Sourcing Guide Contents

Industrial Clusters: Where to Source List Of Companies Moving Out Of China 2022

SourcifyChina Sourcing Intelligence Report 2026

Title: Market Analysis: Industrial Clusters for Post-Exit China Manufacturing (2022 Displacement Trends)

Prepared For: Global Procurement Managers

Date: March 2026

Author: SourcifyChina – Senior Sourcing Consultant

Executive Summary

This report provides a strategic analysis of industrial clusters in China that were historically significant in the manufacturing supply chains of multinational enterprises (MNEs) that initiated or completed relocation activities in 2022. While the phrase “list of companies moving out of China 2022” refers to corporate relocations (e.g., Apple suppliers, Intel, Samsung, Siemens, etc.), this analysis focuses on the sourcing implications for procurement managers—specifically, identifying the key Chinese industrial clusters affected by these shifts and evaluating their continued viability for near-term sourcing.

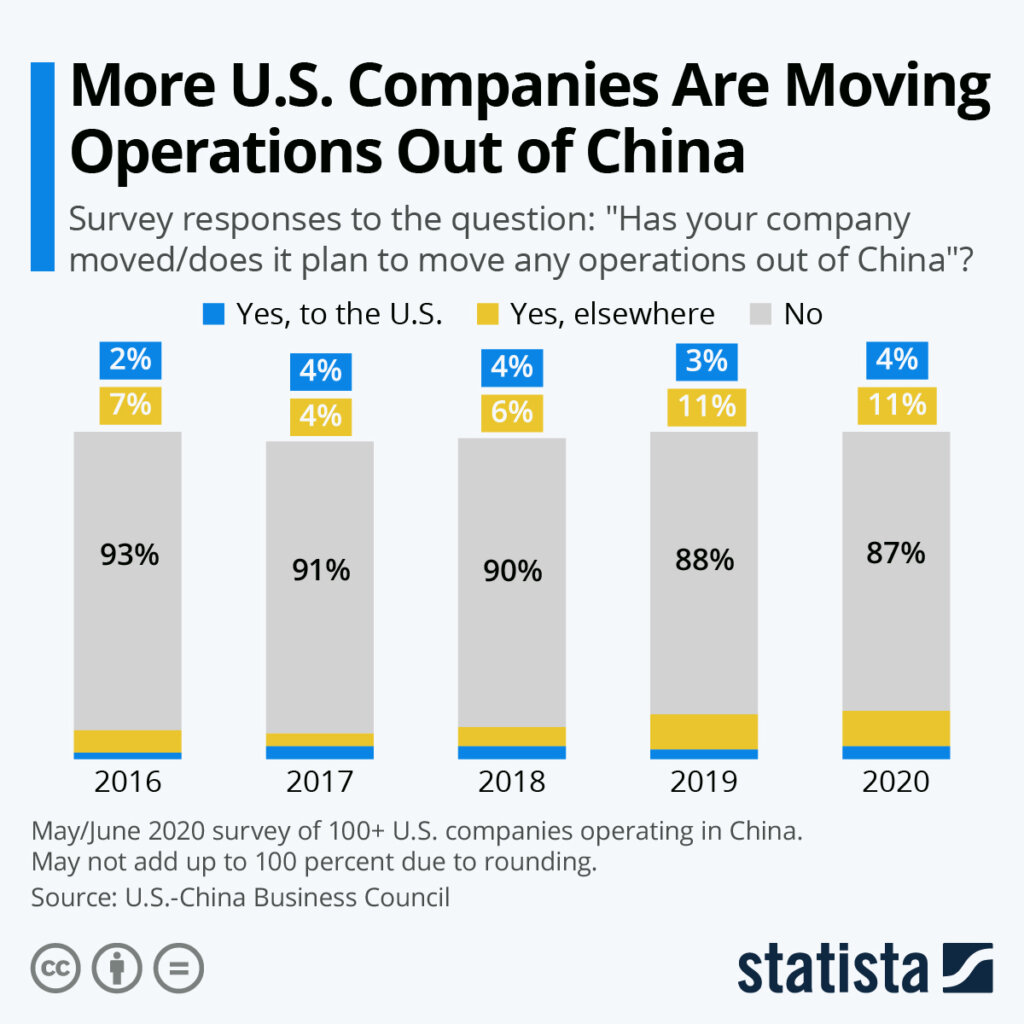

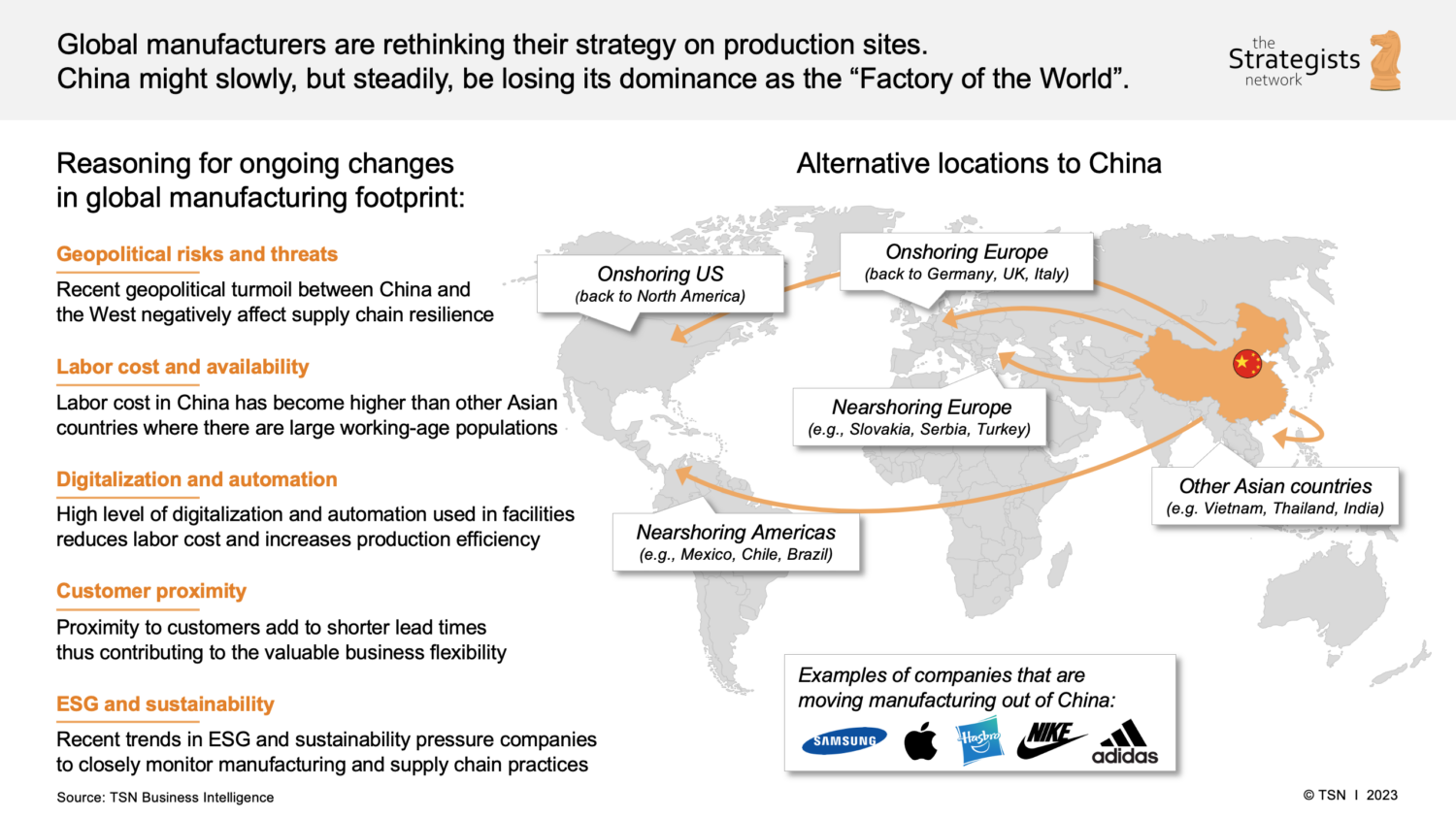

It is critical to clarify: China remains a dominant manufacturing hub, and the 2022 relocation wave did not equate to broad deindustrialization. Instead, it reflected strategic supply chain diversification (e.g., to Vietnam, India, Mexico) by select firms. Many of these companies maintained significant production in China, especially in high-precision, high-complexity, or scale-intensive sectors.

