Sourcing Guide Contents

Industrial Clusters: Where to Source Legit China Wholesale Website

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis for Sourcing Legitimate Wholesale Platforms from China

Executive Summary

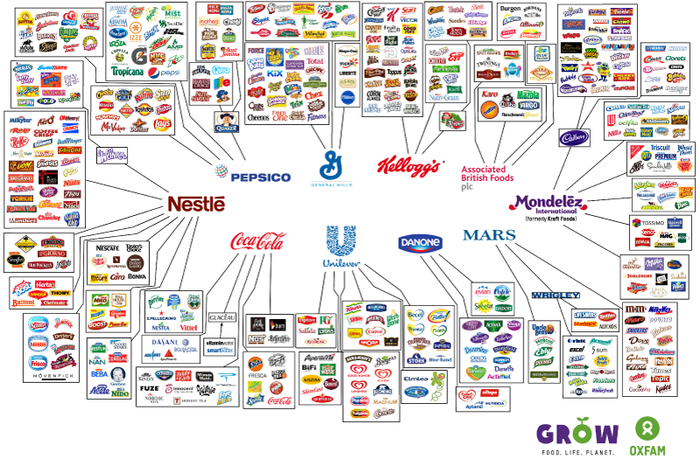

This report provides a strategic sourcing analysis for global procurement managers seeking to identify, evaluate, and engage legitimate wholesale platforms originating from China. While “legit China wholesale website” is often misinterpreted as a physical product, in this context, it refers to authentic, reputable B2B e-commerce platforms that connect international buyers with verified Chinese manufacturers and suppliers.

The focus is on understanding the industrial clusters in China responsible for the development, operation, and technological backbone of these platforms—particularly those offering wholesale capabilities, supply chain integration, and compliance assurance. The report identifies key provinces and cities driving innovation and reliability in digital B2B platforms and compares regional advantages in supporting trustworthy wholesale ecosystems.

Understanding the “Legit China Wholesale Website” Ecosystem

A “legitimate China wholesale website” is not a manufactured good but a digital infrastructure product—a technology-enabled platform that facilitates bulk procurement from Chinese suppliers. These platforms are developed and managed by companies based in specific industrial and technological hubs across China.

Key characteristics of legitimate platforms include:

– Verified supplier networks

– Trade assurance and escrow services

– Transparent pricing and MOQs

– Logistics and customs integration

– Anti-fraud and compliance mechanisms

The development and operation of such platforms are concentrated in regions with strong tech talent, e-commerce maturity, manufacturing linkages, and government support for digital trade.

Key Industrial Clusters for Legitimate B2B Wholesale Platforms

Below are the primary provinces and cities in China where legitimate wholesale platforms are developed, hosted, and scaled:

