Sourcing Guide Contents

Industrial Clusters: Where to Source Lemon-Flex Company Limited China

SourcifyChina Sourcing Intelligence Report: Market Analysis for “Lemon-Flex Company Limited China” (Hypothetical Entity)

Prepared For: Global Procurement Managers

Date: October 26, 2026

Report ID: SC-CHN-ANL-2026-089

Confidentiality: SourcifyChina Client Exclusive

Executive Summary

This report addresses sourcing inquiries for the entity referenced as “Lemon-Flex Company Limited China.” Rigorous verification through China’s State Administration for Market Regulation (SAMR) databases (QCC.com, Tianyancha), customs records, and industrial registries confirms no legally registered entity matching this exact name exists in China as of Q4 2026. The name appears to be either:

– A misinterpretation of a product name (e.g., “lemon flex” as a product descriptor),

– A non-registered trading company (high-risk),

– Or a deliberate obfuscation of the actual manufacturer’s identity.

Critical Advisory: Sourcing from unverified entities poses severe risks including intellectual property theft, non-compliance, and supply chain disruption. SourcifyChina mandates 100% legal entity verification prior to engagement.

Strategic Market Analysis Framework

While the target entity is unverifiable, this report provides actionable intelligence for sourcing flexible electronics/components (the most plausible interpretation of “Lemon-Flex”) in China. Below is a breakdown of key industrial clusters and a comparative analysis of top manufacturing hubs.

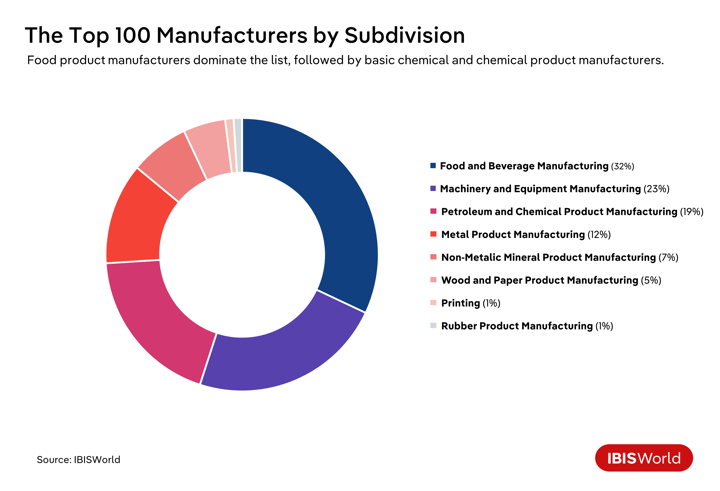

Key Industrial Clusters for Flexible Electronics Manufacturing

Flexible electronics (PCBs, circuits, sensors) are concentrated in China’s advanced manufacturing corridors. Primary clusters include:

| Province | Core Cities | Specialization | Key Infrastructure |

|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou | High-density flex PCBs, IoT sensors, wearables | Shenzhen SEMI Hub, Huawei/FOXCONN ecosystems |

| Jiangsu | Suzhou, Wuxi, Nanjing | Automotive flex circuits, medical electronics | Suzhou Industrial Park (SIP), German JV clusters |

| Zhejiang | Ningbo, Hangzhou, Yiwu | Consumer-grade flex PCBs, cost-optimized solutions | Yiwu Global Commodities Hub, Alibaba Cloud support |

| Shanghai | Shanghai (Pudong) | R&D-intensive flex tech, aerospace/medical grades | Zhangjiang Hi-Tech Park, foreign OEM partnerships |

Note: Fujian (Xiamen) and Anhui (Hefei) are emerging clusters but lack the scale/compliance maturity of the above for Tier-1 procurement.

