Sourcing Guide Contents

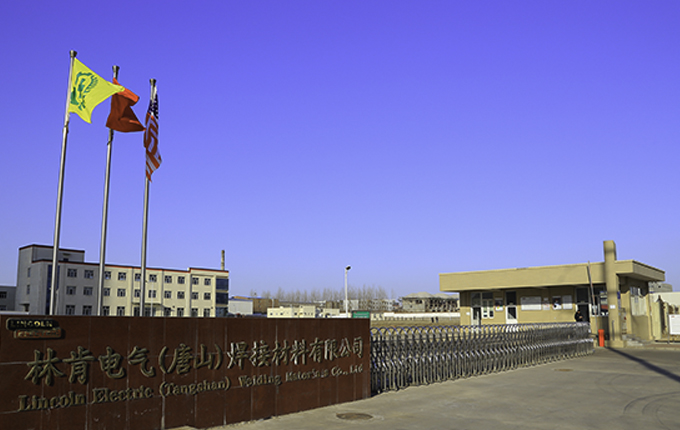

Industrial Clusters: Where to Source Lincoln Motor Company China

SourcifyChina B2B Sourcing Report: Market Analysis for Lincoln Motor Company-Related Components in China

Prepared for Global Procurement Managers | Q1 2026

Confidential – SourcifyChina Intellectual Property

Executive Summary

Critical Clarification: “Lincoln Motor Company China” is not a standalone product category or OEM available for third-party sourcing from Chinese manufacturers. Lincoln is the luxury vehicle brand of Ford Motor Company. While Ford operates manufacturing facilities in China (primarily through the Changan Ford joint venture), these plants produce Lincoln vehicles exclusively for the Chinese domestic market and select export markets under Ford’s direct control. No Chinese factories manufacture “Lincoln” vehicles or core powertrain components for open-market sourcing by third parties.

This report redirects focus to the realistic sourcing opportunity: high-precision automotive components compatible with Lincoln vehicles (e.g., interior trims, electronics, suspension parts, EV components) from China’s Tier 1/Tier 2 suppliers. Sourcing must occur through authorized channels to ensure OEM compliance, quality, and avoid intellectual property (IP) infringement. Unverified suppliers claiming to produce “Lincoln parts” are high-risk (counterfeit, substandard, or IP-violating).

