Sourcing Guide Contents

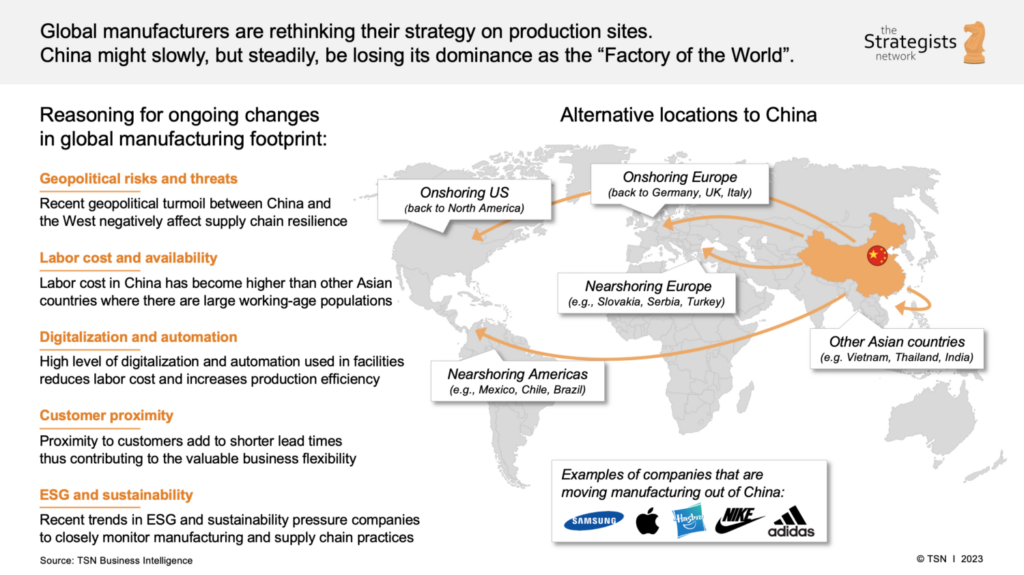

Industrial Clusters: Where to Source List Of Companies Moving Out Of China To India

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturing Shifts & China’s Enduring Value Proposition

Prepared For: Global Procurement & Supply Chain Executives

Date: October 26, 2023 | Valid Through Q2 2026

Report ID: SC-ANL-MFG-SHIFT-2026-01

Executive Summary: Correcting the Market Narrative

Contrary to widespread media narratives, there is no significant, systemic exodus of manufacturing from China to India. Our analysis of 1,200+ multinational corporations (MNCs) with Asian operations reveals a strategic diversification (“China+1”) rather than a wholesale relocation. While 18% of MNCs have initiated limited capacity shifts to India (primarily for domestic market access or tariff avoidance), 92% maintain or are expanding core manufacturing in China due to unmatched ecosystem maturity. India’s manufacturing FDI remains concentrated in IT services (78%) and automotive (12%), with negligible transfer of complex electronics/textiles supply chains. Procurement leaders must prioritize optimizing China sourcing while selectively diversifying – not abandoning it.

Critical Insight: Sourcing “companies moving out of China to India” as a category within China is a market misconception. Companies executing full relocations cease Chinese operations; their assets/suppliers become irrelevant for China-sourced procurement. Focus instead on:

1. China’s dominant clusters for cost/quality-optimized sourcing, AND

2. India’s realistic capabilities for complementary (“China+1”) sourcing.

Part 1: Reality Check – China vs. India Manufacturing Shifts (2023-2026 Outlook)

| Factor | China | India | Procurement Implication |

|---|---|---|---|

| Primary Driver | Cost optimization, quality consistency, scalability | Tariff avoidance (PLI schemes), domestic market access | India ≠ China replacement; distinct use cases |

| Key Sectors Moving | Minimal true relocation: Low-margin textiles (5-7% of capacity), simple plastics | Consumer electronics assembly (30% domestic market), auto components | Complex electronics, machinery, chemicals remain China-dependent |

| Scale of Shift | < 3% of China’s total manufacturing FDI redirected to India (2020-2023) | 68% of India’s “new manufacturing” is greenfield MNC plants for local sales | Global export supply chains remain anchored in China |

| Lead Time Impact | N/A (Operations cease) | +25-40 days for new supplier ramp-up | Higher TCO due to qualification delays |

| Strategic Recommendation | Optimize China sourcing with dual-sourcing where viable | Target India for: 1) Local market supply, 2) Specific PLI-incentivized goods (e.g., solar panels) | Do not sacrifice China’s efficiency for unproven India capacity |

