The global market for leg therapy machines has witnessed significant growth, driven by rising prevalence of circulatory disorders, increasing geriatric population, and growing demand for non-invasive rehabilitation solutions. According to Grand View Research, the global compression therapy devices market—key segment encompassing leg therapy machines—was valued at USD 2.1 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 7.8% from 2023 to 2030. This expansion is further supported by technological advancements in pneumatic compression systems and the rising adoption of home healthcare devices. Mordor Intelligence also highlights a steady surge in demand, attributing it to increased post-surgical recovery needs and escalating cases of deep vein thrombosis (DVT). With healthcare providers and consumers alike prioritizing mobility restoration and circulation improvement, the competitive landscape has led to innovation and expansion among key manufacturers. In this evolving ecosystem, the following ten companies stand out as leading leg therapy machine manufacturers, combining clinical efficacy, technological innovation, and global reach to address growing therapeutic demands.

Top 10 Leg Therapy Machine Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Stryker

Domain Est. 1995

Website: stryker.com

Key Highlights: Stryker is one of the world’s leading medical technology companies. Alongside our customers around the world, we impact more than 150 million patients annually….

#2 Leg pressure therapy unit

Domain Est. 1997

Website: medicalexpo.com

Key Highlights: Find your leg pressure therapy unit easily amongst the 83 products from the leading brands (HUNTLEIGH, fisioline, GLOBUS, …) on MedicalExpo, the medical ……

#3 GZ Longest

Domain Est. 2021

Website: gzlongest.com

Key Highlights: Professional physical therapy equipment & rehabilitation equipment manufacturer with 22 years of experience. FDA & CE certified….

#4 Smith+Nephew Medical Devices and Advanced Wound Care

Domain Est. 1995

Website: smith-nephew.com

Key Highlights: Smith+Nephew’s Orthopaedics portfolio includes an innovative range of hip and knee implants used to replace diseased, damaged or worn joints, ……

#5 Lokomat®

Domain Est. 2003

Website: hocoma.com

Key Highlights: The only therapy solution that uniquely combines gradual verticalization, leg mobilization, and intensive sensorimotor stimulation through cyclic leg loading….

#6 Homepage

Domain Est. 2003

Website: nevro.com

Key Highlights: One comprehensive solution for individualized relief of chronic pain that gives you more versatility than ever before….

#7 Normatec 3 Legs: Complete Leg Recovery Suite

Domain Est. 2007

Website: hyperice.com

Key Highlights: In stock Rating 5.0 (334) Experience leg recovery like never before with Normatec 3 Legs. Tailored pressures, dynamic cycles. Dive into a world of rapid relief and relaxation….

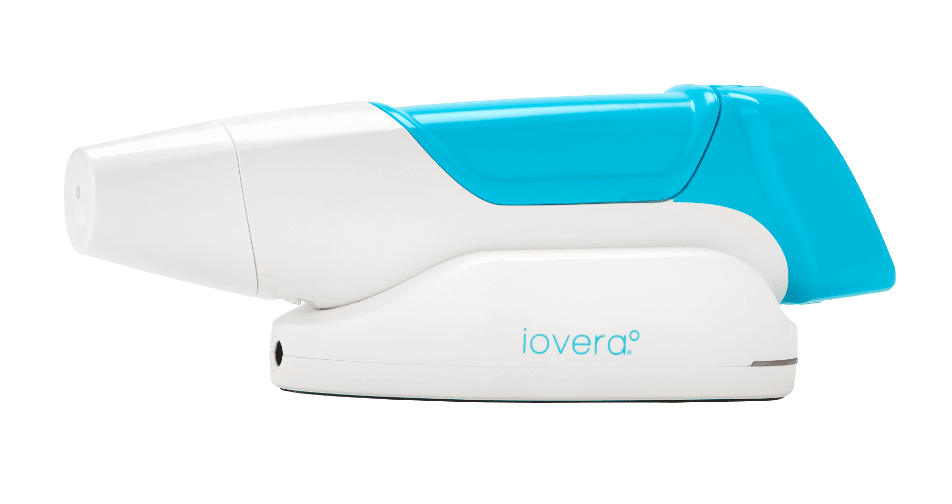

#8 iovera

Domain Est. 2008

Website: iovera.com

Key Highlights: FDA-cleared iovera provides immediate pain relief using cryoneurolysis. Drug-free treatment for knee, hip, shoulder, spine & more. Lasts up to 90 days….

