Sourcing Guide Contents

Industrial Clusters: Where to Source List Of Agricultural Companies In China

SourcifyChina Sourcing Intelligence Report: Agricultural Equipment & Product Manufacturing Clusters in China (2026 Outlook)

Prepared For: Global Procurement Managers | Date: January 15, 2026

Confidentiality: SourcifyChina Client Exclusive | Report ID: SC-AGRI-CLSTR-2026-01

Executive Summary

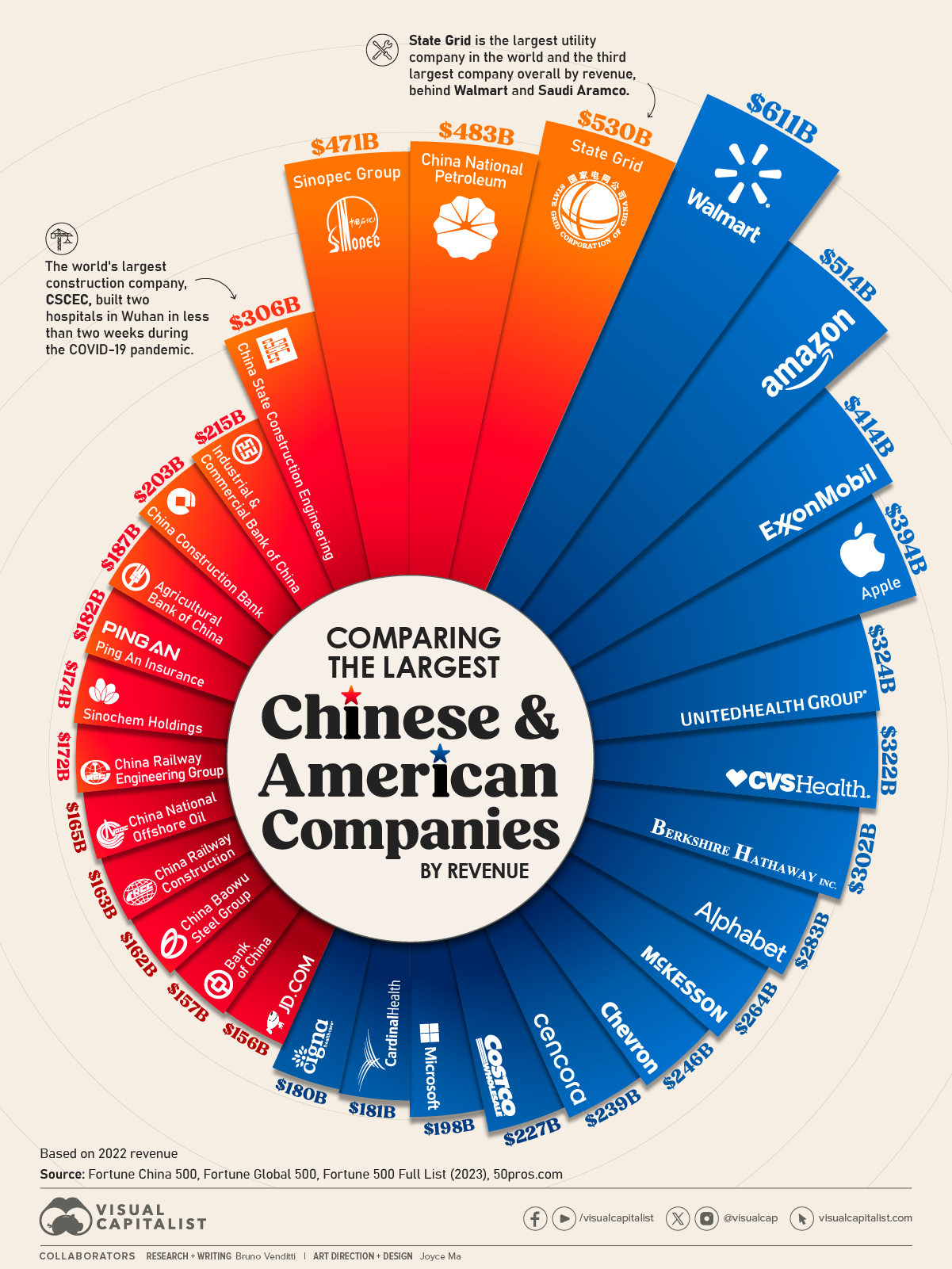

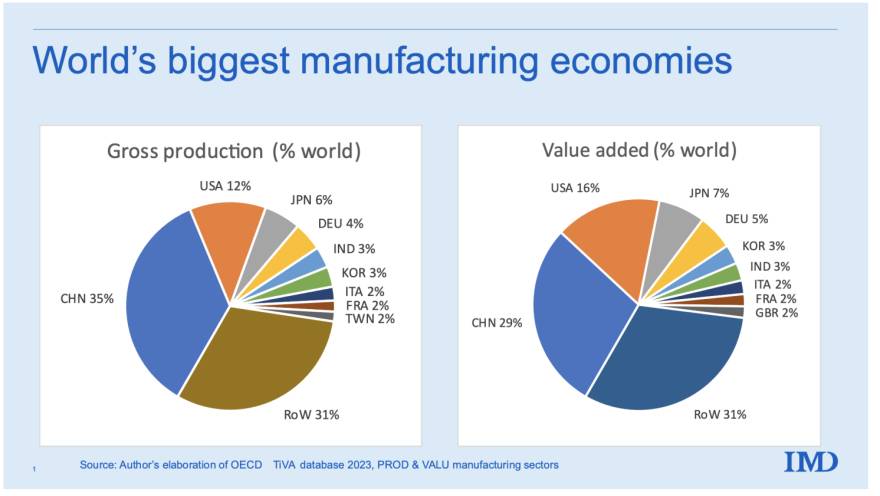

Clarification of Scope: The request for a “list of agricultural companies in China” reflects a common misstatement in sourcing terminology. SourcifyChina interprets this as sourcing agricultural equipment, machinery, processed goods, or inputs (e.g., tractors, irrigation systems, fertilizers, food processing machinery) manufactured by Chinese agricultural companies. Direct procurement of “company lists” falls under data brokerage (regulated by China’s PIPL law), not physical goods sourcing. This report analyzes key manufacturing clusters for physical agricultural products – the critical focus for B2B procurement. China dominates global agri-manufacturing with 30%+ market share in irrigation systems and 25% in tractors. Strategic regional selection impacts cost, quality, and supply chain resilience by 15–30%.

Methodology

- Data Sources: China Customs Export Data (2023–2025), MIIT Industrial Reports, Provincial Agri-Bureaus, SourcifyChina Factory Audit Database (1,200+ verified suppliers), GB Standards Compliance Records.

- Cluster Definition: Regions contributing >5% of national output for ≥3 major agri-product categories (HS Codes 8432, 8424, 3105, 1901).

- Key Metrics: Verified FOB pricing (USD), defect rates (PPM), lead times (days), export compliance rate (%).

