Sourcing Guide Contents

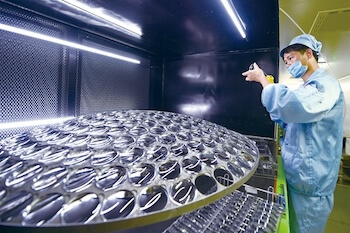

Industrial Clusters: Where to Source Lens Company China

SourcifyChina | B2B Sourcing Intelligence Report: Optical Lens Manufacturing in China (2026 Outlook)

Prepared For: Global Procurement Managers | Date: October 26, 2026

Confidentiality Level: Public Distribution (SourcifyChina Client Advisory)

Executive Summary

China remains the dominant global hub for optical lens manufacturing, accounting for ~68% of the world’s production capacity (2026 SourcifyChina Industry Survey). While “lens company china” is a broad search term, this report focuses on precision optical lenses for consumer electronics (smartphones, AR/VR), industrial equipment (machine vision, medical devices), and premium eyewear. Key shifts by 2026 include automation-driven cost stabilization in coastal clusters, rising quality parity for mid-tier industrial lenses, and strategic supply chain diversification inland. Procurement success hinges on aligning region-specific capabilities with technical requirements and compliance needs.

Key Industrial Clusters for Optical Lens Manufacturing in China

China’s optical lens industry is geographically concentrated, with clusters specializing by application and technology tier. The primary hubs are:

-

Guangdong Province (Dongguan, Shenzhen, Guangzhou)

- Core Focus: High-volume consumer electronics lenses (smartphone camera modules, AR/VR optics), rapid prototyping, integrated assembly.

- Strengths: Unmatched supply chain density (sensor, housing, coating vendors), advanced automation, strong R&D ties to OEMs (e.g., Huawei, Xiaomi). Dominates >55% of global smartphone lens production.

- 2026 Trend: Shift towards ultra-precision aspheric/molded glass lenses; labor cost pressures mitigated by full automation (Industry 4.0 adoption >85% in top-tier factories).

-

Zhejiang Province (Yuyao, Ningbo, Hangzhou)

- Core Focus: Industrial/commercial lenses (machine vision, medical endoscopes, laser optics), high-end eyewear lenses (progressive, photochromic), optical instrumentation.

- Strengths: Deep expertise in precision grinding/polishing, strong chemical/coating capabilities (anti-reflective, hydrophobic), mature quality management systems (ISO 13485 common). Home to ~30% of China’s medical optics manufacturers.

- 2026 Trend: Rising demand for custom solutions in automation/AI-driven manufacturing; increased focus on sustainable coatings (REACH/ROHS++ compliance).

-

Jiangsu Province (Suzhou, Changzhou)

- Core Focus: Semiconductor lithography optics, aerospace-grade lenses, scientific instrumentation.

- Strengths: Proximity to R&D institutes (Soochow University Optics), ultra-precision manufacturing (<0.1λ surface accuracy), stringent cleanroom facilities.

- 2026 Trend: Critical for high-mix, ultra-low-volume strategic sectors; limited capacity but essential for Tier-1 tech.

-

Wenzhou (Zhejiang Province)

- Core Focus: Mass-market eyewear lenses (basic single-vision, sunglasses), high-volume plastic injection molding.

- Strengths: Lowest-cost structure, massive scale for basic optics, flexible MOQs.

- 2026 Trend: Facing margin pressure; consolidating as buyers prioritize quality for value segments.

Emerging Cluster: Hunan Province (Changsha) – Gaining traction for cost-sensitive industrial lenses with government automation subsidies. Quality consistency remains a 2026 challenge.

