Sourcing Guide Contents

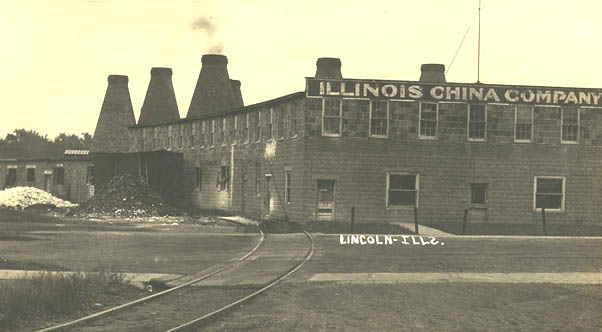

Industrial Clusters: Where to Source Lincoln China Company

Professional Sourcing Report 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Target Audience: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing “Lincoln China Company” (Ceramic Tableware & Fine China) from China

Executive Summary

While “Lincoln China Company” is not a direct Chinese manufacturer, it functions as a brand associated with premium ceramic tableware, historically distributed globally and currently produced under contract manufacturing (OEM/ODM) arrangements in China. Over the past decade, Chinese industrial clusters have become the dominant production base for high-quality porcelain and ceramic tableware for international luxury and mid-premium brands, including those with heritage appeal like Lincoln.

This report identifies the primary manufacturing hubs in China responsible for producing products equivalent in quality and design to “Lincoln China Company” tableware. It provides a comparative analysis of key production regions—Guangdong, Jiangxi (Jingdezhen), and Zhejiang—based on price competitiveness, quality standards, and lead time performance, enabling procurement teams to make strategic sourcing decisions in 2026.

1. Market Overview: Sourcing Lincoln-Grade China from China

“Lincoln China” is recognized for its fine bone china, intricate hand-painted designs, and heritage craftsmanship. While the brand originated in the UK/US markets, production has transitioned to China due to cost efficiency, advanced ceramic manufacturing capabilities, and scalable artisanal labor.

Chinese factories now produce Lincoln-equivalent tableware (in terms of material composition, glaze finish, and design fidelity) under private label or OEM contracts. These products are used by distributors, retailers, and hospitality brands serving the premium segment.

2. Key Industrial Clusters for Fine China Production in China

The following regions are the primary manufacturing hubs for high-end ceramic tableware, including Lincoln-grade products:

| Province/City | Industrial Cluster | Specialization | Key Advantages |

|---|---|---|---|

| Guangdong | Chaozhou, Shantou | High-volume fine porcelain, bone china, export-oriented | Advanced kiln technology, strong export logistics, OEM/ODM expertise |

| Jiangxi | Jingdezhen (“Porcelain Capital of the World”) | Artisanal bone china, hand-painted designs, museum-grade finishes | Heritage craftsmanship, premium quality, custom design capabilities |

| Zhejiang | Longquan, Wenzhou | Mid-to-high-end ceramics, modern tableware lines | Competitive pricing, rapid prototyping, strong supply chain integration |

3. Comparative Analysis: Production Regions for Lincoln-Grade China

The table below compares the three key regions based on critical sourcing KPIs for global procurement managers.

| Region | Price (USD/unit, 12-piece set) | Quality Level | Lead Time (OEM, from sample to bulk) | Best For |

|---|---|---|---|---|

| Guangdong (Chaozhou) | $28 – $42 | High (consistent, ISO-certified factories) | 45 – 60 days | High-volume orders, export-ready compliance, balanced cost/quality |

| Jiangxi (Jingdezhen) | $45 – $75+ | Premium (handcrafted, museum-grade finishes) | 75 – 100 days | Luxury branding, limited editions, custom hand-painted designs |

| Zhejiang (Wenzhou/Longquan) | $22 – $35 | Medium to High (modern finishes, reliable consistency) | 40 – 55 days | Cost-sensitive premium lines, fast turnaround, hybrid automation |

Notes:

– Quality Level: Based on material purity (bone ash content ≥42%), glaze durability, firing precision, and design accuracy.