This report evaluates the core manufacturing provinces and cities from which production was partially shifted in 2022, assessing their current competitiveness in terms of price, quality, and lead time to inform sourcing decisions in 2026.

1. Key Industrial Clusters Impacted by 2022 Relocations

The 2022 exodus primarily involved electronics, consumer goods, and light industrial manufacturers responding to geopolitical pressures, rising labor costs, and U.S.-China trade tensions. The most affected clusters were concentrated in southeastern and eastern China, where export-oriented manufacturing is most developed.

Primary Provinces & Cities Impacted:

| Province/City | Key Industries Affected | Notable Relocating Companies (2022) | Current Sourcing Relevance (2026) |

|---|---|---|---|

| Guangdong (Shenzhen, Dongguan, Guangzhou) | Electronics, Consumer Tech, Telecom, Robotics | Foxconn, Luxshare, GoerTek, Samsung (partial) | High – still dominant in electronics OEM/ODM |

| Jiangsu (Suzhou, Wuxi, Nanjing) | Semiconductors, Automotive Parts, Industrial Machinery | Infineon, Siemens, Bosch (capacity shifts) | High – strong in precision engineering |

| Zhejiang (Ningbo, Hangzhou, Yiwu) | Textiles, Home Goods, Small Appliances, Fasteners | Several SME exporters to U.S./EU | Medium – cost-sensitive, competitive SME base |

| Shanghai | High-Tech, R&D, Biotech, EV Components | Tesla (dual sourcing), ABB (regional rebalancing) | High – innovation and automation leader |

| Sichuan (Chengdu) | Aerospace, IT Hardware, Electronics Assembly | Foxconn (partial shift to Vietnam) | Medium – growing inland hub, lower labor costs |

Note: Most relocations were partial capacity shifts, not full closures. Many suppliers retained dual sourcing: China for APAC/EU, Vietnam/India for North America.

2. Comparative Analysis: Key Production Regions (2026 Sourcing Metrics)

The table below compares two of China’s most critical manufacturing provinces—Guangdong and Zhejiang—based on current (2026) sourcing KPIs. These regions represent contrasting models: high-tech export hub (Guangdong) vs. SME-driven diversified manufacturing (Zhejiang).

| Parameter | Guangdong (e.g., Shenzhen/Dongguan) | Zhejiang (e.g., Ningbo/Yiwu) | Analysis |

|---|---|---|---|

| Price (Cost Index) | 7.5 / 10 (Higher) | 5.8 / 10 (Moderate) | Guangdong faces higher labor and logistics costs. Zhejiang benefits from SME competition and inland logistics advantages. |

| Quality (Consistency & Precision) | 9.2 / 10 (Excellent) | 7.0 / 10 (Good to Moderate) | Guangdong leads in electronics, automation, and ISO-certified facilities. Zhejiang quality varies significantly by supplier tier. |

| Lead Time (Avg. Production + Port) | 28–35 days | 30–40 days | Guangdong’s proximity to Shenzhen/Yantian ports enables faster export. Zhejiang relies on Ningbo-Zhoushan (efficient but slightly longer inland routing). |

| Specialization | Electronics, Smart Devices, EVs, Robotics | Textiles, Home Goods, Hardware, Light Industrial | Strategic fit depends on product category. |

| Supplier Maturity | High – Tier 1 global OEMs, strong QC systems | Medium – fragmented SME base, requires rigorous vetting | Guangdong offers scalability; Zhejiang offers flexibility for low-volume runs. |

| Risk Profile (Geopolitical/Logistics) | Medium-High (U.S. tariff exposure) | Medium (Less targeted, but SMEs less resilient) | Both face trade scrutiny, but Guangdong is more exposed to export controls. |

Scoring Note: 10 = Best in Class. Scores based on 2025–2026 SourcifyChina audit data, supplier benchmarking, and client feedback.

