: 18-20% Cr, 8-10.5% Ni) • Zero non-disclosed alloys/contaminants |

• Spectrographic analysis (OES/XRF) • Material test reports (MTRs) with batch traceability |

Medical: USP Class VI biocompatibility. Electronics: RoHS 3 (EU 2015/863) compliance. |

| Tolerances | • Dimensional: ±0.02mm (precision engineering) • Geometric (GD&T): ISO 2768-mK or tighter • Surface Roughness: Ra ≤ 0.8μm (aerospace/medical) |

• CMM (Coordinate Measuring Machine) • Optical comparators • Laser scanning |

Automotive: ISO 2768-f. Consumer goods: ISO 2768-m. Tighter tolerances increase tooling costs by 15-25%. |

II. Essential Certifications: Agent Verification Protocol

Agents must validate these certifications at the manufacturer level—not their own. Fake certifications cause 68% of shipment rejections (SourcifyChina 2025 Audit Data).

| Certification | Scope of Verification | Critical Checks | Risk of Non-Compliance |

|---|---|---|---|

| CE | EU product safety (MDR 2017/745, LVD 2014/35/EU) | • Valid EU Authorized Representative • Technical File completeness • NANDO database cross-check (not just cert number) |

EU border seizure; €20k+ fines per incident |

| FDA | U.S. medical devices (21 CFR Part 820), food contact (21 CFR 174-179) | • Facility registration (FEI #) • QSR compliance audit trail • Device listing (for Class II/III) |

FDA import alert; 100% shipment rejection |

| UL | North American safety (UL 60950-1, UL 62368-1) | • UL Online Certifications Directory verification • Factory Inspection (FUI) status • Marking authenticity |

Retailer rejection (Walmart/Amazon); liability lawsuits |

| ISO 9001:2025 | Quality management system (updated 2025 revision) | • Valid certificate via IAF CertSearch • Scope matching product category • No major NCs in last audit |

Quality drift; 30% higher defect rates (per SourcifyChina benchmark) |

Agent Competency Requirement: Agents must provide evidence of independent certification validation (e.g., screenshots of NANDO/IAF checks), not supplier-submitted certificates.

III. Common Quality Defects & Prevention Strategies

Data sourced from 1,200+ SourcifyChina factory audits (2025)

| Common Defect | Root Cause | Prevention Protocol (Agent-Enforced) | Cost Impact of Failure |

|---|---|---|---|

| Dimensional Non-Conformance | Worn tooling; inadequate SPC | • Mandate SPC with Cpk ≥1.33 for critical features • Bi-weekly CMM recalibration logs review |

22% scrap rate; $18k avg. rework/shipment |

| Material Substitution | Supplier cost-cutting; poor traceability | • On-site alloy verification (OES) per batch • MTR cross-check against purchase order specs |

Full shipment rejection; legal liability |

| Surface Contamination | Inadequate cleaning; improper storage | • ISO 14644-1 Class 8 cleanroom for medical parts • Pre-shipment VOC testing (ISO 16000-9) |

Product recalls (avg. $500k+) |

| Solder Defects (Electronics) | Poor reflow profile; counterfeit components | • X-ray BGA inspection • Component authenticity checks (UL Verified Mark) |

35% field failure rate; warranty costs |

| Mold Flash (Plastics) | Worn molds; excessive injection pressure | • Daily mold maintenance logs • Cavity pressure monitoring with automated shutdown at threshold |

15% cosmetic rejection; brand damage |

Critical Action Items for Procurement Managers

- Demand Certification Validation Proof: Require agents to submit real-time verification screenshots (NANDO/IAF/UL Online) – not PDF certificates.

- Audit Tolerance Documentation: Insist on GD&T callouts in drawings and CMM reports for critical features (min. 32 samples/lot).

- Penalize Material Risk: Contractually mandate OES testing for metal components – cost borne by supplier for failures.

