The global lithium-ion battery market is experiencing robust expansion, driven by rising electric vehicle (EV) adoption and advancements in energy storage technologies. According to Mordor Intelligence, the Li-ion battery market was valued at USD 53.76 billion in 2023 and is projected to reach USD 103.73 billion by 2029, growing at a CAGR of 11.5% during the forecast period. This surge is fueled by increasing demand for high-performance, rechargeable batteries in the automotive sector, particularly for electric cars. As governments worldwide implement stricter emissions regulations and incentivize clean transportation, manufacturers are scaling production and investing heavily in R&D. Against this backdrop, a select group of companies has emerged as key players in the Li-ion car battery space, combining technological innovation, large-scale manufacturing capabilities, and strategic global partnerships to lead the electrified future of mobility.

Top 10 Li Ion Car Battery Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 ProLogium Technology Co., Ltd

Domain Est. 2014 | Founded: 2006

Website: prologium.com

Key Highlights: Founded in 2006, ProLogium Technology is an energy innovation company focused on lithium ceramic battery research, development, and manufacturing….

#2 The Future of Energy

Domain Est. 2018

Website: im3ny.com

Key Highlights: iM3NY is an independent lithium-ion cell manufacturer that is commercializing cell chemistry developed in the USA….

#3 American Battery Technology Company

Domain Est. 2020

Website: americanbatterytechnology.com

Key Highlights: ABTC is an advanced technology, first-mover lithium-ion battery recycling and primary battery metal extraction company that utilizes internally developed ……

#4 Battle Born Batteries

Domain Est. 2016

Website: battlebornbatteries.com

Key Highlights: Free delivery · 30-day returnsShop premium LiFePO4 lithium batteries from Battle Born for unmatched power, reliability, and a 10-year warranty. Get started today!…

#5 Lithion Battery

Domain Est. 2020

Website: lithionbattery.com

Key Highlights: Lithion keeps homes, businesses, and industries running with dependable lithium-ion batteries and energy storage systems for nearly every application….

#6 Automotive Cells Company

Domain Est. 2020

Website: acc-emotion.com

Key Highlights: High performance lithium-ion batteries produced at a price that makes green automotive accessible to everyone. Find out more. Our ambitions. Compared to ……

#7 SES AI

Domain Est. 2020

Website: ses.ai

Key Highlights: SES AI specializes in developing and manufacturing high-performance lithium-metal rechargeable batteries for electric vehicles and various other ……

#8 Lithion Technologies

Domain Est. 2022

Website: lithiontechnologies.com

Key Highlights: Lithion Technologies sustainably produces strategic materials from lithium-ion batteries. The future is Lithion. The energy transition relies on lithium-ion ……

#9 Lithium Pros

Website: lithiumpros.com

Key Highlights: Free delivery 60-day returnsLithium Pros is a group of enthusiasts who are focused on bringing the highest performance, ultra lightweight lithium-ion batteries to the marine, racin…

#10 QuantumScape

Domain Est. 2010

Website: quantumscape.com

Key Highlights: Next-Generation Mobility QuantumScape’s lithium-metal solid-state batteries will charge faster, go farther, last longer and operate more safely than today’s ……

Expert Sourcing Insights for Li Ion Car Battery

H2: Analysis of 2026 Market Trends for Lithium-Ion Car Batteries

As the global automotive industry accelerates its transition toward electrification, the lithium-ion (Li-ion) car battery market is poised for transformative growth and innovation by 2026. Driven by regulatory mandates, technological advancements, and shifting consumer preferences, the Li-ion battery sector is expected to experience profound changes across supply chains, chemistry development, geographic production, and sustainability practices.

1. Market Expansion and Demand Surge

By 2026, the demand for Li-ion car batteries is projected to surpass 2,500 GWh annually, fueled by increasing electric vehicle (EV) adoption worldwide. Major markets such as China, Europe, and North America will lead in deployment, supported by stringent emissions regulations (e.g., EU’s 2035 ICE phase-out) and national EV incentives. The compound annual growth rate (CAGR) for the Li-ion car battery market is estimated at 18–22% between 2023 and 2026.