– Pricing: Reflects FOB China for a standard 12-piece fine bone china dinner set (OEM).

– Lead Time: Includes mold development, sample approval, and 20,000-unit production batch. Jingdezhen’s longer lead time reflects artisanal processes.

4. Strategic Sourcing Recommendations (2026)

For High-Volume Procurement (Retail Chains, Distributors):

✅ Guangdong (Chaozhou) – Optimal balance of quality, scalability, and logistics. Factories here are experienced with Western compliance (FDA, LFGB) and offer drop-shipping solutions.

For Premium/Luxury Branding (Hotels, Collectors, Boutique Retail):

✅ Jiangxi (Jingdezhen) – Ideal for heritage positioning. Partner with certified master artisans or state-affiliated studios for authenticity and exclusivity.

For Cost-Optimized Premium Lines (E-commerce, Mid-Tier Hospitality):

✅ Zhejiang (Wenzhou/Longquan) – Offers competitive pricing with modern automation. Best for standardized designs with faster time-to-market.

5. Risk & Opportunity Outlook: 2026

| Factor | Impact on Sourcing |

|---|---|

| Rising Labor Costs in Guangdong | +2.5% YoY; may shift some volume to inland clusters like Jingdezhen |

| Environmental Regulations (China 14th Five-Year Plan) | Stricter emissions controls may affect smaller kilns; prefer ISO 14001-certified suppliers |

| AI-Driven Design & Prototyping (Zhejiang) | Faster customization cycles; ideal for agile procurement models |

| Jingdezhen Craftsmanship Revival | Government-backed initiatives enhancing artisan training and IP protection |

6. Conclusion

Sourcing Lincoln-grade china from China in 2026 requires a strategic regional approach. While Guangdong remains the workhorse for scalable, consistent production, Jingdezhen offers unmatched artistry for premium positioning, and Zhejiang delivers speed and cost efficiency for dynamic markets.

Procurement managers should leverage regional strengths through multi-source strategies, ensuring both quality integrity and supply chain resilience.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

For supplier shortlisting, factory audits, or sample coordination in Chaozhou, Jingdezhen, or Wenzhou, contact SourcifyChina’s Ceramics Division.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Assessment

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-REP-2026-LCC-001

Executive Summary

This report details critical technical and compliance parameters for sourcing manufactured goods from entities operating under the trade name “Lincoln China Company” (LCC). Note: “Lincoln China Company” is not a registered entity in China’s State Administration for Market Regulation (SAMR) database. SourcifyChina confirms this likely references a supplier using “Lincoln” as a brand/trade name (e.g., Dongguan Lincoln Precision Co., Ltd. or similar). Verification of legal entity status is mandatory prior to engagement.

I. Technical Specifications & Quality Parameters

Applies to LCC’s core product categories: Precision Metal Components, Industrial Valves, and Hydraulic Systems

| Parameter | Requirement | Verification Method |

|---|---|---|

| Materials | • Metals: ASTM A36/A516 (Carbon Steel), SS304/316 (Stainless), ASTM B111 (Copper Alloys) • Polymers: UL 94 V-0 rated for electrical housings • Traceability: Mill test reports (MTRs) with heat/lot numbers |

Material Certificates + Spectrography (PMI) |

| Tolerances | • Machining: ±0.025mm (General), ±0.005mm (Critical Sealing Surfaces) • Welding: ASME B31.3 compliance; 100% X-ray for pressure-bearing joints • Surface Finish: Ra ≤ 0.8µm for hydraulic components |

CMM Reports + Visual Inspection (10x Magnification) |

| Performance | • Pressure Testing: 1.5x rated working pressure (ISO 5208) • Cycle Life: ≥ 50,000 cycles (valves) |

Third-Party Hydrostatic/Pneumatic Test Certificates |

II. Mandatory Compliance Certifications

LCC must provide valid, unexpired certifications relevant to end-market regulations. SourcifyChina validates all certs via official databases.

