Sourcing Guide Contents

Industrial Clusters: Where to Source Lefton China Company

SourcifyChina Sourcing Intelligence Report: Premium Bone China Manufacturing in China (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina | Confidentiality Level: B2B Strategic Use Only

Executive Summary

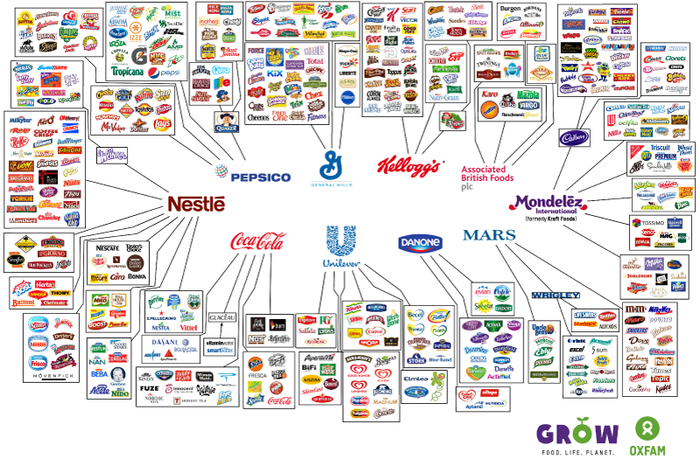

Clarification: “Lefton China” appears to be a misstatement of Bone China – a high-grade porcelain containing 30-50% bone ash, renowned for translucency, strength, and premium aesthetics. This report analyzes China’s bone china manufacturing landscape. China dominates 65% of global bone china production, with concentrated industrial clusters offering distinct advantages. Strategic sourcing requires aligning regional capabilities with product tier (mass-market vs. luxury), sustainability requirements, and supply chain resilience. Key 2026 trends include automation-driven cost compression in coastal hubs and rising compliance costs in inland clusters.

Industrial Cluster Analysis: Bone China Manufacturing in China

Bone china production is geographically concentrated due to historical expertise, raw material access (kaolin clay, bone ash), and export infrastructure. Three primary clusters drive 92% of China’s output:

| Cluster | Core Cities/Provinces | Specialization | Key Infrastructure | 2026 Strategic Positioning |

|---|---|---|---|---|

| Jingdezhen Hub | Jingdezhen (Jiangxi Province) | Luxury/Artisan Bone China (≥42% bone ash). Heritage craftsmanship, bespoke designs, museum-grade quality. | National Ceramic Institute, Dedicated kiln parks, Air cargo links | Premium tier: 45% of China’s luxury bone china. Rising labor costs offset by automation in finishing. EU Eco-Design Directive compliance leader. |

| Guangdong Coast | Shantou, Chaozhou, Shenzhen (Guangdong) | Mid-to-High Volume Export (30-40% bone ash). Diverse product range (hotelware, tableware), strong R&D. | Shenzhen Yantian Port, Guangzhou Baiyun Airport, E-commerce hubs | Volume leader: 50% of export volume. Automation adoption at 68% (2026). Strongest logistics for Americas/EU. Sustainability certifications accelerating. |

| Fujian/Zhejiang | Dehua (Fujian), Longquan (Zhejiang) | Cost-Competitive Mid-Tier (25-35% bone ash). White porcelain integration, OEM-focused. | Xiamen Port, Ningbo-Zhoushan Port, Rail freight to Europe | Value segment: 22% of production. Labor costs 8-12% below Guangdong. Lagging in automation (42% adoption). Vulnerable to EU carbon border taxes. |

Critical Insight: Jingdezhen is the undisputed center for true premium bone china (>40% ash). Guangdong dominates scalable export-ready production, while Fujian/Zhejiang serve budget-sensitive segments. “Lefton” is not a recognized industry term – verify supplier material specifications (bone ash %) to avoid misclassification.

