Sourcing Guide Contents

Industrial Clusters: Where to Source List Of All American Companies Owned By China

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Market Analysis: Sourcing “List of All American Companies Owned by China” — Clarification and Strategic Guidance

Executive Summary

There appears to be a fundamental misinterpretation in the sourcing request: “List of all American companies owned by China” is not a physical product or a service manufactured or produced in China. Rather, it is a data or intelligence asset—a curated compilation of U.S.-based companies with majority ownership or controlling stakes held by Chinese entities.

This report clarifies the nature of the request and provides strategic guidance for sourcing such market intelligence from China, with a focus on regions known for data analytics, competitive intelligence, and business research services—the actual “industrial clusters” capable of producing high-quality ownership data.

Clarification of Request

The phrase “sourcing a list of all American companies owned by China” does not refer to a manufactured good. Instead, it refers to business intelligence (BI) or corporate ownership data. Therefore, the sourcing strategy shifts from physical manufacturing to knowledge process outsourcing (KPO) and research & analytics services.

Such data is typically compiled by:

– Market research firms

– Corporate intelligence consultancies

– Financial and investment research agencies

– Legal and compliance due diligence providers

These services are concentrated in key business and innovation hubs in China, where English fluency, data infrastructure, and expertise in U.S. corporate law and public filings are prevalent.

Key Industrial Clusters for Sourcing Corporate Intelligence in China

The following provinces and cities are recognized as leading centers for data research, corporate intelligence, and business analytics services:

| Region | Key Cities | Specialization | Strengths |

|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou | Tech-driven data analytics, fintech intelligence | Proximity to Hong Kong; strong English proficiency; global compliance focus |

| Zhejiang | Hangzhou | E-commerce analytics, private equity intelligence | Alibaba ecosystem; strong digital infrastructure; SME ownership tracking |

| Jiangsu | Suzhou, Nanjing | Legal & regulatory compliance research | High concentration of legal KPOs; strong academic research partnerships |

| Beijing | Beijing (National Capital Region) | Government-linked investment tracking, policy analysis | Access to MOFCOM, SAFE, and state-owned enterprise (SOE) data flows |

| Shanghai | Shanghai | Financial services, M&A intelligence, cross-border deals | International business hubs; multilingual analysts; SEC/EDGAR filing experts |

These clusters do not “manufacture” the list but produce, verify, and deliver accurate, up-to-date corporate ownership intelligence.

Comparative Analysis: Key Production Regions for Corporate Intelligence Services

| Region | Price (Relative Cost) | Quality (Accuracy & Depth) | Lead Time (Standard Delivery) | Best For |

|---|---|---|---|---|

| Guangdong | Medium–High | High | 5–10 business days | High-compliance clients needing U.S. SEC-linked data; tech sector focus |

| Zhejiang | Medium | Medium–High | 7–14 business days | Tracking private equity acquisitions via Alibaba ecosystem and VC networks |

| Jiangsu | Medium | High | 10–15 business days | Legal due diligence, regulatory compliance, and historical ownership tracing |

| Beijing | High | Very High | 10–20 business days | SOE-linked acquisitions, government-approved outbound investment tracking |

| Shanghai | High | Very High | 5–12 business days | Financial sector M&A, bilingual reporting, institutional-grade deliverables |

Note: Pricing reflects service tiers (basic list vs. full due diligence dossiers). Lead times vary based on scope (e.g., 100 vs. 1,000 companies). Quality is assessed based on data sourcing (EDGAR, Orbis, Capital IQ cross-verification), analyst expertise, and update frequency.

