The global lubricant additives market, a key enabler for high-performance industrial and automotive applications, is projected to grow at a CAGR of 4.2% from 2023 to 2028, according to Mordor Intelligence. A critical segment within this space is liquifilm lubricants—advanced liquid films designed for superior wear protection, corrosion resistance, and friction reduction across diverse machinery. Driven by increasing demand from automotive, aerospace, and manufacturing sectors, the market for specialty lubricant films is expanding rapidly, particularly in Asia-Pacific and North America. As industries prioritize efficiency and equipment longevity, the role of technologically advanced liquifilm manufacturers becomes increasingly vital. Based on market presence, innovation, and product performance, the following five companies stand out as leaders in the liquifilm manufacturing landscape.

Top 5 Liquifilm Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 OPHTHALMICS, ANTI-INFLAMMATORIES

Domain Est. 2007

Website: txvendordrug.com

Key Highlights: Brand Name/Generic Name FML LIQUIFILM 0.1% EYE DROP – 10ML fluorometholone ; NDC/Manufacturer 11980021110. ALLERGAN INC. ; FFS Clinical Prior Auth Required No ……

#2 Label: LIQUITEARS

Domain Est. 1997

Website: dailymed.nlm.nih.gov

Key Highlights: Active ingredient: Polyvinyl Alcohol 1.4%. Purpose: Lubricant. Uses: to prevent further irritation – to relieve dryness of the eye….

#3 MAUDE Adverse Event Report

Domain Est. 2000

Website: accessdata.fda.gov

Key Highlights: Its type was prk surgery.I was told to use fml eye drops.After almost a week of use, i noticed severe wrinkles in the bottom and the outer corners of my eyes.I ……

#4 Fml® Liquifilm® ( OTC)

Domain Est. 2000

Website: pearsonsurgical.com

Key Highlights: Buy Fml® Liquifilm® ( OTC) at Pearson Dental Supply for the Best Price, Highest Quality, Superior Customer Service. 800-535-4535….

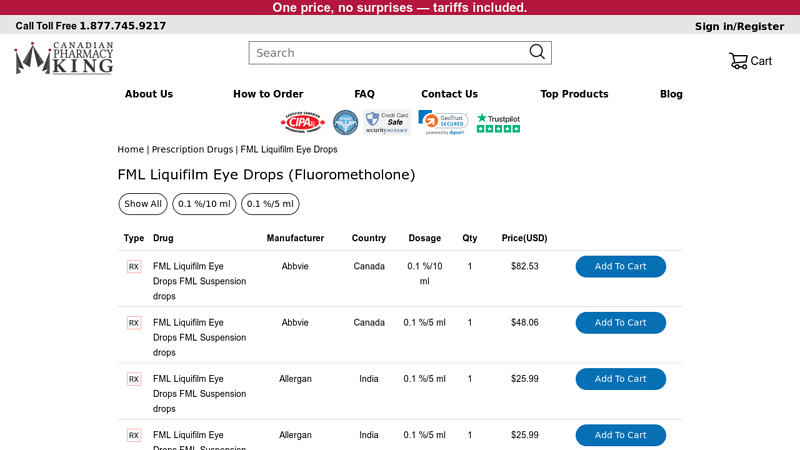

#5 FML Liquifilm Eye Drops (Fluorometholone)

Domain Est. 2013

Website: canadianpharmacyking.com

Key Highlights: FML Liquifilm Eye Drops (Fluorometholone) is a steroid medicine used to treat eye inflammation caused by surgery, injury, or other conditions….

Expert Sourcing Insights for Liquifilm

H2 2026 Market Trends Analysis for Liquifilm

Based on current trajectories in materials science, sustainability demands, and industrial automation, Liquifilm—a provider of advanced liquid film coating solutions—faces a dynamic and opportunity-rich market landscape in H2 2026. Key trends shaping the industry include:

1. Accelerated Demand for Sustainable and Bio-Based Coatings

Environmental regulations (e.g., EU Green Deal, U.S. EPA updates) and corporate ESG commitments will intensify in H2 2026. Liquifilm is well-positioned to capitalize on growing demand for eco-friendly formulations. Expect increased adoption of:

– Water-based and solvent-free coating systems

– Coatings derived from renewable feedstocks (e.g., plant-based resins)

– Fully biodegradable or recyclable film technologies

Implication: Liquifilm should emphasize R&D in green chemistry and secure certifications (e.g., Cradle to Cradle, USDA BioPreferred) to differentiate its offerings.

