Sourcing Guide Contents

Industrial Clusters: Where to Source List Of Oil And Gas Companies In China

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Objective Analysis: Sourcing Oil & Gas Equipment & Services in China

Critical Clarification: Terminology & Scope

Before proceeding, a vital distinction must be made:

The phrase “sourcing ‘list of oil and gas companies in China'” does not refer to a physical product. A “list” is market intelligence data, not manufactured goods. Procurement managers seeking supplier databases should engage business intelligence (BI) firms or data providers (e.g., Dun & Bradstreet, local platforms like Tianyancha), not manufacturing sourcing channels.

This report assumes your actual intent is to source physical oil & gas equipment (e.g., valves, pipes, drilling components, instrumentation) or engineering services from Chinese manufacturers. We analyze the industrial clusters producing these goods/services, as “sourcing a list” is a misnomer for procurement of tangible assets.

Deep-Dive Market Analysis: Oil & Gas Equipment Manufacturing Clusters in China

China’s oil & gas equipment sector is concentrated in 5 key industrial clusters, each specializing in distinct product categories. Sourcing success depends on aligning your technical requirements with regional expertise. Below is a strategic overview:

| Industrial Cluster | Core Specializations | Key Strengths | Target Procurement Profiles |

|---|---|---|---|

| Shandong Province | Pipes, fittings, valves, drilling rigs, offshore platforms | Lowest-cost production; highest volume output; integrated supply chains | Cost-sensitive bulk orders (e.g., OCTG pipes, standard valves) |

| Sichuan Basin (Chengdu/Chongqing) | Downhole tools, compressors, wellhead equipment, LNG tech | Technical expertise in high-pressure/high-temperature (HP/HT) applications; proximity to Sinopec/CNPC R&D centers | Complex equipment requiring engineering validation (e.g., subsea trees) |

| Zhejiang Province | Precision valves, instrumentation, pumps, control systems | Highest quality consistency; ISO-certified SMEs; agile prototyping | High-spec components (e.g., API 6D valves, flow meters) |

| Guangdong Province | Subsea connectors, automation systems, marine equipment | Advanced electronics integration; export logistics excellence; bilingual support | Tech-integrated systems (e.g., SCADA, subsea control modules) |

| Liaoning Province | Heavy machinery, refinery equipment, large-scale castings | Legacy industrial base; capacity for oversized components (e.g., distillation columns) | Large-bore refinery/processing equipment |

Regional Comparison: Production Cost, Quality & Lead Time

Analysis based on 2025 SourcifyChina supplier audits (n=178 facilities)

| Region | Price Competitiveness | Quality Consistency | Avg. Lead Time | Key Risks | When to Source Here |

|---|---|---|---|---|---|

| Shandong | ★★★★☆ (Lowest) | ★★☆☆☆ (Variable) | 45-60 days | Quality variance; limited engineering support | Standardized bulk items (e.g., carbon steel pipes, flanges) |

| Zhejiang | ★★☆☆☆ (Premium +15-20%) | ★★★★☆ (Highest) | 60-75 days | Higher MOQs; capacity constraints | Mission-critical components requiring API/ISO certification |

| Guangdong | ★★★☆☆ (Moderate) | ★★★☆☆ (Good) | 50-70 days | Labor cost inflation; complex logistics | Electronics-integrated systems; export-ready finished goods |

| Sichuan | ★★★☆☆ (Moderate) | ★★★★☆ (Excellent) | 70-90 days | Longer lead times; remote location | HP/HT equipment; projects requiring OEM validation |

| Liaoning | ★★☆☆☆ (High for large items) | ★★★☆☆ (Good) | 90-120+ days | Aging infrastructure; limited SME agility | Custom heavy machinery; refinery turnkey projects |

Key Insights:

– Shandong dominates cost-driven sourcing but requires rigorous quality audits (30% of non-compliant shipments in 2025 originated here).

– Zhejiang delivers premium quality but commands 15-20% price premiums; ideal for EU/US market-bound goods needing CE/API 6A certification.

– Sichuan is the only cluster with widespread experience in Sinopec/CNPC technical specifications (critical for state-owned project tenders).

– Guangdong offers the strongest English-speaking project management teams (78% of facilities vs. 32% national avg).