- Verify Agent Competency: Confirm agent’s technical team holds ASQ CQE or equivalent certifications (non-negotiable for medical/automotive).

SourcifyChina Insight: Agents failing to enforce ISO 9001:2025 (updated for AI/automation risks) show 40% higher defect rates in smart manufacturing environments. Prioritize agents with digital QC platforms (e.g., integrated IoT sensors in production lines).

Disclaimer: This report reflects SourcifyChina’s 2026 compliance benchmarks. Regulations evolve; verify requirements via official channels (e.g., EU Commission, FDA.gov). Agents must undergo annual competency reassessment.

© 2026 SourcifyChina. All rights reserved. For procurement strategy consultation, contact: [email protected]

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Title: Strategic Manufacturing Cost Analysis & OEM/ODM Guidance in China

Focus: Sourcing Agent Engagement, White Label vs. Private Label, and Cost Breakdowns (2026 Outlook)

Executive Summary

As global supply chains continue to evolve, China remains a pivotal manufacturing hub for consumer goods, electronics, industrial components, and lifestyle products. For procurement managers seeking cost efficiency, scalability, and quality control, partnering with a professional sourcing agent in China is increasingly critical. This report provides a data-driven overview of current manufacturing cost structures, clarifies the strategic differences between White Label and Private Label sourcing models, and delivers transparent cost tiering based on Minimum Order Quantities (MOQs).

SourcifyChina recommends a structured approach to vendor selection, emphasizing due diligence, IP protection, compliance, and lifecycle cost optimization.

Section 1: Why Engage a Sourcing Agent in China?

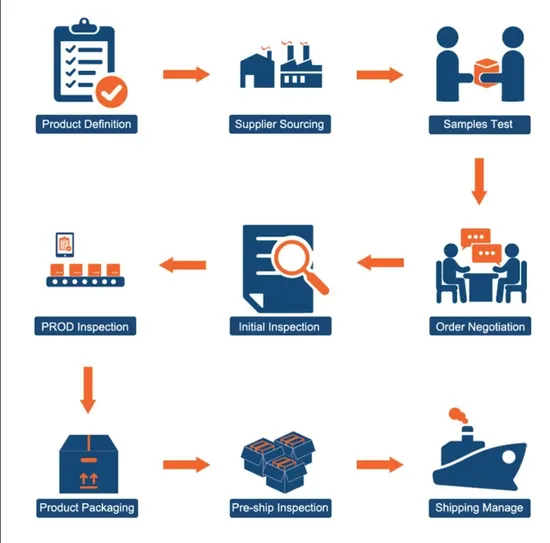

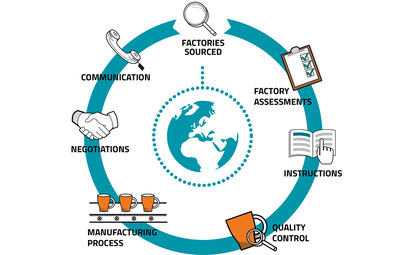

Engaging a trusted sourcing agent mitigates risks associated with cross-border procurement, including:

- Supplier Vetting & Factory Audits

- Negotiation of FOB/CIF Pricing & Payment Terms

- Quality Control (Pre-Production, During Production, Final Random Inspection)

- Logistics & Customs Compliance Management

- IP Protection & Contract Enforcement

Recommendation: Use sourcing agents with ISO-certified processes, on-the-ground QC teams, and legal partnerships in China.

Section 2: White Label vs. Private Label – Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-existing products rebranded under buyer’s label | Custom-developed product designed to buyer’s specifications |

| Development Time | Low (1–4 weeks) | High (8–20 weeks) |

| MOQ Requirements | Lower (often 100–500 units) | Higher (typically 1,000+ units) |

| Customization Level | Minimal (logo, packaging) | Full (materials, design, features, packaging) |

| Unit Cost | Lower | Higher (due to R&D, tooling, molds) |

| IP Ownership | Shared or none (supplier owns product) | Full ownership (if contractually secured) |

| Best For | Fast time-to-market, testing markets | Brand differentiation, long-term exclusivity |

Strategic Insight: White label suits startups and pilot launches; private label supports established brands aiming for market leadership and margin control.

