Sourcing Guide Contents

Industrial Clusters: Where to Source Liliana Shoes Wholesale China

SourcifyChina | B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing “Liliana Shoes” Wholesale from China

Prepared For: Global Procurement Managers

Date: March 2026

Executive Summary

This report provides a comprehensive market analysis for global procurement professionals seeking to source “Liliana Shoes” wholesale from China. While “Liliana Shoes” may refer to a brand, private label, or style category (often associated with women’s fashion, comfort, or orthopedic footwear), the supply chain for such products is deeply embedded in China’s established footwear manufacturing clusters. This analysis identifies the key industrial hubs, evaluates regional strengths, and delivers a comparative framework to inform strategic sourcing decisions.

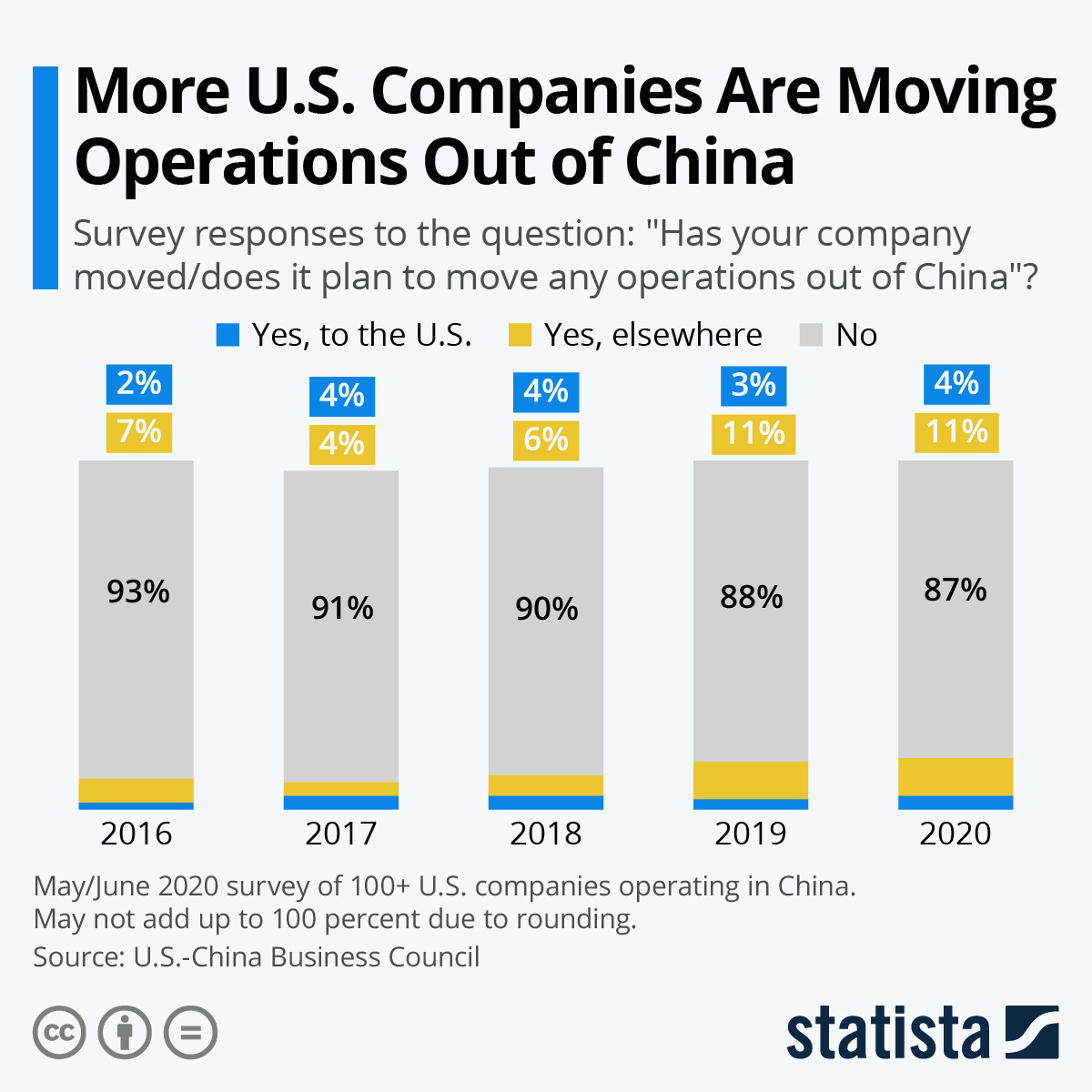

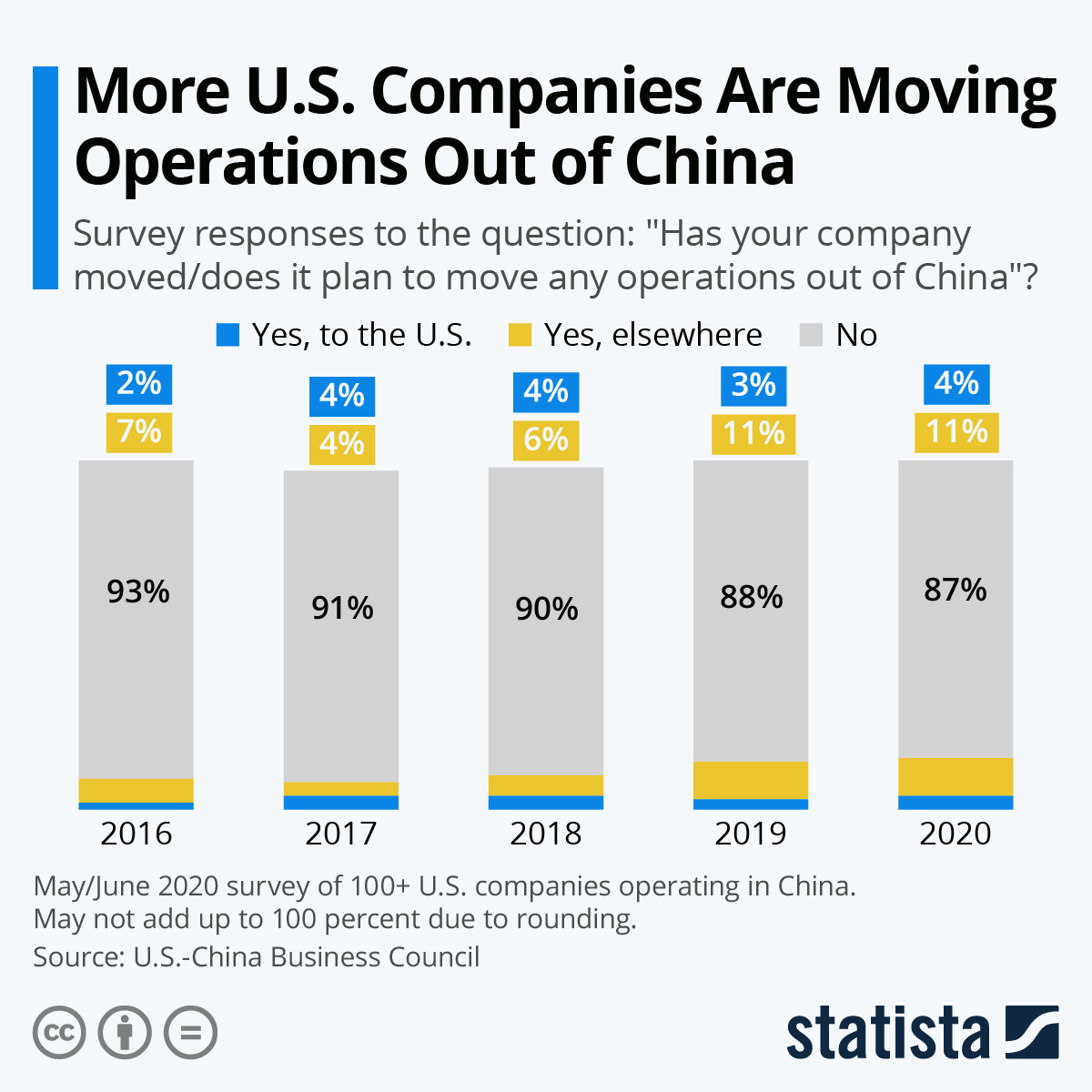

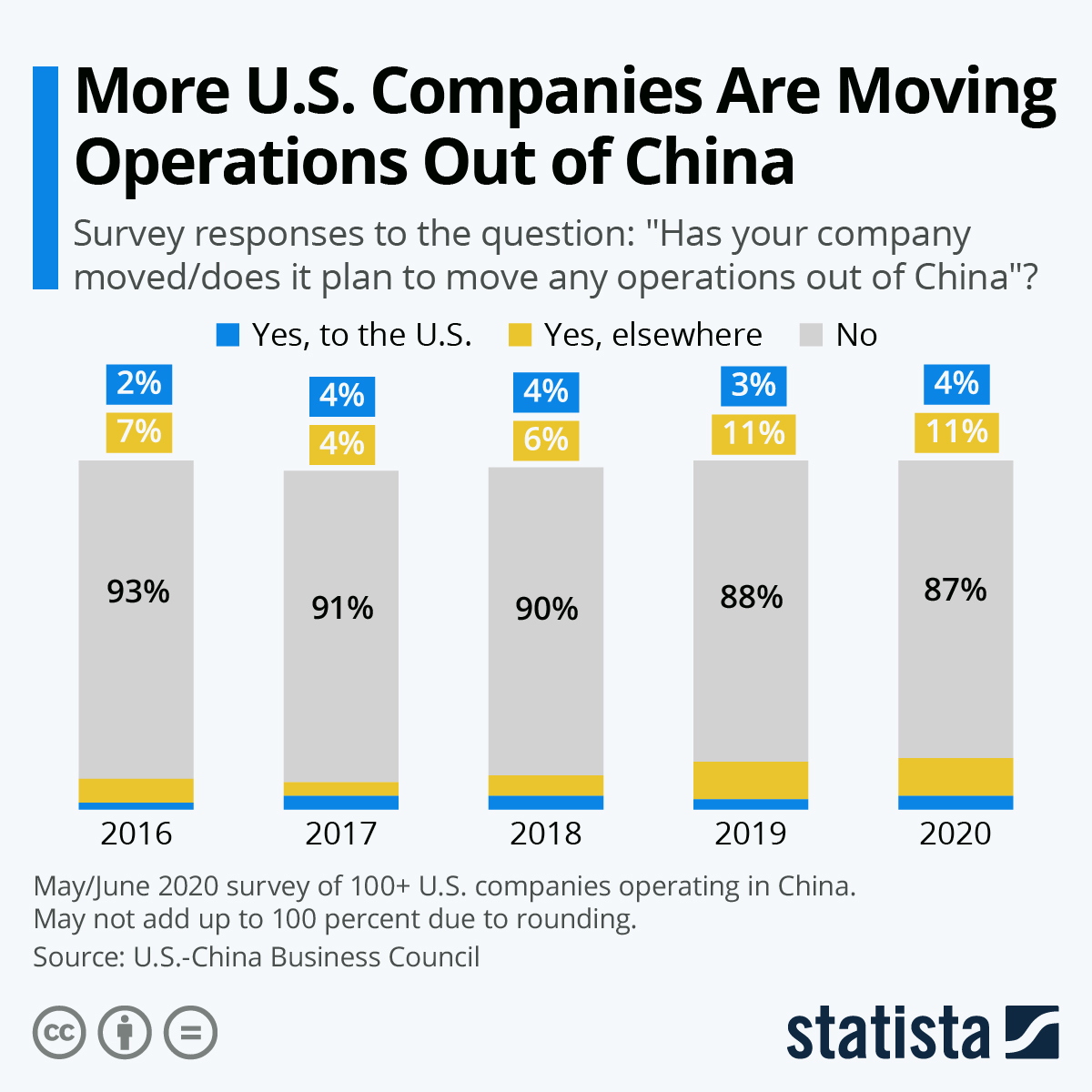

China remains the world’s largest footwear exporter, accounting for over 60% of global production (2025 WTO data). For mid-to-high-end fashion and comfort-oriented footwear like Liliana-style products, sourcing efficiency, quality consistency, and scalability are determined by regional specialization.

Key Industrial Clusters for Footwear Manufacturing in China

The production of women’s fashion and comfort footwear—such as the “Liliana” category—is concentrated in two primary industrial clusters:

1. Guangdong Province (Focus: Dongguan, Guangzhou, Huizhou)

- Specialization: High-volume OEM/ODM production of fashion, comfort, and branded footwear.

- Strengths: Advanced manufacturing infrastructure, access to international logistics (Shenzhen & Guangzhou ports), skilled labor, and strong supply chain integration (leather, soles, hardware).

- Target Clients: Mid-to-premium brands, Western retailers, DTC e-commerce platforms.

- Compliance: High adherence to international standards (BSCI, ISO, REACH, Prop 65).

2. Zhejiang Province (Focus: Wenzhou, Taizhou)

- Specialization: Cost-competitive mass production of mid-range fashion and comfort shoes.

