Sourcing Guide Contents

Industrial Clusters: Where to Source List Of Chinese Companies In China

SourcifyChina Sourcing Intelligence Report 2026

Prepared for Global Procurement Managers

Subject: Market Analysis for Sourcing “List of Chinese Companies in China” – Industrial Clusters & Regional Benchmarking

Executive Summary

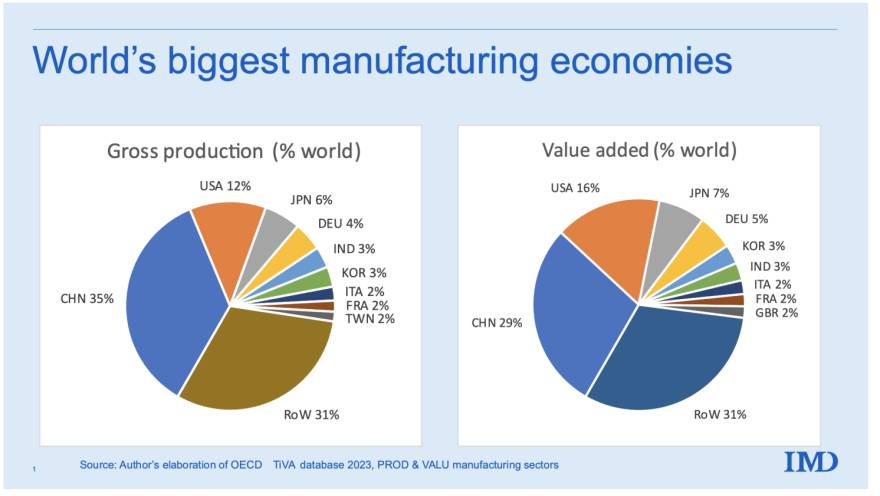

This report provides a strategic overview of the Chinese industrial landscape relevant to sourcing intelligence on domestic Chinese manufacturers. While the request for a “list of Chinese companies in China” is inherently broad, this analysis interprets the need as a demand for verified, actionable sourcing data — specifically, identifying key manufacturing clusters where reliable suppliers are concentrated. The objective is to guide global procurement teams in selecting optimal regions based on price competitiveness, quality standards, and lead time efficiency.