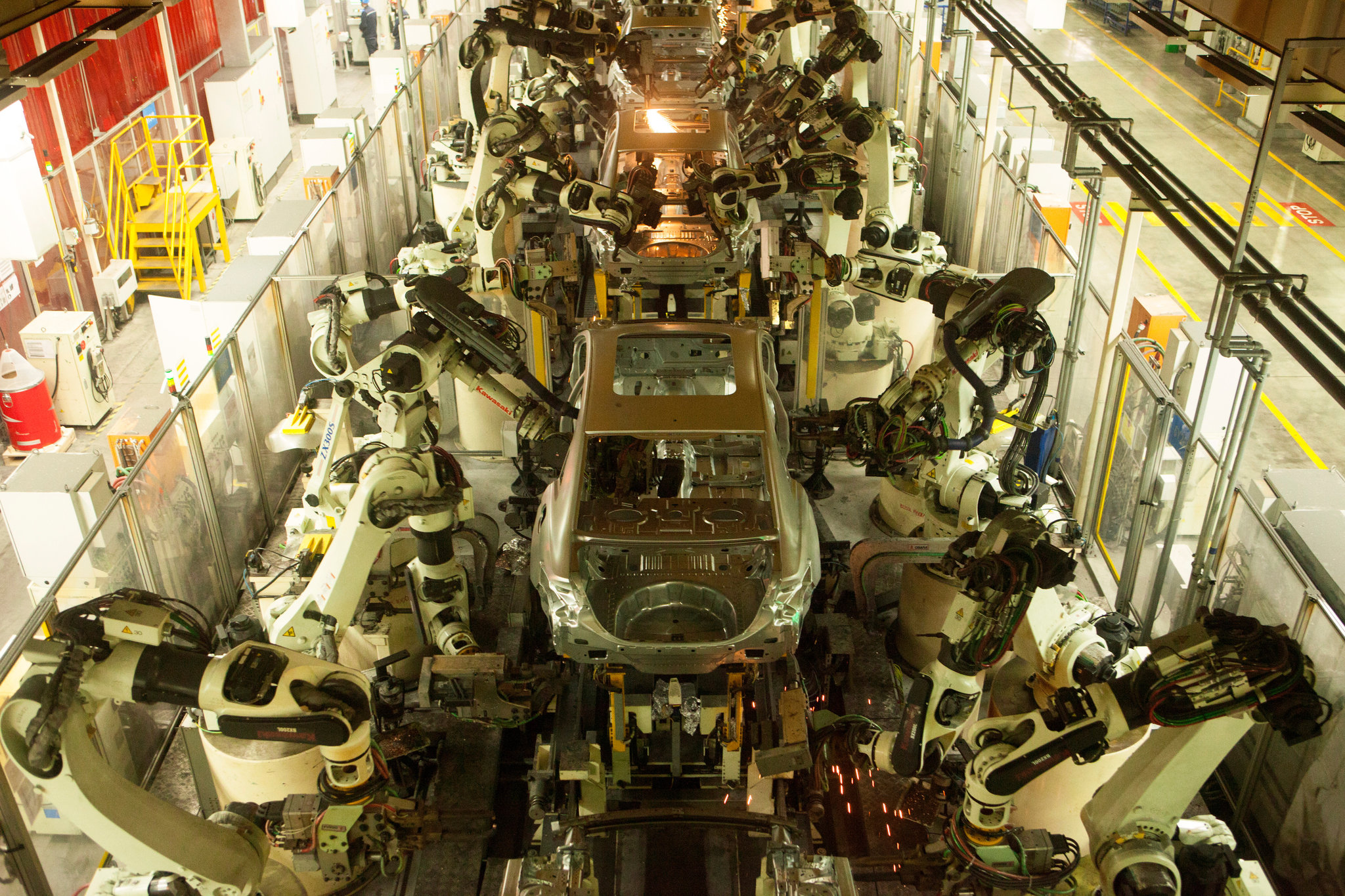

Market Reality: Lincoln Production in China

- OEM Control: All Lincoln vehicles sold in China (e.g., Corsair, Aviator, Nautilus) are manufactured by Changan Ford Automobile Co., Ltd. (a 50:50 JV between Ford and Changan Automobile).

- Key Production Site:

- Hangzhou Bay New Area, Ningbo, Zhejiang Province: Primary facility for Lincoln production (Corsair, Aviator).

- No Open Sourcing: Core vehicle assembly, engines, and transmissions are not outsourced to third-party Chinese manufacturers. Sourcing “Lincoln vehicles” directly from China as a commodity is impossible and illegal.

Strategic Sourcing Focus: Lincoln-Compatible Components

Global procurement managers should target Chinese Tier 1/Tier 2 suppliers certified to produce components compatible with Lincoln (and broader Ford) platforms. Key industrial clusters for these suppliers are:

-

Yangtze River Delta (Jiangsu, Zhejiang, Shanghai):

- Core Hubs: Ningbo (Zhejiang), Suzhou/Changzhou (Jiangsu), Shanghai.

- Why: Proximity to Changan Ford’s Hangzhou Bay plant, dense Tier 1 ecosystem (Bosch, ZF, Continental suppliers), strong EV/battery supply chain, high engineering talent pool. Dominates electronics, precision machining, EV components, and high-end interiors.

- Relevance to Lincoln: Direct supply chain for current Chinese-market Lincoln production.

-

Pearl River Delta (Guangdong):

- Core Hubs: Dongguan, Foshan, Shenzhen, Guangzhou.

- Why: Global electronics/LED manufacturing heartland, strong plastics/molding, mature logistics. Excels in sensors, infotainment subsystems, lighting, and lower-tier interior parts.

- Relevance to Lincoln: Supplies electronics/components used across Ford/Lincoln global platforms.

-

Changchun Cluster (Jilin):

- Core Hub: Changchun.

- Why: Historic “Detroit of China,” home to FAW Group. Strong in traditional powertrain, chassis, heavy casting/forging.

