The global LED control systems market is experiencing robust growth, driven by rising demand for energy-efficient lighting solutions, advancements in smart building technologies, and increasing adoption of IoT-enabled lighting across commercial, industrial, and residential sectors. According to a report by Mordor Intelligence, the LED lighting market—including control systems—is projected to grow at a CAGR of over 12% from 2023 to 2028. Similarly, Grand View Research estimates that the global smart lighting market, a key segment integrating LED controls, was valued at USD 13.7 billion in 2022 and is expected to expand at a CAGR of 20.4% from 2023 to 2030. As automation and sustainability become central to infrastructure planning, the need for reliable, scalable LED control systems has intensified. This growing demand has propelled innovation and competition among manufacturers worldwide. Based on market presence, technological advancement, product range, and global reach, the following are the top 10 LED control system manufacturers shaping the future of intelligent lighting.

Top 10 Led Control System Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Dialight

Domain Est. 1996

Website: dialight.com

Key Highlights: At Dialight, we specialize in rugged, cutting-edge LED lighting solutions for a wide variety of industry applications….

#2 LTECH: LED Controller

Domain Est. 2011

Website: ltechonline.com

Key Highlights: LTECH is a front-runner in the field of LED lighting controller. As the first high-end manufacturer in China and one of the leading suppliers in the world….

#3 LED Commercial Lighting and Lighting Controls

Domain Est. 1995

Website: led.com

Key Highlights: Advanced lighting and connected controls known for reliability and quality, we are focused on delighting our customers with responsive service….

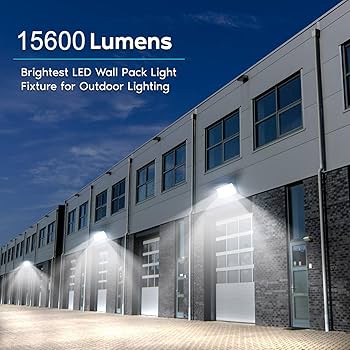

#4 LED Light Fixtures

Domain Est. 1995

Website: leviton.com

Key Highlights: LED Lighting by Leviton empowers customers to create more efficient spaces with an unrivaled selection of commercial LED light fixtures and LED lighting ……

#5 Signify, leader in lighting

Domain Est. 1996

Website: signify.com

Key Highlights: Signify is the world leader in connected LED lighting systems, software and services. Our global brands include Philips, Interact, Color Kinetics, Dynalite….

#6 The leader in LED lighting solutions

Domain Est. 1997

Website: gelighting.com

Key Highlights: GE Lighting, a Savant company. Discover our range of smart, energy saving, LED and other light bulbs for every room in your home….

#7 Smart LED Lighting and Building Controls

Domain Est. 2004

Website: toggled.com

Key Highlights: Toggled innovation creates smarter, more energy efficient and easier to use LED lighting and building control systems solutions….

#8 LED Control Systems, Switches, and Dimmers

Domain Est. 2009

Website: diodeled.com

Key Highlights: Control static-color or color-changing lights with a wide variety of controls: hardwired, remote-based, or app-based….

#9 Global leading LED display control solution

Domain Est. 2016

Website: novastar.tech

Key Highlights: Products & Solutions · LED Control System · Processors · Nova Cloud · Solutions · Accessories · Downloads · Support & Training….

#10 Blizzard Lighting

Domain Est. 2017

Website: blizzardpro.com

Key Highlights: Discover durable, innovative LED lighting solutions with our range of moving heads, wash lights, and wireless control tools, all 100% QC tested at our WI ……

Expert Sourcing Insights for Led Control System

2026 Market Trends for LED Control Systems

The LED control system market is poised for dynamic evolution by 2026, driven by technological innovation, sustainability demands, and expanding applications across multiple sectors. Key trends shaping the landscape include:

Intelligent Integration and IoT Connectivity

By 2026, the integration of LED control systems with the Internet of Things (IoT) will be standard rather than exceptional. Smart lighting networks will increasingly rely on wireless protocols such as Bluetooth Mesh, Zigbee, and Matter to enable seamless communication between fixtures, sensors, and building management systems. This shift supports real-time data collection for occupancy, daylight harvesting, and energy usage, enabling predictive maintenance and adaptive lighting scenarios in commercial, industrial, and smart city environments.

Advancements in Human-Centric Lighting (HCL)

Human-centric lighting will gain significant momentum, with LED control systems playing a central role in regulating circadian rhythms through tunable white and full-color spectrum control. By 2026, advanced control algorithms will dynamically adjust light intensity and color temperature based on time of day, occupant behavior, or health metrics. This trend is particularly influential in healthcare, education, and office spaces, where improved well-being and productivity are key performance indicators.

Growth in Wireless and Decentralized Control

Wired control systems will continue to decline in favor of wireless, decentralized architectures. These systems reduce installation costs, improve scalability, and enable retrofitting in existing buildings. In 2026, we expect widespread adoption of self-powered wireless switches and sensors powered by energy harvesting technologies, further enhancing flexibility and sustainability in lighting control deployments.