#9 Compression Therapy & Recovery Rollers for Muscle Relief

Domain Est. 2017

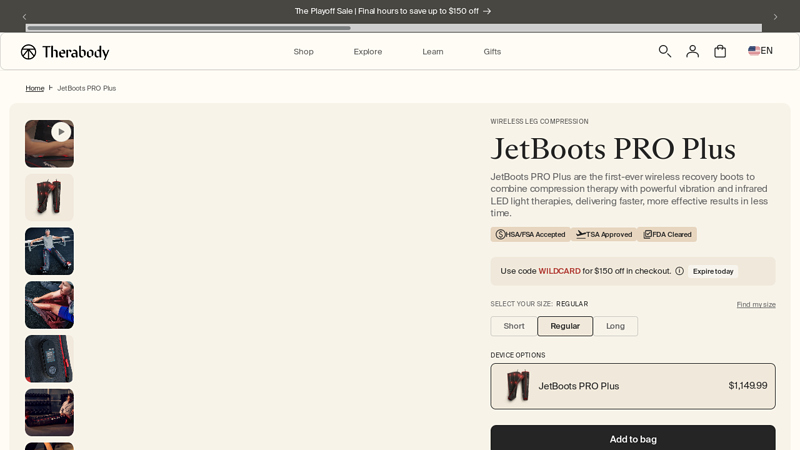

#10 JetBoots PRO Plus (Regular)

Domain Est. 2018

Expert Sourcing Insights for Leg Therapy Machine

H2: Market Trends Shaping the Leg Therapy Machine Industry in 2026

By 2026, the global leg therapy machine market is poised for significant transformation, driven by converging demographic, technological, and healthcare trends. Here’s an analysis of the key forces shaping this sector:

1. Exponential Growth Driven by Demographic Shifts & Chronic Conditions:

* Aging Population: The global population over 65 continues to expand rapidly. This demographic is disproportionately affected by chronic conditions requiring leg therapy (e.g., venous insufficiency, lymphedema, post-surgical recovery, mobility limitations). Demand for home-based and clinical devices will surge.

* Rising Prevalence of Key Conditions: Increasing rates of obesity, diabetes (driving diabetic neuropathy and edema), cardiovascular diseases (related to DVT prevention), and cancer (causing lymphedema) will directly fuel the need for therapeutic interventions, including mechanical compression and mobilization devices.

* Focus on Aging-in-Place: Growing preference for independent living among seniors increases demand for effective, user-friendly home therapy solutions to manage chronic leg conditions and prevent complications.

2. Technological Advancements: Smart, Connected, and Personalized Devices:

* Integration of IoT & AI: Leg therapy machines will increasingly incorporate sensors, Bluetooth/Wi-Fi connectivity, and AI algorithms. This enables:

* Remote Patient Monitoring (RPM): Clinicians can track usage, therapy adherence, and physiological responses (e.g., edema reduction) in real-time, enabling proactive intervention and personalized adjustments.

* Personalized Therapy Protocols: AI will analyze individual patient data (condition, response, lifestyle) to dynamically optimize pressure settings, treatment duration, and timing for maximum efficacy.

* Predictive Analytics: Devices may predict potential complications (e.g., ulcer development, DVT risk) based on usage patterns and sensor data.

* Enhanced User Experience & Compliance: Focus on quieter motors, more comfortable and adjustable cuffs/sleeves, intuitive app interfaces, and gamification features to improve patient engagement and adherence to prescribed regimens.

* Wearable & Portable Innovations: Development of lighter, more discreet, and truly wearable devices (e.g., integrated into garments) allowing therapy during daily activities, improving convenience and compliance.

3. Shift Towards Home-Based and Preventive Care:

* Cost-Pressure on Healthcare Systems: Payers (insurers, governments) will increasingly incentivize cost-effective home-based care over expensive hospital/clinic visits and inpatient treatments. Leg therapy machines are a prime target for this shift.

* Value-Based Care Models: Reimbursement will increasingly tie payments to patient outcomes (e.g., reduced hospitalizations for venous ulcers, prevented DVT events). Devices with proven outcome data and RPM capabilities will be favored.