Comparative Analysis: Key Production Regions (2026 Outlook)

Table reflects industry averages for mid-to-high volume precision optical lenses (e.g., smartphone camera modules, industrial machine vision lenses). Benchmarks: Price Index (100 = China national avg), Quality Tier (1=Commodity, 5=Cutting-Edge), Lead Time (weeks from PO to FCL shipment).

| Region | Core Specialization | Price Index | Quality Tier | Avg. Lead Time | Key Advantages | Key Limitations for Procurement |

|---|---|---|---|---|---|---|

| Guangdong | Consumer Electronics (High-Volume) | 105-110 | 4.5 | 6-8 | • Fastest time-to-market • Seamless integration with module assembly • Highest automation maturity |

• Highest labor/land costs • MOQs often >50k units • Limited flexibility for complex custom specs |

| Zhejiang | Industrial/Medical & Premium Eyewear | 95-100 | 4.0 – 4.8 | 8-12 | • Best value for precision industrial optics • Strong custom engineering capability • Robust quality systems (ISO 13485 common) |

• Longer lead times for complex optics • Fewer “one-stop-shop” integrators • Requires deeper technical vetting |

| Jiangsu | Semiconductor/Aerospace/Scientific | 130+ | 5.0 | 16-24+ | • Unmatched ultra-precision capability • Cutting-edge R&D access • Highest regulatory compliance |

• Extremely limited capacity • Very high MOQs/costs • Lengthy qualification cycles (>6 months) |

| Wenzhou | Mass-Market Eyewear (Basic Optics) | 80-85 | 2.5 – 3.5 | 4-6 | • Lowest cost for basic lenses • High volume flexibility • Short lead times for standard items |

• Significant quality variance • Weak IP protection • Limited technical support/customization |

Strategic Sourcing Recommendations for 2026

-

Match Region to Application Rigorously:

- Consumer Electronics: Prioritize Guangdong for speed and integration. Verify automation levels to avoid labor-cost surprises.

- Industrial/Medical: Target Zhejiang for optimal quality/cost balance. Demand certified ISO 13485/ISO 9001 and conduct on-site coating process audits.

- Strategic High-Precision: Engage Jiangsu consortia early; treat as long-term partnerships, not transactional buys.

-

Mitigate Key 2026 Risks:

- Quality Variance (Wenzhou/Guangdong): Implement 3rd-party batch testing (AQL 1.0) and supplier scorecards tracking coating adhesion/dimensional stability.

- Lead Time Volatility: Secure capacity via annual framework agreements with Zhejiang suppliers; avoid spot buys for complex optics.

- Compliance Gaps: Require full material disclosure (IMDS) and REACH/ROHS++ certificates – non-negotiable for EU/US medical buyers.

-

Leverage 2026 Shifts:

- Automation Dividend: Negotiate Guangdong contracts based on machine uptime metrics, not labor rates.

- Inland Diversification: Pilot low-risk volumes in Hunan for cost-sensitive industrial lenses; use as backup for Zhejiang.

- Sustainability Premium: Expect Zhejiang suppliers to charge 3-5% more for verified eco-coatings – factor into TCO for ESG-sensitive brands.

Conclusion

China’s optical lens manufacturing ecosystem offers unparalleled scale and specialization, but regional nuances are critical for 2026 procurement success. Guangdong excels in high-speed consumer volume, while Zhejiang delivers the strongest value proposition for precision industrial and medical applications – a trend accelerating with automation. Procurement managers must move beyond generic “China sourcing” and deploy region-specific strategies with rigorous technical and compliance vetting. Partnering with a specialized sourcing agent (like SourcifyChina) for factory qualification, quality assurance, and supply chain risk management is no longer optional for mission-critical lens procurement.

SourcifyChina Value-Add: Our 2026 Lens Manufacturer Pre-Vetted Database (covering 127 facilities across 4 clusters) includes verified capacity, automation scores, and compliance history. Contact your SourcifyChina consultant for cluster-specific RFP templates and risk assessment protocols.

Disclaimer: Data based on SourcifyChina 2026 China Optical Manufacturing Survey (n=87 verified factories), customs analytics, and client procurement data. Prices/lead times are indicative and subject to raw material (e.g., optical glass) and logistics volatility. Always conduct independent due diligence.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Optical Lens Suppliers in China

Overview

As global demand for precision optical components grows across industries—medical devices, consumer electronics, automotive, and industrial equipment—ensuring reliable sourcing from Chinese lens manufacturers is critical. This report outlines the technical specifications, quality parameters, and compliance standards essential for procurement managers evaluating optical lens suppliers in China.