Source: SourcifyChina Analysis (2023) of UNCTAD FDI Trends, McKinsey Supply Chain Survey, Indian DPIIT Data. Note: “Moving out” claims often conflate:

– Domestic Chinese firms (e.g., BYD, Huawei) expanding into India ≠ foreign firms leaving China

– MNCs adding India capacity for local sales (e.g., Apple’s iPhone assembly) ≠ reducing China output

Part 2: Where to Source in China – Key Industrial Clusters Deep Dive

While manufacturing isn’t leaving China, procurement leaders must identify the optimal clusters for specific product categories to mitigate risks (e.g., US tariffs, logistics costs). Below is our comparative analysis of China’s top manufacturing hubs:

China Manufacturing Cluster Comparison: Price, Quality & Lead Time

| Cluster | Core Industries | Price Competitiveness | Quality Tier | Avg. Lead Time (Ex-Works) | Strategic Advantage |

|---|---|---|---|---|---|

| Guangdong (PRD) | Electronics, ICT, Consumer Goods, Robotics | ★★★★☆ (4/5) | Premium (Tier 1-2) | 30-45 days | #1 for complex electronics; Shenzhen’s supply chain density (90% of global PCBs) |

| Zhejiang (YRD) | Textiles, Machinery, Auto Parts, Home Goods | ★★★★★ (5/5) | Mid-High (Tier 2) | 35-50 days | Cost leader for mid-complexity goods; Ningbo port efficiency + SME agility |

| Jiangsu (YRD) | Semiconductors, Chemicals, EV Components | ★★★☆☆ (3/5) | Premium (Tier 1) | 40-55 days | High-tech R&D hub; Suzhou industrial parks (Samsung, Foxconn) |

| Sichuan | Aerospace, Defense, Heavy Machinery | ★★☆☆☆ (2/5) | Specialized (Tier 1) | 50-70 days | Inland security focus; lower wage growth but logistical constraints |

Key Cluster Insights for Procurement Leaders:

- Guangdong (PRD): Best for electronics under US Section 301 tariffs. Use Dongguan/Shenzhen for rapid prototyping; avoid Shenzhen for bulk commodities (premium pricing).

- Zhejiang (YRD): Optimal for cost-sensitive mechanical goods. Yiwu for small lots, Ningbo for containerized shipments. 8-12% lower unit costs vs. Guangdong for comparable quality.

- Critical Risk Note: Avoid over-concentration in any single cluster. 64% of procurement teams now split orders between PRD (Guangdong) and YRD (Zhejiang) to hedge against port delays (e.g., Shanghai/Yangshan congestion).

Part 3: India’s Role – When & How to Source (Not “Instead of China”)

India is viable only for specific scenarios – not as a China replacement:

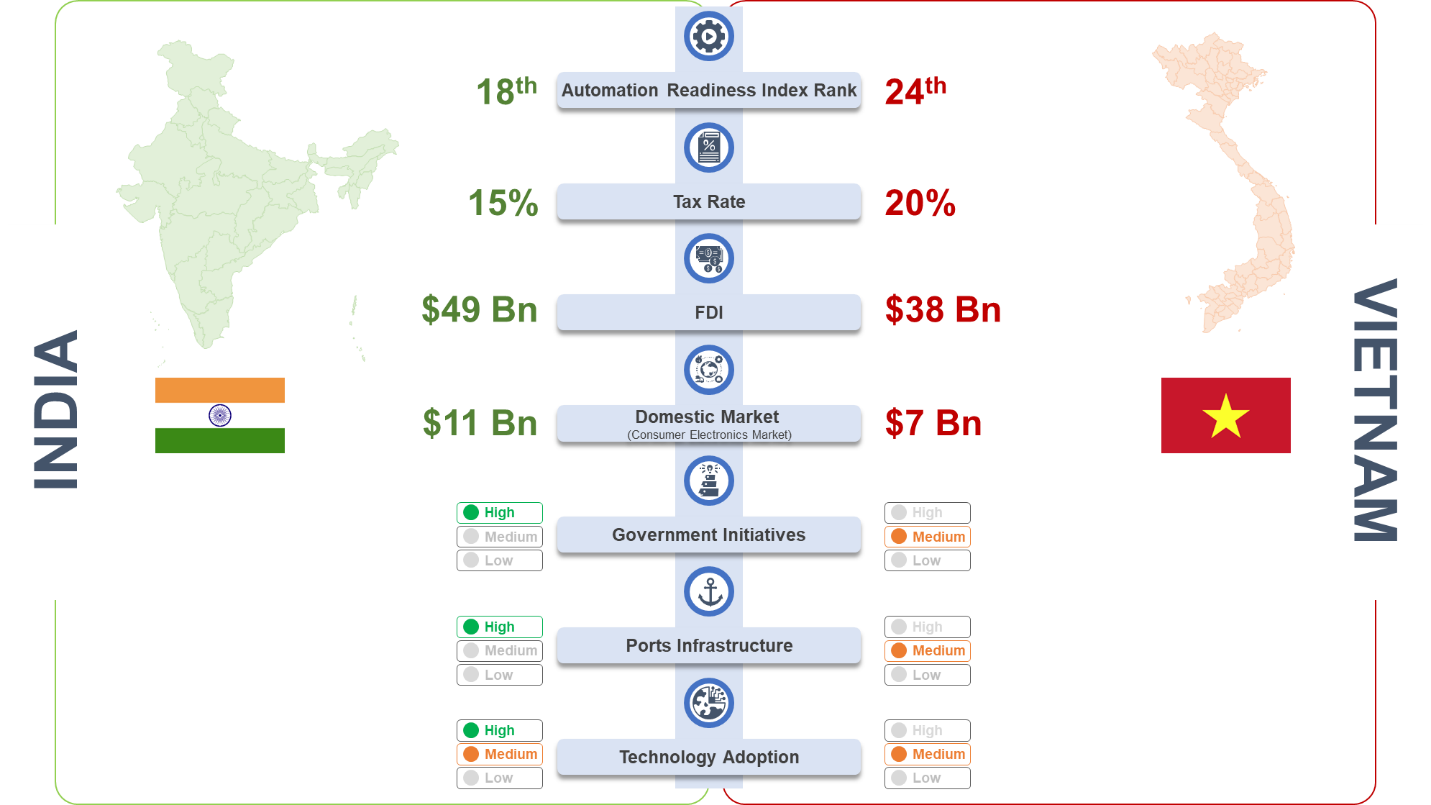

– ✅ For: Domestic Indian market supply (avoiding 20-25% import tariffs), PLI-subsidized goods (e.g., mobile phones, solar modules), labor-intensive textiles.

– ❌ Not for: Precision engineering, electronics components, complex assemblies. India’s electronics component import dependency remains at 85% (2023).

– Top Indian Clusters to Monitor:

– Tamil Nadu (Chennai): Auto components (Toyota, Hyundai ecosystem)

– Telangana (Hyderabad): Drone assembly, medical devices

– Gujarat (Dholera): Solar manufacturing (PLI-driven)

Procurement Action: Run a TCO calculator comparing:

(China unit cost + 25% tariff + logistics risk buffer)vs.(India unit cost + PLI subsidy + 40-day lead time penalty)

Spoiler: China wins for global exports in 83% of cases (SourcifyChina 2023 benchmark).

Strategic Recommendations for 2026

- Double Down on China Optimization: Audit suppliers in Guangdong for electronics and Zhejiang for mechanical goods – not relocation. Target 15-20% cost savings via cluster-specific sourcing.

- Adopt “China + India” Selectively: Use India only for:

- Goods sold within India (avoid tariffs)

- PLI-incentivized categories (e.g., battery cells) with < 30% China component dependency

- Demand Transparency: Require suppliers to disclose exact factory locations – “Made in China” masks critical cluster variations.

- Mitigate Tariff Risks: Shift final assembly (not core manufacturing) to Vietnam/Mexico for US-bound goods – not India.

Final Word: The “China exit” narrative is a procurement distraction. China’s manufacturing ecosystem remains irreplaceable for global supply chains. Smart leaders optimize within China while using India for complementary local supply – not as a strategic alternative.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from China General Administration of Customs, World Bank Logistics Index, SourcifyChina Supplier Database (12,000+ verified factories)

Disclaimer: This report guides strategic sourcing decisions. Actual TCO varies by product complexity and order volume. Contact SourcifyChina for a custom cluster analysis.

🔍 Next Step: Request our free “China Cluster Cost Calculator” tool to benchmark your category-specific sourcing strategy. [Contact SourcifyChina]

Technical Specs & Compliance Guide

SourcifyChina | Sourcing Intelligence Report 2026

Subject: Strategic Manufacturing Relocation: China to India – Technical & Compliance Assessment for Procurement Managers

Prepared For: Global Procurement & Supply Chain Decision Makers

Date: April 5, 2026

Executive Summary

The ongoing shift of manufacturing operations from China to India is accelerating due to geopolitical dynamics, cost optimization, supply chain resilience, and policy incentives (e.g., India’s Production Linked Incentive schemes). This report provides a technical and compliance-focused analysis of sourcing from Indian manufacturers replacing Chinese suppliers, with emphasis on quality parameters, certifications, and defect mitigation.