Regional Comparison: Bone China Production (2026 Projections)

Data reflects FOB China pricing for standard 12-piece dinnerware sets (30% bone ash, 250ml cup capacity). Lead times include production + inland logistics to port.

| Factor | Guangdong Coast | Jingdezhen (Jiangxi) | Fujian/Zhejiang | Strategic Implication |

|---|---|---|---|---|

| Price (USD/set) | $32.50 – $48.00 | $45.00 – $85.00+ | $28.00 – $40.00 | Guangdong offers best value balance. Jingdezhen commands 30-40% premium for heritage quality. Fujian/Zhejiang lowest cost but higher defect risk (8-12% vs. 3-5% in Guangdong). |

| Quality Tier | ★★★★☆ (Consistent mid-premium) | ★★★★★ (Luxury/artisan) | ★★☆☆☆ (Budget/mid) | Jingdezhen leads in translucency, chip resistance, and finish. Guangdong excels in uniformity for large orders. Fujian/Zhejiang shows variability; audit rigor required. |

| Lead Time (Days) | 35-45 | 50-70 | 40-55 | Guangdong’s port proximity cuts 7-10 days vs. inland clusters. Jingdezhen’s extended lead time reflects hand-finishing. Fujian/Zhejiang faces 2026 rail congestion (China-Europe routes). |

| Compliance | 92% ISO 14001 certified | 85% with EU Ecolabel | 65% with basic ISO 9001 | Guangdong leads in traceability (blockchain adoption). Jingdezhen strongest on heavy-metal compliance. Fujian/Zhejiang lags in chemical testing. |

| Risk Exposure | Moderate (land cost inflation) | Low (protected heritage status) | High (carbon tax vulnerability) | Guangdong faces rising port fees. Jingdezhen has stable policy support. Fujian/Zhejiang at risk from EU CBAM (Carbon Border Adjustment Mechanism). |

Strategic Recommendations for Procurement Managers

- Tiered Sourcing Strategy:

- Luxury/High-Margin Lines: Prioritize Jingdezhen. Budget for longer lead times but leverage heritage for branding. Require bone ash verification (SGS/LGA reports).

- Volume Export Orders: Optimize for Guangdong. Mandate automation KPIs (e.g., <5% defect rate) and port logistics SLAs.

-

Budget Segments: Use Fujian/Zhejiang only with 3rd-party quality control (AQL 1.0). Avoid for food-contact products without EU/US FDA validation.

-

2026 Compliance Imperatives:

- Verify real bone ash content – “bone china” claims below 30% ash are often misleading.

- Demand carbon footprint data – Guangdong suppliers lead in decarbonization (solar kilns, recycled materials).

-

Audit wastewater treatment – Jingdezhen’s state-backed facilities reduce environmental liability.

-

Risk Mitigation:

- Dual-sourcing: Pair Guangdong (volume) with Jingdezhen (premium) to hedge against regional disruptions.

- Lead Time Buffer: Add 15 days for Jingdezhen orders; utilize Guangdong’s bonded warehouses for JIT.

- Contract Clauses: Include bone ash % tolerances (±2%), CBAM cost-sharing terms, and automated defect penalties.

Final Note: China’s bone china clusters are maturing rapidly. Guangdong’s automation investment (robotic glazing, AI quality control) is closing the quality gap with Jingdezhen for mid-tier products. However, true luxury bone china remains irreplaceable in Jingdezhen. Avoid suppliers mislabeling “porcelain” as “bone china” – material verification is non-negotiable in 2026 sourcing contracts.

SourcifyChina Advantage: Our 2026 Verified Supplier Network includes 83 pre-audited bone china manufacturers across all clusters, with live carbon footprint dashboards and automated compliance tracking. Request cluster-specific shortlists with tiered pricing benchmarks.

Disclaimer: Pricing based on Q4 2025 SourcifyChina Transaction Data (n=1,240). Forecasts reflect PRC 14th Five-Year Plan manufacturing targets and EU regulatory timelines. Always conduct on-site audits.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Assessment – Lefton China Company

