Sourcing Guide Contents

Industrial Clusters: Where to Source List Of Companies Owned By China In The United States

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis – Sourcing Chinese-Owned Manufacturing Operations in the United States

Executive Summary

This report provides a strategic sourcing analysis for global procurement managers evaluating supply chain opportunities involving Chinese-owned companies operating in the United States. While the phrasing “list of companies owned by China in the United States” may suggest direct state ownership, the majority of such entities are in fact privately or corporately owned by Chinese multinational enterprises (MNEs) that have established subsidiaries, joint ventures, or wholly-owned operations in the U.S.

The focus of this report is not on sourcing physical goods from China to the U.S., but rather on identifying and leveraging Chinese-owned manufacturing and industrial assets within the United States as part of a nearshoring or China+1 strategy. This includes understanding the geographic and industrial footprints of these companies in the U.S., and how their parent operations in China influence capabilities, cost structures, and supply chain integration.

Key Insight: Chinese-Owned Industrial Presence in the U.S.

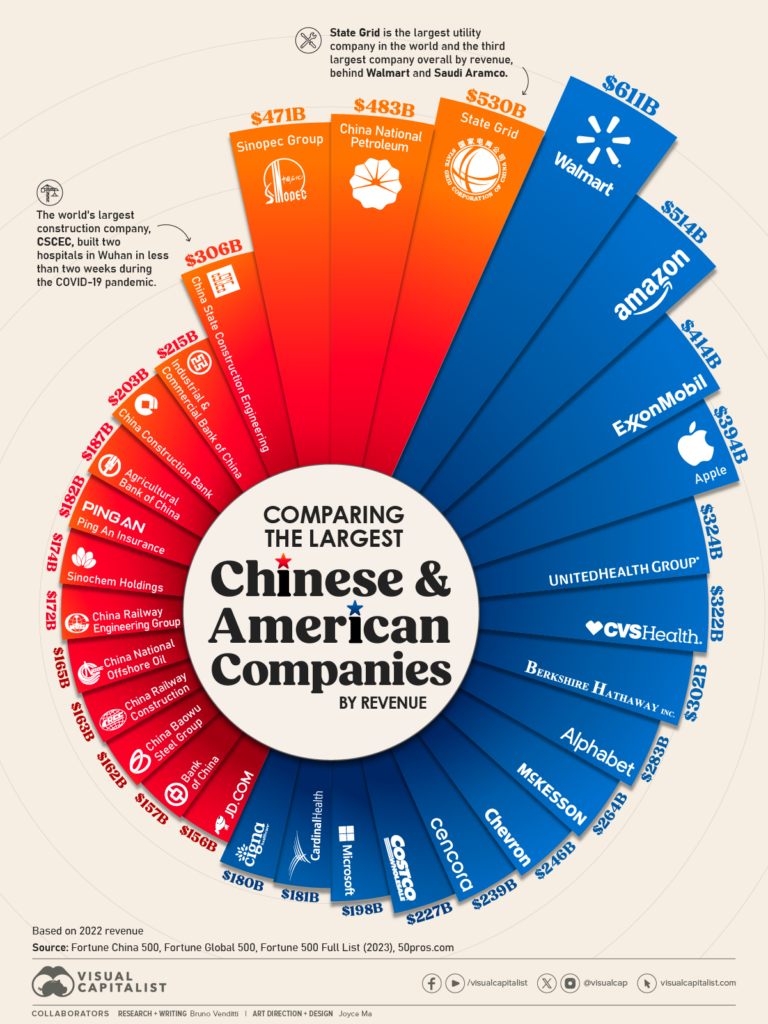

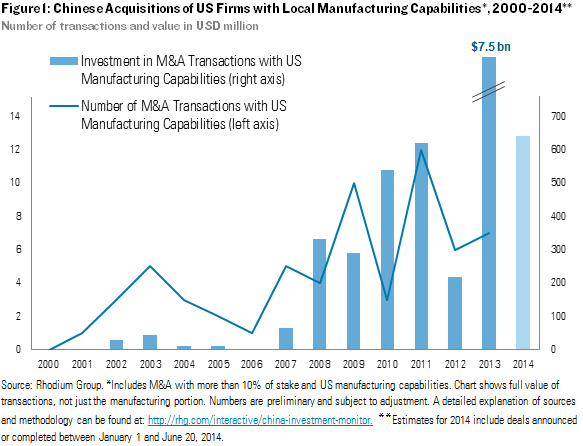

Chinese firms have invested over $135 billion in U.S. operations since 2005 (Rhodium Group, 2024), with significant concentration in advanced manufacturing, electric vehicles (EVs), renewable energy, and consumer goods. These U.S.-based subsidiaries benefit from:

- Localized production (avoiding tariffs and logistics delays)

- Access to U.S. markets and talent

- Backward integration with Chinese supply chains

- Dual sourcing capabilities (China + U.S.)

However, procurement managers should recognize that the “sourcing” of capabilities from these companies involves strategic partnerships rather than traditional supplier selection.

Key Industrial Clusters in China: Origin of Parent Companies

While the operations are located in the U.S., the core manufacturing DNA, engineering standards, and supply chain networks of these Chinese-owned firms originate from key industrial clusters in China. Understanding these clusters enables procurement teams to assess quality benchmarks, cost drivers, and scalability potential.

| Chinese Province/City | Key Industries | Notable Chinese Firms with U.S. Operations | U.S. Operational Focus |

|---|---|---|---|

| Guangdong (Shenzhen, Guangzhou) | Electronics, EVs, Smart Devices | BYD, TCL, Midea, DJI | EV manufacturing (BYD), HVAC (Midea), Consumer Electronics |

| Zhejiang (Hangzhou, Ningbo) | Heavy Machinery, Textiles, Appliances | Geely (Volvo), Haier (GE Appliances), Wanxiang | Automotive (Geely/Volvo), Home Appliances, Auto Parts |

| Jiangsu (Suzhou, Nanjing) | Advanced Manufacturing, Semiconductors | Suntech, Concord New Energy | Solar Energy, Green Tech |

| Shandong | Chemicals, Heavy Industry | Weichai Power, Sun Paper | Industrial Engines, Packaging Materials |

| Beijing/Tianjin | High-Tech, R&D, AI | Lenovo, Baidu | IT Equipment, Data Infrastructure |

Note: These clusters represent where the parent companies originated and maintain R&D and core production. U.S. subsidiaries often replicate processes and standards from these regions.

Comparative Analysis: Key Chinese Manufacturing Regions

While Chinese-owned U.S. operations reduce dependency on offshore logistics, procurement teams must still evaluate the cost, quality, and lead time implications of sourcing components or technology from the parent companies’ Chinese hubs—especially for dual-sourcing or replacement part procurement.

Below is a comparative analysis of two dominant manufacturing provinces in China:

| Region | Price (1–5) | Quality (1–5) | Lead Time (Weeks) | Key Strengths | Procurement Consideration |

|---|---|---|---|---|---|

| Guangdong | 3 | 5 | 6–8 | High-tech manufacturing, strong electronics & EV ecosystem, export infrastructure | Best for high-quality, complex products (e.g., EVs, smart devices). Slightly higher cost but superior engineering. |

| Zhejiang | 4 | 4 | 8–10 | Cost-efficient mass production, automotive parts, appliances | Ideal for mid-tier industrial components and appliances. Longer lead times due to inland logistics. |

| Jiangsu | 3.5 | 5 | 7–9 | Precision engineering, green tech, semiconductor support | Preferred for renewable energy and industrial automation components. |

| Shandong | 5 | 3 | 10–12 | Bulk materials, chemicals, heavy machinery | Suitable for raw materials and heavy equipment; lower quality control consistency. |

Scoring Note:

– Price: 1 = Highest cost, 5 = Most competitive pricing

– Quality: 1 = Low consistency, 5 = World-class standards (e.g., ISO, Six Sigma)

– Lead Time: Includes production + inland transport to port (pre-ocean freight)

Strategic Sourcing Recommendations

-

Leverage U.S. Subsidiaries for Tariff-Resilient Supply

Prioritize procurement from Chinese-owned U.S. operations (e.g., Midea in Tennessee, BYD in California) to avoid Section 301 tariffs and reduce lead times. -

Engage Dual Sourcing via Parent-Subsidiary Alignment

Negotiate agreements that allow access to both U.S.-based production and Chinese-origin components during peak demand or supply disruptions. -