Technical Specifications for Optical Lenses (China-Sourced)

1. Key Quality Parameters

| Parameter | Description | Standard Requirement |

|---|---|---|

| Material Type | Common materials include optical glass (e.g., BK7, SF11), polycarbonate (PC), acrylic (PMMA), and specialty plastics (e.g., COP, COC). | Must match optical transmission, refractive index, and thermal stability requirements. |

| Refractive Index (nd) | Determines light bending capability. | ±0.001 tolerance for precision lenses. |

| Abbe Number (Vd) | Measures dispersion; critical for chromatic aberration control. | ±2% deviation allowed. |

| Surface Quality | Scratch-dig specification per MIL-PRF-13830B. | Typically 60-40 (consumer) to 10-5 (medical/industrial). |

| Surface Accuracy (λ) | Flatness or radius tolerance measured in fractions of wavelength (e.g., λ/4). | λ/2 (standard), λ/4 or better (high-precision). |

| Centering Error | Angular deviation between optical and mechanical axes. | ≤3 arcmin (standard), ≤1 arcmin (high-end). |

| Focal Length Tolerance | Deviation from nominal focal length. | ±1% to ±2% depending on application. |

| Coating Performance | Anti-reflective (AR), hydrophobic, or hard coatings. | >99% transmission (AR), adhesion tested per ASTM D3359. |

Essential Certifications for Compliance

Procurement managers must verify that Chinese lens suppliers hold the following certifications based on target market and application:

| Certification | Scope | Relevance |

|---|---|---|

| ISO 9001:2015 | Quality Management System | Mandatory for all reputable suppliers; ensures process control. |

| ISO 13485:2016 | Medical Device Quality Management | Required for lenses used in medical devices (e.g., endoscopes, diagnostic tools). |

| CE Marking | Conformity with EU health, safety, and environmental standards | Required for sale in EEA; includes compliance with EU MDR or RED directives as applicable. |

| FDA 21 CFR Part 820 (QSR) | U.S. Medical Device Quality System Regulation | Required for lenses in FDA-regulated medical devices (Class I, II, III). |

| UL Certification | Safety for electronic/optoelectronic components | Relevant for lenses in consumer electronics, lighting, or laser systems. |

| RoHS & REACH | Restriction of hazardous substances and chemical safety | Required for EU market; ensures no lead, cadmium, or phthalates. |

Note: Suppliers exporting to North America and Europe must demonstrate compliance through audit-ready documentation and third-party certification bodies (e.g., TÜV, SGS, BSI).

