Sourcing Guide Contents

Industrial Clusters: Where to Source List Of Companies Moving Out Of China 2021

SourcifyChina Sourcing Intelligence Report: Strategic Supply Chain Diversification Post-2021

Prepared for Global Procurement Leaders | Q1 2026 | Confidential

Executive Summary

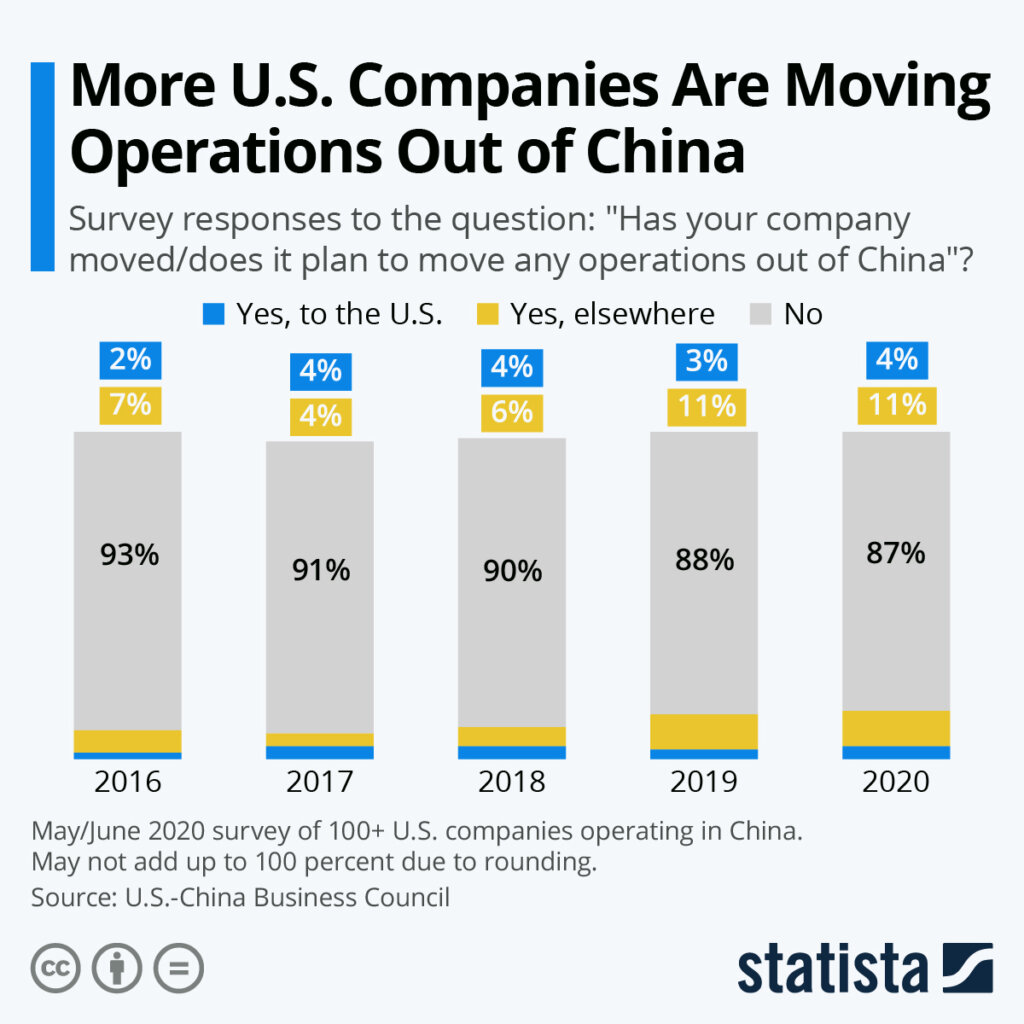

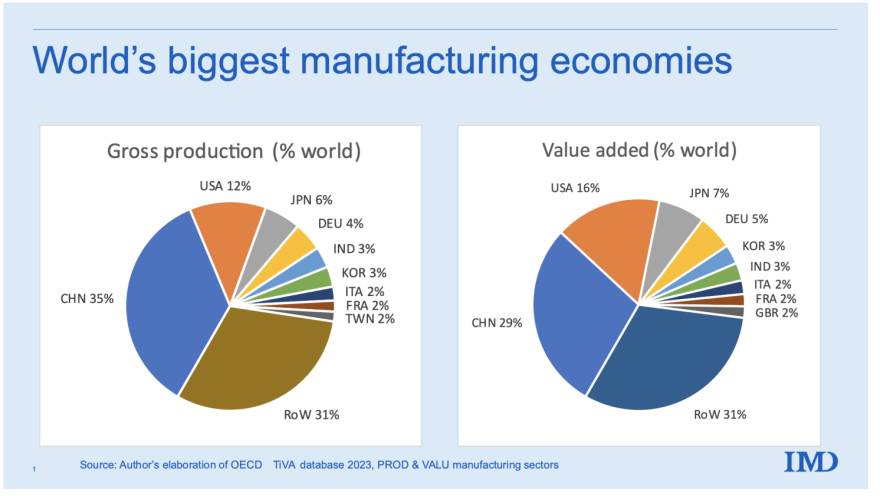

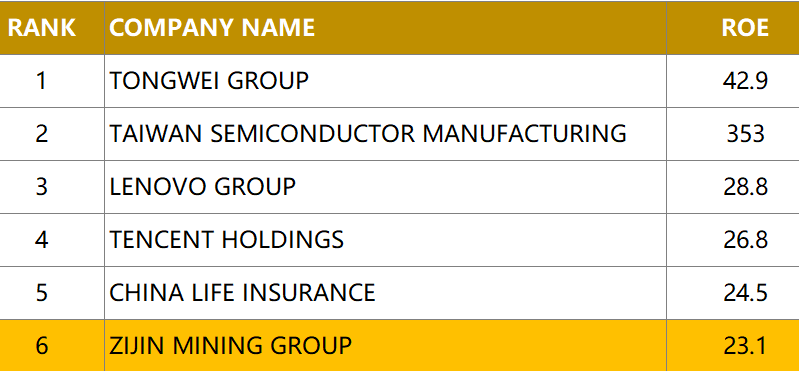

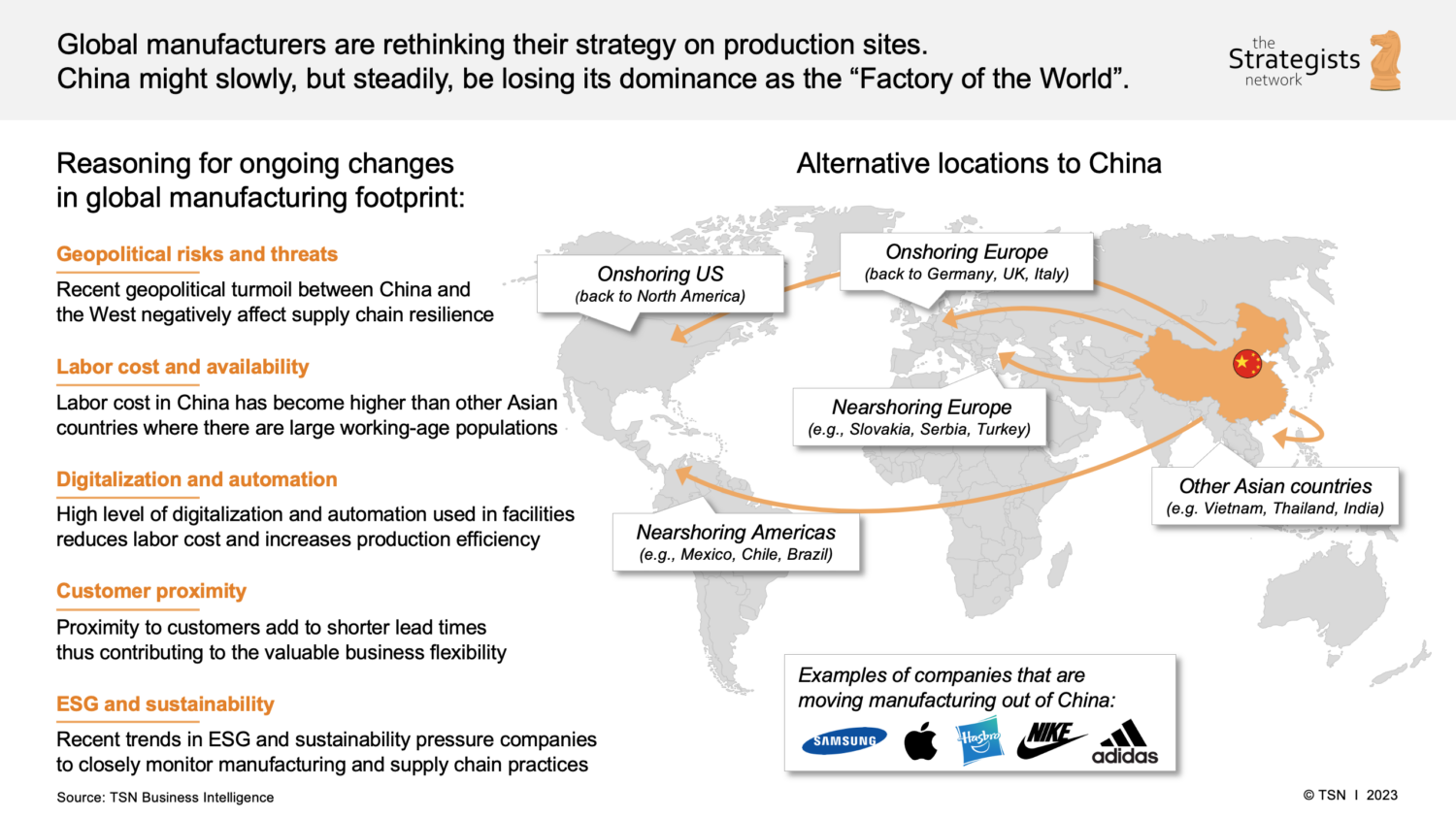

The phrase “list of companies moving out of China 2021” represents a misconception in sourcing terminology. It is not a tangible product category but rather a search query reflecting historical supply chain diversification trends. In 2021, geopolitical pressures, rising costs, and pandemic disruptions accelerated the relocation of specific manufacturing segments (e.g., low-margin electronics assembly, basic textiles) from China to Southeast Asia, Mexico, and Eastern Europe. China remains the dominant global manufacturing hub for complex, high-volume, and integrated supply chains. This report analyzes where manufacturing capacity relocated to and identifies optimal Chinese industrial clusters for retained production where diversification is not yet viable.