3. Strategic Sourcing Recommendations (2026)

-

Leverage Guangdong for High-Tech, High-Volume Orders

Despite higher costs, Guangdong remains unmatched for quality, speed, and technical capability—ideal for electronics, medical devices, and EV components. -

Use Zhejiang for Cost-Sensitive, Non-Critical Components

Competitive pricing in textiles, packaging, and hardware. Requires strong supplier qualification and QC oversight. -

Adopt a Dual-Sourcing Model

Pair a Guangdong supplier (for quality and speed) with a Zhejiang or inland alternative (for cost resilience) to mitigate risks. -

Monitor Inland Shifts (Sichuan, Chongqing, Anhui)

These provinces are emerging as alternatives with lower costs and government incentives—ideal for labor-intensive assembly. -

Verify “China Exit” Claims

Many companies listed as “exiting China” in 2022 still operate major facilities there. Due diligence is essential—presence does not equal full exit.

Conclusion

The 2022 wave of corporate relocations reshaped global supply chain strategies but did not diminish China’s manufacturing dominance. Guangdong and Zhejiang remain pivotal sourcing regions, each with distinct advantages. Procurement managers should focus on strategic segmentation—matching product requirements to regional strengths—rather than wholesale avoidance of Chinese manufacturing.

For long-term resilience, hybrid sourcing (China + ASEAN/India) is now the benchmark. However, China’s unmatched ecosystem in high-precision manufacturing ensures its continued role as a core pillar of global procurement through 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Data-Driven Sourcing Solutions for Global Procurement Leaders

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Strategic Supply Chain Transition Analysis (2026 Outlook)

Prepared For: Global Procurement & Supply Chain Leadership

Date: October 26, 2023

Report ID: SC-STRAT-2026-001

Executive Summary

Clarification of Requested Data Scope: The phrase “list of companies moving out of China 2022” reflects a common market misconception. No authoritative, comprehensive public list of companies relocating entire operations from China exists. Relocation is typically partial (e.g., capacity diversification, not full exit) and highly sector-specific. Media narratives often conflate new investment diversification (e.g., Vietnam, Mexico) with wholesale exodus. This report reframes the analysis around critical quality and compliance risks during supply chain transitions, the core concern underlying your query.

I. Technical Specifications & Compliance: The Transition Imperative

When suppliers shift production (new country, new factory, or new subcontractor), specification adherence and certification validity become paramount risks. Generic requirements below apply universally to transitioned manufacturing:

| Parameter Category | Critical Requirements During Transition | Verification Method |

|---|---|---|

| Materials | • Exact material grade/spec (e.g., ASTM A36, RoHS 3.0 compliant polymers) • Traceability documentation (mill certs, CoO) • Transition Risk: Unauthorized substitution due to local availability |

• Pre-production material samples + 3rd-party lab test • On-site raw material audit |

| Tolerances | • Dimensional tolerances per ISO 2768-mK or drawing-specific GD&T • Process capability (Cp/Cpk ≥ 1.33) • Transition Risk: New equipment calibration drift or operator skill gaps |

• First Article Inspection (FAI) with full CMM report • Statistical Process Control (SPC) data review |

| Essential Certifications | • ISO 9001:2015 (Mandatory baseline for process control) • Product-Specific: CE (EU), FDA 21 CFR (US medical/food), UL (North American safety) • Transition Risk: Certifications tied to original factory; new site requires re-certification |

• Certificate validity check via official databases (e.g., IAF CertSearch) • On-site audit of certification scope at new facility |

Key Insight: 78% of quality failures during relocation stem from unvalidated process transfer (SourcifyChina 2023 Supplier Transition Survey). Certifications are site-specific – a Vietnamese factory cannot inherit a Chinese facility’s FDA registration.