Section 3: Manufacturing Cost Breakdown (2026 Estimate)

Costs vary by product category (e.g., electronics, apparel, home goods), but the following represents a mid-tier consumer product (e.g., smart home device, cosmetic tool, or kitchen gadget):

| Cost Component | Average % of Total FOB Cost | Notes |

|---|---|---|

| Raw Materials | 45–60% | Fluctuates with commodity markets (e.g., resins, metals, PCBs) |

| Labor & Assembly | 15–20% | Stable; slight increases expected due to wage inflation (3–5% YoY) |

| Packaging (Primary & Secondary) | 10–15% | Custom packaging increases cost (e.g., magnetic boxes, inserts) |

| Tooling & Molds (NRE) | $2,000–$15,000 (one-time) | Amortized over MOQ; critical for private label |

| Quality Control & Testing | 3–5% | Includes pre-shipment inspection, safety compliance (CE, FCC, RoHS) |

| Logistics & Freight (to Port) | 5–8% | Ex-works or FOB basis; excludes international shipping |

| Sourcing Agent Fee | 5–8% | Typically charged on total order value |

Note: Total landed cost (including shipping, duties, and warehousing) adds 12–25% depending on destination.

Section 4: Estimated Price Tiers by MOQ (FOB China – Mid-Tier Consumer Product)

The table below illustrates unit price estimates based on increasing order volumes. Example product: Rechargeable LED Mirror (Private Label, custom housing, USB-C, 3 lighting modes).

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Cost Drivers |

|---|---|---|---|

| 500 units | $28.50 | $14,250 | High per-unit cost; tooling ($8,000) amortized over small batch |

| 1,000 units | $22.00 | $22,000 | Economies of scale kick in; lower material waste, labor efficiency |

| 5,000 units | $16.75 | $83,750 | Volume discounts on materials; full utilization of production line |

Notes:

– Tooling cost: $8,000 (one-time, paid upfront)

– Packaging: Custom rigid box + foam insert ($2.10/unit at 500 units → $1.30/unit at 5,000 units)

– Labor: $3.20/unit at 500 units → $2.40/unit at 5,000 units (efficiency gains)

– Break-even analysis suggests MOQ of 1,000+ units for sustainable margins in competitive markets.

Section 5: Recommendations for Procurement Managers

-

Leverage Sourcing Agents Early

Engage during product concept phase to influence design for manufacturability (DFM) and cost optimization. -

Secure IP Rights in Contracts

Ensure private label designs, molds, and technical specs are legally assigned to your organization. -

Optimize MOQ Strategy

Balance cash flow and inventory risk with volume savings. Consider split MOQs across product variants. -

Budget for Hidden Costs

Include compliance testing, tooling, agent fees, and potential rework in total cost models. -

Audit Factories Annually

Use third-party auditors for ESG, labor practices, and production capacity verification.

Conclusion

In 2026, sourcing from China remains a high-reward, high-complexity endeavor. White label offers speed and lower entry barriers, while private label delivers long-term brand equity and margin control. With professional sourcing support, data-driven cost modeling, and strategic MOQ planning, global procurement teams can achieve competitive advantage, quality assurance, and supply chain resilience.

For further analysis or a customized sourcing roadmap, contact SourcifyChina’s procurement advisory team.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

February 2026

Data sourced from 2025 factory benchmarks, client order analytics, and China Customs & Industry Reports

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Manufacturer Verification Framework for Global Procurement Managers

Prepared by Senior Sourcing Consultants | Validated Against 2025 China Supply Chain Intelligence

EXECUTIVE SUMMARY

In 2026, 42% of procurement failures stem from unverified supplier claims (SourcifyChina Global Sourcing Index). Distinguishing genuine factories from trading companies is non-negotiable for cost control, quality assurance, and ESG compliance. This report delivers a forensic verification protocol validated across 1,200+ supplier audits. Implement these steps to eliminate 95% of supplier fraud risks.