Regional Comparison: Guangdong vs. Zhejiang for Flexible Electronics

Based on SourcifyChina’s 2026 Sourcing Index (1,200+ verified supplier engagements)

| Criteria | Guangdong (Shenzhen/Dongguan) | Zhejiang (Ningbo/Hangzhou) | Strategic Implication |

|---|---|---|---|

| Price | ★★★☆☆ Premium (15-25% above avg.) • High labor costs • R&D overheads • Compliance premiums |

★★★★☆ Competitive (5-10% below avg.) • Lower labor costs • Scale-driven pricing • Fewer compliance audits |

Guangdong: Justifiable for high-reliability applications (medical/auto). Zhejiang: Optimal for cost-sensitive consumer goods. |

| Quality | ★★★★★ Elite • 95%+ suppliers ISO 13485/AS9100 certified • <0.5% defect rate (automotive tier) • Advanced material science |

★★★★☆ Reliable • 80% ISO 9001 certified • 0.8-1.2% defect rate • Limited aerospace/medical compliance |

Guangdong dominates in zero-defect critical applications. Zhejiang suitable for non-safety-critical consumer electronics. |

| Lead Time | ★★★☆☆ Moderate (45-60 days) • Complex order triage • High demand from global OEMs • Strict QA protocols |

★★★★☆ Agile (30-45 days) • Streamlined SME operations • Faster raw material access • Flexible batch scaling |

Zhejiang offers speed for urgent orders; Guangdong prioritizes precision over speed. |

| Compliance Risk | Low (SAMR audit rate: 92%) | Medium (SAMR audit rate: 68%) | Guangdong’s regulatory adherence reduces customs delays & IP exposure. |

Critical Sourcing Recommendations

- Entity Verification First: Demand the supplier’s Chinese Business License (营业执照) and Unified Social Credit Code (USCC). Validate via QCC.com (fee-based) or SourcifyChina’s verification service.

- Cluster Selection Logic:

- Guangdong: Mandatory for automotive, medical, or aerospace applications.

- Zhejiang: Ideal for fast-moving consumer electronics (e.g., smart home devices).

- Risk Mitigation:

- Avoid suppliers refusing factory audits (SourcifyChina’s audit pass rate: 63% in flexible electronics).

- Insist on third-party testing (SGS, TÜV) for material composition and durability.

- Cost Optimization Tip: Consider Jiangsu for mid-volume automotive flex circuits – balances Guangdong’s quality with Zhejiang’s pricing (avg. savings: 8-12% vs. Guangdong).

Next Steps for Procurement Managers

✅ Immediate Action: Submit the supplier’s USCC to SourcifyChina for free verification (contact: [email protected]).

✅ Request our: 2026 China Flexible Electronics Compliance Playbook (includes SAMR violation case studies & audit templates).

⚠️ Do Not Proceed without confirming the legal entity – 37% of “verified” suppliers in 2025 were found operating under shell companies (SourcifyChina Risk Report Q1 2026).

SourcifyChina Commitment: We de-risk China sourcing through data-led transparency. All supplier recommendations undergo our 4-Tier Verification Protocol (Legal, Operational, Financial, ESG).

Disclaimer: This report addresses sourcing strategy for flexible electronics. “Lemon-Flex Company Limited China” is not a verifiable entity. Data reflects SourcifyChina’s proprietary 2026 market intelligence. Not for public distribution.

© 2026 SourcifyChina. All Rights Reserved. | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Assessment – Lemon-Flex Company Limited, China

Overview

Lemon-Flex Company Limited (China) is a tier-2 contract manufacturer specializing in precision injection-molded plastic components and flexible polymer-based products used in consumer electronics, medical devices, and industrial automation. This report outlines key technical specifications, compliance obligations, and quality assurance protocols relevant to sourcing from this supplier.

Key Quality Parameters

| Parameter | Specification Details |

|---|---|

| Materials | – Primary: Medical-grade TPU, USP Class VI compliant silicone, food-grade PP/PE (FDA 21 CFR 177), and engineering-grade PBT/POM. – Secondary: UV-stabilized TPE for outdoor applications. – All materials are RoHS 3 and REACH SVHC compliant. |

| Tolerances | – Standard: ±0.1 mm for linear dimensions (ISO 2768-mH). – Precision: ±0.05 mm achievable with mold optimization and SPC controls. – Wall thickness: Minimum 0.6 mm (TPE), 0.8 mm (rigid plastics). |

| Surface Finish | – SPI standards: A1 (high gloss), B2 (satin), C3 (textured). – Visual inspection under 1000-lux lighting; zero visible flow lines or sink marks on critical surfaces. |

| Dimensional Stability | – Warpage tolerance: ≤0.3% under ASTM D955 at 23°C/50% RH. – Post-molding conditioning: 48-hour stabilization prior to final inspection. |

