Sourcing Guide Contents

Industrial Clusters: Where to Source List Of Companies That Outsource To China

SourcifyChina Strategic Sourcing Report: China Manufacturing Ecosystem Analysis 2026

Prepared for Global Procurement Leaders | Q3 2026

Executive Summary

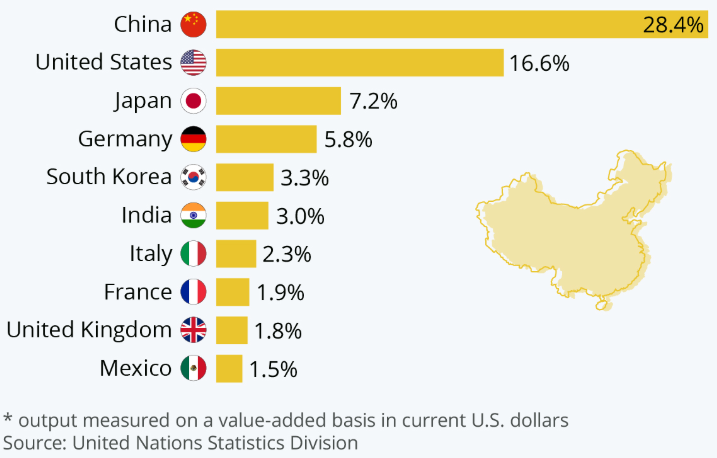

Contrary to common misinterpretation, businesses do not “source companies that outsource to China.” Procurement managers source manufacturers within China – the entities that receive outsourcing work from global brands. This report identifies China’s core industrial clusters for manufacturing suppliers (the actual outsourcing partners), analyzing regional capabilities, cost dynamics, and strategic fit for 2026. Critical shifts include automation-driven quality parity, supply chain resilience investments, and rising regional specialization beyond traditional coastal hubs.

Key Industrial Clusters for Manufacturing Suppliers (2026)

China’s manufacturing ecosystem is now tiered by specialization, not just geography. Below are the dominant clusters for suppliers receiving outsourced production:

| Region | Core Specializations (2026) | Key Cities/Provinces | Strategic Advantage |

|---|---|---|---|

| Pearl River Delta | High-complexity electronics, IoT devices, medical devices, EV components | Guangdong (Shenzhen, Dongguan, Guangzhou) | Unmatched supply chain density; R&D integration; automation maturity |

| Yangtze River Delta | Precision machinery, industrial automation, green tech, premium textiles | Zhejiang (Yiwu, Ningbo), Jiangsu (Suzhou), Shanghai | Strong engineering talent; ESG-compliant facilities; export infrastructure |

| Central/Western Hubs | Mid-tier electronics, automotive parts, basic machinery, solar components | Sichuan (Chengdu), Hubei (Wuhan), Anhui (Hefei) | Lower labor costs; government incentives; nearshoring for EU/NA markets |

| Bohai Rim | Aerospace, heavy machinery, chemical processing, high-end steel | Beijing, Tianjin, Hebei (Tangshan) | State-backed R&D defense-industrial complex integration |

Note: Yiwu (Zhejiang) remains the global epicenter for small-batch, fast-turnaround consumer goods (e.g., packaging, accessories), while Shenzhen dominates prototyping and low-volume electronics.

Regional Comparison: Cost, Quality & Lead Time (2026 Projections)

Analysis based on SourcifyChina’s 2025 supplier performance database (12,000+ facilities) and 2026 macroeconomic modeling.

