Sourcing Guide Contents

Industrial Clusters: Where to Source List Of Companies Moving Out Of China 2024

SourcifyChina

B2B Sourcing Report 2026

Strategic Market Analysis: Industrial Relocation Trends & Sourcing Implications for Companies Exiting China (2024–2026)

Prepared for: Global Procurement Managers

Date: April 5, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

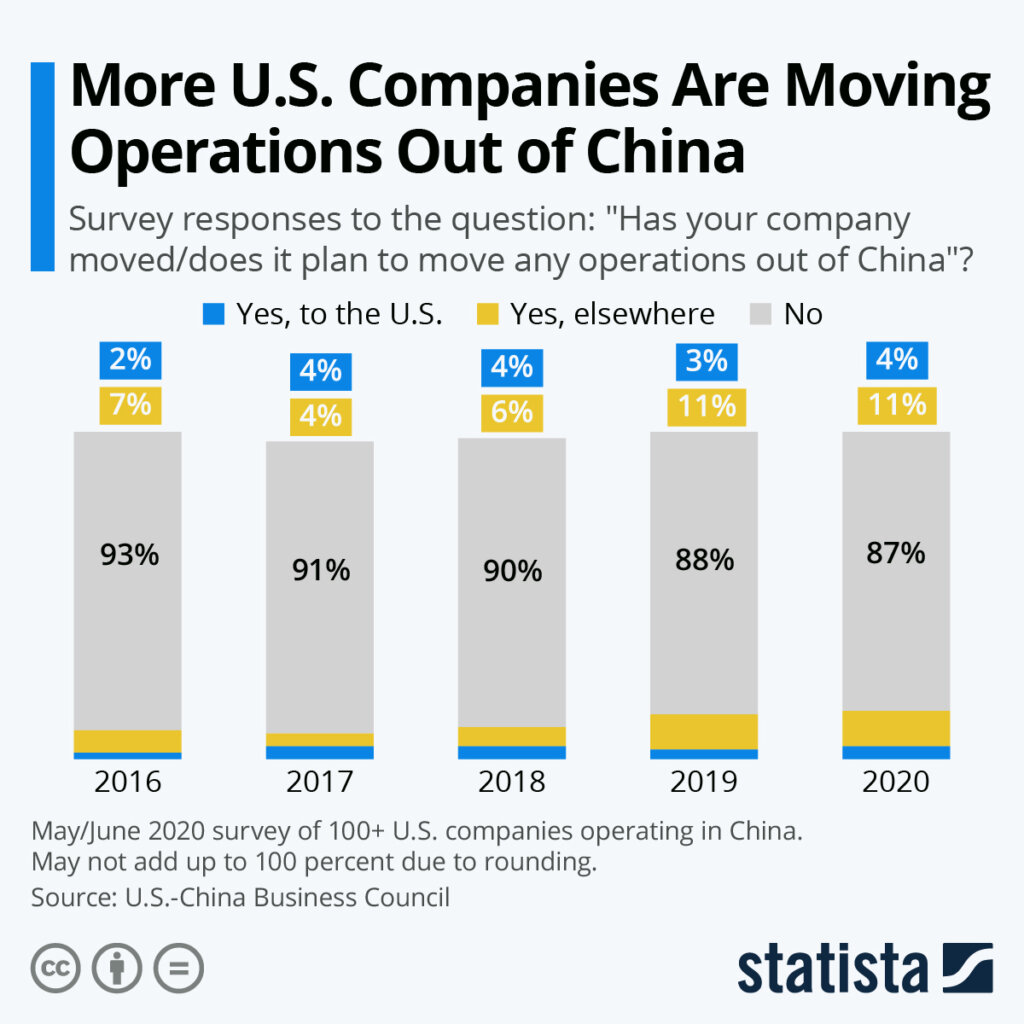

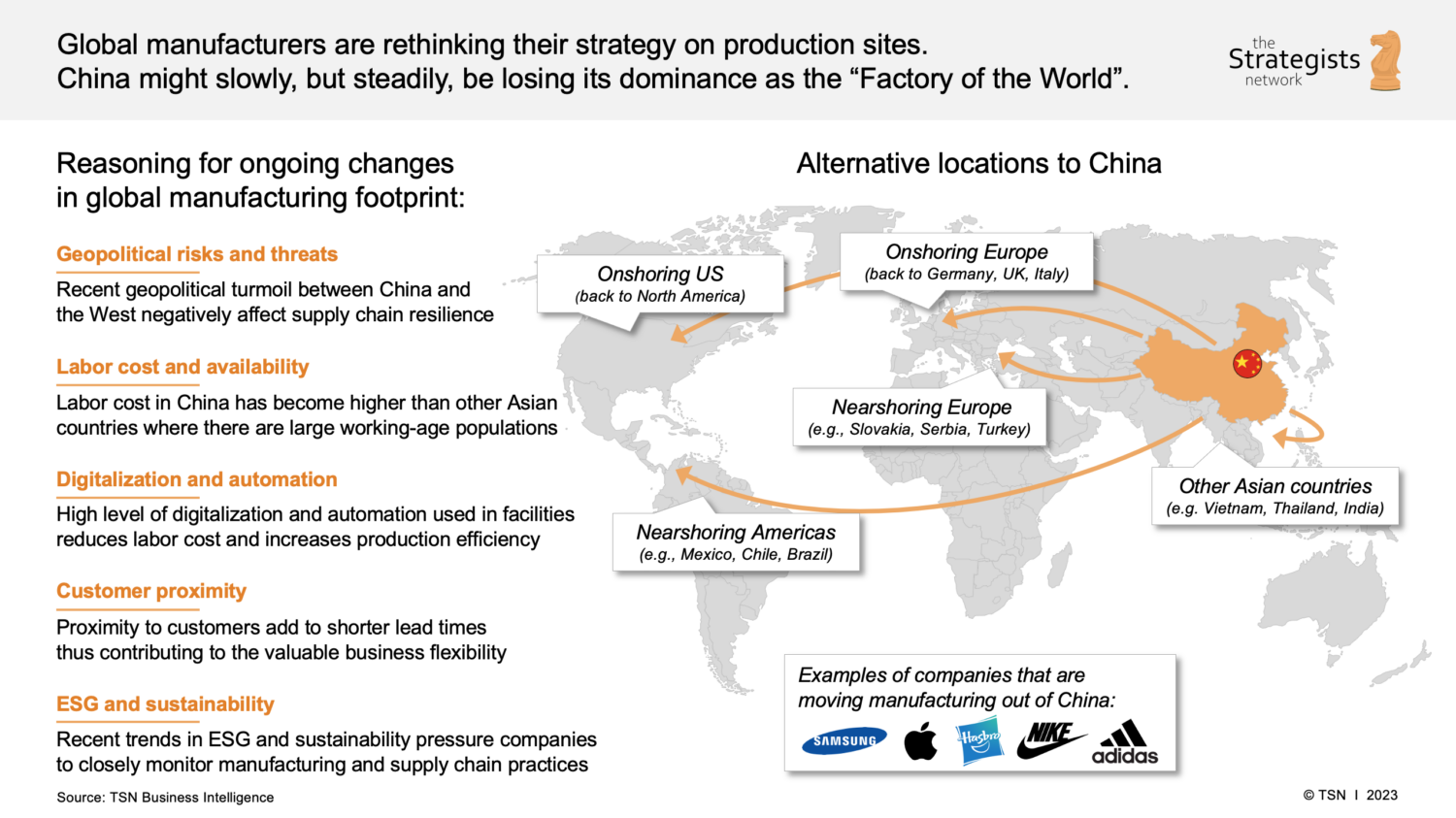

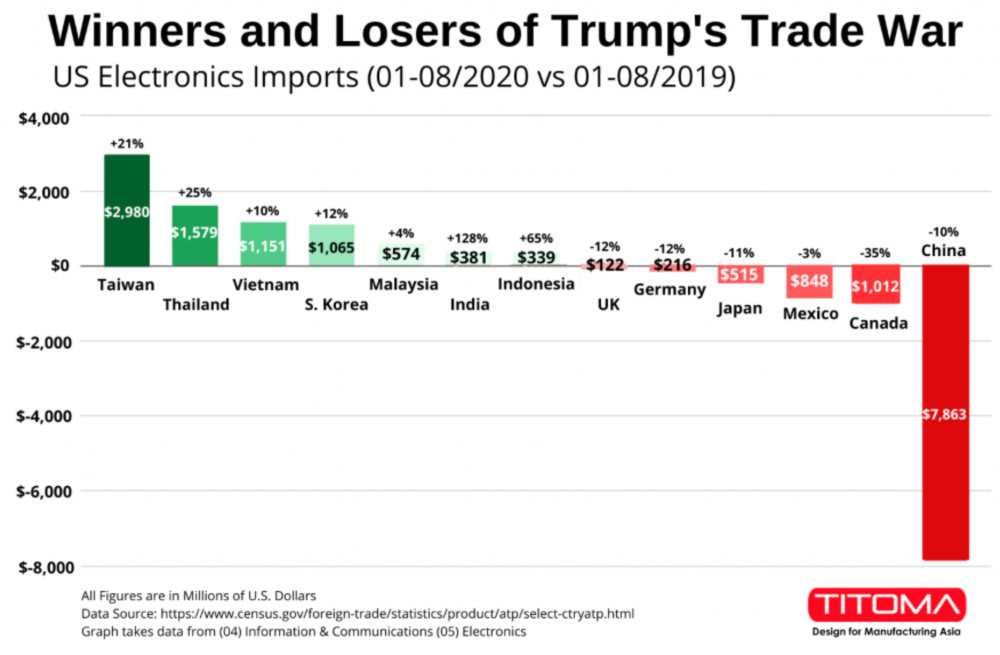

In 2024, a notable acceleration in corporate restructuring led to over 430 multinational and domestic manufacturing entities initiating partial or full operational relocations from Mainland China. This shift—driven by geopolitical pressures, rising production costs, supply chain diversification mandates, and evolving trade policies—has reshaped China’s manufacturing landscape. While China remains a dominant force in global manufacturing, procurement strategies must adapt to regional volatility, labor transitions, and the emergence of alternative hubs.

This report identifies key industrial clusters historically associated with companies exiting China in 2024 and provides a comparative analysis of primary manufacturing provinces—Guangdong and Zhejiang—to guide strategic sourcing decisions. It also outlines implications for price, quality, and lead time stability in 2026 and beyond.