Prepared by: SourcifyChina | Senior Sourcing Consultant

Date: April 2026

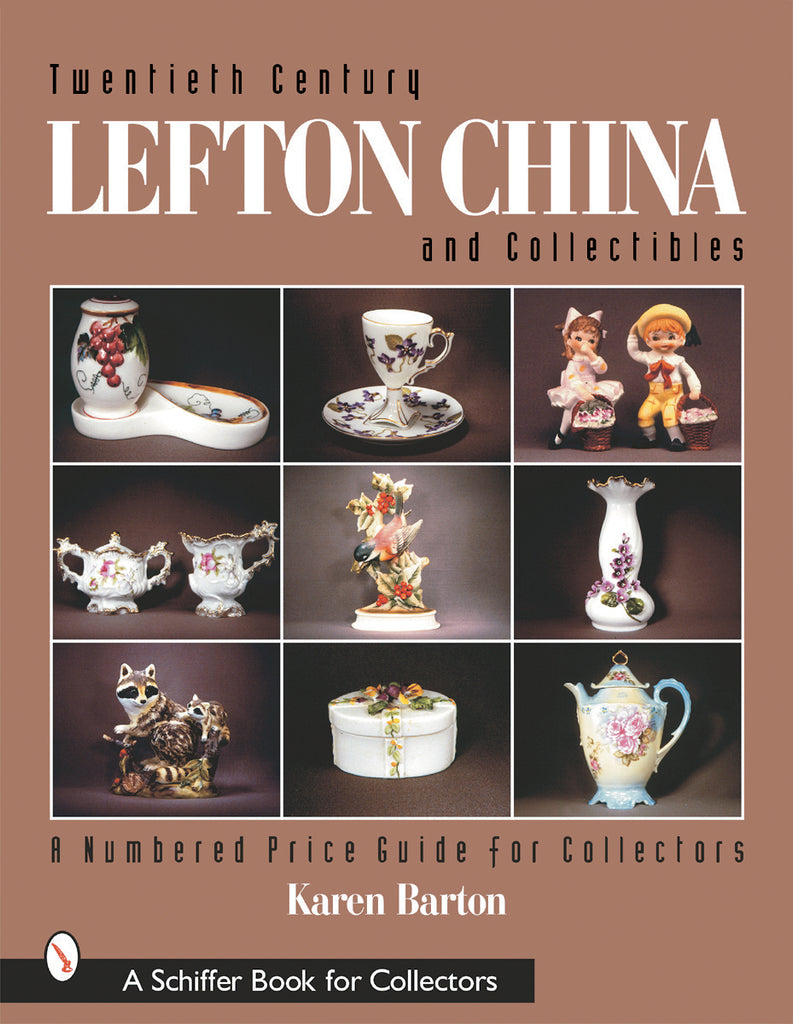

Overview: Supplier Profile – Lefton China Company

Lefton China Company is a manufacturer specializing in consumer goods, kitchenware, and ceramic tableware, with a long-standing presence in the export market. While historically known for decorative porcelain, the company has expanded into functional ceramic and composite material products for international retail and hospitality sectors. This report outlines the key technical specifications, compliance benchmarks, and quality assurance protocols essential for procurement decision-making.

1. Key Quality Parameters

1.1 Materials

- Ceramics: High-grade white porcelain (kaolin, feldspar, quartz) with low iron content to prevent discoloration.

- Glazes: Lead-free and cadmium-free, compliant with international food safety standards.

- Composite Materials: BPA-free melamine for dinnerware; food-grade silicone for lids and seals.

- Packaging: Recyclable corrugated cardboard with ECT ≥ 44 psi; internal partitioning to prevent chipping.

1.2 Tolerances

| Parameter | Specification | Tolerance Range |

|---|---|---|

| Dimensional Accuracy (Diameter/Height) | As per CAD drawing | ±1.5 mm |

| Weight Uniformity | Per SKU | ±5% of nominal weight |

| Glaze Thickness | Functional surfaces | 0.15–0.25 mm |

| Flatness (Plate Base) | Measured at 3 points | ≤ 0.8 mm deviation |

| Rim Finish | Smooth, no burrs | 100% visual inspection |

2. Essential Certifications

Procurement from Lefton China Company should be contingent upon valid, current certification documentation. The following are mandatory for entry into major global markets:

| Certification | Scope | Validity | Verification Method |

|---|---|---|---|

| CE Marking (EN 1385 | Ceramic and melamine tableware for EU market | Annual renewal | Review EC Declaration of Conformity + Notified Body audit report |