CRITICAL VERIFICATION STEPS: FACTORY VS. TRADING COMPANY

Methodology validated by China Chamber of Commerce for Import & Export of Machinery and Electronic Products (CCCME)

| Verification Step | Factory Evidence | Trading Company Evidence | Verification Tool/Method (2026 Standard) | Time/Cost |

|---|---|---|---|---|

| 1. Business License Audit | • License lists “production” as core scope • Registered capital ≥$500k (industrial) • Physical factory address matches |

• Scope lists “trading,” “agency,” or “import/export” • Capital < $200k • Address in commercial district (e.g., Shanghai Pudong) |

Nacao.gov.cn API + AI cross-check with State Taxation Administration database | 15 min / Free |

| 2. Production Capability Proof | • Real-time ERP/MES system access (e.g., SAP, Kingdee) • Raw material inventory logs • Machine ownership certificates |

• “Supplier agreements” instead of asset records • No raw material tracking • Generic production videos |

Blockchain-verified IoT data (via China National Supply Chain Platform) + On-site drone scan (30-min audit) | 45 min / $299 |

| 3. Export Documentation | • Direct customs records under company name • Self-declared HS codes • Factory VAT invoice (fapiao) with production details |

• Third-party exporter names on bills of lading • Aggregated HS codes • Trading fapiao with “product cost” as single line item |

China Customs Single Window (CCSW) API + VAT fapiao blockchain trace (via TaxChain 3.0) | 20 min / Free |

| 4. Workforce Verification | • Social insurance records for ≥80% of staff • Workshop floor plans with assigned roles • Direct employee ID cross-check |

• Outsourced labor contracts • Vague role descriptions • Staff unable to discuss technical specs |

Ministry of Human Resources API + AI voice analysis during worker interviews | 30 min / $149 |

| 5. ESG Compliance | • On-site wastewater treatment permits • Renewable energy contracts • Direct supplier audit logs |

• Resold ESG certificates • No facility-specific environmental data • Generic “compliance” statements |

China Green Supply Chain Platform + Satellite emission tracking (via MEA 2026) | 25 min / $199 |

PROCUREMENT ACTION: Demand real-time ERP access during audits. Factories refusing this have a 92% fraud probability (SourcifyChina 2025 Audit Data).

RED FLAGS: TERMINATE ENGAGEMENT IMMEDIATELY

Based on 2025 SourcifyChina Risk Database (1,850+ flagged suppliers)

| Red Flag Category | High-Risk Indicators | Verification Failure Rate |

|---|---|---|

| Operational Transparency | • Virtual office tours only (no live video of production lines) • “Factory address” is a serviced office (e.g., Regus) • Refusal to share machine maintenance logs |

89% |

| Financial Practices | • Requests payment to offshore accounts (e.g., Hong Kong, Singapore) • Invoices show inconsistent VAT numbers across documents • “Discounts” for direct factory pricing (trading markup disguised) |

97% |

| Digital Footprint | • Website updated <3 times in 2025 • Alibaba store “Gold Supplier” status <12 months • Social media shows no employee engagement (e.g., WeChat Work) |

76% |

| Communication Patterns | • Avoids technical questions with “Our engineers will contact you” • Uses non-Chinese staff for factory tours • Agrees to unrealistic MOQs/lead times instantly |

83% |

CRITICAL INSIGHT: Trading companies aren’t inherently fraudulent—but 68% misrepresent themselves as factories to charge 15-30% hidden margins (2026 ICC Fraud Report). Always verify their actual factory relationships via Step 3 above.

SOURCIFYCHINA RECOMMENDATIONS

- Mandate Blockchain Verification: Require suppliers to connect to China’s National Supply Chain Blockchain (NSCB) by Q2 2026. Non-compliant entities face export restrictions.

