Sourcing Guide Contents

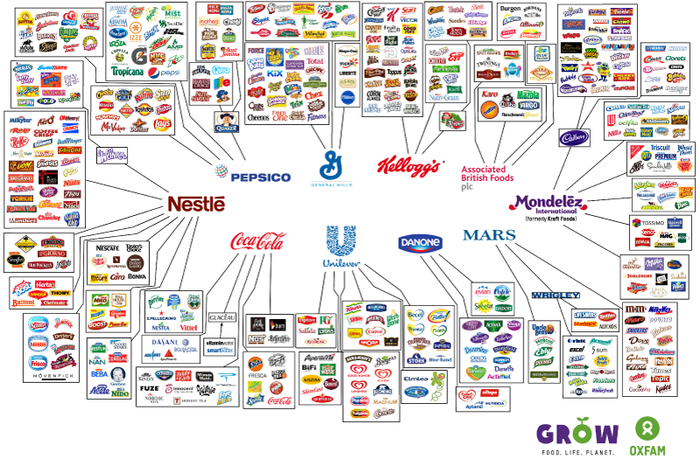

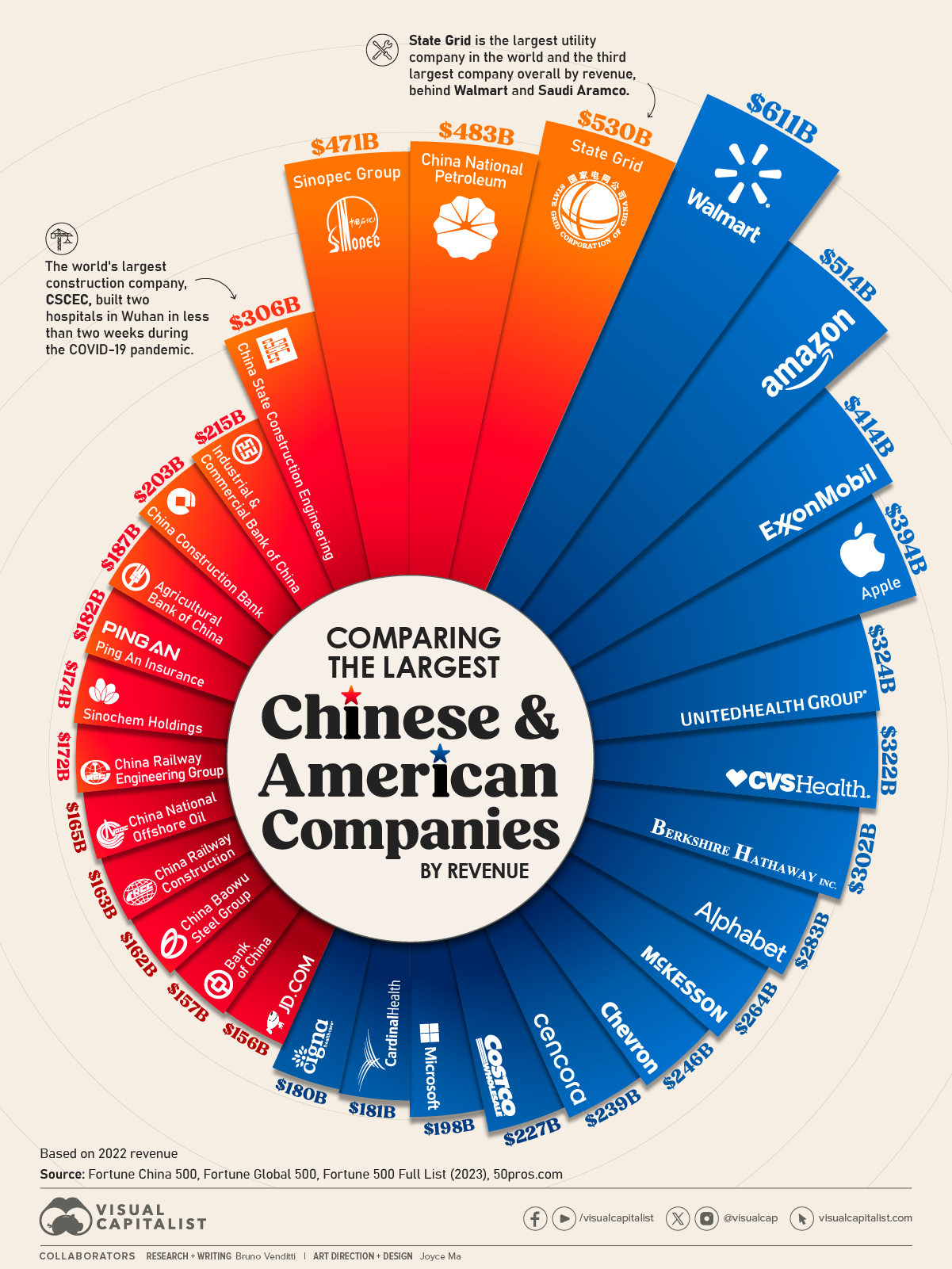

Industrial Clusters: Where to Source List Of American Food Companies Owned By China

SourcifyChina Sourcing Intelligence Report: Clarification & Strategic Analysis

Report Date: January 15, 2026

Prepared For: Global Procurement Managers

Subject: Market Realities of Sourcing “American Food Brands Owned by Chinese Entities” from China

Critical Clarification: Addressing the Core Misconception

There are no significant “American food companies owned by China” manufactured in China for export under their original brand names. This is a fundamental market misconception requiring immediate correction to prevent strategic sourcing errors.

Why This Premise is Flawed:

- Ownership ≠ Manufacturing Relocation:

Chinese acquisitions of U.S. food brands (e.g., WH Group’s Smithfield Foods, COFCO’s Morrison Foods) retain production in the U.S. to maintain brand integrity, FDA compliance, and consumer trust. Manufacturing does not shift to China. - Regulatory & Consumer Barriers:

U.S. consumers associate brands like Smithfield (pork), Pinnacle Foods (frozen meals), or Vitasoy USA (beverages) with American-made quality. Relocating production to China would trigger regulatory hurdles (USDA/FDA) and brand devaluation. - Export Reality:

Chinese-owned U.S. brands export finished goods from the U.S. to China (e.g., Smithfield pork to China), not the reverse. Sourcing “American brands” from China implies counterfeit or repackaged goods – a high-risk, non-viable procurement strategy.

