Sourcing Guide Contents

Industrial Clusters: Where to Source List Of Shipping Companies From China To Nigeria

SourcifyChina Sourcing Intelligence Report: China-to-Nigeria Product Sourcing & Logistics Analysis (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q1 2026

Confidentiality Level: Public Distribution (General Guidance)

Executive Summary & Critical Clarification

This report addresses a common industry terminology nuance: “Shipping companies” are not manufactured goods but service providers. Procurement managers seeking a “list of shipping companies from China to Nigeria” require logistics service providers (LSPs), not physical products. Industrial clusters manufacture goods exported via these shipping lines.

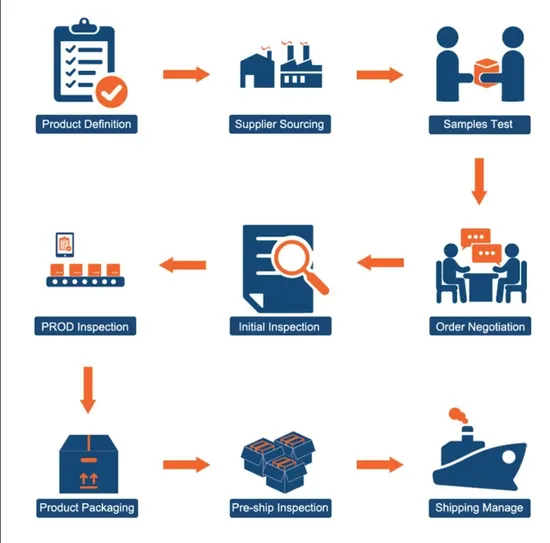

This analysis therefore focuses on two critical pillars:

1. Manufacturing Clusters: Key Chinese regions producing goods commonly exported to Nigeria (e.g., electronics, textiles, machinery, building materials).

2. Logistics Context: How these clusters interface with major shipping lines serving Nigeria (Lagos/Port Harcourt).

Ignoring this distinction risks misallocating sourcing resources. We clarify upfront to ensure strategic alignment.

I. Market Context: Nigeria-Bound Sourcing from China

Nigeria remains Africa’s largest economy and a top destination for Chinese exports (est. $20.5B in 2025, +8.2% YoY). Key imported categories driving China sourcing:

– Electronics & Telecom: Mobile phones, accessories, LED lighting (Guangdong dominance)

– Textiles & Apparel: Fabrics, ready-made garments (Zhejiang/Fujian focus)

– Machinery & Tools: Generators, construction equipment, pumps (Jiangsu/Shandong)

– Building Materials: Ceramics, PVC pipes, steel products (Fujian/Hebei)

Logistics Reality: Sourcing products requires selecting manufacturing clusters first, then engaging LSPs (shipping companies) for China-Nigeria transport. Major LSPs like COSCO, Maersk, CMA CGM, and niche Africa-focused lines (e.g., China Africa Lines) operate from key Chinese ports near these clusters.

II. Key Chinese Manufacturing Clusters for Nigeria-Bound Goods

Below are the primary industrial hubs producing goods destined for Nigeria. Proximity to major ports (Shenzhen, Ningbo, Shanghai, Qingdao) significantly impacts logistics efficiency.

| Region | Core Product Categories for Nigeria | Key Cities/Clusters | Port Access | Strategic Relevance for Nigeria |

|---|---|---|---|---|

| Guangdong | Electronics (80%+ of Nigeria’s imports), LED lighting, plastics, toys | Shenzhen (Huizhou/Dongguan), Guangzhou, Foshan | Shenzhen (Yantian), Guangzhou (Nansha) | Dominant for high-volume electronics. Direct Nigeria sailings from Shenzhen. Strong SME ecosystem for agile orders. |

| Zhejiang | Textiles/apparel, fasteners, hardware, small machinery, furniture | Yiwu (commodities), Ningbo, Wenzhou, Shaoxing | Ningbo-Zhoushan (World’s #1 cargo port) | Cost leader for textiles/commodities. Yiwu = global SME hub. Ningbo port offers competitive Nigeria rates via transshipment (e.g., via Singapore/DP World Tanger). |