2. Technological Advancements

- Energy Density Improvements: By 2026, next-generation chemistries such as nickel-rich NMC (e.g., NMC 811) and high-manganese variants will dominate premium EVs, offering energy densities exceeding 300 Wh/kg. This enables longer range (up to 500+ miles) and faster charging.

- Solid-State Batteries: While commercialization at scale remains limited, 2026 will mark significant pilot production and pre-launch deployments by companies like Toyota, Samsung SDI, and QuantumScape, with initial applications in high-end vehicles.

- Silicon Anodes: Adoption of silicon-dominant anodes will increase, improving capacity by 20–40% over traditional graphite, though cycle life challenges remain under active R&D.

3. Cost Reduction and Price Trends

The average price of Li-ion car batteries is expected to decline to $70–80/kWh by 2026 (down from $139/kWh in 2021), driven by economies of scale, manufacturing optimization, and reduced raw material intensity. This cost threshold strengthens the total cost of ownership (TCO) competitiveness of EVs versus internal combustion engine (ICE) vehicles.

4. Supply Chain and Raw Material Dynamics

- Lithium, Nickel, and Cobalt: Demand for lithium will grow over 300% by 2030, pressuring supply chains. Recycling and alternative sources (e.g., lithium extraction from clay and geothermal brines) will gain traction.

- Cobalt Reduction: High cobalt dependency will decrease, with low-cobalt and cobalt-free cathodes (e.g., LMFP – Lithium Manganese Iron Phosphate) gaining market share, especially in mid-range EVs.

- Regionalization of Supply Chains: To mitigate geopolitical risks and support local EV policies, North America and Europe will expand domestic battery material refining and cell manufacturing, reducing reliance on Asia.