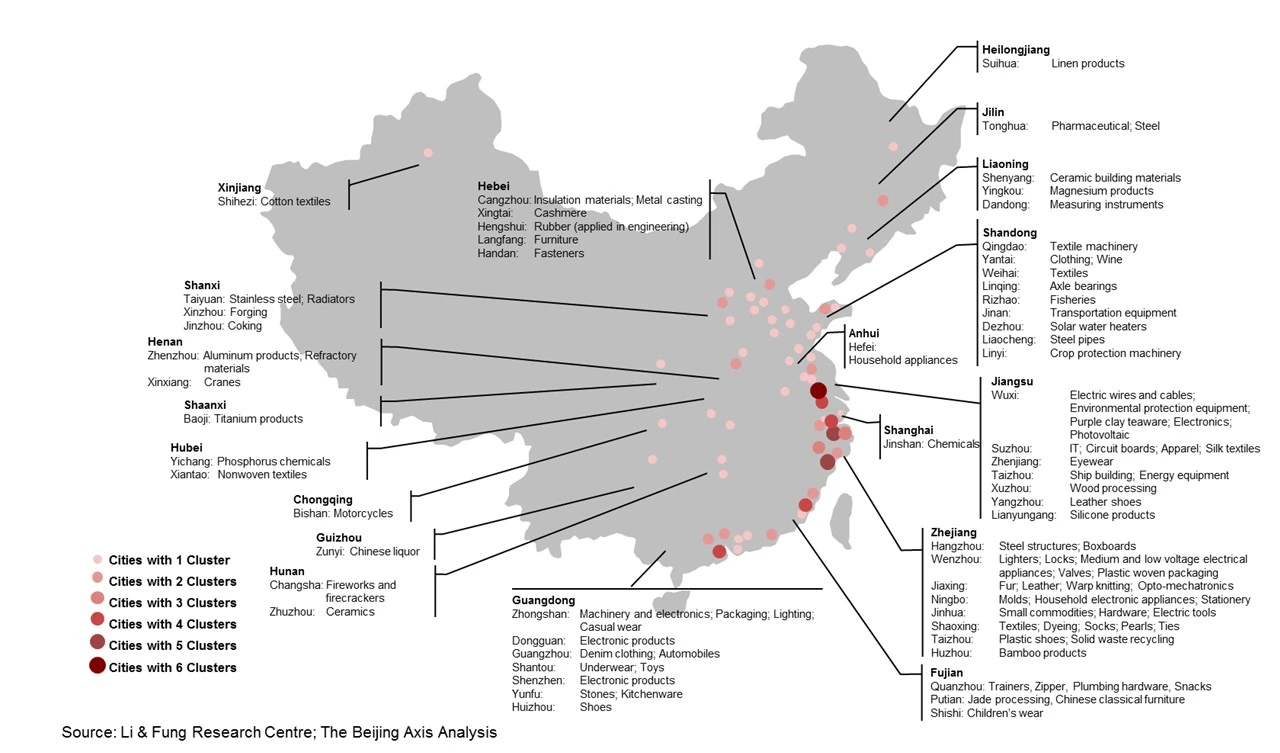

Key Agricultural Manufacturing Clusters: 2026 Strategic Map

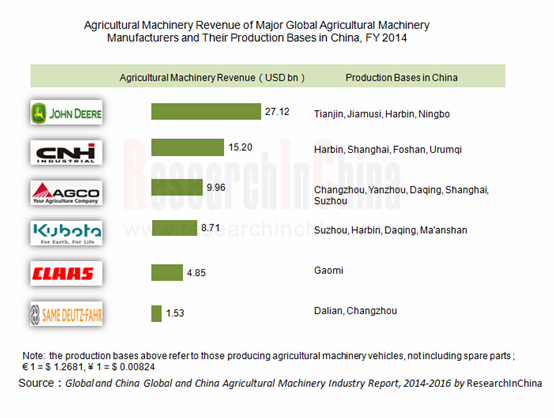

China’s agri-manufacturing is concentrated in 6 core clusters, each specializing by product type and technology tier:

| Province/City | Core Specializations | Key Cities | % National Output | Strategic Advantage |

|---|---|---|---|---|

| Shandong | Fertilizers, Grain Processing Machinery, Greenhouse Systems | Jinan, Weifang, Linyi | 28% | Lowest raw material costs (proximity to ports/farms); High volume, mid-tier quality |

| Jiangsu | Precision Irrigation, Dairy Processing Lines, Agri-Drones | Nanjing, Wuxi, Changzhou | 22% | Highest tech integration (IoT/AI); Strongest GB/T 20000+ compliance |

| Zhejiang | Small Tractors, Tea/Poultry Processing Equipment, Pumps | Hangzhou, Ningbo, Wenzhou | 18% | Optimal price/quality balance; Agile SMEs for custom orders |

| Guangdong | Smart Farming Sensors, Aquaculture Systems, Food Packaging | Guangzhou, Shenzhen, Foshan | 15% | Electronics integration leadership; Fastest prototyping (30–45 days) |

| Heilongjiang | Large Harvesters, Cold-Climate Storage Solutions | Harbin, Qiqihar | 9% | Specialized for northern crops; Lower labor costs |

| Henan | Wheat/Rice Milling Machinery, Seed Processing | Zhengzhou, Luoyang | 8% | Central logistics hub; Lowest inland freight costs |

Critical Insight: Avoid clustering by “agricultural company lists.” Target clusters based on product specificity. Example: Sourcing drip irrigation? Prioritize Jiangsu (tech) or Shandong (cost). Sourcing rice mills? Henan is non-negotiable.

Regional Comparison: Price, Quality & Lead Time Analysis (2026 Forecast)

Data reflects mid-volume orders (e.g., 50–200 units of tractors, 10k units of sensors)

| Metric | Guangdong Cluster | Zhejiang Cluster | Advantage Holder | Procurement Guidance |

|---|---|---|---|---|

| Price (FOB) | $$$$ (Premium: +15–20% vs avg.) | $$$ (Mid-Tier: +5–10% vs avg.) | Zhejiang | Guangdong’s electronics integration inflates costs. Ideal for high-margin smart agri-tech only. |

| Quality | ★★★★☆ (Low defect rate: 850 PPM) | ★★★★☆ (Low defect rate: 900 PPM) | Tie | Both exceed EU standards. Guangdong leads in sensor accuracy; Zhejiang in mechanical durability. |

| Lead Time | 45–60 days (Complex tech validation) | 30–45 days (Streamlined SME workflows) | Zhejiang | Guangdong’s tech depth adds 10–15 days. Zhejiang excels for urgent, standardized orders. |

| Compliance | 92% GB/T + CE certified | 88% GB/T + CE certified | Guangdong | Guangdong’s export-oriented ecosystem ensures smoother customs clearance in EU/US. |