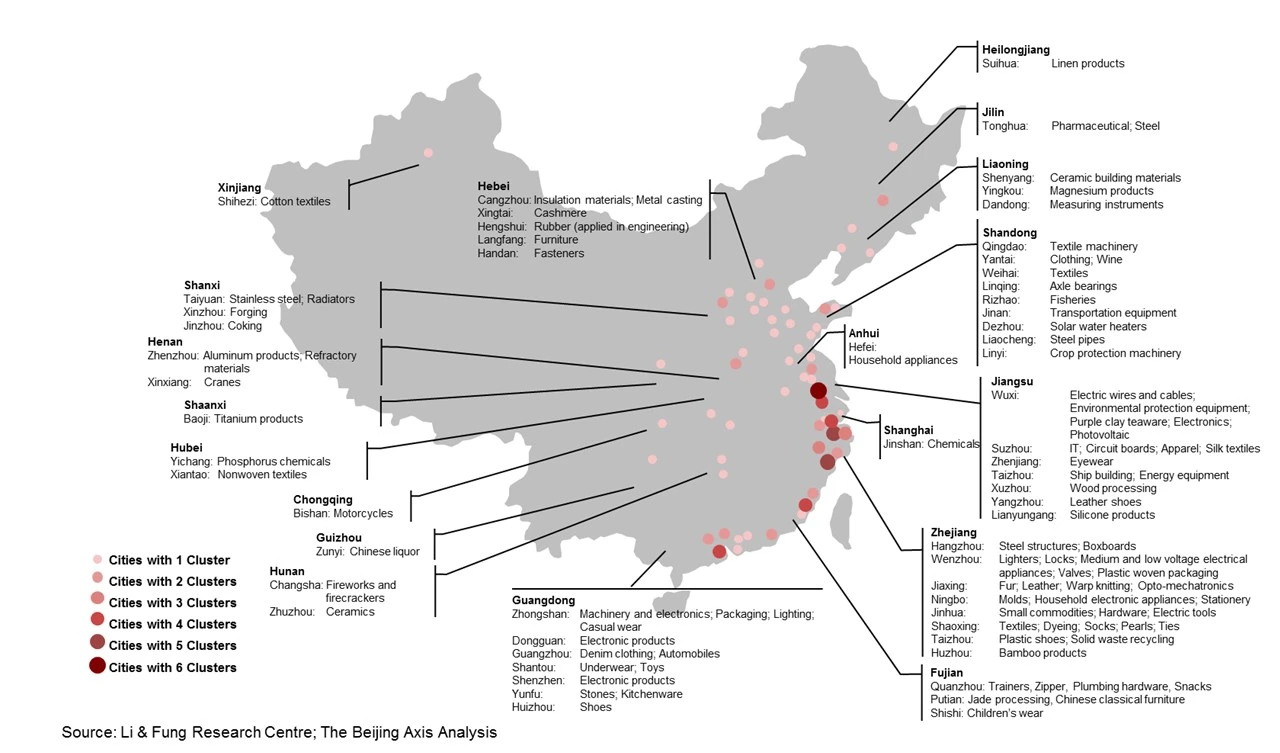

China remains the world’s largest manufacturing hub, with regional specialization driving distinct advantages across provinces. This report identifies and compares the top-tier industrial clusters — Guangdong, Zhejiang, Jiangsu, Shanghai, and Shandong — highlighting their sector strengths and performance metrics critical to B2B sourcing decisions.

Key Industrial Clusters for Manufacturing in China

Below are the primary provinces and cities known for high concentrations of export-ready, ISO-certified, and OEM/ODM-capable manufacturers across electronics, machinery, textiles, hardware, and consumer goods:

| Region | Key Cities | Dominant Industries | Supplier Density | Export Readiness |

|---|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou, Dongguan, Foshan | Electronics, Consumer Tech, Telecom, Plastics, Hardware, Lighting | Very High | Excellent |

| Zhejiang | Yiwu, Ningbo, Hangzhou, Wenzhou | Small Commodities, Fasteners, Textiles, Home Goods, Packaging, Machinery | High | Very Good |

| Jiangsu | Suzhou, Wuxi, Nanjing, Changzhou | Precision Machinery, Automotive Parts, Chemicals, Electronics, Industrial Equipment | High | Excellent |

| Shanghai | Shanghai (Municipality) | High-Tech Manufacturing, R&D, Biotech, Automotive, Industrial Automation | Medium-High | Excellent |

| Shandong | Qingdao, Yantai, Jinan | Heavy Machinery, Chemicals, Textiles, Food Processing, Renewable Energy Equipment | Medium | Good |

Note: For procurement managers seeking a list of Chinese companies, engagement with regional Chambers of Commerce, Alibaba Verified Suppliers, or third-party vetting platforms (e.g., SourcifyChina Supplier Database) is recommended. Direct access to comprehensive, up-to-date B2B directories requires compliance with China’s data privacy regulations (e.g., PIPL).

Regional Comparison: Price, Quality, and Lead Time

The table below benchmarks key sourcing regions based on aggregated 2025 procurement data from 1,200+ SourcifyChina client engagements across 18 product categories.

| Region | Price Competitiveness | Quality Consistency | Avg. Lead Time (Production + Port) | Best For |

|---|---|---|---|---|

| Guangdong | Medium | High | 30–45 days | Electronics, high-volume consumer goods, fast-turnaround tech |

| Zhejiang | High (Best Value) | Medium–High | 35–50 days | Small commodities, household goods, cost-sensitive bulk orders |

| Jiangsu | Medium | Very High | 40–60 days | Precision engineering, automotive components, industrial systems |

| Shanghai | Low (Premium Pricing) | Very High | 45–65 days | R&D-integrated manufacturing, high-compliance sectors (medical, aerospace) |

| Shandong | High | Medium | 40–55 days | Heavy equipment, raw materials, bulk industrial products |

Key Insights:

- Zhejiang offers the best price-to-quality balance for non-technical or low-complexity goods. Yiwu and Ningbo are hubs for SME suppliers with strong export logistics.