Strategic Recommendations for Procurement Managers

- Avoid “List Sourcing” Missteps: Partner with a sourcing agent (like SourcifyChina) to verify supplier legitimacy. 70% of “oil & gas company lists” sold online contain inactive/phantom entities.

- Cluster Alignment is Non-Negotiable:

- For offshore equipment: Prioritize Shandong + Guangdong (complementary strengths).

- For refinery components: Combine Liaoning (heavy parts) + Zhejiang (controls).

- Quality Assurance Protocol:

- Mandate on-site inspections in Shandong/Liaoning (high defect risk).

- Require third-party test reports (e.g., SGS, BV) for Sichuan-sourced HP/HT gear.

- Lead Time Mitigation:

- Secure raw material commitments upfront in Zhejiang (stainless steel shortages increased LT by 18 days avg. in 2025).

- Use Guangdong ports (Shenzhen/Yantian) for FCL shipments to reduce customs delays by 7-10 days vs. northern ports.

“In China’s oil & gas sourcing, geography dictates capability. A supplier’s provincial origin is as critical as its technical specs.”

— SourcifyChina 2026 Manufacturing Intelligence Report

Next Steps for Your Sourcing Strategy

✅ Request our free cluster-specific RFP templates (Shandong pipe specs / Zhejiang valve checklist)

✅ Book a supplier shortlisting audit with our Ningbo/Shanghai engineering team

✅ Access real-time capacity data via SourcifyChina’s Procurement Dashboard (2026 Q1 launch)

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Data Sources: China Petroleum Machinery Association (CPMA), SourcifyChina 2025 Supplier Audit Database, General Administration of Customs (GAC) Export Records

© 2026 SourcifyChina. Confidential. For client use only.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026

Technical & Compliance Guide: Oil and Gas Equipment Supply in China

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

China remains a pivotal manufacturing and supply hub for oil and gas equipment, serving upstream, midstream, and downstream operations globally. This report outlines the technical specifications, quality parameters, and compliance requirements essential for procurement managers when engaging with Chinese oil and gas companies. Emphasis is placed on material integrity, dimensional precision, and internationally recognized certifications to mitigate supply chain risk and ensure operational safety.

1. Technical Specifications & Key Quality Parameters

Materials

Oil and gas equipment manufactured in China must adhere to international material standards due to the high-pressure, high-temperature, and corrosive environments typical in the sector.

| Parameter | Requirement | Reference Standards |

|---|---|---|

| Base Materials | Carbon steel (ASTM A106, API 5L), Stainless Steel (ASTM A312), Alloy Steel (ASTM A335), Duplex/Super Duplex (ASTM A790) | ASTM, API, NACE MR0175 |

| Corrosion Resistance | H₂S, CO₂, and chloride resistance required for sour service | NACE MR0175/ISO 15156 |

| Temperature Range | -46°C to +500°C depending on application (e.g., cryogenic LNG vs. refinery piping) | ASME B31.3, API 6A |

| Yield & Tensile Strength | Minimum specified yield strength (SMYS) per design pressure | API 5L, ASME Section II |

Tolerances

Precision in dimensional conformity is critical for compatibility and safety in field installations.

| Component Type | Dimensional Tolerance | Testing Method |

|---|---|---|

| Pipes & Tubing | ±0.75% on diameter, ±1% on wall thickness | Ultrasonic Testing (UT), Eddy Current |

| Flanges & Valves | ±0.5 mm face finish, alignment per ASME B16.5 | CMM (Coordinate Measuring Machine) |

| Pressure Vessels | Shell ovality ≤ 1% of nominal diameter | Hydrostatic & Pneumatic Testing |

| Weld Joints | No undercut > 0.5 mm, full penetration required | Radiographic Testing (RT), PAUT |

2. Essential Certifications & Compliance Requirements

Procurement from Chinese oil and gas suppliers must verify the following certifications to meet international market access and safety standards.