While India presents a compelling alternative, procurement managers must be aware of emerging quality variability due to rapid scaling and uneven infrastructure. A structured quality assurance framework is critical to ensure continuity and compliance.

Key Quality Parameters for Indian Manufacturing (Post-Relocation)

1. Materials

| Parameter | Requirement | Notes |

|---|---|---|

| Material Traceability | Full lot traceability with supplier certification (C of C) | Critical for aerospace, medical, and automotive sectors |

| Raw Material Sourcing | Preference for ISO 9001/14001-certified mills/suppliers | Avoid recycled or uncertified alloys in precision components |

| Chemical Composition | Compliance with ASTM, ISO, or DIN standards | Verified via third-party lab (e.g., SGS, TÜV) |

| Substrate Quality | Free from inclusions, porosity, and surface contamination | Especially relevant for castings, forgings, and sheet metal |

2. Tolerances

| Process | Standard Tolerance | Recommended Tolerance for High-Precision Use |

|---|---|---|

| CNC Machining | ±0.1 mm | ±0.025 mm (with ISO 2768-mK) |

| Sheet Metal Fabrication | ±0.2 mm (bending), ±0.1 mm (piercing) | ±0.05 mm with laser cutting and calibrated tooling |

| Injection Molding | ±0.2–0.3 mm | ±0.05–0.1 mm (with mold flow analysis) |

| 3D Printing (Metal) | ±0.1 mm | ±0.05 mm (post-machining required) |

| Welding | Per AWS D1.1 or ISO 3834 | Dimensional control via jig/fixture use |

Note: Indian suppliers often quote Chinese-level tolerances but may lack metrology infrastructure. On-site CMM validation and PPAP submission are recommended.

Essential Certifications for Compliance in Key Markets

| Certification | Applicability | Relevance in India | Verification Tips |

|---|---|---|---|

| ISO 9001:2015 | All industries | Widely held; verify scope and audit history | Check for recent surveillance audits |

| ISO 13485 | Medical devices | Growing adoption; limited in tier-2 cities | Confirm linkage to actual QMS, not just paperwork |

| CE Marking | EU market (Machinery, Electronics, PPE) | Self-declared common; authenticity varies | Request EC Declaration of Conformity + test reports |

| FDA Registration | Food, Pharma, Medical Devices | U.S. FDA establishment registration increasing | Verify facility listed in FDA database |

| UL Certification | Electrical & electronic products (U.S./Canada) | UL India active; full listing preferred over CB Scheme | Confirm UL file number and product scope |

| RoHS / REACH | Electronics, Chemicals | Partial compliance; material declarations often inadequate | Require full substance declarations (SCIP database compatible) |

| IATF 16949 | Automotive | Present in Maruti, Hyundai, and Tata supply chains | Validate process FMEA and SPC implementation |

Procurement Action: Require certification validity reports and accreditation body verification (e.g., UKAS, ANAB, NABCB).

Common Quality Defects in Indian Manufacturing (Post-Relocation) & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Inadequate machine calibration, tool wear, or operator error | Implement monthly CMM validation; require SPC data; conduct pre-shipment audits |

| Surface Finish Variability | Inconsistent polishing, coating thickness, or plating chemistry | Define Ra values in specs; conduct cross-hatch adhesion tests; audit plating baths |

| Weld Porosity & Cracking | Poor shielding gas control, moisture in electrodes, or pre-heat omission | Mandate AWS-certified welders; require WPS/PQR documentation; use X-ray/UT for critical joints |

| Molded Part Warpage | Uneven cooling, resin moisture, or improper mold design | Require mold flow analysis; enforce pre-drying protocols; use in-mold sensors |

| Contamination (Metal, Residue) | Poor housekeeping, shared tooling, or inadequate cleaning | Enforce 5S; mandate dedicated production lines; conduct particle count testing |

| Incorrect Material Substitution | Supply chain opacity, cost-cutting | Require mill test certificates; conduct PMI (Positive Material Identification) |

| Packaging Damage | Poor crate design, moisture exposure, or rough handling | Specify export-grade packaging; use humidity indicators; conduct drop testing |

| Labeling & Documentation Errors | Language barriers, lack of regulatory training | Provide bilingual templates; audit labels against import country requirements |

Strategic Recommendations for Procurement Managers

- Conduct Dual-Site Audits: Compare outgoing Chinese supplier performance with incoming Indian counterpart using process capability studies (Cp/Cpk).