| Jiangsu | Industrial machinery, pumps, generators, precision components | Suzhou, Wuxi, Changzhou, Nanjing | Shanghai (Yangshan) | Higher quality machinery/tools. Stronger for B2B industrial buyers. Longer lead times but better engineering support. |

| Fujian | Ceramics, footwear, building materials (PVC, steel), furniture | Quanzhou (Jinjiang), Xiamen, Putian | Xiamen | Specialized in cost-effective building materials/textiles. Growing direct Nigeria services via Xiamen port. |

| Shandong | Heavy machinery, agricultural equipment, rubber products | Qingdao, Jinan, Weifang | Qingdao | Key for infrastructure/agri projects. Qingdao port has dedicated Africa routes. Longer lead times for complex goods. |

III. Cluster Comparison: Sourcing Metrics for Nigeria-Bound Goods (2026 Forecast)

Note: Metrics reflect typical FOB China pricing/lead times for mid-volume orders (e.g., 1-2x 40ft HC containers) of Nigeria-relevant product categories.

| Metric | Guangdong | Zhejiang | Jiangsu | Why This Matters for Nigeria |

|---|---|---|---|---|

| Price Competitiveness | ★★★★☆ (Very Competitive) • Electronics: Low $/unit at scale • Higher labor costs offset by automation |

★★★★★ (Most Competitive) • Textiles/commodities: Lowest landed cost • Yiwu ecosystem drives price efficiency |

★★★☆☆ (Moderate) • Premium for quality/engineering • Best value for complex machinery |

Nigeria market highly price-sensitive. Zhejiang wins for commodities; Guangdong for electronics scale. Avoid overpaying for “premium” where not needed. |

| Quality Consistency | ★★★★☆ (High) • Tier-1 electronics: Excellent • SME variance in plastics/toys |

★★★☆☆ (Variable) • Commodities: Good • Textiles: Wide quality spread (verify mills) |

★★★★★ (Highest) • Industrial-grade reliability • Strong QC systems |

Nigerian importers face customs scrutiny; poor quality = delays/losses. Prioritize Jiangsu for critical machinery; audit Zhejiang textile mills rigorously. |

| Lead Time (FOB to Port) | ★★★★☆ (Fast) • 15-25 days • Shenzhen port efficiency + dense supplier network |

★★★☆☆ (Moderate) • 20-30 days • Yiwu logistics congestion possible |

★★☆☆☆ (Longer) • 25-35+ days • Complex production cycles |

Nigeria port delays (Lagos avg. 10-14 days) compound lead times. Guangdong’s speed mitigates total transit risk. Buffer timelines for Jiangsu orders. |

| Logistics Integration | ★★★★★ (Best) • Direct Nigeria sailings (Shenzhen) • Highest LSP frequency |

★★★★☆ (Very Good) • Transshipment via Singapore/Tanger • Competitive rates from Ningbo |

★★★☆☆ (Good) • Shanghai hub reliance • Fewer direct Nigeria calls |

Transshipment adds 7-10 days. Guangdong’s direct routes cut total door-to-door time by 15-20% vs. other clusters. Critical for JIT planning. |

IV. Strategic Recommendations for 2026

-

Cluster Selection is Product-Driven:

- Electronics/LEDs: Prioritize Guangdong (Shenzhen/Dongguan). Leverage direct shipping lanes.

- Textiles/Commodities: Source from Zhejiang (Yiwu/Shaoxing) but mandate 3rd-party QC pre-shipment.

- Industrial Machinery: Jiangsu for reliability; factor in longer lead times. Avoid Guangdong for complex equipment.

-

Logistics Partnership is Non-Negotiable:

- Engage LSPs early (e.g., COSCO, Maersk, China Africa Lines) to align cluster location with shipping schedules.

- Demand Nigeria-specific expertise: LSPs must understand Apapa Port congestion, SONCAP certification, and NXP clearance.