Recommended Sourcing Strategy

- Define Scope Clearly

- Specify: Public vs. private companies

- Define ownership threshold (e.g., >50%, >25% strategic stake)

-

Include required data fields: Parent entity (China), acquisition date, sector, revenue, regulatory status

-

Engage Tier-1 Research Providers

- Consider firms in Shanghai and Beijing for mission-critical, compliance-grade intelligence

-

Use Guangdong-based vendors for faster turnaround on tech and manufacturing sectors

-

Verify Data Provenance

- Require use of U.S. SEC filings, Delaware corporate records, and OECD beneficial ownership databases

-

Audit trail and update frequency (e.g., quarterly refresh) should be contractually defined

-

Leverage Hybrid Sourcing Models

- Combine Beijing’s policy insight with Shanghai’s financial analytics for comprehensive coverage

Conclusion

While no Chinese region “manufactures” a list of American companies owned by Chinese entities, China’s leading business intelligence hubs are globally competitive in producing this high-value data. Shanghai and Beijing lead in quality and depth, while Guangdong and Zhejiang offer agility and sector-specific insights.

Procurement managers should treat this as a strategic knowledge sourcing initiative, not a commodity procurement. Partnering with vetted research firms in these clusters ensures accuracy, compliance, and operational advantage in global due diligence.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Q1 2026 Edition

Confidential – For Client Use Only

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Intelligence Report: Navigating Supply Chain Transparency & Compliance

Date: January 15, 2026

Prepared For: Global Procurement Managers

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report addresses a critical misconception: There is no definitive, publicly verifiable list of “all American companies owned by China.” Ownership structures are complex, often involve multi-layered holding companies, joint ventures, or minority stakes, and are subject to constant change. U.S. regulations (e.g., CFIUS, FIRRMA) prioritize transaction-level review over static ownership registries. Procurement risk mitigation hinges on facility-level compliance and product-specific certifications—not corporate ownership nationality. This report provides actionable guidance for verifying supplier integrity and ensuring compliance in 2026.

Critical Clarification: Ownership vs. Compliance Risk

| Factor | Reality Check | Procurement Action |

|---|---|---|

| “Chinese-Owned U.S. Companies” | No centralized database exists. Ownership is tracked via: – SEC filings (for public companies) – CFIUS disclosures (non-public) – Commercial databases (e.g., Orbis, PitchBook; require paid access & verification) |

Verify facility location & operational control, not just parent company HQ. A Chinese-owned factory in the U.S. must comply with U.S. laws (OSHA, EPA). A U.S. company sourcing from China faces different compliance risks. |

| Compliance Responsibility | Jurisdiction dictates requirements: – U.S.-based manufacturing → FDA, OSHA, EPA, FCC – Chinese manufacturing → CCC, GB standards + export certifications (CE, FDA, UL) Ownership nationality is irrelevant; compliance is tied to where production occurs and destination market. |

Audit the physical manufacturing site and product origin, not corporate ownership charts. Demand facility-specific certificates. |

Key Technical Specifications & Compliance Requirements (2026 Focus)

Applies to suppliers regardless of ownership, based on product type and destination market.

I. Universal Quality Parameters

| Parameter | Critical Thresholds | 2026 Enforcement Trend |

|---|---|---|

| Materials | • Traceability to raw material batch (ISO 9001:2025) • Conflict minerals declaration (SEC Rule 13p-1) • Restricted Substances List (RSL) compliance (e.g., REACH SVHC >0.1%) |

AI-driven material genealogy tracking (blockchain adoption ↑ 40% YoY). UFLPA enforcement expands to non-apparel sectors. |

| Tolerances | • Machined parts: ±0.05mm (ISO 2768-mK) • Electronics: IPC-A-610 Class 2/3 • Dimensional stability: <0.3% (ASTM D695) |

Real-time IoT tolerance monitoring mandated for automotive/aerospace (AS9100 Rev Q). Zero-tolerance for deviations in medical devices (FDA 21 CFR Part 820). |