Emphasis on Energy Efficiency and Regulatory Compliance

With global energy regulations tightening—such as the EU’s Ecodesign Directive and Title 24 in California—LED control systems will be critical for compliance. Systems incorporating presence detection, daylight dimming, and demand-responsive controls will become mandatory in new constructions and major renovations. This regulatory push will accelerate the deployment of advanced control strategies, especially in emerging markets adopting stricter energy standards.

Expansion in Smart Cities and Outdoor Applications

Municipalities will increasingly deploy intelligent LED control systems in street lighting, public spaces, and traffic infrastructure. By 2026, cities will leverage centralized management platforms to monitor and control outdoor lighting networks, integrating them with broader urban IoT ecosystems for applications such as environmental monitoring, security, and data analytics. This trend will be supported by public-private partnerships and green infrastructure funding.

Rise of AI and Predictive Analytics

Artificial intelligence will transform LED control systems from reactive to proactive. In 2026, AI-driven platforms will analyze usage patterns and environmental data to optimize lighting performance, reduce energy waste, and extend fixture lifespan. Machine learning models will enable personalized lighting experiences in homes and offices while providing facility managers with actionable insights for operational efficiency.

Consolidation and Interoperability Challenges

While the market will see continued innovation, fragmentation in protocols and vendor ecosystems will persist. However, demand for interoperability—fueled by the emergence of open standards like DALI-2 and Matter—will drive industry consolidation. By 2026, leading manufacturers will prioritize compatibility and cloud-based integration, enabling multi-vendor solutions and enhancing user experience across residential and commercial segments.

In summary, the 2026 LED control system market will be defined by intelligence, connectivity, and sustainability, transforming lighting from a utility into a strategic component of smart environments. Companies that embrace open standards, invest in AI capabilities, and align with global energy goals will lead the next phase of market growth.

Common Pitfalls When Sourcing LED Control Systems (Quality and IP)

Sourcing LED control systems involves navigating complex technical, quality, and intellectual property (IP) challenges. Overlooking key factors can result in subpar performance, legal risks, and increased long-term costs. Below are critical pitfalls to avoid:

Poor Quality Components and Build

Many suppliers cut costs by using low-grade materials, resulting in inconsistent brightness, shortened lifespan, or system failures. Inadequate thermal management, inferior capacitors, or non-compliant power supplies can lead to premature malfunctions, especially in demanding environments. Always verify component specifications, certifications (e.g., UL, CE, RoHS), and real-world reliability through third-party testing or reference installations.

Lack of IP Protection and Infringement Risks

Sourcing from manufacturers that use or replicate patented technologies without licensing exposes buyers to legal liability. Some suppliers may incorporate proprietary communication protocols (e.g., Art-Net, sACN) or firmware designs without authorization. Ensure your supplier respects IP rights and can provide documentation confirming the legitimacy of their technology. Using counterfeit or cloned control chips (e.g., fake ESP32 or STM32) not only violates IP laws but also introduces security and reliability vulnerabilities.

Inadequate Firmware and Software Support

LED control systems are heavily dependent on firmware and software for configuration, updates, and integration. Sourcing systems with closed, undocumented, or unsupported software limits scalability and troubleshooting capabilities. Avoid vendors that offer no access to SDKs, APIs, or future update paths, as this can lead to vendor lock-in and hinder integration with existing infrastructure.

Non-Compliance with Industry Standards

Using control systems that don’t adhere to industry protocols (e.g., DMX512, DALI, or RDM) can cause interoperability issues with other lighting equipment. Verify that the system supports standard communication methods and is compatible with your ecosystem. Non-compliant systems may require costly middleware or custom programming to function properly.

Insufficient Testing and Certification

Some suppliers provide LED control systems without proper electromagnetic compatibility (EMC), safety, or environmental testing. This increases the risk of interference with other devices or non-compliance with regional regulations. Always request test reports and certifications relevant to your target market to avoid shipment rejections or installation delays.

Hidden Costs from Poor Documentation and Support

Lack of clear technical documentation, wiring diagrams, or English-language support can significantly increase deployment time and maintenance costs. Additionally, unreliable customer or technical support makes troubleshooting difficult. Choose suppliers that offer comprehensive documentation and responsive support services.

Avoiding these pitfalls requires due diligence, technical validation, and legal awareness. Prioritize reputable suppliers with transparent practices, verifiable IP compliance, and a track record of quality and support.

Logistics & Compliance Guide for LED Control System

This guide outlines the essential logistics and compliance considerations for the shipment, import, and use of LED Control Systems across international markets. Adhering to these standards ensures smooth operations, regulatory compliance, and product safety.