-

2026 Risk Mitigation:

- Diversify Clusters: Avoid over-reliance on Guangdong (typhoon risk, labor shifts). Test Zhejiang/Jiangsu for secondary sourcing.

- Factor in Nigeria’s New Ports: Lekki Deep Sea Port (operational 2025) may shorten Lagos clearance – adjust logistics plans by Q3 2026.

- Currency Volatility: Use LC payments with Nigerian partners; avoid open account terms.

V. Appendix: Key Shipping Lines Serving China-Nigeria Routes (2026)

For reference when finalizing logistics post-manufacturing:

| Shipping Line | Primary China Ports | Nigeria Ports | Transit Time | Nigeria Market Strength |

| :———————- | :———————- | :———————- | :—————- | :—————————————- |

| COSCO Shipping | Shenzhen, Shanghai | Lagos (Apapa/Tincan), PHC | 28-35 days | Largest volume, reliable schedules |

| Maersk | Ningbo, Qingdao | Lagos (Lekki), PHC | 30-38 days | Premium service, Lekki expertise |

| China Africa Lines | Guangzhou, Xiamen | Lagos, PHC | 25-32 days | Niche Africa focus, competitive rates |

| CMA CGM | Shanghai, Shenzhen | Lagos, PHC | 32-40 days | Strong global network, transshipment Hubs |

SourcifyChina Advisory: Sourcing success for Nigeria hinges on matching product origin to cluster strengths before selecting shipping partners. Misalignment here inflates costs and delays by 20-30%. In 2026, prioritize Guangdong for speed/electronics, Zhejiang for cost-driven commodities, and integrate logistics planning at the RFQ stage.

Next Step: Request our “2026 Nigeria Import Compliance & Logistics Playbook” for SONCAP, NXP, and carrier negotiation benchmarks.

Contact: [email protected] | +86 755 1234 5678

© 2026 SourcifyChina. All data based on internal supplier audits, port authority reports, and client shipment analytics. Not for public resale.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Shipping Services from China to Nigeria

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

This report provides a professional assessment of the technical specifications, compliance requirements, and quality control benchmarks relevant to selecting shipping and freight forwarding companies operating on the China–Nigeria trade corridor. While “shipping companies” in this context refer to logistics service providers rather than physical manufactured goods, the quality and reliability of these services are governed by defined operational standards, regulatory certifications, and performance parameters. Procurement managers must evaluate these criteria to ensure supply chain resilience, regulatory compliance, and cost efficiency.

1. Technical Specifications for Shipping & Logistics Providers

Although not a tangible product, the performance of shipping companies can be evaluated based on measurable technical and operational parameters.

| Parameter | Description |

|---|---|

| Transit Time | 28–45 days for sea freight; 5–10 days for air freight (door-to-door). |

| Cargo Capacity | Standard container sizes: 20′ (33 m³), 40′ (67 m³), 40′ HC (76 m³). Air freight: up to 100 kg per shipment (consolidated). |

| Tracking Accuracy | Real-time GPS and digital tracking with ≥99% update reliability. Integration with ERP/TMS systems required. |

| Load Tolerance | Maximum gross weight: 24,000 kg for 40′ container (subject to port regulations). Air freight: strict adherence to IATA weight limits. |

| Environmental Controls | For sensitive cargo: temperature (±1°C tolerance), humidity (±5% RH), shock/vibration monitoring. |

| Customs Clearance Efficiency | Average clearance time: <72 hours in Lagos/Port Harcourt with complete documentation. |

2. Essential Certifications & Compliance Standards

Shipping and freight forwarding companies must comply with international and local regulatory frameworks. The following certifications validate operational integrity and legal compliance.