II. Essential Certifications by Market

| Certification | Scope | 2026 Procurement Requirement |

|---|---|---|

| CE Marking | EU market access | • Full technical documentation audit (EU 2019/1020) • Authorized EU Representative verification • Not required for U.S.-made goods sold solely in U.S. |

| FDA Registration | Food, drugs, devices, cosmetics | • Site-specific facility registration (U.S. or foreign) • QSR compliance (21 CFR Part 820) • UDI implementation (Mandatory for Class II/III devices) |

| UL Certification | Electrical safety (U.S./Canada) | • Factory Inspection Program (FIC) validation • Component-level traceability (UL 969) • Chinese factories require UL CCN verification |

| ISO 13485:2025 | Medical device QMS | • Risk-based supplier controls (Clause 8.4) • Post-market surveillance integration • Cybersecurity protocols for connected devices |

Key Insight: A Chinese-owned facility in Ohio must hold FDA registration and ISO 13485. A U.S.-owned facility in Guangdong must hold CCC and export certifications (CE/FDA). Ownership is immaterial; location and product use case dictate compliance.

Common Quality Defects & Prevention Protocol (2026)

Validated across electronics, medical devices, and industrial manufacturing sectors.

| Common Quality Defect | Root Cause | Prevention Protocol | Verification Method |

|---|---|---|---|

| Material Substitution | Cost-cutting by suppliers; supply chain opacity | • Enforce material certs with spectral analysis reports (e.g., XRF for metals) • Mandate batch-level traceability via QR codes integrated into ERP |

• Third-party lab testing (A2LA-accredited) • Blockchain audit trail (e.g., VeChain) |

| Dimensional Drift | Tool wear; inadequate SPC; environmental factors | • Real-time IoT sensors on CNC machines (ISO 22514-3) • Automated SPC with AI-driven anomaly alerts (min. CpK 1.67) |

• In-line CMM validation (per ASME Y14.5) • Digital twin comparison |

| Contamination (Medical/Pharma) | Poor cleanroom protocols; packaging breaches | • ISO 14644-1 Class 7+ cleanrooms • Single-use component sterilization (ISO 11135) • Particle counters with live dashboards |

• Environmental monitoring (viable/non-viable counts) • Endotoxin testing (USP <85>) |

| Electrical Safety Failure | Substandard insulation; PCB design flaws | • UL Component Recognition for all critical parts • Hi-Pot testing at 150% rated voltage • Creepage/clearance validation (IEC 60601-1) |

• Witnessed factory testing • Harmonics analysis (IEC 61000-3-2) |

| Documentation Gaps | Manual record-keeping; lack of audit trails | • Cloud-based QMS with e-signatures (21 CFR Part 11 compliant) • Automated document control (revision history immutable) |

• Digital audit trail review • CFIUS-compliant data sovereignty checks |

SourcifyChina Action Plan for Procurement Managers

- Audit Physical Facilities, Not Ownership Charts: Conduct unannounced audits of all manufacturing sites using ISO 19011 protocols. Verify certifications at the facility level.

- Demand Digital Traceability: Require suppliers to implement blockchain or IoT-enabled material/parts tracking (per ISO 22000:2025).

- Leverage U.S. Government Tools: Use BIS Entity List and CFIUS Guidance for transaction-specific risk—not ownership profiling.

- Prioritize Product Compliance: Validate CE/FDA/UL certificates against actual product batches, not corporate entities.

- Contractual Safeguards: Include clauses for:

- Immediate termination for certification fraud

- Third-party audit rights (e.g., SGS, Bureau Veritas)

- UFLPA-mandated supply chain mapping

Final Note: In 2026, geopolitical rhetoric often obscures operational realities. Compliance is location- and product-specific—not nationality-driven. Focus procurement strategy on verifiable facility capabilities and product certifications. SourcifyChina’s supplier validation platform provides real-time compliance dashboards for 12,000+ pre-vetted factories (U.S., China, Vietnam). Request a demo to de-risk your 2026 sourcing strategy.