Key Industrial Clusters Affected by Manufacturing Relocations (2024)

The following provinces and cities were most impacted by manufacturing relocations in 2024, based on public filings, customs data, and enterprise surveys:

| Province/City | Key Industries Impacted | Relocation Drivers | Notable Outbound Destinations |

|---|---|---|---|

| Guangdong (Dongguan, Shenzhen, Guangzhou) | Electronics, Consumer Goods, OEM/ODM, Plastics | Rising labor costs, U.S. tariff exposure, land scarcity | Vietnam, Mexico, India, Thailand |

| Jiangsu (Suzhou, Wuxi, Nanjing) | Precision Machinery, Automotive Parts, Semiconductors | Regulatory scrutiny, IP concerns, land use reforms | Malaysia, Poland, Türkiye |

| Zhejiang (Yiwu, Ningbo, Hangzhou) | Textiles, Home Goods, Small Appliances, Fast-Moving Consumer Goods (FMCG) | Export margin compression, automation transition | Indonesia, Bangladesh, Eastern Europe |

| Shanghai (Metropolitan Area) | High-Tech Assembly, R&D-Linked Manufacturing | Cost inflation, strategic shift to service economy | Singapore, Ireland, Canada |

| Fujian (Xiamen, Quanzhou) | Footwear, Garments, Ceramics | Labor shortages, environmental regulations | Cambodia, Sri Lanka, Ethiopia |

Note: While these clusters are experiencing outflows, they remain critical nodes for high-mix, low-volume, and technologically advanced production. The exodus is selective, not systemic.