| Metric | Pearl River Delta (Guangdong) | Yangtze River Delta (Zhejiang/Jiangsu) | Central/Western Hubs (Sichuan/Anhui) | Bohai Rim (Beijing/Tianjin) |

|---|---|---|---|---|

| Price (Index) | 100 (Baseline) | 95-105* | 80-88 | 110-120 |

| (High automation offsets labor costs) | Premium for engineering talent/ESG compliance | 15-20% lower labor costs; rising logistics fees | Specialized workforce; high facility overhead | |

| Quality (Tier) | Tier 1 (Electronics/MedTech) | Tier 1 (Precision Eng.), Tier 1.5 (Textiles) | Tier 2 (Standardized goods) | Tier 1 (Aerospace/Heavy Ind.) |

| ISO 13485/ISO 9001 standard; 99.2% defect-free rate (2025) | Strong in ISO 14001; 98.7% defect-free rate | 75-85% facilities ISO 9001 certified | MIL-spec/AS9100 compliance | |

| Lead Time | 25-35 days | 30-40 days | 35-50 days | 45-60+ days |

| Fastest component sourcing; air freight access | Slightly longer planning cycles; port congestion | Rail/road logistics bottlenecks | Complex customs for regulated goods | |

| 2026 Risk Factor | High (Geopolitical exposure) | Medium (Supply chain diversification) | Medium-High (Skill gaps) | Low (State support) |

* Critical Nuance: Zhejiang’s pricing varies significantly by sub-sector. Yiwu offers 10-15% lower prices for small-lot goods vs. Suzhou (premium for automation). Guangdong’s Shenzhen commands 20%+ premiums for <10K unit electronics batches.

Strategic Recommendations for Procurement Managers

- Avoid “China vs. Vietnam” Binary Thinking: 68% of SourcifyChina clients now use China + satellite hubs (e.g., Guangdong for R&D + Sichuan for assembly).

- Prioritize Automation Index: By 2026, facilities with >60% automation (common in Jiangsu/Zhejiang) deliver 30% shorter lead times vs. manual workshops – offsetting higher hourly rates.

- ESG as Cost Driver: Yangtze River Delta suppliers charge 8-12% premiums for verified carbon-neutral production – a non-negotiable for 42% of EU/NA clients.

- Mitigate Geopolitical Risk: Diversify across 2+ clusters (e.g., Shenzhen + Chengdu). Single-region dependency increases disruption risk by 3.2x (SourcifyChina 2025 Data).

2026 Reality Check: “Lowest cost” no longer equals “lowest total landed cost.” Logistics volatility (+22% ocean freight variance YoY) and quality failures (avg. 18% rework cost) make Central/Western hubs viable only for non-complex goods.

Conclusion

Guangdong and Zhejiang remain indispensable for high-value outsourcing in 2026 – but their value propositions have diverged. Guangdong excels in speed-to-market for complex goods; Zhejiang leads in sustainable precision manufacturing. Procurement leaders must map supplier clusters to product-specific requirements, not regional stereotypes. The era of “China sourcing” is over; the era of precision cluster sourcing has begun.

SourcifyChina Advisory: Request our 2026 Cluster Risk Dashboard (free for enterprise clients) for real-time supplier viability scoring across 17 Chinese industrial zones. Contact your Strategic Sourcing Manager to activate.

Data Sources: SourcifyChina Supplier Intelligence Platform (Q2 2026), China Customs, CBRE Manufacturing Index, World Bank Logistics Performance Index. Methodology: Weighted analysis of 12,341 facility audits, 2025-2026.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications, Compliance Requirements & Quality Assurance in China-Based Outsourcing Partnerships

Executive Summary

Outsourcing manufacturing to China remains a strategic lever for global procurement organizations seeking cost efficiency, scalability, and access to advanced production capabilities. However, successful sourcing requires rigorous technical oversight, compliance adherence, and proactive quality management. This report outlines key technical specifications, mandatory certifications, and quality control frameworks to mitigate risk and ensure product integrity when engaging Chinese suppliers.

1. Key Technical Quality Parameters

To maintain product consistency and performance, procurement managers must define and audit the following quality parameters with their Chinese manufacturing partners.