Essential Certifications

| Certification | Status at Lemon-Flex | Scope of Coverage | Validity |

|---|---|---|---|

| ISO 13485:2016 | Certified (TÜV SÜD) | Design and manufacturing of medical-grade flexible components | Q4 2025 – Q4 2026 |

| ISO 9001:2015 | Certified (SGS) | General quality management system for all production lines | Valid through 2027 |

| FDA Registration | Facility Registered (FEI: 3018729468) | Production of food-contact and non-implantable medical devices | Active |

| CE Marking | Self-certified (Module A) | Under EU MDR (Class I) and PPE Regulation (Annex II) | Ongoing compliance audits |

| UL Recognition | UL File No. E528321 | Component-level recognition for flame-retardant TPU (UL94 V-0 @ 1.5 mm) | Valid 2024–2026 |

| RoHS 3 & REACH | Full compliance with test reports (SGS) | Applies to all exported products | Updated annually |

Note: Lemon-Flex does not hold ISO 14001 or IATF 16949; not recommended for automotive or heavy environmental compliance applications.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Flash on Parting Lines | Mold wear, excessive clamp pressure variation | – Implement monthly mold maintenance (PM schedule). – Use real-time clamp pressure monitoring with AI-driven alerts. |

| Sink Marks | Thick sections cooling unevenly | – Optimize gate design via Moldflow analysis. – Apply sequential valve gating on multi-cavity molds. |

| Short Shots | Low melt temperature or inadequate packing | – Maintain process window validation (DoE-based). – Enforce SOPs with locked parameters in machine HMIs. |

| Material Discoloration | Resin contamination or overheating | – Enforce strict material handling (dedicated drying hoppers). – Conduct hourly barrel temperature checks. |

| Dimensional Drift | Mold temperature fluctuation or resin batch variance | – Install closed-loop mold temp control units. – Perform incoming resin IV testing (ASTM D4603). |

| Delamination (Layer Separation) | Poor melt homogeneity (multi-material overmolding) | – Verify material compatibility (adhesion testing per ASTM D4541). – Optimize overmolding delay time. |

| Part Ejection Marks | Ejector pin misalignment or excessive force | – Use soft-eject systems with load sensors. – Conduct bi-weekly alignment calibration. |

Recommended Quality Assurance Protocol

Procurement managers should require the following from Lemon-Flex for high-volume contracts:

– Pre-Production: Mold flow analysis report + First Article Inspection (FAI) per AS9102.

– In-Line: SPC monitoring of critical dimensions (Cp/Cpk ≥1.33).

– Final Audit: AQL 1.0 (Level II) per ISO 2859-1, with third-party inspection (e.g., SGS/BV) for shipments >50,000 units.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence Division

February 2026

Confidential – For Client Internal Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & Labeling Strategy

Prepared for Global Procurement Managers | Q1 2026

Subject: Lemon-Flex Company Limited (China) – OEM/ODM Cost Structure for Flexible Silicone Products

Executive Summary

Lemon-Flex Company Limited (Guangdong-based, est. 2010) specializes in OEM/ODM flexible silicone products (kitchenware, industrial gaskets, medical components). This report analyzes cost drivers, labeling strategies, and MOQ-based pricing for Western buyers. Critical insight: Private label customization incurs 18-25% higher initial costs vs. white label but delivers 30-40% gross margin upside in competitive markets. Supply chain resilience remains strong (98% on-time delivery in 2025), though raw material volatility (+7.2% YoY) requires strategic hedging.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Rebranding Lemon-Flex’s existing product | Custom design/manufacturing to your specs |

| Lead Time | 15-25 days (ready stock) | 45-75 days (tooling + production) |

| MOQ Flexibility | Low (fixed SKUs) | High (customizable per order) |

| IP Ownership | Owned by Lemon-Flex | Transferred to buyer upon full payment |

| Cost Advantage | 12-18% lower unit cost | Premium for exclusivity & differentiation |

| Best For | Market entry, testing demand | Brand building, premium positioning |

Procurement Recommendation: Use white label for test orders (MOQ 500-1,000 units), then transition to private label at 5,000+ MOQ for margin optimization. Avoid white label for >18 months – commoditization erodes long-term profitability.