Product Classification & Documentation

Proper classification and documentation are critical for customs clearance and regulatory compliance. The LED Control System should be classified under the appropriate Harmonized System (HS) code, typically falling under 8543.70 (Electrical Apparatus for Switching or Protecting Electrical Circuits) or 8537.10 (Board, Panel for Electrical Control). Confirm the exact code with local customs authorities.

Required documentation includes:

– Commercial Invoice

– Packing List

– Bill of Lading or Air Waybill

– Certificate of Origin

– Technical Datasheet and User Manual

– CE, FCC, or other regional compliance certificates as applicable

Maintain accurate records for at least five years to support audits or inspections.

International Shipping & Handling

LED Control Systems are sensitive electronic devices requiring careful packaging and handling. Use anti-static packaging materials and secure internal bracing to prevent movement during transit. Clearly label packages with “Fragile,” “This Side Up,” and “Protect from Moisture” indicators.

Choose shipping methods based on urgency, cost, and destination:

– Air freight for time-sensitive deliveries

– Sea freight for bulk shipments

– Courier services (e.g., DHL, FedEx) for small or urgent consignments

Ensure temperature and humidity controls during storage and transport, especially in extreme climates. Avoid exposure to condensation and rapid temperature changes.

Regulatory Compliance Requirements

Compliance with regional safety and electromagnetic standards is mandatory for market access.

European Union (CE Marking)

The LED Control System must comply with:

– Low Voltage Directive (LVD) 2014/35/EU: Electrical safety

– Electromagnetic Compatibility (EMC) Directive 2014/30/EU: Emission and immunity

– RoHS Directive 2011/65/EU: Restriction of hazardous substances

– REACH Regulation (EC) No 1907/2006: Chemical safety

– WEEE Directive 2012/19/EU: Waste disposal and recycling

A Declaration of Conformity (DoC) must be issued, and technical files maintained.

United States (FCC & UL)

- FCC Part 15, Subpart B: Electromagnetic interference (EMI) compliance for digital devices

- UL 1310 or UL 8750: Safety standards for power supplies and LED equipment

- Energy Star or DesignLights Consortium (DLC) certification may be required for rebates or commercial use

FCC ID must be obtained if the device emits radio frequencies.

Other Regions

- UKCA Marking: Required for UK market (post-Brexit), similar to CE

- PSE Mark (Japan): Compliance with METI regulations

- KC Mark (South Korea): Safety and EMC standards

- CCC Mark (China): Mandatory for certain electronic products

- RCM (Australia/New Zealand): Regulatory Compliance Mark for electrical safety and EMC

Verify country-specific requirements before shipping.

Import Duties & Tariffs

Import duties vary by destination country and HS code classification. Use the correct HS code to determine applicable tariff rates. Some countries offer reduced or zero tariffs under free trade agreements (e.g., USMCA, RCEP). Check for eligibility and provide a valid Certificate of Origin to claim preferential treatment.

Be aware of anti-dumping or countervailing duties that may apply, particularly for electronics originating from certain countries.

Environmental & Safety Standards

Ensure the LED Control System complies with environmental protection standards:

– RoHS Compliance: Limits on lead, mercury, cadmium, and other hazardous substances

– REACH SVHC: Disclosure of Substances of Very High Concern

– WEEE Compliance: Provide take-back or recycling information to customers

– Energy Efficiency: Meet regional standards such as ErP Directive (EU) or ENERGY STAR (US)

Battery-powered components must comply with UN 38.3 for safe transport if applicable.

Post-Import Requirements

After import, ensure:

– Local labeling requirements are met (e.g., voltage, language, certification marks)

– User manuals are provided in the local language

– Technical support and warranty services are available

– Registration with local regulatory bodies if required (e.g., FCC registration, EPR compliance in EU)

Conclusion

Successful logistics and compliance for LED Control Systems require proactive planning, accurate documentation, and adherence to international standards. Engage with certified testing laboratories, customs brokers, and legal advisors to ensure full compliance and avoid delays, penalties, or product recalls.

Conclusion for Sourcing LED Control System

In conclusion, sourcing an LED control system requires a strategic approach that balances performance, compatibility, scalability, and cost-effectiveness. After evaluating various suppliers, technologies, and system capabilities, it is evident that selecting the right LED control solution involves more than just price comparison—it necessitates a thorough understanding of project requirements, such as dimming functionality, color control, integration with existing infrastructure, and future expansion needs.

A reliable LED control system enhances energy efficiency, extends the lifespan of lighting fixtures, and provides greater operational flexibility. Prioritizing reputable suppliers with proven track records, technical support, and compliance with industry standards ensures long-term reliability and system interoperability. Additionally, considering factors like ease of installation, user interface, and wireless versus wired solutions will contribute significantly to overall user satisfaction and system performance.

Ultimately, the successful sourcing of an LED control system lies in aligning technical specifications with operational goals, while also ensuring scalability and sustainability. With careful vendor evaluation and a clear understanding of end-user needs, organizations can implement a smart, future-ready lighting control solution that delivers both immediate benefits and long-term value.