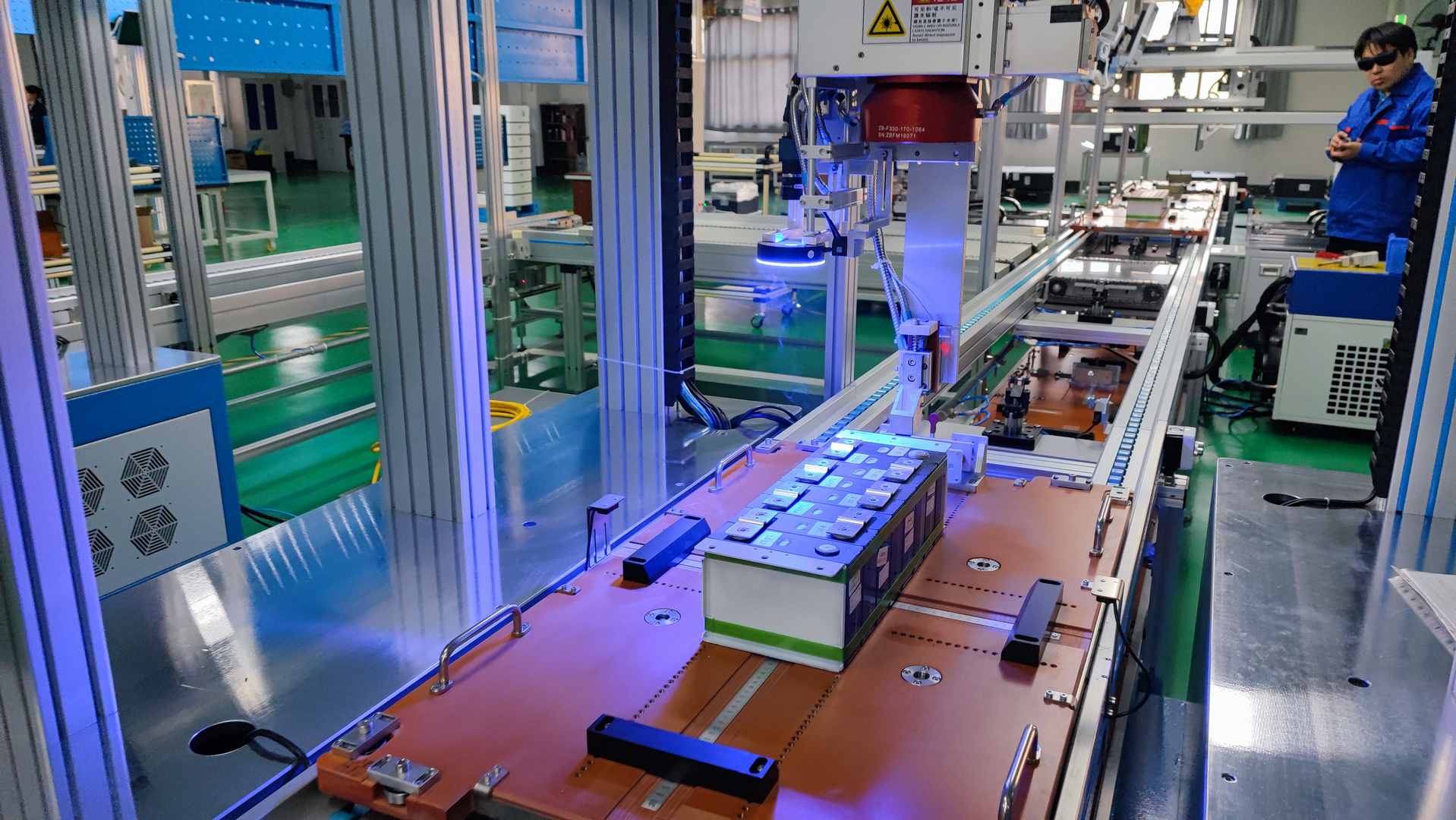

5. Manufacturing Capacity and Gigafactory Expansion

Global battery manufacturing capacity is expected to exceed 4,000 GWh by 2026. China will remain the largest producer (~55% share), but the U.S. and EU will significantly close the gap due to initiatives like the Inflation Reduction Act (IRA) and EU Battery Regulation. Major OEMs (e.g., Tesla, Ford, Volkswagen) and battery makers (CATL, LG Energy Solution, Panasonic) will operate over 100 gigafactories worldwide.

6. Sustainability and Regulatory Compliance

Environmental, Social, and Governance (ESG) factors will shape the 2026 market:

– Battery Passports: The EU’s Battery Regulation will enforce digital battery passports, tracking carbon footprint, recycled content, and chain-of-custody.

– Recycling Infrastructure: Closed-loop recycling systems will mature, with recovery rates for lithium, cobalt, and nickel exceeding 95%. Companies like Redwood Materials and Li-Cycle will scale operations to meet demand.