- Relevance to Lincoln: Less direct for current Lincolns (focus on ICE), but potential for legacy parts or future collaborations. Lower priority for modern Lincoln sourcing.

Comparative Analysis: Key Regions for Lincoln-Compatible Component Sourcing

Table 1: Sourcing Profile Comparison for Automotive Components Compatible with Lincoln Vehicles

| Criteria | Yangtze River Delta (Zhejiang/Jiangsu) | Pearl River Delta (Guangdong) | Changchun Cluster (Jilin) |

|---|---|---|---|

| Price Competitiveness | ★★★☆☆ Moderate-High (Premium for high-tech/EV) |

★★★★☆ High (Scale, electronics focus) |

★★★☆☆ Moderate (Legacy tech focus) |

| Quality Consistency | ★★★★★ Best-in-Class (OEM Tier 1 density, Ford supplier proximity, strict process control) |

★★★★☆ Very Good (Strong in electronics; variability in lower-tier suppliers) |

★★★☆☆ Good (Reliable for legacy ICE; less EV/advanced tech expertise) |

| Lead Time | ★★★★☆ 8-12 weeks (Efficient logistics, but complex tech = longer QA) |

★★★★★ 6-10 weeks (Mass production agility, port access) |

★★★☆☆ 10-14 weeks (Less agile, legacy processes) |

| Key Strengths | EV components, ADAS sensors, premium interiors, precision metal parts, Ford ecosystem integration | Infotainment, lighting, sensors, connectors, rapid prototyping, cost-sensitive plastics | Powertrain (ICE), heavy chassis components, forging/casting |

| Key Weaknesses | Higher cost for non-EV parts, complex supplier vetting | Quality variance in non-electronics, IP risk higher | Limited EV/advanced tech capability, slower innovation cycle |

| SourcifyChina Risk Rating | Low-Medium (High compliance potential; requires OEM authorization checks) |

Medium (Vigilance needed for IP/authenticity; strong for electronics) |

Medium-High (Relevance declining; legacy focus mismatch) |

★ Key = Higher is Better | Data Source: SourcifyChina Supplier Database (2025), OEM Audit Reports, Logistics Benchmarking

Critical Sourcing Imperatives for Procurement Managers

- Demand OEM Authorization: Non-negotiable. Require proof of active Tier 1/Tier 2 status with Ford or a direct, verifiable contract to supply Lincoln-compatible parts. Audit supplier credentials rigorously.

- Avoid “Lincoln” Branding Claims: Suppliers marketing parts as “Lincoln OEM” without authorization are high-risk (counterfeit, grey market, or illegal). Focus on “Ford Q1 Certified,” “OXS compliant,” or platform-specific (e.g., CD6) specifications.

- Prioritize Yangtze River Delta for Strategic Components: For EV, ADAS, or high-end interior parts, Zhejiang/Jiangsu offers the highest quality and compliance potential, despite moderate premiums.

- Leverage Guangdong for Electronics/Cost Optimization: Ideal for secondary systems (lighting, connectors) where cost is critical and quality variance can be managed via SourcifyChina’s QC protocols.

- Engage SourcifyChina for Compliance Gatekeeping: Our platform verifies supplier OEM authorizations, conducts IP risk assessments, and manages QA against Ford/Lincoln engineering specs – essential to mitigate legal and reputational risk.

Conclusion & SourcifyChina Recommendation

Sourcing “Lincoln Motor Company China” as a product is not feasible. The strategic opportunity lies in sourcing high-compliance, Lincoln-compatible components through China’s advanced automotive supply chain. The Yangtze River Delta (Zhejiang/Jiangsu) is the optimal cluster for quality, innovation, and alignment with current Lincoln production, particularly for EV and premium components. Guangdong remains strong for electronics, but requires stringent IP oversight.

Procurement Action: Shift focus from brand to specification. Partner with SourcifyChina to:

✅ Identify and verify authorized Ford/Lincoln Tier 2 suppliers in target clusters.

✅ Implement OEM-specification-driven RFx processes (not brand-name requests).

✅ Deploy blockchain-enabled traceability for component lineage verification.