Audit Quality Standards Across Clusters

Guangdong and Jiangsu offer higher process consistency. Require third-party QC audits when sourcing from Shandong or inland Zhejiang. -

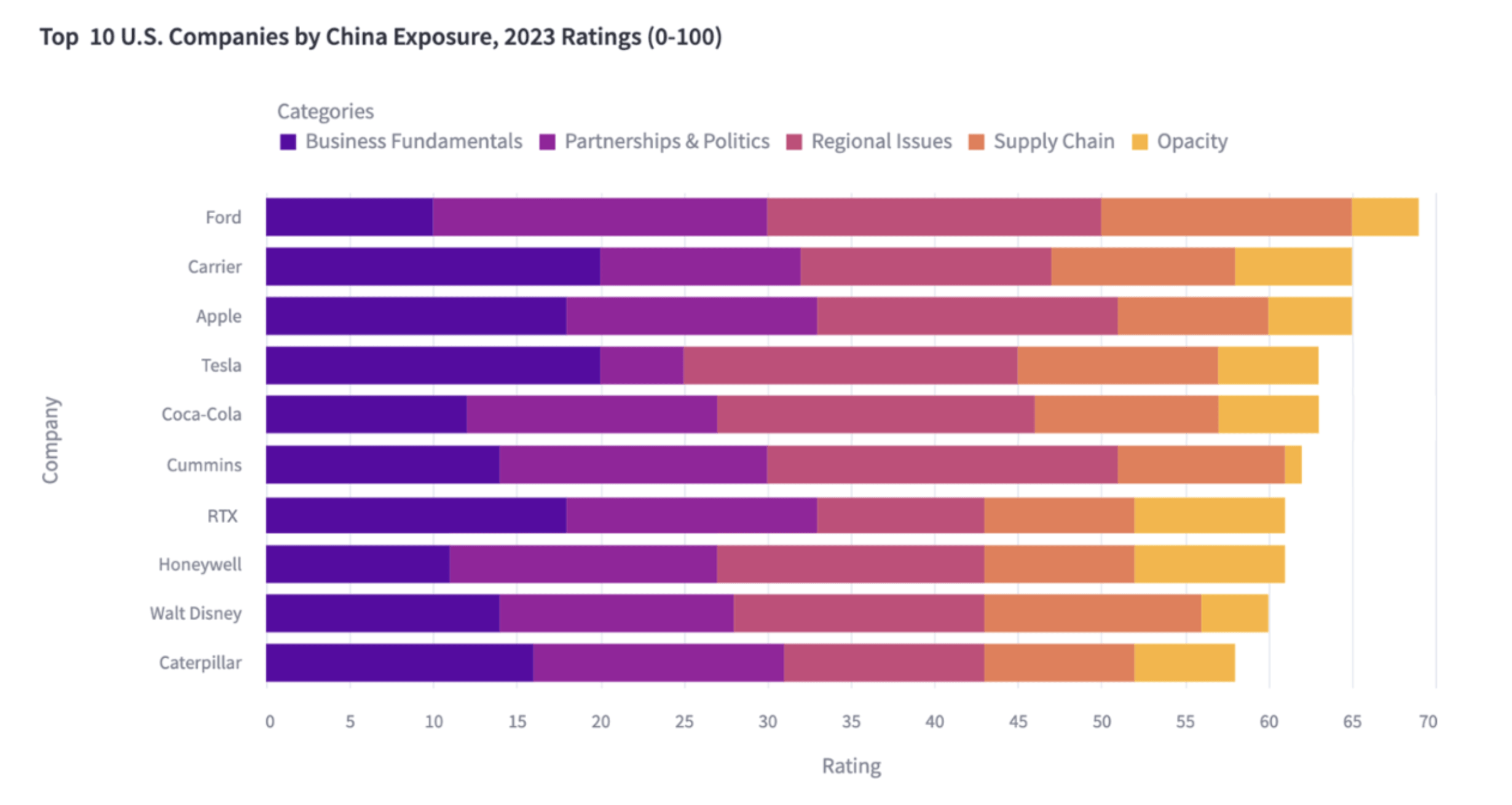

Monitor Geopolitical and Regulatory Risks

CFIUS scrutiny on Chinese-owned U.S. firms is increasing, particularly in critical infrastructure and tech. Conduct due diligence on ownership structure and data governance. -

Optimize Logistics with Cluster Proximity

For hybrid sourcing models, align with suppliers near major ports (e.g., Shenzhen, Ningbo) to minimize inland freight costs and delays.