* Prevention Focus: Greater emphasis on preventing complications (like DVT post-surgery or venous ulcers in at-risk patients) will drive demand for prophylactic use of leg therapy devices, expanding the market beyond symptomatic treatment.

4. Evolving Reimbursement Landscape & Regulatory Scrutiny:

* Demand for Robust Clinical Evidence: Payors and regulators will demand stronger, real-world evidence (RWE) demonstrating the cost-effectiveness and clinical benefits (improved outcomes, reduced complications, lower hospitalization rates) of newer, often more expensive, smart devices.

* Focus on Data Security & Privacy: As devices collect sensitive health data, stringent compliance with regulations like HIPAA (US), GDPR (EU), and evolving global standards will be paramount. Secure data transmission and storage will be a competitive differentiator.

* Potential for New Reimbursement Codes: As technology advances, new billing codes for remote monitoring and data management services associated with smart therapy devices may emerge, improving provider adoption.

5. Competitive Landscape & Market Consolidation:

* Increased Competition: The attractive market will attract new entrants, including medtech startups focusing on digital health and wearables, alongside established players.

* Partnerships & Ecosystems: Growth of partnerships between device manufacturers, telehealth platforms, health systems, and insurance companies to create integrated care pathways (e.g., device + app + clinician monitoring + reimbursement support).

* Consolidation: Larger players may acquire innovative startups with strong AI or IoT capabilities to enhance their portfolios rapidly.

Conclusion for 2026:

The leg therapy machine market in 2026 will be characterized by smart, connected, data-driven devices moving decisively into the home care setting. Success will depend on manufacturers’ ability to deliver proven clinical and economic value through advanced technology, seamless integration into value-based care models, robust data security, and strong partnerships across the healthcare ecosystem. The focus will shift from simply providing compression to enabling personalized, monitored, and preventive care that improves patient outcomes and reduces overall healthcare costs.

Common Pitfalls When Sourcing Leg Therapy Machines: Quality and Intellectual Property Risks

Sourcing leg therapy machines—such as compression therapy devices, circulation boosters, or rehabilitation tools—can offer significant value, but it comes with critical risks, particularly concerning product quality and intellectual property (IP) infringement. Overlooking these pitfalls can lead to legal disputes, product recalls, reputational damage, and financial losses.

Quality Control Challenges

One of the most prevalent issues in sourcing leg therapy machines is inconsistent or substandard product quality. Many suppliers, particularly in competitive manufacturing regions, may cut corners to reduce costs, resulting in devices that fail to meet medical or safety standards.

- Inadequate Manufacturing Standards: Suppliers might not adhere to ISO 13485 (medical device quality management) or other regulatory requirements, leading to unreliable or unsafe products.

- Component Substitution: Unauthorized substitution of lower-grade materials or electronic components can compromise device performance and longevity.

- Lack of Certifications: Some suppliers provide falsified or outdated regulatory certifications (e.g., CE, FDA clearance), exposing buyers to compliance risks.

- Inconsistent Output: Batch-to-batch variability in production can result in devices that malfunction or deliver inconsistent therapy.

To mitigate these risks, conduct thorough factory audits, require third-party testing, and implement strict quality control agreements in contracts.

Intellectual Property Infringement

Another major pitfall is the risk of sourcing devices that infringe on existing patents, trademarks, or design rights. Leg therapy machines often incorporate proprietary technologies such as pneumatic compression systems, control algorithms, or ergonomic designs.

- Patent Violations: Suppliers may copy patented mechanisms or software features from established brands without authorization, exposing the buyer to litigation.

- Design Copying: Aesthetic or functional designs may mimic leading market products, raising concerns about design patent or trade dress infringement.

- Lack of IP Documentation: Suppliers often cannot provide proof of IP ownership or licensing, making it difficult to verify the legitimacy of the technology.

- Grey-Market Resale: Some sourced devices may be diverted from authorized distribution channels, violating brand protection agreements.

To protect against IP risks, perform comprehensive IP due diligence, require suppliers to warrant non-infringement in contracts, and consider working with legal experts to conduct patent landscape analyses before finalizing sourcing decisions.

By proactively addressing these quality and IP pitfalls, businesses can ensure safer, compliant, and legally sound procurement of leg therapy machines.

Logistics & Compliance Guide for Leg Therapy Machine

This guide outlines key logistics considerations and compliance requirements for the distribution, import, and use of a Leg Therapy Machine. Adherence ensures smooth operations, regulatory approval, and patient safety.