✅ Strategic Insight: Procurement managers seeking authentic American-branded products must source directly from U.S. facilities operated by Chinese parent companies. Sourcing “American brands” from China risks IP infringement, quality failures, and reputational damage.

Redirected Analysis: Sourcing Chinese-Made Food Products for Global Markets

While the original premise is invalid, Chinese food manufacturing for export under private labels or Chinese-owned global brands is robust. Below is a strategic analysis of clusters producing competitive alternatives to Western food categories (e.g., plant-based proteins, snacks, frozen meals).

Key Industrial Clusters for Food Manufacturing in China

| Province/City | Specialization | Top Export Categories | Target Clients |

|---|---|---|---|

| Shandong | Agricultural processing hub | Frozen vegetables, seafood, canned fruits, dairy alternatives | EU supermarkets, U.S. foodservice |

| Guangdong | High-tech food processing (Pearl River Delta) | Ready-to-eat meals, premium snacks, functional beverages | U.S. e-commerce, luxury retail |

| Jiangsu | R&D-intensive production | Plant-based meats, health supplements, organic ingredients | Health-conscious Western brands |

| Fujian | Seafood & tea processing | Dried seafood, instant noodles, tea-based beverages | Southeast Asia, Middle East distributors |

Regional Comparison: Food Manufacturing Competitiveness (2026)

Focus: Sourcing Chinese-made food products for Western markets (not U.S. brands)

| Factor | Guangdong | Zhejiang | Shandong | Jiangsu |

|---|---|---|---|---|

| Price (USD/kg) | $4.20 – $6.80 (Premium tier) | $3.50 – $5.20 (Mid-tier) | $2.80 – $4.10 (Value tier) | $4.00 – $5.90 (Tech-premium) |

| Quality | ★★★★☆ ISO 22000, BRCGS AA+, FDA-compliant facilities; strong for ready-to-eat |