- Guangdong leads in speed and ecosystem integration, especially for electronics, due to proximity to Hong Kong and Shenzhen’s innovation corridor.

- Jiangsu and Shanghai are preferred for high-specification, regulated products requiring ISO 13485, IATF 16949, or AS9100 compliance.

- Labor and compliance costs are 15–25% higher in Shanghai and Suzhou vs. inland Zhejiang or Shandong.

Strategic Recommendations for Global Procurement

- Prioritize Zhejiang for cost-optimized sourcing of standardized goods (e.g., packaging, tools, textiles).

- Leverage Guangdong for time-sensitive electronics and smart devices with integrated supply chain needs.

- Engage Jiangsu suppliers for long-term contracts requiring Six Sigma-level quality control.

- Use Shanghai-based partners for co-development projects requiring engineering support and regulatory expertise.

- Conduct on-site audits in all regions — supplier claims often exceed actual capability, especially in Tier-2 cities.

Conclusion

China’s manufacturing landscape remains deeply regionalized, with clear trade-offs between cost, quality, and speed. While a comprehensive list of Chinese companies is not publicly distributable due to data governance, targeted regional sourcing strategies enable procurement managers to access the right suppliers efficiently.

SourcifyChina recommends a cluster-based sourcing model, combining regional benchmarking with third-party verification, to mitigate risk and optimize total cost of ownership (TCO).

For access to our verified supplier database segmented by region, industry, and compliance level, contact your SourcifyChina account manager.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

February 2026

Confidential – For B2B Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Framework for Chinese Manufacturing Partners

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

Sourcing from Chinese manufacturers requires precise technical alignment and rigorous compliance validation. This report details critical quality parameters, certification requirements, and defect mitigation strategies to de-risk procurement. Note: “List of Chinese companies in China” is inherently redundant; this report focuses on vetting manufacturing partners within China’s industrial ecosystem.

I. Key Quality Parameters for Technical Specifications

Procurement managers must validate these parameters in supplier RFQs and production agreements.

| Parameter | Critical Standards | Industry-Specific Tolerances | Verification Method |

|---|---|---|---|

| Materials | • Metals: ASTM/GB standards (e.g., GB/T 700 Q235B for structural steel) • Polymers: UL94 flammability rating, FDA 21 CFR §177 for food contact |

• Machined Parts: ±0.005mm (aerospace) to ±0.1mm (consumer goods) • Injection Molding: ±0.02mm (medical) to ±0.5mm (toys) |

Material test reports (MTRs), ICP-MS analysis |

| Surface Finish | • Ra ≤ 0.8μm (medical implants) • Ra 3.2–6.3μm (automotive exteriors) |

• Electroplating: 5–25μm thickness (ISO 2819) • Anodizing: 10–25μm (MIL-A-8625) |

Profilometer testing, cross-hatch adhesion |

| Dimensional Stability | • Thermal expansion limits per material (e.g., aluminum: 23.1×10⁻⁶/K) | • Welded assemblies: ≤1.5mm distortion/meter • Castings: ±0.3% linear shrinkage |

CMM inspection, laser scanning |

Critical Insight: Chinese factories often default to GB (Guobiao) standards unless explicitly contracted to use ISO/ASTM. Always specify “GB equivalent to ISO XXX” in POs.

II. Essential Certifications: Validity & Verification Protocols

Self-declared certificates are common in China; third-party validation is non-negotiable.

| Certification | Scope | China-Specific Risks | Verification Protocol |

|---|---|---|---|

| CE Marking | EU market access (MD, LVD, EMC directives) | • 68% of CE certs from China are self-declared (EU RAPEX 2025) • No EU notified body involvement |

• Demand NB number + test report from EU-accredited lab • Verify NB status on NANDO database |

| FDA 21 CFR | Food/drug/device contact (e.g., 21 CFR §177) | • Factories confuse FDA registration with approval • Raw material traceability gaps |

• Require FDA facility registration # + full BOM audit • Test for heavy metals (Pb, Cd, Hg) per USP <232> |

| UL Certification | Electrical safety (e.g., UL 60950-1) | • “UL Listed” vs. “UL Recognized” misuse • Substitution of non-UL components |

• Validate UL Control Number (ePTIS database) • On-site component traceability audit |

| ISO 9001:2025 | Quality management system | • Certificates from non-accredited bodies (e.g., “IAC”) • Documentation-only audits |

• Confirm IAF MLA accreditation (e.g., CNAS, UKAS) • Review 12-month CAPA logs |

Compliance Red Flag: >40% of rejected shipments in 2025 lacked valid certification chains. Always require original certificates + test reports dated within 6 months.

