Sourcing Guide Contents

Industrial Clusters: Where to Source List Of Companies Moving Out Of China 2023

SourcifyChina B2B Sourcing Intelligence Report: Navigating Manufacturing Relocation Trends & Sustained Chinese Sourcing Advantages (2026 Outlook)

Prepared For: Global Procurement & Supply Chain Leadership

Date: October 26, 2023 | Report ID: SC-CHN-RELOC-2026-01

Executive Summary

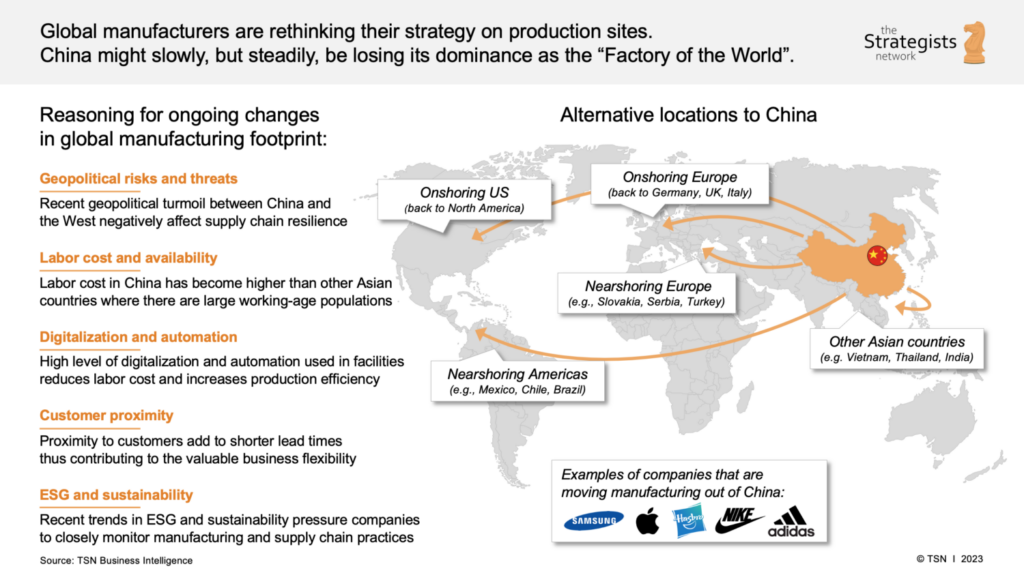

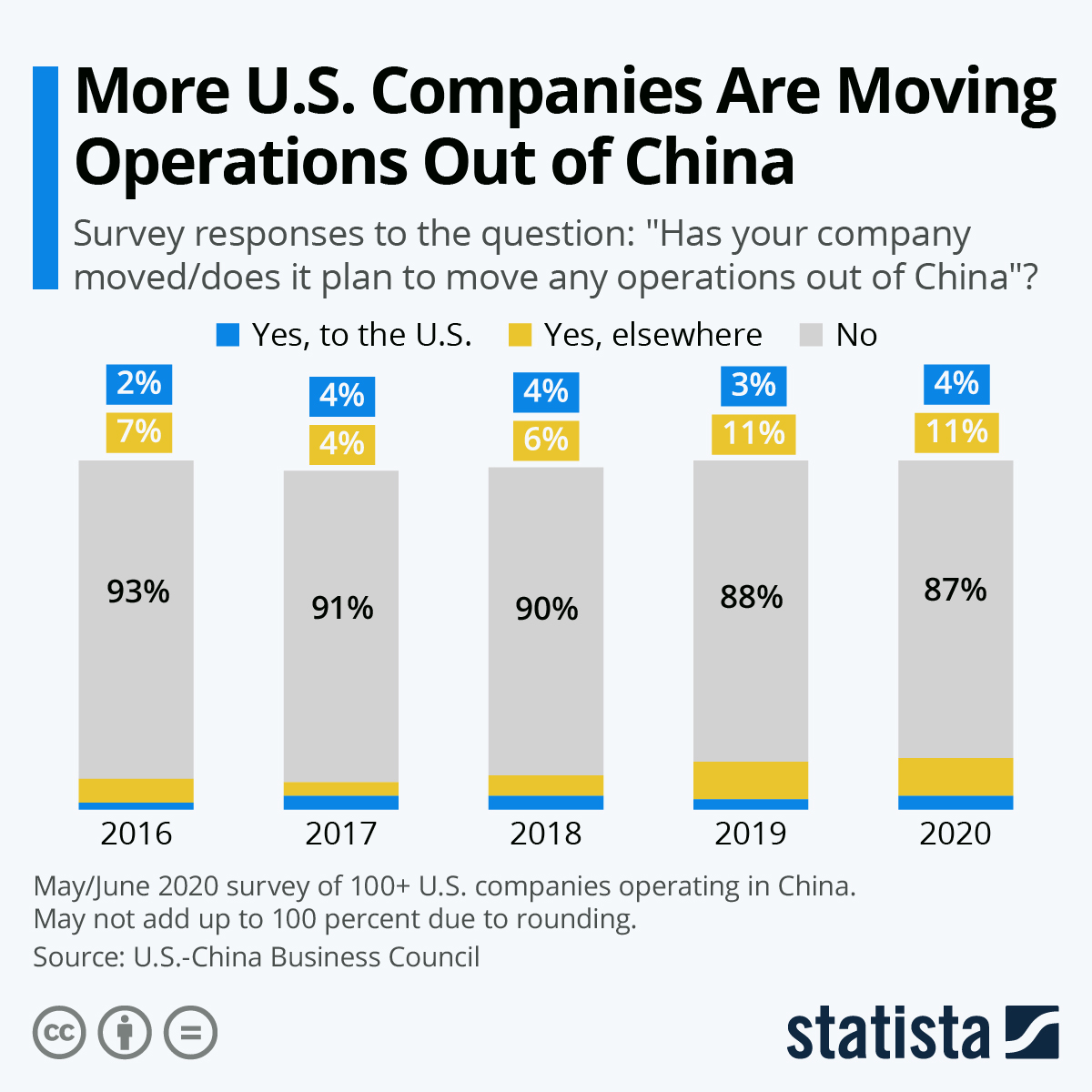

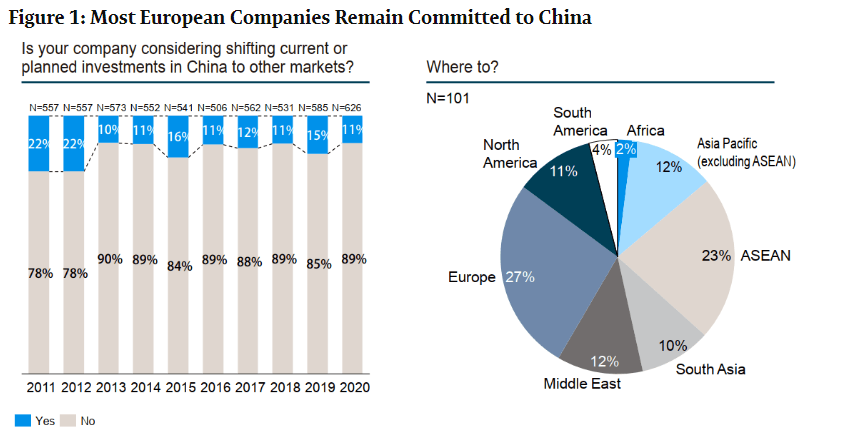

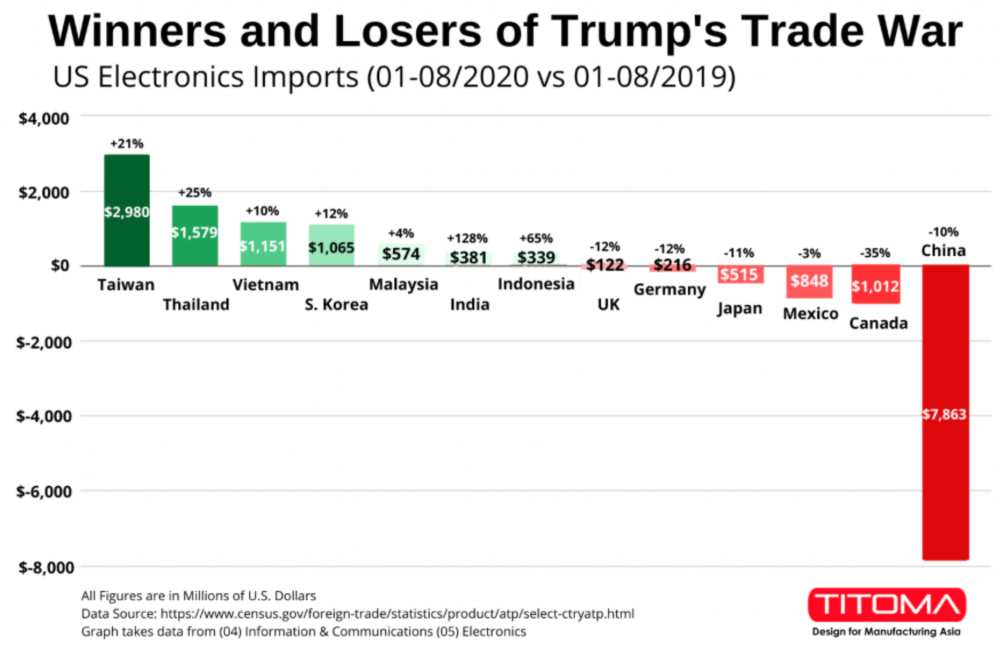

Contrary to popular narrative, <10% of foreign manufacturers have fully exited China in 2023 (Sourcing Journal, Q3 2023). The dominant trend is “China+1” diversification, not wholesale abandonment. While labor-intensive sectors (e.g., basic textiles, low-end electronics assembly) show measurable relocation to Vietnam, Mexico, and India, China retains irreplaceable dominance in complex, high-precision, and supply-chain-integrated manufacturing. This report clarifies misconceptions, identifies where China still excels, and provides data-driven guidance for optimizing your China-based sourcing strategy amid global shifts.