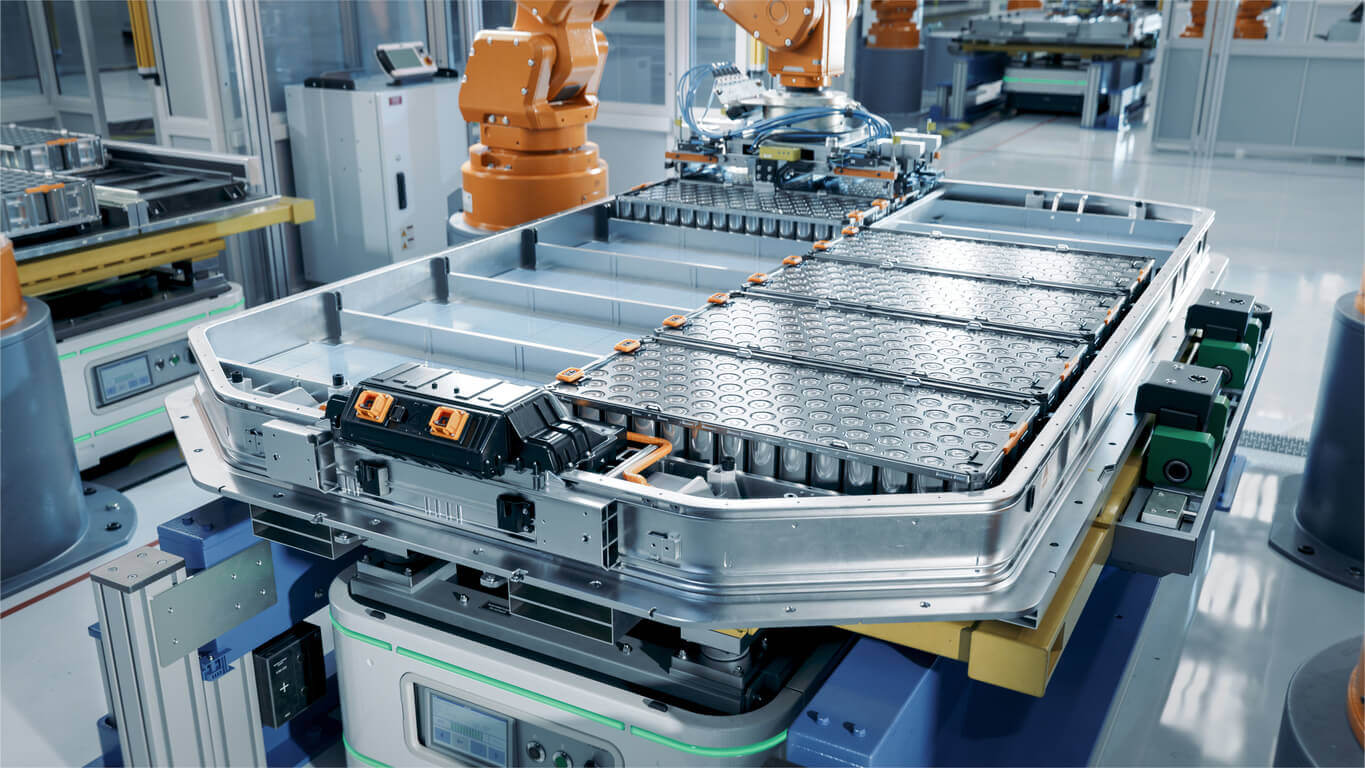

7. OEM Strategies and Battery Integration

Automakers will increasingly adopt vertical integration:

– Cell-to-Pack (CTP) and Cell-to-Chassis (CTC): Technologies from BYD (Blade Battery), Tesla (4680 + structural pack), and others will enhance efficiency, reduce weight, and lower costs.

– In-House Battery Development: OEMs like Tesla, BMW, and Stellantis will deepen control over battery design and production to secure supply and differentiate performance.

8. Emerging Segments

- LFP (Lithium Iron Phosphate) Dominance in Entry-Level EVs: LFP batteries will capture over 40% of the car battery market by 2026, particularly in standard-range models due to lower cost, longer cycle life, and improved safety.

- Second-Life Applications: Used EV batteries will increasingly be repurposed for stationary energy storage, supporting grid resilience and renewable integration.

Conclusion:

By 2026, the Li-ion car battery market will be characterized by heightened competition, innovation in chemistry and form factor, and a stronger emphasis on sustainability and localization. While challenges related to raw material security and ethical sourcing persist, advances in technology and policy support will solidify Li-ion batteries as the cornerstone of the global EV revolution. The path forward will favor players who integrate vertically, innovate rapidly, and align with circular economy principles.

Common Pitfalls When Sourcing Li-Ion Car Batteries (Quality & IP)

Sourcing lithium-ion (Li-ion) car batteries—especially for electric vehicles (EVs), hybrids, or aftermarket replacements—comes with significant risks related to both product quality and intellectual property (IP). Avoiding these pitfalls is critical to ensuring safety, performance, regulatory compliance, and legal integrity.

Quality-Related Pitfalls

1. Substandard Cell Sourcing

Many suppliers, particularly from less regulated markets, use recycled, repurposed, or low-grade Li-ion cells sourced from consumer electronics or damaged EV packs. These cells often lack the cycle life, thermal stability, and safety features required for automotive use, increasing the risk of premature failure, overheating, or fire.

2. Inadequate Battery Management System (BMS)

A poorly designed or low-quality BMS fails to monitor voltage, temperature, and state of charge effectively, leading to cell imbalance, overcharging, deep discharging, and accelerated degradation. Some suppliers use generic or counterfeit BMS units that do not meet automotive-grade reliability standards.

3. Lack of Certifications and Testing

Reputable Li-ion automotive batteries must comply with international standards such as UN 38.3 (transport safety), IEC 62133 (safety for portable cells), and ISO 12405 (EV battery performance). Many suppliers provide falsified or incomplete certification documents, making due diligence essential.