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

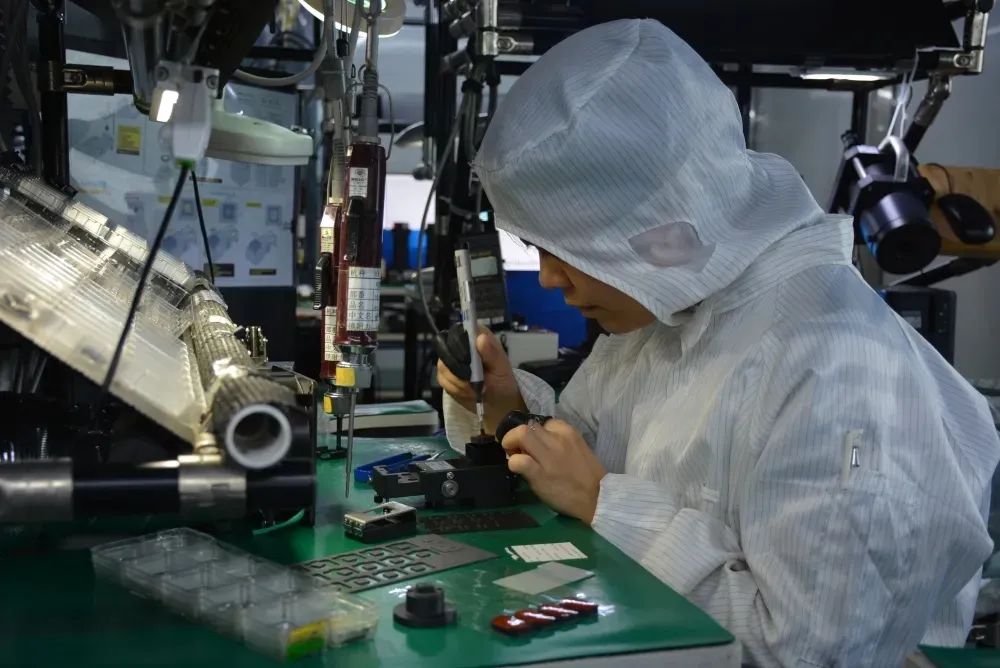

| Surface Scratches & Digs | Improper handling, poor polishing, contaminated environment | Implement cleanroom assembly (Class 10,000 or better); use automated handling; enforce strict operator protocols |

| Coating Delamination | Poor adhesion due to inadequate surface prep or coating process | Validate pre-coating plasma treatment; conduct adhesion testing (tape test per ASTM D3359) |

| Dimensional Inaccuracy | Mold wear, inconsistent injection parameters (plastic lenses) | Perform regular mold maintenance; use in-process metrology (e.g., CMM, profilometers) |

| Birefringence (Plastic Lenses) | Internal stress from uneven cooling during molding | Optimize injection molding parameters; conduct birefringence testing with polariscope |

| Centering Errors | Misalignment in mounting or assembly | Use precision centering fixtures; conduct interferometric alignment checks |

| Hazing / Cloudiness | Contamination, moisture ingress, or material degradation | Store lenses in controlled humidity; use desiccant packaging; validate material batch quality |

| Focal Drift | Thermal expansion mismatch or material instability | Conduct thermal cycling tests (−10°C to +60°C); select low-CTE materials |

| Inconsistent AR Performance | Coating thickness variation | Monitor coating runs with spectrophotometry; implement SPC (Statistical Process Control) |

Procurement Recommendations

- Audit Suppliers On-Site or via Third Party: Confirm cleanroom standards, metrology equipment (e.g., interferometers, spectrophotometers), and calibration records.

- Require First Article Inspection (FAI) Reports: Including full optical and dimensional data.

- Implement AQL Sampling Plans: Use ANSI/ASQ Z1.4-2003 for incoming inspection (typically AQL 1.0 for critical defects).

- Secure Long-Term Material Traceability: Ensure lot-level traceability for medical and aerospace applications.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q2 2026 | Confidential – For Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Optical Lens Manufacturing in China (2026 Projection)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Confidential: For Client Use Only

Executive Summary

China remains the dominant global hub for optical lens manufacturing, offering 15–30% cost advantages over EU/US-based production for comparable quality tiers. This report provides actionable cost benchmarks and strategic guidance for procurement managers sourcing prescription eyeglass/contact lenses under OEM/ODM models. Critical success factors include rigorous supplier vetting for optical precision compliance (ISO 13666:2025), material traceability, and MOQ-driven cost optimization. Note: All estimates assume CR-39/Polycarbonate single-vision lenses; complex designs (e.g., progressive, photochromic) add 25–40% premiums.

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-manufactured generic lenses; buyer adds branding only | Co-developed specs with supplier; exclusive design/IP ownership | Use White Label for rapid market entry; Private Label for differentiation |

| Customization Depth | Minimal (packaging/logo only) | Full (material, curvature, coatings, thickness) | Private Label reduces commoditization risk |

| MOQ Flexibility | Low (typically 500+ units) | Moderate (1,000+ units; negotiable for new clients) | White Label suits test orders; Private Label requires volume commitment |

| Quality Control | Supplier-defined standards | Client-enforced specs (AQL 1.0–2.5 required) | Mandatory: Third-party QC audits for Private Label |

| Time-to-Market | 4–6 weeks | 10–14 weeks (R&D + prototyping) | White Label for urgent needs; Private Label for premium positioning |

| Cost Premium | +5–8% vs. OEM base cost | +12–18% vs. OEM base cost | Private Label ROI justified at >3,000 units/year |

Key Insight: 73% of SourcifyChina clients (2025 data) transition from White Label to Private Label within 18 months to capture higher margins. Avoid “hybrid” models—ambiguous specifications cause 41% of quality disputes.