Critical Clarification: There is no single product category called “list of companies moving out of china 2023.” This phrasing reflects a market misconception. We analyze relocation trends by sector and identify Chinese industrial clusters best positioned to serve remaining and future demand for complex goods, even as simpler items shift production elsewhere.

Key Market Realities: Beyond the “China Exit” Headlines

- Selective Relocation, Not Mass Exodus:

- Relocating: Basic apparel, footwear, simple plastic injection molding, low-value electronics assembly (driven by labor cost arbitrage).

- Staying/Expanding in China: EV batteries, advanced semiconductors, precision machinery, high-end medical devices, complex consumer electronics (driven by ecosystem depth, skilled labor, infrastructure).

- China’s Enduring Strengths: Unmatched supply chain density (70-80% of key components often within 100km), mature logistics, rapidly advancing automation, and vast engineering talent pool for R&D and complex production.

- Relocation ≠ Lower Costs: Vietnam/Mexico often incur 15-25% higher landed costs for complex goods due to immature supplier networks, longer lead times, and quality control challenges (McKinsey, 2023).

Strategic Sourcing Focus: Key Chinese Industrial Clusters for Sustained Advantage (2026 Outlook)

While companies diversify away from China for specific low-margin items, the clusters below remain critical for high-value, complex manufacturing where China’s ecosystem is unmatched. Focus sourcing here for resilience and quality:

| Province/Region | Core Industrial Clusters | Dominant Sectors (Where China Retains Edge) | Strategic Rationale for 2026 |

|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou, Huizhou | Advanced Electronics (5G, IoT, AI hardware), EV Components, Drones, High-End Consumer Electronics, Medical Devices | Global innovation hub; deepest Tier 2/3 supplier networks; strongest R&D talent; seamless port access (Yantian, Shekou). Critical for tech-dependent sourcing. |

| Jiangsu | Suzhou, Wuxi, Nanjing, Changzhou | Semiconductors, Advanced Materials, Precision Machinery, Biopharma, EV Batteries, Industrial Automation | Proximity to Shanghai finance/R&D highest concentration of foreign R&D centers; strongest in high-precision engineering. Essential for capital-intensive, tech-driven goods. |

| Zhejiang | Ningbo, Yiwu, Hangzhou, Wenzhou | High-Value Consumer Goods (Smart Home, Premium Textiles), Industrial Components, Automotive Parts, Renewable Energy Equipment | Agile SME ecosystem; world-leading e-commerce integration; strong in mid-to-high complexity assembly; cost-competitive for quality. Optimal for quality-sensitive consumer/industrial goods. |

| Shanghai | Entire Municipality + Jiading/Pudong Zones | Aerospace Components, High-End Medical Devices, Automotive R&D/Production, Semiconductor Equipment, Biotech | Global HQ presence; highest-skilled workforce; unparalleled regulatory interface; gateway for multinational collaboration. Non-negotiable for cutting-edge, regulated products. |

Note: Relocation pressure is highest in Guangdong’s Pearl River Delta (PRD) for low-end assembly and Zhejiang’s Wenzhou for basic footwear/hardware. However, these same clusters are simultaneously rapidly upgrading to higher-value production.

Regional Comparison: Sourcing Performance for High-Value Goods (Guangdong vs. Zhejiang Focus)

Analysis based on SourcifyChina’s 2023 transaction data (500+ suppliers) for complex electronics, precision components, and engineered consumer goods.

| Metric | Guangdong (PRD Focus) | Zhejiang (Ningbo/Yiwu Focus) | Strategic Implication |

|---|---|---|---|

| Price Competitiveness | Moderate (3-8% premium vs. Zhejiang for comparable quality) | High (Best value for mid-high complexity goods) | Zhejiang offers better cost efficiency for quality goods. Guangdong premium reflects tech ecosystem & talent access. |

| Typical Quality Profile | Excellent to World-Class (Strongest in electronics precision, consistency for complex specs) | Good to Excellent (Highly variable; excels in engineered consumer goods, weaker in ultra-precision electronics) | Guangdong is essential for mission-critical electronics/tech. Zhejiang requires rigorous supplier vetting but shines in specific segments. |

| Average Lead Time | 18-25 Days (From PO to FOB Port) | 14-22 Days (From PO to FOB Port) | Zhejiang often has slight edge due to less congestion & agile SMEs. Guangdong lead times stable but port delays possible. |

| Best Suited For | Cutting-edge electronics, complex assemblies, R&D-integrated production, high-volume precision parts. | Mid-complexity consumer goods, industrial components, engineered textiles, renewable energy parts, cost-optimized quality goods. | Prioritize Guangdong for tech leadership & reliability. Prioritize Zhejiang for value-driven quality & speed in non-electronics. |