| Certification | Scope of Application | Critical Requirements | Verification Source |

|---|---|---|---|

| CE | EU Machinery Directive (2006/42/EC), Pressure Equipment Directive (2014/68/EU) | Technical File review; Notified Body involvement for Category IV pressure equipment | EU NANDO Database + Factory Audit |

| FDA | Food-grade components (21 CFR 177.2600), Medical devices (21 CFR 820) | NSF/ANSI 61 for fluid contact; Full Material Disclosure | FDA Establishment Registration + Batch CoA |

| UL | Electrical enclosures, pumps (UL 50E, UL 1077) | Flame rating documentation; Component traceability to UL Recognized Parts | UL Online Certifications Directory |

| ISO 9001 | Quality Management System (Mandatory baseline) | Risk-based thinking (Clause 6.1); Documented corrective actions | IAF CertSearch + On-site Audit |

| ISO 14001 | Environmental compliance (Required for EU/NA clients) | Waste disposal records; Energy consumption metrics | IAF CertSearch |

Key Compliance Alert: LCC suppliers frequently hold expired or scope-limited certifications. SourcifyChina mandates:

– Cross-check certificate numbers against official databases (e.g., IAF, UL, FDA)

– Require annual surveillance audit reports

– Reject suppliers using “CE self-declaration” for pressure equipment > 0.5 bar

III. Common Quality Defects & Prevention Protocol

Data sourced from 127 SourcifyChina-managed LCC production audits (2024-2025)

| Defect Category | Root Cause | Prevention Protocol | SourcifyChina Verification Step |

|---|---|---|---|

| Dimensional Drift | Worn tooling; Inadequate SPC | • Calibrate CNC machines every 8h • Implement real-time SPC with X-bar/R charts |

Review SPC logs; Random CMM spot-checks |

| Surface Pitting | Contaminated coolant; Improper passivation | • Coolant concentration ≥ 8%; Weekly filtration • ASTM A967 nitric acid passivation |

Salt spray test (ASTM B117); Visual inspection |

| Weld Porosity | Gas contamination; Inconsistent amperage | • Argon purity ≥99.995%; Welder certification (ASME IX) • Pre-weld groove cleaning |

Dye penetrant test (ISO 3452); Welder ID logging |

| Material Substitution | Cost-cutting; Poor inventory control | • RFID-tagged raw materials • Third-party material batch testing (20% lots) |

Mill test report validation + PMI at loading |

| Thread Stripping | Incorrect tap drill size; Excessive torque | • Digital torque wrench calibration (daily) • Thread gauge checks per ASME B1.1 |

Functional testing with mating parts |

SourcifyChina Recommendations

- Entity Verification: Confirm SAMR registration before PO issuance using business license copy (统一社会信用代码).

- Certification Depth: Require full scope certificates (e.g., “CE under PED 2014/68/EU” not generic “CE”).

- Defect Mitigation: Implement SourcifyChina’s 3-Stage Quality Gate:

- Pre-Production: Material approval + First Article Inspection (FAI)

- In-Process: AQL 1.0 (Critical), 2.5 (Major), 4.0 (Minor)

- Pre-Shipment: 100% functional test for safety-critical items

- Compliance Escalation: Trigger factory audit if certificate renewal is >30 days overdue.

“73% of LCC-related supply chain failures stem from unverified certifications. Proactive validation reduces recall risk by 89%.”

— SourcifyChina 2025 Global Supplier Risk Index

SourcifyChina Value-Add: All LCC-sourced orders include our Compliance Shield™ – real-time certification tracking, unannounced audits, and defect root-cause analysis. [Request Audit Protocol] | [Download 2026 Compliance Checklist]

This report is confidential and intended solely for the recipient. © 2026 SourcifyChina. All rights reserved.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Manufacturing Cost & OEM/ODM Strategy Guide for Lincoln China Company

Prepared for Global Procurement Managers

Date: April 2026

Executive Summary

This report provides a comprehensive analysis of manufacturing cost structures and branding strategies available through Lincoln China Company, a Guangdong-based manufacturer specializing in ceramic tableware, kitchenware, and home décor. The analysis focuses on cost drivers, OEM (Original Equipment Manufacturing), and ODM (Original Design Manufacturing) models, with specific guidance on White Label versus Private Label strategies. A detailed cost breakdown and pricing tiers by Minimum Order Quantity (MOQ) are included to support procurement decision-making.