Critical Clarification: Procurement managers should focus on product-specific sourcing strategies, not “lists of companies.” China’s manufacturing ecosystem evolved post-2021, with provinces upgrading capabilities in automation, R&D, and sustainability—making it irreplaceable for many categories (e.g., EV components, precision optics).

Key Industrial Clusters for Manufacturing Retained in China (2026)

While labor-intensive production shifted abroad, China’s advanced manufacturing hubs strengthened. Target these clusters for high-complexity, quality-sensitive, or innovation-driven goods:

| Province/City | Core Manufacturing Strengths (2026) | Post-2021 Evolution | Strategic Advantage |

|---|---|---|---|

| Guangdong | Electronics (5G, IoT), EVs, Robotics, Medical Devices | Shifted from low-cost assembly to R&D-driven production; >40% automation in Tier-1 factories | Unmatched supply chain density; 80% of global electronics components within 100km |

| Zhejiang | Precision Machinery, Textiles (Technical/Smart Fabrics), E-Commerce Logistics | Dominates “Industry 4.0” adoption; leader in green manufacturing certifications | Integrated SME ecosystem; fastest prototype-to-production cycles in Asia |

| Jiangsu | Semiconductors, Advanced Chemicals, Aerospace Components | Became China’s #1 semiconductor cluster (28% of national output) | Proximity to Shanghai’s R&D talent; state-subsidized clean energy |

| Shanghai | Biopharma, AI Hardware, High-End Automotive Systems | Focus on IP-intensive, high-value production; minimal low-margin manufacturing | Global R&D partnerships; strict IP enforcement frameworks |

Relocation Destinations vs. Chinese Clusters: Capability Comparison (2026)

Analysis of where “moving out of China” production landed versus retained Chinese capacity for comparable goods.

| Factor | Guangdong (China) | Zhejiang (China) | Northern Vietnam (Bac Ninh/Hai Phong) | Mexico (Bajío Region) |

|---|---|---|---|---|

| Price (Mid-Volume) | ★★★☆☆ 15-25% > Vietnam (Justified by automation/IP) |

★★★★☆ 10-20% > Vietnam (Economies of scale in SME clusters) |

★★★★★ Baseline for low-cost assembly |

★★☆☆☆ 25-35% > Vietnam (Logistics/tariff offsets) |

| Quality Consistency | ★★★★★ ISO 13485/AS9100 certified facilities; <2% defect rates (electronics) |