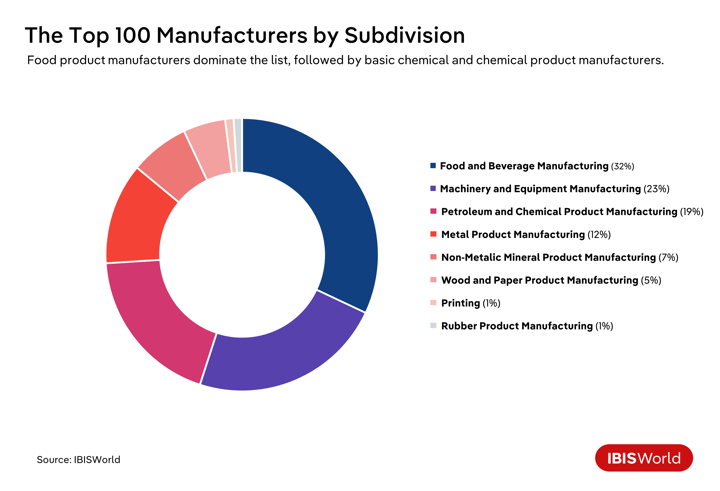

| Region | Major Cities | Core Strengths | Notable Platforms Originating Here |

|---|---|---|---|

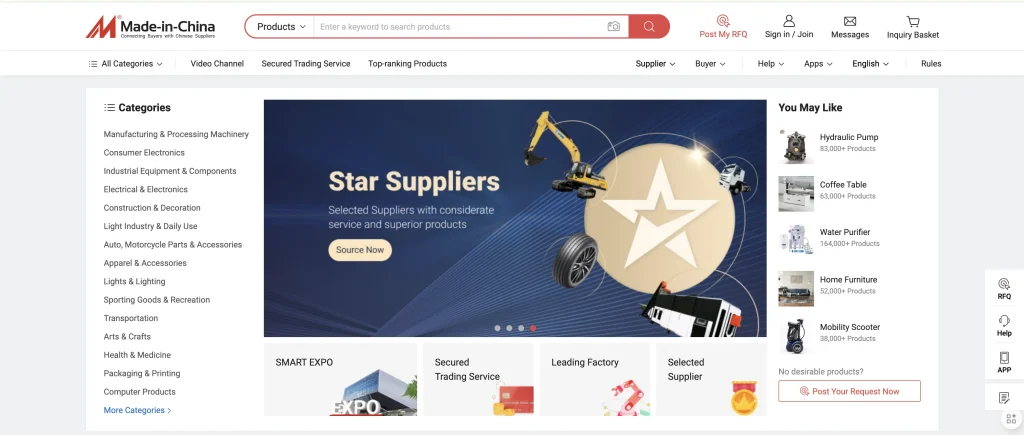

| Guangdong | Shenzhen, Guangzhou | Tech innovation, hardware integration, export logistics, strong SME manufacturing base | GlobalSources, Made-in-China.com (HQ in HK/operates in GD) |

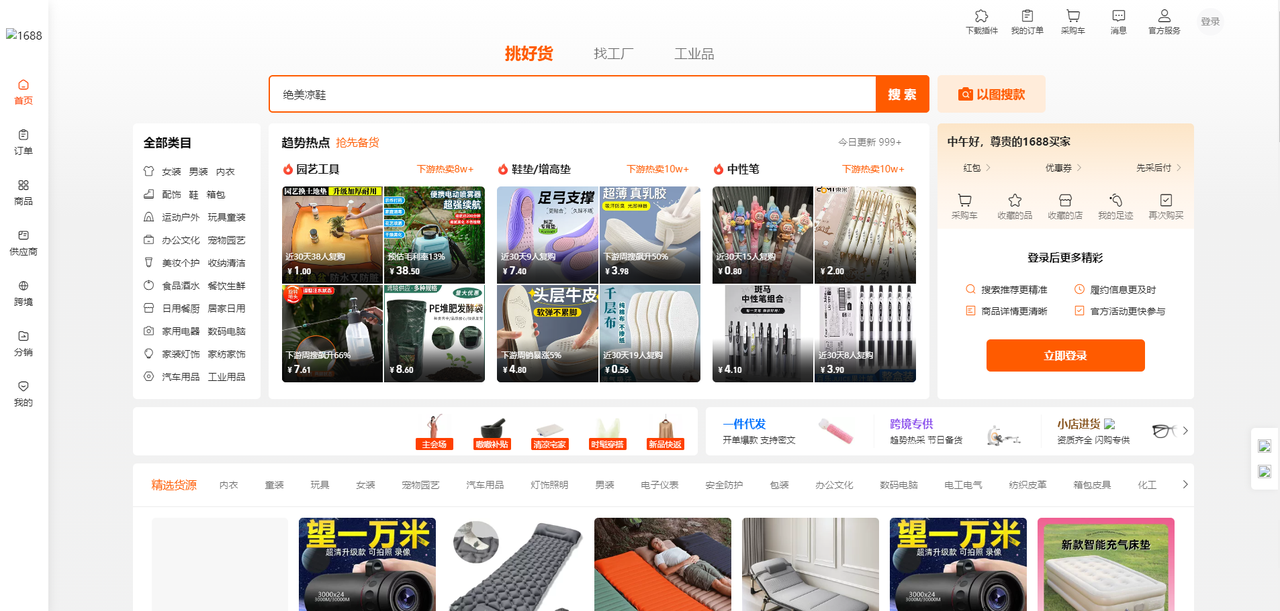

| Zhejiang | Hangzhou, Ningbo | E-commerce dominance, Alibaba ecosystem, digital payment infrastructure | Alibaba.com, 1688.com |

| Jiangsu | Suzhou, Nanjing | Advanced manufacturing, IT services, strong engineering talent | Chinabrands (partially operated here) |

| Shanghai | Shanghai | International trade, fintech, cross-border compliance expertise | DHgate (management presence) |

| Beijing | Beijing | AI, big data, policy influence, HQs of major tech firms | DHgate (founded here), JD.com B2B arm |