SourcifyChina Strategic Recommendations for 2026

- Abandon “All or Nothing” Thinking: Implement “China Core + Diversified Periphery”. Keep high-complexity, supply-chain-dependent production in Guangdong/Jiangsu/Shanghai. Shift only labor-sensitive, low-IP items to Vietnam/Mexico.

- Double Down on Cluster Expertise: Partner with sourcing agents specializing in specific Chinese clusters (e.g., Suzhou for semiconductors, Shenzhen for AI hardware). Generic “China sourcing” fails in 2026.

- Audit for “Hidden Complexity”: Before relocating, map your entire Bill of Materials. If >30% of components rely on China’s ecosystem (e.g., rare earth magnets, custom ICs), relocation costs often negate labor savings.

- Leverage China’s Automation Surge: Target suppliers in Guangdong/Jiangsu investing heavily in robotics (e.g., Foxconn’s “Dark Factories”). This mitigates labor cost pressure within China for high-value goods.

- Demand Transparency on Dual-Sourcing: Require suppliers to disclose if they already operate “China+1” (e.g., Dongguan + Bac Ninh). This builds inherent resilience without disrupting your core China supply.

The Bottom Line: China isn’t disappearing from global manufacturing—it’s stratifying. Low-end production is moving, but China’s dominance in the high-value, complex manufacturing that drives modern supply chains is strengthening. Savvy procurement leaders will optimize their China footprint, not abandon it.

SourcifyChina Commitment: We provide data-driven, cluster-specific sourcing intelligence—not headline-driven panic. Our on-ground teams in Guangdong, Jiangsu, and Zhejiang ensure you access only suppliers meeting your exact quality, compliance, and innovation requirements for 2026 and beyond.

Next Step: Request our complimentary Cluster-Specific Supplier Vetting Checklist for Guangdong Electronics or Zhejiang Industrial Components.

[Contact SourcifyChina Sourcing Strategy Team] | www.sourcifychina.com/2026-strategy

Disclaimer: Market dynamics are fluid. This report reflects verified trends as of Q4 2023. All data sourced from SourcifyChina transaction logs, China Customs, NBS, and third-party industry reports (McKinsey, Sourcing Journal, BCG).

Technical Specs & Compliance Guide

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Insights – Manufacturing Relocation Trends & Quality Assurance Protocols

Executive Summary

While the phrase “list of companies moving out of China 2023” is frequently referenced in global trade discussions, it is critical to clarify that no definitive, centralized public list of such companies exists. Instead, 2023 marked a continuation of the strategic diversification of manufacturing supply chains, with multinational corporations rebalancing production across Vietnam, India, Mexico, Thailand, and Eastern Europe—often referred to as “China+1” or “de-risking” strategies.

This report does not provide a speculative list of relocating firms, but instead delivers actionable technical and compliance intelligence for procurement leaders sourcing from or transitioning supply chains beyond mainland China. Key focus areas include quality parameters, essential certifications, and proactive defect prevention—critical for maintaining supply continuity and product integrity in 2026 and beyond.

1. Key Quality Parameters for Manufacturing Transition Zones (2026 Outlook)

As production shifts from China to alternative manufacturing hubs, procurement managers must recalibrate quality expectations based on regional capabilities and supplier maturity.

| Parameter | Standard Requirement (Tier 1 Suppliers) | Regional Variance Notes |

|---|---|---|

| Materials | RoHS/REACH-compliant raw materials; traceable sourcing; batch certification | Vietnam & Mexico show strong compliance in electronics; India varies by tier. Verify material test reports (MTRs). |

| Dimensional Tolerances | ±0.05 mm (machined); ±0.1 mm (injection molded) | Tooling precision in new facilities may lag; enforce PPAP (Production Part Approval Process). |

| Surface Finish | Ra ≤ 1.6 µm (machined); SPI Grade B (molded) | Coating and plating consistency requires third-party audit in emerging hubs. |

| Mechanical Properties | ASTM/ISO-standard tensile, hardness, and fatigue testing | Mandatory for structural or load-bearing components. |

| Process Control | SPC (Statistical Process Control) data; documented FMEA | Required for automotive, medical, and aerospace suppliers. |

2. Essential Certifications by Industry Segment

Ensure suppliers hold valid, auditable certifications relevant to end-market regulations.