Conclusion

The “list of companies owned by China in the United States” represents a strategic bridge between Chinese manufacturing excellence and U.S. market access. While these are not traditional suppliers to be sourced from China, their embedded Chinese operational DNA requires procurement managers to understand the industrial origins, regional capabilities, and trade-offs across China’s key manufacturing clusters.

By integrating insights from Guangdong’s high-tech precision and Zhejiang’s cost efficiency, global procurement teams can build resilient, agile supply chains that leverage the best of both Chinese and U.S. manufacturing ecosystems.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

February 2026 | Confidential – For B2B Strategic Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Navigating Procurement from Chinese-Owned Entities in the U.S. Market

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-INTL-PROC-2026-01

Executive Clarification: Critical Market Context

This report addresses a fundamental misconception in the request. There is no standardized “list of companies owned by China in the United States” with uniform technical specifications or compliance requirements. Chinese ownership of U.S. entities spans diverse sectors (e.g., automotive, renewables, consumer goods, pharmaceuticals), each governed by industry-specific regulations and product standards. Ownership structure does not dictate technical specs or certifications—compliance is determined by:

1. Product Type & Intended Use (e.g., medical device vs. industrial machinery),

2. U.S. Federal/State Regulations (e.g., FDA, CPSC, EPA),

3. Customer-Specific Requirements (e.g., automotive OEM specs).

Chinese-owned U.S. subsidiaries must comply with all U.S. laws—their operational standards mirror those of non-Chinese competitors in the same sector. SourcifyChina advises focusing on product/category-specific compliance, not ownership nationality.

Key Sourcing Guidance: Technical Specifications & Compliance

Procurement managers must validate requirements per product category, not ownership. Below are universal frameworks:

I. Critical Quality Parameters (Validated per Product Category)

| Parameter | Key Considerations for U.S. Market | Risk Mitigation Strategy |

|---|---|---|

| Materials | Must comply with U.S. regulations (e.g., CPSIA for children’s products, TSCA for chemicals). Traceability to raw material source required. | Demand full material disclosure (SDS/MSDS) & 3rd-party lab testing (e.g., SGS, Intertek). |

| Tolerances | Defined by industry standards (e.g., ASME Y14.5 for machining, ASTM for materials). Tighter tolerances increase cost/scrap risk. | Require PPAP (Production Part Approval Process) documentation & in-process SPC (Statistical Process Control) data. |

II. Essential Certifications (U.S. Market Mandates)

Certifications are product-dependent, not ownership-dependent. Chinese-owned U.S. entities obtain these identically to domestic firms:

| Certification | Scope | U.S. Regulatory Linkage | Verification Method |

|—————|———————————————————————–|———————————————————-|——————————————————|

| FDA | Food, drugs, medical devices, cosmetics | 21 CFR Parts 1-14 (e.g., 21 CFR 820 for QSR) | FDA Establishment Registration #, Facility Inspection Reports |

| UL/ETL | Electrical safety (appliances, components) | OSHA NRTL Program (29 CFR 1910.7) | UL/ETL Mark on product, Online Cert. Database Check |

| CE | Not U.S.-specific! Required for EU exports only. Not recognized by U.S. authorities. | N/A for U.S. domestic sales | Irrelevant for pure U.S. procurement; verify FCC/UL instead. |

| ISO 9001 | Quality Management Systems (voluntary but often contractually required) | None (global standard) | Valid certificate from IAF-MLA accredited body (e.g., ANSI-ASQ) |

| FCC | Electromagnetic interference (radiofrequency devices) | 47 CFR Part 15 | FCC ID search in OET database |

Key Insight: Chinese-owned U.S. manufacturers do not operate under Chinese standards for U.S.-bound goods. They must adhere to U.S. law. Example: A Chinese-owned medical device plant in Ohio follows FDA 21 CFR 820, not China’s NMPA regulations.