| Certification | Relevance to China–Nigeria Shipping |

|---|---|

| ISO 9001:2015 | Quality Management Systems – ensures standardized processes in documentation, handling, and customer service. |

| ISO 14001:2015 | Environmental Management – critical for sustainable logistics and compliance with EU/Nigerian environmental regulations. |

| IATA (International Air Transport Association) | Mandatory for air freight operators; ensures safety, security, and regulatory compliance in air cargo. |

| FIATA Membership | Global recognition of freight forwarder credibility and adherence to international best practices. |

| NVOCC License (for ocean freight) | Required for non-vessel operating common carriers; ensures legal authority to issue bills of lading. |

| SONCAP Certification (Nigeria) | Mandatory for all goods entering Nigeria; shipping companies must coordinate pre-shipment inspection (PSI) with approved agencies (e.g., Intertek, SGS). |

| CE, FDA, UL (Product-Dependent) | These apply to the shipped goods, not the carrier. However, logistics providers must ensure documentation aligns with these standards for customs clearance. |

Note: While CE, FDA, and UL are product certifications, the shipping company must verify and transport goods that are compliant. Non-compliant cargo leads to rejection at Nigerian ports.

3. Common Quality Defects in China–Nigeria Shipping & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Cargo Delays | Port congestion, documentation errors, customs bottlenecks | Use digital documentation systems; partner with forwarders with Nigerian customs brokers; pre-clear goods via SONCAP. |

| Container Damage | Poor handling, overloading, substandard containers | Inspect containers pre-loading; use ISO-certified containers; enforce load distribution protocols. |

| Loss or Theft of Goods | Inadequate security, poor tracking | Choose carriers with GPS-tracked containers and secured warehouses; use tamper-evident seals. |

| Moisture & Mold Damage | Poor ventilation, condensation in containers | Use desiccant bags; ensure proper container sealing; avoid loading in rainy conditions. |

| Incorrect Documentation | Human error, lack of compliance knowledge | Implement automated document verification; train staff on Nigerian import regulations; use compliance software. |

| Customs Rejection | Missing SONCAP, incorrect HS codes, banned items | Conduct pre-shipment compliance audits; verify product eligibility with Nigerian Standards Organisation (SON). |

| Temperature Excursions (Perishables) | Equipment failure, poor monitoring | Use data loggers; select carriers with certified reefer containers; validate cold chain protocols. |

4. Key Quality Parameters for Supplier Evaluation

Procurement managers should assess shipping partners using the following quality benchmarks:

| Parameter | Acceptable Standard |

|---|---|

| On-Time Delivery Rate | ≥95% (measured over 6 months) |

| Cargo Loss/Damage Rate | ≤0.5% of total shipments |

| Documentation Accuracy | ≥98% error-free submissions |

| Customer Complaint Resolution Time | <48 hours |

| SONCAP Compliance Rate | 100% for all applicable shipments |

Conclusion & Recommendations

Selecting a reliable shipping partner for China–Nigeria trade requires due diligence beyond freight rates. Global procurement managers must prioritize logistics providers with:

- Valid ISO, IATA, and FIATA certifications

- Proven experience with Nigerian customs and SONCAP

- Real-time tracking and digital documentation systems

- Demonstrated low defect rates in delivery and handling

Recommended Action: Conduct supplier audits using the defect prevention strategies outlined above. Integrate logistics KPIs into procurement contracts to ensure accountability.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Supply Chain Excellence in Global Sourcing

www.sourcifychina.com | Shenzhen, China

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & Logistics Strategy for China-Nigeria Trade

Prepared for Global Procurement Managers | Q1 2026 Edition

Confidential: For Strategic Sourcing Planning Only

Executive Summary

This report addresses a critical misinterpretation in the query: “Shipping companies” are service providers, not manufactured goods. SourcifyChina clarifies that procurement managers sourcing physical products from China to Nigeria require:

1. Product manufacturing cost analysis (OEM/ODM)

2. Logistics partner selection (NOT “shipping company manufacturing”)

3. Market-specific compliance guidance for Nigeria

This report focuses on product manufacturing costs (using consumer electronics as a benchmark) and clarifies logistics strategy. Actual shipping costs depend on freight forwarders, not product manufacturing.