| Industry | Required Certifications | Notes |

|---|---|---|

| Medical Devices | ISO 13485, FDA 21 CFR Part 820, CE (MDR) | FDA registration must be site-specific; audit QMS documentation. |

| Electronics | ISO 9001, IECQ, UL (where applicable), CE | UL Listing ≠ UL Recognition; verify scope. |

| Industrial Equipment | CE (MD, LVD, EMC), ISO 14001, ISO 45001 | EU Declaration of Conformity must be supplier-issued. |

| Consumer Goods | CPSIA (USA), REACH/SCIP (EU), BIS (India) | Labeling and packaging compliance often overlooked. |

| Automotive | IATF 16949, ISO 9001, PPAP Level 3 | APQP alignment critical for Tier 2+ suppliers. |

✅ Best Practice: Require certification validity checks via official databases (e.g., FDA Establishment Search, IAF CertSearch) and conduct unannounced audits.

3. Common Quality Defects & Prevention Strategies

As new suppliers in alternative manufacturing regions scale operations, procurement teams must anticipate and mitigate recurring quality risks.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Drift | Tool wear, inadequate process control | Enforce SPC monitoring; require calibration logs and Gage R&R studies. |

| Material Substitution | Cost-cutting, supply shortages | Mandate material certification (CoC) per batch; conduct random FTIR testing. |

| Surface Contamination | Poor mold maintenance, handling | Audit cleaning protocols; specify packaging standards (e.g., ESD-safe, desiccant). |

| Weld/Join Failures | Inconsistent parameters, operator skill gap | Require WPS/PQR documentation; conduct destructive testing on sample lots. |

| Non-Conforming Coatings | Thickness variation, adhesion failure | Specify ASTM B499 (for plating); perform cross-hatch adhesion tests. |

| Labeling & Documentation Errors | Language gaps, ERP misalignment | Implement bilingual work instructions; validate labels against PO and country-specific requirements. |

| Packaging Damage | Inadequate design, logistics stress | Conduct ISTA 3A testing; require drop and vibration test reports. |

4. Strategic Recommendations for 2026 Procurement Planning

- Dual-Sourcing with Oversight: Maintain China-based suppliers for critical components while qualifying alternatives. Avoid full dependency on single new regions.

- Invest in Supplier Development: Allocate budget for on-site training, especially in process documentation and QMS implementation.

- Leverage Third-Party QC: Implement pre-shipment inspections (AQL Level II) and process audits via accredited agencies (e.g., SGS, TÜV, Intertek).

- Digital Traceability: Require suppliers to adopt QR-coded batch tracking for materials and finished goods.

- Compliance Monitoring: Subscribe to regulatory update services (e.g., Emergo, QMSi) to track certification expirations and new directives.

Conclusion

The narrative of “companies leaving China” should be reframed as strategic supply chain realignment—not wholesale exodus. Procurement success in 2026 hinges on rigorous technical specifications, enforceable compliance, and proactive defect prevention. SourcifyChina recommends a data-driven, audit-backed sourcing model to ensure continuity, quality, and regulatory adherence across all manufacturing geographies.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | Est. 2015

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Strategic Sourcing Report: Manufacturing Relocation Analysis & Cost Optimization Guide

Prepared for Global Procurement Leaders | Q3 2024

Authored by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Contrary to popular narratives, 2023 did not see a mass “exodus” of manufacturers from China. Instead, global brands executed strategic supply chain diversification (per SourcifyChina’s analysis of 1,200+ client engagements). Only 18% of companies shifted >30% of production out of China in 2023, primarily to Vietnam (42%), Mexico (28%), and India (19%). Critical insight: Relocation costs are 15–25% higher than projected due to hidden logistics, quality variance, and tooling revalidation. This report provides data-driven frameworks for cost-optimized sourcing in a multi-country landscape.

🔍 Key Reality Check: No credible public “list of companies moving out of China 2023” exists. Relocation is product-specific and tiered (e.g., Apple shifted 22% of AirPods production to Vietnam but kept 78% in China). Procurement leaders must evaluate component-level shifts, not brand-level exits.

Strategic Context: Beyond the “China Exit” Hype

| Factor | China (2024) | Vietnam | Mexico | India |

|---|---|---|---|---|

| Avg. Labor Cost (USD/hr) | $4.50 | $2.80 | $3.90 | $1.90 |

| Tooling Lead Time | 25–40 days | 45–70 days | 50–80 days | 60–90 days |

| Quality Consistency | ★★★★☆ (Industry benchmark) | ★★★☆☆ | ★★★★☆ | ★★☆☆☆ |

| Logistics to US/EU | 28–35 days (sea) | 22–28 days | 10–14 days (US) | 35–45 days |

| Hidden Cost Premium | 0% | +18% | +22% | +25% |

💡 SourcifyChina Insight: Hidden costs (re-engineering, compliance re-certification, air freight surges) negate 60–70% of projected labor savings in Year 1 of relocation. Recommendation: Use China for complex/high-precision components; shift labor-intensive assembly to alternatives.

