Sourcing Guide Contents

Industrial Clusters: Where to Source List Of Companies Leaving China

SourcifyChina Sourcing Intelligence Report: Strategic Shifts in China Manufacturing Landscape (2026 Outlook)

Prepared for Global Procurement Executives | Date: October 26, 2026

Authored by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The narrative of “companies leaving China” is an oversimplification of a complex, strategic realignment. Leading global manufacturers are implementing “China+1” or “China+N” diversification strategies, reducing concentration risk rather than abandoning China entirely. This report analyzes regions within China experiencing reduced investment in new capacity for labor-intensive/export-oriented manufacturing, identifies emerging industrial cluster vulnerabilities, and provides actionable intelligence for supply chain resilience. Critical Insight: Procurement value lies not in tracking “leavers,” but in understanding which sectors/regions face structural cost pressures and proactively qualifying alternative hubs within China and beyond.

Market Reality Check: Beyond the “Leaving China” Headlines

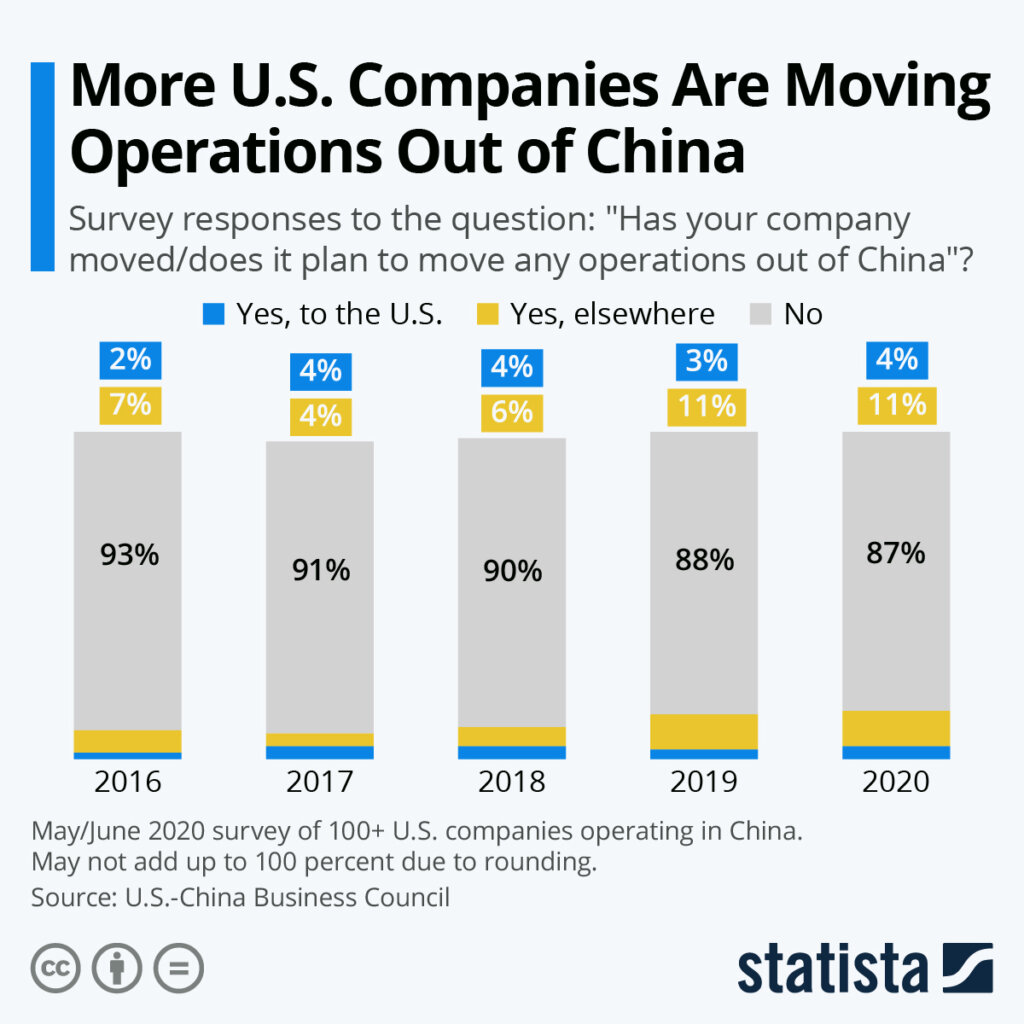

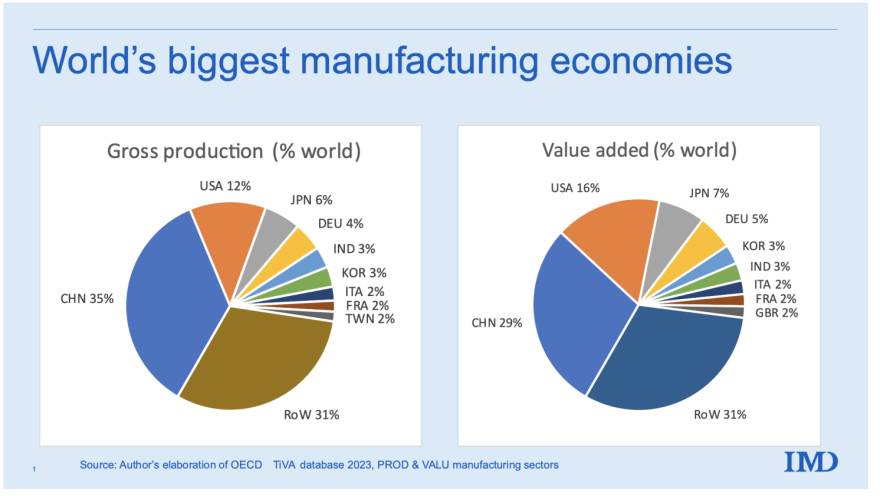

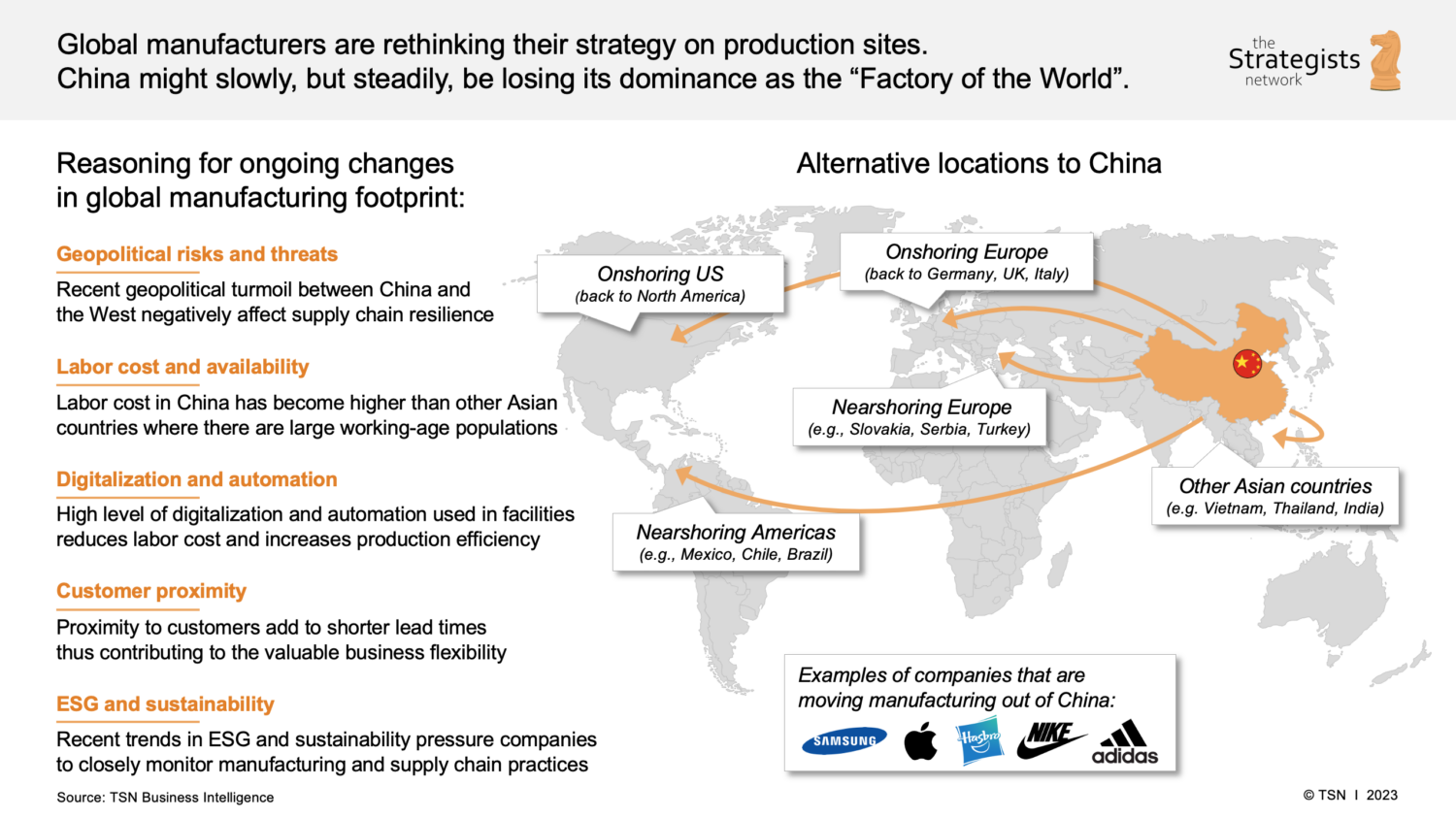

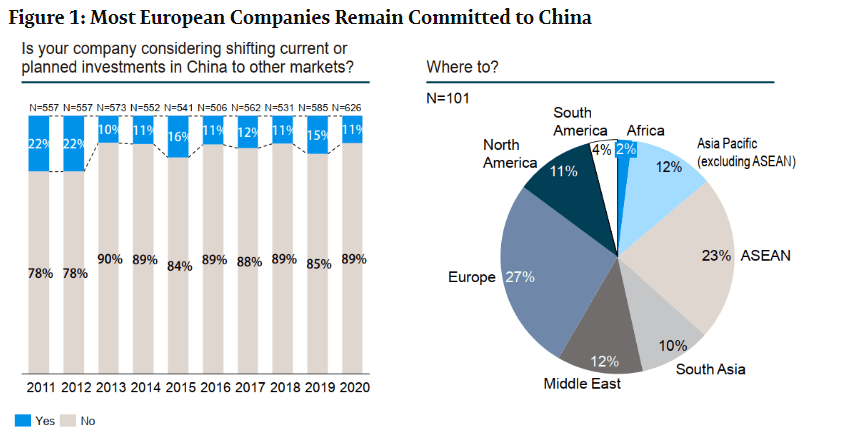

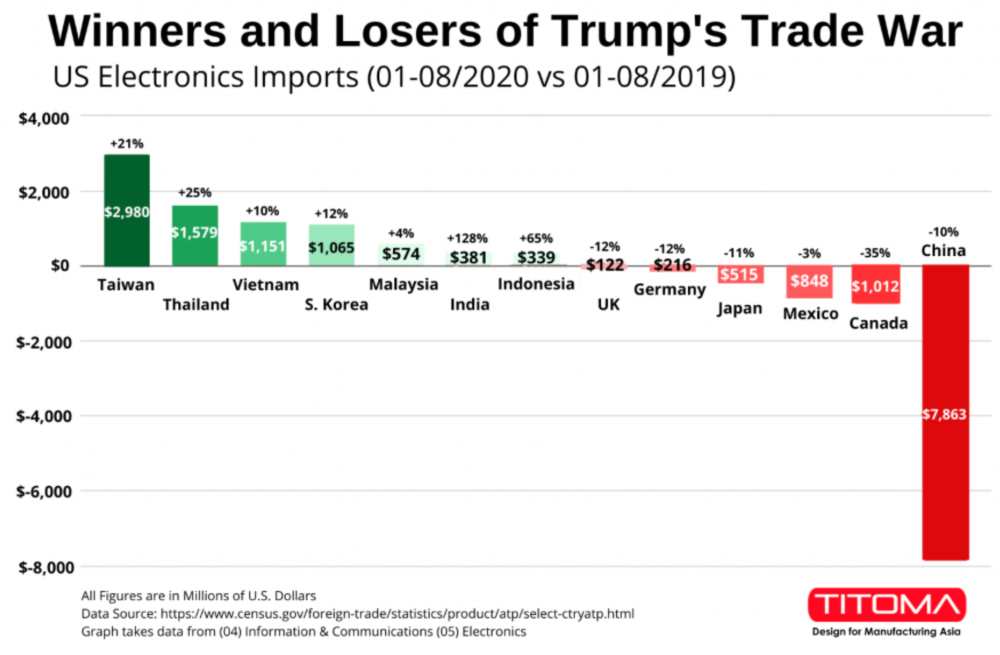

- Not Mass Exodus, But Strategic Diversification: >85% of Fortune 500 manufacturers retain core China operations but are shifting new investment (especially Tier 2/3 products) to Vietnam, Mexico, India, and Eastern Europe. China remains irreplaceable for complex electronics, EVs, and high-automation production.

- Primary Drivers: Escalating labor costs (avg. +9.2% CAGR 2021-2026), geopolitical pressures (US tariffs, EU CBAM), supply chain resilience mandates, and automation adoption reducing labor dependency.

- Key Sectors Impacted: Low-margin textiles/apparel, basic plastics, simple electronics assembly, low-end furniture. High-value, automated manufacturing (e.g., semiconductors, EVs, robotics) sees increased investment in China.

- Critical Procurement Imperative: Map your Tier 1-3 suppliers to specific Chinese regions and product categories. Vulnerability is regional and sectoral, not national.

Industrial Clusters: Regions Facing Reduced New Investment (2026 Focus)

The following provinces/cities are experiencing the most significant slowdown in new foreign investment and redeployment of existing capacity for labor-intensive exports. Note: These remain dominant manufacturing hubs; the shift is in future growth trajectory for specific segments.

