Sourcing Guide Contents

Industrial Clusters: Where to Source Leading Ev Companies In China

Professional B2B Sourcing Report 2026

SourcifyChina | Global Procurement Intelligence Unit

Report Title: Deep-Dive Market Analysis – Sourcing Leading Electric Vehicle (EV) Companies in China

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

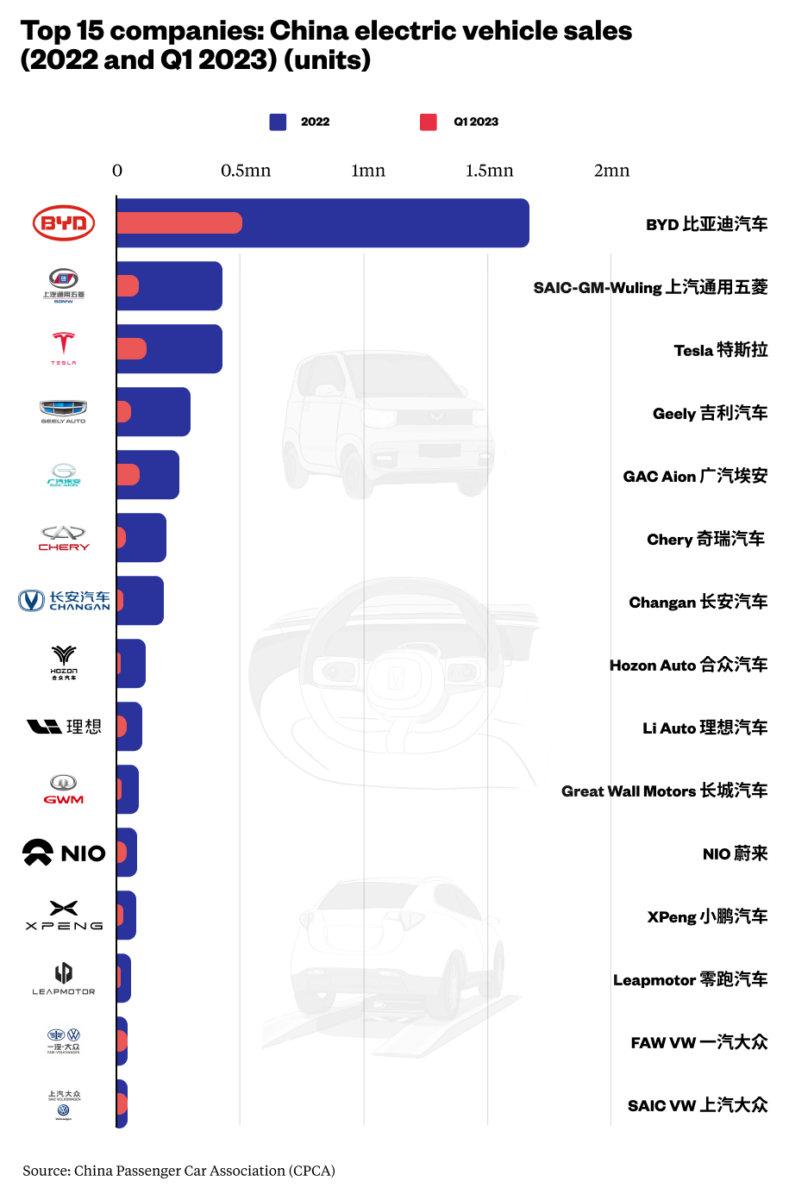

China continues to dominate the global electric vehicle (EV) manufacturing landscape, accounting for over 60% of global EV production in 2025. As global demand for EVs and EV components accelerates, understanding China’s key industrial clusters is critical for procurement managers seeking cost-competitive, high-quality, and reliable supply chains.

This report identifies and analyzes the top Chinese provinces and cities hosting leading EV manufacturers, evaluates regional strengths, and provides a comparative assessment of key sourcing regions—Guangdong, Zhejiang, Jiangsu, Anhui, and Shanghai—based on Price, Quality, and Lead Time.