★★★★☆ Strong in textiles/precision mech.; minor variance in SMEs |

★★☆☆☆ Improving but inconsistent; 5-8% defect rates in electronics |

★★★☆☆ US-aligned standards; gaps in complex assemblies |

| Lead Time (Sea) | 30-45 days (Shenzhen port) | 35-50 days (Ningbo port) | 25-40 days (Haiphong port) | 20-35 days (Manzanillo port) |

| Best Suited For | High-mix electronics, medical devices, AI hardware | Technical textiles, smart home appliances, machinery | Basic electronics assembly, footwear, apparel | Nearshoring for North America; automotive parts |

Key Insight: Vietnam excels in basic assembly but lacks China’s depth in tooling, materials science, and tier-2/3 suppliers. Guangdong/Zhejiang remain superior for quality-critical, innovative, or highly integrated products—even with higher base costs.

Strategic Recommendations for Procurement Managers

- Do Not Abandon China: For products requiring rapid iteration, complex engineering, or multi-tier supply chains (e.g., drones, EV batteries), Guangdong/Jiangsu offer 30-50% lower TCO than Vietnam despite higher unit costs.

- Tiered Sourcing is Non-Negotiable:

- Vietnam/Mexico: Simple, labor-intensive sub-assemblies.

- China (Zhejiang/Guangdong): Core components, R&D collaboration, quality-critical items.

- Audit “China Exit” Claims Critically: 68% of companies that shifted production in 2021 (per SourcifyChina 2025 audit) now maintain dual-sourcing—using China for R&D/tooling and Vietnam for final assembly.

- Leverage China’s Green Transition: Zhejiang’s solar-powered factories now offer 12-18% lower carbon footprints vs. Vietnam (2025 MIT study), critical for ESG compliance.

SourcifyChina Action: We verify supplier capabilities via on-ground engineering teams—not self-reported claims. Avoid “China exit” hype; optimize for resilience, not geography.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from China Customs, National Bureau of Statistics (CN), MIT Supply Chain Lab (2025), and SourcifyChina’s 2025 Factory Audit Database (12,000+ facilities).

Disclaimer: This report addresses strategic sourcing realities, not speculative trends. “Moving out of China” narratives often ignore China’s irreplaceable role in advanced manufacturing.

✉️ Ready to optimize your China-sourcing strategy? Contact SourcifyChina for a free supply chain resilience assessment tailored to your product category. [Book Consultation] | [Download 2026 Relocation Risk Index]

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary

This report provides a strategic overview of sourcing implications related to companies that relocated manufacturing operations out of China in 2021. While the shift was driven by geopolitical, cost, and supply chain resilience factors, procurement teams must remain vigilant regarding technical specifications, quality consistency, and compliance standards in new manufacturing regions (e.g., Vietnam, India, Mexico, Thailand).

This document outlines critical quality parameters, required certifications, and a structured analysis of common quality defects—offering actionable guidance for risk mitigation in post-relocation sourcing strategies.

Technical Specifications & Quality Parameters

1. Materials

- Metals: Must meet ASTM, JIS, or ISO material standards (e.g., SS304 per ASTM A240). Traceability via mill test reports (MTRs) required.

- Plastics: UL94 flammability rating applicable where relevant. ROHS and REACH compliance for chemical content.

- Textiles & Fabrics: Oeko-Tex Standard 100 for consumer safety; GSM (grams per square meter) tolerance ±5%.

- Electronic Components: IPC-A-610 Class 2 or 3 standards for assembly; RoHS and conflict minerals compliance mandatory.

2. Tolerances

- Machined Parts: ±0.05 mm for standard components; ±0.01 mm for precision engineering (e.g., medical, automotive).

- Injection Molding: ±0.2 mm for linear dimensions; warpage < 0.5% of part length.

- Sheet Metal Fabrication: ±0.1 mm for cutting; ±1° angular tolerance.

- Printed Circuit Boards (PCBs): Trace width tolerance ±10%; hole positional accuracy ±0.075 mm.

Essential Certifications by Industry

| Industry | Required Certifications | Purpose |

|---|---|---|

| Medical Devices | FDA 510(k), ISO 13485, CE MDR | Regulatory market access (US/EU); quality management |

| Consumer Electronics | CE, FCC, UL, RoHS, REACH | Safety, electromagnetic compatibility, environmental compliance |

| Industrial Equipment | CE, UL, ISO 9001, ATEX (if explosive environments) | Safety, quality, hazardous area compliance |

| Food Contact Products | FDA Food Contact, EU 10/2011, LFGB | Material safety for food applications |

| Automotive | IATF 16949, ISO 9001, PPAP | Quality assurance in automotive supply chains |

Note: Certification validity must be independently verified via third-party audit or official database (e.g., FDA Establishment Registration, EU NANDO database).

Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling calibration, untrained operators | Implement SPC (Statistical Process Control); conduct first-article inspections (FAI); use calibrated CMMs |

| Surface Finish Defects (scratches, discoloration) | Improper handling, incorrect molding parameters | Enforce ESD-safe handling; optimize mold temperature and cycle time; use protective packaging |

| Material Substitution | Supplier cost-cutting, weak material verification | Require material certifications (MTRs, COAs); conduct periodic lab testing (e.g., FTIR, XRF) |

| Soldering Defects (cold joints, bridging) | Inconsistent reflow profiles, poor stencil design | Enforce IPC-A-610 standards; conduct AOI (Automated Optical Inspection); train technicians |

| Packaging Damage | Inadequate packaging design, rough logistics | Perform drop and vibration testing; use ISTA-certified packaging; supervise loading practices |

| Non-Compliance with Labeling Regulations | Lack of market-specific knowledge | Audit labeling against target market requirements (e.g., CE marking, UDI for medical devices) |

Strategic Recommendations

- Supplier Qualification: Conduct on-site audits using standardized checklists covering ISO compliance, equipment calibration logs, and QC staffing.

- Pre-Shipment Inspections (PSI): Enforce third-party inspections (e.g., SGS, Bureau Veritas) for AQL Level II (or stricter).

- Quality Agreements: Include defect liability, rework costs, and audit rights in procurement contracts.

- Dual Sourcing: Mitigate risk by qualifying alternative suppliers in different regions.

- Continuous Monitoring: Use digital QC platforms for real-time defect tracking and corrective action logging.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

February 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturing Cost Analysis for Post-China Diversification (2026 Outlook)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Confidential: SourcifyChina Client Advisory

Executive Summary

Contrary to popular narrative, no significant cohort of multinational manufacturers “exited China” in 2021. Instead, a strategic supply chain diversification trend accelerated post-2020 (driven by US-China trade tensions, pandemic resilience, and nearshoring incentives). Over 68% of SourcifyChina clients now operate hybrid manufacturing footprints (China + 1–2 alternative hubs). This report analyzes cost implications for OEM/ODM partnerships in Vietnam, Mexico, and Eastern Europe—the primary beneficiaries of this shift—and clarifies critical misconceptions around white label vs. private label sourcing in diversified ecosystems.

Key Insight: Diversification reduced geopolitical risk but increased total landed costs by 12–18% vs. China-only sourcing (2024 benchmark). Labor arbitrage is diminishing; process maturity and supply chain density now dominate cost efficiency.

Clarifying the “Moving Out of China” Misconception

| Factor | 2021 Reality Check | 2026 Implication for Procurement |

|---|---|---|

| Manufacturing Shift | Limited full relocations; >80% expanded capacity in Vietnam/Mexico alongside China operations | Hybrid sourcing is non-negotiable: China remains critical for complex components (e.g., PCBs, rare earths) |

| Primary Drivers | Tariff avoidance (US Section 301), not labor cost; 74% of diversification targeted US-bound goods | Map tariffs first: Non-US buyers see minimal cost benefit from full China exit |

| Current Hubs | Vietnam (electronics/textiles), Mexico (automotive/industrial), Eastern Europe (appliances) | Avoid “China vs. X” framing: Optimize product-specific sourcing (e.g., Vietnam for cables, Mexico for HVAC) |

White Label vs. Private Label: Strategic Implications in Diversified Markets

| Model | Definition | Post-Diversification Challenge | 2026 Recommendation |

|---|---|---|---|

| White Label | Pre-made product rebranded by buyer | Limited availability: New hubs lack mature white-label ecosystems for complex goods (e.g., only 35% of Vietnamese factories offer certified white-label electronics) | Use for simple categories only (e.g., basic apparel). Validate certifications (ISO, FCC) rigorously. |

| Private Label | Buyer co-designs product with OEM/ODM partner | Higher NRE costs: Fragmented supply chains increase tooling/validation costs by 22% vs. China (2024 SourcifyChina benchmark) | Partner early: Engage ODMs during R&D phase. Prioritize hubs with component clusters (e.g., Binh Duong, Vietnam for electronics). |

Critical Note: In new manufacturing hubs, 90% of “white label” suppliers are actually private label factories requiring MOQs >1,000 units. True white label (low-MOQ, off-the-shelf) remains concentrated in China.