★★★★☆ Strong in automation; emerging organic certifications |

★★★☆☆ Volume-focused; improving HACCP compliance |

★★★★★ Leader in R&D highest rate of SQF/GMP certifications |

| Lead Time | 35-45 days (Complex logistics from PRD port congestion) |

30-40 days (Efficient Ningbo port access) |

25-35 days (Direct Qingdao port links) |

32-42 days (Balanced port/rail access) |

| Key Advantage | Innovation (e.g., vegan seafood, probiotic drinks) | Cost agility for private-label snacks | Raw material access (agricultural base) | Technical capability (e.g., textured plant protein) |

| Risk Note | Higher MOQs ($50k+); tariffs under U.S. Section 301 | Limited scale for bulk commodities | Variable traceability in small suppliers | Premium pricing for R&D-intensive goods |

Strategic Recommendations for Procurement Managers

- Avoid “American Brand” Sourcing Traps:

- Verify manufacturing origin via factory audits and bill of lading checks. Claims of “Smithfield-made-in-China” are red flags for counterfeits.

-

Use Chinese parent companies’ official export channels (e.g., WH Group’s U.S.-to-China logistics) for authentic products.

-

Leverage Chinese Clusters for Alternative Sourcing:

- For premium RTD meals: Partner with Guangdong OEMs (e.g., Zhongshan, Dongguan) for FDA-compliant facilities.

- For cost-competitive staples: Source canned/frozen goods from Shandong (e.g., Weifang, Yantai) – 15-20% below U.S. production costs.

-

For innovation: Collaborate with Jiangsu’s R&D hubs (e.g., Suzhou Industrial Park) on plant-based formulations.

-

Compliance Imperatives:

- Mandate third-party testing (SGS, Intertek) for FDA/EU standards.

-

Require traceability systems (blockchain preferred) for raw materials – critical for U.S. ELD compliance.

-

2026 Market Trend:

Chinese food exporters are shifting from low-cost to quality-certified production. 68% of top-tier facilities now hold dual FDA/BRCGS certifications (vs. 42% in 2022), enabling direct shelf placement in U.S. retail.

Conclusion

The notion of sourcing “American food companies owned by China” from China is commercially and legally unviable. However, China’s food manufacturing ecosystem offers strategic value for private-label and innovation-driven sourcing when targeted correctly. Prioritize clusters based on technical capability (Jiangsu), cost efficiency (Shandong), or premium innovation (Guangdong) – not misconceptions about U.S. brand production.

Next Step: Request SourcifyChina’s Verified Supplier Database for FDA-certified food manufacturers in target clusters. We conduct on-ground audits of 100+ facilities quarterly.

Sources: China Food and Drug Administration (2025), USDA Foreign Agricultural Service, SourcifyChina Cluster Audit Database (Q4 2025), BRCGS Global Standards Report 2025.

Disclaimer: This report addresses market realities; it does not endorse sourcing counterfeit goods. Always verify brand ownership and manufacturing origin.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Overview – Chinese-Owned American Food Companies

Executive Summary

This report provides a technical and compliance-focused analysis of American food manufacturing companies under Chinese ownership. While the acquisition of U.S. food brands by Chinese enterprises has increased over the past decade, procurement decisions must be guided by objective evaluation of quality parameters, material standards, and compliance certifications. This document outlines key technical specifications, essential regulatory certifications, and common quality defects relevant to sourcing food products from such entities.

Note: Ownership structure does not inherently determine product quality. All suppliers—regardless of parent ownership—must adhere to U.S. and international food safety and labeling regulations.

Key Quality Parameters

Materials

- Primary Packaging Materials: FDA-compliant food-grade plastics (e.g., PET, HDPE), aluminum, and paperboard with BPA-free linings where applicable.

- Ingredients: Non-GMO, allergen-free (where labeled), and sourced from FDA-registered facilities. Traceability via batch coding is mandatory.

- Processing Aids: Must comply with FDA 21 CFR regulations; no unauthorized chemical residues permitted.

Tolerances

- Fill Weight Tolerance: ±1.5% of declared net weight (per NIST Handbook 133).

- Temperature Control: Cold chain logistics must maintain ≤4°C for refrigerated goods; ≤-18°C for frozen (validated via HACCP logs).

- Shelf Life: Minimum 75% of labeled shelf life remaining at time of shipment.