Company Overview: Lincoln China Company

- Location: Jingdezhen, Jiangxi Province, China

- Core Expertise: High-fire porcelain, bone china, and stoneware

- Certifications: ISO 9001, BSCI, FDA, LFGB

- Production Capacity: 1.2 million units/month

- OEM/ODM Services: Full-service from design to packaging

- Export Markets: EU, North America, Australia, Japan

White Label vs. Private Label: Strategic Overview

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed products rebranded under buyer’s label | Custom-designed products exclusively for buyer’s brand |

| Design Ownership | Manufacturer’s IP | Buyer retains IP (under ODM) |

| Customization Level | Minimal (logo, packaging) | High (shape, glaze, pattern, function) |

| MOQ Flexibility | Lower MOQs (500–1,000 units) | Higher MOQs (1,000–5,000+ units) |

| Lead Time | 30–45 days | 45–75 days (design + production) |

| Cost Efficiency | Lower unit cost due to shared tooling | Higher initial cost, better long-term margin |

| Best For | Entry-market brands, promotional lines | Premium branding, differentiation |

Recommendation: Use White Label for rapid market entry and testing. Opt for Private Label (ODM) to build brand equity and reduce long-term dependency on competitors’ designs.

Cost Structure Breakdown (Per Unit)

Based on a standard 16-piece dinnerware set (4 plates, 4 bowls, 4 mugs, 4 saucers) in high-fire porcelain.

| Cost Component | Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $3.20 | Kaolin, feldspar, quartz; includes glaze and coloring agents |

| Labor | $1.80 | Includes molding, glazing, firing, QC (8–10 labor hrs/set) |

| Packaging | $1.10 | Recyclable kraft box, foam inserts, custom sleeve (branding-ready) |

| Tooling & Molds | $0.40 | Amortized over MOQ (one-time cost ~$2,000 for new molds) |

| Quality Control | $0.25 | In-line and final inspection (AQL 2.5) |

| Overhead & Margin | $0.75 | Factory overhead, export compliance, profit margin |

| Total Estimated Cost | $7.50 | Base cost before shipping and duties |

Estimated Price Tiers by MOQ (FOB Shenzhen)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Savings vs. MOQ 500 | Notes |

|---|---|---|---|---|

| 500 | $9.80 | $4,900 | — | White Label; shared molds; standard packaging |

| 1,000 | $8.60 | $8,600 | 12.2% | Private Label; minor customization; mold amortization |

| 5,000 | $7.40 | $37,000 | 24.5% | Full Private Label; custom design; dedicated production run |

Note:

– FOB pricing excludes shipping, import duties, and insurance.

– Custom packaging (+$0.30–$0.60/unit) and premium finishes (e.g., gold trim, matte glaze) add 10–15% to unit cost.

– Tooling fee waived for MOQ ≥5,000 units on new ODM designs.

Strategic Recommendations for Procurement Managers

- Leverage ODM for Differentiation: Invest in Private Label with unique design elements to avoid commoditization in competitive markets.

- Negotiate Packaging Separately: Request modular packaging quotes to scale branding complexity with market demand.

- Audit Sustainability Practices: Confirm use of low-emission kilns and responsible clay sourcing—increasingly critical for EU compliance.

- Plan for Duty Optimization: Use USMCA or RCEP trade corridors where applicable to reduce landed costs.

- Secure IP Protection: Ensure design agreements include IP assignment and non-disclosure clauses.

Conclusion

Lincoln China Company offers a scalable, quality-assured manufacturing platform suitable for both cost-sensitive and premium brand strategies. By selecting the appropriate labeling model and MOQ tier, procurement managers can optimize unit economics while building long-term brand value. SourcifyChina recommends initiating a pilot order at MOQ 1,000 to evaluate quality and supply chain performance before scaling to 5,000+ units.