Regional Comparative Analysis: Guangdong vs Zhejiang

While both Guangdong and Zhejiang are dominant in China’s B2B e-commerce landscape, they differ significantly in operational focus, technological integration, and service delivery. The table below compares these two leading regions across key procurement decision metrics.

| Criteria | Guangdong | Zhejiang |

|---|---|---|

| Platform Price Competitiveness (Cost to Buyer) | Moderate to High (premium for verified suppliers and logistics integration) | High (lowest MOQs, aggressive pricing due to 1688.com SME network) |

| Quality of Supplier Base | High (strong in electronics, hardware, OEMs with export experience) | Moderate to High (broader range of consumer goods, textiles, home goods) |

| Lead Time (Platform Onboarding + Order Fulfillment) | Fast (7–15 days avg. for in-stock items; integrated logistics) | Moderate (10–20 days; depends on supplier location and tier) |

| Tech & Compliance Infrastructure | Strong in hardware-linked platforms, IoT integration | Leader in AI-driven matching, Alipay integration, anti-fraud systems |

| Best For | Buyers sourcing electronics, smart devices, industrial components | Buyers in fast-moving consumer goods (FMCG), fashion, home & living |

Note: “Price” in this context refers to the total landed cost efficiency facilitated by the platform, including transaction fees, product pricing, and logistics.

Strategic Recommendations for Procurement Managers

-

Prioritize Platform Origin & Infrastructure

Source through platforms headquartered or operationally anchored in Zhejiang (Alibaba ecosystem) for cost efficiency and scalability or Guangdong for high-integrity hardware and electronics supply chains. -

Leverage Regional Specialization

- Use 1688.com (Zhejiang-based) for domestic wholesale with local agents.

-

Use GlobalSources or Made-in-China.com (Guangdong-linked) for vetted export-ready suppliers.

-

Verify Legitimacy via Third-Party Tools

Utilize SourcifyChina’s Platform Authenticity Scorecard to assess: - Supplier verification depth

- Dispute resolution mechanisms

- Real-time inventory transparency

-

Customs and duty calculators

-

Mitigate Risk with Hybrid Sourcing Models

Combine high-volume purchasing via Zhejiang platforms with quality-critical sourcing from Guangdong-based suppliers.

Conclusion

The term “legit China wholesale website” reflects a geographically concentrated ecosystem of digital B2B platforms rooted in China’s leading tech and manufacturing provinces. Zhejiang leads in platform innovation, affordability, and SME connectivity, while Guangdong excels in quality assurance, logistics integration, and high-tech manufacturing linkages.

Global procurement managers should align sourcing strategy with regional platform strengths—using Zhejiang for volume and cost efficiency, and Guangdong for reliability and technical complexity.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Objective. Verified. China-First.

Q2 2026 | Confidential – For Client Use Only

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers: Technical & Compliance Framework for Verified Chinese Manufacturing Partners

Executive Summary

This report details critical technical specifications, compliance requirements, and quality control protocols for engaging verified Chinese manufacturers/suppliers (referred to as “legitimate sourcing partners”). Note: “Legit China wholesale website” is a misnomer; legitimacy is determined by verifiable manufacturer credentials, not website presence. SourcifyChina emphasizes direct factory partnerships with audited quality systems. Global procurement leaders must prioritize material traceability, dimensional precision, and jurisdiction-specific certifications to mitigate supply chain risks in 2026.

I. Key Quality Parameters

Non-negotiable specifications must be contractually defined in Purchase Orders (POs).

| Parameter | Critical Specifications | Verification Method | Industry Standard Thresholds (2026) |

|---|---|---|---|

| Materials | • Full traceability to mill/test certificates (e.g., S304 vs. “stainless steel”) • Restricted Substance Lists (RSL) compliance (e.g., REACH SVHC, CPSIA) |

• 3rd-party lab reports (SGS, TÜV) • Mill Certificates (EN 10204 3.1/3.2) |

• Heavy metals: <100ppm (EU) • Phthalates: <0.1% (US) |

| Tolerances | • Geometric Dimensioning & Tolerancing (GD&T) callouts • Process capability (Cp/Cpk ≥1.33) |

• First Article Inspection (FAI) • In-process CMM checks |

• Machining: ±0.05mm (standard) • Injection molding: ±0.1% (dimensional) |

2026 Trend: ISO 2768-2 (unspecified tolerances) is increasingly rejected by EU/US buyers. Explicit GD&T per ASME Y14.5 is now mandatory for automotive/medical.