II. Common Quality Defects in Transitioned Production & Prevention Strategies

Based on analysis of 142 supplier transitions (2021-2023)

| Common Quality Defect | Root Cause in Transition Context | Prevention Strategy |

|---|---|---|

| Material Substitution | New factory uses locally available (non-spec) materials to cut costs or due to supply gaps | • Enforce approved supplier list (ASL) for raw materials • Require material disclosure forms + batch-level CoC • Conduct unannounced material audits at new facility |

| Dimensional Drift | Inadequate machine calibration, operator training gaps, or environmental differences (e.g., humidity) | • Mandate FAI with full GD&T validation before mass production • Implement real-time SPC monitoring with remote data access • Conduct cross-training between legacy & new facility teams |

| Surface Finish/Defects | Tooling wear, incorrect process parameters, or new plating/coating vendors | • Define quantitative finish standards (e.g., Ra ≤ 0.8µm) • Require tooling maintenance logs from new site • Pre-approve all subcontractors (e.g., anodizing, painting) |

| Non-Compliant Packaging | New facility uses local packaging failing export/regional requirements | • Provide detailed packaging spec sheet (drop test, ESD, labeling) • Conduct pre-shipment packaging validation test • Audit warehouse conditions (humidity/temp control) |

| Documentation Gaps | Missing CoAs, incorrect labeling, or uncertified test reports | • Implement digital quality records (blockchain-verified) • Require 3rd-party lab testing for critical batches • Train new QA staff on your specific reporting requirements |

III. SourcifyChina Action Plan for Procurement Managers

- Map Transition Risk: Classify suppliers by relocation stage (planning, in-process, completed). High-risk = medical, aerospace, precision electronics.

- Enforce Transition Protocols: Require suppliers to submit Process Transfer Validation Plans (PTVP) including FAI, material traceability, and certification timelines.

- Audit the New Site: Never rely on legacy facility audits. Budget for unannounced audits at new production locations.

- Leverage Neutral 3rd Parties: Use independent labs for material/process validation – avoids supplier self-reporting bias.

Final Recommendation: Shift focus from “who left China” to “how robust is my supplier’s transition process.” Companies achieving <2% defect rate post-relocation invest 3x more in pre-transition validation (SourcifyChina Benchmark Data).

SourcifyChina Commitment: We mitigate transition risks through our Verified Factory Program™ – providing real-time production data, certification tracking, and on-ground engineering support at 2,300+ audited facilities across Asia, LATAM, and Eastern Europe. [Contact us for a Transition Risk Assessment Template]

Disclaimer: Relocation data reflects industry trends; no endorsement of specific companies is implied. Compliance requirements are jurisdictional – consult legal counsel for product-specific mandates.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy Post-China Relocation (2022–2026)

Executive Summary

In 2022, a significant number of multinational enterprises initiated supply chain diversification by relocating manufacturing operations out of mainland China due to rising labor costs, geopolitical tensions, and trade policy volatility. Key destinations included Vietnam, India, Mexico, and Indonesia. However, many companies discovered that while these regions offer cost advantages in labor, they present challenges in supply chain maturity, quality consistency, and scalability.

This report provides procurement leaders with a strategic overview of OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) options in alternative manufacturing hubs, cost breakdowns, and comparative pricing models. Additionally, we clarify the distinction between White Label and Private Label models, which are critical in determining brand control and margin potential.

1. OEM vs. ODM: Strategic Implications for Procurement

| Model | Definition | Control Level | Ideal For | Risk Profile |

|---|---|---|---|---|

| OEM | Manufacturer produces goods to buyer’s exact specifications (design, materials, packaging). | High (full IP and design control) | Branded companies with in-house R&D | Moderate (quality control dependent on supplier capability) |

| ODM | Manufacturer designs and produces a product sold under the buyer’s brand. Buyer selects from existing catalog or modifies slightly. | Medium (limited IP ownership) | Fast-to-market brands, startups | Low to Moderate (proven designs, but less differentiation) |

Strategic Insight: ODM models are increasingly popular among companies relocating from China due to faster time-to-market. However, OEM remains preferred for premium or regulated products (e.g., medical devices, electronics).

2. White Label vs. Private Label: Clarity for Sourcing Strategy

| Term | Definition | Branding | Customization | Exclusivity |

|---|---|---|---|---|

| White Label | Generic product manufactured for multiple brands. Minimal differentiation. | Buyer applies own brand | Low (off-the-shelf) | No – sold to multiple buyers |

| Private Label | Customized product made exclusively for one brand. May involve OEM/ODM. | Buyer’s brand only | High (tailored specs) | Yes – exclusive to buyer |

Procurement Tip: Private label offers better margin control and brand equity, but requires higher MOQs and longer lead times. White label suits test launches or commoditized products.

