The global LED lighting market is experiencing robust expansion, driven by increasing demand for energy-efficient solutions, supportive government regulations, and advancements in solid-state lighting technology. According to Grand View Research, the global LED market was valued at USD 82.9 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 11.7% from 2023 to 2030. Similarly, Mordor Intelligence projects a CAGR of over 10.5% during the forecast period of 2023–2028, citing rapid urbanization and adoption in commercial and industrial applications as key growth catalysts. As market demand intensifies, LED armature (arm) manufacturers are under pressure to innovate in design, thermal management, and smart integration. This has led to the emergence of leading manufacturers who combine scalability, technological prowess, and a broad product portfolio. In this context, the following eight companies have distinguished themselves as top-tier LED arm manufacturers, shaping the future of intelligent and sustainable lighting infrastructure worldwide.

Top 8 Led Arm Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

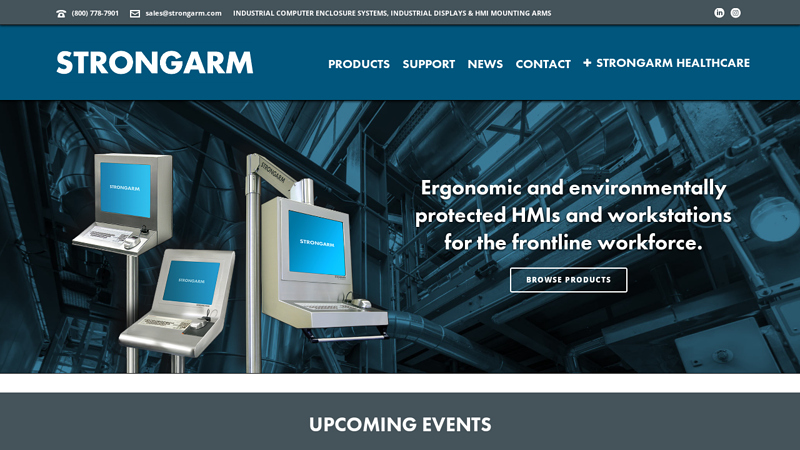

#1 Strongarm

Domain Est. 2001

Website: strongarm.com

Key Highlights: Strongarm can accelerate your project by providing turnkey mechanical and electrical systems, including simple preinstall, wiring, and functional testing….

#2 LED Gate Arm Company

Domain Est. 2012

Website: gatearmlight.com

Key Highlights: Our new Gate Arm design, with DOT reflective tape on both sides, not only looks better but greatly improves the way drivers see the gate arm – day or night….

#3 Contemporary Arms Outdoor Lighting

Domain Est. 2016

Website: currentlighting.com

Key Highlights: AAL’s Contemporary Arms are factory fabricated and assembled. Where To Buy SPEC SHEET Specifications Wattage Range 31 – 150 Color Offering…

#4 Machine Vision Ring Lights for Robotic Arm

Domain Est. 2021

Website: 3amled.com

Key Highlights: 3AM’s machine vision ring lights, equipped with high-power chips, are ideal for robotic arm applications. Our lights diffuse reflections and minimize ……

#5 Hapco Pole Products

Domain Est. 1998 | Founded: 1951

Website: hapco.com

Key Highlights: Since 1951, industry lighting professionals have made Hapco their trusted source for aluminum and steel light poles and accessories….

#6 LED articulated arm luminaires

Domain Est. 2006

Website: led2work.com

Key Highlights: The LED articulated arm luminaire for the workplace with infinitely variable light colour selection and previously unattained colour rendering….

#7 LED

Domain Est. 2012

Website: gatearms.com

Key Highlights: Our patented gate arms have LED lighting built into the gate arm. The LEDs are bright red when the arm is down, but turn bright green when the arm goes up….