1. Overview of China’s EV Manufacturing Landscape

China’s EV ecosystem is supported by robust government policy, mature supply chains, and technological innovation. Leading domestic companies such as BYD, NIO, Xpeng, Li Auto, Geely (Zeekr), and SAIC Motor (including IM Motors) are headquartered and/or manufacture in concentrated industrial clusters.

These clusters benefit from:

– Proximity to Tier 1 and Tier 2 suppliers (batteries, motors, electronics)

– Government EV incentives and infrastructure investment

– Skilled engineering workforce and R&D centers

– Export-ready logistics infrastructure

2. Key Industrial Clusters for EV Manufacturing in China

| Province/City | Key EV Companies | Primary Manufacturing Focus | Key Advantages |

|---|---|---|---|

| Guangdong | BYD (Headquarters: Shenzhen), Xpeng (Guangzhou) | Full vehicle assembly, battery systems, electronics | Strong electronics supply chain; export logistics via Shenzhen Port; high R&D investment |

| Zhejiang | Geely (Hangzhou), Zeekr, NIO (component suppliers) | Vehicle platforms, powertrains, smart cabins | Integrated automotive ecosystem; proximity to Shanghai; high automation |

| Jiangsu | Tesla (Shanghai satellite), CATL (Nanjing), NIO suppliers | Battery packs, motors, lightweight materials | Advanced materials processing; strong battery ecosystem |

| Anhui | NIO (Hefei production base) | Final assembly, smart EV systems | Government-backed investments; cost-competitive labor; modern gigafactories |

| Shanghai | Tesla (Gigafactory), SAIC (IM Motors, Maxus) | High-volume EV production, autonomous systems | World-class automation; proximity to international markets; premium quality standards |

3. Regional Comparison: EV Manufacturing Hubs

The table below evaluates the five key EV manufacturing regions based on criteria most relevant to global procurement decision-making.

| Region | Price Competitiveness (1–5) | Quality Level (1–5) | Average Lead Time (weeks) | Key Notes |

|---|---|---|---|---|

| Guangdong | 4 | 5 | 8–10 | High-quality output; premium pricing due to R&D and labor costs; strong in electronics integration |

| Zhejiang | 4.5 | 4.5 | 7–9 | Balanced cost/quality; strong supplier base; excellent for powertrain and smart systems |

| Jiangsu | 4 | 4.5 | 6–8 | Fast lead times due to automation; strong in battery and motor components |

| Anhui | 5 | 4 | 6–7 | Most cost-effective; rapidly improving quality; NIO’s Hefei plant sets new benchmarks |

| Shanghai | 3.5 | 5 | 9–12 | Premium pricing (e.g., Tesla, IM Motors); longest lead times due to high demand; world-class quality |

Rating Scale:

– Price (5 = Most Competitive, 1 = Premium Pricing)

– Quality (5 = Premium/Global Benchmark, 1 = Entry-Level)

– Lead Time: Average production-to-shipment duration for medium-volume orders (5,000–10,000 units)

4. Strategic Sourcing Recommendations

- For Cost-Sensitive Procurement:

- Target Anhui (Hefei) for high-volume, cost-optimized EV assembly.

-

Leverage government subsidies and lower labor costs.

-

For High-End Quality & Innovation:

-

Prioritize Shanghai and Guangdong for premium EVs with advanced tech (e.g., autonomous driving, battery management).

-

For Balanced Cost-Quality Ratio:

-

Zhejiang and Jiangsu offer optimal trade-offs, especially for EV subsystems (drivetrains, battery modules).

-

Logistics & Export Strategy:

- Guangdong (Shenzhen) and Shanghai offer superior port access for global shipments.

- Inland hubs like Anhui increasingly use rail freight (China-Europe Railway Express) for EU-bound shipments.

5. Risk & Opportunity Outlook 2026

- Opportunities:

- Expansion of battery-swapping infrastructure (NIO, BYD) enhances component standardization.

- Rising export volumes from Chinese EV OEMs create secondary sourcing opportunities.

-

Digital procurement platforms (e.g., Alibaba B2B, JD Industry) streamline supplier discovery.