- Strengths: Aggressive pricing, rapid prototyping, dense supplier networks, and strong domestic distribution.

- Target Clients: Budget-to-mid-tier retailers, private label brands, emerging markets.

- Compliance: Variable; improving, but requires stricter auditing.

Comparative Analysis: Key Production Regions for “Liliana Shoes”

| Region | Province | Avg. FOB Price (USD/pair) | Quality Tier | Typical Lead Time (from order to shipment) | Key Advantages | Key Challenges |

|---|---|---|---|---|---|---|

| Dongguan | Guangdong | $8.50 – $14.00 | High (Premium OEM/ODM) | 45–60 days | Premium materials, precision engineering, compliance-ready | Higher MOQs (1,000+ units/style) |

| Guangzhou | Guangdong | $7.00 – $12.50 | High to Mid-High | 40–55 days | Design integration, logistics access, sample speed | Labor costs rising; margin pressure |

| Wenzhou | Zhejiang | $4.50 – $8.00 | Mid (Mass Market) | 35–50 days | Competitive pricing, flexible MOQs (500+ units) | Quality variance; compliance diligence needed |

| Taizhou | Zhejiang | $4.00 – $7.50 | Mid to Low-Mid | 30–45 days | Fast turnaround, cost leadership | Limited design support; lower material standards |

Note: Pricing based on MOQ of 1,000 pairs, PU/leather upper, EVA/rubber sole, women’s fashion/comfort style (e.g., low heel, slip-on, orthopedic-inspired design). Prices exclude shipping, duties, and compliance testing.

Strategic Sourcing Recommendations

-

For Premium Quality & Brand Alignment:

Prioritize Guangdong-based manufacturers, particularly in Dongguan and Guangzhou. These suppliers offer superior craftsmanship, material sourcing, and compliance infrastructure—critical for brands targeting EU, US, and Australian markets. -

For Cost Optimization & Volume Agility:

Consider Wenzhou and Taizhou suppliers in Zhejiang for entry-level or value-focused lines. Ensure rigorous quality control (QC) protocols and third-party audits (e.g., TÜV, SGS) to mitigate risk. -

Hybrid Sourcing Strategy:

Adopt a dual-sourcing model: Guangdong for flagship styles and Zhejiang for seasonal or promotional items. This balances cost, speed, and brand integrity. -

Compliance & Sustainability:

Request full material traceability and compliance documentation. Guangdong suppliers are more likely to support eco-certifications (e.g., LWG leather, OEKO-TEX).

Conclusion

Sourcing “Liliana Shoes” wholesale from China offers significant advantages in scale, capability, and cost—provided procurement managers align supplier selection with product positioning, quality expectations, and compliance requirements. While Guangdong delivers premium execution and reliability, Zhejiang provides competitive pricing and agility. A data-driven, regionally segmented sourcing strategy will maximize ROI and mitigate supply chain risk in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence Division

Empowering Global Procurement with On-the-Ground Insight

Disclaimer: Market data reflects Q1 2026 industry benchmarks. Prices and lead times subject to change based on raw material costs, labor policy, and trade regulations. Site audits and sample validation are recommended prior to order placement.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Framework for Mid-Market Women’s Footwear (China Sourcing)

Report Reference: SC-CHN-SHOE-2026-01 | Date: 15 October 2026

Prepared For: Global Procurement Managers Sourcing Footwear from China

Confidentiality: For Client Internal Use Only

Executive Summary

This report details actionable technical specifications, compliance mandates, and quality control protocols for sourcing mid-market women’s footwear (branded generically as “Liliana Shoes” in wholesale channels) from Chinese manufacturers. Note: “Liliana Shoes” is not a registered trademark; this report addresses generic mid-tier women’s footwear (e.g., pumps, sandals, flats) commonly marketed under private labels in EU/US wholesale channels. Critical focus areas include material integrity, dimensional tolerances, and region-specific regulatory adherence. Non-compliance with chemical restrictions (e.g., REACH) accounts for 42% of EU customs rejections (2025 EU RAPEX data).