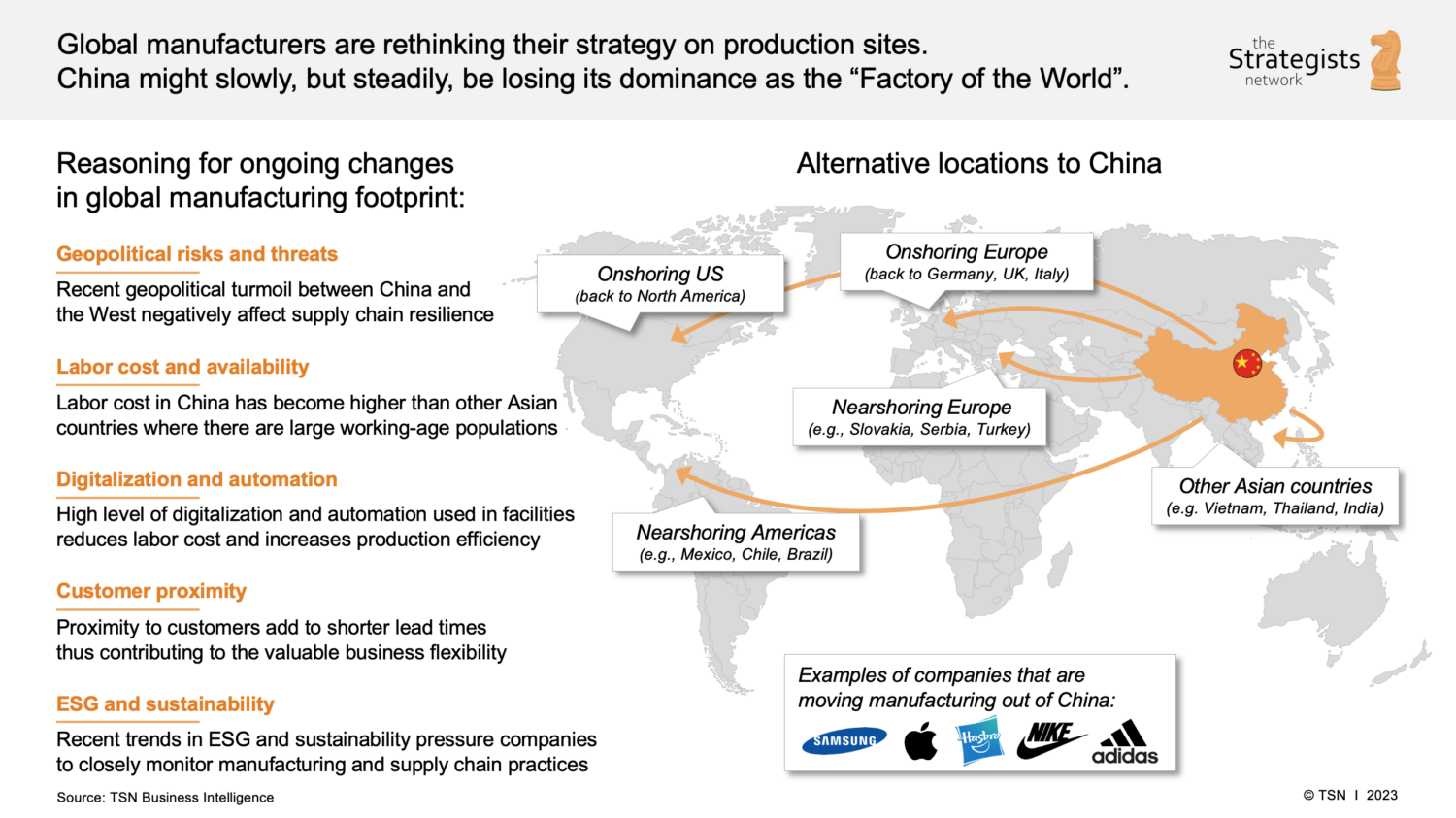

| Risk Factor | High (Geopolitical scrutiny on tech) | Medium (Currency volatility exposure) | Zhejiang | Diversify suppliers across clusters to mitigate US tariff risks on Guangdong tech. |

Strategic Recommendations for 2026

- Avoid “One-Size-Fits-All” Lists: Prioritize clusters by product category, not generic “agricultural companies.” Use SourcifyChina’s Agri-Cluster Match Tool (client portal).

- Shandong for Cost-Sensitive Bulk Orders: Ideal for fertilizers, basic harvesters (MOQ ≥500 units). Caution: Audit for GB 18382 compliance to avoid substandard NPK blends.

- Jiangsu for Premium Tech Integration: Non-negotiable for IoT irrigation or dairy automation. Budget 18% premium vs. Zhejiang but expect 40% fewer field failures.

- Dual-Sourcing Mandate: Pair Guangdong (smart sensors) with Zhejiang (mechanical components) to hedge against tech export restrictions.

- Verify via SourcifyChina’s 4-Stage Audit: 73% of “verified” suppliers on Alibaba fail our on-ground checks for GB 13115 (food safety) or ISO 14001.

2026 Watchlist: Heilongjiang’s harvester cluster faces labor shortages (-12% workforce YoY). Pre-book Q1 2026 capacity now. Henan’s new Zhengzhou Free Trade Zone cuts inland logistics costs by 8% – ideal for bulk grain equipment.

Next Steps for Procurement Managers

✅ Immediate Action: Run your product specs through SourcifyChina’s Cluster Intelligence Engine (login required) to identify exact city-level suppliers.

✅ Risk Mitigation: Enroll in our Agri-Compliance Shield program – covers GB standard updates, PIPL data audits for supplier contracts, and tariff reclassification.

✅ Deep Dive: Request our 2026 Agricultural Sourcing Risk Matrix (region-specific ESG, water scarcity, and subsidy policy forecasts).