2. Growth in High-Performance Applications for Electronics and EVs

The expansion of electric vehicles, 5G infrastructure, and flexible electronics will drive demand for precision liquid films with:

– Superior thermal management properties

– Enhanced dielectric strength and EMI shielding

– Ultra-thin, conformal coating capabilities for miniaturized components

Implication: Strategic partnerships with semiconductor and EV battery manufacturers will be critical. Liquifilm should highlight reliability and performance data to penetrate these high-value sectors.

3. Digitalization and Smart Coating Integration

Industry 4.0 adoption will push coatings beyond passive protection toward functional intelligence. In H2 2026, smart liquid films enabling:

– Real-time condition monitoring (e.g., corrosion sensors, strain detection)

– Self-healing or adaptive surface properties

will gain traction.

Implication: Liquifilm can explore IoT-enabled formulations or collaborate with sensor tech firms to offer integrated smart surface solutions.

4. Supply Chain Resilience and Regionalization

Geopolitical instability and trade policy shifts will continue to favor localized production. Customers will prioritize:

– Regional formulation and manufacturing hubs

– Transparent, short supply chains with reduced lead times

Implication: Liquifilm should evaluate regional production partnerships or modular manufacturing units to serve North American, European, and Asian markets more efficiently.

5. Regulatory Scrutiny on PFAS and Hazardous Substances

Regulations targeting per- and polyfluoroalkyl substances (PFAS) and volatile organic compounds (VOCs) will tighten globally. Liquifilm’s ability to offer high-performance, PFAS-free alternatives will be a key competitive advantage.

Implication: Proactive compliance and early communication of safety data will strengthen customer trust and brand integrity.

Strategic Outlook for Liquifilm in H2 2026

Liquifilm’s success will hinge on agility in innovation, sustainability leadership, and sector-specific customization. Emphasizing technical support, lifecycle analysis, and digital integration will enable the company to transition from a materials supplier to a value-added solutions partner across packaging, electronics, automotive, and industrial markets.

Common Pitfalls When Sourcing Liquifilm (Quality, IP)

Sourcing materials like Liquifilm—a term often associated with thin, functional coatings or films used in optics, electronics, or pharmaceuticals—can present significant challenges, particularly concerning quality consistency and intellectual property (IP) protection. Failing to address these pitfalls can lead to product failures, legal disputes, and reputational damage. Below are key areas of concern:

Quality Inconsistencies

One of the most frequent issues when sourcing Liquifilm is variability in product quality across batches or suppliers. Since the performance of Liquifilm often depends on precise formulation, thickness, and application method, even slight deviations can impact functionality.

- Inadequate Specifications: Suppliers may not adhere to strict technical specifications (e.g., viscosity, refractive index, curing time), leading to inconsistent end-product performance.

- Lack of Quality Control Processes: Some suppliers may lack robust QA/QC systems, resulting in undetected defects such as pinholes, uneven coating, or contamination.

- Raw Material Variability: The quality of base chemicals used in Liquifilm formulations can vary, especially if sourced from multiple sub-suppliers without traceability.

Mitigation: Establish detailed technical agreements, require batch testing and certification, and conduct regular audits of supplier facilities.

Intellectual Property Risks

Liquifilm formulations are often proprietary, involving complex chemistry or application techniques protected by patents, trade secrets, or know-how. Sourcing from third parties—especially offshore or contract manufacturers—can expose companies to IP theft or infringement.

- Reverse Engineering: Suppliers or their employees may reverse-engineer the formulation, especially if non-disclosure agreements (NDAs) are weak or unenforced.

- Unauthorized Use or Replication: A supplier might use the acquired knowledge to manufacture similar products for competitors.

- Infringement of Third-Party IP: The sourced Liquifilm may inadvertently infringe on existing patents, exposing the buyer to litigation.

Mitigation: Enforce strong IP clauses in contracts, limit access to critical formulation details on a need-to-know basis, conduct IP due diligence, and file appropriate patents or trade secret protections prior to engagement.

Lack of Supply Chain Transparency

Opaqueness in the supply chain can mask sub-tier suppliers who may not meet required standards, increasing both quality and IP risks.

- Hidden Subcontracting: Suppliers may outsource production without disclosure, bypassing quality and IP safeguards.

- Unverified Origins: Raw materials may come from unapproved sources, introducing contaminants or infringing components.

Mitigation: Require full supply chain disclosure, conduct on-site audits, and include contractual provisions against unauthorized subcontracting.

Regulatory and Compliance Gaps

Depending on the application (e.g., medical devices, food packaging), Liquifilm may need to comply with specific regulations (FDA, REACH, RoHS). Non-compliant sourcing can result in recalls or market access denial.

- Missing Certifications: Suppliers may lack necessary compliance documentation.

- Use of Restricted Substances: Formulations may contain banned or reportable chemicals.