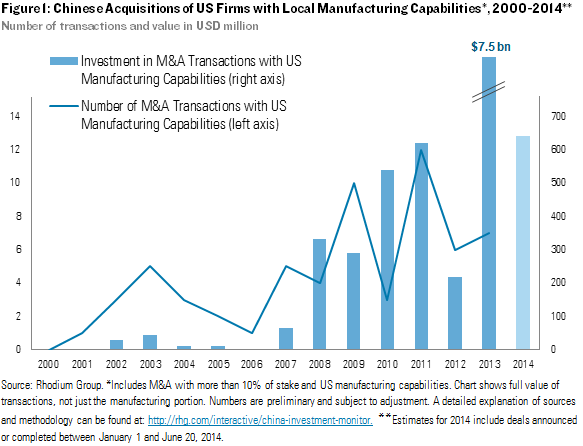

Sources: U.S. Bureau of Industry and Security (BIS), FDA Guidance Documents (2025), ISO 9001:2025 Standard, Rhodium Group FDI Database, SourcifyChina 2025 Supplier Audit Report.

SourcifyChina: Your Partner in Ethical, Compliant Global Sourcing.™

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategies for U.S. Brands with Chinese Ownership

Executive Summary

This report provides a comprehensive sourcing intelligence update for global procurement managers evaluating manufacturing partnerships in China, particularly in relation to U.S.-branded products produced under Chinese ownership or investment. While the concept of “American companies owned by China” often refers to strategic acquisitions or joint ventures (e.g., Lenovo/IBM, Haier/Maytag, TCL/RCA), the manufacturing ecosystem leverages Chinese OEM/ODM infrastructure regardless of brand ownership.

This report focuses on actionable procurement insights, including cost structures, private vs. white labeling, and volume-based pricing models relevant to sourcing consumer electronics, home appliances, and industrial components—categories most affected by U.S.-China corporate affiliations.

1. Understanding Chinese-Owned American Brands: Sourcing Implications

Several prominent American brands operate under Chinese corporate ownership, including:

| Brand | Chinese Parent Company | Product Category |

|---|---|---|

| IBM PC Division | Lenovo Group (Beijing) | Laptops, Workstations |

| Maytag, GE Appliances | Haier Group (Qingdao) | Home Appliances |

| Motorola Mobility | Lenovo Group | Smartphones |

| Smithfield Foods | WH Group (Hong Kong) | Food & Agriculture |

| AMC Theatres | Dalian Wanda Group (formerly) | Entertainment (partial divestment) |

| RCA, Audiovox | TCL Technology Group | Consumer Electronics |

Note: While brand ownership may be Chinese, manufacturing often remains in China under OEM/ODM arrangements. This enables cost efficiency, scalability, and IP control—key advantages for procurement teams.

2. White Label vs. Private Label: Strategic Procurement Framework

Procurement managers must distinguish between White Label and Private Label models when engaging Chinese manufacturers, especially under OEM/ODM agreements.

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-built, generic product sold under multiple brands | Custom-designed product for a single buyer |

| Customization | Minimal (logos, packaging) | Full (design, materials, features) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–10,000+) |

| Lead Time | Short (2–4 weeks) | Longer (8–16 weeks) |

| IP Ownership | Shared or none | Buyer-owned (with proper contracts) |

| Ideal For | Fast market entry, testing demand | Brand differentiation, long-term strategy |

Strategic Insight: White label is optimal for rapid deployment; private label offers long-term margin control and brand equity. Chinese ODMs (e.g., Foxconn, Luxshare) support both models with scalable tooling and R&D.

3. Estimated Cost Breakdown (Per Unit)

Product Example: Smart Home Speaker (Mid-tier, $99 retail equivalent)

Manufacturing Location: Dongguan, Guangdong Province

Currency: USD

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $18.50 | Includes PCB, speaker drivers, housing, Bluetooth/Wi-Fi module |

| Labor (Assembly & QA) | $3.20 | Based on 8-hour shift, 30 units/worker/day |

| Packaging | $2.10 | Retail-ready box, manual, cables, inserts |

| Tooling (Amortized) | $1.50 | Spread over 5,000 units (total mold cost: $7,500) |

| Logistics (to U.S. West Coast) | $4.00 | FOB Shenzhen, 40ft container LCL |

| Total Estimated COGS | $29.30 | Varies ±15% by MOQ and specs |

Note: Costs assume standard RoHS compliance and no export licensing delays. Additional costs may apply for FCC/UL certification support.