#8 LED Display Arm Lights

Domain Est. 2017

Website: prismlightinggroup.com

Key Highlights: We offer a full line of innovative LED products, theatrical and DMX lighting, and rechargeable battery powered lighting solutions. Our unique designs, ……

Expert Sourcing Insights for Led Arm

H2: Projected 2026 Market Trends for LED Arms

As the global lighting industry continues to evolve, LED arms—articulating, adjustable LED lighting fixtures widely used in photography, videography, medical applications, industrial inspection, and smart home environments—are poised for significant transformation by 2026. Driven by technological innovation, sustainability mandates, and shifting consumer and commercial demands, the LED arm market is expected to enter a phase of accelerated growth and diversification. Below is an analysis of key market trends anticipated in H2 2026:

-

Increased Adoption in Professional Video and Content Creation

With the rise of remote work, live streaming, and influencer marketing, demand for high-quality, adaptable lighting remains strong. By H2 2026, LED arms will be increasingly integrated into content creator setups due to their flexibility, color accuracy (CRI >95), and smart control features. Manufacturers will focus on compact, modular designs suitable for home studios and portable kits. -

Smart Integration and IoT Connectivity

LED arms will increasingly feature built-in Wi-Fi, Bluetooth, and compatibility with ecosystems like Apple HomeKit, Google Home, and Amazon Alexa. By H2 2026, predictive lighting (AI-driven ambient adjustments), voice control, and app-based scheduling will become standard in premium models, especially in smart office and healthcare environments. -

Growth in Medical and Industrial Applications

The medical sector will continue adopting LED arms for examination lights and surgical lighting due to their cool operation, energy efficiency, and precise beam control. Similarly, industrial automation and machine vision systems will utilize LED arms for targeted, adjustable illumination. Regulatory compliance with medical device standards (e.g., IEC 60601) will drive product differentiation. -

Sustainability and Energy Efficiency Standards

As global regulations such as the EU’s Ecodesign Directive and U.S. DOE standards tighten, manufacturers will prioritize longer LED lifespans (>50,000 hours), recyclable materials, and reduced e-waste. Energy Star-certified LED arms with adaptive brightness and occupancy sensors will gain market share, especially in commercial installations. -

Advancements in Material and Design Innovation

Lightweight composite materials (e.g., carbon fiber-reinforced polymers) and improved joint mechanics will enhance durability and ease of positioning. By H2 2026, we expect slimmer profiles, 360-degree articulation, and magnetic or quick-release mounting systems to become mainstream, driven by user-centric design. -

Regional Market Expansion

While North America and Western Europe remain dominant markets, H2 2026 will see accelerated growth in Asia-Pacific (especially China, India, and South Korea) due to rising demand in electronics manufacturing, healthcare modernization, and digital content production. Localized production and distribution will reduce costs and improve supply chain resilience. -

Price Competition and Market Consolidation

As technology matures, mid-tier and budget LED arms will become more capable, squeezing margins for entry-level brands. This may lead to consolidation among smaller players, while larger firms invest in R&D to differentiate through AI, thermal management, and design patents. -

Focus on Human-Centric Lighting (HCL)

Advanced LED arms will offer tunable white light (2700K–6500K) and circadian rhythm support, especially in office and healthcare settings. Integration with biometric sensors to adjust lighting based on user presence or fatigue levels could emerge as a niche but growing trend by late 2026.

Conclusion

By H2 2026, the LED arm market will be characterized by smarter, more adaptable, and application-specific lighting solutions. Success will depend on balancing performance, design, and connectivity while meeting evolving regulatory and sustainability standards. Companies that innovate in integration, user experience, and cross-industry applications will lead the market transformation.

Common Pitfalls Sourcing LED Arms: Quality and Intellectual Property Issues

Sourcing LED arms—commonly used in lighting fixtures, medical equipment, or industrial applications—can present several challenges, particularly concerning product quality and intellectual property (IP) rights. Being aware of these pitfalls helps buyers mitigate risks and ensure reliable, legally compliant procurement.

Quality-Related Pitfalls

Inconsistent LED Performance and Lifespan

One of the most frequent quality issues is variability in LED brightness, color temperature, and longevity. Low-cost suppliers may use substandard diodes or inadequate heat dissipation designs, leading to premature failure or inconsistent light output. Without proper testing or certifications (such as LM-80 or TM-21), performance claims may be misleading.

Poor Thermal Management Design

LED arms generate heat during operation, and insufficient thermal design—such as low-quality heat sinks or improper material selection—can cause overheating. This not only reduces LED lifespan but also increases safety risks like component degradation or fire hazards.