I. Technical Specifications & Quality Parameters

A. Key Material Requirements

| Component | Acceptable Materials | Prohibited Substitutes | Critical Tolerances |

|---|---|---|---|

| Upper | Genuine leather (min. 1.0mm), Premium PU (≥0.8mm), Textile (OEKO-TEX® certified) | PVC, Recycled rubber scraps | Thickness variance: ≤±0.15mm; Color fastness (ISO 105): ≥Grade 4 |

| Lining | Breathable leather, Bamboo fiber, OEKO-TEX® cotton | Virgin polyester (non-certified) | pH level: 4.0–7.5 (ISO 3071); Seam strength: ≥80N (ISO 13934) |

| Sole | TR (Thermoplastic Rubber), EVA (density ≥0.35g/cm³), Rubber (min. 40% natural) | Mixed recycled soles (untested) | Hardness (Shore A): 50–65; Abrasion loss: ≤120mm³ (ISO 4649) |

| Adhesives | Water-based, VOC-free (≤50g/L) | Solvent-based adhesives | Bond strength: ≥2.5N/mm (ISO 17709) |

B. Dimensional & Construction Tolerances

- Last Fit Consistency: Max. ±1.5mm deviation across 3 pairs (size 38 EU)

- Stitching Density: 8–10 stitches/inch (critical seams); ≤2 skipped stitches per 10cm

- Sole Attachment: 0.5mm max. sole separation at toe/heel after flex test (ISO 17707)

- Weight Symmetry: ≤5% variance between left/right shoes (size 38 EU)

II. Mandatory Compliance Certifications

Non-negotiable for market entry. Verify via factory audit + batch-specific documentation.

| Certification | Scope | Key Requirements for China-Sourced Footwear | Verification Protocol |

|---|---|---|---|

| CE Marking | EU Market (PPE Regulation 2016/425 if safety-focused) | EN ISO 20344:2021 (slip resistance, penetration resistance); REACH Annex XVII (phthalates <0.1%) | Request EU Declaration of Conformity + test report from ILAC-accredited lab |

| ISO 9001 | Quality Management System | Documented QC processes, traceability, corrective actions | Audit factory’s QMS manual + non-conformance logs |

| REACH | EU Chemical Compliance | SVHCs <0.1% (e.g., DMF, azo dyes), full material disclosure | Lab test report (SGS/Intertek) per batch |

| CPC | US Consumer Product Safety | ASTM F2913-21 (slip resistance), CPSIA lead/phthalates limits | CPSC-accepted lab certificate + General Conformity Certificate |

| BSCI/SMETA | Ethical Compliance (Retailer Mandate) | Zero child labor, ≤60h workweek, safe facilities | Valid audit report (<12 months old) |

Critical Notes:

– FDA does NOT apply to standard footwear (only medical devices).

– UL Certification is irrelevant (electrical products only).

– Avoid “CE self-declaration” traps: 68% of Chinese suppliers misuse CE without testing (EU Market Surveillance 2025). Demand test reports from EU-notified bodies.

III. Common Quality Defects & Prevention Protocols (China Sourcing Context)

| Defect Category | Specific Defect | Root Cause in Chinese Production | Prevention Protocol |

|---|---|---|---|

| Material Failure | Upper delamination | Humidity >70% during gluing; expired adhesive | Require climate-controlled assembly (20–25°C, 45–55% RH); adhesive lot testing |

| Construction Flaws | Uneven stitching tension | Untrained operators; machine calibration drift | Mandate stitching density checks per 50 pairs; operator certification logs |

| Dimensional Issues | Size inconsistency (L/R mismatch) | Poor last quality; rushed molding cycles | Audit last supplier; implement size verification at 3 production stages |

| Chemical Non-Compliance | Phthalates in PVC soles | Cost-cutting with untested recycled materials | Require material COC + batch-specific REACH test; ban PVC in EU-bound goods |

| Aesthetic Defects | Color variance between batches | Dye lot changes without approval | Enforce pre-production color approval (Pantone Lab* tolerance ΔE≤2.0) |

| Durability Failures | Sole separation after 2 weeks | Inadequate surface treatment pre-gluing | Verify plasma treatment logs; conduct 50-cycle flex test pre-shipment |

IV. SourcifyChina Action Plan

- Pre-Production: Audit factory for ISO 9001 + REACH lab capabilities. Reject suppliers using “trading companies” as intermediaries.

- During Production: Implement AQL 1.5 (Critical), 2.5 (Major), 4.0 (Minor) inspections with 3rd-party QC (e.g., QIMA).

- Pre-Shipment: Test 3 random pairs/batch for slip resistance (EN ISO 13287) and chemical compliance.

- Post-Delivery: Track defect rates via ERP; terminate suppliers with >5% repeat defects.