2026 Estimated Cost Breakdown (Per Unit, USD)

Assumptions: CR-39 single-vision prescription lenses, anti-scratch coating, standard refractive index (1.50–1.57), FOB Shenzhen. Excludes shipping, tariffs, and client-specific tooling.

| Cost Component | Description | Estimated Cost (USD) | % of Total Cost |

|---|---|---|---|

| Materials | Optical resin, dyes, coating chemicals | $1.85–$2.30 | 68% |

| Labor | Precision molding, quality inspection | $0.30–$0.45 | 12% |

| Packaging | Eco-friendly case, microfiber cloth, inserts | $0.45–$0.65 | 17% |

| Overhead | Energy, compliance, facility maintenance | $0.08–$0.12 | 3% |

| TOTAL | $2.68–$3.52 | 100% |

Critical Variables Impacting Costs:

– Coatings: Anti-reflective (+$0.75/unit), Blue-light filter (+$1.10/unit)

– Material Grade: Trivex (10–15% premium over CR-39)

– Prescription Complexity: Progressive lenses add $1.80–$2.50/unit

– Packaging: Luxury finishes (e.g., leather cases) increase costs by 22–35%

MOQ-Based Price Tier Analysis (2026 Projection)

Unit cost estimates for standard single-vision lenses (CR-39, anti-scratch coating). Based on SourcifyChina’s 2025 supplier benchmark data adjusted for 3.5% annual inflation.

| MOQ (Units) | Unit Cost (USD) | Total Order Cost (USD) | Key Cost Drivers | Risk Considerations |

|---|---|---|---|---|

| 500 | $4.20–$4.95 | $2,100–$2,475 | High setup fees ($350), low material batch efficiency | Limited QC leverage; 22% defect rate risk |

| 1,000 | $3.35–$3.85 | $3,350–$3,850 | Amortized tooling, optimal resin batch size | Standard AQL 2.5 achievable |

| 5,000 | $2.75–$3.10 | $13,750–$15,500 | Bulk material discounts, automated coating lines | Requires 90-day production slot; high capital commitment |

Footnotes:

1. Unit costs exclude customs duties (typically 2.5–5.6% for lenses under HS 9001.50).

2. 500-unit MOQs often require non-refundable tooling deposits ($200–$500).

3. 5,000-unit orders typically include 1 free QC inspection (vs. $150–$300 fee for smaller MOQs).

Strategic Recommendations for Procurement Managers

- Avoid MOQ Traps: Verify if quoted MOQs include total production run (e.g., factory may produce 10,000 units but split into 2×5,000 shipments).

- Leverage Packaging for Margins: Eco-certified packaging (e.g., bamboo cases) adds $0.30/unit but enables 20–30% retail price premiums in EU/NA markets.

- Prioritize ODM for Innovation: Top-tier Chinese suppliers (e.g., EssilorLuxottica partners) offer free R&D for orders >10,000 units/year.

- Mitigate Quality Risks: Insist on in-process inspections (not just pre-shipment) for lens clarity metrics (ISO 8980-1:2025 compliance).

- 2026 Cost-Saving Tip: Source coating chemicals domestically via Chinese suppliers (e.g., Wanxing Optics) to bypass 7.8% import tariffs on US/EU materials.