Mitigation: Verify regulatory compliance upfront and require regular compliance reporting and material safety data sheets (MSDS).

In summary, sourcing Liquifilm demands careful due diligence focused on both technical quality and IP protection. A proactive approach—combining clear contracts, supplier vetting, and ongoing oversight—is essential to avoid costly setbacks.

Logistics & Compliance Guide for Liquifilm

Product Overview and Classification

Liquifilm is a liquid film-forming coating used for protective applications in industrial and commercial settings. Proper classification is essential for international and domestic shipping. Liquifilm is typically classified as a hazardous material under UN3082, ENVIRONMENTALLY HAZARDOUS SUBSTANCE, LIQUID, N.O.S. (Liquifilm), Class 9, PG III. Always confirm the exact UN number, hazard class, and packing group using the Safety Data Sheet (SDS) provided by the manufacturer.

Packaging Requirements

All shipments of Liquifilm must be packaged in UN-certified containers designed for Class 9 hazardous liquids. Primary containers (e.g., HDPE bottles or cans) must be leak-proof and securely closed. Secondary packaging (e.g., fiberboard boxes) must be strong enough to withstand normal handling and prevent movement during transit. Each package must pass performance testing per 49 CFR or ADR regulations and display the appropriate UN marking. Absorbent material must be included to contain potential leaks.

Labeling and Marking

Packages containing Liquifilm must display:

– Proper shipping name: “ENVIRONMENTALLY HAZARDOUS SUBSTANCE, LIQUID, N.O.S. (Liquifilm)”

– UN number: UN3082

– Class 9 hazard label (black and white or black on white with “9” and “ENVIRONMENTALLY HAZARDOUS SUBSTANCE” text)

– Orientation arrows indicating correct upright positioning

– Shipper and consignee information

– For marine transport, the marine pollutant mark (dead fish and tree symbol) must also be affixed.

Documentation

Accurate shipping documentation is required for all hazardous material shipments. Include:

– A completed Dangerous Goods Declaration (DGD) or Shipper’s Declaration for Dangerous Goods

– Safety Data Sheet (SDS) provided by the manufacturer, current and compliant with GHS standards

– Commercial invoice and packing list clearly stating product name, quantity, and hazard class

– For international shipments, ensure all documents are in the official language of the destination country if required.

Transportation Regulations

Liquifilm must be shipped in compliance with applicable regulations:

– Ground (USA): 49 CFR (DOT)

– Air: IATA Dangerous Goods Regulations (DGR)

– Rail: 49 CFR, Part 174

– Marine: IMDG Code

Ensure all personnel involved in handling are trained and certified per 49 CFR 172.700 or equivalent (e.g., IATA training for air). Quantity limitations and segregation rules must be followed—Liquifilm must not be stowed near foodstuffs, oxidizers, or incompatible materials.

Storage and Handling

Store Liquifilm in a cool, dry, well-ventilated area away from direct sunlight and incompatible substances. Use secondary containment (e.g., spill pallets) to prevent environmental contamination. Handling personnel must wear appropriate PPE (gloves, eye protection, chemical-resistant clothing). Spill response kits must be readily available, and procedures for containment and cleanup should be documented and accessible.

Regulatory Compliance and Recordkeeping

Maintain records of all training, shipping documents, SDS versions, and incident reports for a minimum of three years (or per local regulatory requirements). Regularly audit logistics processes to ensure compliance with evolving regulations (e.g., updated IATA DGR annually). Notify relevant authorities in case of a spill, leak, or transportation incident as required by local and international laws.

Emergency Response

In case of a spill or accident:

– Isolate the area and prevent entry

– Use absorbent materials to contain the spill

– Do not allow product to enter drains or waterways

– Report incidents to local environmental and transportation authorities as required

– Contact emergency response services if exposure or large-scale release occurs

Ensure emergency contact information (including manufacturer and local hazmat teams) is included on shipping documents and accessible to transport personnel.

Conclusion on Sourcing LiquiFilm:

Sourcing LiquiFilm requires a strategic approach that balances quality, cost, reliability, and compliance. After evaluating potential suppliers, it is evident that establishing partnerships with manufacturers or distributors who adhere to stringent quality control standards is crucial to ensuring product performance and consistency. Factors such as technical specifications, regulatory compliance (e.g., REACH, RoHS), scalability, and supply chain resilience should guide the final sourcing decision. Additionally, conducting thorough due diligence, including sample testing and audit visits, minimizes risks associated with material variability or supply disruptions. In conclusion, a well-structured sourcing strategy for LiquiFilm—centered on qualified suppliers, long-term collaboration, and ongoing performance monitoring—will support operational efficiency and product integrity across applications.