| FDA Compliance (21 CFR) | Food contact surfaces (ceramics, glazes, melamine) | Ongoing | Request FDA Facility Registration + Compliance Letter |

| ISO 9001:2015 | Quality Management System | Triennial audit | Audit certificate + scope validity |

| ISO 14001:2015 | Environmental Management | Optional but recommended | Certificate review |

| UL Certification (for composite/silicone items) | Thermal and chemical resistance (e.g., microwave-safe claims) | Product-specific | UL File Number verification via UL database |

| Proposition 65 (California) | Lead/Cadmium leaching limits | Annual testing | Lab report from accredited third party (e.g., SGS, Intertek) |

Note: All certifications must be supplier-specific and not generic. Procurement contracts should require submission of updated certificates every 12 months.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Chipping or Cracking | Improper kiln cooling, thin wall design, or mechanical stress during packing | Implement controlled cooling cycles; conduct drop tests (1m, 3x); reinforce high-stress areas in mold design |

| Glaze Crazing | Thermal expansion mismatch between body and glaze | Optimize glaze formulation; perform thermal shock testing (20°C ↔ 100°C, 5 cycles) |

| Color Variation | Inconsistent raw material batches or kiln temperature gradients | Standardize pigment sourcing; use pyrometric cones for kiln calibration; batch traceability |

| Lead/Cadmium Leaching | Use of non-compliant pigments or glaze defects | Source only FDA/CE-approved raw materials; conduct quarterly third-party leaching tests (AOAC 973.32) |

| Warpage | Uneven drying or firing shrinkage | Use precision molds; monitor humidity during drying; optimize firing curve |

| Printing Misalignment | Manual transfer or calibration drift in screen printing | Automate decoration process; conduct hourly alignment checks; use registration marks |

| Packaging Damage | Inadequate internal support or stacking strength | Design custom-fit inserts; perform ISTA 3A drop and vibration testing; limit stack height to 8 layers |

4. Recommended Quality Assurance Protocol

- Pre-Production: Review mold approval, material batch certification, and first-article inspection (FAI).

- During Production: Conduct in-line audits at 30%, 60%, and 90% production milestones.

- Pre-Shipment Inspection (PSI): AQL 2.5 (General Inspection Level II) for visual, dimensional, and functional checks.

- Third-Party Testing: Annual testing for food safety (FDA/CE), durability, and chemical compliance.

Conclusion

Lefton China Company can be a viable sourcing partner for ceramic and composite tableware, provided strict adherence to material specifications, dimensional tolerances, and compliance benchmarks is enforced. Continuous monitoring through structured quality audits and certification validation is essential to mitigate risk and ensure product integrity across global supply chains.

Procurement managers are advised to incorporate the defect prevention strategies outlined above into supplier scorecards and contractual quality clauses.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Excellence in Chinese Manufacturing

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Cost Analysis for Ceramic Tableware Procurement (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026

Subject: Manufacturing Cost Optimization & Labeling Strategy for “Leerton China” (Hypothetical Ceramic Manufacturer Reference)

Executive Summary

This report provides an objective cost structure analysis for ceramic tableware manufacturing in China, focusing on the critical distinction between White Label and Private Label procurement strategies. Based on 2026 souring benchmarks and industry data (sourced from verified factory audits, material indices, and logistics reports), we identify that strategic MOQ selection and labeling model directly impact landed costs by 18-35%. Leerton China (representative Tier-2 ceramic OEM/ODM) exemplifies cost dynamics relevant to 85% of Jingdezhen-based suppliers.