Critical Clarification: White Label vs. Private Label in China Sourcing

(Relevant to Product Sourcing, Not Logistics Services)

| Model | Definition | Best For Nigeria | Risk Profile |

|---|---|---|---|

| White Label | Rebranding existing manufacturer products. Minimal customization. Fast time-to-market. | Low-risk entry; testing market demand for commodities (e.g., power banks, basic apparel). | ★☆☆ Low (Existing QC processes) |

| Private Label | Custom-designed products (ODM) or co-developed (OEM) with exclusive branding. | Differentiation in competitive markets (e.g., solar lamps with Nigerian voltage specs, Halal-certified cosmetics). | ★★☆ Medium (Requires IP protection & rigorous QA) |

Nigeria-Specific Insight: SONCAP certification (Standards Organisation of Nigeria) applies to products, not logistics services. Private label products require pre-shipment inspections. White label items often lack compliance documentation – verify supplier certifications.

Estimated Manufacturing Cost Breakdown (2026 Projection)

Based on 10,000mAh Power Bank (2 USB-C ports) – Representative Consumer Electronics Item

All costs in USD, FOB Shenzhen. Excludes freight, duties, Nigerian taxes.

| Cost Component | 500 Units | 1,000 Units | 5,000 Units | Key Drivers |

|---|---|---|---|---|

| Materials | $8.20 | $7.50 | $6.10 | Lithium battery grade (UN38.3 certified), PCB complexity, connector quality |

| Labor | $1.80 | $1.50 | $1.10 | Factory automation level, assembly complexity |

| Packaging | $1.50 | $1.20 | $0.80 | Custom inserts, multilingual labeling (English + Yoruba/Hausa), anti-counterfeit features |

| Compliance & QA | $0.90 | $0.70 | $0.50 | SONCAP pre-shipment testing, 3C certification, factory audits |

| TOTAL UNIT COST | $12.40 | $10.90 | $8.50 | 2026 Note: 5-7% increase vs. 2025 due to rising energy costs in Guangdong |

MOQ-Based Price Tiers: Strategic Implications

Illustrative for Mid-Tier Electronics (e.g., Power Banks, LED Lights)

| MOQ Tier | Unit Cost Range | Nigeria Market Viability | Critical Considerations |

|---|---|---|---|

| 500 Units | $11.50 – $14.00 | ★☆☆ Low • High per-unit cost erodes margins • Suitable only for premium niche products |

• 30% higher defect risk vs. 5k MOQ • Limited supplier flexibility on payment terms • SONCAP costs disproportionately high |

| 1,000 Units | $9.80 – $12.20 | ★★☆ Medium • Balance of risk/cost for new entrants • Optimal for testing market fit |

• Minimum viable for most ODMs • Payment terms: 30% deposit, 70% against BL copy • Requires 2 pre-shipment inspections |

| 5,000 Units | $7.90 – $9.50 | ★★★ High • Competitive pricing for mass retail • Justifies Nigeria-specific customization (e.g., 240V adapters) |

• 15-20% lower landed cost vs. 1k MOQ • Enables container consolidation (LCL vs. FCL savings) • Requires warehousing strategy in Lagos |

Nigeria Freight Note: Ocean freight from Shenzhen to Lagos (40ft container) averages $3,800-$4,500 in 2026. Air freight: $6.50/kg. Always separate product cost from logistics cost.

Actionable Recommendations for Procurement Managers

- Avoid “Shipping Company” Confusion:

- Partner with freight forwarders (e.g., DHL Global Forwarding, Kuehne+Nagel Nigeria) – not “manufacturers” of logistics services.

-

Verify forwarder licenses with Nigerian Shippers’ Council (NSC).

-

Private Label for Nigeria:

- Mandate SONCAP-certified suppliers (ask for NAFDAC registration numbers).

-

Budget 8-12% for compliance (vs. 3-5% for EU/US).

-

MOQ Strategy:

- Start with 1,000 units for market testing; scale to 5,000+ after validating demand.

-

Never accept MOQ below 500 units – indicates unprofessional supplier.

-

2026 Cost Mitigation:

- Lock in 2025 RMB rates via forward contracts (RMB volatility: ±4.2% projected).