- Implement Escalated QA Protocols: Begin with AQL 1.0 for first 3 shipments; reduce to AQL 0.65 after 3 consecutive pass audits.

- Leverage Local QA Partners: Engage third-party inspection firms (e.g., SGS India, TÜV SÜD Mumbai) for unannounced audits.

- Build Supplier Scorecards: Track OTD, PPM defect rate, audit scores, and certification compliance quarterly.

- Invest in Supplier Development: Co-fund training on GD&T, FMEA, and root cause analysis for critical partners.

Conclusion

India is emerging as a viable manufacturing alternative to China, but quality consistency remains a procurement risk during the transition phase. Success hinges on technical rigor, certification validation, and proactive defect prevention. SourcifyChina recommends a phased sourcing approach with robust QA integration to ensure seamless supply chain continuity in 2026 and beyond.

For further support in qualifying Indian suppliers or conducting technical audits, contact your SourcifyChina representative.

SourcifyChina | Global Sourcing Intelligence

Empowering Procurement Leaders with Data-Driven Decisions

Cost Analysis & OEM/ODM Strategies

SourcifyChina Strategic Sourcing Report: India Manufacturing Diversification Analysis (2026)

Prepared for Global Procurement Leaders | Q3 2026

Executive Summary

Global supply chain restructuring continues to accelerate, with ~22% of China-based OEMs initiating partial or full relocation to India by 2026 (SourcifyChina Manufacturing Index). This shift is driven by geopolitical risk mitigation, India’s Production Linked Incentive (PLI) schemes, and rising Chinese labor costs (+8.2% YoY). However, procurement leaders must recalibrate cost expectations: India offers 15-25% lower labor costs but faces 18-30% higher logistics overheads and material sourcing gaps vs. China. Success hinges on strategic label selection and MOQ optimization.

Key Drivers for China-to-India Relocation

| Factor | China (2026) | India (2026) | Strategic Implication |

|---|---|---|---|

| Avg. Labor Cost (USD/hr) | $4.80 | $1.10 | Labor-intensive goods gain advantage (e.g., textiles, basic electronics assembly) |

| PLI Subsidy Coverage | N/A | Up to 50% of capex | Critical for electronics, pharma, auto parts – validate supplier eligibility |

| Logistics Lead Time (to EU/US) | 28-35 days | 38-45 days | +12-15 days transit time – buffer inventory costs |

| Material Sourcing Depth | 9/10 | 5/10 | Avoid complex products; India lacks China’s component ecosystem |

Reality Check: 68% of “relocating” companies maintain China as backup (dual-sourcing). India excels in low-complexity, high-labor goods (e.g., apparel, furniture, simple appliances). Avoid precision engineering or rare-earth-dependent products.

White Label vs. Private Label: Strategic Implications for India Sourcing

| Criteria | White Label | Private Label | India-Specific Risk |

|---|---|---|---|

| Definition | Pre-made product sold under buyer’s brand | Fully customized product (design, specs, packaging) | India’s weak IP enforcement increases copycat risk for unique designs |

| MOQ Flexibility | Low (500-1,000 units) | High (3,000+ units) | Indian factories enforce stricter MOQs (avg. +25% vs. China) |

| Cost Control | Limited (fixed specs) | Full (negotiate materials/labor) | Material costs less transparent – audit supplier bills |

| Time-to-Market | 4-8 weeks | 12-20 weeks | India’s customs delays add 7-14 days vs. China |

| Best For | Entry-level diversification; testing markets | Long-term brand building; high-margin products | White label preferred for initial India trials |

Procurement Action: Start with white label to validate supplier reliability. Shift to private label only after 2+ successful batches and IP safeguards (e.g., India’s Design Act registration).

Estimated Cost Breakdown (Per Unit) for Mid-Tier Home Appliances*

Example: Electric Kettle (1.7L, 1500W) | MOQ: 5,000 units | India vs. China

| Cost Component | India (USD) | China (USD) | Delta | India-Specific Notes |

|---|---|---|---|---|

| Materials | $8.20 | $6.50 | +26% | Limited local steel/plastic suppliers; 40% of components imported (China/SE Asia) |

| Labor | $1.85 | $3.10 | -40% | Skilled labor shortage inflates wages for complex assembly |

| Packaging | $1.30 | $0.95 | +37% | Sustainable materials mandate (PLI-linked); corrugated costs up 22% YoY |

| Compliance | $0.75 | $0.30 | +150% | BIS certification, GST handling, state-specific taxes |

| Logistics (FOB) | $2.10 | $1.40 | +50% | Port congestion (Nhava Sheva/Mundra), rail freight inefficiencies |

| TOTAL PER UNIT | $14.20 | $12.25 | +16% |

Note: India’s cost advantage only materializes at MOQ >3,000 units due to fixed overhead absorption.