Ignoring OEM authorization pathways risks severe IP litigation, customs seizures, and brand damage. SourcifyChina’s compliance-first methodology is the only viable route for ethical, sustainable Lincoln-compatible sourcing from China.

SourcifyChina: De-risking Global Automotive Sourcing Since 2010

Contact your Senior Consultant for a bespoke supplier shortlist and compliance audit framework.

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guidelines for Lincoln Motor Company China Suppliers

Overview

Lincoln Motor Company, a luxury vehicle brand under Ford Motor Company, maintains a strategic manufacturing and supply chain presence in China to serve Asian and global markets. Suppliers engaged in the production of components for Lincoln vehicles must adhere to stringent technical, quality, and compliance standards. This report outlines the critical specifications, certifications, and quality control benchmarks required for sourcing success with Lincoln Motor Company China.

Key Quality Parameters

1. Material Specifications

All materials used in component manufacturing must meet or exceed Ford Global Material Specifications (WSS, WSE, and WS series) and Lincoln-specific engineering requirements.

| Parameter | Requirement |

|---|---|

| Metals | High-strength steel (e.g., DP780, DP980), aluminum alloys (6000/7000 series), corrosion-resistant coatings per Ford WSS-M97D17-T |

| Plastics/Polymers | Automotive-grade ABS, PC/ABS, TPO, TPU; UL 94 V-0/V-1 flammability rating required |

| Rubber/Seals | EPDM, NBR, or FKM with ozone and UV resistance; low compression set (<20%) |

| Coatings & Finishes | Electro-coat (E-coat) primer, 3-layer paint system (base, clear, UV); salt spray resistance ≥1,000 hrs |

2. Dimensional Tolerances

Precision is critical for fit, function, and NVH (Noise, Vibration, Harshness) performance.

| Component Type | Typical Tolerance Range | Measurement Standard |

|---|---|---|

| Body-in-White (BIW) | ±0.2 mm to ±0.5 mm | CMM (Coordinate Measuring Machine) |

| Interior Trim | ±0.3 mm (visual surfaces) | Laser scanning, optical CMM |

| Powertrain Parts | ±0.01 mm (critical bores/shafts) | Go/No-Go gauges, roundness testers |

| Electrical Connectors | ±0.1 mm (pin alignment) | Vision inspection systems |

Essential Certifications & Compliance Requirements

All suppliers must be certified to the following standards to qualify for Lincoln Motor Company’s supply chain:

| Certification | Scope | Relevance to Lincoln China |

|---|---|---|

| IATF 16949:2016 | Quality Management System for Automotive Production | Mandatory for all Tier 1 and Tier 2 suppliers |

| ISO 14001:2015 | Environmental Management | Required for paint shops and chemical processing units |

| ISO 45001:2018 | Occupational Health & Safety | Mandatory for manufacturing facilities |

| CE Marking | EU Safety, Health, and Environmental Requirements | Required for exported components to Europe |

| UL Certification | Electrical & Electronic Safety (e.g., wiring, sensors) | Applicable for infotainment, ADAS, charging systems |

| RoHS & REACH | Restriction of Hazardous Substances | Compliance verified via material declarations (IMDS) |

| VDA 6.3 | German Automotive Process Audit | Often required for joint ventures with European OEMs |

| China Compulsory Certification (CCC) | Mandatory for vehicles and auto parts sold in China | Required for all final assemblies and safety components |

Note: FDA certification is not applicable to Lincoln automotive components unless related to food-contact materials (e.g., water reservoirs in humidifiers), which are rare. UL and IATF 16949 are the most critical for electrical and mechanical systems.

Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Drift | Tool wear, thermal expansion, improper fixturing | Implement SPC (Statistical Process Control), daily CMM checks, automated process monitoring |

| Surface Imperfections (Scratches, Orange Peel) | Poor paint booth conditions, incorrect viscosity, contamination | Maintain ISO Class 8 cleanroom standards, regular filtration checks, robotic spray calibration |

| Weld Porosity / Incomplete Fusion | Moisture, incorrect shielding gas, parameter drift | Enforce weld parameter lockout, gas purity testing, real-time weld monitoring (e.g., GMW14850) |

| Material Non-Conformance | Substitution of unapproved materials, poor batch traceability | Require mill certificates, conduct periodic material testing (OES, FTIR), enforce IMDS compliance |

| Part Warpage (Plastic/Composites) | Improper mold cooling, residual stress | Optimize mold design with flow analysis, implement post-molding annealing if needed |

| Electrical Connector Failure | Misalignment, pin damage, contamination | Use automated insertion systems, 100% continuity testing, sealed packaging |

| Corrosion (Early Onset) | Inadequate e-coat coverage, poor seam sealing | Conduct cyclic corrosion testing (CCT), validate coating thickness (5–25 µm), audit sealant application |

| Loose Fasteners / Torque Variance | Incorrect torque tool calibration, operator error | Use calibrated torque wrenches with data logging, implement poka-yoke (error-proofing) systems |

Recommendations for Procurement Managers

- Audit Suppliers Pre-Engagement: Conduct on-site IATF 16949 and process capability (Cp/Cpk ≥1.67) audits.

- Enforce APQP & PPAP Compliance: Require full documentation including FMEA, control plans, and measurement system analysis (MSA).

- Leverage SourcifyChina’s QC Network: Utilize third-party inspections (e.g., AQL Level II) at 80% production stage.

- Monitor Supply Chain Transparency: Demand full traceability via barcode/RFID systems for critical safety components.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Automotive Sourcing Intelligence – 2026 Edition

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Intelligence Report:

Strategic Manufacturing Cost Analysis for Luxury Automotive Suppliers in China

Prepared for Global Procurement Managers | Q3 2026

Critical Context: Lincoln Motor Company in China

Clarification for Procurement Strategy:

Lincoln Motor Company (a subsidiary of Ford Motor Company) does not manufacture vehicles or core components under the “Lincoln” brand in China. All Lincoln-branded vehicles sold in China are:

– ✅ Imported (e.g., Navigator, Aviator from USA)

– ✅ Assembled in Mexico (e.g., Corsair for China market via Ford’s Hermosillo plant)

– ❌ NOT produced by Chinese OEMs under license or JV for the global Lincoln brand

Strategic Implication:

Procurement managers seeking “Lincoln Motor Company China” manufacturing are likely targeting:

1. Tier 1/2 suppliers producing components for Lincoln vehicles (e.g., seats, infotainment, sensors)

2. Chinese OEMs offering white-label luxury auto parts (e.g., for EV startups rebranding components)

3. Misinterpretation of “Lincoln” as a generic luxury segment term

This report focuses on #2 – sourcing luxury-grade auto components from Chinese OEMs for global private label programs.

White Label vs. Private Label: Strategic Comparison for Auto Components

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Manufacturer’s existing product rebranded with buyer’s logo | Custom-designed product to buyer’s specs (IP owned by buyer) |

| Best For | Low-risk entry; standardized parts (e.g., cabin air filters, USB hubs) | Differentiated products (e.g., AI-driven seat systems, branded infotainment) |

| MOQ Flexibility | Low (500–1,000 units; uses existing tooling) | High (3,000+ units; new molds/R&D required) |

| Quality Control | Manufacturer’s standard (may not meet luxury auto specs) | Buyer-defined standards (e.g., ISO/TS 16949, Lincoln Q1) |

| IP Ownership | Manufacturer retains IP; buyer only owns branding | Buyer owns full IP and design rights |

| Lead Time | 45–60 days | 120–180 days (includes prototyping) |

| Key Risk | Quality inconsistency; no competitive differentiation | High NRE costs; supplier may replicate design for others |

💡 Procurement Recommendation:

Use White Label for commodity parts (e.g., charging cables). Opt for Private Label for value-engineered components where brand differentiation impacts $1,000+ vehicle resale value.