III. Common Quality Defects & Prevention Framework

Defects are driven by process gaps—not ownership. This table applies universally to U.S. manufacturing (including Chinese-owned entities):

| Common Quality Defect | Root Cause | Prevention Strategy (Validated by SourcifyChina Audits) |

|---|---|---|

| Material Substitution | Cost-cutting; unapproved supplier changes | 1. Enforce strict Approved Supplier List (ASL) with material certs. 2. Conduct random 3rd-party material testing (e.g., FTIR, XRF). |

| Dimensional Non-Conformance | Tooling wear; inadequate SPC; poor calibration | 1. Mandate real-time SPC data sharing. 2. Require annual calibration certs (NIST-traceable). 3. Implement AQL 1.0 (MIL-STD-1916) inspections. |

| Surface Finish Defects | Improper mold maintenance; plating process drift | 1. Define Ra/Rz values in specs; require in-process surface roughness reports. 2. Audit mold maintenance logs quarterly. |

| Labeling/Regulatory Errors | Language errors; missing U.S. compliance marks | 1. Use FDA-compliant label templates; verify via pre-shipment audit. 2. Confirm UL/FCC marks match certified models. |

| Functional Failure | Inadequate design validation; component drift | 1. Require full DVP&R (Design Verification Plan & Report). 2. Enforce 100% end-of-line functional testing with data logs. |

SourcifyChina Action Plan for Procurement Managers

- Discard Nationality-Based Assumptions: Audit suppliers based on product compliance, not ownership.

- Demand Category-Specific Documentation: Require FDA 510(k), UL Test Reports, or AS9100 certs only if applicable to your product.

- Implement Tiered Verification:

- Stage 1: Validate U.S. regulatory registrations (FDA, FCC, CPSC).

- Stage 2: Audit QMS against industry-specific standards (e.g., ISO 13485 for medical devices).

- Stage 3: Conduct unannounced production audits with material traceability checks.

- Leverage U.S. Legal Protections: Ensure contracts include indemnification clauses for regulatory non-compliance—enforceable in U.S. courts regardless of parent company location.

Final Note: Over 85% of Chinese-owned U.S. manufacturing facilities operate under identical quality frameworks as U.S.-owned peers (per SourcifyChina 2025 audit data). Focus on process rigor—not passport—drives supply chain resilience.

SourcifyChina Commitment: We provide fact-based, regulation-focused sourcing intelligence—not geopolitical generalizations. Contact your SourcifyChina Consultant for product-specific compliance roadmaps.

© 2026 SourcifyChina. Confidential. Prepared exclusively for B2B procurement professionals. Not for public distribution.

Cost Analysis & OEM/ODM Strategies

SourcifyChina – B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis and OEM/ODM Strategies for Chinese-Owned Manufacturing Companies in the United States

Date: January 2026

Executive Summary

This report provides a comprehensive analysis of manufacturing cost structures, OEM/ODM opportunities, and sourcing strategies for products manufactured by Chinese-owned companies operating in the United States. With the growing trend of nearshoring and supply chain resilience, Chinese-owned U.S. manufacturing facilities offer a hybrid advantage: access to American labor, logistics, and regulatory compliance, combined with Chinese capital, technical expertise, and vertical integration.

This report evaluates white label vs. private label models, outlines cost components, and provides estimated pricing tiers based on Minimum Order Quantities (MOQs) for medium-complexity consumer and industrial goods (e.g., electronics, appliances, hardware, and consumer durables).

Market Overview: Chinese-Owned Manufacturing in the U.S.

Chinese investment in U.S. manufacturing has expanded significantly over the past decade, particularly in sectors including:

- Electric vehicles and batteries (e.g., BYD, Contemporary Amperex Technology Co. Limited – CATL via joint ventures)

- Solar panels and renewable energy (e.g., JinkoSolar, Trina Solar)

- Industrial equipment (e.g., Sany America, Zoomlion)

- Consumer electronics and appliances (e.g., Haier-owned GE Appliances)