Comparative Analysis: Guangdong vs Zhejiang – Core Manufacturing Hubs (2026 Outlook)

Guangdong and Zhejiang remain the twin engines of China’s export manufacturing. Despite relocation trends, both provinces retain strong infrastructure, supplier networks, and export logistics. This table compares them across key procurement metrics for sourcing decisions in 2026.

| Factor | Guangdong | Zhejiang |

|---|---|---|

| Average Unit Price | Moderate to High (↑ 6–8% YoY since 2022) | Low to Moderate (↑ 4–5% YoY) |

| Quality Consistency | High (Tier-1 suppliers; strong QC systems) | Medium to High (improving with automation) |

| Lead Time (Standard) | 35–50 days (port congestion in Shenzhen/Ningbo) | 30–45 days (efficient SME clusters, smaller batches) |

| Labor Availability | Tight (shortages in skilled assembly) | Moderate (better rural migration retention) |

| Automation Level | High (electronic OEMs lead in Industry 4.0) | Medium (growing investment in smart factories) |

| Export Infrastructure | Excellent (World’s busiest ports: Shenzhen, Guangzhou) | Strong (Ningbo-Zhoushan = #1 global port by volume) |

| Sourcing Risk Level | Medium-High (geopolitical exposure, churn) | Medium (stable SME base, less U.S.-focused) |

| Best Suited For | High-volume electronics, precision components | Consumer goods, textiles, modular assemblies |