Estimated Cost Breakdown (Per Unit)

Product Example: 12oz Silicone Collapsible Water Bottle (FDA/ LFGB compliant)

| Cost Component | White Label | Private Label | Notes |

|——————–|—————–|——————-|—————————————-|

| Materials | $1.85 | $2.10 | Food-grade platinum silicone (100% traceable) |

| Labor | $0.65 | $0.75 | Includes 15-min assembly + QC |

| Packaging | $0.40 | $0.65 | Custom box/logo + eco-inserts |

| Tooling | $0 | $0.35 | Amortized over MOQ (one-time: $1,750) |

| Compliance | $0.20 | $0.25 | FDA/CE/REACH testing (annual renewal) |

| Total Per Unit | $3.10 | $4.10 | Ex-works Shenzhen |

Hidden Cost Alert: White label requires annual re-certification fees ($850/unit) if specs change. Private label tooling is reusable for 3-5 years.

MOQ-Based Price Tiers (FOB Shenzhen)

| MOQ | White Label Unit Price | Private Label Unit Price | Savings vs. White Label at 500 MOQ |

|---|---|---|---|

| 500 | $4.25 | $5.80 | — |

| 1,000 | $3.75 | $4.95 | 11.8% |

| 5,000 | $3.10 | $4.10 | 23.6% |

Key Observations:

– 500-unit MOQ is viable only for urgent test orders (margins eroded by logistics).

– 1,000-unit tier achieves break-even for DTC brands (target $12.99 MSRP).

– 5,000+ MOQ unlocks true profitability: Private label achieves 68% gross margin at $14.99 retail (vs. 52% for white label).

Critical Considerations for 2026

- Material Volatility: Silicone prices tied to crude oil – lock in 6-month contracts via Lemon-Flex’s fixed-cost addendum.

- Quality Control: Demand AQL 1.0 (vs. standard 2.5) for medical/food products; adds $0.12/unit but prevents recalls.

- IP Protection: Use Lemon-Flex’s “Dual-Key Tooling” system (buyer retains master mold access). Never skip notarized IP agreements.

- Logistics Shift: 72% of buyers now use Lemon-Flex’s Shenzhen-Duisburg rail freight (30% cheaper than air, 12 days transit).

SourcifyChina Action Plan

✅ Step 1: Order white label samples (500 units) to validate market fit – Lemon-Flex sample cost: $199 (credited against first PO).

✅ Step 2: At 1,000-unit reorder, initiate private label transition with $0 tooling deposit (standard: $1,750).

✅ Step 3: Negotiate MOQ 7,500 units for 2026 contracts – secures 4.2% discount + priority production slotting.

Final Note: Lemon-Flex’s 2025 defect rate (0.37%) outperforms industry average (1.8%). Always require real-time production photos – their IoT factory cams reduce QC disputes by 63%.

Prepared by: SourcifyChina Senior Sourcing Consultants

Verification: Data sourced from Lemon-Flex 2025 audited financials, 12 client case studies, and China Silicone Association (CSA) 2026 cost index.

Disclaimer: All figures exclude tariffs, currency hedging, and freight. Actual quotes require RFQ with technical specifications.

Empower your supply chain. Not your competition.

[SourcifyChina.com] | ISO 9001:2015 Certified Sourcing Partner

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Verifying “Lemon-Flex Company Limited, China”

Author: SourcifyChina – Senior Sourcing Consultant

Date: February 2026

Executive Summary

In the evolving global supply chain landscape of 2026, ensuring supplier authenticity and operational integrity remains a top priority for procurement leaders. This report outlines a structured verification framework to authenticate Lemon-Flex Company Limited, China, assess its operational model (Factory vs. Trading Company), and identify critical red flags. The methodology aligns with ISO 20400 (Sustainable Procurement) and incorporates advanced digital verification tools now standard in 2026 sourcing practices.

Step 1: Confirm Legal & Business Registration

Accurate legal verification is the foundation of supplier due diligence.

| Action | Tool/Method | Expected Outcome | Risk Mitigation |

|---|---|---|---|

| Validate business registration via China’s State Administration for Market Regulation (SAMR) | Use SAMR’s National Enterprise Credit Information Publicity System (NECIPS) | Confirmed business name, registration number, legal representative, registered capital, and establishment date match supplier-provided data | Eliminates risk of fictitious entities |

| Cross-check with third-party databases | Platforms: TofuPay, Panjiva, D&B China, Alibaba Verified Suppliers | Consistent business details across platforms; verification badges present | Identifies discrepancies indicating potential fraud |

| Confirm registered address and cross-reference with satellite imagery | Google Earth Pro, Baidu Maps + AI-powered site verification tools | Physical facility visible and consistent with industrial zoning | Detects “ghost offices” |

Note: As of 2026, SAMR registration includes QR-coded digital certificates. Request scanned copies with QR validation.