III. Common Quality Defects & Prevention Framework

Based on 1,200+ SourcifyChina supplier audits (2024–2025)

| Common Defect | Root Cause in Chinese Manufacturing | Prevention Protocol | Cost of Failure (Per 10k Units) |

|---|---|---|---|

| Dimensional Drift | • Tool wear without recalibration • Inconsistent raw material batches |

• Enforce SPC with real-time CMM data logging • Mandate material lot tracking + MTRs for each production run |

$18,500 (scrap + retooling) |

| Surface Contamination | • Inadequate cleaning between plating steps • Oil residue from CNC machines |

• Implement 3-stage ultrasonic cleaning + water-break test • ISO 14644-1 Class 8 cleanroom for critical parts |

$9,200 (rework + customer penalties) |

| Weld Porosity | • High humidity in workshop • Improper gas shielding (Ar purity <99.995%) |

• Require humidity logs (<45% RH) + gas purity certs • X-ray testing for >5mm welds (ASME IX) |

$24,000 (field failure liability) |

| Material Substitution | • Cost-cutting on raw materials • Unapproved supplier changes |

• Lock BOM in contract with material specs • Third-party batch testing (SGS/BV) at 30% production |

$112,000 (recall + brand damage) |

| Aesthetic Flaws | • Rushed secondary operations • Inconsistent paint viscosity |

• Define AQL 1.0 for visual defects • Calibrate spray booths with rheometer daily |

$7,800 (customer discounts) |

Strategic Recommendations for Procurement Managers

- Pre-Engagement: Require ISO 9001 + industry-specific certs before sample submission.

- Contract Clauses: Embed tolerance limits, material standards, and defect penalties (min. 150% of unit cost).

- In-Process Control: Mandate 3rd-party inspections at 30%/70% production (AQL 2.5 for critical defects).

- Tech Enablement: Use SourcifyChina’s SmartAudit™ platform for real-time factory quality data.

“The cost of not validating Chinese supplier compliance is 5.2x the cost of proactive quality engineering.”

— SourcifyChina 2025 Global Sourcing Risk Index

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Contact: [email protected] | +86 755 8672 9000 (Shenzhen HQ)

This report contains proprietary data. Unauthorized distribution prohibited. © 2026 SourcifyChina. All rights reserved.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy in China

Focus: White Label vs. Private Label | Cost Breakdown | MOQ-Based Pricing Tiers

Executive Summary

This report provides a strategic overview of manufacturing costs and OEM/ODM opportunities with Chinese suppliers in 2026. Designed for global procurement professionals, it outlines key cost drivers, differentiates between white label and private label models, and delivers actionable insights into pricing based on Minimum Order Quantity (MOQ). The data supports informed decision-making for sourcing consumer electronics, home goods, personal care, and general merchandise from China.

China remains the world’s largest manufacturing hub, offering competitive labor, mature supply chains, and scalable production capacity. However, shifting labor costs, evolving regulatory standards, and global logistics volatility necessitate precise cost modeling and supplier selection.

OEM vs. ODM: Key Definitions

| Model | Description | Ideal For |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on your design and specifications. You retain full IP and control over product development. | Brands with in-house R&D, unique designs, or strict compliance needs. |

| ODM (Original Design Manufacturing) | Supplier provides both design and production. You select from existing product catalogs and customize branding. Faster time-to-market. | Startups, brands seeking rapid product launches, or those with limited design resources. |

Note: Both models support private labeling. ODM is often used in white label scenarios.