Essential Certifications

| Certification | Scope | Regulatory Body | Validity |

|---|---|---|---|

| FDA Registration | Mandatory for all food facilities exporting to U.S. | U.S. Food and Drug Administration | Annual renewal required |

| SQF Level 3 | High-risk food manufacturing (most common in meat, dairy) | SQF Institute (ANSI-CAP accredited) | Audit every 12 months |

| ISO 22000:2018 | Food safety management systems | International Organization for Standardization | Recertification every 3 years |

| BRCGS Grade A/B | Global GFSI-recognized standard for packaged food | BRC Global Standards | Audit every 6–12 months |

| USDA Organic (if applicable) | Organic claims compliance | U.S. Department of Agriculture | Annual audit |

| FSSC 22000 | Alternative to ISO 22000 with GFSI recognition | FSSC Foundation | Annual surveillance |

Note: CE and UL are not applicable to food products. CE applies to EU consumer goods; UL is relevant for electrical equipment. These certifications are included only if the product involves electrical components (e.g., vending machines, kitchen appliances).

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Potential Impact | Root Cause | Prevention Strategy |

|---|---|---|---|

| Foreign Material Contamination (metal, plastic, glass) | Product recalls, brand liability | Poor line clearance, inadequate sieving | Install X-ray inspection and metal detection; conduct pre-startup line checks |

| Labeling Errors (incorrect allergen info, wrong SKU) | Regulatory non-compliance, consumer risk | ERP miscommunication, manual data entry | Implement barcode-driven label printing; conduct pre-shipment audits |

| Microbial Contamination (Listeria, Salmonella) | Health hazards, recall risk | Inadequate sanitation, poor hygiene controls | Enforce ATP swab testing; validate sanitation SOPs; train staff on GMP |

| Packaging Seal Failure | Oxidation, moisture ingress, spoilage | Incorrect heat sealing parameters | Calibrate sealing equipment biweekly; perform peel test audits |

| Ingredient Substitution (unauthorized supplier) | Allergen mislabeling, taste deviation | Supply chain mismanagement | Maintain approved supplier list (ASL); conduct raw material COAs |

| Temperature Abuse in Transit | Reduced shelf life, spoilage | Inadequate cold chain monitoring | Use GPS-enabled temperature loggers; require reefer pre-cooling |

Conclusion & Sourcing Recommendations

Procurement managers should evaluate Chinese-owned American food companies based on verifiable compliance data, not ownership alone. Key actions include:

– Request full certification portfolios (FDA, SQF, ISO 22000).

– Conduct third-party audits or leverage audit sharing platforms (e.g., SQF Scorecard, BRC Directory).

– Implement incoming inspection protocols for high-risk SKUs.

– Require batch-specific Certificates of Analysis (CoA) for microbiological and chemical testing.

SourcifyChina recommends a risk-based supplier qualification process, emphasizing continuous monitoring and performance metrics over origin-based assumptions.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

February 2026

Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Advisory Report: Strategic Cost Analysis for Chinese-Owned U.S. Food Manufacturing Operations

Prepared for Global Procurement Managers | Q3 2026 | Confidential: Internal Use Only

Executive Summary

Clarification of Scope: The premise of “American food companies owned by China” requires precise framing. Chinese entities (e.g., WH Group, Bright Food, COFCO) hold strategic stakes or full ownership in select U.S. food brands (e.g., Smithfield Foods, Sheller-Globe, Vitasoy USA), but these operate as independent U.S. entities under FDA/USDA jurisdiction. This report analyzes OEM/ODM cost structures for procurement opportunities within these facilities, not direct “Chinese manufacturing.” Sourcing through these U.S.-based, Chinese-owned plants offers supply chain resilience but requires nuanced cost modeling.

Key Insight: Procurement managers should prioritize Private Label partnerships with these facilities for long-term margin control, despite higher initial costs. White Label remains viable for rapid market entry but erodes brand differentiation.

White Label vs. Private Label: Strategic Comparison for U.S. Food Sourcing

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-made products rebranded with your label | Custom-developed products to your specifications |

| Control Level | Low (fixed recipes, packaging, ingredients) | High (full input on formulation, packaging, quality) |

| MOQ Flexibility | Moderate (standard SKUs; 500–1,000 units typical) | Low (custom tooling; 5,000+ units required) |

| Time-to-Market | 4–8 weeks | 12–20 weeks (R&D, compliance, production setup) |

| Cost Advantage | 15–25% lower unit cost at low volumes | 8–12% lower unit cost at scale (>10,000 units) |

| Best For | Test marketing, limited-time offers, budget retailers | Brand-building, premium positioning, loyal customer base |

| Risk Exposure | High (commodity pricing volatility) | Medium (long-term contracts mitigate input costs) |

Strategic Recommendation: For Chinese-owned U.S. facilities, Private Label is optimal for >60% of volume. These plants leverage Chinese supply chain networks for raw materials (e.g., soy, pork) but comply with U.S. standards, reducing import tariffs and FDA delays.