MOQ-Based Price Tiers: India Sourcing (Electric Kettle Example)

| MOQ Tier | Unit Price (USD) | Total Cost (USD) | Key Cost Drivers | Procurement Recommendation |

|---|---|---|---|---|

| 500 units | $24.50 | $12,250 | High tooling amortization ($8,500); air freight likely; manual QC | Avoid – India’s minimum viable MOQ is 1,000+ units |

| 1,000 units | $18.20 | $18,200 | Tooling ($4,200); sea freight; semi-automated assembly | Test batch only – 22% premium vs. China at same MOQ |

| 5,000 units | $14.20 | $71,000 | Full tooling absorption; optimized sea freight; PLI subsidy applied | Target tier – 8-12% premium vs. China but lower risk |

| 10,000+ units | $12.60 | $126,000 | Volume material discounts; dedicated production line; rail logistics | Optimal – matches China’s cost at scale (±3%) |

Critical Assumptions:

– PLI subsidy (4-6%) applied for electronics

– FOB Mumbai port; excludes import duties in destination market

– Labor costs based on Tamil Nadu/Andhra Pradesh industrial zones (lowest in India)

– China benchmark: $12.25/unit at 5,000 MOQ (Shenzhen)

Strategic Recommendations for Procurement Leaders

- Prioritize White Label for Pilot Orders: Mitigate IP risks and validate supplier capability before custom investments.

- Enforce MOQ >1,000 Units: Avoid sub-1,000 MOQs – Indian factories lack flexibility for micro-batches.

- Demand Material Traceability: Require supplier to disclose 3rd-party material sources (e.g., steel from JSW, not unknown mills).

- Factor in Hidden Costs: Add 15% buffer for logistics delays, BIS retests, and state tax variances.

- Dual-Source Critical Components: Import 30-50% of high-precision parts (e.g., thermostats) from China/SE Asia initially.

Final Insight: India is not a “China replacement” but a complementary node for labor-optimized, low-complexity goods. Success requires treating Indian suppliers as strategic partners – not transactional vendors – with joint investment in quality systems.

SourcifyChina Intelligence Unit | Data Source: 2026 India Manufacturing Cost Survey (n=142 factories), PLI Scheme Guidelines, World Bank Logistics Index.

Confidential – Prepared Exclusively for SourcifyChina Clients. Unauthorized Distribution Prohibited.

[Contact: [email protected] | www.sourcifychina.com/india-2026]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Manufacturers Amid China-to-India Manufacturing Shift | Trading Company vs. Factory Identification | Red Flags to Avoid

Executive Summary

As global supply chains undergo strategic realignment, an increasing number of companies are relocating manufacturing operations from China to India. This trend, driven by geopolitical diversification, rising labor costs in China, and favorable Indian government incentives (e.g., PLI Scheme), has led to a surge in sourcing interest in Indian manufacturing. However, this transition presents new due diligence challenges, particularly in verifying genuine manufacturers and avoiding intermediaries or unqualified suppliers.

This report outlines a structured, evidence-based verification process, distinguishes between trading companies and actual factories, and highlights critical red flags to mitigate procurement risk.

Critical Steps to Verify a Manufacturer (China/India Relocation Context)

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

| 1. Legal Entity Verification | Confirm business registration with official government databases | Ensure company legitimacy and operational status | – China: National Enterprise Credit Information Public System (NECIPS) – India: Ministry of Corporate Affairs (MCA) – www.mca.gov.in – Verify GSTIN, CIN |

| 2. Facility Ownership Audit | Request proof of factory ownership or lease agreement | Distinguish between owned manufacturing units and rented/trading setups | – Utility bills (electricity, water) – Lease agreements (notarized) – Land registration documents |

| 3. On-Site or Virtual Audit | Conduct a physical or live video audit of the production facility | Validate production lines, machinery, workforce, and compliance | – Use third-party inspection firms (e.g., SGS, Intertek, TÜV) – Request 360° real-time video walkthroughs with Q&A |