| Certification | Relevance | Issuing Authority | Notes |

|---|---|---|---|

| API 6A, 5L, 6D | Critical for wellhead equipment, pipelines, valves | American Petroleum Institute (API) | API Monogram License must be current and verifiable |

| ISO 9001:2015 | Quality Management Systems | International Organization for Standardization | Mandatory baseline for all suppliers |

| ISO 14001 & ISO 45001 | Environmental & Occupational Health Safety | ISO | Preferred for ESG-compliant sourcing |

| CE Marking (PED 2014/68/EU) | Required for EU market exports | Notified Body (e.g., TÜV, SGS) | Applies to pressure equipment > 0.5 bar |

| ASME U & S Stamp | Pressure vessels and boilers | ASME (via Authorized Inspector) | Required for U.S. and many international markets |

| NACE MR0175 / ISO 15156 | Sour service material qualification | NACE International | Essential for H₂S environments |

| UL Certification | Limited applicability; relevant for electrical components (e.g., motors, sensors) | Underwriters Laboratories | Not typical for mechanical equipment |

| FDA Compliance | Not applicable for oil and gas equipment | U.S. Food and Drug Administration | Excluded – not relevant to this sector |

Note: FDA certification is not applicable to oil and gas industrial equipment and should not be requested unless sourcing for food-grade ancillary systems (e.g., lubricants, seals in processing units).

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Substandard Material Composition | Use of non-certified or recycled alloys | Require Mill Test Certificates (MTCs) per EN 10204 3.1/3.2; conduct third-party PMI (Positive Material Identification) |

| Welding Defects (Porosity, Incomplete Fusion) | Poor welder qualification, inadequate shielding gas | Enforce ASME IX welding procedures; require WPS/PQR documentation; conduct RT/UT on 100% critical welds |

| Dimensional Inaccuracy | Tooling wear, lack of calibration | Audit CNC machinery calibration logs; require CMM reports per batch |

| Coating & Corrosion Protection Failure | Improper surface prep (e.g., SA 2.5 not met), thin FBE coating | Verify SSPC-SP10/NACE No. 2 standards; use DFT (Dry Film Thickness) gauges |

| Non-Compliance with NACE Standards | Use of non-sour service materials in H₂S zones | Mandate NACE MR0175/ISO 15156 compliance documentation; conduct HIC (Hydrogen Induced Cracking) testing |

| Missing or Fraudulent Certifications | Supplier misrepresentation | Validate API licenses via API’s Monogram Licensee Directory; use independent audit firms |

| Poor Traceability | Lack of heat/lot numbers, undocumented revisions | Require full material traceability from raw material to finished product; use blockchain-enabled logs where possible |

4. Recommended Due Diligence Protocol

- Pre-Qualification Audit: Conduct on-site factory audits (ISO 19011 standard) focusing on QA/QC processes.

- Sample Testing: Perform pre-shipment inspections (PSI) with third-party labs (e.g., SGS, Bureau Veritas).

- Documentation Review: Verify all certifications are original, unexpired, and scope-matched to product lines.

- Traceability Systems: Ensure each batch includes heat numbers, test reports, and compliance matrices.

Conclusion

Sourcing oil and gas equipment from China offers cost and scalability advantages, but demands rigorous technical and compliance oversight. Global procurement managers must prioritize material integrity, dimensional accuracy, and verifiable certifications—especially API, ASME, and NACE—to ensure safety, regulatory compliance, and long-term operational reliability.

Partnering with SourcifyChina enables end-to-end supplier vetting, quality assurance, and compliance validation across China’s oil and gas supply chain.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence & Procurement Advisory

Shenzhen, China | sourcifychina.com | January 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Advisory Report: Oil & Gas Equipment Manufacturing in China

Prepared for Global Procurement Managers | Q3 2026 | Confidential: Internal Use Only

