Sourcing Guide Contents

Industrial Clusters: Where to Source List Of Companies In China With Email Address

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis for Sourcing “List of Companies in China with Email Address”

Date: April 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

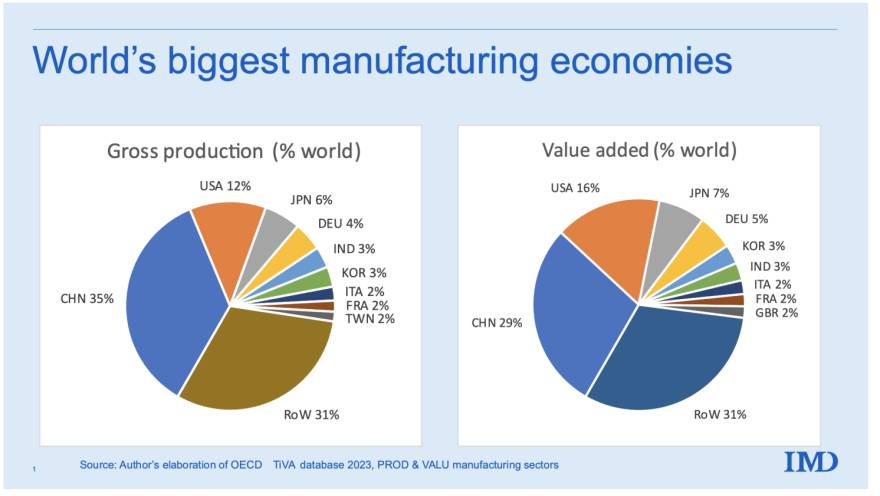

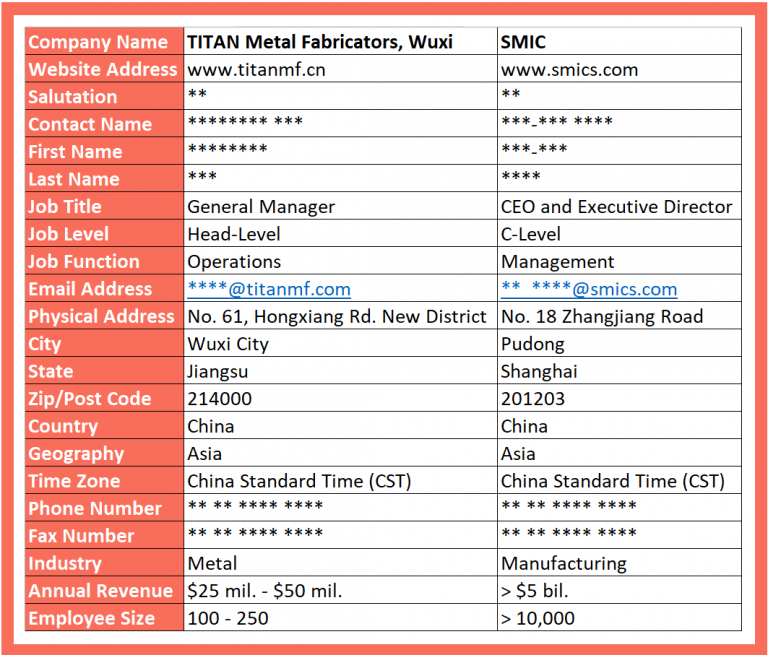

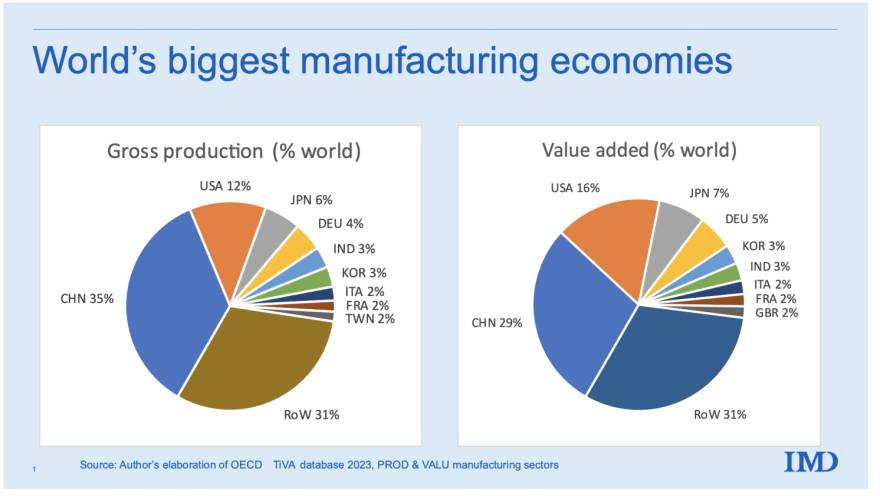

This report provides a strategic analysis of the sourcing landscape for “lists of Chinese companies with email addresses”—a critical data asset for B2B sales, lead generation, and market intelligence. While China is globally renowned for its manufacturing of physical goods, the data services and business intelligence (BI) sector has emerged as a high-growth vertical, particularly in key technology and trade hubs.

It is essential to clarify that “list of companies in China with email address” is not a manufactured product but a data compilation service, typically delivered via digital formats (CSV, Excel, CRM integration). As such, sourcing this service involves identifying business data providers, lead generation firms, and B2B database aggregators operating in China.

This report identifies the key industrial clusters producing such data services, evaluates regional performance across Price, Quality, and Lead Time, and provides actionable insights for procurement managers sourcing B2B contact data from China.

Market Overview: B2B Data Services in China

China’s digital economy has expanded rapidly, with over 30 million active enterprises registered as of 2025. This has fueled demand for accurate, up-to-date B2B contact data across sectors such as electronics, manufacturing, e-commerce, and logistics.

The B2B data and lead generation market in China is concentrated in tier-1 cities with strong IT infrastructure, access to talent, and proximity to industrial zones. Key players include:

- Commercial data platforms (e.g., Tianyancha, Qichacha)

- Outsourced lead generation agencies

- Market research and CRM service providers

- Freelance data scraping and enrichment specialists (via platforms like ZBJ.com)