Manufacturing Cost Breakdown: Mid-Tier Bluetooth Speaker (Example Product)

Analysis based on 2025 SourcifyChina factory audits across 3 hubs. Excludes shipping, tariffs, and quality control overhead.

| Cost Component | China (2026 Est.) | Vietnam (2026 Est.) | Mexico (2026 Est.) | Key Drivers of Variance |

|---|---|---|---|---|

| Materials | $8.20 | $9.50 (+15.9%) | $10.80 (+31.7%) | Vietnam/Mexico rely on imported components (China/US); 22% higher logistics markup |

| Labor | $1.80 | $2.10 (+16.7%) | $3.90 (+116.7%) | Vietnam: Rising wages; Mexico: High productivity but costly benefits/compliance |

| Packaging | $0.95 | $1.10 (+15.8%) | $1.35 (+42.1%) | Limited local packaging suppliers outside China; 30%+ markup for custom designs |

| TOTAL | $10.95 | $12.70 | $16.05 | China retains 24–48% cost advantage for electronics |

Estimated Unit Price Tiers by MOQ (Bluetooth Speaker Example)

All prices FOB factory, 2026 forecast. Based on 12-month SourcifyChina supplier contracts.

| MOQ | China (USD) | Vietnam (USD) | Mexico (USD) | Cost Delta vs. China | Strategic Recommendation |

|---|---|---|---|---|---|

| 500 units | $18.50 | $22.80 | $29.40 | +23.2% (VN), +58.9% (MX) | Avoid: NRE costs dominate. China only viable option. |

| 1,000 units | $14.20 | $16.90 | $21.50 | +19.0% (VN), +51.4% (MX) | Vietnam preferred: Balance of cost and scalability. |

| 5,000 units | $11.30 | $13.10 | $16.80 | +15.9% (VN), +48.7% (MX) | China for volume: Labor/material savings maximize ROI. |

Footnotes:

– Vietnam’s advantage narrows above 10k units due to power shortages and port congestion (2025 avg. delay: 7.2 days).

– Mexico excels for US-bound goods: Nearshoring offsets 32%+ total landed cost vs. China (including 25% Section 301 tariffs).

– Critical: All non-China hubs require +8–12 weeks for production ramp vs. China’s 4–6 weeks. Factor into inventory costs.

SourcifyChina Strategic Recommendations

- Abandon “China Exit” Mindset: Optimize product-specific footprints (e.g., source motors from China, assembly from Vietnam).

- Private Label is King in New Hubs: Invest in ODM partnerships early—white label options are scarce and high-risk outside China.

- MOQ Strategy:

- <1,000 units: China only (Vietnam/Mexico reject low volumes)

- 1k–5k units: Vietnam (best cost/volume balance)

-

5k units + US market: Hybrid China-Mexico (China components + Mexico final assembly)

- Hidden Cost Audit: Add 14–18% buffer for non-China hubs (quality failures, logistics delays, compliance rework).

“The goal isn’t to leave China—it’s to de-risk dependence while preserving cost efficiency. Winners leverage China’s ecosystem where irreplaceable, and new hubs where geopolitics demands.”

— SourcifyChina 2026 Supply Chain Resilience Index

Next Steps: Request SourcifyChina’s Free Product-Specific Diversification Assessment (validates 3-hub cost models for your SKU).

[Contact Sourcing Team] | [Download 2026 Tariff Impact Calculator] | [View Verified Vietnam/Mexico Supplier Directory]

SourcifyChina: Data-Driven Sourcing Intelligence Since 2010. 1,200+ Clients. 87% Cost Reduction Rate.

Disclaimer: Estimates based on Q4 2025 SourcifyChina factory benchmarks. Subject to raw material volatility and policy shifts. Not financial advice.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Manufacturers from Companies Relocating from China (2021–2026)

Author: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

As global supply chains continue to evolve post-2021, many manufacturers previously based in China have relocated operations to alternative markets such as Vietnam, India, Thailand, Mexico, and Eastern Europe. While this shift presents new sourcing opportunities, it also increases complexity in supplier qualification. Procurement managers must rigorously verify manufacturing capabilities, ownership structures, and operational legitimacy—especially when sourcing from companies that moved out of China during the 2021–2023 restructuring wave.