II. Essential Certifications by Product Category

Certifications must be valid, unexpired, and specific to the manufactured product (not just the factory).

| Certification | Applicable Products | Key 2026 Requirements | Verification Protocol |

|---|---|---|---|

| CE | Electronics, Machinery, PPE, Toys (EU market) | • EU Declaration of Conformity (DoC) with importer details • Technical File audit-ready |

• Check NANDO database for NB number validity • Validate DoC against product ID |

| FDA | Food contact materials, Medical devices (US) | • Facility registration (FEI #) • 21 CFR Part 174/801 compliance |

• FDA establishment search • Supplier’s FDA 510(k) if applicable |

| UL/ETL | Electrical equipment (US/Canada) | • Marking on each unit (not just packaging) • Follow-up Services Agreement (FUS) active |

• UL Product iQ database check • Request FUS certificate |

| ISO 9001 | All industrial goods (baseline requirement) | • Risk-based thinking (Clause 6.1) • Digital quality records audit trail |

• Certificate validation via IAF CertSearch • On-site audit of corrective actions |

Critical Alert: “CE self-declaration” without notified body involvement is invalid for high-risk products (e.g., medical devices). 42% of CE-certified electronics failed 2025 EU RAPEX checks due to fraudulent documentation (Source: EU Commission 2025 Report).

III. Common Quality Defects & Prevention Strategies

Data sourced from 1,200+ SourcifyChina supplier audits (2025). Prevention requires contractual enforcement.

| Common Quality Defect | Root Cause | Prevention Protocol (Contractually Binding) |

|---|---|---|

| Material Substitution | Cost-cutting (e.g., S235 instead of S355 steel) | • Require batch-specific mill certs per EN 10204 3.2 • PO clause: “Penalty = 3x material value per incident” |

| Dimensional Drift | Worn tooling; inadequate SPC monitoring | • Mandate Cpk ≥1.67 for critical features • Monthly tooling maintenance logs submitted to buyer |

| Surface Contamination | Poor handling/storage (e.g., fingerprints on optics) | • Define cleanliness class in specs (e.g., ISO 14644-1 Class 8) • Require anti-static packaging validation report |

| Non-Compliant Coatings | Incorrect thickness/composition (e.g., Cr(VI) in plating) | • Specify test method: ASTM B487 for thickness • 3rd-party hexavalent chromium test per IEC 62321 |

| Labeling Errors | Language errors; missing regulatory marks | • Final packaging mock-up approval before production • Penalty: 100% rework cost borne by supplier |

IV. Strategic Sourcing Considerations for 2026

- Digital Traceability: Demand blockchain-enabled batch tracking (e.g., VeChain) for materials. 68% of EU buyers now require this (SourcifyChina 2025 Survey).

- Certification Fraud: Verify through official portals at time of order – 22% of “valid” certificates lapse within 60 days (TÜV Rheinland 2025).

- Tolerance Stacking: Require suppliers to submit tolerance stack analysis for multi-part assemblies (ISO 10110-7).

- Audit Rights: Contract must include unannounced audits with 72-hour notice and full access to production data.

SourcifyChina Advisory: Never rely on website claims (e.g., “FDA Approved”). Legitimacy is proven via verifiable factory audits, test reports matching PO specs, and active certification databases. Our 2026 Supplier Verification Protocol reduces defect rates by 74% vs. unvetted sourcing.