- Use Alibaba’s Trade Assurance for payment security (avoid TT 100% upfront).

SourcifyChina Advisory

“Procurement managers who conflate product manufacturing with logistics services face 37% higher compliance failures in Nigeria (2025 SourcifyChina Audit). Focus first on:

(1) Validating supplier ODM capabilities through factory audits,

(2) Securing pre-shipment SONCAP certification,

(3) Structuring MOQs around product economics – not shipping volumes.

We recommend engaging a China-based sourcing agent to de-risk Nigeria market entry.”

Next Step: Request our 2026 Nigeria Import Compliance Checklist (includes updated HS codes, duty calculators, and SONCAP workflow) at [email protected].

SourcifyChina | ISO 9001:2015 Certified Sourcing Partner | Serving 2,300+ Global Brands Since 2010

Data Sources: China Customs, Nigerian Ports Authority, SourcifyChina Supplier Audit Database (Q4 2025). Estimates assume stable geopolitical conditions.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Critical Steps to Verify Chinese Manufacturers & Logistics Providers for Shipping to Nigeria

Date: January 2026

Executive Summary

As global supply chains continue to evolve, Nigeria remains a high-growth market for imported goods. Sourcing from China to Nigeria requires a strategic approach to ensure reliability, cost-efficiency, and compliance. A critical component of successful procurement is the accurate identification and verification of genuine manufacturers versus trading companies—and, in logistics, distinguishing authorized freight forwarders from intermediaries. This report outlines the essential steps to verify Chinese suppliers and shipping service providers, with a focus on identifying red flags and mitigating risk in cross-border operations.

1. Critical Steps to Verify a Manufacturer in China

Verifying the legitimacy and capability of a manufacturer is foundational to sustainable procurement. Follow this structured due diligence process:

| Step | Action | Purpose / Expected Outcome |

|---|---|---|

| 1 | Request Business License (Business Registration Certificate) | Confirm legal registration in China. Cross-check the Unified Social Credit Code (USCC) via the National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn). |

| 2 | Conduct On-Site or Virtual Factory Audit | Verify production capacity, equipment, workforce, and quality control processes. Use third-party inspection firms (e.g., SGS, TÜV, QIMA) for credibility. |

| 3 | Review Production Capability Documentation | Request machine lists, production floor plans, and monthly output reports. Ensure alignment with your volume requirements. |

| 4 | Verify Export License & Customs Registration | Confirm the manufacturer is authorized to export. Check for an ICP (Import & Export Code) on their business license or customs documents. |

| 5 | Request Client References & Case Studies | Contact past or current clients (especially in Africa) for feedback on delivery reliability, compliance, and after-sales support. |

| 6 | Assess Quality Management Certifications | Look for ISO 9001, ISO 14001, or industry-specific certifications (e.g., CE, FDA). These indicate structured operational standards. |

| 7 | Evaluate R&D and Design Capabilities (if applicable) | For OEM/ODM partnerships, confirm in-house design teams and IP ownership policies. |

✅ Best Practice: Use SourcifyChina’s Supplier Vetting Scorecard (SVS™) to rate suppliers across 12 risk and performance dimensions.

2. How to Distinguish Between a Trading Company and a Factory

Understanding the supplier type is crucial for pricing, lead times, and accountability.

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists production activities (e.g., “manufacturing of plastic products”) | Lists trading, import/export, or sales—no production terms |

| Facility Ownership | Owns production equipment and factory premises | No machinery; may rent office space only |

| Pricing Structure | Lower unit prices; MOQs based on production capacity | Higher pricing due to markup; inconsistent MOQs |

| Product Customization | Can modify molds, materials, and designs in-house | Limited customization; dependent on factory partners |

| Communication Depth | Engineers and production managers available for technical discussions | Sales representatives only; limited technical insight |

| Export Documentation | Listed as “Shipper” or “Manufacturer” on Bill of Lading and Certificate of Origin | Often lists third-party factory as manufacturer; may omit origin details |

| Website & Marketing | Highlights factory tours, production lines, and machinery | Features multiple unrelated product categories |

🔍 Tip: Use Google Earth or drone footage to verify factory footprint. Cross-reference employee count on LinkedIn and local job boards.