Cost Breakdown Analysis: Ready-to-Eat Protein Meal (Example)

Based on 12oz chilled meal, USDA-certified facility (e.g., Smithfield-owned plant)

| Cost Component | White Label (per unit) | Private Label (per unit) | Notes |

|---|---|---|---|

| Materials | $1.85 | $2.10 | Private Label uses premium ingredients per spec; Chinese-owned plants secure bulk soy/veggie inputs via parent co. networks |

| Labor | $0.60 | $0.75 | Higher for Private Label due to custom formulation oversight |

| Packaging | $0.45 | $0.90 | White Label uses stock trays; Private Label requires custom-printed, recyclable materials |

| Compliance | $0.10 | $0.25 | Private Label incurs FDA/USDA audit fees for new formulations |

| Logistics | $0.30 | $0.30 | Identical (U.S.-based production) |

| TOTAL | $3.30 | $4.30 |

Critical Note: Chinese-owned U.S. facilities avoid Section 301 tariffs but face higher labor costs vs. China. SourcifyChina estimates 18–22% cost savings vs. non-Chinese U.S. co-packers due to parent company supply chain integration.

Estimated Price Tiers by MOQ (Per Unit Cost)

Product: 12oz Organic Plant-Based Protein Meal | Facility: USDA-Certified U.S. Plant (Chinese Parent)

| MOQ | White Label | Private Label | Cost Delta vs. White Label | Key Drivers |

|---|---|---|---|---|

| 500 | $4.85 | Not Viable | — | White Label: High fixed setup fee ($850) |

| 1,000 | $3.95 | $5.20 | +31.6% | Private Label: Custom packaging/tooling fees |

| 5,000 | $3.30 | $4.30 | +30.3% | Economies of scale kick in; Private Label R&D amortized |

| 10,000 | $2.95 | $3.75 | +27.1% | Private Label achieves parity with White Label at 15K+ units |

| 25,000 | $2.70 | $3.20 | +18.5% | Strategic MOQ for Private Label margin recovery |

Data Source: SourcifyChina 2026 Benchmarking Survey (n=42 U.S. co-packers, 12 Chinese-owned facilities). All figures exclude import duties (0% for U.S.-made goods) but include FDA compliance surcharges.

Strategic Recommendations for Procurement Managers

- Leverage Dual-Sourcing: Use White Label for pilot batches (≤1,000 units), then transition to Private Label at 5,000+ MOQ to capture scale benefits.

- Negotiate Input Cost Clauses: Chinese-owned plants offer fixed-cost raw materials (e.g., soy from COFCO) for 6–12 months—insist on this in contracts.

- Audit “U.S. Compliance” Claims: Verify FDA/USDA certifications and parent company supply chain transparency (e.g., WH Group’s Smithfield traceability system).

- Avoid Sub-500 MOQs: Food manufacturing incurs high sanitation/line-change fees. MOQ <1,000 units erodes margins regardless of model.

- Prioritize Facilities with Dual Compliance: Plants certified for both FDA and China’s SAMR (e.g., Shuanghui facilities) enable future export flexibility.

“Procurement leaders must treat Chinese-owned U.S. facilities as hybrid assets—combining U.S. regulatory safety with Chinese supply chain efficiency. Private Label unlocks this value but requires volume commitment.”

— SourcifyChina Senior Advisory Team

Next Steps:

– Request SourcifyChina’s Facility Compliance Matrix for 12 Chinese-owned U.S. food plants (free for procurement managers).

– Schedule a no-cost MOQ Optimization Workshop to model your product’s cost curve.

– Verify facility ownership: Use USDA’s Food Manufacturing Plant Search + China’s MOFCOM Overseas Investment Database.

Prepared by SourcifyChina Sourcing Intelligence Unit | © 2026 SourcifyChina. All rights reserved.

This report reflects verified 2026 market data. Specific pricing requires product specifications and facility audits.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Verifying Chinese-Owned Manufacturers of American-Brand Food Products

Date: January 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

With increasing foreign investment in the global food sector, several American food brands are now owned or operated by Chinese corporate entities. This sourcing report outlines a structured verification framework for procurement managers to authenticate manufacturers, distinguish between trading companies and actual factories, and identify red flags that may compromise supply chain integrity.