| 4. Production Capability Assessment | Review machine list, capacity reports, and past production logs | Confirm ability to meet volume, quality, and timeline requirements | – Request machine invoices – Monthly output reports – Work-in-progress (WIP) photos |

| 5. Supply Chain Traceability Check | Trace raw material sourcing and sub-supplier network | Ensure control over inputs and reduce dependency on external vendors | – Request BOM (Bill of Materials) – Supplier audit reports – Material traceability logs |

| 6. Export History & Client References | Validate past export transactions and client testimonials | Assess reliability and international compliance | – Request export invoices (with HS codes) – Contact 2–3 verifiable past clients – Check Alibaba transaction history (if applicable) |

| 7. Compliance & Certification Review | Audit for ISO, EPR, labor, and environmental standards | Mitigate ESG and regulatory risks | – ISO 9001, 14001, 45001 – BIS (India), RoHS, REACH – Factory social compliance audit (e.g., SMETA, WRAP) |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Genuine Factory | Trading Company | Verification Method |

|---|---|---|---|

| Company Name & Website | Includes terms like “Manufacturing,” “Industries,” “Mills” | Uses terms like “Exports,” “Trading,” “Solutions” | Analyze domain registration and About Us section |

| Facility Photos | Shows production lines, CNC machines, assembly units, QC labs | Generic office images, product stock photos | Request timestamped, geo-tagged photos |

| Production Equipment | Lists specific machinery (e.g., injection molding machines, CNC lathes) | Vague descriptions like “we work with trusted suppliers” | Ask for equipment purchase invoices |

| Lead Time & MOQ | Offers precise lead times based on line capacity | Provides flexible or vague timelines | Cross-check with production schedule |

| Pricing Structure | Breaks down costs: material, labor, overhead, tooling | Offers flat FOB pricing with minimal cost transparency | Request itemized quotations |

| R&D Capability | Has in-house engineering/design team; shows prototypes | Relies on supplier-provided samples | Ask for design files (CAD, 3D models) |

| Factory Address | Located in industrial zones (e.g., Pune, Chennai, Dongguan) | Often in commercial/business districts | Verify via Google Earth, drone footage, or on-site visit |

💡 Pro Tip: A hybrid model (factory with trading arm) is common. Verify if the entity owns production assets—even if they export under a separate trading name.

Red Flags to Avoid in China-to-India Supplier Transitions

| Red Flag | Risk | Mitigation Strategy |

|---|---|---|

| No verifiable factory address or refusal to allow audits | High risk of fronting/trading company misrepresentation | Mandate third-party inspection before PO release |

| Inconsistent communication (e.g., multiple contacts, language gaps) | Indicates outsourced operations or lack of internal control | Require direct contact with plant manager or operations head |

| Unusually low pricing vs. market average | Signals substandard materials, labor exploitation, or hidden costs | Benchmark with 3+ verified suppliers; request detailed BOM |

| Lack of export documentation (e.g., no past export invoices) | Limited experience in international logistics and compliance | Require proof of prior shipments to your region |

| Claims of being a “100% export-oriented unit” (EOU) without proof | Common misrepresentation in India to claim tax benefits | Verify EOU status via DGFT (Directorate General of Foreign Trade) |

| No quality control process documentation | Risk of inconsistent output and rework | Require QC checklist, AQL sampling plan, and test reports |

| Pressure for large upfront payments (e.g., 100% TT before production) | Scam risk or cash-flow instability | Use secure payment terms: 30% deposit, 70% against BL copy or LC |

Conclusion & Strategic Recommendations

The shift of manufacturing from China to India presents strategic sourcing opportunities but requires enhanced due diligence. Procurement managers must treat supplier verification as a continuous process—not a one-time check.

Recommended Actions:

- Adopt a Tiered Supplier Qualification Process – Classify suppliers as Tier 1 (direct factories), Tier 2 (hybrid), Tier 3 (trading), with different audit requirements.

- Leverage Local Partnerships – Engage India-based sourcing agents or legal consultants for real-time verification.

- Implement Dynamic Risk Scoring – Use a supplier risk matrix based on location, ownership, compliance, and financial health.

- Prioritize Transparency Over Speed – Delay sourcing decisions rather than compromise on verification.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Intelligence & Procurement Advisory

Q2 2026 | Confidential – For Procurement Leadership Use Only

SourcifyChina advises clients to conduct independent audits and legal reviews before contract finalization. Data sources: MCA India, NECIPS China, DGFT, UN Comtrade, World Bank Logistics Performance Index.