Use of Counterfeit or Recycled Components

Some suppliers may use counterfeit LEDs or recycled parts to cut costs. These components often fail to meet performance standards and can lead to system failures. Verifying component authenticity through reputable distributors is essential.

Lack of Compliance with Safety and Environmental Standards

Many LED arms fail to comply with international safety certifications (e.g., UL, CE, RoHS). Non-compliant products may pose electrical, fire, or environmental risks and could lead to legal or customs issues upon import.

Intellectual Property Pitfalls

Infringement of Patented Designs or Technologies

LED arms often incorporate patented optical designs, driver circuits, or mechanical mounting systems. Sourcing from manufacturers that replicate branded products—especially without licensing—can expose buyers to IP litigation, shipment seizures, or product recalls.

Unclear or Missing IP Ownership Agreements

When working with OEM/ODM suppliers, failure to define IP ownership in contracts can lead to disputes. For example, a custom-designed LED arm could be legally owned by the manufacturer unless explicitly transferred to the buyer.

Risk of Clone or Knockoff Products

Some suppliers market their LED arms as compatible with well-known brands but closely mimic protected designs. While marketed as “compatible,” these may still infringe on design patents or utility models, especially in jurisdictions with strong IP enforcement.

Limited Recourse in Case of IP Disputes

Sourcing from overseas suppliers, particularly in regions with weak IP enforcement, may limit legal recourse if infringement claims arise. Buyers may bear liability even if they were unaware of the violation.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Request independent test reports and certifications.

– Audit suppliers and verify component supply chains.

– Conduct IP due diligence, including patent searches.

– Include clear IP clauses in procurement contracts.

– Work with legal counsel to assess risks in target markets.

By proactively addressing quality and IP concerns, organizations can safeguard their supply chains and ensure long-term reliability and compliance of sourced LED arms.

Logistics & Compliance Guide for LED ARM

Overview

This guide outlines the essential logistics and compliance considerations for the import, export, distribution, and use of LED ARM (presumed to refer to an LED lighting product or component, such as an LED armature or LED fixture). Adherence to these guidelines ensures smooth global operations, regulatory compliance, and supply chain efficiency.

Regulatory Compliance

International Standards & Certifications

LED ARM products must comply with international safety, performance, and electromagnetic compatibility (EMC) standards. Key certifications include:

– IEC 62471: Photobiological safety of lamps and lamp systems.

– IEC 60598: Luminaires – safety requirements.

– IEC 61347: Lamp controlgear standards (if applicable).

– CE Marking: Required for sale in the European Economic Area (EEA), indicating conformity with health, safety, and environmental protection standards.

– UKCA Marking: Required for sale in the United Kingdom post-Brexit.

– FCC Part 18: Electromagnetic interference regulations for digital devices in the U.S.

– RoHS Compliance: Restriction of Hazardous Substances Directive (EU), limiting lead, mercury, cadmium, and other substances.

– REACH: Registration, Evaluation, Authorisation and Restriction of Chemicals (EU).

Energy Efficiency & Environmental Regulations

- Energy Star (U.S.): Voluntary program certifying energy-efficient lighting.

- ERP Directive (EU): Ecodesign requirements for energy-related products, including minimum efficiency and labeling.

- Labeling Requirements: Products must include energy labels (e.g., EU Energy Label from A to G).

- WEEE Directive (EU): Waste Electrical and Electronic Equipment – mandates take-back and recycling programs.

Country-Specific Requirements

- USA: Requires FCC, ENERGY STAR (if claimed), and compliance with Title 20 (California) for certain lighting products.

- Canada: Needs CSA/UL certification and compliance with NRCan energy regulations.

- China: Requires CCC (China Compulsory Certification) for certain lighting products.

- Australia/New Zealand: Must meet AS/NZS standards and obtain RCM (Regulatory Compliance Mark).

- India: BIS (Bureau of Indian Standards) certification may be required.

Packaging & Labeling

Packaging Requirements

- Use anti-static, shock-resistant packaging for sensitive electronic components.

- Clearly label packages with handling symbols (e.g., fragile, do not stack, protect from moisture).

