The global satellite communication market is experiencing robust expansion, driven by increasing demand for high-speed data transmission across aerospace, defense, and broadcast sectors. According to a 2023 report by Mordor Intelligence, the global satellite communication market is projected to grow at a CAGR of nearly 7.2% from 2023 to 2028, with LNBs (Low Noise Block downconverters) playing a critical role in enhancing Ku-band signal reception. As satellite-based internet services and direct-to-home (DTH) broadcasting proliferate—particularly in emerging economies—the demand for high-performance Ku-band LNBs has surged. Grand View Research further supports this outlook, noting that the satellite market size was valued at USD 143.2 billion in 2022 and is expected to expand at a CAGR of 5.6% through 2030, fueled by advancements in miniaturized, low-noise components. In this evolving landscape, several manufacturers have emerged as leaders in innovation, reliability, and global market reach. Below are the top 5 LNB Ku-band manufacturers shaping the industry’s future.

Top 5 Lnb Ku Band Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 VSAT Components

Website: nisshinbo-microdevices.co.jp

Key Highlights: Nisshinbo Micro Devices is the only Japanese manufacturer – and one of the few specialized manufacturers in the world – to provide components essential for VSAT ……

#2 Satellite Communications

Website: pals.com.tr

Key Highlights: Ku-Band, Universal 2LO PLL LNB – Input Voltage (High/Low), NJR2843 series … PALS is a manufacturer of satellite and broadcast products and turnkey systems ……

#3 Ku Equipment

Domain Est. 1995

Website: idirect.net

Key Highlights: Our line of Ku equipment is specifically tailored around the capabilities of our satellite routers to produce excellent and performance….

#4 LNB

Domain Est. 1995

Website: smw.se

Key Highlights: With professional LNBs from C-Band to Q-Band, we have state-of-the-art products for various satellite communication earth station applications….

#5 Satellite TV Solutions – Products

Domain Est. 2003

Website: mtigroup.com

Key Highlights: MTI has been a leading LNB (Low Noise Block Downconverter) supplier, designing and manufacturing complete LNB products to meet the various frequency ……

Expert Sourcing Insights for Lnb Ku Band

H2: Market Trends for LNB Ku Band in 2026

As the global demand for high-speed connectivity and satellite-based services continues to expand, the market for Low-Noise Block Downconverters (LNBs) in the Ku band is poised for significant evolution by 2026. Driven by advancements in satellite technology, increasing broadband penetration in remote areas, and the proliferation of direct-to-home (DTH) television services, the Ku band LNB market is expected to experience steady growth and transformation during the second half (H2) of 2026.

1. Growth in Satellite Broadband and VSAT Deployments

In H2 2026, the demand for Ku band LNBs will be significantly influenced by the expansion of satellite broadband networks, particularly in underserved and rural regions. With Low Earth Orbit (LEO) satellite constellations like Starlink and OneWeb ramping up services, there is a complementary need for ground infrastructure, including high-performance Ku band LNBs. Enterprises, maritime operators, and aviation sectors are increasingly adopting Very Small Aperture Terminal (VSAT) systems, which rely on Ku band LNBs for reliable signal reception. This trend is expected to boost both volume and technological sophistication in LNB design.

2. Technological Advancements and Miniaturization

By H2 2026, manufacturers are focusing on integrating advanced semiconductor materials (e.g., GaAs and SiGe) to improve noise figures and power efficiency in Ku band LNBs. There is also a growing trend toward compact, ultra-low phase noise LNBs suitable for mobile and portable applications. Innovations such as dual-band (Ku/Ka) LNBs and smart LNBs with built-in signal diagnostics are gaining traction, offering improved user experience and simplified installation.

3. Regional Market Dynamics

Asia-Pacific and Africa are expected to emerge as key growth regions for Ku band LNBs in H2 2026. Government initiatives to bridge the digital divide, coupled with rising DTH subscriptions in countries like India, Indonesia, and Nigeria, will drive demand. In contrast, mature markets in North America and Europe will see moderate growth, primarily fueled by replacements and upgrades to support higher bandwidth services and 4K/8K satellite TV.

4. Impact of 5G and Hybrid Networks

While terrestrial 5G networks are expanding, they are not always feasible in remote or geographically challenging areas. This limitation reinforces the relevance of satellite communication, where Ku band LNBs play a critical role. Hybrid networks combining 5G backhaul with satellite links are expected to emerge, increasing the need for interoperable and high-reliability LNB units capable of handling dynamic bandwidth allocation.

5. Sustainability and Cost Optimization

In response to environmental concerns and supply chain volatility, LNB manufacturers are prioritizing energy-efficient designs and recyclable materials. Additionally, the shift toward automated production and modular designs is helping reduce costs, making Ku band LNBs more accessible in price-sensitive markets.