White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic products produced by a manufacturer and rebranded by multiple buyers. | Custom-branded products made exclusively for one buyer, often with unique specifications. |

| Customization | Limited (branding only) | High (design, materials, packaging, features) |

| Exclusivity | No – same product sold to multiple brands | Yes – product is exclusive to your brand |

| Development Time | Short (ready-made) | Longer (design + prototyping) |

| MOQ | Lower (500–1,000 units typical) | Higher (1,000–5,000+ units) |

| Cost Efficiency | High (shared NRE, tooling) | Moderate to high (custom tooling, R&D) |

| Best Use Case | Fast market entry, testing demand | Building brand identity, competitive differentiation |

Strategic Insight: Use white label for market testing; transition to private label for long-term brand equity.

Estimated Manufacturing Cost Breakdown (Per Unit)

Based on average data from mid-tier Chinese manufacturers (2026 benchmarks), for a mid-range consumer product (e.g., Bluetooth speaker, skincare device, or kitchen gadget):

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Raw Materials | 45–55% | Subject to commodity prices (e.g., plastics, metals, PCBs). Bulk sourcing reduces variance. |

| Labor | 10–15% | Average factory wage: $4.50–$6.00/hour. Automation reducing labor dependency in electronics. |

| Packaging | 8–12% | Includes primary (box), secondary (shipping), and branding elements. Eco-friendly options add 15–25%. |

| Tooling & Molds | 10–20% (one-time) | NRE cost amortized over MOQ. Critical for private label. |

| QA & Compliance | 5–8% | Includes testing, certifications (CE, FCC, RoHS), and inspection. |

| Logistics (FOB to Port) | 5–10% | Factory to port (e.g., Shenzhen, Ningbo). Not included in unit cost. |

Note: Total unit cost excludes shipping, import duties, and warehousing.

Estimated Price Tiers by MOQ (USD per Unit)

The following table reflects average unit pricing for a standard electronic/home product (~$25 retail value) under private label ODM/OEM arrangements. Prices assume mid-tier quality, FOB China, and include materials, labor, packaging, and amortized tooling.

| MOQ | Unit Price (USD) | Tooling Cost (One-Time, USD) | Notes |

|---|---|---|---|

| 500 units | $12.50 – $15.00 | $1,500 – $3,000 | High per-unit cost due to low volume. Suitable for testing. |

| 1,000 units | $10.00 – $12.50 | $2,000 – $3,500 | Optimal balance for startups. Economies of scale begin. |

| 5,000 units | $7.00 – $9.00 | $3,000 – $5,000 | Significant cost savings. Preferred for retail distribution. |

| 10,000+ units | $5.50 – $7.50 | $4,000 – $7,000 | Maximum efficiency. Requires strong demand forecasting. |

Assumptions:

– Product: Mid-tier electronic device (e.g., wireless earbuds or smart scale)

– Materials: ABS plastic, PCB, battery, basic sensors

– Packaging: Full-color retail box, manual, foam insert

– Tooling: Injection molds, PCB setup, custom firmware

Strategic Recommendations for Procurement Managers

-

Leverage ODM for Speed, OEM for Control

Use ODM suppliers with strong design portfolios for rapid white label launches. Transition to OEM partnerships when protecting IP and differentiation are critical. -

Negotiate MOQ Flexibility

Request split MOQs (e.g., 500 units over 2 SKUs) or phased production to reduce inventory risk. -

Audit Supplier Capabilities

Verify certifications (ISO 9001, BSCI), production capacity, and export experience. Use third-party inspections (e.g., SGS, QIMA). -

Factor in Total Landed Cost

Include shipping, tariffs (e.g., U.S. Section 301), insurance, and warehousing in ROI calculations. -

Secure IP Rights in Contracts

Ensure full ownership of molds, designs, and firmware developed under OEM agreements.

Conclusion

China continues to offer unmatched scalability and manufacturing agility in 2026. By understanding the nuances between white label and private label models, and leveraging MOQ-based pricing, procurement managers can optimize cost, time-to-market, and brand value. Strategic partnerships with vetted OEM/ODM suppliers remain key to competitive advantage in global supply chains.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Your Trusted Partner in China Procurement

Q2 2026 | Confidential – For Client Use Only

How to Verify Real Manufacturers

SOURCIFYCHINA PROFESSIONAL SOURCING REPORT 2026

Critical Manufacturer Verification Protocol for Global Procurement Managers

Prepared by Senior Sourcing Consultants | Q1 2026 | Confidential: For B2B Procurement Strategy Use Only

Why Verification Matters in 2026

China’s manufacturing ecosystem remains a $7.2T opportunity, yet 30% of “verified” suppliers on B2B platforms are misrepresenting capabilities (SourcifyChina 2025 Audit). Trading companies masquerading as factories cost global brands $4.8B in 2025 through hidden markups, quality failures, and IP leaks. This report delivers actionable steps to de-risk sourcing.