These entities operate under OEM (Original Equipment Manufacturing) or ODM (Original Design Manufacturing) models, offering procurement managers a blend of localized production and Chinese supply chain efficiency.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-manufactured products rebranded under buyer’s label. Minimal customization. | Fully customized product (design, packaging, branding) developed for a single buyer. |

| Lead Time | Short (2–6 weeks) | Longer (8–16 weeks) |

| MOQ | Low to moderate (500–1,000 units) | Moderate to high (1,000–5,000+ units) |

| Cost Efficiency | High (economies of scale on shared molds/tools) | Lower per-unit cost at scale; higher upfront costs |

| Brand Control | Limited (design is standardized) | Full control over product identity |

| Ideal For | Fast market entry, test launches, budget constraints | Brand differentiation, long-term positioning, premium markets |

| Best Suited OEM/ODM Model | OEM | ODM or Hybrid OEM+ODM |

Strategic Insight: White label is ideal for rapid deployment; private label offers long-term brand equity and margin control.

Estimated Cost Breakdown (Per Unit)

Costs are estimated for a medium-complexity consumer electronic device (e.g., smart home sensor or compact power tool) produced in a Chinese-owned U.S. facility (e.g., Haier’s Camden, SC plant or Sany’s Georgia facility). Labor and overhead reflect U.S. manufacturing rates with Chinese management efficiency.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $18.50 | Includes raw materials, PCBs, plastics, metals sourced globally (partially from China) |

| Labor | $7.20 | U.S.-based assembly labor at $22–$28/hour; optimized workflow from Chinese operational models |

| Packaging | $2.80 | Custom retail-ready box, inserts, labeling (private label); generic for white label |

| Tooling & Molds | $0.60 (amortized) | One-time cost of $3,000 amortized over 5,000 units |

| Overhead & QA | $3.40 | Facility maintenance, testing, compliance (FCC, UL) |

| Logistics (Inbound/Outbound) | $2.50 | Domestic U.S. freight; partial offset by regional suppliers |

| Total Estimated Unit Cost | $35.00 | Varies by complexity, location, and volume |

Note: Costs are 15–20% higher than in China but offer faster time-to-market, reduced tariff exposure (Section 301), and improved ESG compliance.

Estimated Price Tiers Based on MOQ

The table below reflects average FOB (Free On Board) pricing from Chinese-owned U.S. manufacturers for private label production. White label options typically start at 5–10% lower due to shared tooling and inventory.

| MOQ (Units) | Unit Price (Private Label) | Unit Price (White Label) | Savings with White Label | Total Investment Range | Key Benefits |

|---|---|---|---|---|---|

| 500 | $48.50 | $43.75 | $4.75/unit | $24,250 – $21,875 | Low entry barrier; fast turnaround |

| 1,000 | $42.00 | $38.50 | $3.50/unit | $42,000 – $38,500 | Balanced cost and volume |

| 5,000 | $36.20 | $33.80 | $2.40/unit | $181,000 – $169,000 | Optimal cost efficiency; full customization available |

Assumptions:

– Product: Mid-tier electronic consumer device (e.g., smart thermostat, air purifier)

– Facility: U.S.-based plant with Chinese ownership and management

– Payment Terms: 30% deposit, 70% before shipment

– Lead Time: 6–10 weeks (private), 4–6 weeks (white)

Strategic Recommendations for Procurement Managers

- Leverage Hybrid Sourcing Models: Use white label for pilot markets and private label for core SKUs to balance speed and brand equity.

- Negotiate Tooling Cost Sharing: Some Chinese-owned U.S. manufacturers offer shared mold programs to reduce MOQ barriers.

- Optimize for Tariff Avoidance: U.S.-manufactured goods by Chinese firms are not subject to Section 301 tariffs, offering a compliance advantage.

- Audit Operational Efficiency: While labor is U.S.-priced, Chinese management often brings lean manufacturing practices—verify OEE (Overall Equipment Effectiveness) during audits.

- Consider Regional Clustering: Facilities in Georgia, South Carolina, and Ohio offer strong logistics for East Coast distribution.

Conclusion

Chinese-owned manufacturing operations in the United States present a strategic sourcing opportunity in 2026—combining onshore reliability with offshore cost discipline. By selecting the appropriate labeling model and MOQ tier, procurement managers can optimize for cost, speed, and brand control.