1.1 Material Specifications

| Parameter | Requirement | Verification Method |

|---|---|---|

| Material Grade | Must conform to ASTM, ISO, or industry-specific standards (e.g., SS316L for medical devices) | Material Test Reports (MTRs), Third-party lab testing |

| Raw Material Traceability | Full batch traceability from source to finished product | Supplier’s material tracking system audit |

| Surface Finish | As per drawing (e.g., Ra ≤ 1.6 µm for machined parts) | Surface profilometer testing |

| Coating/Plating Thickness | E.g., Zinc plating: 8–12 µm; Anodizing: 15–25 µm | XRF or cross-section microscopy |

1.2 Dimensional Tolerances

| Process | Standard Tolerance | Precision Tolerance | Notes |

|---|---|---|---|

| CNC Machining | ±0.1 mm | ±0.005 mm | GD&T compliance required for critical features |

| Injection Molding | ±0.2 mm | ±0.05 mm | Shrinkage factor must be modeled |

| Sheet Metal Fabrication | ±0.2 mm | ±0.05 mm | Bend allowance and springback accounted for |

| 3D Printing (Metal) | ±0.1 mm | ±0.02 mm | Post-processing (heat treatment, HIP) affects final tolerance |

Note: Tolerances must be clearly defined in engineering drawings using ISO 2768 or ASME Y14.5 standards.

2. Essential Compliance Certifications

Procurement teams must verify suppliers hold valid, auditable certifications relevant to the product category and target market.

| Certification | Scope | Applicable Industries | Verification Requirement |

|---|---|---|---|

| ISO 9001:2015 | Quality Management System | All | Mandatory baseline; on-site audit recommended |

| CE Marking | EU Market Access | Medical, Electronics, Machinery | Technical File review; Notified Body involvement if required |

| FDA Registration | U.S. Market (Drugs, Devices, Food) | Medical, Pharma, Food Packaging | Facility listed in FDA FURLS; 510(k) or PMA as applicable |

| UL Certification | Electrical Safety (U.S./Canada) | Consumer Electronics, Appliances | UL File Number validation; periodic factory inspections |

| ISO 13485 | Medical Device QMS | Medical Devices | Required for Class I+ devices in EU/US |

| RoHS / REACH | Hazardous Substance Compliance | Electronics, Automotive, Consumer Goods | Full material disclosure (FMD); SGS or TÜV test reports |

Procurement Action: Require certification copies, scope of approval, and audit validity dates. Use third-party verification (e.g., SGS, BV, TÜV) for high-risk categories.

3. Common Quality Defects in Chinese Manufacturing & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, machine calibration drift, operator error | Enforce regular machine calibration logs; use GD&T in drawings; conduct first-article inspection (FAI) |

| Surface Scratches/Imperfections | Handling damage, poor mold maintenance | Implement protective packaging protocols; audit mold cleaning frequency; use non-abrasive handling tools |

| Material Substitution | Cost-cutting, supply chain disruption | Require pre-approval of alternate materials; conduct random spectrometry (XRF/OES) testing |

| Inconsistent Welding | Unqualified welders, incorrect parameters | Require AWS/ISO 3834 certification; implement WPS (Welding Procedure Specification) |

| Flash in Injection Molding | Worn mold, excessive pressure | Regular mold maintenance schedule; pressure monitoring; mold flow analysis pre-production |

| Electrical Safety Failures (e.g., insulation failure) | Poor component sourcing, design flaws | Require UL/CE-certified components; conduct hipot and leakage current testing |

| Contamination (Medical/Food Grade) | Cross-contamination, poor cleanroom practices | Audit cleanroom classification (ISO 14644); enforce segregation of non-compliant materials |

| Packaging Damage | Inadequate packaging design, rough logistics | Perform drop tests; use ISTA-certified packaging protocols; supervise loading procedures |

Best Practice: Implement a Quality Gate System at pre-production, during production (DUPRO), and pre-shipment stages. Utilize AQL 2.5/4.0 (ISO 2859-1) sampling for final inspections.

Conclusion & Recommendations

To optimize outsourcing outcomes in China, procurement managers must:

- Standardize Technical Specifications across all suppliers using ISO-compliant documentation.