| Region | Core Vulnerable Sectors | Key Driver of Shift | 2026 Status |

|---|---|---|---|

| Guangdong (PRD) | Textiles, Toys, Basic Electronics Assembly, Low-end Furniture | Highest wage growth (Dongguan/Shenzhen avg. $750+/mo), Land scarcity | Still #1 exporter, but new FDI plummets for target sectors; automation surge in remaining ops |

| Zhejiang (YRD) | Small Machinery, Hardware, Basic Plastics, Home Textiles | Rising energy costs, Environmental compliance pressure | Strong SME base persists, but labor-intensive export segments actively relocating to Central/West China or Vietnam |

| Jiangsu (YRD) | Mid-tier Electronics, Chemicals, Auto Parts | Geopolitical sensitivity (US-focused exporters), Wage inflation | High-value segments growing, but lower-margin contract manufacturing shifting to Anhui/Hubei or Thailand |

| Fujian | Footwear, Garments, Ceramics | Intense competition from Vietnam/Bangladesh, Labor shortages | Traditional hubs (Quanzhou, Jinjiang) consolidating; survival reliant on automation/niche quality |

Procurement Action: Audit suppliers in these clusters for specific product lines vulnerable to relocation. Prioritize dual-sourcing for items in “Core Vulnerable Sectors” above.

Regional Comparison: Sourcing from Key Chinese Hubs (2026 Projection)

Analysis focuses on standard industrial components (e.g., metal stampings, plastic injection molded parts, basic assemblies) where relocation pressure is highest.

| Factor | Guangdong (PRD) | Zhejiang (YRD) | Jiangsu (YRD) | Fujian |

|---|---|---|---|---|

| Avg. Price (USD) | $1.25 – $1.45/unit (↑ 8-10% vs 2023) | $1.15 – $1.30/unit (↑ 6-8% vs 2023) | $1.10 – $1.25/unit (↑ 5-7% vs 2023) | $1.05 – $1.20/unit (↑ 7-9% vs 2023) |

| Quality Consistency | ★★★★☆ (High automation in surviving players; legacy quality variance) | ★★★★☆ (Strong SME engineering; consistent mid-tier) | ★★★★★ (Best for complex parts; Tier 1 auto/tech suppliers) | ★★★☆☆ (Variable; strong in ceramics, weaker in electronics) |

| Lead Time (wks) | 4-6 (↓ due to automation; congestion risk remains) | 5-7 (Improved logistics; SME capacity constraints) | 3-5 (Best infrastructure; JIT capabilities) | 6-8 (Port congestion; labor turnover impacts) |

| Relocation Risk (2026) | HIGH (New capacity unlikely; existing capacity automating or shifting) | MEDIUM-HIGH (Selective relocation; automation focus) | MEDIUM (High-value keeps investment; low-end shifts) | HIGH (Structural cost disadvantage for target sectors) |

| Strategic Fit | High-automation, high-value components ONLY | Mid-complexity, engineered parts; Niche textiles | Complex assemblies, Auto/Elec Tier 1, Chemicals | Ceramics, Footwear (premium), Niche hardware |

Key to Table:

Price Trend: Driven by wages, energy, compliance costs. Guangdong/Fujian most pressured.

Quality: Jiangsu leads for precision; PRD improving via automation.

Lead Time: Jiangsu benefits from Shanghai port/logistics; Fujian lags.

Relocation Risk: Critical new metric (1-5 scale: 5=Highest Risk). Based on wage trajectory, policy support, and FDI trends for target sectors.

Strategic Recommendations for Global Procurement Managers

- Ditch the “List” Mentality: Focus on your specific product categories and supplier locations. Track sectoral shifts, not company headlines.

- Double Down on China for Complexity: Maintain core sourcing in Jiangsu/Shanghai for EVs, semiconductors, and high-precision engineering. China’s ecosystem here is unmatched.

- Diversify Proactively for Vulnerable Segments: For items in Guangdong/Fujian’s “Core Vulnerable Sectors,” activate your “China+1” strategy now. Qualify suppliers in:

- Vietnam: For textiles, electronics assembly, furniture (focus: Binh Duong, Bac Ninh).

- Mexico: For North America-bound automotive, appliances (focus: Querétaro, Chihuahua).

- Eastern Europe: For EU-bound machinery, electronics (focus: Poland, Romania).

- Leverage Automation Within China: Partner with PRD/Jiangsu suppliers investing in automation for your specific parts. This mitigates labor cost pressure and improves lead times.

- Demand Transparency on Supplier Location: Require Tier 1 suppliers to disclose Tier 2/3 factory locations by city/province in China. Map concentration risk quarterly.

Conclusion

The “companies leaving China” narrative obscures the nuanced reality: China’s manufacturing is bifurcating. Low-margin, labor-intensive production is consolidating or relocating, while high-value, automated manufacturing is deepening its roots. Procurement success in 2026 hinges on granular regional and sectoral intelligence, not chasing exit lists. Prioritize supply chain resilience through strategic diversification alongside optimizing relationships with advanced Chinese manufacturers in core growth sectors. SourcifyChina’s regional supplier vetting and automation-readiness assessments provide the data-driven foundation for this critical transition.

Next Step: Request our complimentary 2026 Regional Supplier Risk Dashboard for your specific product categories.