6. Competitive Landscape

The market will see intensified competition among key players such as Avlite Systems, Titanium, and CTT in H2 2026. Strategic partnerships with satellite operators and integration with IoT-enabled monitoring systems are becoming differentiators. Smaller innovators are also entering the space with specialized LNBs for niche applications like UAVs and mobile broadcasting.

Conclusion:

In H2 2026, the Ku band LNB market will be shaped by digital inclusion initiatives, technological innovation, and the growing synergy between satellite and terrestrial networks. While challenges such as spectrum congestion and component shortages persist, the overall outlook remains positive, with steady growth expected across emerging economies and specialized applications. Stakeholders who invest in R&D, sustainability, and strategic market positioning are likely to capture significant value in this evolving landscape.

Common Pitfalls When Sourcing LNB Ku Band (Quality, IP)

Sourcing LNB (Low Noise Block) converters for the Ku band requires careful attention to ensure optimal signal reception and long-term reliability. Overlooking key factors related to quality and IP (Ingress Protection) ratings can lead to poor performance, frequent failures, and increased maintenance costs. Below are common pitfalls to avoid:

Choosing Low-Cost, Poor-Quality Components

Opting for the cheapest available LNBs often results in subpar materials, inconsistent frequency stability, and higher noise figures. These issues degrade signal quality, especially in weak signal conditions, leading to pixelation or complete signal loss.

Ignoring Noise Figure Specifications

The noise figure determines how much signal degradation the LNB introduces. A higher noise figure reduces sensitivity. Sourcing LNBs without verifying that the noise figure is within acceptable Ku band ranges (typically 0.7dB to 1.5dB) can severely impact reception quality.

Overlooking Local Frequency Band Requirements

Ku band frequencies vary by region (e.g., 10.7–12.75 GHz in most areas, but specific segments like FSS, BSS, or commercial VSAT bands differ). Using an LNB not tuned to the target frequency range results in inability to receive desired channels or services.

Assuming All LNBs Are Weather-Resistant

Not all LNBs are built to withstand harsh outdoor conditions. Failing to verify the IP (Ingress Protection) rating—especially resistance to dust and moisture—can lead to water ingress, corrosion, and premature failure. An IP65 or higher rating is recommended for outdoor installations.

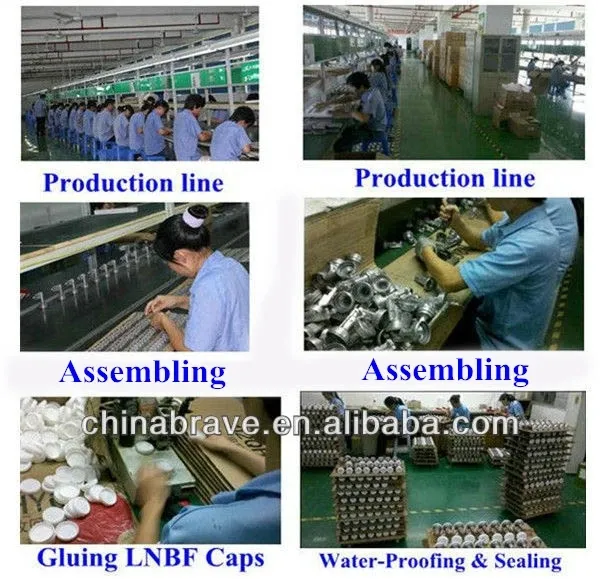

Neglecting Build Quality and Sealing Integrity

Even with a good IP rating, poor manufacturing (e.g., inadequate sealing around the F-connector or housing joints) can allow moisture penetration. Always assess the physical build, including O-ring quality and housing material, to ensure durability.

Purchasing Counterfeit or Non-Certified Units

The market is flooded with counterfeit LNBs that mimic reputable brands but use inferior internal components. These often lack proper regulatory certifications (such as CE, FCC, or RoHS), increasing the risk of poor performance and non-compliance with local regulations.

Overlooking Local Voltage and Polarization Compatibility

Ku band LNBs require specific voltage inputs (usually 13V/18V for vertical/horizontal polarization) and may support tone burst or DiSEqC for switching. Incompatible LNBs won’t communicate properly with the satellite receiver, leading to signal switching failures.

Failing to Verify Long-Term Supplier Reliability

Sourcing from unreliable suppliers may result in inconsistent product quality, lack of technical support, and difficulty obtaining replacements or warranties. Always vet suppliers for reputation, consistency, and after-sales service.

Not Testing Samples Before Bulk Orders

Skipping sample testing before large purchases can result in mass deployment of faulty or underperforming units. Always conduct field tests under real-world conditions to validate signal strength, stability, and environmental resilience.

Avoiding these pitfalls ensures reliable, high-performance satellite reception and reduces lifecycle costs in both consumer and commercial applications.