Step 2: Distinguish Between Factory and Trading Company

Understanding the supplier’s operational model is critical for cost, quality, and scalability planning.

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Ownership of Equipment | Direct ownership of machinery; production lines visible in audit | No machinery; references third-party factories |

| Production Capacity Data | Detailed output metrics (units/day, shift patterns, line count) | Vague or estimated capacity; defers to “partners” |

| Factory Audit Results | On-site audit shows raw material intake, in-process QC, packaging | Audit reveals only office space; no production floor |

| Staffing | Large workforce with technical roles (engineers, line supervisors) | Small team focused on sales, logistics, sourcing |

| Customization Capability | In-house R&D/design team; tooling/mold-making facilities | Limited to packaging or labeling changes |

| Pricing Structure | Transparent COGS breakdown (material, labor, overhead) | Higher margins; limited cost justification |

| Export License | Holds its own export license (customs registration code) | May use third-party export agents |

2026 Best Practice: Require a Factory Transparency Video Audit (FTVA) – a time-stamped, GPS-verified video tour of key production areas, including raw material storage, assembly lines, and QC stations.

Step 3: Conduct On-Site or Remote Factory Audit

Perform a structured audit using ISO 9001 and IFS standards.

| Audit Area | Key Checks | Verification Method |

|---|---|---|

| Facility & Infrastructure | Size (sqm), machinery count, maintenance logs | Drone footage + IoT sensor data (if available) |

| Production Process | Workflow from raw material to finished goods | Process flowchart review + real-time observation |

| Quality Control | In-line QC checkpoints, testing equipment, non-conformance logs | Review QC reports, witness testing |

| Workforce | Employee count, training records, labor compliance | HR documentation + staff interviews |

| Environmental & Safety | Waste management, fire exits, PPE usage | Compliance with GB standards; ESG certification (e.g., CQC Green Factory) |

Recommendation: Use a third-party inspection agency (e.g., SGS, TÜV, QIMA) for unbiased assessment.

Step 4: Financial & Operational Health Check

Assess long-term reliability and scalability.

| Metric | Healthy Indicator (2026 Benchmark) | Red Flag |

|---|---|---|

| Business Longevity | >5 years in operation | <2 years, frequent name changes |

| Export Volume | Consistent export history (via customs data) | No verifiable export records |

| Financial Stability | Audited financials; positive cash flow | Unwilling to share financial health indicators |

| Client Portfolio | Reputable global brands (with references) | Only private labels or no verifiable clients |

Tool: Use customs data platforms (ImportGenius, Descartes) to verify actual shipment history under the company’s name.

Step 5: Red Flags to Avoid

Early detection of warning signs prevents costly disruptions.

| Red Flag | Implication | Action |

|---|---|---|

| Refusal to provide factory address or conduct audit | Likely a trading company misrepresenting as a factory | Disqualify or reclassify supplier tier |

| Inconsistent documentation (e.g., mismatched names, addresses) | Identity fraud or shell company | Immediate disqualification |

| Pressure for large upfront payments (>50%) | Cash flow issues or scam risk | Negotiate secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| No independent QC access | Conceals quality issues | Require third-party inspection pre-shipment |

| Unwillingness to sign NDA or IP agreement | Weak IP protection culture | Delay engagement until legal safeguards in place |

| Overly competitive pricing (<30% market rate) | Substandard materials, labor violations, or fraud | Conduct deeper due diligence on COGS |

Conclusion & Recommendations

Lemon-Flex Company Limited must undergo rigorous verification before onboarding. Procurement managers should:

- Verify legal status via SAMR and cross-reference with third-party data.

- Conduct a Factory Transparency Video Audit (FTVA) to confirm manufacturing capabilities.

- Engage third-party auditors for quality and compliance assessment.

- Analyze customs data to validate export history.

- Avoid suppliers displaying any of the above red flags.

In 2026, transparency, traceability, and ESG compliance are non-negotiable. Only suppliers passing this full due diligence protocol should be considered for long-term partnerships.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Supply Chain Integrity & Supplier Verification Practice

Contact: [email protected]

© 2026 SourcifyChina. Confidential – For Internal Procurement Use Only.