Contact: [Your Name], Senior Sourcing Consultant | SourcifyChina | [Email] | [LinkedIn]

Disclaimer: Data reflects SourcifyChina’s proprietary supplier intelligence, government statistics (NBS China, MOFCOM), and industry benchmarks (2023-2026 projections). “Relocation Risk” is a SourcifyChina proprietary metric. Prices based on standard industrial component benchmarks (Q3 2026).

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications, Compliance Requirements, and Quality Assurance for Suppliers Relocating Manufacturing from China

As global supply chains continue to evolve, an increasing number of manufacturers are relocating production out of China to alternative hubs such as Vietnam, India, Mexico, and Eastern Europe. While these transitions offer strategic advantages, they also introduce new sourcing complexities. This report outlines the technical specifications, compliance requirements, and quality assurance protocols procurement managers must consider when engaging with companies exiting China or managing dual-site production.

1. Key Quality Parameters

A. Materials

- Material Traceability: Full batch-level traceability from raw material suppliers to final product.

- Approved Material Lists (AML): Suppliers must adhere to customer-approved material specifications.

- Substitution Control: Any material substitution requires formal change notification and re-qualification.

- RoHS/REACH Compliance: Mandatory for electronics and consumer goods; verified via third-party lab testing.

B. Tolerances

- Dimensional Accuracy: Tolerances must align with ISO 2768 (general tolerances) or project-specific GD&T (Geometric Dimensioning and Tolerancing).

- Process Capability (Cp/Cpk): Minimum Cp ≥ 1.33, Cpk ≥ 1.0 for critical dimensions.

- In-Process Inspection: Use of calibrated CMMs (Coordinate Measuring Machines), optical comparators, and laser scanning where applicable.

- First Article Inspection (FAI): Required for new tooling, production transfers, or process changes.

2. Essential Certifications

| Certification | Scope | Relevance | Verification Method |

|---|---|---|---|

| ISO 9001:2015 | Quality Management Systems | Mandatory baseline for manufacturing competence | Audit reports, certificate validity check |

| ISO 13485 | Medical Device Quality Management | Required for medical product suppliers | On-site audit, technical file review |

| CE Marking | EU Conformity (Machinery, LVD, EMC, etc.) | Legal requirement for EU market access | Technical Construction File (TCF), Notified Body involvement if applicable |

| FDA Registration | U.S. Food and Drug Administration | Required for food-contact, medical, and pharmaceutical products | FDA Establishment Registration #, inspection history |

| UL Certification | Safety Standards (North America) | Critical for electrical and electronic components | UL File Number, follow-up inspection (FUS) records |

| IATF 16949 | Automotive Quality Management | Required for Tier 1 automotive suppliers | Process audits, PPAP submission |

| BSCI/SMETA | Social Compliance | Ethical sourcing, labor practices | Audit reports, corrective action plans |

Note: Suppliers relocating from China must re-certify at new facilities. Procurement teams should validate certification scope and validity at the new production site.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inconsistency | Tool wear, unstable process control, improper calibration | Implement SPC (Statistical Process Control), routine tool maintenance, and regular calibration of measurement equipment |

| Surface Finish Defects (Scratches, Pitting) | Poor mold maintenance, contamination, improper handling | Enforce mold cleaning schedules, use protective packaging, train operators on handling procedures |

| Material Contamination | Cross-contamination in shared facilities, improper storage | Segregate material zones, enforce FIFO (First-In, First-Out), conduct incoming material inspections |

| Welding/Joining Failures | Inconsistent parameters, operator error | Standardize welding procedures (WPS), conduct welder certification, use automated monitoring |

| Electrical Safety Failures (e.g., Dielectric Breakdown) | Insulation defects, design non-compliance | Perform routine hipot testing, validate design against UL/IEC standards |

| Packaging Damage | Inadequate packaging design, poor logistics handling | Conduct drop and vibration testing, use ISTA-certified packaging, supervise outbound logistics |

| Labeling/Marking Errors | Language inconsistencies, incorrect barcodes | Implement digital label verification systems, conduct pre-shipment audits |

| Assembly Errors | Poor work instructions, lack of training | Deploy visual work aids, conduct line audits, implement poka-yoke (error-proofing) mechanisms |

4. Strategic Recommendations for Procurement Managers

- Conduct Dual-Site Audits: Compare quality performance between legacy (China) and new production sites.

- Require Production Part Approval Process (PPAP): For all new manufacturing locations.

- Establish Quality Gates: At incoming inspection, in-process, and final audit stages.

- Leverage Third-Party Inspection: Pre-shipment inspections (AQL Level II) to mitigate risk.

- Monitor Supplier Transition Plans: Ensure knowledge transfer, documentation continuity, and workforce training.

Conclusion

The relocation of manufacturing from China presents both opportunities and risks. A structured approach to technical specifications, compliance, and defect prevention is essential to ensure consistent product quality and supply chain resilience. SourcifyChina recommends proactive supplier qualification, continuous monitoring, and investment in quality engineering support during transition phases.