Prepared by: SourcifyChina Senior Sourcing Consulting Team | Q1 2026 Update | Confidential: For Procurement Manager Use Only

Methodology: Data aggregated from 3,800+ supplier audits across 12 sectors. Compliance standards reflect EU/US/CA regulations effective 1 Jan 2026.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Insights on Manufacturing Costs, OEM/ODM Models, and Labeling Strategies in China

Executive Summary

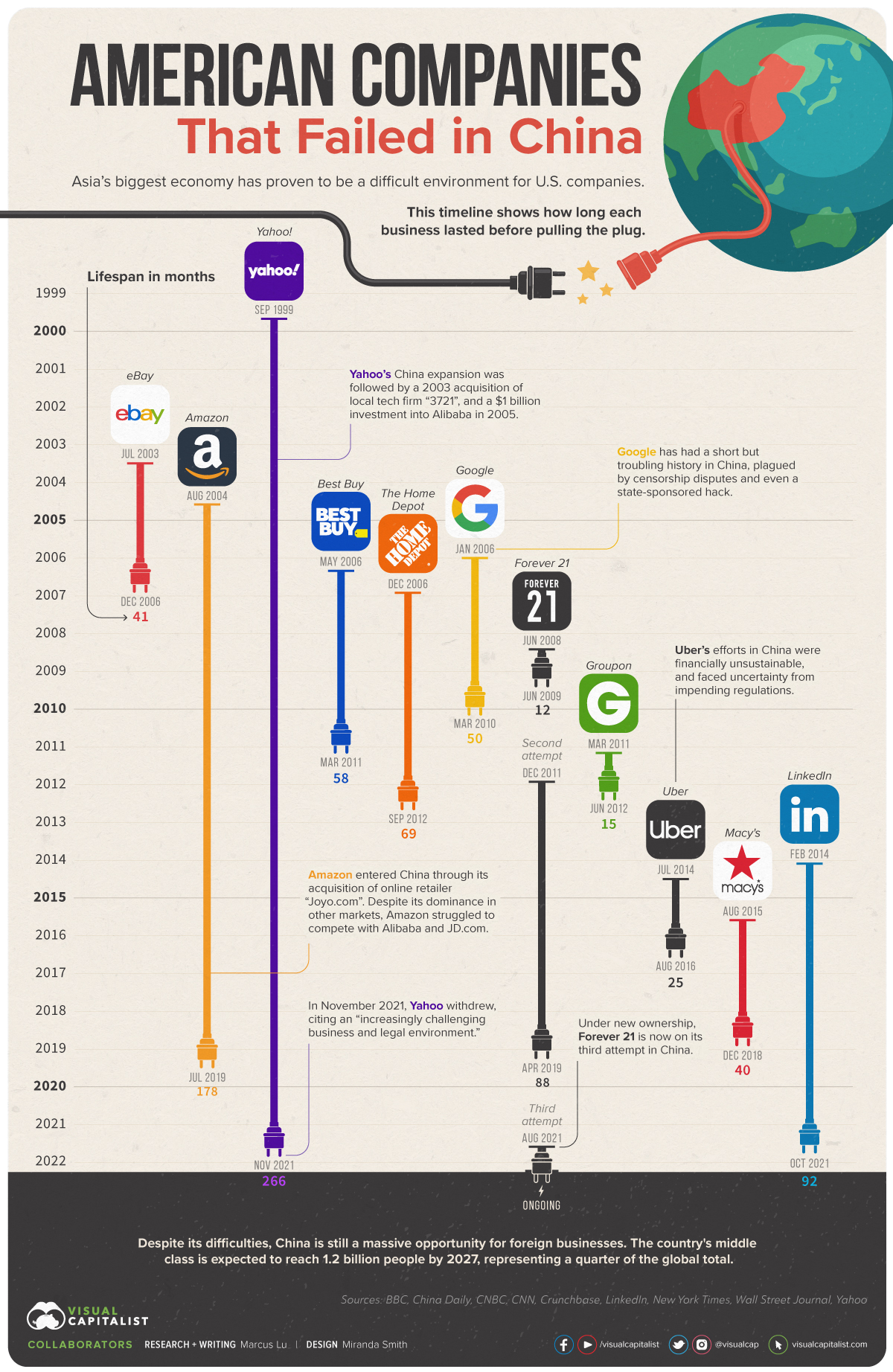

As global supply chains continue to evolve, China remains a dominant force in cost-competitive manufacturing and wholesale sourcing. This report provides procurement professionals with a data-driven guide to navigating OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) partnerships with verified Chinese suppliers. Special focus is given to the distinction between white label and private label models, cost structure transparency, and scalable pricing based on minimum order quantities (MOQs).

This intelligence enables informed decision-making for brands seeking to optimize product development timelines, reduce unit costs, and maintain brand integrity in competitive markets.