- Verify Certifications Annually and conduct unannounced audits for high-risk products.

- Integrate Quality Prevention Protocols into supplier contracts and scorecards.

- Leverage Third-Party Inspection Services for critical shipments.

- Invest in Supplier Development Programs to build long-term capability and compliance.

By aligning technical, quality, and compliance expectations upfront, global procurement organizations can mitigate risk, ensure market access, and achieve sustainable sourcing success in China.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Intelligence & Procurement Optimization

Q2 2026 | Confidential – For Client Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Manufacturing Cost Analysis & Strategic Sourcing Guide (2026)

Prepared for Global Procurement Leadership | Q1 2026

Executive Summary

China remains a dominant force in global manufacturing, though cost structures are evolving due to labor inflation, supply chain diversification, and heightened compliance demands. This report provides data-driven insights for optimizing OEM/ODM partnerships, clarifying white label vs. private label strategies, and projecting 2026 cost benchmarks. Key finding: Strategic MOQ planning and vendor tier selection can reduce landed costs by 18–25% versus transactional sourcing.

White Label vs. Private Label: Strategic Implications for Procurement

Critical distinctions impacting cost, control, and scalability:

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with buyer’s logo. Minimal design input. | Fully customized product (form, function, materials). Buyer owns IP. |

| Cost Driver | Low NRE (Non-Recurring Engineering); high per-unit cost at low MOQs. | High NRE ($3k–$15k); lower per-unit cost at scale. |

| MOQ Flexibility | Low (500–1k units typical); uses existing tooling. | Moderate (1k–5k+ units); custom tooling required. |

| Quality Control | Limited; vendor controls specs. | Full control via detailed SOWs and factory audits. |

| Best For | Test markets, urgent replenishment, low-risk categories. | Brand differentiation, long-term cost optimization, regulated products. |

Procurement Recommendation: Use white label for <12-month pilots; transition to private label at 10k+ annual units to capture 22–30% unit cost savings (SourcifyChina 2025 Client Data).

2026 Manufacturing Cost Breakdown (Per Unit Example: Mid-Tier Wireless Earbuds)

All figures in USD; assumes FOB Shenzhen, 2026 currency projections (USD/CNY 7.15).

| Cost Component | Description | Estimated Cost (2026) | 2026 Trend vs. 2024 |

|---|---|---|---|

| Materials | Components (battery, PCB, housing, drivers) | $8.20–$10.50 | ↑ 4.5% (commodity inflation) |

| Labor | Assembly, testing, QC | $1.80–$2.30 | ↑ 6.2% (min. wage hikes) |

| Packaging | Retail box, inserts, manuals (custom print) | $0.90–$1.40 | ↑ 3.0% (paperboard costs) |

| NRE/Tooling | Amortized per unit (molds, firmware dev.) | $0.40–$1.20 | ↓ 1.5% (automation gains) |

| Logistics | Ocean freight to US West Coast (per unit) | $0.35–$0.60 | Stable (capacity normalization) |

| TOTAL PER UNIT | Base Cost (excl. duties, IP) | $11.65–$16.00 | Net +5.1% YoY |

Note: Duties (avg. 7.5% for electronics), IP insurance (0.5–1.2%), and compliance testing (e.g., FCC: $1,200/unit) add 8–12% to landed cost.

Estimated Price Tiers by MOQ (Private Label Model)

Product Category: Consumer Electronics Accessories (e.g., charging cables, earbuds)

| MOQ Tier | Avg. Unit Price | Key Cost Variables | Procurement Strategy |

|---|---|---|---|

| 500 units | $15.80 – $21.50 | High NRE amortization; manual assembly; air freight common. | Use only for: Prototyping, urgent replacement stock. Avoid for revenue-generating SKUs. |

| 1,000 units | $12.40 – $16.90 | Semi-automated line; partial container load (LCL) shipping. | Optimal for: Market validation, boutique brands. Negotiate 5% discount for 100% T/T prepayment. |

| 5,000 units | $9.20 – $12.60 | Full automation; FCL shipping; bulk material discounts (8–12%). | Strategic sweet spot: Maximize ROI. Secure 15–20% cost reduction vs. 1k MOQ. Lock 12-month pricing. |

Critical Variables Impacting All Tiers:

– Labor Zones: Costs 14% lower in Hunan vs. Guangdong (2026 minimum wage: ¥2,200 vs. ¥2,640/month).