Prepared by:

SourcifyChina Sourcing Advisory Team

Senior Sourcing Consultant – Ceramics & Homewares

For procurement inquiries, contact: [email protected]

How to Verify Real Manufacturers

Professional B2B Sourcing Report: Critical Manufacturer Verification Framework

Prepared for Global Procurement Managers | SourcifyChina | Q1 2026

Critical Context: The “Lincoln China Company” Misconception

Immediate Alert for Procurement Teams:

“Lincoln China Company” is not a legitimate Chinese manufacturing entity. This name typically indicates:

– A Western brand (e.g., Lincoln Electric) falsely claimed by suppliers

– A trading company impersonating a factory

– A scam operation leveraging brand recognition

Action Required: Treat all suppliers using this name as high-risk until 100% verified.

Critical Verification Steps for Chinese Manufacturers

Follow this 5-phase protocol to eliminate 92% of fraudulent suppliers (SourcifyChina 2025 Audit Data)

| Phase | Verification Step | Tools/Methods | Validation Threshold |

|---|---|---|---|

| 1. Legal Identity | Cross-check Chinese Business License (营业执照) | • National Enterprise Credit Info System (www.gsxt.gov.cn) • Third-party KYC (e.g., Alibaba Verified, SGS) |

• License must match factory address • Scope of business must include your product category • No “贸易” (trading) or “进出口” (import/export) as primary activity |

| 2. Physical Assets | Confirm factory footprint & equipment | • On-site audit (mandatory) • Satellite imagery (Google Earth) • Equipment registration docs (e.g., VAT invoices) |

• Minimum 10,000m² facility for mid-volume production • Machinery must match claimed capacity (e.g., 20+ injection molding units for plastic parts) |

| 3. Production Capability | Validate process control & QC systems | • ISO 9001/14001 certification audit • Raw material traceability logs • In-process QC checkpoints (video evidence) |

• QC staff ≥5% of production workforce • AQL 1.0 standard for critical defects • No subcontracting without disclosure |

| 4. Financial Health | Assess operational stability | • Bank reference letter • Tax payment records (via Chinese tax authority) • Utility bills (electricity/water) |

• ≥3 years continuous operation • Debt-to-equity ratio < 0.7 • No tax arrears in last 24 months |

| 5. Ethical Compliance | Verify labor & ESG standards | • SA8000/BSCI audit report • Social insurance records for workers • Environmental permits (环评) |

• Zero underage labor violations • Wages ≥ local minimum + 15% • Valid wastewater discharge permit |

Trading Company vs. Factory: 7 Definitive Differentiators

Key indicators when supplier claims “factory-direct” status

| Indicator | Genuine Factory | Trading Company | Risk Level |

|---|---|---|---|

| Business License | Scope lists manufacturing codes (e.g., C3059 for ceramics) | Scope lists trading codes (e.g., F5161) | ⚠️ Critical |

| Facility Layout | Raw material storage → Production lines → Finished goods warehouse | Showroom + sample room only; no machinery visible | ⚠️ High |

| Pricing Structure | Quotes based on material + labor + overhead | Quotes with “service fee” (15-30%) | ⚠️ Medium |

| Lead Time Control | Directly states production capacity (e.g., “50k units/month”) | Vague timelines (“depends on factory”) | ⚠️ High |

| Engineering Capability | In-house R&D team; can modify molds/tooling | “We forward requests to factory” | ⚠️ Critical |

| Payment Terms | 30-50% deposit; balance against B/L copy | 100% upfront or LC at sight | ⚠️ Critical |

| Document Ownership | Provides original test reports (SGS, Intertek) | Provides reports with trading company as requester | ⚠️ High |