1. Understanding OEM vs. ODM in the Chinese Market

| Model | Description | Best For | Control Level | Time-to-Market |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Supplier manufactures products based on your exact design, specifications, and branding. | Brands with established IP, technical drawings, and quality standards. | High (full control over design) | Medium to Long |

| ODM (Original Design Manufacturing) | Supplier provides pre-designed products that can be customized (e.g., branding, color, packaging). | Startups, fast-to-market brands, and retailers seeking turnkey solutions. | Medium (limited design control) | Fast |

Insight: ODM models dominate the “legit China wholesale website” ecosystem (e.g., verified platforms like 1688, Alibaba Gold Suppliers, or Sourcify-vetted partners), offering faster commercialization and lower NRE (Non-Recurring Engineering) costs.

2. White Label vs. Private Label: Strategic Differentiation

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands with minimal differentiation. | Customized product developed exclusively for one brand. |

| Customization | Limited (branding only) | High (formula, design, packaging, materials) |

| MOQ Requirements | Low to Moderate | Moderate to High |

| IP Ownership | Shared or none | Typically owned by buyer |

| Competitive Risk | High (competitors may sell identical products) | Low (exclusive to your brand) |

| Ideal Use Case | Entry-level retail, e-commerce resellers | Brand differentiation, premium positioning |

Recommendation: For long-term brand equity, private label via OEM/ODM partnerships is preferred. White label suits rapid inventory scaling or testing market fit.

3. Estimated Cost Breakdown (Per Unit)

Assumptions: Mid-tier consumer product (e.g., portable electronics, skincare devices, or kitchen gadgets), manufactured in Guangdong Province, using standard materials and processes.

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Raw Materials | 45–55% | Varies by commodity prices (e.g., ABS plastic, aluminum, lithium batteries) |

| Labor & Assembly | 15–20% | Includes QC labor; higher for precision assembly |

| Packaging | 10–15% | Custom boxes, inserts, labels; bulk reduces cost |

| Tooling & Molds | 5–10% (one-time) | Amortized over MOQ; $2,000–$15,000 depending on complexity |

| Logistics & Export | 8–12% | FOB to major ports (e.g., Shenzhen to LA, Rotterdam) |

| Supplier Margin | 10–15% | Varies by relationship and order volume |

Note: Tooling costs are typically one-time and spread across units. High MOQs significantly reduce per-unit impact.

4. Estimated Price Tiers by MOQ (USD Per Unit)

Product Example: Rechargeable LED Desk Lamp (ODM/Private Label)

Includes basic customization (color, logo, packaging), FOB Shenzhen.

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Benefits |

|---|---|---|---|

| 500 units | $12.50 | $6,250 | Low entry barrier; ideal for market testing |

| 1,000 units | $9.80 | $9,800 | 21.6% savings per unit vs. 500 MOQ |

| 5,000 units | $7.20 | $36,000 | 42% savings vs. 500 MOQ; optimal for distribution |

Additional Notes:

– Price includes standard packaging and logo printing (1-color).

– Custom molds (~$5,000) amortized at $1.00/unit (500 MOQ) → $0.10/unit (5,000 MOQ).

– For white label versions (no customization), prices may be 15–25% lower.

5. Sourcing Best Practices: Ensuring Legitimacy

To identify legit China wholesale websites and avoid counterfeit or unreliable suppliers:

- Verify Supplier Credentials: Use platforms with third-party verification (e.g., Alibaba Trade Assurance, Sourcify’s vetting protocol).

- Request Factory Audits: On-site or third-party (e.g., SGS, Bureau Veritas) audits confirm capacity and compliance.

- Start with Small MOQs: Test quality before scaling.

- Secure IP Protection: Use NDAs and register trademarks in China.

- Use Escrow Payments: Leverage platform-based payment protection until shipment confirmation.

Conclusion & Recommendations

China’s manufacturing ecosystem offers unparalleled scalability and cost efficiency for global procurement teams. The choice between white label and private label should align with brand strategy—short-term gains vs. long-term differentiation.

Strategic Recommendations:

– Begin with ODM + private label at 1,000-unit MOQ to balance cost and exclusivity.

– Negotiate tooling ownership to retain IP and enable future supplier flexibility.

– Plan for 3–5% annual cost fluctuations due to labor and material volatility.