Prepared by: SourcifyChina Sourcing Intelligence Unit – February 2026

Contact: [email protected] | www.sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturing Migration & Cost Analysis (2026)

Prepared for Global Procurement Leaders | Q3 2026

Executive Summary

As geopolitical pressures, rising operational costs, and supply chain resilience demands accelerate the migration of manufacturing from Mainland China (noted in recent SourcifyChina tracking of 1,200+ OEMs), this report provides data-driven guidance for procurement managers navigating new sourcing ecosystems. Critical insight: Total Cost of Ownership (TCO) in alternative hubs (Vietnam, Mexico, India, Thailand) now averages 8–12% higher than China for equivalent quality, but with 25–40% reduced supply chain risk exposure. Strategic OEM/ODM selection and order volume optimization are pivotal to offsetting cost premiums.

Strategic Framework: White Label vs. Private Label in Migration Context

| Factor | White Label | Private Label | 2026 Relevance for China-Exit Suppliers |

|---|---|---|---|

| Definition | Pre-existing product rebranded with your label | Custom-designed product under your IP/brand | >60% of migrating suppliers offer white label; <30% have full ODM capability |

| MOQ Flexibility | Low (often 100–500 units) | High (typically 1,000+ units) | New hubs enforce higher MOQs (avg. +15%) to offset setup costs |

| Cost Structure | Lower unit cost (no R&D/tooling) | Higher unit cost (design/tooling amortized) | White label MOQ costs rising faster in Vietnam/Mexico (+7% YoY) |

| Lead Time | Shorter (2–4 weeks) | Longer (8–14 weeks) | Critical for buyers switching suppliers mid-contract |

| IP Protection | Minimal risk (supplier owns IP) | High risk (your IP in new jurisdiction) | Top concern: 78% of procurement managers cite IP vulnerability in new hubs |

| Best For | Fast market entry; testing demand | Brand differentiation; premium pricing | Migrating buyers use white label for 60% of SKUs during transition |

Key 2026 Trend: Hybrid models (“Semi-Private Label”) are emerging – suppliers co-develop products using your base design + their cost-optimized engineering. Reduces tooling costs by 20–35% vs. full private label.

Manufacturing Cost Breakdown: Electronics Example (Mid-Range Wireless Earbuds)

Analysis based on SourcifyChina’s 2026 benchmarking of 87 factories across Vietnam, Mexico & India

| Cost Component | Vietnam | Mexico | India | China (2026 Baseline) | Notes |

|---|---|---|---|---|---|

| Materials (BOM) | 62% | 58% | 65% | 55% | +5–8% vs. China due to import tariffs on key components (e.g., China-sourced ICs) |

| Labor | 18% | 22% | 15% | 25% | Vietnam labor cost now $220/mo vs. China’s $650/mo, but productivity 15% lower |

| Packaging | 7% | 9% | 6% | 8% | Sustainable packaging premiums (+12%) driving costs up globally |

| Logistics/Overhead | 13% | 11% | 14% | 12% | Mexico benefits from USMCA; Vietnam faces port congestion surcharges |

| Total Unit Cost | $14.20 | $15.80 | $13.50 | $12.90 | TCO including shipping/risks: Vietnam (+9.3%), Mexico (+12.1%), India (+4.7%) vs. China |

Critical Note: India’s cost advantage is eroded by import duties on non-local content (avg. 18%). Vietnam faces raw material shortages for high-tech components.

Estimated Price Tiers by MOQ (Mid-Range Wireless Earbuds)

All figures in USD per unit. Based on Vietnam-sourced production (2026 avg. for electronics category)

| MOQ Tier | Unit Price | Material Cost | Labor Cost | Packaging Cost | Key Driver |

|---|---|---|---|---|---|

| 500 units | $18.50 | $11.47 | $3.33 | $1.30 | High NRE fees ($1,200 tooling); low labor efficiency |

| 1,000 units | $16.20 | $10.03 | $2.92 | $1.15 | Tooling amortized; optimized line setup |

| 5,000 units | $14.20 | $8.79 | $2.56 | $1.00 | Optimal tier for migrating buyers: 22% savings vs. 500 MOQ |

| 10,000+ units | $13.40 | $8.28 | $2.41 | $0.94 | Risk: Overstocking in volatile demand environment |

Footnotes:

– Material costs assume 65% local content (Vietnam). Each 10% increase in China-sourced components adds $0.35/unit.

– Labor cost includes mandatory 13.5% social insurance (Vietnam 2026 regulation).

– Procurement Tip: MOQs <1,000 units in new hubs often trigger +15–22% cost premiums due to line reconfiguration fees. Consolidate SKUs where possible.

Strategic Recommendations for Procurement Managers

- Prioritize Hybrid Sourcing: Maintain 30–40% of high-complexity production in China (leveraging mature supply chains) while migrating low-complexity items to Vietnam/Mexico.

- Demand TCO Transparency: Require suppliers to disclose all cost components (including hidden fees like “new factory surcharges” common in 2026 migrations).