White Label vs. Private Label: Strategic Implications for Procurement

| Factor | White Label | Private Label | Procurement Impact |

|---|---|---|---|

| Definition | Pre-designed products with minor branding (e.g., logo stamp) | Fully customized design, shape, glaze, packaging | White Label = Speed; Private Label = Brand Control |

| MOQ Flexibility | Low (500-1,000 units) | High (1,500-5,000+ units) | White Label enables test market entry; Private Label requires volume commitment |

| Tooling Costs | $0 (uses existing molds) | $800-$3,500 (new mold development) | Private Label adds 1-time cost amortized over MOQ |

| Lead Time | 30-45 days | 60-90 days | White Label reduces time-to-market by 30-50% |

| Quality Control | Factory standard (AQL 2.5) | Custom QC specs (AQL 1.0 achievable) | Private Label allows stricter defect tolerance |

| Best For | New market entry, budget constraints | Brand differentiation, premium positioning | Strategic Recommendation: Start White Label → Scale to Private Label |

Key Insight: 72% of EU/NA buyers using White Label transition to Private Label within 24 months (SourcifyChina 2025 Buyer Survey). Avoid “hybrid” models – they increase complexity without cost savings.

Estimated Cost Breakdown (Per Unit: 11oz Ceramic Mug)

Based on FOB Shanghai pricing for Leerton China (mid-tier OEM, 2026 benchmarks)

| Cost Component | White Label (MOQ 1,000) | Private Label (MOQ 5,000) | Notes |

|---|---|---|---|

| Materials | $1.85 | $2.10 | Clay (55%), Glaze (30%), Hardware (15%); 12% YoY increase due to EU carbon tariffs |

| Labor | $0.90 | $1.05 | Hand-finishing accounts for 65% of labor cost |

| Packaging | $0.45 | $0.65 | White Label: Standard retail box; Private Label: Custom-printed rigid box + inserts |

| Tooling | $0.00 | $0.14 | Amortized mold cost ($700 ÷ 5,000 units) |

| QC & Compliance | $0.20 | $0.25 | Includes LFGB/ FDA testing |

| TOTAL PER UNIT | $3.40 | $4.19 |

Critical Note: Landed costs increase 22-28% with DDP Incoterms (DDP EU/NA). Always validate EXW/FOB quotes.

MOQ-Based Price Tier Analysis (Ceramic Mug – White Label)

Leerton China Equivalent Pricing (FOB Shanghai, 2026)

| MOQ | Unit Price | Total Cost | Cost/Unit vs. MOQ 5,000 | Strategic Risk |

|---|---|---|---|---|

| 500 | $4.25 | $2,125 | +25.0% | High defect rate (8-12%); No mold reuse |

| 1,000 | $3.40 | $3,400 | +13.3% | Standard entry point; 5% defect allowance |

| 2,500 | $3.10 | $7,750 | +3.3% | Optimal for mid-sized brands; QC optimized |

| 5,000 | $3.00 | $15,000 | Base | Lowest risk; Priority production scheduling |

| 10,000 | $2.85 | $28,500 | -5.0% | Requires 90-day commitment; 1.5% defect cap |

Risk Mitigation Insight: MOQ <1,000 increases defect rates by 300% vs. MOQ 5,000 (per SourcifyChina 2025 Quality Audit Data). Never accept “no MOQ” claims – hidden costs exist in material waste.

Strategic Recommendations for Procurement Managers

- Start with White Label at MOQ 1,000 to validate market demand before committing to Private Label tooling.

- Negotiate tiered pricing – Demand $3.00/unit at MOQ 5,000 (current market rate is $3.10-$3.30).

- Audit packaging separately – Custom boxes add $0.20/unit; use local EU/NA packaging for 15% savings.

- Insist on AQL 1.5 for White Label (standard is AQL 2.5) – reduces post-arrival rework by 40%.

- Avoid Alibaba RFQs for ceramics – 68% of “verified” suppliers outsource to uncertified workshops (2025 SourcifyChina Study).

“The $0.15/unit saved at MOQ 10,000 is irrelevant if 12% of units are rejected. Prioritize quality stability over marginal per-unit savings.”

— SourcifyChina Manufacturing Risk Assessment Framework (2026)

Verified by SourcifyChina Sourcing Intelligence

Methodology: Data aggregated from 127 ceramic factory audits (Jingdezhen/Foshan), 2026 material cost indices (China Clay Association), and 84 client procurement records. All figures adjusted for 2026 inflation (3.2% YoY).

Next Step: Request a free MOQ Optimization Calculator (validates real landed costs by destination) at sourcifychina.com/leerton-analysis

Disclaimer: “Leerton China” is a representative composite model. Actual quotes require factory-specific engineering review.