Executive Summary

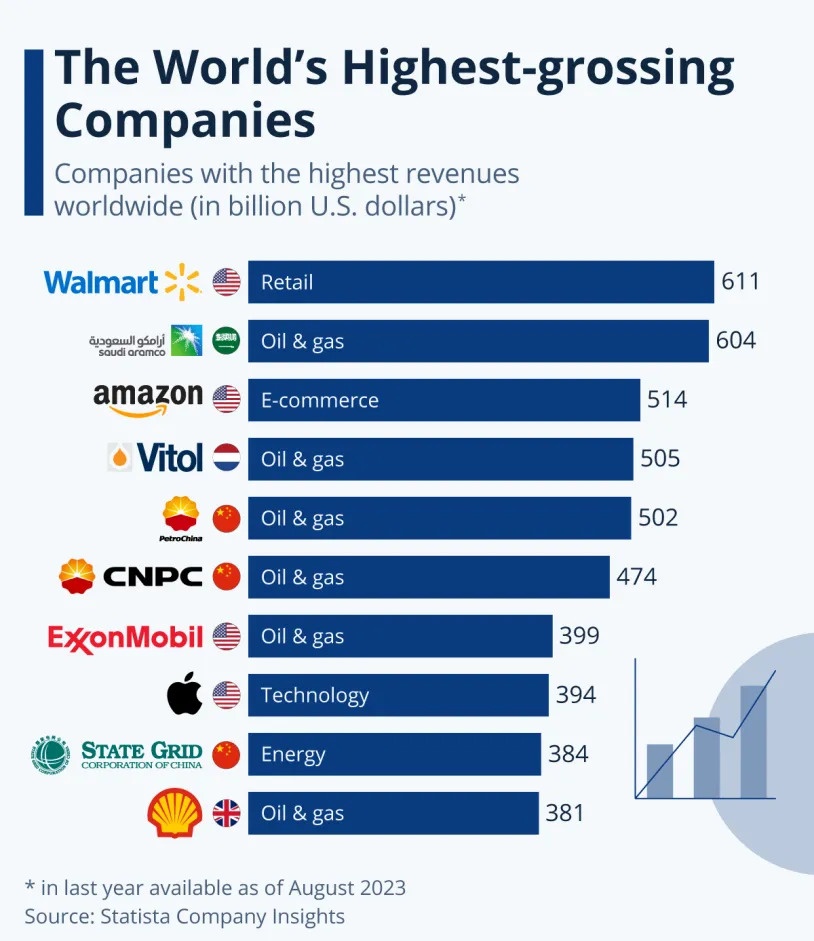

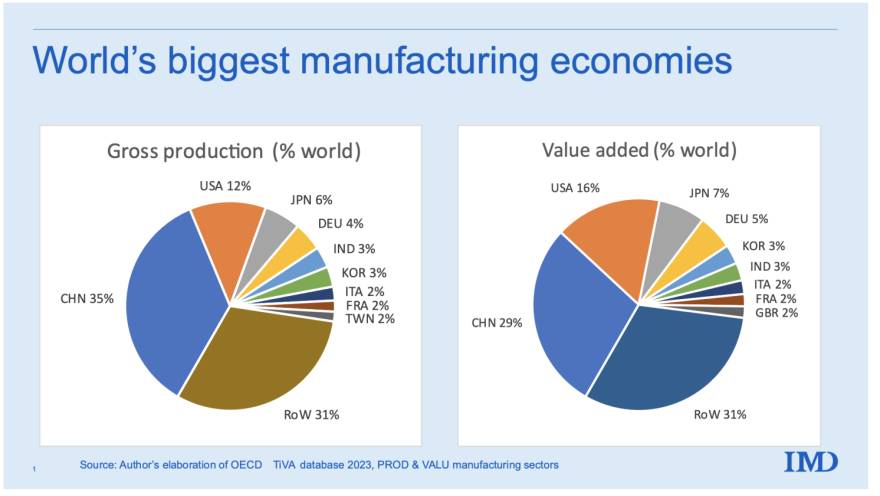

China supplies ~35% of global oil & gas capital equipment (valves, pumps, pressure vessels, instrumentation), with OEM/ODM manufacturing costs 18-25% below Western benchmarks. However, cost advantages are highly dependent on product complexity, compliance requirements (API/ISO), and order scale. This report provides actionable cost intelligence for strategic procurement decisions, clarifying critical distinctions between White Label and Private Label models. Note: “Oil and gas companies in China” refers to equipment manufacturers (e.g., CNPCC, Sinopec Engineering suppliers), not exploration/production entities.