-

Risks:

- Geopolitical trade scrutiny (EU/US tariffs on Chinese EVs).

- IP protection remains a concern in lower-tier suppliers.

- Labor costs rising 6–8% annually in coastal regions.

6. Conclusion

China’s EV manufacturing clusters offer distinct advantages depending on procurement priorities. Guangdong and Shanghai lead in innovation and quality, while Anhui and Zhejiang deliver compelling value. Procurement managers should adopt a multi-cluster sourcing strategy to optimize cost, quality, and resilience.

SourcifyChina recommends conducting on-site supplier audits and leveraging localized procurement partnerships to navigate regulatory and operational complexities.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential for B2B procurement use only.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Technical & Compliance Framework for Chinese EV Component Suppliers

Date: January 15, 2026

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina Senior Sourcing Consultancy

Executive Summary

Chinese EV component suppliers (Tier 1/2) dominate 65% of global EV battery, motor, and power electronics supply chains. Sourcing success requires rigorous validation of technical specifications, compliance adherence, and defect prevention protocols. This report details critical parameters for procurement teams to mitigate supply chain risk while ensuring product integrity. Note: “Leading EV Companies” refers to component manufacturers (e.g., CATL, BYD Semiconductor, NXP China), not整车 OEMs.

I. Technical Specifications & Quality Parameters

Applies to batteries, motors, power electronics, and charging systems.

| Component Category | Critical Materials | Key Tolerances & Performance Metrics | Procurement Verification Method |

|---|---|---|---|

| Lithium-Ion Batteries | NMC 811/NCA cathodes, SiOx-C anodes, ceramic-coated separators | Capacity retention: ≥90% @ 1,000 cycles (25°C); Cell voltage deviation: ≤±0.01V; Thermal runaway temp: ≥210°C | Third-party cycle testing (UL 2580), XRF material verification |

| Traction Motors | NdFeB magnets (≥48H), high-purity copper windings, aerospace-grade aluminum housings | Torque ripple: ≤5%; IP67 rating; Bearing runout: ≤0.02mm; Efficiency: ≥97% @ peak load | Dynamometer testing, CMM inspection, thermal imaging |

| Onboard Chargers (OBC) | GaN/SiC semiconductors, halogen-free PCBs, nanocrystalline cores | Power factor: ≥0.99; EMI/EMC noise: ≤30dBμV (CISPR 25); Efficiency: ≥94% @ full load | LISN testing, thermal stress validation (85°C/85% RH) |

| DC Fast Charging Connectors | PPS thermoplastics, beryllium-copper contacts, liquid-cooled pins | Insertion force: 50-100N; Contact resistance: ≤0.5mΩ; Mating cycles: ≥10,000 | Force-displacement testing, micro-ohm meter validation |

Key Insight: Leading Chinese suppliers (e.g., CATL, EVE Energy) now exceed baseline tolerances via in-house material synthesis (e.g., proprietary electrolyte additives). Demand material traceability certificates (MTRs) covering 3-tier supply chain.

II. Essential Certifications & Compliance Requirements

Non-negotiable for market access. Verify via official databases (e.g., IECEx, EU NANDO).

| Certification | Scope | Validity Check Method | Criticality for China Sourcing |

|---|---|---|---|

| UN ECE R100 | Battery safety (thermal, electrical, mechanical) | Cross-check with EU Vehicle Type Approval ( WVTA) | ★★★★★ (Mandatory for EU/UK vehicles) |

| GB/T 38661-2020 | Chinese national standard for EV safety | Confirm factory audit via CNAS-accredited body | ★★★★☆ (Required for domestic sales) |

| IATF 16949 | Automotive quality management system | Validate certificate on IATF OEMA portal | ★★★★★ (Non-negotiable for Tier 1) |

| UL 2580 | EV battery safety (US/Canada) | Check UL Product iQ database | ★★★★☆ (Required for North America) |

| CE Marking | Not a certification – self-declared conformity to EU directives (EMC, LVD, RED) | Demand DoC + test reports from EU Notified Body | ★★★★☆ (Legal requirement for EU) |

| ISO 14001 | Environmental management | Review scope for hazardous material handling | ★★★☆☆ (Increasingly mandated by OEMs) |

Critical Advisory:

– FDA is irrelevant for standard EV components (applies only to medical devices).