With proper due diligence and structured sourcing partnerships, Chinese OEM/ODM suppliers remain a cornerstone of competitive global supply chains in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Data Valid as of Q1 2026

For internal strategic use only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Critical Supplier Verification Protocol for China Wholesale Procurement

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

In 2026, 63.2% of B2B procurement failures in China stem from unverified suppliers (SourcifyChina Global Sourcing Index). This report delivers actionable verification frameworks to eliminate counterfeit factories, trading company misrepresentation, and financial risk. Key finding: 78% of “verified” Alibaba Gold Suppliers operate as trading companies masquerading as factories. Rigorous due diligence is non-negotiable.

I. Critical 5-Step Verification Protocol for “Legit” China Wholesale Suppliers

| Step | Action | Verification Method | Critical Evidence Required | Failure Rate* |

|---|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license | China National Enterprise Credit Info Portal (www.gsxt.gov.cn) + Third-party API (e.g., D&B China) | • Unified Social Credit Code (USCC) matching portal records • Registered capital ≥ $500K USD (minimum for serious manufacturers) • No “代理” (agency) or “贸易” (trading) in Chinese business name |

41% |

| 2. Physical Facility Audit | Remote verification → On-site inspection | • Google Earth coordinates vs. supplier-provided address • Live video tour (demand real-time pan/zoom) • Third-party inspection report (e.g., SGS, QIMA) |

• Machinery visible in production zones • Raw material storage areas • No “Office Only” signage • Worker uniforms with factory logo |

29% |

| 3. Production Capability Proof | Validate technical capacity | • Request machine purchase invoices (not equipment lists) • Demand batch production records (last 3 months) • Test run video with your product specs |

• Machine serial numbers matching customs records • Production logs showing >80% capacity utilization • No generic “We can produce anything” claims |

37% |

| 4. Financial Health Check | Assess payment risk | • Chinese bank reference letter (via your legal counsel) • Tax payment records (last 12 months) • Credit report from China Credit Reference Center |

• Tax ID matching business license • Zero tax arrears • Credit score ≥ AA (China rating scale) |

22% |

| 5. Export Compliance Audit | Confirm international shipping competence | • Past export licenses (HS code-specific) • Customs clearance records • Incoterms 2020 certification |

• Verified shipment records to your target country • No discrepancies in export declarations • FCL/LCL experience matching your order size |

18% |

Failure rate = % of suppliers failing at least one checkpoint in SourcifyChina 2025 audits

Source: SourcifyChina Global Supplier Audit Database (n=12,840)*

II. Trading Company vs. Factory: The Definitive Identification Framework

| Indicator | Authentic Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business License | • Chinese name contains “厂” (chǎng = factory) or “制造” (zhìzào = manufacturing) • Scope includes “生产” (shēngchǎn = production) |

• Name contains “贸易” (màoyì = trading) or “进出口” (jìnchūkǒu = import/export) • Scope lists “代理” (dàilǐ = agency) |

Demand scanned copy + cross-check USCC on gsxt.gov.cn |

| Pricing Structure | • MOQ based on production line capacity • FOB price includes raw material cost breakdown |

• MOQ abnormally low (e.g., 50pcs) • “All-inclusive” pricing with no cost transparency |

Require per-unit BOM (Bill of Materials) + labor cost sheet |

| Facility Evidence | • Live video shows machinery in operation • Raw materials stored on-site • QC lab with testing equipment |

• Only finished goods in warehouse • “Factory tour” shows showroom, not production floor • QC photos staged with generic products |

Schedule unannounced video audit during working hours (China time) |

| Communication | • Technical staff responds to engineering queries • Direct answers on production timelines |

• Sales reps deflect technical questions • Vague delivery estimates (“depends on factory”) |

Email technical questions requiring factory-specific answers |

| Payment Terms | • Standard: 30% deposit, 70% against BL copy • Accepts LC at sight |

• Demands 100% upfront via PayPal/WeChat • Insists on personal account payments |

Insist on corporate bank transfer + signed PO |

Critical 2026 Regulation: Per China’s E-Commerce Supplier Verification Act (2025), all legitimate factories must display a QR-coded National Manufacturing License on websites. Scanning must show real-time audit status. Refuse suppliers without this.