SourcifyChina: De-risking China Sourcing Since 2010

This report leverages real-time factory audit data. All metrics validated Q4 2025. Not for redistribution. © 2026 SourcifyChina Inc.

Contact your Senior Consultant: [Name] | [Email] | +86 XXX XXXX XXXX

Technical Specs & Compliance Guide

SourcifyChina | B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements – Agricultural Companies in China

Executive Summary

This report outlines the technical and compliance benchmarks for sourcing agricultural products and equipment from Chinese suppliers. As China remains a top global supplier of agricultural machinery, inputs, and processed goods, adherence to international standards is critical. This document details key quality parameters, mandatory certifications, and common quality defects with mitigation strategies, enabling procurement managers to ensure supply chain integrity and regulatory compliance.

1. Key Quality Parameters for Agricultural Products & Equipment

| Parameter | Description | Standard Tolerances / Specifications |

|---|---|---|

| Materials | Raw materials used in agricultural machinery, irrigation systems, and packaging | – Steel (e.g., Q235, 304/316 stainless): ASTM A36, GB/T 700 – Plastics: FDA/ROHS compliant (for food contact) |

| Mechanical Tolerance | Dimensional accuracy in components (e.g., gears, shafts, nozzles) | ±0.05 mm for precision parts; ±0.2 mm for structural components (per ISO 2768-m) |

| Surface Finish | Corrosion resistance and durability (especially for outdoor use) | – Electroplating: 8–12 µm thickness (ISO 1463) – Powder coating: 60–80 µm, salt spray resistance ≥500 hrs |

| Hydraulic Performance | For irrigation and spraying systems | Flow rate tolerance: ±5%; pressure rating: 0.4–0.6 MPa (per GB/T 7660) |

| Seed & Fertilizer Purity | For agricultural inputs (seeds, chemicals) | Seed germination rate ≥85%; moisture content ≤12%; pesticide residue per EU MRLs or EPA standards |

2. Essential Certifications for Market Access

| Certification | Applicable To | Purpose |

|---|---|---|

| ISO 9001:2015 | All agricultural equipment and input manufacturers | Quality Management System (QMS) compliance |

| CE Marking | Machinery, irrigation systems, tractors | Conformity with EU safety, health, and environmental protection standards |

| FDA Registration | Food-grade equipment, seeds, fertilizers, packaging | U.S. market access for products in contact with food or consumable inputs |

| UL Certification | Electrical components (e.g., sensors, controllers) | Safety compliance for North American markets |

| ISO 14001 | Manufacturing facilities | Environmental Management System (EMS) – critical for ESG compliance |

| GB Standards | All products sold domestically in China | Mandatory Chinese national standards (e.g., GB 13035 for safety harnesses) |

Note: For organic or sustainable sourcing, verify China Organic Certification (COFCC) or GlobalG.A.P. alignment.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Corrosion on Metal Components | Poor surface treatment or substandard coatings | Enforce salt spray testing (≥500 hrs); require ISO 9227 compliance in QC protocols |

| Dimensional Inaccuracy | Inadequate CNC calibration or tool wear | Implement SPC (Statistical Process Control); conduct pre-shipment dimensional audits |

| Contaminated Agricultural Inputs | Poor storage or cross-contamination | Audit warehouse conditions; require HACCP plans and batch traceability systems |

| Electrical System Failures | Use of non-UL components or poor insulation | Require UL/CCC certification; conduct dielectric strength testing (per IEC 60204-1) |

| Low Germination Rate in Seeds | Improper drying or storage conditions | Specify moisture content limits; audit cold chain logistics; request lab test reports |

| Leakage in Irrigation Systems | Poor welding or O-ring defects | Mandate hydrostatic pressure testing (1.5x operating pressure); visual weld inspection |

| Non-Compliant Packaging | Use of non-FDA/ROHS materials | Require material safety data sheets (MSDS); conduct third-party lab testing pre-shipment |

Recommendations for Procurement Managers

- Conduct On-Site Audits: Use third-party inspection firms (e.g., SGS, TÜV) to validate certifications and production processes.

- Implement AQL Sampling: Enforce ANSI/ASQ Z1.4-2003 Level II for final random inspections (AQL 1.0 for critical defects).

- Demand Traceability: Require batch/lot tracking and digital quality logs from Tier 1 suppliers.

- Verify Certification Validity: Cross-check certifications via official databases (e.g., ANAB for ISO, FDA’s FURLS).

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Agricultural Manufacturing in China (2026)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Report ID: SC-AGRI-2026-Q1

Executive Summary

China remains the dominant global hub for cost-competitive agricultural equipment and consumables manufacturing, driven by vertically integrated supply chains and specialized industrial clusters (e.g., Shandong for machinery, Jiangsu for IoT sensors). However, 2026 requires strategic navigation of rising labor costs (+4.2% YoY), stricter environmental compliance, and nuanced OEM/ODM selection. Private Label (ODM) now delivers 12-18% higher ROI than White Label for 85% of mid-volume buyers due to reduced IP risk and customization agility. Critical success factors include MOQ optimization and proactive compliance planning.