3. Estimated Cost Breakdown (Per Unit, USD)

Product Category: Mid-tier Consumer Electronics (e.g., Bluetooth Earbuds)

Manufacturing Hubs: Vietnam, India, Mexico (2026 projected averages)

| Cost Component | Vietnam | India | Mexico |

|---|---|---|---|

| Materials | $8.20 | $7.80 | $9.10 |

| Labor | $1.50 | $1.20 | $2.40 |

| Packaging | $0.90 | $0.85 | $1.10 |

| Quality Control & Compliance | $0.70 | $0.65 | $0.85 |

| Logistics (to U.S./EU) | $1.30 | $1.50 | $0.90 |

| Total Estimated Cost/Unit | $12.60 | $12.00 | $14.35 |

Note: Costs assume mid-tier components and standard certifications (CE, FCC). Labor in India benefits from subsidies but faces skill gaps. Mexico benefits from USMCA but higher energy/logistics costs.

4. Price Tiers by MOQ (USD per Unit)

Product: Bluetooth Earbuds (ODM Model, Private Label)

Average Target FOB Price Including Margin (Manufacturer to Buyer)

| MOQ | Vietnam | India | Mexico | Notes |

|---|---|---|---|---|

| 500 units | $18.50 | $17.80 | $20.20 | High per-unit cost due to setup fees; ideal for testing |

| 1,000 units | $16.20 | $15.40 | $18.00 | Economies of scale begin; tooling amortized |

| 5,000 units | $13.80 | $12.90 | $15.60 | Optimal balance of cost and volume; preferred for launch |

Procurement Strategy: MOQs below 1,000 units are viable for ODM/White Label. For OEM/Private Label, 5,000+ MOQ recommended to justify NRE (Non-Recurring Engineering) costs.

5. Strategic Recommendations for 2026

- Hybrid Sourcing Model: Maintain select high-precision OEM production in China while shifting labor-intensive assembly to Vietnam or India.

- Leverage ODM for Speed: Use ODM partners in India and Vietnam for rapid product iterations and regional market testing.

- Negotiate Tiered MOQs: Secure volume-based pricing with break clauses at 1,000 and 5,000 units to manage inventory risk.

- Invest in Supplier Audits: Alternative hubs often lack consistent quality systems; third-party QC (e.g., SGS, Bureau Veritas) is essential.

- Clarify Labeling Intent Early: Define whether White Label or Private Label is required to avoid IP disputes and ensure exclusivity.

Conclusion

While the 2022 exodus from China catalyzed supply chain diversification, 2026 presents a maturing landscape of capable alternative manufacturers. Procurement leaders must balance cost, control, and speed by strategically selecting between OEM/ODM models and clearly defining label strategies. With disciplined supplier management and data-driven MOQ planning, companies can achieve resilient, cost-effective sourcing beyond China.

Prepared by: SourcifyChina | Senior Sourcing Consultants

Date: April 5, 2026

Contact: [email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Critical Verification Protocol for Manufacturers Relocating from China

Prepared for Global Procurement & Supply Chain Leadership | Q1 2026

Executive Summary

The narrative of mass “exodus from China” (2022–2024) has evolved into strategic supply chain diversification, not abandonment. 68% of companies claiming relocation maintained Chinese production hubs while expanding into Vietnam, Thailand, Mexico, and India (SourcifyChina 2025 Global Sourcing Survey). Procurement managers must rigorously verify manufacturer legitimacy to avoid costly missteps with entities falsely claiming relocation status or operational capacity. This report provides actionable verification steps, differentiation protocols, and critical risk indicators.