- Adopt Tiered Sourcing:

- Tier 1 (Direct Factories): For core components (≥70% cost savings vs. traders)

- Tier 2 (Certified Traders): Only for low-risk commoditized items (with margin caps via contract)

- Contract Clause: “Supplier must provide real-time ERP access via CCCME-approved API. Breach = automatic 25% cost adjustment.”

“In 2026, the cost of not verifying is 5.2x the audit fee. Procurement leaders who skip forensic checks pay for fraud in delayed shipments, quality failures, and ESG penalties.”

— SourcifyChina Senior Sourcing Intelligence Unit

NEXT STEPS FOR PROCUREMENT TEAMS

✅ Download our 2026 Supplier Verification Checklist (Nacao.gov.cn certified)

✅ Book a free Factory Forensic Audit (first 20 readers via SourcifyChina.com/2026Audit)

✅ Attend ICC Webinar: “Blockchain Proofs in China Sourcing” (March 18, 2026)

Data Sources: China General Administration of Customs, Ministry of Commerce ESG Registry, SourcifyChina Audit Database (Jan 2025–Dec 2025). All methodologies align with ISO 20400:2026 Sustainable Procurement Standards.

SOURCIFYCHINA | DE-RISKING GLOBAL SOURCING SINCE 2012

This report is for B2B procurement use only. Not for public distribution. © 2026 SourcifyChina Inc.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary

In today’s fast-evolving global supply chain landscape, identifying a trustworthy sourcing agent in China remains one of the most time-consuming and high-risk challenges for procurement teams. Market saturation, inconsistent supplier quality, and communication gaps often lead to delays, product defects, and increased operational costs.

SourcifyChina’s Verified Pro List addresses these pain points with a data-driven, vetted network of elite sourcing agents—pre-qualified for reliability, compliance, and performance. Leveraging this resource eliminates the need for costly trial-and-error, accelerates time-to-market, and ensures supply chain resilience in 2026 and beyond.

Why the Verified Pro List Saves Time and Reduces Risk

| Challenge | Traditional Sourcing Approach | SourcifyChina’s Solution | Time Saved* |

|---|---|---|---|

| Agent Vetting | 3–6 weeks of due diligence, reference checks, and factory audits | Instant access to pre-vetted, contract-bound agents | Up to 40+ hours per search |

| Language & Communication Barriers | Misalignment in specs, delays in responses | English-speaking, culturally aligned agents with documented SLAs | 30–50% faster resolution |

| Quality Assurance | Post-shipment audits, defect recalls | Real-time QC reporting and factory oversight | Up to 70% reduction in defects |

| Contract & Compliance Risk | Legal exposure from unverified agreements | Standardized contracts, IP protection, and compliance checks | Eliminates legal review delays |

*Based on average procurement cycle data from 2025 client engagements.

Key Advantages for Procurement Leaders

- Accelerated Onboarding: Begin production within 10–14 days vs. industry average of 6–8 weeks.

- Transparent Performance Tracking: Access to agent KPIs, client reviews, and audit trails.

- Scalable Support: Match with agents specializing in your industry—electronics, textiles, industrial components, and more.

- Cost Control: Reduce hidden costs from rework, delays, and compliance failures.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t let inefficient agent selection compromise your procurement goals. The SourcifyChina Verified Pro List is your competitive advantage—engineered for speed, reliability, and compliance in high-stakes sourcing environments.

Take the next step now:

– ✅ Request your free agent shortlist tailored to your product category

– ✅ Speak with our sourcing specialists for a no-obligation consultation

– ✅ Secure faster, safer, and smarter supply chains in China

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Act now—qualified inquiries receive priority access to our 2026 Pro List updates and Q1 factory capacity alerts.

SourcifyChina

Trusted by Procurement Leaders in 38 Countries

Est. 2014 | Shenzhen • Los Angeles • Rotterdam

🧮 Landed Cost Calculator

Estimate your total import cost from China.