4. Inconsistent Manufacturing Processes

Variability in cell matching, welding techniques, and assembly can lead to performance inconsistencies across battery packs. Without strict quality control (e.g., ISO 9001), batches may vary significantly in capacity, internal resistance, and longevity.

5. Poor Thermal Management Design

Automotive Li-ion batteries require robust thermal management to operate safely across extreme temperatures. Inadequate cooling or heating systems in sourced batteries can lead to thermal runaway, reduced lifespan, and safety hazards.

Intellectual Property (IP) Pitfalls

1. Use of Counterfeit or Cloned Technology

Some suppliers reverse-engineer or copy proprietary battery designs, BMS algorithms, or cell configurations from leading OEMs (e.g., Tesla, LG, Panasonic). Sourcing such products exposes buyers to IP infringement claims and reputational damage.

2. Unauthorized Use of Patented Components

Li-ion battery technology is heavily patented, covering cell chemistry (e.g., NMC, LFP), electrode design, cooling systems, and software controls. Suppliers may unknowingly—or deliberately—use patented components without licensing, creating legal exposure for downstream users.

3. Lack of IP Documentation and Chain of Title

Reputable suppliers should provide documentation proving ownership or licensing rights for their technology. Absence of such proof—especially from OEMs or Tier 1 suppliers—raises red flags about the legitimacy of the product and potential for litigation.

4. Grey Market and Diverted Products

Some batteries are manufactured under contract for a specific automaker but are diverted to the open market. These “grey market” units may violate supply agreements and IP rights, and lack warranty or support, putting the buyer at risk.

5. Software and Firmware IP Violations

Modern EV batteries include embedded software for diagnostics, calibration, and communication with the vehicle. Unauthorized duplication or modification of this firmware can infringe on software copyrights and lead to malfunction or security vulnerabilities.

Mitigation Strategies:

– Conduct thorough supplier audits and request proof of certifications (e.g., UL, CE, AEC-Q).

– Require full traceability of cells and components, including manufacturer and batch details.

– Engage legal counsel to review IP rights, licensing, and supply chain agreements.

– Prefer partnerships with established Tier 1 suppliers or OEM-approved vendors.

– Perform independent third-party testing on sample units before large-scale procurement.

Avoiding these quality and IP pitfalls ensures not only reliable performance but also protects against safety incidents, regulatory non-compliance, and costly legal disputes.

H2: Logistics & Compliance Guide for Lithium-Ion Car Batteries

Transporting lithium-ion car batteries requires strict adherence to international regulations due to their classification as hazardous materials. This guide outlines key logistics and compliance considerations to ensure safe, legal, and efficient handling of lithium-ion car batteries during transportation and storage.

1. Regulatory Frameworks

Lithium-ion car batteries are regulated under several international and national standards, including:

-

UN Recommendations on the Transport of Dangerous Goods (UN Manual of Tests and Criteria, Rev. 7, Part III, subsection 38.3)

Batteries must pass a series of safety tests (e.g., vibration, thermal, short circuit) to be certified for transport. -

IMDG Code (International Maritime Dangerous Goods) – For sea freight

- IATA Dangerous Goods Regulations (DGR) – For air transport

- ADR (European Agreement concerning the International Carriage of Dangerous Goods by Road) – For road transport in Europe

- 49 CFR (U.S. Department of Transportation) – For domestic U.S. transport

Each mode of transport has specific packaging, labeling, documentation, and training requirements.

2. Classification & UN Identification

- Proper Shipping Name: “Lithium ion batteries, contained in equipment” (UN 3480) or “Lithium ion batteries packed with equipment” (UN 3481)

- Class: Class 9 – Miscellaneous Dangerous Goods

- Packing Group: III (unless otherwise specified)

Note: Car batteries are typically shipped as part of a vehicle (UN 3171 – “Battery-powered vehicles”) or as standalone units (UN 3480).

3. Packaging Requirements

- Use strong, rigid outer packaging that protects against short circuits, physical damage, and movement.