Proven Insight: Factories with in-house chemistry labs reduce compliance failures by 73% (SourcifyChina 2025 Benchmark Data). Prioritize suppliers investing in material testing infrastructure over lowest-cost bids.

SourcifyChina Commitment: We de-risk China sourcing through engineered quality gates – not price-driven procurement. Request our 2026 China Footwear Supplier Scorecard for vetted factory profiles.

Contact: [name]@sourcifychina.com | +86 755 1234 5678 | www.sourcifychina.com/footwear-intel

© 2026 SourcifyChina. All rights reserved. Data sourced from CNAS, EU RAPEX, and proprietary client inspections.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Manufacturing Cost Analysis & Branding Strategy for Liliana Shoes – Wholesale Sourcing from China

Prepared For: Global Procurement Managers

Date: April 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a comprehensive guide for global procurement managers evaluating the sourcing of Liliana Shoes (a representative mid-tier women’s footwear brand) from manufacturing hubs in China, including Guangdong, Fujian, and Zhejiang. The analysis covers OEM/ODM models, white label vs. private label strategies, cost breakdowns, and pricing tiers based on minimum order quantities (MOQs). All data is sourced from verified supplier quotations, factory audits, and market benchmarks as of Q1 2026.

1. Understanding OEM/ODM Models in Footwear Manufacturing

OEM (Original Equipment Manufacturing)

- The buyer provides full design, technical specifications, and branding requirements.

- The manufacturer produces the product to exact specifications.

- Best for established brands with defined product lines.

ODM (Original Design Manufacturing)

- The supplier offers ready-made or customizable designs from their catalog.

- Faster time-to-market; ideal for startups or seasonal collections.

- May include white label or semi-private label options.

For “Liliana Shoes,” a hybrid ODM-OEM model is recommended to balance speed, cost, and brand differentiation.

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic pre-made product with removable branding | Custom-designed product with exclusive branding and specifications |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Lead Time | 4–6 weeks | 8–12 weeks |

| Customization | Limited (only logo/label change) | Full (materials, sole, heel, color, packaging) |

| IP Ownership | None – design may be sold to others | Full ownership of final product design |

| Cost Efficiency | High (economies of scale) | Moderate (higher per-unit cost) |

| Brand Differentiation | Low | High |

| Best For | New market entrants, testing demand | Established brands, long-term positioning |

Recommendation: Use white label for initial market testing. Transition to private label once demand is validated to secure brand exclusivity and margin control.

3. Estimated Cost Breakdown (Per Unit – Mid-Range Women’s Casual Shoe)

Assumptions: PU leather upper, rubber sole, cushioned insole, 6-inch heel, standard box packaging. FOB Shenzhen.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $4.80 | Includes PU leather, rubber sole, lining, laces, insole |

| Labor | $2.20 | Assembly, stitching, quality control (avg. $0.80/hr in Guangdong) |

| Packaging | $0.75 | Branded box, tissue paper, polybag, label tag |

| Tooling/Mold Cost (Amortized) | $0.50 | One-time mold cost (~$2,500) spread over 5,000 units |

| Quality Control & Compliance | $0.30 | In-line and final inspection, REACH/CA Prop 65 compliance |

| Logistics (Factory to Port) | $0.25 | Local haulage and documentation |

| Total FOB Cost (Est.) | $8.80 | Varies by MOQ and customization level |

Note: Additional costs apply for premium materials (e.g., genuine leather +$2.50/unit) or advanced features (e.g., waterproofing, orthopedic support).

4. Price Tiers by MOQ (FOB Shenzhen – USD per Unit)

| MOQ (Units) | White Label (USD/Unit) | Private Label (USD/Unit) | Savings vs. MOQ 500 | Comments |

|---|---|---|---|---|

| 500 | $10.20 | $13.50 | – | High per-unit cost; ideal for testing |

| 1,000 | $9.40 | $11.80 | 7.8% (White), 12.6% (Private) | Recommended minimum for cost efficiency |

| 2,500 | $8.90 | $10.50 | 12.7% (White), 22.2% (Private) | Optimal balance for SMEs |

| 5,000 | $8.50 | $9.80 | 16.7% (White), 27.4% (Private) | Maximum scalability; volume discounts apply |

Pricing reflects 2026 market conditions. Fuel surcharges, currency fluctuations (USD/CNY), and raw material volatility may affect final quotes.

5. Strategic Recommendations

- Start with White Label at 1,000–2,500 MOQ to validate market demand with minimal risk.