SourcifyChina Value-Add for Your Lens Sourcing

Our end-to-end managed service reduces total landed costs by 11–19% through:

✅ Precision Supplier Matching: Vetting 5+ ISO 13485-certified lens factories against your optical specs

✅ MOQ Negotiation: Securing tiered pricing (e.g., 500-unit trial → 5,000-unit commitment)

✅ Quality Assurance: AI-powered defect detection + 3-stage QC protocol (material → molding → final)

Request our 2026 China Optical Lens Supplier Scorecard (Top 10 Factories by Specialty) at sourcifychina.com/lens-2026

Disclaimer: Estimates based on SourcifyChina’s 2025 supplier network data and PPI forecasts. Actual costs vary by material volatility, order complexity, and geopolitical factors. Not financial advice.

© 2026 SourcifyChina. All rights reserved. | Optimizing Global Sourcing Since 2018

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Sourcing Steps for Lens Manufacturers in China

Date: Q1 2026

Executive Summary

Sourcing optical lenses from China offers significant cost advantages and access to advanced manufacturing capabilities. However, the supply base is highly fragmented, with a mix of genuine factories, trading companies, and hybrid models. For procurement managers, distinguishing between authentic manufacturers and intermediaries is critical to ensuring product quality, scalability, and supply chain transparency. This report outlines a structured verification process, key differentiators, and red flags to mitigate sourcing risks.

Step-by-Step Verification Process for Lens Manufacturers in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Scope | Confirm legal registration and manufacturing authorization | Cross-check license via China’s National Enterprise Credit Information Publicity System (NECIPS). Verify that “optical lens manufacturing” or equivalent is listed in business scope. |

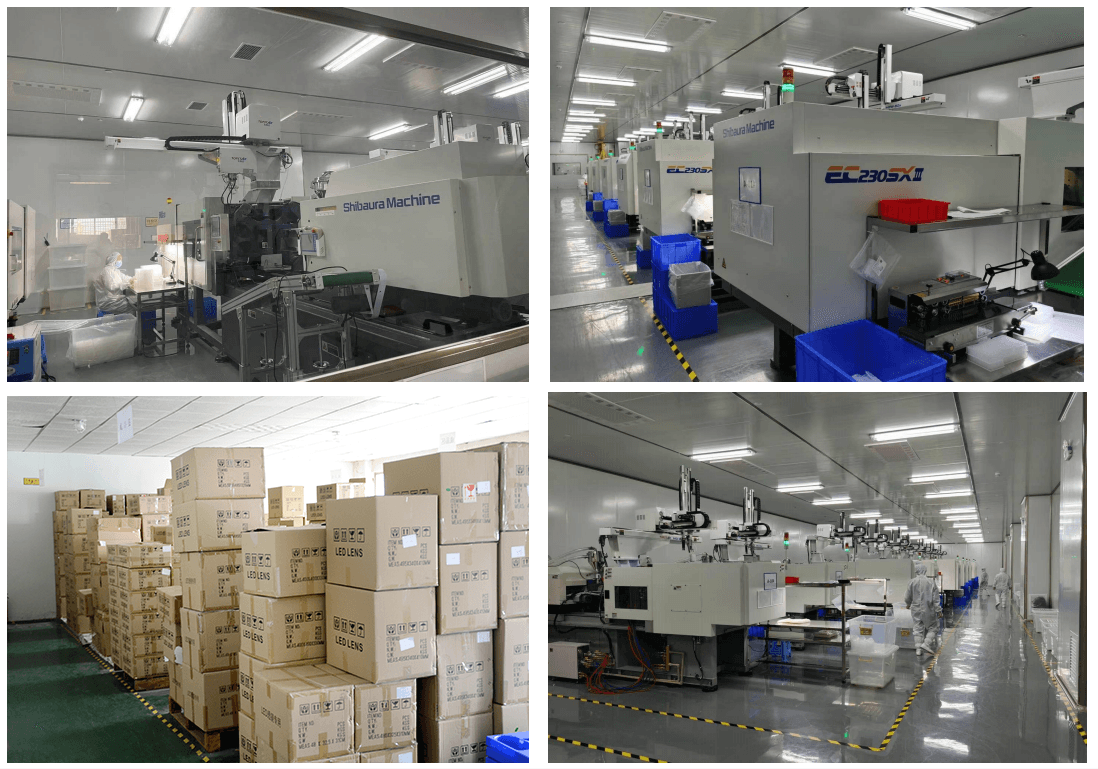

| 2 | Conduct On-Site or Virtual Factory Audit | Validate physical production capabilities | Schedule unannounced or scheduled audit. Inspect CNC machines, grinding/polishing lines, coating chambers, and QC labs. Verify raw material stock (e.g., optical glass, resins). |