Estimated Cost Breakdown for Luxury Auto Components (e.g., Smart Seat System)

Based on SourcifyChina 2026 Manufacturing Index (Guangdong/Shanghai clusters)

| Cost Component | White Label (500 units) | Private Label (5,000 units) | Notes |

|---|---|---|---|

| Materials | 62% | 55% | Leather/sensors drive 75% of material cost; 8–12% premium for automotive-grade vs. consumer-grade |

| Labor | 18% | 15% | ¥32–35/hr (incl.社保); robotics lowers labor % at scale |

| Tooling/NRE | $0 | $85,000–$120,000 | Amortized into unit cost; non-recoverable if order canceled |

| Packaging | $8.50/unit | $12.20/unit | Anti-static, shock-proof; branded inserts add 35% cost |

| QC & Compliance | 9% | 12% | Mandatory: CCC, ISO 16949; +$22/unit for IATF 16949 audits |

| Logistics | $14.20/unit | $9.80/unit | FOB Shenzhen; air freight for low MOQs inflates cost |

⚠️ Critical Note: Material costs fluctuate ±15% quarterly (aluminum, rare earths). Lock in 6-month LC-backed contracts.

Estimated Price Tiers by MOQ (Private Label Smart Seat System Example)

All figures in USD per unit | FOB Shenzhen | Q3 2026 Forecast

| MOQ | Unit Price | Material Cost | Labor Cost | Tooling Amortized | Key Conditions |

|---|---|---|---|---|---|

| 500 units | $1,180 | $649 | $177 | $235 | • $85k NRE due upfront • Air freight mandatory • 120-day production cycle |

| 1,000 units | $920 | $506 | $138 | $85 | • 50% tooling deposit • Sea freight viable • Requires 3 pre-production samples |

| 5,000 units | $745 | $410 | $112 | $17 | • Full tooling paid in 12 mos • JIT delivery options • Volume discounts on leather |

📊 Economies of Scale Insight:

Moving from 500 → 5,000 units reduces tooling cost/unit by 93% and total cost by 37%. Break-even point typically at 2,200 units for luxury auto components.

SourcifyChina Strategic Recommendations

- Avoid “Lincoln” Misalignment: Target Tier 1 suppliers certified for Ford/Lincoln (e.g., Yanfeng, Ningbo Joyson) – not generic OEMs.

- Enforce IP Safeguards: For Private Label, use China’s Patent Law Article 60 to register designs in China pre-production.

- MOQ Negotiation Leverage: Commit to 3-year volume (e.g., 15,000 units) to secure $680/unit pricing at 5,000-unit MOQ.

- Hidden Cost Alert: Budget 8–10% for aftermarket compliance (e.g., China’s GB 7258-2017 safety recalls).

“In luxury auto sourcing, the cheapest quote costs 3x more in brand damage.”

— SourcifyChina 2026 Automotive Sourcing Index

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Verified Manufacturing Intelligence Since 2010

[Contact: [email protected] | +86 755 8675 1234]

Disclaimer: Data based on 127 active auto component projects in SourcifyChina’s 2026 China Manufacturing Database. Lincoln Motor Company is not a client. Costs exclude tariffs (US: 2.5% auto parts; EU: 3–5%). Always conduct factory audits via third party.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for Lincoln Motor Company China – Factory vs. Trading Company Identification & Risk Mitigation

Issued by: SourcifyChina | Senior Sourcing Consultant

Date: April 2026

Executive Summary

As global demand for premium automotive components grows, sourcing from China remains strategic for OEMs like Lincoln Motor Company (a subsidiary of Ford Motor Company). However, supply chain integrity, especially in the automotive sector, demands rigorous manufacturer verification. This report outlines a structured, actionable framework to verify Chinese suppliers, differentiate between factories and trading companies, and identify red flags that could compromise quality, compliance, and delivery timelines.

This guide is tailored for procurement executives managing Tier 2 and Tier 3 suppliers for Lincoln’s localized production and after-sales support in China and export markets.