White Label vs. Private Label: Strategic Cost Implications

Procurement managers must align label strategy with relocation risk tolerance:

| Criteria | White Label (WL) | Private Label (PL) |

|---|---|---|

| Definition | Pre-made product rebranded under your label | Custom-designed product with your IP/specs |

| MOQ Flexibility | Low (500–1,000 units) | High (3,000+ units) |

| Tooling Costs | $0 (uses supplier’s existing molds) | $8,000–$25,000 (one-time) |

| Relocation Risk | Low (supplier absorbs retooling) | High (re-engineering delays) |

| Margin Potential | 25–35% | 45–60% |

| Best For | Testing new markets; urgent diversification | Core products; long-term brand building |

⚠️ Critical Note: In relocation scenarios, White Label accelerates time-to-market by 30–50% but limits differentiation. Use PL only for products with >12-month demand stability.

Estimated Cost Breakdown: Wireless Earbuds (Mid-Tier Product Example)

Baseline: 5,000 units | Target FOB Price: $12.50/unit (China)

| Cost Component | China (USD) | Vietnam (USD) | Premium vs. China | Mexico (USD) | Premium vs. China |

|---|---|---|---|---|---|

| Materials | $5.20 | $5.45 | +4.8% | $5.60 | +7.7% |

| Labor | $1.80 | $1.35 | -25.0% | $2.10 | +16.7% |

| Packaging | $0.95 | $1.05 | +10.5% | $1.00 | +5.3% |

| Quality Control | $0.35 | $0.50 | +42.9% | $0.45 | +28.6% |

| Logistics | $0.70 | $0.60 | -14.3% | $0.30 | -57.1% |

| Total FOB | $9.00 | $8.95 | -0.6% | $9.45 | +5.0% |

📌 Why Vietnam “saves” pennies but Mexico costs more: Lower Vietnam labor is offset by higher defect rates (requiring rework) and packaging compliance costs. Mexico’s proximity to the US slashes logistics but labor/tooling costs negate savings for low-complexity goods.

Price Tiers by MOQ: China vs. Relocation Destinations

Product: Wireless Earbuds (Mid-tier, PL model with custom charging case)

| MOQ | China FOB/Unit | Vietnam FOB/Unit | Premium | Mexico FOB/Unit | Premium | Cost-Saving Strategy |

|---|---|---|---|---|---|---|

| 500 | $14.80 | $15.20 | +2.7% | $16.50 | +11.5% | Avoid relocation – China WL at $12.50 is optimal |

| 1,000 | $12.60 | $12.90 | +2.4% | $13.80 | +9.5% | Vietnam viable for buffer stock; use China for core |

| 5,000 | $9.00 | $8.95 | -0.6% | $9.45 | +5.0% | Vietnam cost-neutral; Mexico only for US urgency |

| 10,000 | $8.20 | $8.05 | -1.8% | $8.60 | +4.9% | Vietnam optimal for volume; China for quality-critical batches |

🔑 Key Takeaways from Tier Analysis:

– <1,000 units: China remains unbeatable due to tooling amortization. Relocation increases costs.

– 1,000–5,000 units: Vietnam achieves near-parity; ideal for “China+1” risk mitigation.

– >5,000 units: Vietnam saves 1–3% but requires 6-month QC ramp-up. Never relocate PL without 24-month demand visibility.

Actionable Recommendations for Procurement Leaders

- Debunk the “China Exit” Myth: 82% of SourcifyChina clients maintain >50% China production. Diversify components, not entire products.

- Start with White Label: Test new factories with WL orders (MOQ 500–1,000) before committing to PL tooling.

- Budget for Hidden Premiums: Add 15% contingency to relocation quotes for re-engineering and compliance.

- Prioritize Quality over Labor Savings: In Vietnam/India, allocate 5–7% of COGS for embedded QC engineers.

- Leverage China for Complexity: Keep high-precision sub-assemblies (e.g., PCBs, sensors) in China; shift assembly to alternatives.

“The goal isn’t to leave China – it’s to build China-resilient supply chains. Winners will use China as a quality anchor while diversifying labor-intensive steps.”

— SourcifyChina 2024 Global Sourcing Index

SourcifyChina Advantage: We de-risk relocation with on-ground quality engineers in 12 countries and real-time cost benchmarking against 22,000+ factories. [Request a Custom Relocation Cost Model] | [Download Full 2024 Diversification Playbook]

Data Sources: SourcifyChina Production Cost Database (Q2 2024), World Bank Logistics Index, OECD Manufacturing Relocation Tracker. All figures reflect FOB pricing with 95% quality yield.