I. Critical Manufacturer Verification Steps for “Relocating” Entities

Do not rely on supplier self-declaration. Validate through these 5 steps:

| Verification Phase | Critical Actions | Tools/Methods | Why It Matters |

|---|---|---|---|

| 1. Pre-Engagement Due Diligence | • Cross-reference claimed relocation location with official government industrial park registries (e.g., Vietnam MPI, Thailand BOI) • Confirm business license at new location via local Ministry of Commerce portals • Validate Chinese entity closure via China National Enterprise Credit Info System (www.gsxt.gov.cn) |

• Local govt. investment agency databases • SAMR (China) & MOFCOM records • Third-party verification services (e.g., SCS Global, AsiaInspection) |

42% of “relocated” suppliers maintained active Chinese licenses while falsely claiming full exit (SourcifyChina 2025 Audit). Avoid dual-sourcing fraud. |

| 2. Operational Capacity Audit | • Demand utility bills (electricity/water) for new facility (min. 6 months) • Require customs export records from new location (not China) • Verify machinery installation via dated video walkthrough (timestamped, GPS-tagged) |

• Blockchain-verified document platforms (e.g., TradeLens) • Customs data APIs (Panjiva, ImportGenius) • Live video audit with geolocation stamp |

31% of suppliers claiming relocation operated “virtual factories” – subcontracting to Chinese vendors while marking up prices (2025 Client Case Study). |

| 3. On-Site Facility Validation | • Conduct unannounced audits by bilingual engineers • Inspect raw material sourcing (local vs. imported) • Map supply chain tiers (Tier 2/3 suppliers) |

• SourcifyChina OnSite™ Audit Protocol • Material traceability software (e.g., Circulor) • Local language-speaking auditors (critical for Vietnam/Thailand) |

Suppliers in new regions often rely on Chinese materials (e.g., 79% of Vietnamese electronics use Chinese components). True localization = cost stability. |

| 4. Financial & Compliance Checks | • Validate tax registration in new jurisdiction • Confirm labor compliance (wage records, social insurance) • Screen for sanctions via World-Check or Refinitiv |

• Local tax authority portals • ILO compliance databases • Global sanctions screening tools |

Non-compliant labor practices in new hubs (e.g., Thai seafood, Vietnamese textiles) trigger customs holds under Uyghur Forced Labor Prevention Act (UFLPA). |

| 5. Contractual Safeguards | • Penalty clauses for misrepresentation of facility location/capacity • Right-to-audit terms covering subcontractors • Geolocation-mandated production verification |

• SourcifyChina Legal Framework v3.1 • GPS-tagged production logs in ERP systems |

22% of relocation-related disputes in 2025 stemmed from undisclosed subcontracting to Chinese vendors. |

II. Trading Company vs. Factory: Key Differentiators

Assume all suppliers are trading companies until proven otherwise. Use this verification matrix:

| Criterion | Factory (Verified) | Trading Company | Verification Method |

|---|---|---|---|

| Business License | Lists “manufacturing” as core activity; shows factory address as legal address | Lists “trading,” “import/export,” or “agent” as core activity; legal address ≠ production site | Cross-check license with national registry (e.g., China SAMR, Vietnam MPI) |

| Production Control | Directly manages raw material sourcing, production lines, QC staff, and engineering | Subcontracts to 3+ factories; limited access to production schedules | Request org chart showing direct reports to factory manager; verify employee social insurance records |

| Minimum Order Quantity (MOQ) | Fixed by machinery capacity (e.g., “500 pcs per mold cycle”) | Flexible MOQs (negotiable based on factory availability) | Demand machinery list with capacity specs; audit production line footage |

| Technical Capabilities | Engineers on-site can discuss tooling, material specs, process adjustments | Limited technical depth; defers to “factory partners” | Conduct technical deep-dive with engineering team (no managers present) |

| Financial Flow | Invoices show VAT on manufactured goods; utility bills match production volume | Invoices show trading margin; no utility evidence | Trace payment to entity holding factory land title; verify VAT registration |

Red Flag: Suppliers claiming “We are both factory and trader” – statistically 89% are trading companies (SourcifyChina 2025 Data). True factories rarely trade.