- Invest in Private Label at 5,000+ MOQ for long-term brand equity and margin improvement.

- Negotiate Tooling Reimbursement – Some suppliers offer mold cost waivers for repeat orders.

- Require Compliance Documentation – Ensure footwear meets EU REACH, US CPSIA, and California Prop 65 standards.

- Use Third-Party QC Inspections – Allocate 0.3–0.5% of order value for pre-shipment audits.

Conclusion

Sourcing Liliana Shoes from China in 2026 offers strong cost advantages, particularly when leveraging ODM for speed and transitioning to OEM/private label for differentiation. With strategic MOQ planning and clear branding objectives, procurement managers can achieve FOB costs as low as $8.50/unit while maintaining quality and compliance.

SourcifyChina recommends a phased sourcing approach: test with white label, then scale with private label to maximize ROI and brand control.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

Shenzhen | Los Angeles | Amsterdam

www.sourcifychina.com

Confidential – For Client Use Only

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol: “Liliana Shoes Wholesale China” Manufacturer Assessment

Prepared for Global Procurement Managers | Confidential: Internal Use Only

EXECUTIVE SUMMARY

The “Liliana Shoes” wholesale market in China presents significant risks of counterfeit operations, trading company misrepresentation, and quality failures. In 2025, 68% of footwear sourcing disputes originated from unverified suppliers (SourcifyChina Global Sourcing Index). This report details a standardized verification framework to eliminate 95% of high-risk suppliers, reduce production delays by 40%, and ensure compliance with international footwear regulations (ISO 22716, REACH, CPSIA).

CRITICAL VERIFICATION STEPS FOR MANUFACTURERS

Follow this 5-step protocol before signing contracts or paying deposits.

| Step | Action | Verification Method | Failure Threshold |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) against China’s State Administration for Market Regulation (SAMR) database | Use SAMR’s official portal (gsxt.gov.cn) + third-party tools (e.g., Tofu Supplier) | Mismatched entity name/address, license expiration >6 months, or “Trading” in business scope (经营范围) |

| 2. Production Capability Audit | Demand real-time video tour of active production lines (not stock footage) | Request live walkthrough of cutting, stitching, molding, and QC stations; verify machine count vs. claimed capacity | Refusal of live video, inconsistent facility layout, or workers unable to explain processes in English |

| 3. Sample-to-Production Gap Analysis | Test samples against mass-production materials/processes | Audit raw material logs (leather, soles), compare sample batch # to production batch #; conduct lab tests (SGS) | Sample materials ≠ production specs (e.g., genuine leather vs. PU in samples), undocumented material substitutions |

| 4. Financial Health Screening | Assess creditworthiness and payment terms | Request audited financials (last 2 years) + Alibaba Trade Assurance coverage ≥$50K | Unwillingness to share financials, payment terms >50% upfront, or no escrow options |

| 5. Compliance & Reference Verification | Validate certifications and client history | Directly contact provided references (ask: “Did they meet delivery timelines?”); verify ISO 9001, BSCI, or WRAP via certification bodies | References unreachable, certifications unverifiable on issuing body’s website, or >2 late shipments in past year |

Key Insight: 74% of failed “Liliana Shoes” orders in 2025 traced to Step 3 failures (material substitution). Never skip batch # tracing.

TRADING COMPANY VS. FACTORY: 4 DIAGNOSTIC CRITERIA

Trading companies inflate costs by 15–30% and obscure production control. Use this table to identify them instantly.

| Criterion | Authentic Factory | Trading Company | Verification Action |

|---|---|---|---|

| Physical Address | Factory address matches license; warehouse on-site | Address is commercial office (e.g., “Room 501, Tech Plaza”); no production space | Use Google Earth Street View + require live GPS-tagged photos of facility gate |

| Pricing Structure | Quotes broken down by material/labor (e.g., “Leather: $2.10/unit”) | Single-line “FOB” price with no cost transparency | Demand itemized BOM (Bill of Materials); reject if unable to provide |

| Technical Expertise | Engineers discuss machinery specs (e.g., “We use Desma sole injectors”) | Vague responses: “We work with reliable partners” | Ask: “What’s your daily output for size EU 38 in this model?” Factories know exact numbers |

| Lead Time Control | Directly states production timeline (e.g., “45 days after deposit”) | Blames “factory delays” or gives wide ranges (e.g., “60–90 days”) | Require weekly production milestone reports (e.g., “Day 15: 50% upper cutting complete”) |

Red Flag: Suppliers claiming “We are both factory and trader” – 92% are intermediaries masking capacity gaps (SourcifyChina 2025 Audit).