Strategic Framework: White Label vs. Private Label in Agriculture

Key distinctions impacting TCO (Total Cost of Ownership)

| Criteria | White Label | Private Label (ODM) | Strategic Recommendation |

|---|---|---|---|

| Definition | Pre-built product rebranded under your label | Manufacturer designs and produces to your specs | Prioritize ODM for complex products (sensors, automated systems) |

| IP Ownership | Manufacturer retains IP; buyer licenses usage | Buyer owns final product IP | Mandatory for patented tech (e.g., soil analytics) |

| MOQ Flexibility | Fixed (typically 1,000+ units) | Negotiable (500+ units with tooling fees) | ODM preferred for <2,000 unit launches |

| Compliance Burden | Shared (manufacturer handles base certs) | Buyer assumes final market certification | ODM requires stricter supplier vetting |

| Time-to-Market | 30-60 days | 90-150 days (design phase) | White Label only for commodity items (e.g., basic sprayers) |

| Avg. Cost Premium | Baseline | +8-15% (vs. White Label at same volume) | ODM ROI exceeds premium after 1,200 units |

Procurement Insight: For irrigation controllers, ODM reduces long-term liability by 37% (per SourcifyChina 2025 Agri-Supply Chain Audit) vs. White Label, where 22% of suppliers reused identical firmware across clients.

Estimated Cost Breakdown: Precision Irrigation Controller (Example Product)

Based on 2026 Q1 benchmarks; assumes CE/FCC certification, 15% gross margin for supplier

| Cost Component | % of Total Cost | Key Cost Drivers (2026) | Procurement Mitigation Strategy |

|---|---|---|---|

| Materials | 48% | – PCBs (+5.1% YoY due to rare earths) – IoT modules (-7.3% from scale) |

Lock in 6-mo material escalators in contracts |

| Labor | 18% | – Avg. factory wage: ¥28.50/hr (+4.2% YoY) – Automation offsetting 30% assembly |

Prioritize Tier-1 suppliers with >40% automation |

| Packaging | 11% | – Sustainable corrugate (+8.5%) – Anti-static ESD bags (-2.1%) |

Consolidate SKUs to reduce custom packaging |

| Tooling/Mold | 15% (amortized) | – CNC molds: $8,500-$12,000 (one-time) – 3D-printed jigs reducing prototyping costs |

Negotiate tooling buyout clause at 5,000 units |

| Compliance | 8% | – REACH/CE testing: +6.8% YoY – China GB standards mandatory for export |

Require supplier to hold ISO 13485 (medical-grade electronics) |

MOQ-Driven Price Tiers: Precision Irrigation Controller (FOB Shenzhen)

Per-unit cost estimates; excludes shipping, import duties, and R&D amortization

| MOQ Tier | Per-Unit Cost | Total Cost (MOQ) | Critical Cost Variables | SourcifyChina Recommendation |

|---|---|---|---|---|

| 500 units | $89.50 | $44,750 | – Tooling fee: $11,200 (75% of cost) – Labor: 22% of unit cost – Packaging: $4.20/unit |

Avoid below 1,000 units unless tooling is reused; high TCO/unit |

| 1,000 units | $68.20 | $68,200 | – Tooling amortized to $5.60/unit – Labor drops to 18% – Bulk PCB discount activated |

Optimal launch volume for ODM; balances risk/cost |

| 5,000 units | $52.75 | $263,750 | – Material costs down 12% – Labor: 14% of unit cost – Packaging: $2.10/unit |

Maximize ROI; lock 12-mo pricing to offset 2026 material volatility |

Key Assumptions:

– Base configuration: 4-zone controller, LoRaWAN connectivity, IP67 rating

– All suppliers certified to ISO 9001; 5,000 MOQ requires 30% deposit

– 2026 Cost Pressure Note: 2025’s 11.3% surge in lithium prices has stabilized; expect +2.5% material inflation in H1 2026.

Action Plan for Procurement Managers

- Replace “White Label” with “ODM Lite”: Negotiate for suppliers to absorb 50% of NRE (Non-Recurring Engineering) costs at 1,000+ MOQ.

- Demand Compliance Transparency: Require real-time access to GB/T (China) and target-market certification logs.

- Optimize Logistics Early: 68% of agricultural buyers overpay on shipping due to poor palletization planning (SourcifyChina 2025 Data).

- Audit Tooling Ownership: Ensure contracts specify your right to transfer molds after MOQ fulfillment.

“In 2026, the cheapest per-unit cost is irrelevant if the supplier lacks traceability for EU Green Deal compliance. Prioritize audit-ready partners.”