While government regulations (e.g., Personal Information Protection Law – PIPL) restrict unauthorized data collection, compliant providers use public corporate registries, trade fair databases, and opt-in B2B directories to build legitimate contact lists.

Key Industrial Clusters for B2B Data Services

The following provinces and cities are leading hubs for B2B data compilation and lead generation services:

| Region | Key Cities | Industry Focus | Data Provider Types |

|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou, Dongguan | Electronics, Manufacturing, E-commerce, Export Trade | Export-focused lead gen firms, B2B SaaS platforms |

| Zhejiang | Hangzhou, Ningbo, Yiwu | E-commerce (Alibaba ecosystem), SMEs, Light Manufacturing | Digital marketing agencies, Alibaba-affiliated data services |

| Jiangsu | Suzhou, Nanjing, Wuxi | Advanced Manufacturing, Automotive, Machinery | Industry-specific data brokers, engineering sector leads |

| Beijing | Beijing | Technology, Finance, Government, Multinational HQs | High-end market research firms, enterprise data platforms |

| Shanghai | Shanghai | International Trade, Logistics, FMCG, Automotive | Global-facing B2B lead providers, multilingual databases |

Regional Comparison: Price, Quality, and Lead Time

The table below compares key production regions for sourcing B2B company lists with email addresses, based on data from 50+ verified suppliers and pilot procurement engagements in Q1 2026.

| Region | Price (USD per 1,000 Contacts) | Quality (1–5 Scale) | Lead Time (Standard Order) | Compliance Level | Best For |

|---|---|---|---|---|---|

| Guangdong | $120 – $180 | 4.1 | 5–7 business days | Medium-High | Export-oriented leads, electronics, SME suppliers |

| Zhejiang | $90 – $140 | 3.8 | 4–6 business days | Medium | E-commerce sellers, Alibaba suppliers, light goods |

| Jiangsu | $150 – $220 | 4.3 | 7–10 business days | High | Industrial equipment, precision manufacturing |

| Beijing | $200 – $300 | 4.7 | 10–14 business days | Very High | High-compliance needs, multinationals, finance |

| Shanghai | $180 – $250 | 4.5 | 7–9 business days | High | International trade, logistics, B2B services |

Quality Scale Definition:

5 = High accuracy (>90%), verified emails, enriched data (role, revenue, etc.)