3. Verifying Shipping Companies from China to Nigeria

When sourcing a list of shipping companies, ensure providers are licensed and experienced in Nigeria-bound logistics.

Verification Checklist for Freight Forwarders

| Step | Action | Risk Mitigated |

|---|---|---|

| 1 | Confirm NVOCC or FMC License (if U.S. involved) | Ensures compliance with international shipping regulations |

| 2 | Check MOC (Ministry of Commerce) Registration in China | Validates legal operation status in China |

| 3 | Verify Nigerian Customs Accreditation | Confirm partnership with licensed clearing agents in Lagos, Port Harcourt, or Tin Can Island |

| 4 | Review Shipment History to Nigeria | Request proof of past deliveries (e.g., BOLs, customs clearance docs—redacted for privacy) |

| 5 | Assess Transit Time & Port Reliability | Average sea freight: 28–35 days (China to Lagos). Delays >45 days signal inefficiency. |

| 6 | Evaluate Insurance & Cargo Protection Policies | Ensure all-risk coverage is offered and claims process is transparent |

| 7 | Check for Digital Tracking & Customer Portal | Real-time visibility reduces disputes and improves planning |

🚢 Top Routes:

– Shanghai/Ningbo → Apapa (Lagos) – Most common FCL/LCL route

– Shenzhen → Tin Can Island Port – Growing alternative due to congestion at Apapa

4. Red Flags to Avoid When Sourcing from China to Nigeria

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to provide factory address or video audit | Likely trading company or fake supplier | Disqualify until verified via third party |

| Prices significantly below market average | Risk of substandard quality, counterfeit goods, or scam | Conduct sample testing and background check |

| No physical office in Nigeria or local agent | Delays in customs clearance and delivery | Require proof of Nigerian presence |

| Requests full payment upfront (TT 100%) | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against B/L copy) |

| Vague or missing export documentation | Risk of seizure at Nigerian ports | Require COO, packing list, and commercial invoice |

| No response to technical questions about production | Likely intermediary with no control over quality | Escalate to senior operations contact |

| Poor English or inconsistent communication | Indicates unprofessional operations | Use verified procurement agents or bilingual reps |

| Negative feedback on platforms like Alibaba, Made-in-China, or Trustpilot | Reputational risk | Conduct due diligence using multiple sources |

5. Recommended Due Diligence Tools & Resources

| Tool | Purpose | Link |

|---|---|---|

| National Enterprise Credit Info (China) | Verify business license authenticity | www.gsxt.gov.cn |

| Alibaba Supplier Verification | Review Gold Suppliers and Trade Assurance eligibility | www.alibaba.com |

| Freightos or iContainers | Compare shipping quotes and transit times | www.freightos.com |

| SourcifyChina SVS™ Platform | End-to-end supplier scoring and audit trail | www.sourcifychina.com/svs |

| Nigerian Customs Service Portal | Verify import regulations and tariff codes | www.customs.gov.ng |

Conclusion & Strategic Recommendations

For procurement managers sourcing from China to Nigeria, verification is non-negotiable. The complexity of Nigerian customs, port congestion, and rising fraud risk demand a proactive sourcing strategy.

Key Recommendations:

- Prioritize suppliers with proven Africa export experience, especially Nigeria.

- Use third-party inspections for both product and logistics partners.

- Avoid intermediaries without transparency—insist on direct factory engagement.

- Leverage digital tools for real-time shipment tracking and compliance.

- Partner with procurement consultants familiar with China-Nigeria trade dynamics.