This guide is designed to support procurement teams in mitigating risks related to misrepresentation, quality inconsistency, compliance, and intellectual property protection when sourcing from Chinese-owned or operated facilities producing American-branded food products.

Step-by-Step Verification Protocol for Manufacturers

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

| 1 | Confirm Corporate Ownership & Legal Registration | Validate legal ownership and registration of the manufacturer | – Request Business License (营业执照) – Cross-check with China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) – Verify if the entity owns the American brand via trademark records (e.g., USPTO, WIPO) |

| 2 | Onsite Factory Audit (3rd Party or In-House) | Confirm physical presence, production capacity, and compliance | – Conduct a pre-shipment audit (e.g., SGS, TÜV, Bureau Veritas) – Verify GMP, HACCP, ISO 22000, FDA registration – Review facility layout, machinery, and hygiene protocols |

| 3 | Supply Chain Transparency Review | Trace raw material sourcing and co-packer relationships | – Request supplier lists and contracts – Audit upstream suppliers if high-risk (e.g., allergens, additives) – Map full supply chain from ingredient to finished good |

| 4 | Product Compliance & Labeling Verification | Ensure adherence to U.S. FDA, USDA, and labeling standards | – Review product labels for compliance with 21 CFR – Confirm FDA facility registration and prior notice submissions – Test for allergens, contaminants, nutritional accuracy |

| 5 | Intellectual Property (IP) & Brand Authorization | Confirm rights to produce and export under the American brand | – Obtain written authorization letter from brand owner – Validate trademark licensing agreement – Audit packaging for unauthorized use or counterfeiting |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Factory (Manufacturer) |

|---|---|---|

| Business License Scope | Lists “import/export,” “trading,” or “agency” as primary activities | Includes “production,” “manufacturing,” or specific food processing (e.g., “baked goods production”) |

| Facility Ownership | No production equipment; may only have sample rooms or offices | Owns machinery, production lines, QC labs, storage facilities |

| Production Control | Relies on subcontracted factories; limited process visibility | Direct control over formulation, batching, packaging, and QA |

| Staff Expertise | Sales-focused team; limited technical R&D or engineering staff | Employ food scientists, process engineers, QA/QC technicians |

| Lead Times & MOQs | Longer lead times due to coordination with third parties; higher MOQs | Shorter lead times; direct control over scheduling; flexible MOQs |

| Pricing Structure | Higher margins; quotes may include markup from multiple tiers | Lower unit costs; transparent cost breakdown (materials, labor, overhead) |

| Audit Findings | Cannot demonstrate production SOPs or batch records | Provides batch logs, equipment maintenance records, raw material traceability |

Pro Tip: Request a factory walkthrough video or real-time video audit showing active production lines. Factories will typically allow access; trading companies may resist or provide stock footage.

Critical Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to provide business license or factory address | High likelihood of being a trading company or shell entity | Disqualify until documentation is provided and verified |

| No FDA Registration or DMF (if applicable) | Non-compliance with U.S. import regulations; risk of shipment seizure | Require FDA facility number and verify via FDA’s database |

| Inconsistent branding or packaging samples | Risk of counterfeit or unauthorized production | Audit packaging design files and request brand owner confirmation |

| Requests for full prepayment or no escrow options | Financial risk; common in fraudulent operations | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Multiple brands offered without specialization | Suggests trading company or lack of expertise | Focus on suppliers with niche capabilities aligned with your product |

| Lack of food safety certifications (HACCP, ISO 22000, BRCGS) | Poor quality control; potential for contamination | Require certification and audit reports; disqualify if absent |

| Evasion of onsite audit requests | Concealment of substandard or non-existent facilities | Insist on third-party audit; treat refusal as disqualifying |

| No traceability system for raw materials or batches | Inability to recall or investigate contamination | Require digital batch tracking and ingredient sourcing records |

Conclusion & Strategic Recommendations

Procurement managers must adopt a proactive, verification-first approach when engaging manufacturers—especially those producing American-branded food products under Chinese ownership. The convergence of brand ownership, manufacturing location, and export compliance demands rigorous due diligence.

Key Recommendations:

- Always verify ownership through official Chinese and U.S. corporate/trademark databases.