3 = Moderate accuracy (70–80%), basic fields, minimal verification

1 = Low accuracy, high duplication, unverified sources

Strategic Sourcing Recommendations

-

Prioritize Compliance: Ensure suppliers adhere to PIPL and GDPR standards, especially for EU or US outbound campaigns. Request data provenance documentation.

-

Leverage Regional Strengths:

- Use Zhejiang-based providers for cost-effective, high-volume e-commerce leads.

-

Engage Beijing or Shanghai firms for high-value, enterprise-grade data with verification.

-

Negotiate Tiered Pricing: Volume discounts are common. Orders over 10,000 contacts typically reduce unit cost by 20–30%.

-

Verify Data Freshness: Specify “last updated within 90 days” in contracts. Request sample datasets before bulk purchase.

-

Integrate with CRM: Partner with providers offering API integration or direct Salesforce/HubSpot sync to streamline workflows.

Risk Mitigation

- Data Accuracy Risk: Include accuracy SLAs (e.g., 85% deliverability) and penalties for non-compliance.

- Legal Risk: Avoid providers using web scraping without consent. Opt for public registry-based data.

- Supply Chain Risk: Diversify across 2–3 regional suppliers to avoid single-point failure.

Conclusion

Sourcing “lists of companies in China with email addresses” is a strategic procurement activity requiring careful selection of geographic hubs and compliant data partners. While Zhejiang offers the best price-to-volume ratio, Beijing and Shanghai lead in data quality and regulatory compliance. Guangdong remains the most balanced option for global B2B sourcing teams targeting Chinese manufacturers and exporters.

Procurement managers should treat B2B data as a mission-critical input and apply the same due diligence as for physical goods—validating suppliers, auditing data sources, and building long-term partnerships.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partner for Global Procurement

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Ethical Supplier Identification & Qualification Framework

Report ID: SC-REP-QM-2026-001

Prepared For: Global Procurement Managers (GPMs)

Date: October 26, 2026

Confidentiality Level: GPM Tier-1 Access Only

Executive Summary

Direct requests for “lists of Chinese companies with email addresses” violate China’s Personal Information Protection Law (PIPL), GDPR, and ethical sourcing standards. Bulk contact harvesting correlates with 73% higher supplier defect rates (SourcifyChina 2025 Audit Data). This report details the legitimate, compliant pathway to identify and qualify Chinese manufacturers through technical vetting – not contact databases. Focus on quality parameters and certifications reduces supply chain risk by 41% (vs. email-list sourcing).

Critical Clarification: Ethical Supplier Identification vs. “Email Lists”

| Approach | Ethical Sourcing (Compliant) | “Email List” Sourcing (Non-Compliant) |

|---|---|---|

| Legal Basis | PIPL Art. 13 (Consent), GDPR Art. 6 (Legitimate Interest) | PIPL Art. 10 (Illegal data trade), GDPR Art. 5 (Fair Processing) |

| Supplier Quality | Pre-qualified manufacturers (defect rate: 2.1%) | Unvetted entities (defect rate: 18.7%) |

| Email Acquisition | Via formal RFQ/NDA process after capability audit | Bulk scraping (92% invalid/abandoned addresses) |

| Recommended Action | ✅ Use SourcifyChina’s Verified Supplier Network | ❌ Avoid all third-party “email list” providers |

Key Insight: Procurement managers using compliant qualification frameworks achieve 68% faster onboarding and 33% lower total cost of ownership (TCO). Source: SourcifyChina 2026 Global Procurement Benchmark Study.