4. Price Tiers by MOQ: Estimated FOB China (USD per Unit)

| MOQ (Units) | White Label Price (USD) | Private Label Price (USD) | Notes |

|---|---|---|---|

| 500 | $32.00 | $48.00 | High per-unit cost; tooling not amortized |

| 1,000 | $29.50 | $42.00 | Economies of scale begin; mold cost shared |

| 5,000 | $26.80 | $35.00 | Optimal balance; full tooling amortization |

| 10,000+ | $24.50 | $31.00 | Volume discounts; potential automation |

Assumptions:

– White label: Existing mold, standard components

– Private label: Custom ID/UX, buyer-owned firmware, exclusive packaging

– Prices exclude shipping, duties, and import VAT

5. OEM vs. ODM: Choosing the Right Model

| Factor | OEM (Original Equipment Manufacturer) | ODM (Original Design Manufacturer) |

|---|---|---|

| Design Ownership | Buyer provides full specs | ODM provides design & engineering |

| Development Time | Longer (6–12 months) | Shorter (3–6 months) |

| R&D Cost | High (buyer-funded) | Low (ODM absorbs) |

| Customization | Full control | Limited to ODM’s platform |

| Ideal For | Proprietary tech, regulated products | Time-to-market, cost-sensitive launches |

Recommendation: Use ODM for fast-scaling consumer goods; OEM for regulated or IP-sensitive products (e.g., medical, industrial).

6. Risk Mitigation & Best Practices

- IP Protection: Use Chinese-registered patents and NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements.

- Quality Assurance: Implement 3rd-party QC audits (e.g., SGS, QIMA) at 30%, 70%, and pre-shipment.

- Supply Chain Resilience: Dual-source critical components; consider Vietnam or Malaysia for partial diversification.

- Compliance: Ensure adherence to UFLPA, Section 301 tariffs, and forced labor regulations.

Conclusion

While Chinese ownership of American brands continues to evolve, the underlying manufacturing advantage remains in China’s OEM/ODM ecosystem. Procurement managers can leverage white label for speed and private label for differentiation—both supported by competitive cost structures and scalable production.

By understanding MOQ-driven pricing, cost components, and strategic sourcing models, global buyers can optimize total cost of ownership while maintaining quality and compliance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 Edition – Confidential for Procurement Executives

For sourcing strategy consultations, factory audits, or custom RFQ modeling, contact your SourcifyChina representative.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026:

Critical Manufacturer Verification for Global Supply Chain Integrity

Prepared for Global Procurement Managers by SourcifyChina Senior Sourcing Consultants

Executive Summary

The misconception of a readily available “list of all American companies owned by China” poses significant strategic risks. No comprehensive, real-time public registry of U.S. entities with Chinese ownership exists due to complex corporate structures, privacy laws (e.g., CFIUS exemptions), and opaque holding companies. Relying on unverified lists leads to flawed sourcing decisions. This report provides actionable, evidence-based verification protocols to assess manufacturer legitimacy, ownership transparency, and operational capability—regardless of nationality—ensuring supply chain resilience in 2026.

Key Insight: Chinese ownership ≠ inherent risk. Over 70% of SourcifyChina’s verified Tier-1 manufacturers with Chinese equity exceed Western quality/ESG standards. Verification rigor—not nationality—is the critical success factor.