- Include product identifiers: model number, batch/lot number, manufacturing date.

Labeling Requirements

- Include compliance marks (e.g., CE, FCC, RoHS).

- Provide technical specifications: input voltage, power consumption (W), color temperature (K), luminous flux (lm).

- Include warnings: “Do not dispose of with household waste,” “For indoor use only,” or “Avoid direct eye exposure.”

- Multilingual labeling may be required in certain regions (e.g., EU, Canada).

Shipping & Transportation

Incoterms

Clearly define responsibilities using appropriate Incoterms (e.g., EXW, FOB, CIF, DDP) to allocate costs and risks between buyer and seller.

Mode of Transport

- Air Freight: Suitable for urgent or high-value shipments. Requires compliance with IATA regulations, especially for lithium batteries (if included).

- Sea Freight: Cost-effective for large volumes. Requires proper containerization and documentation.

- Ground Transport: Used for regional distribution; must comply with local road safety and load regulations.

Hazardous Materials

If the LED ARM contains batteries (e.g., backup or smart controls), determine if they are classified under UN 3480 (lithium-ion) or UN 3090 (lithium metal). Proper UN marking, packaging, and shipping documentation (e.g., MSDS, Shipper’s Declaration) are required.

Customs & Documentation

Required Documents

- Commercial Invoice

- Packing List

- Bill of Lading (B/L) or Air Waybill (AWB)

- Certificate of Origin

- Compliance Certificates (e.g., CE, FCC, RoHS, ISO)

- Import/Export Licenses (if applicable)

HS Code Classification

Use the correct Harmonized System (HS) code for LED lighting. Common codes include:

– 8539.50: Light-emitting diodes (LEDs).

– 9405.40: Electric filament or discharge lamps, including LED lamps.

Accurate classification affects tariffs, duties, and regulatory scrutiny.

Duty & Tax Considerations

- Evaluate duty rates based on destination country and preferential trade agreements (e.g., USMCA, EU FTAs).

- Consider VAT, GST, or sales tax obligations upon import.

- Use bonded warehouses or temporary admission procedures where applicable to defer duties.

Quality Assurance & Traceability

Incoming Inspection

Conduct quality checks upon receipt of goods to verify compliance with specifications and detect shipping damage.

Batch Traceability

Maintain records linking product batches to manufacturing dates, components, and compliance testing to support recalls or audits.

Non-Conformance Handling

Establish a process for managing non-compliant shipments, including rework, return, or destruction, in line with local regulations.

End-of-Life & Sustainability

Recycling & Disposal

- Comply with WEEE, battery recycling laws, and local e-waste regulations.

- Partner with certified recyclers and provide consumer take-back information.

- Design for disassembly and recyclability to support circular economy principles.

Carbon Footprint & Sustainability Reporting

Track emissions across the supply chain and consider environmental product declarations (EPDs) for corporate sustainability reporting.

Conclusion

Successfully managing the logistics and compliance of LED ARM products requires proactive planning, adherence to international and local regulations, and clear communication across the supply chain. Regular audits, staff training, and engagement with certified testing laboratories are recommended to maintain compliance and operational efficiency.

Conclusion for Sourcing LED Arm Lights

After a comprehensive evaluation of potential suppliers, cost structures, product quality, lead times, and compliance standards, sourcing LED arm lights—whether for architectural, industrial, or decorative applications—proves to be both cost-effective and strategically advantageous. By partnering with reliable manufacturers, particularly in regions known for LED production such as China, Southeast Asia, or Eastern Europe, companies can achieve significant savings without compromising on quality.

Key success factors include selecting suppliers with proven certifications (e.g., CE, RoHS, UL), strong R&D capabilities, and the ability to customize designs to meet specific project requirements. Additionally, considering total landed costs—including shipping, customs, and potential tariffs—ensures accurate financial forecasting. Strategic long-term contracts and supplier diversification can further mitigate risks related to supply chain disruptions.

In conclusion, sourcing LED arm lights offers a sustainable, energy-efficient lighting solution with a strong return on investment. With the right supplier selection and supply chain management, businesses can enhance lighting performance, reduce energy consumption, and support environmental goals while maintaining competitive pricing and reliable delivery timelines.