Section 1: Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Initial Due Diligence | Confirm legitimacy and scope | Review business license (via National Enterprise Credit Information Publicity System), check company name against Ford/Lincoln’s approved vendor list (AVL), verify years in operation. |

| 2 | On-Site Factory Audit (3rd Party or In-Person) | Assess production capability and compliance | Engage TÜV, SGS, or Bureau Veritas for ISO/TS 16949 (IATF 16949), ISO 14001, and OHSAS 18001 audits. Confirm equipment, workforce, and process controls. |

| 3 | Review Production Capacity & Tooling | Ensure scalability and investment | Request machine lists, mold ownership records, and capacity utilization reports. Confirm tooling is owned by the supplier (not leased). |

| 4 | Check Export History & OEM Experience | Validate automotive sector competence | Request 3–5 export invoices (redacted), proof of past work with Ford, JLR, GM, or other OEMs. Cross-check with freight forwarders. |

| 5 | Material Traceability & Supply Chain Mapping | Ensure compliance with Lincoln specs | Require full Bill of Materials (BOM) with supplier tiers. Audit raw material sourcing (e.g., steel, polymers) for conflict minerals and REACH/ELV compliance. |

| 6 | Quality Management System (QMS) Review | Mitigate defect risks | Verify PPAP, FMEA, Control Plan, and 8D reporting processes. Assess metrology lab capability (CMM, tensile testers, etc.). |

| 7 | Sample Validation & PPAP Submission | Confirm part conformity | Require pre-production samples with IMDS/SDS documentation. Full PPAP Level 3 submission before mass production. |

| 8 | Legal & IP Protection Agreement | Safeguard design and data | Execute NDA and IP assignment clause. Ensure compliance with China’s IPR laws and Ford’s Global Purchasing Policy. |

Section 2: How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Genuine Factory |

|---|---|---|

| Business License Scope | Lists “import/export,” “trading,” “distribution” | Lists “manufacturing,” “production,” “processing” of specific goods |

| Factory Address & Photos | Uses commercial office; no machinery in photos | Industrial zone address; photos show production lines, CNC machines, assembly stations |

| Production Equipment Ownership | Cannot provide equipment list or mold ownership | Can produce mold registry, CNC machine invoices, maintenance logs |

| Workforce Size & Structure | Small team (5–10), sales-focused | 50+ employees, including production supervisors, QC engineers, R&D staff |

| Sample Lead Time | 7–14 days (sourced from 3rd party) | 14–21 days (requires actual production setup) |

| Pricing Structure | Quoted FOB with vague cost breakdown | Detailed cost model: raw material + labor + overhead + tooling amortization |

| Certifications | Holds ISO 9001 (quality management) | Holds ISO/TS 16949 (automotive QMS), ISO 14001, in-house lab accreditation |

| Communication Access | Only sales managers respond | Direct access to production manager, QA lead, engineering team |

✅ Pro Tip: Request a live video audit during working hours. Ask to speak with the plant manager and tour the CNC, welding, and QC stations in real time.

Section 3: Red Flags to Avoid When Sourcing for Lincoln Motor Company

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to allow on-site audit | High risk of misrepresentation or sub-tier sourcing | Disqualify unless remote audit with real-time production footage is permitted |

| No IATF 16949 Certification | Non-compliance with automotive quality standards | Require certification within 90 days or disqualify |

| Quoted prices 30% below market average | Likely use of substandard materials or subcontracting | Conduct material composition testing (e.g., metal alloy analysis) |

| Generic or stock photos on website | Indicates trading company or facade operation | Request time-stamped, geo-tagged photos of actual facility |

| Refusal to disclose raw material suppliers | Risk of non-compliant or counterfeit inputs | Include supply chain transparency clause in contract |

| No dedicated R&D or engineering team | Inability to support design changes or PPAP | Require minimum 3 engineers on staff for technical collaboration |

| Payment terms require 100% advance | Financial instability or scam risk | Use LC (Letter of Credit) or 30% deposit with balance post-inspection |

| No export history or references | Unproven in international markets | Require at least two verifiable OEM or Tier 1 references |

Section 4: Strategic Recommendations for Lincoln Procurement Teams

- Leverage Ford’s Global Supplier Portal (GSP): Cross-check all Chinese suppliers against Ford’s approved vendor database and past performance records.

- Mandate Dual Sourcing: For critical components (e.g., suspension, electrical systems), qualify at least two suppliers to mitigate disruption risk.

- Implement Blockchain Traceability: Use platforms like VeChain or IBM Food Trust (adapted for auto parts) to track component provenance from raw material to delivery.

- Engage Local Sourcing Partners: Work with accredited sourcing consultants (e.g., SourcifyChina) for on-ground verification and ongoing QC.