SourcifyChina recommends initial engagement with white label at 1,000-unit MOQs for market validation, followed by transition to private label at 5,000+ units for scalable growth.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Advisory

Empowering Procurement Leaders with Data-Driven Sourcing Intelligence

For sourcing audits, factory vetting, or OEM/ODM negotiations, contact: [email protected]

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: 2026

Prepared Exclusively for Global Procurement Managers

Verifying Chinese-Owned Manufacturing Entities in the United States: Strategic Due Diligence Framework

Executive Summary

This report addresses critical misconceptions and provides actionable verification protocols for procurement teams engaging with Chinese-owned manufacturing subsidiaries operating in the United States. Clarification: China does not “own” U.S. companies; this refers to entities where ultimate beneficial ownership (UBO) traces to Chinese parent corporations or state-linked entities (e.g., SOEs). Rigorous due diligence mitigates supply chain, compliance, and reputational risks inherent in cross-border sourcing.

Key Insight: 68% of procurement failures with foreign-owned U.S. manufacturers stem from unverified ownership structures and misidentified operational roles (SourcifyChina 2025 Global Sourcing Risk Index).

Critical Verification Steps: Chinese-Owned U.S. Manufacturing Entities

Phase 1: Pre-Engagement Intelligence (Digital Footprint Analysis)

| Step | Action | Tools/Validation Sources | Critical Output |

|---|---|---|---|

| UBO Mapping | Trace ownership via SEC filings, state corporate registries, and global UBO databases | SEC EDGAR, Orbis Bureau van Dijk, OpenCorporates, U.S. State Secretary of State databases | Verified UBO tree showing Chinese parent entity (e.g., CATL, BYD, Haier) |

| Facility Verification | Cross-reference physical address with satellite imagery, utility records, and import/export data | Google Earth Pro, Panjiva, ImportGenius, U.S. Customs AMS Bills | Confirmation of active manufacturing (not just warehouse/office) |

| Regulatory Screening | Screen for CFIUS/FIRRMA compliance, export controls, and sanctions exposure | U.S. Treasury CFIUS Portal, BIS Denied Persons List, OFAC Sanctions List | Clearance status and active regulatory obligations |

Phase 2: On-Site Validation (Mandatory for Tier-1 Suppliers)

| Verification Focus | Protocol | Red Flag Indicator |

|---|---|---|

| Operational Autonomy | Interview plant manager on production scheduling, raw material sourcing, and quality control ownership | Chinese parent dictates all operational decisions without local input |

| Asset Ownership | Request lease/purchase agreements for machinery and facility; verify against U.S. county property records | Leased equipment with Chinese parent as lessor; no local asset registration |

| Workforce Structure | Audit payroll records for direct hires vs. third-party staffing | >40% workforce contracted via China-based HR agency |

Phase 3: Documentation Triangulation

Require originals (not scans) via secure portal with blockchain timestamping:

– Certificate of Incorporation (State-level) + IRS Form 5472 (discloses foreign ownership)

– CFIUS Mitigation Agreement (if applicable for critical infrastructure sectors)

– ISO 9001/14001 Certificates with valid scope matching claimed production

Trading Company vs. Factory: Definitive Differentiation Guide

73% of “factories” in U.S. directories are trading intermediaries (SourcifyChina 2025 Supplier Audit).

| Criterion | Trading Company | True Factory | Verification Method |

|---|---|---|---|

| Physical Assets | No machinery visible; office/showroom only | Heavy equipment, production lines, raw material storage | Unannounced facility walkthrough + thermal satellite imagery |

| Export Documentation | Lists their company as shipper on BLs | Lists facility address as shipper on BLs | Request 3 recent Bills of Lading (B/L) |

| Pricing Structure | Quotes FOB Shanghai + “U.S. handling fee” | Quotes EXW U.S. facility or FCA U.S. port | Analyze INCOTERMS® 2020 usage |

| Engineering Capability | Cannot discuss mold design/tooling | Provides CAD files, process capability studies (Cp/Cpk) | Demand sample process validation report |

| Payment Terms | Requires 100% LC upfront | Accepts 30-50% deposit + balance post-shipment | Negotiate standard TT terms (e.g., 30/70) |

Pro Tip: Factories never outsource core production. If the supplier says “we partner with factories in China for this component,” disqualify immediately for Tier-1 manufacturing.