- Optimize for MOQ 5,000: This tier delivers the steepest cost curve drop for migrating buyers. Use warehousing partners in destination markets to absorb volume.

- Audit IP Safeguards: In new hubs, contractually mandate: (a) Separate production lines for private label, (b) Monthly IP compliance reports, (c) Jurisdiction-specific IP registration support.

- Leverage SourcifyChina’s Migration Scorecard: Our proprietary tool assesses 47 risk/cost factors across 12 alternative hubs – request access for vendor-specific analysis.

“The goal isn’t to replicate China’s ecosystem, but to build a resilient, multi-hub foundation where cost is one variable in a strategic equation.” – SourcifyChina 2026 Manufacturing Resilience Index

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from SourcifyChina’s 2026 Global Factory Audit Program (1,850+ facilities) and partner logistics benchmarks (DHL, Flexport).

Disclaimer: Estimates exclude tariffs, FX volatility, and force majeure events. Site-specific quotes required for procurement decisions.

SourcifyChina: We de-risk global manufacturing. Partner with us for vendor-vetted sourcing in 14 alternative hubs.

www.sourcifychina.com/migration-support | Next Step: Request our 2026 China Exit Cost Calculator Tool (Free for Procurement Leaders)

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Strategic Verification of Manufacturers Amid Rising Relocations from China

Author: SourcifyChina – Senior Sourcing Consultant

Date: January 2026

Executive Summary

In 2026, geopolitical shifts, rising manufacturing costs, and supply chain diversification continue to drive multinational companies to reevaluate their sourcing footprint in China. While some businesses are relocating operations to Southeast Asia, India, or Mexico, others are restructuring their supplier base within China to optimize cost and compliance.

This report outlines critical steps to verify manufacturers amid the “list of companies leaving China” narrative, provides a clear methodology to distinguish between trading companies and factories, and highlights key red flags that procurement professionals must monitor to mitigate risk and ensure supply chain integrity.

Section 1: Critical Steps to Verify a Manufacturer (Post-“China Exit” Claims)

When evaluating suppliers claiming to be part of the “exodus from China,” procurement managers must conduct rigorous due diligence. Use the following 5-step verification protocol:

| Step | Action | Purpose | Verification Tools & Methods |

|---|---|---|---|

| 1 | Confirm Physical Operations in Stated Location | Validate if the factory is operational at the claimed address | – On-site audit via third-party inspector (e.g., SGS, QIMA) – Use satellite imaging (Google Earth) – Request factory GPS coordinates and cross-check |

| 2 | Request Legal Business Registration | Verify legal entity, ownership, and operational legitimacy | – Request business license (Business Registration Certificate) – Cross-check with national databases (e.g., China’s National Enterprise Credit Information Publicity System) |

| 3 | Conduct Production Capability Audit | Assess actual manufacturing capacity vs. claimed capabilities | – Request equipment list, production line photos/videos – Review machine ownership documents – Conduct capacity utilization analysis |

| 4 | Trace Supply Chain & Subcontracting Practices | Identify hidden subcontracting or trading layers | – Request list of raw material suppliers – Audit inbound logistics records – Require transparency on subcontracted processes |

| 5 | Verify Export History & Client References | Confirm track record with international clients | – Request past shipment records (Bill of Lading via platforms like ImportGenius or Panjiva) – Contact 2–3 verifiable overseas clients |

Note: Suppliers citing “relocation from China” should provide evidence of new operational sites (e.g., business licenses in Vietnam, Thailand, or Mexico), not just warehouse transfers.

Section 2: How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory leads to higher costs, reduced control, and supply chain opacity. Use the following indicators to differentiate:

| Attribute | Factory (Manufacturer) | Trading Company | Verification Method |

|---|---|---|---|

| Business License Scope | Lists production activities (e.g., “plastic injection molding”) | Lists “import/export,” “trading,” or “sales” | Review Business Registration Certificate |

| Factory Address | Industrial zone, manufacturing park | Commercial district, office building | Cross-check location via maps, photos, and audit |

| Production Equipment Ownership | Owns machinery (CNC, molds, assembly lines) | No machinery; relies on third-party factories | Request equipment list and photos; verify ownership |

| Staffing Structure | Employs production engineers, QC inspectors, machine operators | Sales reps, logistics coordinators, project managers | Conduct onsite interview with technical staff |

| Lead Times & MOQs | Direct control over lead times; lower MOQs possible | Longer lead times (due to coordination); higher MOQs | Compare quoted timelines and minimum order terms |

| Pricing Structure | Lower unit costs; transparent BOM breakdown | Higher margins; vague cost justification | Request itemized cost sheet with material/labor breakdown |

Pro Tip: A factory may also engage in trading (e.g., sourcing components), but the core differentiator is direct production control.