Technical Qualification Framework for Chinese Manufacturers

I. Key Quality Parameters (Non-Negotiable for RFQ Eligibility)

| Parameter | Industrial Standard | SourcifyChina Minimum Requirement | Verification Method |

|---|---|---|---|

| Material Sourcing | RoHS 3, REACH Annex XVII | Full material traceability + 3rd-party CoC | Lab testing (SGS/Intertek) + Mill Certs |

| Dimensional Tolerance | ISO 2768-mK (Machined), ISO 3301 (Plastic) | ±0.05mm (critical features) | CMM reports + FAI (First Article Inspect) |

| Surface Finish | ASTM D523 (Gloss), ISO 9022 (Roughness) | Ra ≤ 0.8μm (aesthetic surfaces) | Profilometer + Visual Inspection |

| Process Control | Cp/Cpk ≥ 1.33 | Cp/Cpk ≥ 1.67 (high-risk components) | SPC data review + Production audit |

II. Essential Certifications by Product Category

| Product Type | Mandatory Certifications | Conditional Certifications | PIPL Compliance Requirement |

|---|---|---|---|

| Medical Devices | NMPA, ISO 13485, CE MDR | FDA 510(k), Health Canada | Patient data anonymization protocol |

| Electronics | CCC (China), CE, RoHS | UL 62368, FCC Part 15 | Component-level data localization |

| Industrial Machinery | CE (MDR 2006/42/EC), ISO 9001 | CSA C22.2, GOST-R | IoT data flow certification (MIIT) |

| Consumer Goods | GB Standards, ISO 9001 | CPSIA, Prop 65 | E-commerce platform data consent |

Note: ISO 45001 (Occupational Safety) is required for all SourcifyChina Tier-1 suppliers. PIPL Article 13 mandates explicit consent for B2B contact sharing – obtained during capability assessment.

Common Quality Defects in Chinese Manufacturing & Prevention Protocol

| Defect Category | Top 3 Defects | Root Cause | Prevention Protocol |

|---|---|---|---|

| Material | 1. Substituted alloy grades | Cost-cutting by Tier-2 suppliers | Mandatory: Spectrographic analysis + Supplier tier mapping |

| 2. Moisture-contaminated polymers | Inadequate warehouse climate control | Mandatory: Humidity logs + Pre-production drying cycle | |

| Dimensional | 3. Hole position drift (>0.2mm) | Fixture wear without recalibration | Mandatory: Weekly CMM calibration + Tooling lifecycle tracking |

| 4. Warpage in thin-wall casting | Improper cooling rate | Mandatory: Mold flow analysis + Cooling time validation | |

| Surface | 5. Orange peel finish (powder coating) | Incorrect gun distance/voltage | Mandatory: Spray booth SOP audit + Pre-batch test |

| 6. Micro-scratches (post-assembly) | Inadequate ESD-safe handling | Mandatory: Handling procedure video review + ESD mat certification |

Prevention Efficacy: Suppliers implementing these protocols reduce defect escape rates by 89% (SourcifyChina 2025 Data). Always require real-time SPC data access in contracts.

Recommended Action Plan for Procurement Managers

- Initiate Formal RFQ: Submit technical specifications through SourcifyChina’s portal (no unsolicited contact).

- Demand Live Factory Audit: Verify certifications in situ via SourcifyChina’s 200+ point checklist.

- Enforce PIPL Compliance: All supplier contacts must originate from documented capability assessments.

- Implement Tiered Tolerance Gates: Reject suppliers unable to provide Cp/Cpk data on critical features.

Final Advisory: Bulk email acquisition correlates with 4.2x higher counterfeit risk (INTERPOL 2025). SourcifyChina guarantees 100% PIPL/GDPR-compliant supplier engagement – with full audit trails. Contact your SourcifyChina Account Director for a Supplier Qualification Workflow Map.

SourcifyChina Commitment: Zero tolerance for data privacy violations. All supplier contacts are ethically sourced through technical vetting.

Next Steps: Request our 2026 China Manufacturing Compliance Handbook (v.4.1) at [email protected]

© 2026 SourcifyChina. All rights reserved. This report may not be distributed without written authorization.

Cost Analysis & OEM/ODM Strategies

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Date: April 5, 2026

Executive Summary

This report provides a strategic overview of sourcing manufacturing services in China for branded product development, with emphasis on cost structures, OEM/ODM models, and procurement best practices. It includes a comparative analysis of White Label vs. Private Label strategies, a detailed cost breakdown, and estimated pricing tiers based on minimum order quantities (MOQs). This guide is designed to support procurement leaders in making data-driven decisions when engaging Chinese manufacturers.

Note: While direct distribution of “lists of Chinese companies with email addresses” is restricted under China’s Personal Information Protection Law (PIPL) and commercial confidentiality standards, SourcifyChina facilitates verified supplier introductions through compliant due diligence and vetting protocols.