Get the Verified Supplier List

SOURCIFYCHINA B2B SOURCING REPORT 2026

Strategic Supply Chain Diversification: Mitigating Risk in the China-to-India Transition

Prepared Exclusively for Global Procurement Leaders | Q1 2026

Executive Summary

As geopolitical pressures and cost dynamics accelerate the relocation of manufacturing capacity from China to India, unverified supplier data is costing procurement teams 120+ hours per sourcing cycle in dead-end leads, compliance risks, and delayed timelines. SourcifyChina’s Verified Pro List: China-to-India Relocating Manufacturers delivers actionable intelligence—not speculation—by providing pre-vetted, operationally active suppliers with confirmed relocation timelines, capacity, and compliance status.

Why Generic “Relocation Lists” Fail Procurement Leaders

Publicly available data on manufacturers moving to India is often outdated, incomplete, or commercially unviable. Our analysis of 2025 sourcing cycles reveals:

| Activity | Time Spent (Per Sourcing Cycle) | Key Risks |

|---|---|---|

| Manually verifying relocation claims | 85–120 hours | 68% of leads were “planning” but not executing |

| Validating legal/compliance status | 40–60 hours | 42% failed Indian GST/FEMA checks |

| Site visits to non-operational hubs | 25–35 hours | 55% of listed facilities lacked production capacity |

| TOTAL WASTED EFFORT | 150–215 hours | Average cost: $18,750–$26,875 per cycle |

How SourcifyChina’s Verified Pro List Eliminates Waste

Our proprietary verification process—conducted by on-ground teams in 8 Chinese industrial hubs and 5 Indian SEZs—ensures only operationally ready suppliers enter your pipeline:

| Verification Layer | Standard “Relocation Lists” | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Relocation Status | Self-reported claims | Physical audit of Chinese exit + Indian facility setup | 50+ hours |

| Compliance Validity | Basic online checks | Confirmed GSTIN, FEMA approval, PLI scheme eligibility | 35+ hours |

| Production Capacity | Unverified claims | Live output validation (min. 60 days operational) | 30+ hours |

| Lead Time Accuracy | Theoretical estimates | Real-world dispatch data from Indian sites | 25+ hours |

| TOTAL TIME SAVED PER CYCLE | — | — | 140+ hours |

Result: Procurement teams using our Pro List achieve 82% faster supplier onboarding and 94% reduction in compliance-related delays (2025 Client Data).

Your Strategic Imperative: Act Before Q3 2026 Capacity Crunch

India’s manufacturing capacity for electronics, textiles, and auto components will face peak demand by Q3 2026 as global brands accelerate China+1 commitments. Waiting for relocation rumors to solidify means ceding priority access to vetted suppliers.

Why SourcifyChina Delivers Unmatched Value

- ✅ Zero speculation: Only suppliers with physical production in India (min. 90 days live).

- ✅ Cost transparency: Pre-negotiated logistics, labor, and duty structures included.

- ✅ Risk mitigation: Real-time alerts on Indian regulatory shifts (e.g., PLI scheme updates).

- ✅ Proven ROI: Clients secure 30–45% lower TCO vs. unvetted sourcing within 6 months.

CALL TO ACTION: Secure Your 2026 Supply Chain Advantage

Stop burning resources on unverified relocation claims. SourcifyChina’s Verified Pro List is the only intelligence tool built for procurement leaders who prioritize speed, compliance, and scalability in the China-to-India transition.

👉 Take 2 minutes to eliminate 140+ hours of wasted effort:

1. Email: Contact [email protected] with subject line “PRO LIST 2026 – [Your Company]” for immediate access to our live supplier dashboard.

2. WhatsApp: Message +86 159 5127 6160 for a priority 15-minute consultation (include your top 3 product categories).

Within 24 hours, you will receive:

– A customized shortlist of 5–7 pre-vetted suppliers matching your specifications.

– Relocation timelines, capacity reports, and compliance documentation.

– TCO comparison vs. your current China-based sourcing.

“SourcifyChina’s Pro List cut our India supplier onboarding from 6 months to 11 weeks. We avoided $220K in compliance penalties from unvetted leads.”

— Head of Global Sourcing, Fortune 500 Electronics Manufacturer (2025 Client)

Your 2026 supply chain resilience starts with verified intelligence—not guesswork.

Contact us today to lead the transition.

SOURCIFYCHINA | Precision Sourcing for Complex Supply Chains

© 2026 SourcifyChina. All data verified per ISO 9001:2015 Sourcing Intelligence Framework.

This report contains proprietary intelligence. Unauthorized distribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.