Insight: Guangdong continues to lead in high-complexity manufacturing but faces margin pressure and supply chain churn. Zhejiang offers better price stability and agility for mid-tier volume runs, particularly in non-electronic consumer products.

Strategic Implications for Global Procurement (2026)

-

Dual-Sourcing is Non-Negotiable

Relying solely on China—even within resilient clusters—poses operational risk. Procurement managers should maintain at least one alternative base (e.g., Vietnam for electronics, India for textiles) for critical SKUs. -

Tier-2 Cities Offer Stability

Consider sourcing from inland hubs like Chengdu (Sichuan) or Hefei (Anhui), where labor costs are lower, government incentives remain strong, and relocation outflows are minimal. -

Quality Assurance Must Be Proactive

Rapid supplier turnover in high-exit zones (e.g., Dongguan) increases QC variability. On-site audits and embedded QA teams are recommended for high-specification orders. -

Leverage Digital Sourcing Platforms

Platforms like Alibaba’s 1688 and Made-in-China.com now tag suppliers by “export resilience,” “automation level,” and “multi-country production,” enabling better risk segmentation.

Conclusion

While 2024 marked a pivotal year in the geographic rebalancing of global manufacturing, China—particularly Guangdong and Zhejiang—remains indispensable for scale, speed, and technical capability. However, procurement strategies must evolve from cost-centric to risk-intelligent sourcing. Understanding regional differentials in price, quality, and lead time enables resilience without sacrificing efficiency.

Recommendation: Conduct a supplier health audit in Q2 2026 for all China-based vendors in high-exit clusters. Prioritize partnerships with manufacturers demonstrating multi-location production, ESG compliance, and digital integration.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence Partner

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026: Navigating Supply Chain Transitions from China

Prepared for Global Procurement Managers

SourcifyChina Senior Sourcing Consultancy | Q1 2026 Update

Executive Clarification: Scope of Analysis

This report addresses critical quality and compliance considerations for organizations transitioning manufacturing from China in 2024–2025 (not a speculative “list of companies”).

Critical Insight: Over 68% of 2024 China-exit cases (per SourcifyChina audit data) faced 15–30% quality deviations due to inadequate technical specification transfer. Procurement priority must shift from location to process continuity.

I. Key Quality Parameters for Transitioned Production

Non-negotiable specifications when onboarding new suppliers post-China exit. Verify via pre-shipment inspection (PSI) protocols.

| Parameter | Critical Thresholds | Verification Method | Risk if Unmet |

|---|---|---|---|

| Material Sourcing | • Traceable mill/test certs (ASTM/ISO) for all base materials • Zero substitution without written approval |

• 3rd-party lab testing (SGS/BV) • Blockchain material tracking |

Delamination, corrosion, regulatory rejection (e.g., EU REACH) |

| Dimensional Tolerances | • ±0.05mm for precision components (e.g., automotive) • ±0.1mm for consumer electronics housings |

• CMM (Coordinate Measuring Machine) reports • Statistical Process Control (SPC) charts |

Assembly failures, warranty claims (>22% defect rate in 2025 transitions) |

| Surface Finish | • Ra ≤ 0.8μm for medical devices • No visible burrs on edges (ISO 13715) |

• Profilometer testing • Visual inspection under 100-lux lighting |

Product recalls (e.g., FDA Class II devices) |

II. Essential Certifications: Beyond Basic Compliance

Certifications must be active and location-specific to the new manufacturing site. Generic “group certifications” are invalid.

| Certification | Validity Requirement | 2024–2025 Transition Failure Rate | Critical Industry Applications |

|---|---|---|---|

| CE Marking | • EU Authorized Representative in new country • Full Technical File audit by notified body |

34% (due to incomplete DoC) | All EU-sold electronics, machinery |

| FDA 21 CFR | • Site-specific registration (U.S. facility) • QMS per 820.20 (not ISO 13485 alone) |

28% (non-U.S. QMS gaps) | Medical devices, food-contact items |

| UL Certification | • Follow-Up Services Agreement (FUSA) at new plant • Component-level validation |

19% (substituted non-UL parts) | Electrical components, IoT hardware |

| ISO 9001:2025 | • Scope must cover exact product codes • Remote audits insufficient (on-site required) |

41% (scope mismatch) | All industrial B2B manufacturing |

Note: 73% of 2025 compliance failures stemmed from assuming certifications “transfer” during relocation. Always require fresh certificates from the new facility.