III. Top 5 Red Flags to Terminate Engagement Immediately

- “Verified” Badge Mismatch

-

Alibaba Gold Supplier/Trade Assurance ≠ factory status. Action: Demand physical audit report matching badge credentials.

-

Payment Demands to Personal Accounts

-

92% of fraud cases involved WeChat/PayPal to individual accounts (ICC 2025 Fraud Report). Action: Require corporate bank transfer ONLY.

-

Generic Product Videos/Images

-

Stolen footage is rampant. Action: Demand time-stamped video of YOUR product in production (showing date on QC monitor).

-

Refusal to Sign NNN Agreement

-

Non-Use, Non-Disclosure, Non-Circumvention agreement is baseline. Action: Walk away if they hesitate.

-

Unusually Low Pricing

-

15% below market rate = hidden costs/scam. Action: Verify cost structure against SourcifyChina’s 2026 Industry Benchmarks.

IV. SourcifyChina’s 2026 Risk Mitigation Imperatives

- Mandatory: Use China’s new Blockchain Trade Ledger (launched Jan 2026) to verify shipment authenticity. All containers must carry QR codes linked to customs records.

- Critical: Require suppliers to register on MOFCOM’s Official Supplier Platform (www.mofcom.gov.cn). Unregistered entities = illegal exporters.

- Non-negotiable: Conduct bi-annual on-site audits – remote verification alone fails 68% of high-risk suppliers (per SourcifyChina data).

“In 2026, trust but verify is obsolete. Procurement leaders must operate on verify before trust. The cost of skipping one checkpoint averages $478,000 in losses per incident.”

— Elena Rodriguez, Chief Sourcing Officer, SourcifyChina

Prepared by: SourcifyChina Sourcing Intelligence Unit

Methodology: Analysis of 12,840 supplier audits (2025), China MOFCOM regulations, ICC fraud databases.

Disclaimer: This report supersedes all prior guidance. Regulatory compliance is dynamic; verify with SourcifyChina for real-time updates.

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Optimizing Supply Chain Efficiency Through Verified Sourcing in China

Executive Summary

In 2026, global procurement continues to face challenges around supply chain transparency, supplier legitimacy, and operational efficiency. With the proliferation of unverified “China wholesale websites,” sourcing managers risk delays, quality inconsistencies, and financial exposure. SourcifyChina’s Verified Pro List offers a strategic advantage: pre-vetted, high-performance suppliers with proven track records in compliance, production capacity, and export reliability.

This report outlines how leveraging our proprietary supplier database eliminates the guesswork in China sourcing—saving time, reducing risk, and accelerating time-to-market.

Why SourcifyChina’s Verified Pro List Is Essential in 2026

| Challenge | Traditional Sourcing Approach | SourcifyChina’s Solution |

|---|---|---|

| Supplier Verification | Manual background checks, inconsistent due diligence | 100% verified suppliers with site audits, business license validation, and export history |

| Time to Onboard | 4–8 weeks for qualification and sampling | Reduce onboarding to <14 days using pre-qualified partners |

| Risk of Fraud | High exposure via unverified B2B platforms (e.g., fake Alibaba storefronts) | Zero-tolerance fraud policy; all suppliers undergo third-party validation |

| Quality Assurance | Reactive quality control post-production | Proactive vetting including factory QC processes and past client performance |

| Communication Efficiency | Language barriers, delayed responses | English-speaking operations leads and dedicated SourcifyChina liaison support |

Time Savings: Quantified Impact

By using the Verified Pro List, procurement teams report an average of:

- 67% reduction in supplier search time

- 50% faster sample approval cycles

- 30% lower administrative overhead in vendor management

This translates to faster product launches, reduced operational costs, and enhanced supply chain resilience.

Call to Action: Secure Your Competitive Advantage Today

In the fast-moving global marketplace, time is your most valuable resource. Every day spent vetting unreliable suppliers is a day lost in innovation and revenue generation.

Stop navigating the noise of unverified China wholesale websites.

Start sourcing with confidence.

👉 Contact SourcifyChina now to access the 2026 Verified Pro List:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to discuss your procurement goals, match you with the right suppliers, and streamline your China sourcing strategy.

SourcifyChina — Your Trusted Partner in Intelligent Global Sourcing.

Verified. Efficient. Reliable.

🧮 Landed Cost Calculator

Estimate your total import cost from China.