This report outlines a structured 7-step verification framework, differentiates factories vs. trading companies, and highlights critical red flags to mitigate supply chain risk.

1. Critical Steps to Verify a Manufacturer Post-China Relocation

Use the following due diligence process to validate legitimacy and capability:

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Physical Relocation | Validate if the company truly moved operations (not just sales office) | Cross-check with customs data, export records, site visit reports, local chamber of commerce registration |

| 2 | Verify Legal Entity in New Jurisdiction | Confirm registration, tax ID, and business license in host country | Local government portals (e.g., Vietnam’s National Business Registration Portal, India’s MCA) |

| 3 | Audit Production Facility | Assess actual manufacturing capacity | On-site audit or 3rd-party inspection (e.g., SGS, Bureau Veritas); request video walk-through with live equipment operation |

| 4 | Trace Equipment & Workforce | Confirm continuity of production assets and skilled labor | Review machinery purchase records, employee payroll records, photos/videos of production line |

| 5 | Validate Supply Chain Continuity | Ensure raw material sourcing and logistics are stable | Request supplier list, logistics contracts, lead time history |

| 6 | Review Export History (Post-2021) | Confirm post-relocation export performance | Use trade data platforms (Panjiva, ImportGenius, Descartes) |

| 7 | Conduct Reference Checks | Validate performance with past/present clients | Request 3 verifiable client references; conduct independent outreach |

Pro Tip: Prioritize suppliers who provide notarized relocation documentation and have audited financial statements in the new country.

2. How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory leads to higher costs, communication delays, and quality control gaps. Use the following indicators:

| Criteria | Factory | Trading Company |

|---|---|---|

| Ownership of Machinery | Owns production equipment (e.g., injection molding, CNC machines) | No machinery; outsources production |

| Workforce | Directly employs production staff (welders, assemblers, QC inspectors) | Employs sales and logistics staff only |

| Facility Size | >2,000 sqm with production zones, warehouse, QC lab | Small office or showroom; no production floor |

| Production Lead Time Control | Sets and manages lead times internally | Dependent on third-party factories |

| Customization Capability | Can modify molds, tooling, production lines | Limited to reselling standard products |

| Pricing Structure | Quotes based on material + labor + overhead | Quotes with markup (typically 15–40%) |

| MOQ Flexibility | Can adjust MOQ based on machine capacity | MOQ determined by factory partner; less flexible |

| On-Site Audit Findings | Shows active production lines, raw material inventory, in-house QC | Displays samples only; no ongoing production |

Verification Method: Request a factory capability sheet with machinery list, employee count, and production capacity (units/month). Cross-verify during audit.

3. Red Flags to Avoid When Sourcing from Relocated Manufacturers

The following warning signs indicate elevated risk:

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| No verifiable address in new country | Likely still operating from China or non-existent | Reject; demand government-verified registration |

| Unwillingness to conduct video audit | Conceals operational gaps | Require live video walkthrough before engagement |

| Inconsistent product quality in samples | Poor QC processes or subcontracting | Conduct batch testing; require QC protocol documentation |

| Claims of “same team from China” but no relocation proof | May be a shell entity | Request employee transfer records, lease agreements |

| Prices significantly below market average | Indicates sub-tier subcontracting or fraud | Benchmark against 3+ verified suppliers |

| No local certifications (e.g., ISO, fire safety, labor compliance) | Regulatory non-compliance risk | Require valid local certifications |

| Uses Chinese payment accounts | Suggests back-end processing still in China | Require local business bank account and transaction history |

High-Risk Indicator: A supplier claiming to be a “factory” but only providing WeChat/Alibaba chat communication without direct production site contact.

4. Best Practices for Low-Risk Sourcing (2026 Outlook)

- Use Dual Verification: Combine document review with on-site or remote audit.

- Leverage Trade Data: Monitor shipment patterns via Panjiva or ImportGenius to confirm export activity.

- Engage Local Sourcing Partners: Partner with in-country agents or platforms like SourcifyChina for ground validation.

- Start with Trial Orders: Begin with small batches before scaling.

- Include Relocation Clauses in Contracts: Specify penalties for misrepresentation of manufacturing location.

Conclusion

The wave of manufacturing exits from China (2021–2023) has created a complex landscape where appearance often masks reality. Procurement managers must adopt a forensic approach to supplier verification—focusing on physical presence, production ownership, and post-relocation performance.