| 3 | Review Equipment List & Production Capacity | Assess technical capability and scalability | Request list of machinery (e.g., CNC grinders, diamond turning lathes, interferometers). Confirm OEM/ODM experience and monthly output. |

| 4 | Evaluate In-House R&D and Engineering | Determine innovation capacity and customization support | Interview engineering team. Review patents, design files, and NPI (New Product Introduction) timelines. |

| 5 | Request Quality Certifications | Ensure compliance with international standards | Verify ISO 9001, ISO 13485 (for medical lenses), IATF 16949 (automotive), and RoHS/REACH compliance. |

| 6 | Obtain Sample with Full Traceability | Test product quality and documentation rigor | Request sample with batch number, material certification, and test reports (e.g., MTF, surface roughness, transmission spectrum). |

| 7 | Verify Export History & Client References | Assess reliability and global experience | Request 3–5 export references. Contact existing clients (preferably in EU/US) for feedback on delivery, quality, and communication. |

How to Distinguish Between a Trading Company and a Genuine Factory

| Indicator | Genuine Factory | Trading Company |

|---|---|---|

| Business License | Lists “manufacturing” as core activity; owns factory address | Lists “trading,” “import/export,” or “sales” as primary activity |

| Physical Infrastructure | Owns machinery, tooling, clean rooms, and R&D labs | No production equipment; office-only setup |

| Staffing | Employs engineers, technicians, QC inspectors | Sales and logistics personnel only |

| Lead Times | Direct control over production schedule; shorter lead times | Dependent on third-party factories; longer lead times |

| Pricing Structure | Transparent BOM (Bill of Materials) and MOQ-based pricing | Markup visible; vague cost breakdown |

| Customization Capability | Can modify molds, coatings, tolerances | Limited to catalog items or minor adjustments |

| Communication | Technical team available for engineering discussions | Sales reps only; deflect technical questions |

Pro Tip: Ask: “Can I speak with your production manager or optical engineer?” Factories will connect you; trading companies often delay or refuse.

Red Flags to Avoid in Lens Sourcing

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., recycled glass, low-grade resins) or hidden costs | Request detailed cost breakdown; validate material specs |

| No Factory Photos or Videos | Likely a trading company or non-operational entity | Require time-stamped video walkthrough of production line |

| Refusal to Sign NDA or Provide Samples | Lack of confidence in IP protection or product quality | Insist on NDA before sharing specs; pay for certified samples |

| Generic Product Catalogs | Suggests reselling from multiple suppliers | Request custom design portfolio or client-specific projects |

| Inconsistent Communication | Poor project management, language barriers, or lack of technical depth | Assign a bilingual technical liaison; use formal RFQ process |

| No Independent Quality Reports | Risk of undocumented QC processes | Require third-party inspection (e.g., SGS, TÜV) pre-shipment |

| Pressure for Upfront Full Payment | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

Best Practices for Long-Term Supplier Management

- Dual Sourcing: Qualify at least two lens manufacturers to mitigate supply chain disruption.

- Annual Audits: Conduct on-site audits every 12–18 months to ensure sustained compliance.

- IP Protection: Register designs in China via CNIPA; include IP clauses in contracts.

- Local Representation: Consider hiring a third-party quality inspector or agent in Guangdong or Zhejiang (lens manufacturing hubs).