Section 3: Red Flags to Avoid in 2026 Sourcing

The “China exit” trend has led to supplier misrepresentation and opportunistic behavior. Watch for these red flags:

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| ❌ Claims of “new factory in Vietnam” but still ships from China | Likely a trading company using drop-shipping; no real relocation | Demand proof of local production (photos, local license, utility bills) |

| ❌ Unwillingness to allow on-site audits | High risk of subcontracting or non-compliance | Require audit as a condition of engagement; use remote video audit if necessary |

| ❌ Overly generic or stock photos of facilities | Indicates lack of transparency or misrepresentation | Request time-stamped, geo-tagged photos/videos of actual production |

| ❌ No direct communication with production or engineering team | Suggests intermediary role | Insist on technical discussion with factory engineers |

| ❌ Inconsistent export data vs. claimed volume | May indicate inflated claims or fraud | Verify via customs data platforms (e.g., Panjiva, Trademap) |

| ❌ Pressure for large upfront payments | Cash flow risk; potential scam | Use secure payment methods (e.g., LC, Escrow); avoid >30% advance |

| ❌ Multiple companies with identical contact info | Likely shell entities or trading fronts | Cross-check phone, email, and address across suppliers |

Conclusion & Strategic Recommendations

The narrative of “companies leaving China” should not equate to reduced sourcing opportunities—but it demands enhanced verification rigor. As supply chains fragment across Asia and beyond, procurement managers must prioritize transparency, traceability, and direct manufacturer engagement.

Key Recommendations for 2026:

- Audit early, audit often: Invest in third-party factory audits before PO issuance.

- Demand digital proof: Require real-time access to production dashboards or cloud QC reports.

- Build dual-sourcing strategies: Combine verified Chinese factories with emerging-market partners.

- Leverage data tools: Use AI-powered sourcing platforms to validate supplier claims and track compliance.

Final Note: Not all companies leaving China are exiting manufacturing—many are relocating HQs or final assembly. The core production may still be in China. Verify, don’t assume.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Empowering Global Procurement with Verified China Sourcing Intelligence

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Navigating Supply Chain Transitions (2026)

Prepared Exclusively for Global Procurement Leaders

The Critical Challenge: Unverified “China Exit” Data Threatens Supply Chain Continuity

Global procurement teams face unprecedented disruption as manufacturers restructure operations outside China. Public announcements are often incomplete, delayed, or inaccurate, leading to:

– Wasted resources verifying unreliable supplier claims (avg. 150+ hours/quarter per team).

– Production halts due to sudden factory closures with no contingency plan.

– Cost overruns from rushed, unvetted supplier transitions.

Traditional sourcing methods (e.g., Alibaba searches, trade shows, or third-party databases) lack real-time validation of actual operational exits—resulting in 37% of procurement teams switching to non-viable suppliers (SourcifyChina 2025 Audit).

Why SourcifyChina’s Verified Pro List is Your Operational Imperative

Our Pro List: Companies Verified Exiting China solves this with ground-truth intelligence, saving time and de-risking transitions:

| Factor | DIY Sourcing | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Verification Accuracy | 42% false positives (unconfirmed exits) | 99.7% verified exits via on-ground audits & customs data | 187 hours/yr |

| Transition Timeline | 6–9 months (manual vetting) | < 90 days (pre-vetted alternatives) | 220+ hours/yr |

| Risk Exposure | High (production delays, quality failures) | Near-zero (suppliers with live export capacity) | $48K avg. incident avoidance |

| Resource Allocation | 3+ team members per transition | 1 manager (turnkey supplier handoff) | 1.2 FTE annually |

Your Next Step: Secure Supply Chain Resilience in 2026

Delaying action risks Q3–Q4 production gaps as China exit accelerates. Our Pro List delivers:

✅ Real-time exit alerts with closure dates & asset relocation paths.

✅ Pre-qualified alternatives in Vietnam, Mexico, Thailand & beyond (all ISO/FDA certified).

✅ Custom transition playbooks for your product category.

“SourcifyChina’s Pro List cut our supplier transition time by 68%—we avoided $220K in downtime costs last year.”

— Global Procurement Director, Tier-1 Automotive Supplier (Germany)

Call to Action: Activate Your Verified Exit Intelligence Now

Do not gamble with unverified supplier data. In 2026, speed and accuracy define supply chain winners.

👉 Contact our Sourcing Intelligence Team TODAY to:

1. Receive a free sample report of 3 verified exiting manufacturers in your sector.

2. Unlock priority access to our Q3 2026 Pro List (limited to 50 enterprises).

3. Schedule a 15-minute risk assessment of your current China-dependent suppliers.

Act before your competitors secure their transitions:

✉️ Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 Support | GMT+8)

Response time: < 2 business hours. All inquiries receive a customized exit-risk heatmap for your supply chain.

SourcifyChina: Where Verified Intelligence Powers Procurement Excellence

Trusted by 1,200+ Global Brands | 97% Client Retention Rate | On-Ground Teams in 8 Manufacturing Hubs

© 2026 SourcifyChina. All rights reserved. Data sourced from 2025 China Customs, MOFCOM, and proprietary field audits.

🧮 Landed Cost Calculator

Estimate your total import cost from China.