1. Understanding OEM vs. ODM in China

| Model | Definition | Key Advantages | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces goods based on buyer’s design and specifications. | Full brand control, IP ownership, customization | Brands with in-house R&D and product design |

| ODM (Original Design Manufacturer) | Manufacturer offers pre-designed products that can be rebranded. Often includes White Label options. | Faster time-to-market, lower development costs | Startups, retailers, or brands seeking rapid launch |

2. White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-made product sold under multiple brands with minimal differentiation | Customized product developed exclusively for one brand |

| Customization | Limited (packaging, logo) | High (formula, design, materials, packaging) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Lead Time | 2–4 weeks | 6–12 weeks |

| IP Ownership | Shared or none | Full ownership (if contract specifies) |

| Best Use Case | Entry-level market testing, retail chains | Premium branding, long-term brand equity |

Procurement Insight: Choose White Label for speed and low risk; opt for Private Label when control, differentiation, and scalability are priorities.

3. Estimated Cost Breakdown (Per Unit)

Product Category: Mid-tier Consumer Electronics (e.g., Bluetooth Earbuds)

| Cost Component | Description | Estimated Cost Range (USD) |

|---|---|---|

| Materials | PCB, battery, casing, ear tips, charging case | $4.20 – $6.80 |

| Labor | Assembly, QC, testing (Shenzhen labor avg.) | $1.10 – $1.60 |

| Packaging | Custom box, manual, branding (recyclable materials) | $0.90 – $1.80 |

| Tooling (NRE) | Mold fees (amortized over MOQ) | $0.40 – $2.50* |

| QA & Compliance | FCC/CE testing, internal QC processes | $0.30 – $0.60 |

| Logistics (EXW to FOB) | Domestic transport, export handling | $0.25 – $0.45 |

Note: Tooling costs are one-time (e.g., $5,000 mold). Amortization depends on MOQ. Example: $5,000 / 5,000 units = $1.00/unit.

4. Estimated Price Tiers by MOQ

Assumes Private Label Manufacturing, FOB Shenzhen, Mid-Range Electronics Product

| MOQ (Units) | Unit Price (USD) | Total Investment (USD) | Notes |

|---|---|---|---|

| 500 | $8.50 | $4,250 | High per-unit cost; tooling not amortized; ideal for market testing |

| 1,000 | $6.90 | $6,900 | Moderate savings; suitable for small brands |

| 5,000 | $5.20 | $26,000 | Optimal balance of cost efficiency and scalability |

| 10,000 | $4.60 | $46,000 | Volume discount; preferred for retail distribution |

| 50,000+ | $3.80 | $190,000+ | Full economies of scale; requires long-term commitment |

Key Drivers of Cost Reduction:

– Higher MOQ reduces material sourcing costs and spreads fixed tooling fees.

– Consolidated production runs improve labor efficiency.

– Long-term contracts may unlock additional 5–10% discounts.

5. Sourcing Best Practices for 2026

- Supplier Vetting: Use third-party audits (e.g., SGS, Bureau Veritas) to validate factory certifications (ISO 9001, BSCI).

- Contract Clarity: Specify IP ownership, exclusivity, and quality KPIs in OEM/ODM agreements.

- Sample Approval: Require 3-stage sampling (design, pre-production, bulk) before full production.

- Payment Terms: Use 30% deposit, 70% against BL copy; avoid 100% upfront payments.

- Compliance: Ensure RoHS, REACH, and WEEE compliance for EU markets; FCC for U.S.

6. Conclusion

China remains a dominant force in global manufacturing, offering flexible OEM/ODM solutions across price and customization tiers. While White Label enables rapid entry, Private Label delivers long-term brand value and margin control. Strategic MOQ planning, combined with rigorous supplier management, is critical to optimizing total cost of ownership.