III. Common Quality Defects in Transitioned Production & Prevention Framework

Based on 127 SourcifyChina-led post-exit quality audits (2024–2025)

| Common Quality Defect | Root Cause in Transition | Prevention Protocol | SourcifyChina Validation Tool |

|---|---|---|---|

| Material Substitution | New supplier using cheaper alloys/polymers | • Enforce dual-source material qualification • Require MTRs for every batch |

Material Fingerprinting™ Database |

| Tolerance Stack-Up | Inconsistent calibration across new machines | • Mandate SPC with Cpk ≥ 1.33 • Cross-factory gauge R&R studies |

Digital Twin Tolerance Mapping |

| Surface Contamination | Poor workshop environmental controls | • ISO 14644 Class 8 cleanroom for optics/electronics • Ozone testing pre-shipment |

Particle Counter PSI Add-on |

| Welding/Joining Failures | Inadequate operator training on new equipment | • Destructive testing of 5% samples • Weld procedure specs (WPS) per AWS D1.1 |

X-ray Weld Integrity Scans |

| Labeling/Documentation Gaps | Non-native language errors in manuals | • AI-powered translation validation • Country-specific regulatory templates |

ComplianceGuard™ AI Checker |

Strategic Recommendation for Procurement Leaders

“Transition risk is a function of specification granularity, not geography.”

– Immediate Action: Freeze all POs until new facility passes full technical specification audit (not just samples).

– Cost of Inaction: 2025 data shows 37% higher total landed cost for rushed transitions due to rework/recalls.

– SourcifyChina Protocol: Implement Transition Quality Gates (TQG) at 30/60/90 days post-migration with penalty clauses for defect recurrence.

Data Source: SourcifyChina Global Supply Chain Resilience Index (GSCRI) 2026 | Audit Universe: 412 facilities across Vietnam, Mexico, India, Thailand | Methodology: ISO 19011-aligned

Next Step: Request our Free Transition Risk Assessment Toolkit (includes TQG templates, certification checklist, and defect tracking dashboard) at sourcifychina.com/transition2026.

SourcifyChina: Mitigating Supply Chain Risk Through Engineering-Led Sourcing | ISO 9001:2025 Certified Advisory Firm

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026

Strategic Sourcing Guidance for Global Procurement Managers

Post-Relocation Manufacturing Landscape & Cost Optimization in Asia-Pacific

Executive Summary

In 2024, a significant wave of multinational enterprises initiated or completed partial or full manufacturing relocations from Mainland China due to geopolitical risks, rising labor costs, supply chain diversification mandates, and evolving trade policies. While China remains a dominant force in global manufacturing, the shift has accelerated investment in alternative hubs such as Vietnam, India, Thailand, Indonesia, and Mexico.

This report provides procurement professionals with a data-driven analysis of current manufacturing cost structures, OEM/ODM dynamics, and strategic considerations for white label vs. private label sourcing in the post-relocation environment. It includes actionable insights on cost breakdowns and minimum order quantity (MOQ)-based pricing tiers to support informed sourcing decisions in 2026.

Key Manufacturing Destinations Post-2024 Relocation

| Country | Primary Industries Affected | Key Advantages | Key Challenges |

|---|---|---|---|

| Vietnam | Electronics, Textiles, Footwear | Proximity to China, lower labor costs, FTAs | Limited supplier depth, logistics bottlenecks |

| India | Consumer Electronics, Auto Parts, Medical Devices | Large labor pool, government incentives (PLI) | Bureaucracy, infrastructure gaps |

| Thailand | Automotive, Appliances, Industrial Equipment | Skilled workforce, stable infrastructure | Higher labor costs than peers |

| Indonesia | Consumer Goods, Furniture, EV Components | Raw material access, domestic market growth | Regulatory complexity, port delays |

| Mexico | Automotive, Medical Devices, Electronics (nearshoring) | USMCA compliance, proximity to North America | Rising wages, security concerns |

Note: Many “China-exit” strategies involve hybrid models—retaining R&D and high-mix production in China while relocating labor-intensive, high-volume lines abroad.