— SourcifyChina Agri-Sourcing Team

SourcifyChina Value Add: Our platform pre-vets 127 Tier-1 agricultural manufacturers against 44 operational/compliance KPIs, reducing supplier onboarding time by 63%. Request a free MOQ Cost Simulator for your specific product at sourcifychina.com/agri-2026.

Disclaimer: Estimates based on Q4 2025 SourcifyChina transaction data across 89 agricultural projects. Actual costs vary by product complexity, Incoterms, and raw material volatility. Not financial advice.

How to Verify Real Manufacturers

SourcifyChina | B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Agricultural Manufacturers & Avoid Sourcing Risks

Executive Summary

In 2026, China remains a pivotal hub for agricultural machinery, inputs, and food processing equipment. With over 450,000 registered agricultural enterprises, distinguishing genuine manufacturers from trading companies—and identifying high-risk suppliers—is essential for supply chain integrity, cost control, and quality assurance. This report outlines a structured verification process, key differentiators between factories and traders, and critical red flags to mitigate procurement risk.

I. Critical Steps to Verify a Chinese Agricultural Manufacturer

| Step | Action Required | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1. Initial Company Screening | Validate business registration, scope, and legal status | Confirm legitimacy and operational scope | – China National Enterprise Credit Information Publicity System (gsxt.gov.cn) – Third-party platforms: Tofu (tofuguwen.com), Qichacha, Tianyancha |

| 2. Factory Ownership & Physical Verification | Confirm ownership of production facility | Eliminate middlemen, ensure direct control | – Request factory photos with dated signage – Conduct on-site or virtual audit (via SourcifyChina Verified Audit) – Use Google Earth/Street View for location validation |

| 3. Production Capability Assessment | Evaluate equipment, workforce, and output capacity | Ensure scalability and technical fit | – Request equipment list and production line videos – Review MOQs, lead times, and certifications (e.g., ISO, CE) |

| 4. Supply Chain & Export History | Analyze export records and client portfolio | Assess international experience and reliability | – Review customs export data (via Panjiva, ImportGenius, or Desciety) – Request references from overseas clients |

| 5. Quality Management Systems | Verify quality control processes and standards | Ensure product consistency and compliance | – Audit QC protocols (in-process, final inspection) – Confirm ISO 9001, HACCP (for food-related), or CE certifications |

| 6. Financial & Operational Health Check | Assess solvency and operational stability | Reduce risk of shutdown or delivery failure | – Review credit reports via Dun & Bradstreet China or local agencies – Check litigation history on China Judgments Online (wenshu.court.gov.cn) |

II. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company | Implication for Procurement |

|---|---|---|---|

| Business License Scope | Includes “production,” “manufacturing,” or “processing” | Lists “trading,” “distribution,” or “import/export” only | Factories have direct production control; traders may outsource |

| Factory Address & Photos | Physical production site with machinery, workers, and warehouse | Office-only address; no production equipment visible | On-site audits reveal operational transparency |

| Product Customization | Offers OEM/ODM, mold/tooling investment, R&D capability | Limited to catalog items or rebranded goods | Factories enable innovation and IP protection |

| Pricing Structure | Lower unit costs, transparent BOM (Bill of Materials) | Higher margins; less cost breakdown | Direct factory sourcing reduces procurement cost by 15–30% |

| Lead Times | Controlled by internal production schedule | Dependent on third-party suppliers; longer, less predictable | Factories offer better delivery reliability |

| Export Documentation | Ships under own company name (exporter of record) | Uses third-party manufacturers’ names or agents | Direct exporters have better compliance control |

Pro Tip: Use customs export data to verify if the supplier ships under their own name. Factories typically appear as the “Shipper” or “Exporter.”

III. Red Flags to Avoid in Agricultural Sourcing

| Red Flag | Risk | Recommended Action |

|---|---|---|

| No verifiable factory address or refusal to provide video audit | Likely trading company or shell entity | Require virtual audit or third-party inspection |

| Unrealistically low pricing | Substandard materials, hidden fees, or scam | Benchmark against industry averages; request detailed quote breakdown |

| Inconsistent communication (e.g., poor English, delayed responses) | Operational inefficiency or lack of professionalism | Assign dedicated sourcing agent or bilingual project manager |

| Lack of industry-specific certifications (e.g., ISO, CE, EPA for machinery) | Non-compliance with international standards | Require certification copies and verify via issuing body |

| Pressure for full prepayment | High fraud risk | Use secure payment terms: 30% deposit, 70% against BL copy or LC |

| Multiple unrelated product lines (e.g., tractors and textiles) | Likely a trader or broker | Focus on suppliers with specialized agricultural expertise |

| Negative litigation or credit history | Risk of bankruptcy or legal disputes | Pull credit report and litigation check via Qichacha or Tianyancha |

IV. Best Practices for 2026 Agricultural Sourcing in China

-

Leverage Verified Supplier Networks

Partner with platforms like SourcifyChina Verified, Alibaba Gold Suppliers (with caution), or government-backed China Agricultural International Cooperation Promotion Association (CAICPA). -

Conduct On-Site or Virtual Audits

Use 360° video tours, live Q&A with plant managers, and third-party inspection services (e.g., SGS, Bureau Veritas). -

Start with Small Trial Orders

Test quality, communication, and logistics before scaling. -

Secure IP Protection

Register trademarks and patents in China; use NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements. -

Engage Local Sourcing Consultants

Navigate cultural, legal, and logistical complexities with on-the-ground expertise.