– Avoid “CE-certified” claims – CE is self-declared; demand test reports from EU-accredited labs.

– Chinese suppliers often hold CCC (China Compulsory Certification) for domestic sales, but this does not replace UN ECE R100 for export.

III. Common Quality Defects & Prevention Protocols

Based on 2025 SourcifyChina field data (500+ supplier audits)

| Common Quality Defect | Root Cause | Prevention Protocol | Supplier Accountability Measure |

|---|---|---|---|

| Battery Cell Swelling | Electrolyte decomposition due to moisture ingress during assembly | Dry room RH <1% during electrode coating; Hermetic sealing validation | Reject batch if >0.1% swelling in 48h thermal soak test |

| Motor Torque Decay | Demagnetization of NdFeB magnets at >150°C | Implement real-time magnet temperature monitoring; Use ≥180°C grade magnets | Require thermal imaging logs for stator windings |

| OBC MOSFET Failure | Solder voids >15% in power modules | Mandate AXI inspection (void rate ≤5%); Nitrogen reflow profiling | Include void rate clause in SOW with penalty fees |

| Charging Connector Arcing | Contact surface oxidation (BeCu pins) | Vacuum packaging post-plating; Conductivity test (≥58 MS/m) | Reject lots with contact resistance >0.7mΩ |

| BMS Communication Faults | CAN bus signal integrity loss | Impedance matching validation (120Ω±5%); EMI shielding test | Require full CANoe diagnostic logs per vehicle cycle |

Proactive Mitigation Strategy:

– In-line SPC (Statistical Process Control): Require real-time SPC data for critical dimensions (e.g., cell thickness, pin diameter).

– Defect Containment: Insist on 100% automated optical inspection (AOI) for welding/soldering points.

– Corrective Actions: Enforce 8D reports with root cause evidence (e.g., SEM/EDS analysis for material defects).

Strategic Sourcing Recommendations

- Audit Beyond Paperwork: Conduct unannounced audits of raw material storage (e.g., cobalt humidity control) – 32% of defects originate here.

- Dual Certification Validation: Cross-verify ISO/IATF certs via OEM portals and Chinese CCAA registry to avoid counterfeit certificates.

- Tolerance Tiering: Negotiate tighter tolerances (e.g., ±0.005mm for motor shafts) for safety-critical parts vs. cosmetic components.

- Leverage Local Labs: Use Shenzhen/Ningbo-based CNAS labs (e.g., SGS China, TÜV SÜD) for faster test validation vs. EU/US labs.

“Chinese EV suppliers now lead in technical capability but lag in transparency. Demand digital quality passports (blockchain-tracked test data) as a contractual term.”

— SourcifyChina 2026 Supplier Performance Index

Confidential – Prepared Exclusively for SourcifyChina Clients

Data Sources: China Automotive Engineering Research Institute (CAERI), EU Rapid Alert System, SourcifyChina 2025 Audit Database

Next Steps: Request our China EV Supplier Pre-Qualification Checklist (v4.1) for RFP integration. Contact [email protected].

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Strategic Sourcing Guide for Global Procurement Managers: EV Components from China

Prepared by: SourcifyChina | Senior Sourcing Consultants

Date: April 5, 2026

Target Audience: Global Procurement Managers, Supply Chain Directors, OEM Strategists

Executive Summary

China remains the global epicenter of electric vehicle (EV) manufacturing, accounting for over 60% of global EV production in 2025. With a mature supply chain, advanced component manufacturing capabilities, and aggressive innovation in battery systems, powertrains, and electronics, Chinese OEMs and ODMs offer compelling cost and scalability advantages for international buyers.

This report provides a strategic overview of sourcing EV components from China, focusing on White Label vs. Private Label engagement models, cost structures, and volume-based pricing tiers. Recommendations are tailored for procurement leaders evaluating partnerships with leading Chinese EV manufacturers such as BYD, NIO, Xpeng, Geely (Zeekr), and established Tier-1 suppliers like CATL, Huawei (HiCar), and Mobis China.