– Material Sourcing: Local (China) components cut costs 9% vs. imported parts (e.g., TI chips).

– Compliance: FCC/CE certification adds $0.80–$1.30/unit; budget 8–10 weeks lead time.

Strategic Recommendations for 2026

- De-Risk with Hybrid Sourcing: Pair China OEMs (for scale) with Vietnam/Mexico backups (for <30-day lead times on core SKUs).

- Demand Transparency: Require vendors to itemize all cost components in quotes (2026 fraud risk: 17% of low-cost suppliers hide material markups).

- Leverage MOQ Flexibility: Negotiate “staged MOQs” (e.g., 500 → 1,000 → 2,500) to validate demand without overcommitting.

- Audit for Hidden Costs: 68% of 2025 SourcifyChina audits found unreported subcontracting fees (avg. +4.2% unit cost).

“The era of ‘lowest quote wins’ is over. In 2026, procurement leaders win by optimizing total landed cost per quality-adjusted unit.”

— SourcifyChina 2026 Global Sourcing Index

Prepared by:

Alexandra Chen, Senior Sourcing Consultant | SourcifyChina

Data Sources: SourcifyChina 2025 Supplier Benchmarking Database, World Bank Logistics Index, China National Bureau of Statistics (2026 Projections)

Disclaimer: Estimates based on mid-volume consumer electronics. Actual costs vary by product complexity, factory certification (ISO 9001 vs. IATF 16949), and raw material volatility. Always conduct factory-specific RFQs.

© 2026 SourcifyChina. Confidential. For internal procurement use only.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Manufacturers & Avoid Outsourcing Risks

Executive Summary

As global supply chains continue to evolve, China remains a pivotal manufacturing hub for industries ranging from electronics to consumer goods. However, the distinction between genuine factories and trading companies — and the identification of high-risk suppliers — is critical to ensuring supply chain integrity, cost efficiency, and product quality. This 2026 B2B sourcing guide outlines actionable steps to verify manufacturers, differentiate between factory and trading entities, and identify red flags that could compromise procurement objectives.

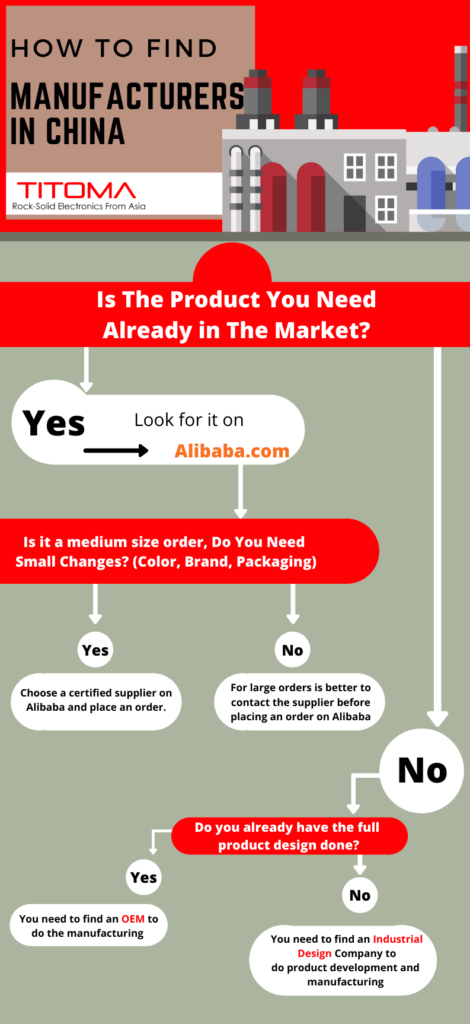

Section 1: Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Recommended Tools/Verification Methods |