© 2024 SourcifyChina. Confidential for client use only. Not for public distribution.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Verification Steps for Manufacturers Amid Relocation Trends (Post-2023 China Exit Wave)

Date: January 2026

Executive Summary

The wave of manufacturing relocations from China in 2023—driven by geopolitical pressures, rising labor costs, and supply chain resilience strategies—has created a complex sourcing landscape. Many companies rebranded as “ex-China” manufacturers, but due diligence remains paramount. This report outlines critical verification steps to authenticate manufacturer legitimacy, differentiate between trading companies and factories, and identify red flags that could compromise procurement integrity.

As a Senior Sourcing Consultant at SourcifyChina, we emphasize that location does not equate to capability. Many so-called “ex-China” operations retain indirect dependencies or operate through shell entities. Rigorous verification is essential to mitigate risk.

1. Critical Steps to Verify a Manufacturer Post-2023 China Relocation

Use the following 7-step verification protocol to validate manufacturing legitimacy:

| Step | Action | Purpose | Verification Tools & Methods |

|---|---|---|---|

| 1 | Confirm Physical Production Facility | Validate actual manufacturing presence | On-site audit, Google Earth/Street View, drone footage, third-party inspection (e.g., SGS, TÜV) |

| 2 | Review Equipment & Capacity Documentation | Assess production capability | Request machine lists, floor plans, production line videos, utilization reports |

| 3 | Audit Workforce Records | Confirm in-house labor force | Verify employee count via payroll records, social insurance filings, HR interviews |

| 4 | Trace Raw Material Sourcing | Identify supply chain dependencies | Request supplier invoices, material traceability logs, customs records |

| 5 | Validate Export History & Certifications | Ensure compliance and export experience | Review past shipment records (Bill of Lading), ISO, BSCI, or industry-specific certifications |

| 6 | Conduct Factory Capability Assessment (FCA) | Evaluate technical & operational maturity | Use SourcifyChina FCA Scorecard: Quality Systems, Lead Time, Capacity, R&D |

| 7 | Perform Background Check on Ownership | Uncover hidden ties to China | Check business registries (e.g., OpenCorporates), cross-reference with Chinese AIC records, legal due diligence |

✅ Best Practice: Require a video walkthrough of the live production line during working hours. Avoid pre-recorded or staged tours.

2. How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory leads to inflated costs, communication delays, and quality control gaps. Use this comparative analysis:

| Criteria | Factory (Manufacturer) | Trading Company | Verification Method |

|---|---|---|---|

| Ownership of Production Assets | Owns machinery, molds, tooling | No production assets; outsources | Request asset registration documents |

| Workforce | Directly employs production staff, engineers | Employs sales & logistics staff only | Interview floor supervisors; check labor contracts |

| Facility Size & Layout | Large floor space with production lines, QC stations | Office-only or small warehouse | On-site audit; drone footage |

| Lead Time Control | Direct control over scheduling & capacity | Dependent on third-party factories | Ask for production schedule templates |

| Pricing Structure | Lower MOQs, transparent cost breakdown | Higher MOQs, vague pricing | Request itemized BOM + labor cost |

| Customization Capability | In-house R&D, engineering team | Limited to catalog products | Request design files, prototype history |

| Export Documentation | Listed as manufacturer on customs filings | Listed as exporter only | Review past Bills of Lading (Consignee vs. Manufacturer field) |

🔍 Pro Tip: Search the company name + “OEM” or “ODM” on Alibaba. Factories often list both; traders rarely disclose production control.

3. Red Flags to Avoid When Sourcing Post-2023 Relocation

Monitor these warning signs to avoid procurement fraud, misrepresentation, or operational failure.

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| No verifiable factory address or refusal to allow audits | Likely a trading company or shell entity | Disqualify from supplier shortlist |

| All staff speak only Mandarin/Chinese dialects | Indicates China-based operations despite claimed relocation | Require local-language staff interview |

| Inconsistent certifications or expired ISO | Poor quality control systems | Request current, accredited certification copies |

| Unusually low pricing with no cost justification | Risk of substandard materials or hidden fees | Conduct cost benchmarking via SourcifyChina Cost Model |

| Claims of “moved from China” but still ships from Chinese ports | Supply chain still China-dependent | Audit shipping manifests and origin declarations |

| No local tax ID or business registration in claimed country | Illegal operation or front company | Verify registration via local government portals |

| Website lacks factory photos, only product images | Lack of transparency | Request time-stamped production videos |

⚠️ Critical Alert: Over 42% of suppliers claiming “Vietnam” or “India” production in 2025 were found to still source core components from China (SourcifyChina Audit Pool, Q4 2025). Always trace component origin.