Logistics & Compliance Guide for LNB Ku Band

Overview of LNB Ku Band

A Low-Noise Block Downconverter (LNB) for the Ku band (10.7–12.75 GHz) is a critical component in satellite communication systems, commonly used in VSAT, direct-to-home (DTH) television, and broadband services. Proper logistics planning and compliance with international regulations are essential for the legal import, export, and operation of Ku band LNBs.

Regulatory Compliance

Ku band LNBs are subject to various national and international regulations due to their use in satellite communications. Key compliance areas include:

Export Control Regulations

- ITAR (International Traffic in Arms Regulations): Most commercial Ku band LNBs are not ITAR-controlled, but high-gain or military-spec models may fall under USML (U.S. Munitions List). Verify classification under the CCL (Commerce Control List).

- EAR (Export Administration Regulations): Commercial LNBs typically fall under ECCN 5A991.b.1 (satellite communication equipment) and may be eligible for license exceptions (e.g., LVS, BAG) depending on destination and value.

- Dual-Use Considerations: Ensure the LNB does not incorporate encryption or signal processing features that could trigger stricter controls.

Frequency and Spectrum Compliance

- ITU Regulations: The Ku band is internationally allocated by the International Telecommunication Union (ITU). Local licensing is required for satellite uplink/downlink operations.

- National Spectrum Authorities: Devices must comply with national regulations (e.g., FCC in the USA, Ofcom in the UK, TRA in UAE). Confirm that the LNB model is approved for use in the destination country.

- Type Approval: Many countries require type approval or certification for satellite reception equipment. Provide manufacturer certification (e.g., FCC ID, CE marking) during import.

Import and Customs Requirements

Documentation

- Commercial Invoice (with full technical specs and HS code)

- Packing List

- Certificate of Origin

- FCC/CE/ROHS Certifications (as applicable)

- Technical Datasheet (to clarify non-ITAR status)

Harmonized System (HS) Code

- Typical HS Code: 8543.70.90 (Other apparatus for transmission or reception of voice, images, or other data, for wired or wireless networks)

- Alternative: 8529.90.80 (Parts of radar, radio navigational aid, or radio remote control apparatus)

Note: Confirm local classification with customs broker.

Duties and Taxes

- Duty rates vary by country. Some regions (e.g., ASEAN, GCC) offer reduced or zero tariffs on telecom equipment.

- VAT or GST typically applies unless exempted under special import schemes (e.g., for licensed operators).

Packaging and Handling

- ESD Protection: LNBs are sensitive to electrostatic discharge. Use anti-static packaging and labeling.

- Environmental Protection: Protect from moisture and extreme temperatures during transit. Include desiccant if shipping long distances.

- Fragile Labeling: Clearly mark packages as fragile and indicate correct orientation.

Shipping and Transportation

- Mode of Transport: Air freight recommended for urgent deliveries; sea freight for bulk shipments.

- Carrier Requirements: Inform carriers if goods are electronic and potentially sensitive.

- Customs Clearance: Use a licensed customs broker familiar with telecom equipment to avoid delays. Provide technical documents proactively.

End-Use and Installation Compliance

- Licensing: End users must have valid satellite reception licenses where required (e.g., for C-band or data services).

- Antenna Alignment: Ensure installation complies with national technical standards to avoid interference.

- Prohibited Uses: Ku band LNBs must not be used for unauthorized signal interception or decryption.

Recordkeeping and Audits

- Maintain export records for at least 5 years (per EAR requirements).

- Document end-user information and certifications for audit purposes.

- Track shipments using unique identifiers for traceability.

Conclusion

Compliance in the logistics of Ku band LNBs involves understanding export controls, spectrum regulations, customs procedures, and proper handling. Partnering with experienced freight forwarders, customs brokers, and legal advisors ensures smooth international movement and adherence to all regulatory frameworks. Always verify current regulations in both origin and destination countries prior to shipment.

Conclusion for Sourcing LNB Ku Band:

Sourcing a Ku-band LNB (Low Noise Block downconverter) requires careful consideration of technical specifications, quality, reliability, and supplier credibility to ensure optimal satellite signal reception. Key factors such as frequency range (typically 10.7–12.75 GHz), local oscillator stability, noise figure (preferably below 0.2 dB for high performance), and compatibility with existing satellite systems are crucial in selecting the right LNB.

It is advisable to source from reputable manufacturers or authorized distributors to guarantee genuine products that meet international standards (e.g., ETSI, FCC). Additionally, evaluating cost-effectiveness, warranty terms, and after-sales support helps mitigate risks associated with counterfeit or substandard components.

In conclusion, a strategic sourcing approach—balancing performance, reliability, and supplier reputation—ensures the successful integration of Ku-band LNBs into satellite communication systems, supporting efficient TV broadcasting, broadband services, and VSAT applications in diverse environments.