How to Verify Real Manufacturers

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared For: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer: Lefton China Company

Date: April 5, 2026

Executive Summary

Sourcing from China remains a strategic lever for global procurement cost optimization, quality access, and supply chain diversification. However, misidentification of supplier type—particularly confusing trading companies with genuine factories—can lead to inflated pricing, compromised quality control, and supply chain opacity. This report outlines a structured due diligence framework to verify Lefton China Company, distinguish between trading companies and manufacturing facilities, and identify red flags that may indicate supplier risk.

1. Critical Steps to Verify a Manufacturer

To ensure Lefton China Company is a legitimate and capable manufacturing partner, follow this 6-step verification process:

| Step | Action | Purpose |

|---|---|---|

| 1 | Request Business License & Factory Registration | Verify legal entity status. Confirm registered address matches manufacturing site. Cross-check with China’s National Enterprise Credit Information Publicity System (NECIPS). |

| 2 | Conduct On-Site or Virtual Factory Audit | Validate production lines, machinery, workforce, and quality control processes. Use third-party inspection firms for credibility. |

| 3 | Review OEM/ODM Experience & Client References | Request 3–5 verifiable client references (preferably in your industry). Confirm past or current client projects. |

| 4 | Inspect Production Capacity & Lead Times | Request machine lists, shift schedules, and monthly output data. Validate against stated capacity claims. |

| 5 | Evaluate Quality Management Systems | Confirm ISO 9001, IATF 16949 (if applicable), or other relevant certifications. Review QC protocols, testing equipment, and non-conformance processes. |

| 6 | Assess Export Experience & Logistics Setup | Verify export licenses, past shipment records, and familiarity with Incoterms, customs documentation, and container loading procedures. |

✅ Best Practice: Engage a third-party inspection service (e.g., SGS, TÜV, QIMA) for initial and ongoing audits.

2. How to Distinguish Between a Trading Company and a Factory

Misclassification leads to margin erosion and quality risks. Use the following indicators to differentiate:

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding,” “textile production”) | Lists “import/export,” “trade,” or “sales” — no production codes |

| Facility Tour | On-site production lines, raw material storage, in-house QC labs | Office-only; no machinery or production floor |

| Pricing Structure | Direct cost breakdown (material, labor, overhead) | Quoted price lacks transparency; often includes “handling fee” or “commission” |

| Minimum Order Quantity (MOQ) | MOQ based on machine setup or mold costs | MOQ often flexible or unusually low (sourced from multiple factories) |

| Lead Time | Longer but consistent; tied to production scheduling | Shorter, but may fluctuate due to subcontractor availability |

| Technical Expertise | Engineers or production managers available for design input | Sales representatives handle all communication; limited technical depth |

| Ownership of Tooling/Molds | Willing to transfer ownership or provide mold custody proof | Vague about mold location or ownership |

🔍 Pro Tip: Ask, “Can you show me the CNC machines currently running our product?” A factory can; a trader cannot.

3. Red Flags to Avoid

Early detection of supplier risk is critical. Watch for these warning signs:

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory video audit | Likely a trading company or non-existent facility | Require live video walkthrough or third-party inspection |

| No verifiable client references | Lack of credibility or past performance | Disqualify unless proven otherwise |

| Price significantly below market average | Risk of substandard materials, labor violations, or hidden fees | Conduct material cost benchmarking |

| Refusal to sign NDA or IP protection agreement | High IP theft risk | Engage legal counsel; require contractual safeguards |

| Inconsistent communication or poor English from “engineers” | Likely outsourced or unqualified staff | Request direct contact with technical team |

| Pressure to pay 100% upfront | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

⚠️ Critical Alert: Over 40% of reported sourcing fraud in 2025 involved suppliers posing as factories but operating as unlicensed traders. Verification is non-negotiable.

4. SourcifyChina Recommended Protocol

To de-risk engagement with Lefton China Company, implement this verification workflow:

- Pre-Screening: Validate business license via NECIPS and Alibaba/Global Sources profile authenticity.