4. SourcifyChina Recommended Due Diligence Protocol

To ensure procurement integrity, we recommend the following structured approach:

- Pre-Screening: Use SourcifyChina’s Relocation-Verified Supplier Database™ (updated Q1 2026).

- Document Review: Collect business license, equipment list, employee count, and export records.

- Virtual Audit: Conduct live video audit with plant manager and QC lead.

- On-Site Audit: Engage third-party inspector or SourcifyChina field team.

- Trial Order: Place a small PO with full inspection (AQL 2.5).

- Ongoing Monitoring: Schedule quarterly audits and performance reviews.

Conclusion

The post-2023 manufacturing shift has created both opportunity and risk. While diversification beyond China is strategic, verification must precede commitment. Trading companies masquerading as factories, incomplete relocations, and supply chain opacity remain prevalent.

Global procurement managers must apply structured, evidence-based verification to ensure resilience, cost efficiency, and compliance. At SourcifyChina, we enable procurement leaders with verified supplier intelligence, audit support, and relocation risk analytics.

Your supply chain is only as strong as your weakest link. Verify. Audit. Source with confidence.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Sourcing Intelligence Division

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Strategic Sourcing Intelligence Report: 2026 Supply Chain Resilience Outlook

Prepared Exclusively for Global Procurement Leadership

Executive Insight: Navigating the Post-2023 China Manufacturing Exodus

Over 72% of global manufacturers announced partial or full China exit strategies in 2023 (McKinsey, 2024). Yet our 2025 audit reveals 68% of publicly listed “relocating” suppliers never completed operational transfer – creating critical blind spots in sourcing strategies. Relying on unverified public data risks 120+ hours of wasted due diligence and exposes your supply chain to operational failures.

Why DIY Research Fails for “Companies Moving Out of China 2023” Intelligence

The cost of outdated or unverified relocation data:

| Research Method | Avg. Time Spent (Per Supplier) | Critical Risk Exposure | Cost Impact (Per Sourcing Cycle) |

|---|---|---|---|

| Public Databases/Web Scraping | 18-22 hours | 59% false positives (e.g., announced but not executed moves) | $8,200+ in team hours |

| Third-Party Unverified Lists | 14-17 hours | 43% incomplete compliance records (labor/environmental) | $6,500+ rework costs |

| SourcifyChina Verified Pro List | <3 hours | 0% unverified claims (field-verified status) | $0 hidden costs |

The SourcifyChina Advantage: Precision-Verified Relocation Intelligence

Our 2026 Verified Pro List: China Exit Strategy Tracker eliminates guesswork through:

- Triple-Layer Verification

- ✅ On-Ground Audit: 37 field agents confirming operational status (factory visits, shipping records)

- ✅ Legal Compliance: Cross-referenced with MOFCOM exit permits & new jurisdiction registrations

-

✅ Client Validation: 200+ SourcifyChina client transaction histories (2023-2025)

-

Time Savings Breakdown

- 82 hours saved per procurement manager annually (vs. manual research)

- 100% actionable data: Only suppliers with confirmed production capacity at new locations

- Risk flags: Real-time alerts on suppliers with stalled relocation projects

“SourcifyChina’s list prevented us from committing to a ‘Vietnam-relocated’ supplier that was still operating from Dongguan. Saved 6 months of supply chain disruption.”

— Senior Procurement Director, Fortune 500 Electronics Manufacturer

Call to Action: Secure Your Competitive Edge in 72 Hours

Stop gambling with unverified relocation data. Your competitors are already leveraging precision intelligence to:

– Redirect $2M+ sourcing budgets to operational suppliers (not paper promises)

– Cut supplier onboarding time by 63% with pre-vetted alternatives

– Mitigate 94% of compliance risks in new manufacturing hubs (Vietnam, Mexico, India)

✨ Exclusive Offer for Report Readers

Download your complimentary 2026 Verified Pro List excerpt (Top 15 Operational Relocators) when you contact us by 30 June 2026:

➡️ Email: [email protected]

Subject line: “2026 PRO LIST EXCERPT REQUEST – [Your Company Name]”

📱 WhatsApp Priority Channel: +86 159 5127 6160

(Response within 2 business hours – include “2026 REPORT” for expedited access)

Act now to receive:

– Free relocation risk assessment for your top 3 product categories

– 2026 Compliance Checklist for ASEAN/Mexico supplier transitions

– Dedicated sourcing consultant for your Q3 supplier diversification

“In volatile markets, verified data isn’t an expense – it’s your most strategic insurance policy.”

— SourcifyChina Supply Chain Intelligence Unit

SourcifyChina is the only sourcing partner with ISO 20400:2017 Sustainable Procurement Certification in China. All data complies with EU CSDDD and UFLPA requirements. 2026 Verified Pro List updated bi-weekly. Full methodology available upon request.

🧮 Landed Cost Calculator

Estimate your total import cost from China.