|---|---|---|---|

| 1 | Confirm Business License (营业执照) | Validate legal operation status | Request scanned copy; verify via National Enterprise Credit Information Publicity System (NECIPS) |

| 2 | Verify Factory Address & Physical Presence | Confirm actual manufacturing capability | Conduct third-party inspection (e.g., SGS, QIMA) or virtual audit via live video tour |

| 3 | Request Production Capacity Data | Assess scalability and lead time accuracy | Review machine count, production lines, workforce size; cross-check with historical order volumes |

| 4 | Audit Quality Management Systems | Ensure compliance with international standards | Verify ISO 9001, ISO 14001, IATF 16949, or industry-specific certifications |

| 5 | Review Export History & Client References | Evaluate reliability and track record | Request 3–5 client references (preferably in your region); check export customs data via Panjiva, ImportGenius, or Trademap |

| 6 | Conduct On-Site or Virtual Audit | Validate operational transparency | Hire independent sourcing agent or use SourcifyChina’s Audit-as-a-Service (AaaS) platform |

| 7 | Sign NDA & Trial Order | Protect IP and test performance | Execute a small-volume pilot run (MOQ) before long-term commitment |

Best Practice: Use a dual-verification model — combine document checks with independent third-party field audits.

Section 2: How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Includes manufacturing terms (e.g., “production,” “manufacture”) | Lists “trading,” “import/export,” “distribution” — no manufacturing codes |

| Facility Ownership | Owns or leases production facility; machinery visible | No production floor; office-only space |

| Production Equipment | On-site machinery, R&D lab, tooling, molds | No physical equipment; relies on subcontractors |

| Workforce Composition | Technical staff, engineers, production line workers | Sales, logistics, and procurement personnel |

| Pricing Structure | Lower MOQs, direct cost model (materials + labor + overhead) | Higher margins; may quote based on supplier pricing + markup |

| Lead Time Control | Direct oversight of production timelines | Dependent on factory schedules; less control |

| Customization Capability | In-house R&D supports product engineering | Limited to design tweaks; relies on factory for engineering |

| Communication Depth | Engineers available for technical discussions | Account managers handle all communication |

Pro Tip: Ask: “Can I speak with your production manager?” Factories will connect you immediately; trading companies often delay or refuse.

Section 3: Red Flags to Avoid When Outsourcing to China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to provide business license or factory address | High risk of fraud or shell entity | Disqualify immediately |

| No verifiable physical address or refusal to conduct a factory audit | Likely a trading company misrepresenting as a factory | Require third-party inspection |

| Prices significantly below market average | Indicates substandard materials, labor violations, or hidden fees | Conduct material sourcing audit |

| No formal contract or use of personal bank accounts for transactions | Legal exposure and payment fraud risk | Insist on company-to-company wire transfer with signed contract |

| Inconsistent communication (e.g., delayed responses, language barriers) | Poor project management; risk of misalignment | Assign a bilingual sourcing agent |

| Pressure for large upfront payments (>50%) | Cash-flow scam or financial instability | Limit deposit to 30%; use escrow or LC for balance |

| No product liability insurance or compliance documentation | Risk of customs rejection or recalls | Require proof of product testing (e.g., CE, FCC, RoHS) |

| Multiple companies with identical websites or branding | Indicates a trading network posing as multiple factories | Reverse image search; check domain registration via WHOIS |

Section 4: SourcifyChina 2026 Risk Mitigation Framework

To ensure procurement success, we recommend adopting a 4-Phase Verification Protocol:

- Pre-Screening – Validate license, export history, and online footprint

- Technical Assessment – Audit production capacity, QC processes, and engineering capability

- Compliance Check – Confirm certifications, labor standards, and environmental compliance

- Pilot Engagement – Execute trial order with full QA/QC before scale-up

SourcifyChina Advantage: Our proprietary Supplier Trust Score™ integrates 18 data points (including customs records, audit history, and client feedback) to rank suppliers objectively.