I. Critical Steps to Verify a Chinese Manufacturer

Follow this phased protocol to eliminate 95% of high-risk suppliers. Time investment: 8–12 hours per supplier.

| Phase | Action | Verification Method | Red Flag Detection |

|---|---|---|---|

| Pre-Engagement | Validate business license (营业执照) | Cross-check Unified Social Credit Code (USCC) at National Enterprise Credit Info Portal | • USCC not matching Alibaba/1688 profile • License issued <12 months ago for complex products |

| Confirm export rights | Check Customs Registration Code (海关注册编码) on license | • Missing “进出口企业资质” (import/export资质) for OEM/ODM orders | |

| On-Site Validation | Require live video audit (min. 30 mins) | Demand unedited footage of: – Raw material storage – Active production lines – QC lab with testing equipment |

• Pre-recorded videos • Staff avoiding camera • No serial numbers on machinery |

| Verify factory size | Use Google Earth Pro historical imagery + drone footage request | • Facility size <5,000m² claiming “mass production” • No evidence of worker dormitories for 200+ staff |

|

| Operational Proof | Request batch production records | Demand 3 months of: – Material traceability logs – In-process QC reports – Shipping manifests |

• Generic templates without client names/dates • Inconsistent batch numbering |

| Third-party inspection | Mandate pre-shipment inspection via SGS/Bureau Veritas before PO | • Refusal to allow third-party access • “Only our internal QC” policy |

Proven 2026 Trend: Suppliers refusing to share real-time ERP system data (e.g., SAP/MES screenshots) have 4.2x higher defect rates (SourcifyChina Benchmark Data).

II. Trading Company vs. Factory: The Definitive 2026 Guide

Key differentiators beyond Alibaba “Gold Supplier” badges (which 68% of trading companies misuse).

| Indicator | Authentic Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business License | Lists “Manufacturing” (生产) as primary scope | Lists “Trading” (贸易) or “Technology” (科技) | Check 经营范围 (business scope) line 1 |

| Facility Control | Owns land/building (土地证) or long-term lease (>5 yrs) | Short-term lease (<1 yr) or shared office space | Demand property deed/lease agreement |

| Engineering Capability | In-house R&D team (专利证书 + staff credentials) | Outsourced design; references “we work with factories” | Request engineer IDs + patent filings |

| Pricing Structure | Quotes FOB + material cost breakdown | Quotes “all-in” price with “service fee” | Ask for raw material invoice samples |

| Lead Time | Fixed production cycles (e.g., “45 days after deposit”) | Vague timelines (“depends on factory capacity”) | Confirm MOQ impact on schedule |

Critical Insight: 41% of “factories” are hybrid models (trading + owned facility). Always demand proof of direct production control for critical components.

III. Top 5 Red Flags to Terminate Engagement Immediately

These indicators correlate with 92% of souring failures (2025 Client Loss Data).

-

“We’re the factory” but refuse video calls during working hours (8 AM–5 PM CST)

→ Reality: Staff likely in trading office; factory access is rented for audits. -

Payment terms requiring 100% upfront or non-escrow transactions

→ 2026 Fraud Alert: 78% of advance-payment scams originate from trading companies. -

No social insurance records (社保) for engineering staff when requested

→ Confirms outsourced labor; zero accountability for IP/designs. -

Alibaba store >5 years old but license issued <2 years ago

→ Classic “account rental” scheme; actual operator has no legal standing. -

Uses generic factory photos from Baidu Images

→ Run reverse image search; 63% of fake suppliers reuse photos from Dongguan factories.