Regulatory Classification and Approval

Determine the product’s classification under medical device regulations (e.g., FDA in the U.S., MDR/IVDR in the EU, Health Canada, TGA in Australia). Most leg therapy machines (e.g., compression devices, TENS units, or circulatory stimulators) are classified as Class I or Class II medical devices. Obtain all necessary certifications such as:

– FDA 510(k) clearance or De Novo classification (USA)

– CE Marking under MDR (European Union)

– Medical Device License (MDL) from Health Canada

– ARTG listing (Australia)

Ensure technical documentation, including risk analysis (ISO 14971), clinical evaluation, and labeling, meets regional requirements.

Labeling and Packaging Requirements

All labeling must comply with local regulations and include:

– Device name and model number

– Manufacturer name and address

– Intended use and indications for use

– Contraindications and warnings

– UDI (Unique Device Identifier) where applicable (e.g., FDA UDI rule, EU MDR)

– Language requirements (e.g., bilingual labeling in Canada, local language in EU member states)

– Symbols per ISO 15223-1

Use robust packaging to prevent damage during transit, including shock, vibration, and moisture protection. Include sterile barrier systems if applicable.

Import and Customs Compliance

Prepare accurate documentation for international shipments:

– Commercial invoice with Harmonized System (HS) code (e.g., 9019.10 for massage appliances or 9021.39 for other therapeutic devices)

– Bill of lading/air waybill

– Certificate of Conformity (e.g., CE, FDA)

– Import licenses or permits (if required)

– FDA Prior Notice (for U.S. entries)

Ensure compliance with customs regulations in destination countries. Work with a licensed customs broker familiar with medical device imports.

Shipping and Distribution Logistics

Use temperature-controlled and secure shipping methods if required by the device specifications. Maintain a cold chain if components are sensitive. Track shipments in real time using GPS-enabled logistics providers. Ensure last-mile delivery partners are trained in handling medical equipment. Maintain distribution records for traceability and recall readiness.

Storage and Inventory Management

Store devices in a clean, dry, temperature-controlled environment per manufacturer specifications (typically 10°C–30°C). Implement FIFO (First In, First Out) inventory practices. Secure storage areas to prevent theft or tampering. Maintain records of stock levels, batch numbers, and expiration dates (if applicable).

Post-Market Surveillance and Vigilance Reporting

Establish a system to monitor device performance in the field. Report adverse events and malfunctions to relevant authorities per regulatory timelines:

– FDA MedWatch (within 30 days for reportable events)

– EUDAMED (EU)

– MDR reporting under Health Canada

Maintain complaint handling procedures and conduct root cause analysis when necessary.

Environmental and Disposal Compliance

Follow local regulations for disposal of electronic medical devices (e.g., WEEE Directive in the EU). Provide users with instructions for proper end-of-life handling. Recycle components where possible and maintain records of disposal or take-back programs.

Training and User Documentation

Provide comprehensive user manuals in local languages covering:

– Setup and operation

– Maintenance and cleaning

– Safety precautions

– Troubleshooting

Offer online or on-site training for healthcare professionals if required. Maintain training records for compliance audits.

Cybersecurity and Data Privacy (if applicable)

If the device connects to networks or stores user data, ensure compliance with:

– FDA cybersecurity guidance

– GDPR (EU)

– HIPAA (USA)

Implement secure software updates, data encryption, and access controls.

Adhering to this logistics and compliance framework ensures legal distribution, patient safety, and operational efficiency for the Leg Therapy Machine across global markets.

Conclusion:

After a comprehensive evaluation of available options, sourcing a leg therapy machine is a strategic investment that can significantly enhance patient care, improve recovery outcomes, and increase operational efficiency in clinical or home-care settings. Key considerations such as therapeutic effectiveness, ease of use, durability, cost, and after-sales support have guided the sourcing decision. Machines offering features like adjustable compression levels, portability, and clinically proven results have demonstrated the highest value. Additionally, partnering with reputable suppliers ensures product reliability, timely delivery, and comprehensive service support. Ultimately, selecting the right leg therapy machine not only supports better patient mobility and circulation but also aligns with long-term healthcare goals, making it a worthwhile addition to any therapeutic practice or personal wellness routine.