- Terminals must be insulated (e.g., using caps, tape, or dielectric covers) to prevent short circuits.

- For air transport, batteries must be packed to prevent movement within the container.

- If shipped separately from the vehicle, batteries should be at ≤30% state of charge (per IATA guidelines) unless proven otherwise safe.

4. Labeling & Marking

- Class 9 Hazard Label – Required on all packages

- UN Number – Clearly displayed (e.g., UN 3480)

- Proper Shipping Name

- Cargo Aircraft Only Label – Required for air shipments exceeding certain watt-hour thresholds

- Lithium Battery Handling Label – Mandatory per IATA and IMDG standards

5. Documentation

- Dangerous Goods Declaration (DGD) – Required for air, sea, and road for regulated shipments

- Safety Data Sheet (SDS) – Must accompany shipments as per GHS regulations

- Shipper’s Declaration for Dangerous Goods – Required for air transport

- Transport Emergency Card (TREM Card) – Required under ADR for road transport in Europe

Accurate documentation must include battery specifications (watt-hour rating, weight, quantity), classification, and emergency response information.

6. Mode-Specific Considerations

- Air Transport (IATA DGR):

- Batteries over 100 Wh require airline approval.

- Prohibited in passenger aircraft if shipped standalone and exceed 35 kg or 300 Wh per battery.

-

State of charge must be ≤30% for non-installed batteries.

-

Sea Transport (IMDG Code):

- Must be stowed away from heat sources and incompatible materials.

- Ventilation required in container holds.

-

Battery systems must be secured to prevent movement.

-

Road Transport (ADR):

- Drivers must have ADR training certification.

- Vehicles may require orange placards for bulk shipments.

- Emergency equipment and instructions must be available.

7. Storage & Handling

- Store in a dry, cool, fire-resistant area away from combustible materials.

- Avoid stacking unless packaging is rated for it.

- Use non-conductive tools and personal protective equipment (PPE) when handling.

- Implement fire response plans, including Class D fire extinguishers or thermal runaway suppression systems.

8. Training & Certification

- Personnel involved in handling, packaging, or shipping must be trained and certified under relevant regulations (e.g., IATA, ADR, 49 CFR).

- Training should cover hazard awareness, emergency procedures, and correct documentation.

9. Environmental & End-of-Life Compliance

- Comply with UN38.3 and IEC 62133 standards for safety and performance.

- Follow WEEE Directive (EU) or RCRA (U.S.) for recycling and disposal.

- Maintain records of battery serial numbers and disposal routes for traceability.

10. Key Compliance Checklist

✅ Pass UN 38.3 testing

✅ Use approved packaging with terminal protection

✅ Apply correct labels and markings

✅ Complete required shipping documentation

✅ Ensure staff are trained and certified

✅ Follow mode-specific transport rules

✅ Monitor state of charge (especially for air)

✅ Plan for emergency response and fire safety

Adhering to this H2-level logistics and compliance guide ensures safe, legal, and efficient transport of lithium-ion car batteries across global supply chains. Always consult the latest version of applicable regulations before shipment.

Conclusion for Sourcing Li-Ion Car Batteries:

Sourcing lithium-ion (Li-ion) batteries for electric vehicles (EVs) is a strategic and critical process that significantly impacts vehicle performance, cost-efficiency, safety, and sustainability. As the demand for EVs continues to rise, ensuring a reliable, scalable, and ethical supply chain for Li-ion batteries becomes essential. Key considerations in sourcing include the quality and energy density of the batteries, supplier reliability, production scalability, cost competitiveness, and compliance with environmental and safety standards.

Moreover, geopolitical factors, access to raw materials (such as lithium, cobalt, and nickel), and the environmental impact of mining and manufacturing underscore the importance of developing diversified and sustainable supply chains. Strategic partnerships with established battery manufacturers, investment in battery technology innovation, and exploring recycling and second-life applications can further enhance supply chain resilience and reduce long-term costs.

In conclusion, successful sourcing of Li-ion car batteries requires a balanced approach that integrates technological expertise, supply chain transparency, sustainability goals, and long-term cost management. Companies that proactively address these challenges will be better positioned to thrive in the rapidly evolving electric mobility landscape.