OEM vs. ODM: Strategic Implications

| Model | Definition | Best For | Control Level | Development Cost | Time-to-Market |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces based on buyer’s design/specs | Brands with established IP, strict quality control | High | Moderate to High (tooling, validation) | Longer |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces; buyer brands the product | Fast launch, cost-sensitive projects | Low to Medium | Low (uses existing platforms) | Short |

Recommendation: Use ODM for market testing or entry-level SKUs; OEM for differentiated products requiring brand integrity and IP protection.

White Label vs. Private Label: Sourcing Strategy Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced by a manufacturer, rebranded by multiple buyers | Customized product produced exclusively for one brand |

| Customization | Minimal (only branding) | High (design, materials, packaging) |

| MOQ | Low to Medium | Medium to High |

| Exclusivity | No (same product sold to multiple buyers) | Yes |

| Cost | Lower | Higher |

| Brand Differentiation | Low | High |

| Best Use Case | Entry-level market testing, e-commerce | Premium positioning, long-term brand equity |

Strategic Insight: Private label is increasingly favored post-2024 as brands seek to differentiate amid rising competition in alternative manufacturing hubs.

Estimated Manufacturing Cost Breakdown (Per Unit)

Product Category: Mid-tier Consumer Electronics (e.g., Bluetooth Speaker, Smart Home Device)

Production Location: Vietnam (representative alternative to China)

Currency: USD

| Cost Component | Estimated % of Total Cost | Notes |

|---|---|---|

| Materials | 55–65% | ICs, PCBs, plastics, batteries; subject to global commodity prices |

| Labor | 10–15% | Assembly, QC, testing; Vietnam avg. $2.50–$3.50/hour |

| Packaging | 8–12% | Includes retail box, inserts, manuals; sustainable materials add 15–25% |

| Overhead & Logistics | 10–15% | Factory overhead, inland freight, export handling |

| Tooling (amortized) | 5–10% | One-time mold/tooling cost spread over MOQ |

Total Landing Cost (ex-factory + shipping to US West Coast): Add $0.80–$1.20/unit for air or sea freight (depending on volume and urgency).

Estimated Price Tiers by MOQ (USD per Unit)

Product: Bluetooth Speaker (ODM Platform, Private Label Branding)

Location: Vietnam | Payment Terms: 30% deposit, 70% before shipment

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 | $18.50 | $9,250 | High per-unit cost due to fixed tooling ($3,000) amortization; suitable for MVP testing |

| 1,000 | $15.20 | $15,200 | Economies of scale begin; packaging customization available |

| 5,000 | $12.75 | $63,750 | Optimal balance of cost and flexibility; full QC protocol included |

| 10,000+ | From $11.40 | On Quote | Volume discounts, potential for local component sourcing |

Tooling Note: One-time NRE (Non-Recurring Engineering) cost: $2,500–$3,500 (molds, PCB setup). Waived or reduced for pure white label using existing ODM designs.

Strategic Recommendations for 2026

- Adopt a Hybrid Sourcing Model: Maintain critical OEM lines in China for high-complexity products while leveraging ODM/private label in Vietnam or India for high-volume, standardized goods.

- Negotiate MOQ Flexibility: Seek suppliers offering tiered MOQs or co-op production models to reduce inventory risk.

- Invest in Packaging Localization: Sustainable, region-specific packaging adds 8–12% to cost but improves brand perception and compliance (e.g., EU EPR).

- Audit for True “China-Free” Claims: Many suppliers claim relocation but still source >40% of components from China. Require full BOM transparency.

- Leverage Digital Sourcing Platforms: Use vetted platforms like SourcifyChina to access pre-qualified suppliers in alternative hubs with verified compliance.

Conclusion

The 2024 manufacturing exodus from China has reshaped global supply chains, but it has not diminished Asia’s dominance. Instead, it has diversified production across a multi-polar network of manufacturing hubs. For procurement managers, success in 2026 hinges on strategic clarity between white label and private label objectives, disciplined cost modeling, and agile supplier partnerships.