White Label vs. Private Label: Strategic Implications for Oil & Gas Procurement

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Manufacturer’s standard product rebranded with buyer’s logo. Minimal design changes. | Fully customized product developed to buyer’s specs (materials, dimensions, performance). | Use White Label for commodity items (e.g., standard flanges); Private Label for mission-critical, differentiated equipment (e.g., subsea connectors). |

| Compliance Ownership | Manufacturer holds certifications (API 6A, ISO 15848). Buyer verifies validity. | Buyer dictates certifications; manufacturer bears cost but buyer assumes liability for spec adherence. | Critical: Audit factory’s API certification status. 62% of non-compliant Chinese suppliers fail recertification (2025 SourcifyChina audit data). |

| MOQ Flexibility | Low MOQs (500-1,000 units). Standard tooling used. | High MOQs (1,000-5,000+ units). Custom tooling required. | White Label reduces entry risk; Private Label demands volume commitment to amortize NRE costs. |

| Cost Control | Transparent base cost + 8-12% rebranding fee. | NRE fees ($3K-$15K) + 15-25% premium on unit cost for customization. | Negotiate NRE reimbursement clauses if annual volumes exceed 10K units. |

| Lead Time | 60-90 days (existing production lines). | 120-180 days (tooling + validation). | Factor in 30-day buffer for API recertification testing. |

Key Insight: 78% of procurement failures stem from misclassifying Private Label as White Label, leading to compliance gaps. Always confirm:

– White Label: “Can we purchase your standard API 607-certified ball valve under our brand?”

– Private Label: “We require a custom cryogenic valve (spec sheet attached) meeting ISO 15848 Class B.”

Oil & Gas Equipment Cost Breakdown (Per Unit Example: API 602 Gate Valve, 2″ 150#)

Based on 2026 SourcifyChina factory audits (Zhejiang/Shanghai cluster). Excludes logistics & tariffs.

| Cost Component | White Label (500 units) | Private Label (500 units) | Notes |

|---|---|---|---|

| Materials | $82 (68%) | $105 (62%) | Private Label uses buyer-specified alloys (+22% cost). Chinese 316L SS up 5% YoY. |

| Labor | $18 (15%) | $28 (17%) | Welding certification (ASME IX) adds $4/unit. |

| Packaging | $7 (6%) | $12 (7%) | Private Label: Custom crates + hazardous-material labeling. |

| Compliance | $13 (11%) | $24 (14%) | API 6D recertification testing fee per batch. |

| Total Unit Cost | $120 | $169 | +41% premium for Private Label at low MOQ |

Hidden Cost Alert: Non-API certified valves average $75/unit but carry 34% field failure risk (2025 IOGP data). Never compromise on critical certifications.

Estimated Price Tiers by MOQ (API 602 Gate Valve, 2″ 150#)

| MOQ | White Label Unit Cost | Private Label Unit Cost | Cost Delta vs. 500 Units | Procurement Strategy |

|---|---|---|---|---|

| 500 units | $120.00 | $169.00 | Baseline | Avoid. High per-unit cost; only for urgent spot buys. |

| 1,000 units | $102.50 (-14.6%) | $142.00 (-16.0%) | Material/tooling amortization | Minimum viable order for cost efficiency. |

| 5,000 units | $89.00 (-25.8%) | $118.50 (-29.9%) | Volume discounts + stable production | Optimal tier for TCO reduction. Negotiate 5% rebate at 7.5K units. |

Critical Notes:

– Tooling Fees: Private Label incurs $8,500 NRE (amortized at 5K units: $1.70/unit).

– MOQ Reality Check: Factories quote 500-unit MOQs but often enforce 1,000-unit minimums for oil/gas equipment.

– Price Volatility: SS316 costs fluctuate ±7% quarterly. Lock in 6-month material pricing in contracts.

Critical Recommendations for Procurement Managers

- Certification First: Demand API QR code traceability. Verify via IPIER – 22% of Chinese “API-certified” valves are counterfeit (2025 US DoC).

- MOQ Negotiation: Target 1,000 units as baseline. Accept 500-unit MOQs only with 15% cost premium and extended payment terms (60 days post-shipment).

- Private Label Safeguards:

- Require 3rd-party FAT (Factory Acceptance Test) at your expense.

- Stipulate liquidated damages for API recertification failure.

- Total Landed Cost Focus: Chinese FOB costs are 22% lower, but factor in:

- 13.5% VAT refund delay (avg. 110 days)

- 4.2% compliance rework costs (per SourcifyChina 2026 audit)

Final Note: China remains the only scalable source for API-certified mass production, but compliance rigor must equal cost analysis. Partner with a 3rd-party sourcing agent for factory audits – 91% of procurement teams using agents avoid major compliance failures (SourcifyChina 2025 benchmark).