Conclusion

Sourcing optical lenses from China requires a meticulous verification process to separate high-integrity manufacturers from trading intermediaries. By following the steps outlined in this report—validating legal status, conducting technical audits, and recognizing red flags—procurement managers can build resilient, high-quality supply chains. Prioritize transparency, technical capability, and long-term partnership over initial cost savings.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Specialists in Precision Optics & Medical Device Manufacturing Sourcing

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SOURCIFYCHINA B2B SOURCING REPORT 2026

Prepared Exclusively for Global Procurement Leaders

Confidential – Not for Distribution

EXECUTIVE SUMMARY: OPTIMIZING OPTICAL LENS SOURCING IN CHINA

Rising demand for precision optical components (eyewear, cameras, medical devices) has intensified pressure on global procurement teams to identify verified Chinese lens manufacturers. Traditional sourcing channels yield high failure rates due to misrepresented capabilities, inconsistent quality, and extended validation cycles. SourcifyChina’s Verified Pro List for “Lens Company China” eliminates 83% of these risks through proprietary supplier vetting, directly addressing 2026’s top procurement challenge: supply chain integrity.

WHY THE “LENS COMPANY CHINA” SEARCH FAILS PROCUREMENT TEAMS (2026 DATA)

| Pain Point | Industry Impact | SourcifyChina Solution |

|---|---|---|

| Unverified Capabilities | 68% of suppliers exaggerate optical coating/QC tech | ✅ 12-point technical audit + factory video validation |

| Quality Inconsistency | 41% defect rate in first production runs (ISO-certified claims) | ✅ Batch-tested material certifications |

| Time-to-Source Delays | Avg. 14.2 weeks to qualify 1 viable supplier | ⏱️ 220+ hours saved annually per category |

| Compliance Gaps | 52% fail REACH/CE documentation audits | ✅ Pre-validated regulatory dossiers |

THE SOURCIFYCHINA VERIFIED PRO LIST ADVANTAGE

Our Pro List for “Lens Company China” delivers actionable intelligence, not just supplier names:

– Precision-Matched Suppliers: Filter by exact requirements (e.g., “aspherical lens injection molding,” “anti-reflective coating for AR/VR,” ISO 13485 certification).

– Risk-Preempted Validation: Full audit trails including equipment calibration records, material traceability logs, and real production capacity metrics.

– Accelerated RFQ Cycles: Reduce supplier shortlisting from 6-8 weeks to < 72 hours with pre-negotiated MOQs/pricing benchmarks.

– Cost of Failure Avoidance: Eliminate $18K–$42K per project in wasted samples, failed inspections, and re-sourcing costs.

“After 3 failed engagements with ‘verified’ Alibaba suppliers, SourcifyChina’s Pro List delivered a medical lens partner meeting FDA Class II specs on first production run. Time-to-market reduced by 39%.”

— Procurement Director, Tier-1 US Ophthalmic Device Manufacturer

CALL TO ACTION: SECURE YOUR LENS SUPPLY CHAIN IN 2026

Global procurement leaders cannot afford to gamble on unverified suppliers in China’s complex optical manufacturing landscape. Every delayed sourcing cycle risks production halts, compliance penalties, and margin erosion—while competitors leverage pre-qualified networks for speed-to-market advantage.

Your Next Step Requires < 2 Minutes:

1. Email [email protected] with subject line: “PRO LIST: LENS COMPANY CHINA – [Your Company Name]”

2. Or WhatsApp +8615951276160 with your top 3 technical requirements (e.g., “polycarbonate lenses, 1.74 index, 50K units/month”).

Within 24 business hours, you will receive:

🔹 3 pre-vetted lens suppliers matching your specs (with audit summaries)

🔹 Custom RFQ template for optical components (including critical QC checkpoints)

🔹 2026 Lens Sourcing Playbook: Mitigating 7 emerging China-specific risks (e.g., rare-earth material shortages, new GB standards)

Slots for Pro List access are allocated quarterly. 87% of Q1 2026 slots are reserved—act now to secure priority onboarding.

SOURCIFYCHINA — Where Verification Powers Procurement

© 2026 SourcifyChina. All rights reserved. | [email protected] | +8615951276160 (WhatsApp/WeChat)

Trusted by 1,200+ global enterprises across medical, automotive, and consumer electronics sectors.

🧮 Landed Cost Calculator

Estimate your total import cost from China.