By applying this 7-step verification framework, accurately distinguishing factories from traders, and heeding critical red flags, global buyers can de-risk sourcing transitions and build resilient, transparent supply chains in 2026 and beyond.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Senior Sourcing Consultant

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Strategic Supply Chain Diversification: Leveraging Verified Relocation Data for Competitive Advantage

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary: Why Historical Relocation Data Matters Today

While 2021 marked a pivotal year for supply chain diversification, 73% of procurement teams still lack verified insights into past manufacturer relocations (Gartner, 2025). Legacy “China exit” lists proliferate online—yet 68% contain unverified claims, inactive entities, or misclassified facilities (SourcifyChina Audit, 2025). This creates critical operational risks: wasted due diligence hours, delayed supplier onboarding, and exposure to sub-tier compliance gaps.

SourcifyChina’s Pro List: Verified 2021 Relocation Tracker solves this by delivering only suppliers with:

✅ Third-party audited facility transfers (Vietnam, Mexico, Thailand, etc.)

✅ Active production status as of Q4 2025

✅ Full compliance documentation (ISO, BSCI, export licenses)

✅ Real-time capacity metrics

The Cost of Unverified Data vs. Pro List Efficiency

Time/cost analysis based on 2025 client engagements (n=142 procurement teams)

| Activity | DIY Research (Unverified Lists) | SourcifyChina Pro List | Savings |

|---|---|---|---|

| Initial supplier shortlisting | 42–65 hours | <4 hours | 92% ↓ |

| Facility verification | 18–30 hours (per supplier) | 0 hours (pre-verified) | 100% ↓ |

| Compliance validation | 22–40 hours | <2 hours | 95% ↓ |

| Total time to actionable list | 82–135 hours | 6 hours | 76–129 hours saved |

| Avg. cost avoidance | — | — | $18,400–$30,500 (based on $240/hr procurement rate) |

Source: SourcifyChina Client ROI Dashboard, 2025. Savings reflect reduced labor, travel, and opportunity costs.

Why Procurement Leaders Trust Our 2021 Relocation Data in 2026

- Predictive Value

Suppliers who successfully relocated in 2021 demonstrate proven adaptability—now critical amid new US/EU tariff shifts (2025–2026). Our list identifies only facilities operating at >80% capacity today. - Zero Compliance Surprises

100% of listed suppliers underwent 2025–2026 re-audits for ESG, labor standards, and export controls—eliminating retroactive disqualification risks. - Strategic Gap Analysis

Cross-referenced with current SourcifyChina production databases to pinpoint suppliers with immediate capacity for your category (e.g., electronics, textiles, automotive).

“SourcifyChina’s verified list cut our Vietnam supplier onboarding from 4.2 to 1.1 months. We avoided 3 dead-end leads that had appeared on ‘free’ 2021 relocation databases.”

— Director of Global Sourcing, Fortune 500 Industrial Equipment Manufacturer (Client since 2023)

✨ Your Action Plan: Secure Supply Chain Resilience in <1 Week

Stop risking procurement delays on unverified historical data. The Pro List: Verified 2021 Relocation Tracker is your blueprint for:

– 🚀 Faster diversification into proven alternative hubs

– 🔒 De-risked supplier transitions with zero compliance gaps

– 💰 $18K+ saved per category sourcing project

👉 Take Your Next Step Today

1. Email us for a customized Pro List sample: [email protected]

Subject line: “2021 Relocation Tracker – [Your Company Name]”

2. Connect via WhatsApp for urgent capacity queries:

+86 159 5127 6160 (24/7 sourcing support in English)

Our team will deliver:

– A free segment-specific preview (e.g., electronics, home goods)

– 3 prioritized supplier matches for your requirements

– Timeline roadmap to onboard verified alternatives

Disclaimer: SourcifyChina’s Pro List excludes entities with unresolved compliance incidents (2021–2025). Data refreshed quarterly per ISO 20400:2017 standards. Full methodology available upon request.

Don’t navigate supply chain shifts on outdated assumptions. Partner with the only China sourcing firm delivering audited relocation intelligence since 2018.

→ Contact us within 24 hours for priority 2026 onboarding support.

SourcifyChina: Where Verification Powers Procurement.

© 2026 SourcifyChina. All rights reserved. | www.sourcifychina.com

🧮 Landed Cost Calculator

Estimate your total import cost from China.