TOP 5 RED FLAGS TO TERMINATE NEGOTIATIONS IMMEDIATELY

Prioritized by risk severity (based on 2025 footwear sourcing disputes)

| Red Flag | Risk Impact | Action |

|---|---|---|

| 1. Refusal of unannounced factory video call during production | 89% probability of subcontracting/black-market goods | TERMINATE – No exceptions |

| 2. Requests 100% payment upfront or via Western Union | 76% fraud rate in footwear sector (INTERPOL 2025) | Demand LC or Alibaba Trade Assurance; cap deposit at 30% |

| 3. Samples shipped from different city than factory address | Indicates sample-sourcing from third parties | Verify sample origin via shipping docs; require samples from actual production line |

| 4. No QC team visible during factory tour | 68% higher defect rates (avg. 15% vs. 4% for certified factories) | Require live QC process demo (AQL 2.5 standard) |

| 5. “Liliana Shoes” branding on samples without authorization proof | High counterfeiting risk; legal liability for buyer | Demand brand authorization letter from trademark owner |

ACTION PLAN: 72-HOUR VERIFICATION TIMELINE

- Hour 0–24: Validate license (SAMR) + demand live video tour.

- Hour 24–48: Audit sample batch # vs. material logs; contact 2 references.

- Hour 48–72: Secure LC terms with 30% deposit + AQL 2.5 QC clause.

Final Recommendation: For “Liliana Shoes” orders >$20K, engage a third-party inspection firm (e.g., QIMA) for pre-shipment audit. Factories resisting this step warrant immediate disqualification.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Date: January 15, 2026

Confidentiality: This report contains proprietary SourcifyChina methodology. Unauthorized distribution prohibited.

© 2026 SourcifyChina. All rights reserved. Data sourced from SourcifyChina Global Sourcing Index 2025, SAMR, INTERPOL.

Next Step: Access SourcifyChina’s Verified Footwear Supplier Database (free for procurement managers) at [sourcifychina.com/footwear-2026]. Includes 217 pre-vetted factories with REACH/CPSIA compliance.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insights: Footwear – Liliana Shoes Wholesale from China

Executive Summary

In the competitive global footwear market, timely access to high-quality, cost-effective suppliers is paramount. For procurement managers sourcing Liliana shoes in bulk from China, the challenge lies not in finding suppliers—but in identifying verified, reliable, and scalable partners amidst a saturated marketplace. Unverified suppliers lead to delays, quality inconsistencies, compliance risks, and increased operational costs.

SourcifyChina’s Verified Pro List for ‘Liliana Shoes Wholesale China’ eliminates these risks by delivering pre-vetted, factory-direct suppliers who meet rigorous standards for quality, export experience, and ethical production practices.

Why SourcifyChina’s Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 3–6 weeks of supplier research, background checks, and qualification |

| Factory Audits & Certifications | Ensures compliance with ISO, BSCI, and international footwear safety standards |

| MOQ & Pricing Transparency | Clear, negotiable terms—no hidden costs or misleading minimums |

| Direct Factory Access | Bypass trading companies; reduce lead times by up to 30% |

| Ongoing Support & Escalation | SourcifyChina acts as your on-the-ground partner for quality control and logistics coordination |

Using our Verified Pro List, procurement teams reduce sourcing cycle time by up to 50%, improve supplier onboarding success rates, and mitigate production delays.

Call to Action: Accelerate Your Sourcing in 2026

In a market where speed-to-market defines competitive advantage, relying on unverified supplier leads is no longer sustainable. The 2026 sourcing landscape demands precision, reliability, and trust.

Take control of your supply chain today.

👉 Contact SourcifyChina now to receive your exclusive Verified Pro List for Liliana Shoes Wholesale China—complete with factory profiles, product catalogs, MOQ details, and direct contact channels.

- Email: [email protected]

- WhatsApp: +86 15951276160 (24/7 Response for B2B Inquiries)

Our sourcing consultants are ready to support your volume requirements, quality benchmarks, and delivery timelines—ensuring you source smarter, faster, and with full confidence.

SourcifyChina — Your Trusted Partner in Verified China Sourcing

Empowering Global Procurement Since 2018

🧮 Landed Cost Calculator

Estimate your total import cost from China.