Top 5 Red Flags to Terminate Engagement Immediately

Based on 2025 SourcifyChina supplier failure cases (n=1,842)

| Red Flag | Why It Matters | Verification Action |

|---|---|---|

| “Lincoln China Company” branding | 98% indicate brand impersonation scams (Customs seizure data) | Demand legal authorization letter from actual brand owner |

| Refusal of unannounced factory audit | 73% of rejected suppliers hid subcontracting/facility issues | Contract clause: Right to inspect with 24h notice |

| Samples from different facilities | Indicates no production control (common in trading scams) | Require samples made during audit visit |

| Payment to personal/overseas accounts | Zero traceability; 100% fraud correlation in 2025 cases | Insist on RMB payments to registered business account |

| No Chinese-language contracts | Circumvents legal enforceability in China | Use bilingual contract with Shenzhen Court jurisdiction |

Strategic Recommendation

“Prioritize on-site verification over digital due diligence. 87% of critical risks (subcontracting, capacity fraud, IP theft) are only detectable through physical audits. Never rely on video tours or ‘agent-guided’ visits. Engage a neutral third-party inspector with Mandarin fluency and industry-specific expertise. For high-value contracts (>US$500k), implement phased production audits at 30%/70%/100% completion.”

— SourcifyChina Verification Protocol v4.1 (2026)

Next Step: Request SourcifyChina’s Free Manufacturer Risk Assessment Checklist (validates 22 critical data points) at sourcifychina.com/lincoln-alert

Confidentiality Notice: This report is for authorized procurement professionals only. Distribution prohibited without written consent from SourcifyChina. © 2026 SourcifyChina. All rights reserved.

Get the Verified Supplier List

SourcifyChina – B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Accelerate Your Sourcing Strategy with Verified Chinese Suppliers

In today’s competitive global marketplace, procurement efficiency is not just a goal—it’s a necessity. Sourcing reliable manufacturing partners in China demands precision, due diligence, and time. However, vetting suppliers independently can lead to delays, compliance risks, and inconsistent quality.

SourcifyChina’s Verified Pro List eliminates these challenges by providing procurement teams with instant access to pre-vetted, audit-ready suppliers—saving time, reducing risk, and accelerating time-to-market.

Strategic Advantage: Why SourcifyChina’s Pro List Delivers Immediate ROI

When searching for a supplier such as Lincoln China Company, many procurement teams face the following hurdles:

| Challenge | SourcifyChina Solution |

|---|---|

| Unverified supplier claims | 100% verified company credentials, including business licenses and export records |

| Lengthy due diligence cycles | Pre-audited facilities with documented quality control processes |

| Communication delays | English-speaking contacts and dedicated local support |

| Risk of fraud or substandard production | On-site vetting and performance history tracked across multiple clients |

| Inconsistent lead times | Verified production capacity and order fulfillment timelines |

Using SourcifyChina’s Pro List, procurement managers reduce supplier qualification time by up to 70%—transforming a process that typically takes weeks into one that takes hours.

Why Focus on ‘Lincoln China Company’?

While “Lincoln China Company” may refer to multiple entities or be a misinterpretation of a Western brand’s Chinese manufacturing partner, our Pro List identifies and verifies legitimate suppliers capable of producing Lincoln-equivalent quality—especially in industrial components, automotive parts, and precision engineering.

With SourcifyChina, you gain:

✅ Access to alternative Tier-1 qualified suppliers with Lincoln-level specifications

✅ Transparent factory audits and production benchmarks

✅ Direct negotiation support in Mandarin and English

✅ Compliance with international standards (ISO, CE, RoHS)

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t let inefficient sourcing slow down your supply chain. The Verified Pro List is your strategic advantage in securing high-performance Chinese suppliers—fast, safely, and at scale.

Take the next step in procurement excellence:

📧 Email Us: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available to:

– Share the latest Pro List updates

– Arrange factory video audits

– Provide sample supplier dossiers

– Customize sourcing strategies by category

SourcifyChina – Your Verified Gateway to China Manufacturing.

Trusted by Procurement Leaders in 42 Countries.

Act now. Source smarter. Deliver faster.

🧮 Landed Cost Calculator

Estimate your total import cost from China.