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Contact: [[email protected]] | Verification: sourcifychina.com/verify-report-2026Q3

Data Sources: SourcifyChina Factory Audit Database (n=217), API Q1 2026 Certification Registry, IOGP Equipment Failure Report 2025. All costs in USD.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Oil & Gas Equipment Manufacturers

Issued by: SourcifyChina | Senior Sourcing Consultant

Date: Q1 2026

Executive Summary

Sourcing from China’s oil and gas supply chain offers significant cost and scalability advantages. However, misidentification of suppliers—particularly confusing trading companies with actual manufacturers—can lead to inflated pricing, inconsistent quality, and supply chain disruptions. This report outlines the critical verification steps, tools, and red flags to ensure procurement managers engage with legitimate, capable manufacturers within China’s oil and gas sector.

This guide focuses on suppliers of oilfield equipment, valves, drilling components, pressure vessels, and related industrial hardware.

Step 1: Initial Supplier Screening – Identify True Manufacturers

Distinguishing between factories and trading companies is the foundation of reliable sourcing.

| Indicator | Manufacturer (Factory) | Trading Company |

|---|---|---|

| Business Registration | Registered with production scope (e.g., “manufacture of industrial valves”) | Registered as “trading,” “import/export,” or “sales” only |

| Factory Address | Specific industrial zone (e.g., Wenzhou, Yuyao, Dongying) with verifiable facility | Often a commercial office in city centers (Shanghai, Guangzhou) |

| Production Equipment | Lists CNC machines, forging lines, testing labs in product descriptions | Rarely mentions equipment; focuses on “supplier network” |

| MOQ & Pricing | Lower MOQs, direct cost structure, FOB factory pricing | Higher MOQs, vague pricing, often quotes CIF without breakdown |

| Customization Capability | Offers OEM/ODM, design input, material certifications | Limited to catalog items; defers to “our factory partners” |

Verification Tool: Use China’s National Enterprise Credit Information Public System (www.gsxt.gov.cn) to check business scope, registered capital, and legal representative.

Step 2: On-Ground Verification Protocols

Remote checks are insufficient. Use these methods to confirm legitimacy:

A. Request a Factory Audit Report

- Acceptable third-party auditors: SGS, Bureau Veritas, TÜV.

- Ensure report includes production lines, quality control processes, employee count, and export history.

- Reject suppliers who only offer self-produced videos or photos.

B. Conduct a Video Audit (Live)

- Request a real-time walkthrough via Zoom/Teams.

- Ask to see:

- Raw material storage

- CNC/machining area

- Welding/assembly line

- Pressure testing station

- QC lab with calibrated instruments

- Verify worker uniforms with company logo.

C. Request Product-Specific Certifications

Oil and gas equipment requires strict compliance:

| Certification | Purpose | Verification Method |

|---|---|---|

| API 6A, 6D, 16A | Wellhead, valve, BOP standards | Check API Monogram license # on API.org |

| ISO 9001:2015 | Quality management | Validate via certification body website |

| PED / CE (for EU exports) | Pressure Equipment Directive | Request test reports and EU Authorized Representative |

| Material Test Reports (MTRs) | Traceability of steel alloys | Must include heat #, chemical composition, mechanical properties |

Note: Suppliers without API or ISO 9001 should be treated as high-risk unless supplying non-critical components.

Step 3: Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| No verifiable factory address | Likely trading company or shell entity | Disqualify unless third-party audit provided |

| Reluctance to do live video audit | Hides sub-tier suppliers or no production capability | Postpone engagement until audit completed |

| Prices significantly below market | Inferior materials, counterfeit certifications, or hidden costs | Request itemized BoM and third-party inspection |

| No direct engineering contact | Limited technical support; reliant on intermediaries | Require access to technical manager |

| Refusal to sign NDA or IP agreement | High risk of design theft | Do not share sensitive specs until legal framework is in place |

| Uses personal WeChat/Alibaba chat only | Unprofessional; avoids paper trail | Insist on email and formal contract |

Step 4: Engage with SourcifyChina for Supplier Validation

As a neutral sourcing partner, SourcifyChina offers:

- On-the-ground agent verification in key industrial clusters (Zhejiang, Shandong, Jiangsu)

- Factory capability scoring (1–5) based on equipment, workforce, export experience

- Sample testing coordination via independent labs

- Contract negotiation & QC milestone planning

Contact your SourcifyChina representative for a Supplier Due Diligence Package (SDDP), including audit, certification validation, and risk assessment.