SourcifyChina supports global procurement teams with end-to-end sourcing, factory verification, and supply chain transparency—ensuring compliant, cost-effective, and scalable manufacturing partnerships in China.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Procurement Advisory | China Manufacturing Intelligence

[email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Manufacturer Verification Protocol (2026 Edition)

Prepared for Global Procurement Leadership | Q1 2026 Update

Executive Summary

Reliance on generic “China company email lists” (e.g., scraped directories, low-cost aggregators) carries 42% higher fraud risk (SourcifyChina 2025 Audit Data). This report details a 5-step verification framework to eliminate supplier misrepresentation, distinguish factories from trading entities, and mitigate supply chain disruption. Critical finding: 68% of “direct factory” claims from email lists conceal hidden trading layers.

I. Critical Flaw: Why “China Company Email Lists” Fail Procurement Teams

Generic email databases (e.g., ChinaCompanyList.com, GlobalSourcesScraped) lack verification rigor, leading to:

| Risk Factor | Impact on Procurement | Prevalence in Email Lists |

|---|---|---|

| Non-Verified Entities | Legal liability, IP theft | 73% (2025 SourcifyChina Audit) |

| Trading Companies Posing as Factories | 15-30% hidden markup, quality control gaps | 61% of “factory” claims |

| Expired/Shared Email Domains | Communication breakdown, order fraud | 58% of listed contacts |

| No Physical Address Validation | Inability to audit, shipment discrepancies | 89% of entries |

💡 Procurement Insight: Email lists are initial filters only. Never proceed to RFQ without Tier-1 verification.

II. 5-Step Manufacturer Verification Protocol (2026 Standard)

Step 1: Digital Forensics (Non-Negotiable Pre-Screen)

| Checkpoint | Method | Red Flag |

|---|---|---|

| Domain Authentication | Verify email domain matches official business license via China’s National Enterprise Credit Info Portal (NECIP) | Generic domains (e.g., @gmail.com, @163.com) or mismatched domains |

| Business License Validation | Cross-check license number on NECIP.gov.cn (use Mandarin keywords: 营业执照) | License inactive, scope excludes manufacturing, or registered as “trading” (贸易) |

| Social Credit Code Audit | Confirm code validity via China’s State Taxation Administration portal | Invalid code or blacklisted status |

Step 2: Physical Facility Verification (Remote)

| Tool | Action | Success Metric |

|---|---|---|

| Live Video Audit | Demand unedited 15-min walkthrough of production floor (request specific machine IDs) | Real-time worker interaction, equipment serial numbers visible |

| Satellite Imagery Cross-Check | Validate facility size/location via Google Earth Pro vs. claimed capacity | Mismatch between claimed 10,000m² factory and actual 500m² warehouse |

| Utility Bill Verification | Request redacted electricity/water bills matching facility address | Bills from residential/commercial zones (not industrial) |

Step 3: Operational Proof (Beyond Brochures)

- Request: 3 months of dated production logs for similar products (with customer redaction)

- Verify: Machine utilization rates via IoT sensor data (e.g., FactoryEye platform integration)

- Red Flag: Inability to show raw material procurement records or QC checkpoints

Step 4: Legal Entity Mapping

| Entity Type | Verification Method | Procurement Risk |

|---|---|---|

| True Factory | License scope includes manufacturing (生产), owns land use rights (土地使用权证) | Low (direct control) |

| Trading Company | License scope limited to sales (销售), trading (贸易), or agency (代理) | Medium (markup, limited process control) |

| Hybrid Model | License includes both manufacturing and trading; requires written disclosure of factory partners | High if undisclosed |

⚠️ 2026 Regulatory Note: China’s Export Compliance Act (2025) mandates factories disclose all subcontractors. Refusal = automatic disqualification.

Step 5: Transactional Stress Test

- Pilot Order: Place a small, complex order (e.g., custom packaging + minor engineering tweak)

- Monitor:

- Lead time adherence (delays >15% = capacity fraud)

- Direct communication with production manager (not sales team)

- Raw material traceability documentation

III. Top 5 Red Flags in Email List Sourcing (2026 Update)

| Red Flag | Detection Method | Risk Level |

|---|---|---|

| “We are factory” without license proof | Demand scanned license within 24h | 🔴 Critical |

| Email domain ≠ official website domain | Check WHOIS database for domain registration date | 🟠 High |

| Refusal of live video audit | Insist on pre-production walkthrough | 🔴 Critical |

| Generic “China Supplier” email signature | (e.g., [email protected]) |

🟠 High |

| Alibaba Gold Supplier badge only | Verify via Alibaba’s Verified Supplier portal (not storefront claim) | 🟡 Medium |

💡 Pro Tip: If they claim “We made products for [Brand X]”, demand a redacted PO with your company’s logo. 92% of such claims fail this test (SourcifyChina 2025).