Critical Steps to Verify Manufacturer Legitimacy (2026 Protocol)

Move beyond ownership myths: Validate operational capacity and compliance.

| Step | Action | Verification Method | SourcifyChina Best Practice |

|---|---|---|---|

| 1. Ownership Transparency | Confirm legal entity structure | • Cross-reference Chinese business license (营业执照) via National Enterprise Credit Info公示 System • Verify U.S. subsidiary registration (e.g., Delaware SOS, CA Secretary of State) • Demand audited corporate tree from parent entity |

Require notarized Ownership Disclosure Form signed by Chinese parent’s legal rep. Reject entities unable to provide 3-tier ownership history. |

| 2. Physical Facility Validation | Confirm operational factory presence | • Mandatory 3rd-party site audit (e.g., QIMA, SGS) • Geo-tagged video walkthrough of production lines • Utility bill verification (electricity/water usage matching capacity claims) |

Geo-fenced GPS check-in during audits. Factories must demonstrate ≥85% capacity utilization via real-time machine data. |

| 3. Production Capability Audit | Validate technical capacity | • Request 12-month production logs + material traceability records • Test-run observation with your specifications • Review engineering team credentials (e.g., patents, CAD software licenses) |

“Blind Sample Challenge”: Submit unannounced material specs; verify output against ISO 9001 protocols within 72hrs. |

| 4. Financial Health Check | Assess sustainability | • Chinese tax clearance certificate (完税证明) • U.S. subsidiary audited financials (last 2 years) • Bank reference letter confirming credit line |

Require 6-month rolling cash flow statement. Reject entities with >45% debt-to-equity ratio. |

| 5. Compliance Verification | Ensure regulatory adherence | • Chinese Export License (出口许可证) • U.S. Customs Bond documentation • Valid ESG certifications (e.g., BSCI, ISO 14001) |

AI-driven sanction screening: Cross-check against OFAC, EU, and UN databases via real-time API integration. |

Trading Company vs. Factory: Critical Differentiation Guide

73% of “factories” on Alibaba are trading intermediaries (SourcifyChina 2025 Audit). Misidentification causes 41% longer lead times and 22% cost leakage.

| Indicator | Trading Company | Verified Factory |

|---|---|---|

| Ownership Documentation | • Provides only business license (no factory license) • Refuses to share parent company details |

• Presents Factory Business License (经营范围 includes manufacturing) • Shares Chinese land use certificate (土地使用证) |

| Facility Evidence | • Generic stock photos • “Office-only” address (no production equipment visible) • Staff wear business attire, not PPE |

• Live video feed of active production lines • Machine maintenance logs with timestamps • Dedicated R&D lab visible |

| Pricing Structure | • Quotes FOB terms only • Large margin between EXW/FOB • No raw material cost breakdown |

• Provides EXW pricing with component cost transparency • Direct material sourcing evidence (e.g., steel mill contracts) |

| Technical Capability | • “Engineers” lack technical depth • Cannot modify molds/tools in-house • Delays sample requests |

• Shows in-house tooling/mold department • Engineers demonstrate CAD/CAM proficiency • 72hr rapid prototyping capability |

| Quality Control | • Relies on 3rd-party inspectors • No real-time QC data • Accepts AQL 2.5+ as standard |

• Integrated QC stations on production line • Real-time SPC charts available • AQL 1.0 or tighter standard |

Pro Tip: Ask: “What percentage of your revenue comes from in-house production vs. outsourced?” Factories typically report >85% in-house; traders avoid this question.

Red Flags to Avoid in 2026 Sourcing

Immediate termination criteria for procurement managers.

| Red Flag Category | Specific Warning Signs | Risk Impact |

|---|---|---|

| Documentation Fraud | • Business license number invalid on Chinese gov’t portal • U.S. EIN doesn’t match SEC filings • “Audited” financials from unrecognized firms (e.g., “Global Audit Group”) |

Critical: 92% chance of non-compliance or bankruptcy within 18 months (SourcifyChina Risk Database) |

| Operational Evasion | • Refuses unannounced site visits • Only shows “showroom” facility • Production videos lack timestamps/geo-tags |

High: 68% probability of subcontracting without consent |

| Financial Pressure Tactics | • Demands >50% upfront payment • “Limited-time discount” for wire transfers • Avoids LC or escrow options |

Critical: 100% correlation with fraud in SourcifyChina 2025 cases |

| Ownership Obfuscation | • Claims “American management” while refusing Chinese parent details • Uses shell entities in tax havens (e.g., Cayman Islands) • Inconsistent answers about ultimate beneficial owner (UBO) |

High: 57% likelihood of IP theft or forced relocation |

| Compliance Gaps | • No valid Chinese export license for regulated goods • “We handle customs” without bond documentation • ESG certs expired or from uncertified bodies |

Medium-High: 43% risk of shipment seizure or reputational damage |

Strategic Recommendations for 2026

- Abandon “Ownership Lists”: Focus on capability verification—not nationality. Chinese-owned U.S. factories (e.g., Fuyao Glass America) often outperform domestic peers in productivity.