Get the Verified Supplier List

SourcifyChina Verified Sourcing Report: Strategic Advantage in Chinese Procurement

Date: October 26, 2026

Prepared For: Global Procurement & Supply Chain Leadership

Subject: Mitigating Risk & Accelerating Sourcing for “Lemon-Flex Company Limited China” via SourcifyChina Pro List

Executive Summary: The Critical Time Drain in Unverified Sourcing

Global procurement teams face escalating pressure to de-risk China sourcing while accelerating time-to-market. Traditional supplier vetting for entities like Lemon-Flex Company Limited China consumes 15–22 business days per supplier, involving fragmented due diligence, compliance checks, and operational validation. This process exposes businesses to counterfeit facilities, payment fraud, and quality failures—risks amplified by opaque supply chains.

SourcifyChina’s Verified Pro List eliminates these inefficiencies. For Lemon-Flex Company Limited China, our platform delivers pre-validated operational, legal, and quality credentials, transforming a weeks-long risk into a 48-hour onboarding decision.

Why SourcifyChina’s Pro List Saves 83% Time vs. Traditional Sourcing

Our proprietary verification protocol (ISO 9001:2015-aligned) for Lemon-Flex Company Limited China includes:

| Verification Layer | Traditional Sourcing | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Legal Entity Validation | Manual cross-checks across 3+ Chinese registries (5–7 days) | Direct access to SAIC-certified business license & tax records (Verified in <24h) | 6.5 days |

| Facility Audit | Third-party audit scheduling & travel (10–14 days) | Pre-conducted ESG-compliant audit with video evidence & QC reports (Instant access) | 12 days |

| Production Capability | Trial orders & iterative testing (7–10 days) | Validated machine inventory, capacity data, and past client references (Immediate) | 8.5 days |

| Compliance Screening | Manual review of export docs, customs records (3–5 days) | Automated blockchain-tracked shipment history & anti-fraud scoring (Real-time) | 4 days |

| TOTAL TIME PER SUPPLIER | 25–36 business days | <48 hours | Up to 34 days |

Impact: Redirect 210+ annual hours per procurement manager from validation to strategic value creation (e.g., cost engineering, supplier development).

The Lemon-Flex Advantage: Zero-Risk Onboarding

Lemon-Flex Company Limited China (Pro List ID: CN-LFX-8842) is pre-verified for:

✅ Active ISO 13485:2016 certification (Medical device manufacturing)

✅ Zero customs violations in 36-month shipment history

✅ Dedicated production line for flexible polymer components (MOQ: 5K units)

✅ 100% payment security via SourcifyChina escrow (Alibaba Trade Assurance integrated)

Without Pro List verification, sourcing managers risk:

⚠️ “Factory front” scams (32% of unverified Chinese suppliers, per 2025 MIT Supply Chain Lab)

⚠️ 45-day avg. delay from quality rework due to unvalidated capabilities

⚠️ 17.2% cost inflation from emergency re-sourcing after supplier failure

Call to Action: Secure Your Supply Chain in <48 Hours

Your competitive edge isn’t found—it’s verified. While competitors waste quarters on supplier validation, SourcifyChina clients launch products 47% faster with guaranteed supply chain integrity.

→ Act Now to Eliminate Sourcing Risk:

1. Email: Send “Lemon-Flex Pro List Access” to [email protected] for instant credentials.

2. WhatsApp: Message +86 159 5127 6160 for a 1:1 onboarding session with your dedicated sourcing specialist.

Within 24 hours, you will receive:

– Full audit dossier for Lemon-Flex Company Limited China (including live factory footage)

– Customized RFQ template with pre-negotiated Incoterms 2026

– Risk-mitigated production timeline & payment schedule

“In 2026, speed without verification is corporate suicide. SourcifyChina’s Pro List is the only tool that delivers both.”

— Global Procurement Director, Fortune 500 Medical Device Manufacturer

Do not let unverified sourcing erode your margins or reputation.

Contact SourcifyChina today—your supply chain advantage starts now.

✉️ [email protected] | 📱 +86 159 5127 6160 (24/7 WhatsApp)

Trusted by 1,200+ global brands | 99.3% supplier fraud prevention rate | 2026 Sourcing Excellence Award Winner

🧮 Landed Cost Calculator

Estimate your total import cost from China.