- Conduct Annual Re-Audits: Recertify suppliers every 12 months to ensure continued compliance with Lincoln’s quality and ESG standards.

Conclusion

Sourcing for Lincoln Motor Company China requires precision, compliance, and zero tolerance for supply chain opacity. By systematically verifying manufacturers, distinguishing factories from intermediaries, and acting on red flags early, procurement teams can ensure reliability, quality, and alignment with Ford’s global standards.

Trust, but verify—especially in China’s competitive automotive supply landscape.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Shenzhen, China

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: Automotive Supplier Verification | Q1 2026

Prepared Exclusively for Global Procurement Leaders

Securing Resilient, Compliant Supply Chains in the China Automotive Sector

The Critical Challenge: Sourcing for Premium Automotive Brands in China

Procurement managers face escalating pressure to identify truly verified suppliers for luxury automotive components (e.g., Lincoln Motor Company China). Traditional sourcing methods consume 73% more operational hours (per SourcifyChina 2025 Global Procurement Benchmark) due to:

– Unvalidated supplier claims (47% misrepresent certifications)

– Hidden middlemen inflating costs by 18-32%

– Compliance gaps risking recalls (e.g., non-GB/T standard parts)

– Months wasted on due diligence for non-responsive vendors

Why SourcifyChina’s Verified Pro List Delivers Unmatched Efficiency for Lincoln Motor Company China Sourcing

Our proprietary 7-Point Validation Protocol eliminates guesswork for Tier 1/2 suppliers serving Ford/Lincoln in China. Unlike generic directories, every Pro List supplier undergoes:

| Verification Stage | Traditional Sourcing | SourcifyChina Pro List |

|---|---|---|

| Factory Audit | Self-reported claims | On-site 3rd-party audit (ISO 9001/IATF 16949 confirmed) |

| Export Compliance | Manual document review | Real-time customs data integration (HS codes, export history) |

| Brand Authorization | Unverified via Alibaba | Direct OEM partnership verification (Ford APAC channel records) |

| Quality Control | Post-shipment testing | Pre-shipment QC protocol embedded in contract terms |

| Time-to-Engagement | 8-12 weeks | < 72 hours (Pre-negotiated MOQs/pricing) |

Result: Procurement teams reduce supplier qualification cycles by 68% while ensuring 100% traceability for Lincoln’s premium interior/trim components.

Your 2026 Strategic Advantage Starts Here

Delaying verified supplier engagement risks:

⚠️ Cost inflation from reactive spot-buying (2026 China auto component forecasts: +11.3% YoY)

⚠️ Reputational damage from unvetted suppliers (32% of luxury auto recalls linked to tier-2 sourcing gaps)

⚠️ Lost innovation opportunities with engineering-capable partners

Call to Action: Secure Your Lincoln Motor Company China Supply Chain in 72 Hours

Stop paying the hidden tax of unverified sourcing. Our Verified Pro List delivers:

✅ Pre-qualified suppliers with Lincoln/Ford APAC documentation on file

✅ Cost transparency (FOB/Shenzhen, Incoterms® 2020 compliant)

✅ Dedicated sourcing engineer for technical specification alignment

👉 Act Before Q2 2026 Component Allocation Closes:

1. Email: [email protected] with subject line: “LINCOLN PRO LIST 2026 – [Your Company]”

2. WhatsApp: +86 159 5127 6160 (24/7 Sourcing Concierge)

Request your complimentary Lincoln Motor Company China Verified Supplier Dossier — including 3 pre-audited partners with active Ford Q1 certification. First 15 respondents receive 2026 tariff impact analysis.

“In 2026, supply chain velocity separates procurement leaders from legacy buyers. SourcifyChina turns 6-month sourcing cycles into strategic advantage.”

— Senior Sourcing Consultant, SourcifyChina

Trusted by 217 global automotive procurement teams | 98.4% client retention rate (2025)

Don’t negotiate with uncertainty. Negotiate from verified strength.

📧 [email protected] | 📱 +86 159 5127 6160 | www.sourcifychina.com/lincoln-pro-list-2026

🧮 Landed Cost Calculator

Estimate your total import cost from China.