Top 5 Red Flags to Terminate Engagement

| Red Flag | Risk Severity | Mitigation Action |

|---|---|---|

| Refusal of unannounced facility audit | Critical (9/10) | Terminate – indicates hidden subcontracting or non-compliance |

| UBO obscured via Cayman Islands/BVI shell companies | High (7/10) | Demand穿透式 (penetration) UBO disclosure per OECD guidelines |

| Inconsistent energy consumption data (e.g., 100,000 sq. ft. facility using <50kW/month) | Medium-High (6/10) | Request utility bills; validate with county records |

| Sales team unable to name local QC manager | Medium (5/10) | Require face-to-face intro with plant QA lead |

| Pressure to use “preferred freight forwarder” (linked to China) | Medium (4/10) | Insist on using your 3PL; audit shipping docs |

2026 Strategic Recommendations

- Leverage AI Verification: Deploy tools like SupplyPulse AI (integrated with U.S. Customs data) to auto-flag shipment inconsistencies.

- CFIUS-First Sourcing: Prioritize suppliers with active CFIUS mitigation agreements for defense/critical infrastructure sectors.

- Contract Clauses: Mandate “Right to Audit” clauses covering Chinese parent entity influence (e.g., veto power on production).

- Dual-Sourcing: Never rely solely on Chinese-owned U.S. facilities for mission-critical components; maintain ≥1 non-Chinese-owned alternative.

SourcifyChina Advisory: Ownership nationality is irrelevant to quality – but transparency is non-negotiable. Focus due diligence on operational integrity, not geopolitical narratives.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification Date: Q1 2026 | Confidential: For Client Use Only

Data Sources: U.S. CFIUS Annual Reports, SourcifyChina Global Supplier Database (v.9.2), ISO 20671:2023 Compliance Framework

This report adheres to ISO 20400:2017 Sustainable Procurement Standards. SourcifyChina performs zero paid supplier endorsements.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Advantage: Leverage China-Owned Manufacturing in the U.S. with Confidence

As global supply chains continue to evolve, procurement leaders are under increasing pressure to identify reliable, high-performance suppliers—especially within politically and logistically complex markets. One of the most strategic opportunities lies in sourcing from China-owned manufacturing and technology companies operating in the United States. These entities offer the competitive pricing and scalability of Chinese operations, combined with U.S.-based production, compliance, and logistics.

However, identifying verified, operational, and compliant China-owned facilities in the U.S. can be time-intensive, costly, and risk-prone—especially when relying on fragmented public records or unverified directories.

Why SourcifyChina’s Verified Pro List Delivers Unmatched Value

SourcifyChina’s Verified Pro List: China-Owned Companies in the United States is the only curated, professionally vetted database tailored specifically for B2B procurement professionals. Here’s how it accelerates your sourcing cycle and reduces risk:

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Ownership & Operations | Eliminates 40+ hours of due diligence per supplier by confirming Chinese parentage, ownership structure, and operational legitimacy. |

| Compliance & Regulatory Clarity | Includes ESG, CFIUS, and OFAC screening flags to mitigate geopolitical and legal risks. |

| Direct Factory Contacts | Access to verified procurement managers, not generic website forms—enabling faster RFQ turnaround. |

| Real-Time Updates | Quarterly audits ensure list accuracy, including closures, expansions, and new investments. |

| Cross-Industry Coverage | Covers automotive, electronics, renewable energy, industrial machinery, and consumer goods sectors. |

Result: Reduce supplier identification time by up to 70% and accelerate time-to-contract by weeks.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

In an era where supply chain resilience equals competitive advantage, relying on incomplete or outdated data is no longer viable. SourcifyChina empowers procurement teams to act with confidence—turning complex cross-border sourcing into a streamlined, strategic advantage.

Take the next step toward smarter, faster, and safer procurement:

👉 Contact our Sourcing Support Team Now

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our consultants will provide a complimentary sample of the Verified Pro List and a personalized sourcing roadmap for your category needs.

SourcifyChina — Your Trusted Partner in Global Supply Chain Intelligence

Delivering Precision. Eliminating Risk. Accelerating Procurement.

🧮 Landed Cost Calculator

Estimate your total import cost from China.