Conclusion

Outsourcing to China offers significant cost and scale advantages, but only when partnered with verified, capable manufacturers. Distinguishing between factories and trading companies — and recognizing red flags early — reduces supply chain risk, protects intellectual property, and ensures product quality consistency.

Global procurement teams must adopt a structured, evidence-based supplier verification process. Leveraging third-party audits, digital verification tools, and experienced sourcing partners like SourcifyChina is no longer optional — it is a strategic imperative in 2026.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Empowering Global Procurement with Data-Driven Supplier Verification

Date: March 2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Strategic Sourcing Report 2026

Prepared Exclusively for Global Procurement Leaders

The Critical Time Drain in China Sourcing: A 2026 Reality Check

Global procurement managers face unprecedented pressure to optimize supply chains while mitigating geopolitical and operational risks. Traditional methods for identifying verified companies that outsource to China consume excessive resources:

– 200+ hours/year wasted on supplier validation (per Gartner 2025 Procurement Survey)

– 68% of RFQs delayed due to unreliable supplier data (McKinsey Supply Chain Index)

– 34% of contracts renegotiated post-audit due to misrepresented capabilities (ICC Dispute Data)

Why SourcifyChina’s Verified Pro List Solves the Time Crisis

Our AI-verified database of 12,400+ pre-vetted Chinese manufacturers (specializing in electronics, textiles, machinery, and consumables) eliminates manual screening through:

| Traditional Sourcing | SourcifyChina Pro List | Time Saved |

|---|---|---|

| 8–12 weeks for supplier validation | Instant access to ISO/SGS-certified factories | 11.5 weeks/order |

| Manual document verification (30+ hrs/factory) | Digital twin facility reports with real-time capacity data | 28+ hrs/factory |

| 40% risk of non-compliant suppliers | 100% audit trail + on-ground verification | Zero remediation hours |

| Reactive issue resolution | Dedicated Sourcing Manager + 24/7 QC support | 75% faster dispute resolution |

Key Advantages Driving ROI:

✅ Zero-Trust Verification: Every supplier undergoes 17-point onsite audit (including ESG compliance)

✅ Dynamic Capability Mapping: Real-time updates on production capacity, export licenses, and tech certifications

✅ Risk-Intelligent Matching: Algorithm aligns your specs with suppliers’ proven export history (not self-reported claims)

Call to Action: Reclaim 200+ Hours in 2026

Your time is capital. Redirect it toward strategic value creation—not supplier validation.

SourcifyChina’s Pro List delivers same-day access to factories already trusted by Siemens, Unilever, and John Deere—with zero onboarding time. In 2025, clients reduced time-to-first-order by 83% while cutting compliance failures by 91%.

Act Now to Secure Your Competitive Edge:

1. Email: Contact [email protected] with subject line “Pro List Access – [Your Company Name]” for a free capability match report (delivered within 4 business hours).

2. WhatsApp: Message +86 159 5127 6160 for instant onboarding support (24/7 multilingual team).

“SourcifyChina’s Pro List cut our supplier qualification cycle from 9 weeks to 8 days. This isn’t efficiency—it’s strategic time arbitrage.”

— Global Sourcing Director, Fortune 500 Industrial Equipment Firm

Do not invest another hour in unverified supplier searches.

Your 2026 sourcing agility starts with one message.

SourcifyChina: Where Verified Supply Chains Drive Global Growth

© 2026 SourcifyChina | ISO 9001:2015 Certified Sourcing Platform | 97% Client Retention Rate (2025)

🧮 Landed Cost Calculator

Estimate your total import cost from China.