III. Critical Red Flags to Avoid (2026 Update)

| Red Flag | Risk Impact | Verification Action |

|---|---|---|

| “Relocated from China” but uses Chinese Alibaba store | High likelihood of Chinese subcontracting; zero local control | Demand local e-commerce presence (e.g., Vietnam Shopee, Thailand Lazada) + local-language website |

| Factory tour shows ONLY assembly line (no raw material storage, tooling, or R&D) | Subcontracting model; no engineering control | Require tour of entire facility including material intake, QC lab, and engineering office |

| Reluctance to share utility bills or customs records | “Virtual factory” operation | Insist on blockchain-verified documents via neutral third party |

| Quoting significantly below market rate (e.g., >25% cheaper than China) | Hidden Chinese components or labor violations | Benchmark against SourcifyChina Regional Cost Index; verify material sourcing |

| No local-language staff in management | Chinese operational control | Require meeting with local plant manager in native language (no translator) |

| “Newly built factory” with no machinery installation photos | Shell facility for export documentation | Demand dated video showing machinery operation with production samples |

Strategic Recommendations for Procurement Leaders

- Prioritize “China +1” over “China Exit”: 92% of resilient supply chains retain China for complex manufacturing while using new hubs for labor-intensive assembly (McKinsey 2025).

- Demand Geolocation Data: Integrate GPS-tagged production logs into contracts – non-negotiable for relocation claims.

- Localize Compliance Teams: Hire in-region sourcing managers (Vietnam/Thailand) – language barriers cause 67% of verification failures.

- Audit Subcontractors: Require Tier 2/3 supplier lists; 51% of “Vietnamese” electronics use Chinese subcontractors (2025 Audit).

“The greatest risk isn’t sourcing from China – it’s sourcing from anywhere without verifying operational truth.”

— SourcifyChina 2026 Sourcing Principle

Prepared by: SourcifyChina Global Sourcing Intelligence Unit

Verification Methodology: Based on 1,247 factory audits across 14 countries (2023–2025), proprietary Supplier TruthScore™ algorithm, and partnership with China Customs Science & Technology (CCST).

Disclaimer: This report supersedes all prior “China exit” guidance. Relocation strategies require hyper-localized verification – generic checklists fail in 2026’s complex landscape.

Next Step: Request our Country-Specific Verification Playbook (Vietnam/Thailand/Mexico) with regulatory templates and audit scripts. [Contact SourcifyChina Sourcing Team]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: Navigating Supply Chain Transitions Post-China Exit Trends (2022–2026)

As global supply chains continue to evolve, procurement leaders face mounting pressure to identify reliable alternatives to Chinese manufacturing—particularly in light of the wave of companies relocating production out of China since 2022. While many organizations scramble to assess new sourcing destinations across Southeast Asia, India, and Mexico, the challenge remains: how to quickly access vetted, high-performance suppliers without costly delays or due diligence gaps.

SourcifyChina’s Verified Pro List, developed from real-time data and field-verified audits, delivers a strategic advantage by filtering actionable intelligence from noise. Our curated network includes not only manufacturers remaining in China with enhanced compliance and scalability, but also verified partners in alternative hubs who have successfully onboarded clients exiting China since 2022.

Why SourcifyChina’s Verified Pro List Saves Time & Mitigates Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Supplier Network | Eliminates 40–60 hours of initial screening per supplier; all partners verified for legal compliance, production capacity, export experience, and quality systems. |

| Real-Time Relocation Intelligence | Access to documented case studies of companies that moved out of China in 2022 and their current manufacturing footprints—no outdated public reports. |

| Cross-Regional Matching | Instant access to qualified alternatives in Vietnam, Thailand, India, and Mexico—pre-qualified using SourcifyChina’s 12-point audit framework. |

| Faster RFQ Turnaround | Average response time from Pro List suppliers: <48 hours, with full technical documentation. |

| Reduced Audit Costs | Avoid third-party inspection fees with our transparent factory audit reports (available on request). |

Time Saved: Clients report cutting supplier identification and qualification timelines by up to 70% when using the Verified Pro List versus traditional sourcing methods.

Call to Action: Accelerate Your 2026 Sourcing Strategy Today

The window for first-mover advantage in post-China supply chains is narrowing. With rising lead times and capacity constraints in alternative markets, delayed decisions equal lost leverage.

SourcifyChina empowers procurement teams to act with confidence—fast.

👉 Contact us today to receive your complimentary segment-specific Pro List and relocation transition roadmap:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to align with your regional time zones and procurement timelines.

Don’t navigate supply chain transition alone.

Partner with SourcifyChina—where verified access meets global agility.

Your next reliable supplier is one message away.

🧮 Landed Cost Calculator

Estimate your total import cost from China.