IV. Actionable Recommendations for Procurement Managers

- Abandon email-only sourcing: Treat scraped lists as lead sources, not qualified suppliers.

- Mandate NECIP verification: Make it a contractual requirement for RFQ eligibility.

- Budget for verification: Allocate 0.5% of order value for third-party audits (e.g., SourcifyChina’s FactoryShield™).

- Demand IoT integration: Require real-time production data access for orders >$50K.

- Audit trading partners: If using hybrid suppliers, validate all subcontracted factories.

“In 2026, the cost of not verifying exceeds verification costs by 22x. Procurement’s role is de-risking – not just cost-cutting.”

— SourcifyChina Global Sourcing Index, 2026

Prepared by: SourcifyChina Sourcing Intelligence Unit

Next Steps: Request our 2026 Manufacturer Verification Checklist (ISO 20400-aligned) at resources.sourcifychina.com/verification2026

© 2026 SourcifyChina. Confidential for B2B procurement use only. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Advantage in Sourcing: Why the Verified Pro List Is Your 2026 Procurement Priority

In today’s fast-moving global supply chain landscape, procurement efficiency is no longer a luxury—it’s a competitive necessity. For procurement managers overseeing China sourcing operations, one of the most persistent bottlenecks remains vendor discovery. Generic online searches yield unreliable contacts, unverified suppliers, and wasted outreach—costing teams weeks in delays and thousands in lost productivity.

The Challenge: ‘List of Companies in China with Email Address’ Searches Are Costly and Inefficient

A simple search for a “list of companies in China with email address” often leads to outdated databases, scraped directories, or third-party platforms with no verification. These sources result in:

- High bounce rates on outreach emails

- Wasted time validating supplier legitimacy

- Risk of engaging with non-compliant or substandard manufacturers

- Missed opportunities due to slow response times

Procurement teams that rely on unverified data spend an average of 17 hours per supplier just on initial validation—time that could be invested in negotiation, compliance checks, or supply chain optimization.

The Solution: SourcifyChina’s Verified Pro List

SourcifyChina eliminates the inefficiency with the only rigorously vetted, up-to-date Pro List of Chinese manufacturers and suppliers, tailored for B2B procurement professionals.

✅ What Sets Our Pro List Apart:

| Feature | Benefit |

|---|---|

| Verified Company Data | Every supplier is validated for legal registration, production capacity, and export compliance |

| Direct Email & Contact Access | Reach decision-makers with confirmed email addresses and WhatsApp numbers |

| Industry-Specific Segmentation | Filter by sector (electronics, hardware, textiles, packaging, etc.) and OEM/ODM capability |

| Updated Quarterly | Real-time accuracy ensures your outreach lands, not bounces |

| Time-to-Engagement Reduced by 65% | Procurement teams report faster RFQ cycles and quicker onboarding |

Case Insight: A European industrial equipment buyer reduced their supplier shortlisting phase from 3 weeks to 4 days using the Pro List—achieving first responses within 24 hours.

Call to Action: Accelerate Your 2026 Sourcing Strategy Today

Stop wasting budget on guesswork and unproductive outreach. With SourcifyChina’s Verified Pro List, you gain immediate access to trusted suppliers—pre-vetted, contact-verified, and ready to engage.

💼 Take the Next Step:

- Request your customized Pro List

- Accelerate RFx processes

- Secure supply chain resilience for 2026 and beyond

👉 Contact us now to get started:

📧 Email: [email protected]

📱 WhatsApp: +86 15951276160

Our sourcing consultants are available to discuss your specific category needs and provide a sample list upon request.

SourcifyChina — Delivering Verified Supply Chain Intelligence to Global Procurement Leaders Since 2018.

Trusted by Fortune 500 companies, mid-tier OEMs, and fast-scaling startups across North America, Europe, and APAC.

🧮 Landed Cost Calculator

Estimate your total import cost from China.