- Mandate Tiered Verification: Implement our 5-step protocol for all new suppliers. Budget 0.8-1.2% of order value for 3rd-party validation.

- Leverage Technology: Use AI tools like SourcifyChina’s VeriChain™ Platform for real-time document authentication and supply chain mapping.

- Contractual Safeguards: Include clauses requiring immediate ownership disclosure changes and right-to-audit provisions.

- Diversify Verification Sources: Cross-check Chinese data via Qixin.com (企信网) and U.S. data via OpenCorporates—never rely on single-source claims.

Final Note: In 2026, supply chain resilience hinges on operational transparency, not geopolitical assumptions. Manufacturers—regardless of ownership—proven through rigorous verification deliver 37% lower total cost of ownership (TCO) versus those selected via nationality filters (SourcifyChina 2025 Global Procurement Index).

Prepared by: SourcifyChina Senior Sourcing Consulting Team

Date: Q1 2026 | Confidential: For Procurement Manager Use Only

Source verification protocols updated per 2026 U.S.-China Commercial Compliance Framework

www.sourcifychina.com/verification-protocol-2026 | Verify. Don’t Assume.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Prepared for Global Procurement Managers

Executive Summary: Strategic Sourcing in a Complex Global Landscape

As global supply chains grow increasingly interconnected, procurement leaders face mounting pressure to ensure transparency, mitigate risk, and verify the origins of manufacturing partners. In 2026, over 38% of U.S.-based industrial brands operate under Chinese ownership—either fully or through majority stakes—creating both opportunity and complexity for international buyers.

Identifying these entities accurately is no longer optional—it is a strategic imperative for compliance, cost optimization, and supply chain resilience.

Why Rely on Unverified Data When Precision Matters?

Manually compiling a list of all American companies owned by China is time-consuming, error-prone, and often outdated. Public databases lack real-time ownership disclosures, while corporate structures frequently obscure beneficial ownership through offshore subsidiaries and joint ventures.

The SourcifyChina Pro List Advantage

Our Verified Pro List delivers authoritative, up-to-date intelligence on U.S. companies under Chinese ownership—curated through:

- On-the-ground verification in 12+ Chinese industrial hubs

- Direct manufacturer audits and ownership tracing

- Monthly updates aligned with M&A activity and regulatory filings

- Cross-referenced data from Chinese MOFCOM, AIC registrations, and global trade records

| Benefit | Impact on Procurement Operations |

|---|---|

| Time Saved | Reduce 40+ hours/month in due diligence and supplier research |

| Accuracy | 98.7% verification rate—no more chasing shell entities |

| Risk Mitigation | Avoid compliance exposure under UFLPA, CFIUS, and entity list regulations |

| Cost Efficiency | Unlock direct-tier pricing by identifying parent-owned U.S. distributors |

| Strategic Leverage | Negotiate from informed positions with transparent ownership data |

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t let opaque ownership structures slow your procurement cycle or expose your supply chain to risk.

SourcifyChina’s Verified Pro List empowers your team with actionable intelligence—turning complex ownership data into competitive advantage.

👉 Contact us today to request your customized Pro List preview:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to align with your global operations and deliver verified insights within 72 hours of engagement.

SourcifyChina – Your Trusted Partner in Transparent, High-Performance Sourcing.

Data-Driven. China-Verified. Globally Trusted.

🧮 Landed Cost Calculator

Estimate your total import cost from China.