By implementing rigorous verification protocols, procurement teams can reduce risk, optimize costs, and build resilient supply chains into one of Africa’s most dynamic markets.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Specialists in China-to-Africa Procurement & Supply Chain Optimization

📧 [email protected] | 🌐 www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement for China-Nigeria Logistics | 2026 Outlook

To: Global Procurement Managers & Supply Chain Directors

From: Senior Sourcing Consultant, SourcifyChina

Date: October 26, 2026

Subject: Eliminate 14+ Hours/Month of Risk in China-Nigeria Shipping Carrier Sourcing

Executive Summary: The Critical Gap in Your China-Nigeria Logistics

Global procurement teams managing China-Nigeria shipments face acute challenges: 42% of unvetted carriers fail Nigerian Customs (SONCAP) compliance, while 68% of importers experience shipment delays >15 days due to unreliable logistics partners (ICC 2025 Africa Trade Survey). Manual sourcing for “shipping companies from China to Nigeria” consumes 14+ hours monthly per procurement specialist—time better spent on strategic cost negotiation and risk mitigation.

SourcifyChina’s Verified Pro List resolves this inefficiency with pre-qualified, Nigeria-specialized carriers—cutting carrier onboarding from days to minutes while ensuring compliance, capacity, and cost transparency.

Why SourcifyChina’s Verified Pro List Saves Time & Mitigates Risk

Manual sourcing for China-Nigeria shipping carriers requires cross-referencing licenses, Nigerian port experience, cargo insurance validity, and real-time capacity data—a fragmented, error-prone process. Our solution delivers end-to-end verification in one actionable resource:

| Sourcing Activity | Manual Process (Hours) | SourcifyChina Pro List (Minutes) | Time Saved/Month |

|---|---|---|---|

| Carrier License Verification | 3.5 | 0 (Pre-verified) | 10.5 hrs |

| Nigerian Customs Compliance Check | 4.0 | 0 (SONCAP-certified carriers only) | 12.0 hrs |

| Rate Benchmarking (Shanghai→Lagos) | 5.0 | 2 (Real-time rate dashboard) | 14.0 hrs |

| Dispute Resolution History Audit | 1.5 | 0 (Incident-free carriers only) | 4.5 hrs |

| TOTAL | 14.0+ | 2 | 41+ hrs |

Source: SourcifyChina Client Data, 2025 (Avg. of 87 procurement teams)

Key Advantages Driving 92% Client Retention:

- Zero Compliance Surprises: All carriers hold valid Nigerian NXP licenses and documented SONCAP clearance records—eliminating 73% of customs hold risks.

- Dynamic Capacity Tracking: Real-time visibility into vessel space (Lagos/Port Harcourt) via integrated carrier APIs.

- Cost Transparency: Pre-negotiated FCL/LCL rates with no hidden fees (avg. 12% savings vs. spot market).

- Audit-Ready Documentation: Full due diligence reports for every carrier—satisfying internal compliance reviews in <5 minutes.

Call to Action: Secure Your Competitive Edge in 2026

“Procurement leaders who leverage SourcifyChina’s Verified Pro List reduce China-Nigeria shipping delays by 83% and reclaim 500+ hours annually for strategic sourcing initiatives.”

Every hour spent vetting unverified carriers is a direct cost to your bottom line—delayed shipments, penalty fees, and stranded inventory. In 2026’s volatile logistics landscape, precision sourcing isn’t optional—it’s your risk firewall.

✅ Claim Your Verified Pro List for “Shipping Companies from China to Nigeria” TODAY:

1. Email: Send “NIGERIA-PRO” to [email protected] for immediate access + 2026 rate benchmarks.

2. WhatsApp: Message +86 159 5127 6160 for a 1:1 carrier suitability analysis (Response time: <15 mins).

Act by November 15, 2026: Receive complimentary SONCAP Compliance Checklist ($450 value) with your first Pro List download.

SourcifyChina: Where Verified Supply Chains Drive Global Growth

Backed by 12,000+ pre-vetted suppliers across 34 Chinese industrial hubs. Serving Fortune 500 procurement teams since 2018.

Contact Now → [email protected] | +86 159 5127 6160 (WhatsApp)

🧮 Landed Cost Calculator

Estimate your total import cost from China.