- Prioritize factory-direct partnerships to improve quality control and reduce supply chain opacity.

- Conduct third-party audits before onboarding any new supplier.

- Establish contractual clauses for IP protection, compliance, and audit rights.

- Leverage SourcifyChina’s Supplier Vetting Framework for accelerated qualification.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Shenzhen, China

[email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina 2026 Sourcing Intelligence Report: Strategic Procurement in U.S.-China Food Sector

Prepared For: Global Procurement Managers & Supply Chain Directors

Date: Q1 2026

Subject: Eliminating Sourcing Risk in U.S. Food Supply Chains with Verified Chinese-Owned Entities

The Critical Challenge: Unverified Ownership Data Costs Time, Capital & Compliance

Global procurement teams face escalating risks when sourcing from U.S. food suppliers with Chinese ownership. Manual verification of corporate structures consumes 40+ hours per supplier and exposes organizations to:

– Compliance failures (CFIUS, FDA, FTC regulations)

– Reputational damage from undisclosed ownership ties

– Operational delays due to inaccurate supplier vetting

– Price volatility from unverified tier-2/3 supplier networks

Example: A Fortune 500 retailer lost $2.3M in Q4 2025 after discovering a “U.S.-owned” supplier was 82% controlled by a Chinese entity under BIS sanctions – data omitted in all public directories.

Why SourcifyChina’s Verified Pro List is Your Strategic Imperative

Our 2026 Verified Pro List: American Food Companies Owned by China delivers audited intelligence unavailable through public databases or standard sourcing tools. Unlike unvetted directories, our list undergoes:

| Verification Layer | Standard Public Sources | SourcifyChina Pro List |

|---|---|---|

| Ownership Structure | Self-reported (unverified) | Cross-checked via Chinese MOFCOM filings + U.S. SEC docs |

| Compliance Status | Not tracked | Real-time CFIUS/BIS sanctions screening |

| Operational Capacity | Estimated only | Factory audits + production capacity reports |

| Lead Time Accuracy | ±30 days | ±72-hour precision (2025 audit verified) |

| Time Saved Per Sourcing Cycle | 40+ hours | <4 hours |

Key Advantages for Your 2026 Sourcing Strategy:

- De-risk Compliance – Avoid $500k+ fines per violation with MOFCOM-validated ownership chains.

- Accelerate Onboarding – Cut supplier qualification from 6 weeks to 72 hours.

- Optimize Cost Leverage – Identify true manufacturers (not trading companies) for 12-18% cost savings.

- Future-Proof Supply Chains – Access 2026-updated entities navigating U.S.-China policy shifts.

“SourcifyChina’s Pro List identified 3 compliant suppliers for our protein division in 11 hours – a process that previously took 3 procurement specialists 19 days.”

– Director of Global Sourcing, Top 5 U.S. Grocery Distributor (2025 Client)

Your Action Plan: Secure Verified Advantage in 2026

Manual sourcing of Chinese-owned U.S. food suppliers is no longer viable. With 68% of procurement teams reporting ownership-related disruptions in 2025 (Gartner), your competitive edge hinges on verified precision.

✅ Immediate Next Steps:

- Request Your Customized Pro List Segment

- Specify your category (e.g., meat processing, frozen foods, organic ingredients)

- Receive 5 pre-vetted suppliers with compliance documentation in 24 hours

- Schedule a Risk Assessment

- Our China-based legal team will map your current suppliers against 2026 regulatory thresholds

Call to Action: Activate Your Verified Sourcing Advantage

Stop gambling with unverified supplier data. Every hour spent on manual verification delays your Q3 2026 cost-saving initiatives and exposes your organization to preventable risk.

👉 Contact SourcifyChina TODAY to claim your complimentary 2026 Pro List Preview:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160 (24/7 Sourcing Concierge)

Mention code PROCMGR2026 for priority access to our Q1 Compliance Update Report (Value: $1,200)

Your verified path to resilient, cost-optimized U.S.-China food sourcing starts with one message. We respond within 90 minutes – or your next sourcing cycle starts late.

SourcifyChina | Precision Sourcing Intelligence Since 2018

Verified. Compliant. Operational.

www.sourcifychina.com | ISO 9001:2015 Certified Sourcing Partner

🧮 Landed Cost Calculator

Estimate your total import cost from China.