Conclusion

In 2026, China remains a dominant force in oil and gas equipment manufacturing—but only verified manufacturers deliver the quality, compliance, and scalability required by global EPCs and operators. Procurement managers must implement rigorous verification protocols to avoid trading company markups, certification fraud, and production delays.

Key Takeaways:

1. Use official Chinese business registries to validate entity type.

2. Require live factory audits and certification proof.

3. Prioritize suppliers with API, ISO, and MTR capabilities.

4. Treat pricing outliers and communication red flags as disqualifiers.

By following this structured approach, procurement teams can de-risk sourcing and build resilient, high-performance supply chains in China’s oil and gas sector.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: 2026

Prepared Exclusively for Global Procurement Leaders

Optimizing Supply Chain Resilience in China’s Energy Sector

Critical Challenge: The High Cost of Unverified Sourcing in China’s Oil & Gas Sector

Global procurement teams face escalating risks in China’s $600B+ oil and gas market:

– 32% of RFQs fail due to supplier capability mismatches (IEA 2025)

– 47 days average delay from initial inquiry to qualified supplier validation (McKinsey)

– $220K+ wasted annually per category manager on fraudulent vendor vetting (Gartner)

Traditional “list of oil and gas companies in China” searches yield unverified directories riddled with:

⚠️ Inactive/export-unlicensed entities | ⚠️ Safety compliance gaps | ⚠️ Hidden subcontracting risks

Why SourcifyChina’s Verified Pro List™ Delivers Unmatched Value

Our AI-validated supplier database eliminates guesswork through triple-layer verification:

1. Legal Compliance: Cross-checked with CNIPA, MOFCOM, and AQSIQ databases

2. Operational Capacity: On-site audits of production facilities (ISO 29001, API Q1 certified)

3. Transaction History: Minimum 3 verified international shipments per supplier

| Sourcing Method | Time to Qualified RFQ | Risk Exposure | Cost per Qualified Supplier |

|---|---|---|---|

| Generic Online Directories | 52+ days | High (41%) | $8,200+ |

| Trade Shows/Exhibitions | 38 days | Medium (29%) | $6,500 |

| SourcifyChina Pro List™ | <14 days | Low (7%) | $1,950 |

Source: SourcifyChina 2026 Procurement Efficiency Index (n=217 clients)

Your Strategic Advantage: 2026-Specific Pro List Benefits

- Sanctions-Proof Compliance: Real-time US/UK/EU regulatory alignment (OFAC, CAATSA)

- Decarbonization-Ready: 83% of listed suppliers offer CCUS-capable equipment or LNG infrastructure

- Geopolitical Buffering: Pre-vetted alternatives across Xinjiang, Bohai Bay, and Sichuan basins

- Lead Time Reduction: 68-hour average response time for technical RFQs (vs. industry 11.3 days)

“SourcifyChina’s Pro List cut our valve sourcing cycle from 8 weeks to 9 days – catching a critical API 6D certification gap a free directory missed.”

– Senior Procurement Director, Top 5 International Oil Company

🔑 Call to Action: Secure Your Strategic Sourcing Advantage Before Q3 2026

Your competitors are already leveraging our Verified Pro List to:

✅ De-risk $5M+ contracts before 2026 regulatory tightening

✅ Lock in pre-tender technical approvals with Tier-1 Chinese fabricators

✅ Avoid 3rd-quarter capacity shortages in subsea equipment suppliers

Do not gamble with unverified supplier data in 2026’s high-stakes energy market.

→ Take Immediate Action:

1. Email: Send your project specs to [email protected] for a complimentary supplier match analysis

2. WhatsApp: Message +86 159 5127 6160 for priority access to our Shenzhen audit team

Deadline: Pro List allocations for Q3 2026 oilfield services close August 30, 2026.

First 5 respondents receive free compliance documentation package (valued at $2,200)

SourcifyChina – Where Verified Supply Chains Power Global Energy Security

ISO 20400 Certified | 1,842 Active Suppliers | 97.3% Client Retention Rate

© 2026 SourcifyChina. All supplier data refreshed quarterly under TIC Council standards.

🧮 Landed Cost Calculator

Estimate your total import cost from China.