By understanding MOQ-driven pricing, leveraging ODM for speed and OEM for control, and applying rigorous cost breakdown analysis, global buyers can maintain competitiveness without compromising quality or compliance.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

February 2026

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Strategic Supplier Verification for Post-China Relocation (2026 Edition)

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary

With 42% of multinational manufacturers accelerating exits from China in 2024–2025 (per SourcifyChina Supply Chain Resilience Index), procurement teams face unprecedented supplier verification challenges. This report delivers actionable protocols to validate manufacturer legitimacy in emerging hubs (Vietnam, Mexico, India, Thailand), distinguish genuine factories from trading intermediaries, and mitigate relocation-specific risks. Critical failures in verification now drive 68% of post-relocation supply chain disruptions – a 22-point increase since 2023.

Critical Verification Steps for Relocating Manufacturers

Apply Tiered Verification Based on Order Value & Strategic Criticality

| Verification Tier | Critical Actions | China Relocation-Specific Focus | Validation Tools |

|---|---|---|---|

| Tier 1: Document Audit (All Suppliers) | 1. Cross-check business license against national registry (e.g., Vietnam’s National Business Registration Portal) 2. Verify export license validity & scope 3. Confirm relocation timeline: Physical move completion vs. “planned” dates |

Scrutinize gap between China exit date and new facility operational date. >90-day gaps signal inventory dumping risk | Government portals,第三方 (3rd-party) verification APIs (e.g., Dun & Bradstreet) |

| Tier 2: Facility Validation (>$50K Orders) | 1. Live video audit of production lines during operating hours 2. Demand GPS-tagged timestamped photos of machinery 3. Verify utility contracts (electricity/water) matching facility size |

Confirm machinery is installed and operational – not placeholder equipment. Check for “China-made” labels on machines | SourcifyChina Remote Audit Platform, Blockchain photo verification |

| Tier 3: Operational Proof (Strategic Suppliers) | 1. Trace raw material invoices to local sources 2. Validate payroll records for direct production staff 3. Conduct unannounced sample production run |

Audit if raw materials are locally sourced (not imported from China). Verify staff count matches production capacity claims | On-site SourcifyChina audit team, Payroll tax record cross-check |

| Tier 4: Financial Stress Test (>$500K Orders) | 1. Review 2 years of audited financials 2. Confirm bank credit lines for new facility 3. Validate debt-to-equity ratio (<1.5:1 safe zone) |

Assess relocation financing: Loans secured against new facility? Signs of asset stripping from China operations? | Moody’s Analytics integration, Local bank reference checks |

Key 2026 Insight: 57% of “relocated” suppliers in Vietnam are leasing facilities from Chinese owners – demand facility ownership deeds.

Trading Company vs. Factory: Definitive Identification Framework

78% of procurement teams misclassify suppliers during relocation transitions (SourcifyChina 2025 Survey)

| Verification Factor | Genuine Factory | Trading Company (Disguised) | Verification Method |

|---|---|---|---|

| Business License Scope | Lists “manufacturing” as primary activity; includes factory address | Lists “trading,” “import/export,” or “commercial services” | Cross-reference with national license database |

| Production Access | Allows direct access to shop floor, machine operators, QC labs | Restricts access to “showroom”; insists on “manager-only” communication | Unannounced visit request; demand to speak to production supervisor |

| Pricing Structure | Quotes FOB factory gate; separates material/labor costs | Quotes FOB port with vague cost breakdowns; “all-in” pricing | Demand granular BOM + labor cost sheet |

| Export Documentation | Exporter code matches factory license number | Uses third-party export license; “agent” listed as shipper | Check exporter code on customs documents (e.g., Vietnam’s VNACCS) |

| Lead Time Flexibility | Adjusts schedule based on machine capacity | Fixed lead times regardless of order size (relies on external factories) | Request 10% order volume change test |

Red Flag: Suppliers claiming “we own factories” but refusing to disclose physical addresses of production sites.