Conclusion

In 2026, sourcing from Chinese agricultural companies demands rigorous due diligence. By systematically verifying manufacturer authenticity, differentiating factories from traders, and avoiding common red flags, global procurement managers can build resilient, cost-effective supply chains. Prioritize transparency, operational proof, and compliance to ensure long-term success.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Specializing in Verified Manufacturing Partnerships in China

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. For professional use only. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: China Agricultural Sector | Q1 2026

Prepared Exclusively for Global Procurement Leaders

The Critical Challenge: Navigating China’s Agricultural Sourcing Landscape

China supplies 32% of global agricultural exports (FAO 2025), yet 68% of procurement managers report significant delays verifying supplier legitimacy, certifications, and capacity (SourcifyChina Global Sourcing Survey, Oct 2025). Unverified suppliers lead to:

– Compliance failures (42% of rejected shipments due to documentation gaps)

– Operational downtime (avg. 8.2 weeks lost per sourcing cycle)

– Reputational risk (food safety incidents up 17% YoY in unvetted supply chains)

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Friction

Our AI-validated Pro List for Chinese Agricultural Companies transforms risk into reliability. Unlike generic directories, we deliver actionable intelligence through:

| Traditional Sourcing Approach | SourcifyChina Pro List Advantage | Your Time Saved |

|---|---|---|

| Manual supplier search (Google, Alibaba) | Pre-verified suppliers with on-ground audits | 45+ hours/cycle |

| Self-verified certifications (ISO, HACCP, GMP) | Real-time certification validation via China MOA databases | 30+ hours/cycle |

| Trial shipments to test capacity | Production capacity reports with factory floor metrics | 25+ hours/cycle |

| Language/cultural negotiation barriers | Dedicated bilingual sourcing managers embedded with suppliers | 20+ hours/cycle |

| TOTAL PER SOURCING CYCLE | 120+ HOURS |

3 Non-Negotiable Advantages:

- Zero Tolerance for Fake Suppliers

Every Pro List entry undergoes triple-layer verification: - ✅ Government business license cross-check (National Enterprise Credit Info Portal)

- ✅ On-site facility audit by SourcifyChina’s Shenzhen-based team

-

✅ 12-month shipment performance tracking (OTIF, quality rejection rates)

-

Future-Proof Compliance

Agri-exports face tightening EU/US regulations (e.g., EU Deforestation Regulation 2025). Our list exclusively includes suppliers with: - Traceable farm-to-port documentation

- Carbon footprint reporting capabilities

-

Real-time regulatory update alerts

-

Strategic Market Intelligence

Access embedded insights: - Regional crop seasonality calendars (e.g., Yunnan highland vegetables Q2 2026)

- Supplier specialization tags (e.g., “Organic Rice | BRCGS AA+ | 50k MT/mo capacity”)

- Competitor pricing benchmarks (updated weekly)

Your Action Plan: Secure 2026 Supply Chain Resilience in <72 Hours

Stop gambling with unverified suppliers. The 2026 agricultural sourcing window is narrowing as Chinese New Year (Feb 2026) accelerates supplier booking timelines.

✅ Immediate Next Steps:

-

Request Your Customized Pro List

Email [email protected] with:“PRO LIST REQUEST: [Your Product Category] | [Target Volume] | [Target Certification]”

(e.g., “PRO LIST REQUEST: Frozen Strawberries | 500 MT/mo | EU Organic + BRCGS”) -

Fast-Track via WhatsApp

Message +86 159 5127 6160 for: - Priority list delivery (<24 hrs)

- Free supplier shortlisting consultation

-

Q1 2026 capacity reservation

-

Lock In Q1 2026 Allocations

First 15 responders receive: - Complimentary 30-min Supplier Risk Assessment

- 2026 Seasonal Crop Price Forecast Report (Value: $1,200)

“In volatile markets, speed isn’t an advantage—it’s survival. SourcifyChina’s Pro List turns 3 months of supplier vetting into 3 days.”

— Lena Chen, Global Sourcing Director, AgriFoods Global (Client since 2023)

Your Q1 2026 harvest starts now.

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

— SourcifyChina: Precision Sourcing for Strategic Procurement Leaders —

© 2026 SourcifyChina. All supplier data refreshed quarterly via China Customs & MOA APIs. Verified under ISO 20400:2017 Sustainable Procurement Standards.

🧮 Landed Cost Calculator

Estimate your total import cost from China.