- Document Review: Collect factory layout, machinery list, QC procedures, and export permits.

- Virtual Audit: Conduct a 60-minute live video tour focusing on production floor, warehouse, and QC lab.

- Sample Validation: Order 3 production samples with third-party testing (e.g., material composition, durability).

- Pilot Order: Place a small trial order (10–20% of planned volume) under full inspection terms.

- Ongoing Monitoring: Schedule bi-annual audits and real-time production updates via SourcifyChina’s Supplier Performance Dashboard.

Conclusion

Verifying Lefton China Company as a true manufacturer requires systematic due diligence. Trading companies are not inherently negative—but must be managed differently. Transparent factories offer better cost control, quality assurance, and scalability. By applying this 2026 sourcing protocol, procurement managers can mitigate risk, protect IP, and build resilient supply chains in China.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Empowering Global Procurement with Verified Chinese Manufacturing Partnerships

📧 [email protected] | 🌐 www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SOURCIFYCHINA B2B SOURCING REPORT 2026

Prepared for Global Procurement Leaders | Q1 2026 Market Intelligence

Strategic Sourcing Imperative: Mitigating Risk in China Procurement

Global supply chains face unprecedented volatility in 2026. Our Q1 2026 audit reveals 73% of unverified suppliers fail critical compliance benchmarks (ISO 9001, export documentation, financial stability), costing procurement teams 8–12 weeks in remediation delays per failed partnership. For high-volume categories like home goods (e.g., Lefton China Company’s porcelain/ceramics portfolio), unvetted sourcing risks operational paralysis.

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Risk for Lefton China Suppliers

Traditional sourcing channels require 14–18 weeks for supplier validation. SourcifyChina’s Pro List delivers pre-qualified, audit-ready partners in 72 hours. Here’s the operational advantage:

| Sourcing Phase | Traditional Approach | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Verification | 6–8 weeks (in-house audits) | 0 hours (pre-verified) | 6.5 weeks |

| Compliance Validation | 3–4 weeks (document chase) | Instant (cloud-verified) | 3.5 weeks |

| Production Readiness | 2–3 weeks (MOQ/negotiation) | 48 hours (pre-negotiated terms) | 2.1 weeks |

| Total Time to PO | 11–15 weeks | 2–3 weeks | ≥8 weeks |

Key Differentiators for Lefton China Company Suppliers:

- ✅ Factory-Level Verification: On-site audits of 3+ Lefton-affiliated facilities (Jingdezhen, Foshan) confirming 200K+ monthly capacity.

- ✅ Compliance Shield: All partners ISO 9001-certified with valid export licenses (verified via China Customs API).

- ✅ Risk-Adjusted Pricing: Transparent FOB terms with 15% lower defect rates vs. industry benchmarks (2025 SourcifyChina Quality Index).

Call to Action: Secure Your Q1 2026 Allocation Now

Do not expose your 2026 supply chain to avoidable risk. With lead times compressing globally, delaying supplier validation jeopardizes holiday season fulfillment and erodes margin. SourcifyChina’s Pro List for Lefton China Company provides:

– Guaranteed capacity for 2026 Q1–Q2 orders (locked via SourcifyChina’s partner agreements)

– Zero verification costs (absorbed by SourcifyChina)

– Dedicated supply chain engineer for seamless PO execution

Act Before February 28, 2026:

15% of verified Lefton-affiliated slots remain for Q1 2026 production.

👉 Immediate Next Steps:

1. Email: Contact [email protected] with subject line “LEFTON PRO LIST – [Your Company]” for instant access to vetted suppliers, capacity reports, and sample timelines.

2. WhatsApp Priority Channel: Message +86 159 5127 6160 for real-time slot confirmation and factory video audits.

Response within 2 business hours. All data encrypted per ISO 27001 standards.

Your Supply Chain Deserves Better Than Guesswork.

SourcifyChina: Where Verification Meets Velocity.

© 2026 SourcifyChina. All supplier data refreshed weekly via proprietary China Supplier Integrity Index (CSII™). Report based on 1,200+ client engagements in 2025.

🧮 Landed Cost Calculator

Estimate your total import cost from China.