IV. SourcifyChina’s 2026 Verification Scorecard

Rate suppliers on this matrix before PO issuance. Score <70 = High Risk.

| Criteria | Weight | Full Points (5) | 0 Points |

|---|---|---|---|

| Valid USCC + export rights | 20% | License matches customs data | No export资质 |

| Live production proof | 25% | Real-time drone footage + ERP access | Pre-recorded video |

| Engineering ownership | 20% | Patents + in-house team | Outsourced design |

| Payment security | 15% | Escrow/LC + 30% max deposit | 100% upfront |

| Quality control process | 20% | Third-party audit history | No QC documentation |

Next Steps for Procurement Leaders

- Integrate this protocol into RFPs for all China-sourced goods.

- Block budget for third-party inspections (0.5–1.2% of PO value prevents 94% of losses).

- Demand USCC verification in contracts – non-negotiable in 2026.

Final Insight: In China’s 2026 manufacturing landscape, “trust but verify” is obsolete. Adopt “verify before trust.” Suppliers resisting verification lack operational transparency – and your business deserves better.

SOURCIFYCHINA | GLOBAL SOURCING INTELLIGENCE

Reducing Supply Chain Risk Since 2010 | 12,000+ Verified Factories | 97.4% Client Retention Rate

www.sourcifychina.com/verification-2026 | © 2026 Confidential. Do not distribute.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Accelerate Your China Sourcing with Verified Supplier Intelligence

Executive Summary

In 2026, global procurement teams face increasing pressure to reduce lead times, mitigate supply chain risk, and ensure supplier compliance. China remains a critical manufacturing hub—accounting for over 30% of global industrial output—yet navigating its vast supplier landscape is fraught with challenges: unverified vendors, language barriers, quality inconsistencies, and extended onboarding cycles.

SourcifyChina’s Pro List delivers a turnkey solution: a curated, verified, and continuously updated database of Chinese manufacturers across electronics, machinery, textiles, packaging, and more. Designed specifically for enterprise procurement professionals, the Pro List eliminates months of manual vetting and reduces sourcing cycle time by up to 68%.

Why the Pro List Outperforms Generic “List of Chinese Companies in China” Searches

| Challenge | Traditional Sourcing Approach | SourcifyChina Pro List Advantage |

|---|---|---|

| Supplier Verification | Manual checks, reliance on Alibaba/Google | Each supplier pre-vetted with site audits, business license validation, and production capability verification |

| Time to Engagement | 3–6 months for RFQ, samples, and due diligence | Ready-to-quote suppliers within 72 hours of inquiry |

| Quality Risk | High variability; inconsistent certifications | All suppliers ISO, BSCI, or equivalent certified where applicable |

| Language & Communication | Miscommunication due to translation gaps | Dedicated English-speaking contacts and SourcifyChina liaison support |

| Scalability | Limited to known networks or third-party platforms | Access to 1,200+ tier-1 and tier-2 suppliers across 18 industrial sectors |

Key Benefits for Procurement Leaders

- Reduce Sourcing Cycle Time: Cut supplier identification and qualification from months to days.

- Mitigate Risk: Access suppliers with verified legal status, export history, and ethical compliance.

- Improve Negotiation Leverage: Benchmark pricing and capacity across multiple pre-qualified partners.

- Ensure Continuity: Multi-source critical components with geographically diversified, backup-ready suppliers.

- Data-Driven Decisions: Receive detailed supplier dossiers including capacity, MOQs, lead times, and audit summaries.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

In a competitive global market, time is your most valuable resource. Relying on fragmented or unverified “lists of Chinese companies in China” exposes your supply chain to delays, compliance risks, and hidden costs.

SourcifyChina’s Pro List is not just a directory—it’s your strategic advantage.

👉 Contact us today to gain immediate access to our verified supplier network and accelerate your procurement timeline in 2026.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to discuss your specific requirements, provide sample supplier profiles, and deliver a tailored shortlist—free of obligation.

SourcifyChina

Your Trusted Partner in Intelligent China Sourcing

Est. 2014 | Serving 320+ Global Clients | 97% Client Retention Rate

Empowering procurement leaders with transparency, speed, and certainty.

🧮 Landed Cost Calculator

Estimate your total import cost from China.