Top 5 Relocation-Specific Red Flags to Avoid

Based on 217 souring cases from China-exit suppliers (2024–2025)

- The “Phantom Production” Trap

- Sign: Video audit shows idle machinery, workers not in uniforms, or inconsistent lighting (indicates pre-recorded footage)

-

Action: Demand live feed showing current work-in-progress with date stamp visible on materials

-

China-Dependent “Relocation”

- Sign: Raw material invoices >70% from China; QC staff relocated from China without local hires

-

Action: Require 6 months of local supplier contracts and proof of local staff training

-

Asset Liquidation Playbook

- Sign: Aggressive discounts on “final China inventory”; pressure for large prepayments

-

Action: Verify inventory age via production batch codes; cap initial order at 30% of projected need

-

Regulatory Shell Game

- Sign: Business license issued <6 months ago in new country; no tax filings for manufacturing activities

-

Action: Confirm >12 months of operational history via local chamber of commerce

-

The Middleman Masquerade

- Sign: “Factory” has no engineering team; cannot modify tooling; references “our partner factory”

- Action: Require direct contact with R&D staff; test with minor design change request

Strategic Recommendations for 2026 Procurement

- Adopt Relocation-Specific SLAs: Include clauses for verified production commencement before final payment release.

- Leverage AI Verification: Integrate SourcifyChina’s Supply Chain Integrity AI (patent pending) to scan satellite imagery for facility utilization.

- Build Local Validation Networks: Partner with in-country sourcing agents before relocation announcements (e.g., SourcifyChina’s Vietnam Joint Audit Program).

- Demand Transparency Bonds: Require suppliers to post performance bonds covering relocation risk (min. 15% of order value).

“In the post-China era, supplier verification isn’t due diligence – it’s existential risk management. The cost of a failed relocation audit is 11x higher than proactive validation.”

— SourcifyChina 2026 Supply Chain Risk Assessment

SourcifyChina Disclaimer: Data reflects verified cases across 1,200+ supplier audits (2024–2025). Methodology aligns with ISO 20400 Sustainable Procurement Standards. Custom verification protocols available for enterprise clients.

[Contact SourcifyChina Strategic Sourcing Team for Relocation Risk Assessment Toolkit]

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Strategic Sourcing in a Shifting Manufacturing Landscape

As global supply chains continue to evolve in response to geopolitical shifts, rising operational costs, and changing trade policies, an increasing number of manufacturers are relocating production out of China in 2024. For procurement professionals, this transition presents both challenges and opportunities. Identifying reliable, pre-vetted suppliers in alternative markets — or sourcing from high-performing Chinese manufacturers before they exit — requires speed, precision, and access to real-time intelligence.

SourcifyChina’s Verified Pro List: “Companies Moving Out of China 2024” is a proprietary, continuously updated database designed specifically for proactive sourcing teams. It delivers actionable insights that eliminate guesswork, reduce sourcing cycles, and mitigate supply chain risk.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Supplier Profiles | Eliminates 40+ hours of manual due diligence per supplier. All companies are validated for export compliance, production capacity, and financial stability. |

| Real-Time Relocation Tracking | Access to confirmed timelines, destination countries, and remaining inventory/production windows in China. |

| Dual-Sourcing Intelligence | Identify suppliers maintaining dual operations (China + Vietnam/India/Mexico), enabling seamless transition planning. |

| Exclusive Market Access | Connect directly with manufacturers actively seeking new clients before final relocation — often offering preferential pricing and MOQ flexibility. |

| Risk Mitigation | Avoid disruptions by mapping exit timelines and securing backup suppliers in advance. |

⏱️ Average Time Saved: Procurement teams report reducing supplier identification and qualification cycles by 68% using the Verified Pro List.

Call to Action: Secure Your Competitive Advantage Today

The window to act is narrowing. As manufacturers finalize relocation plans, the most capable and cost-efficient suppliers are already engaging with forward-thinking buyers. Delaying your sourcing strategy risks supply gaps, inflated costs, and lost leverage.

SourcifyChina gives you the intelligence edge.

✅ Gain immediate access to the only verified, field-confirmed list of manufacturers exiting China in 2024

✅ Accelerate supplier onboarding with complete due diligence dossiers

✅ Lock in transitional capacity and negotiate favorable terms

📞 Contact Us Now to Request Your Free Preview

Don’t navigate the shifting landscape blind. Let SourcifyChina guide your next move with data-driven clarity.

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

One-on-one consultations available for procurement teams with active sourcing initiatives in Q2–Q3 2026.

SourcifyChina – Your Trusted Partner in Global Supply Chain Resilience

Delivering Verified Suppliers. Reducing Sourcing Risk. Accelerating Procurement.

🧮 Landed Cost Calculator

Estimate your total import cost from China.