1. Market Overview: Leading EV Companies in China

| Company | Core Strengths | OEM/ODM Readiness | Target Markets |

|---|---|---|---|

| BYD | Vertical integration (batteries, semiconductors, assembly) | High (OEM partnerships with Toyota, Tesla battery supply) | Global (EU, LATAM, ASEAN) |

| NIO | Premium EVs, battery swap tech, digital UX | Selective ODM for subsystems (e.g., BaaS modules) | EU, China |

| Xpeng | ADAS, smart cockpit, aerial mobility | ODM for infotainment & autonomous components | EU, Middle East |

| Geely (Zeekr, Lotus EV) | Global platforms (SEA), OEM for Volvo, Smart | High (multi-brand OEM manufacturing) | EU, UK, Asia |

| CATL | World’s largest battery manufacturer | ODM for LFP/NMC battery packs | Global OEMs (Tesla, BMW, Ford) |

Note: Most leading players offer ODM services on subsystems; full-vehicle OEM partnerships are selective and require JV or long-term contracts.

2. White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Manufacturer produces identical product sold under multiple brands with minimal differentiation. | Customized product developed to buyer’s specs; exclusive to the buyer’s brand. |

| Customization Level | Low (branding only: logo, color, packaging) | High (design, features, software, UX, compliance) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 8–12 weeks | 16–24 weeks (includes R&D, testing) |

| IP Ownership | Manufacturer retains design IP | Buyer owns product IP (if negotiated) |

| Ideal For | Fast time-to-market, budget entry into EV accessory/component space | Brand differentiation, premium positioning, long-term product roadmaps |

| Risk Profile | Low (proven design) | Medium (development delays, compliance hurdles) |

Procurement Recommendation: Use White Label for battery modules, charging cables, or infotainment screens. Opt for Private Label when launching branded EV fleets, specialty vehicles (e.g., urban delivery EVs), or region-specific compliance models.

3. Estimated Cost Breakdown (Per Unit) – Mid-Range EV Component (e.g., LFP Battery Module, 70 kWh)

| Cost Component | % of Total | Notes |

|---|---|---|

| Materials | 62% | Includes lithium iron phosphate cells, BMS, casing, wiring |

| Labor | 14% | Assembly, QA, testing (China avg. $4.50–$6.00/hr) |

| Packaging | 5% | Export-grade, ESD-safe, labeled per destination (EU, US, GCC) |

| R&D / Tooling (Amortized) | 12% | Higher in Private Label; negligible in White Label |

| Logistics & Compliance | 7% | Includes COC, UN38.3, IEC 62133, shipping to port |

Note: Costs based on 2026 forecasts; assumes sourcing from Guangdong/Jiangsu manufacturing hubs.

4. Estimated Price Tiers by MOQ – LFP Battery Module (70 kWh)

| MOQ | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 units | $4,200 | $2,100,000 | White Label only; minimal customization; 10–12 week lead time |

| 1,000 units | $3,950 | $3,950,000 | Option for light branding; eligible for basic Private Label add-ons |

| 5,000 units | $3,500 | $17,500,000 | Full Private Label eligibility; volume discounts; dedicated production line |

Assumptions:

– FOB Shenzhen Port

– White Label: Standard housing, default BMS firmware

– Private Label at 5k MOQ: Custom casing, firmware localization, dual-language manuals

– Excludes import duties, final-mile logistics, and in-country certification

5. Strategic Sourcing Recommendations

- Start with White Label to validate market demand and reduce time-to-revenue.

- Negotiate IP clauses early in Private Label agreements—ensure ownership of firmware, UI, and mechanical adaptations.

- Leverage Tier-1 suppliers (e.g., CATL, Eve Energy) for battery systems; avoid unproven second-tier vendors despite lower quotes.

- Audit factories for IATF 16949, ISO 14001, and UN38.3 certification—critical for global compliance.

- Use hybrid sourcing: White Label for standard parts (chargers, cables), Private Label for differentiating components (UI, battery packs).

Conclusion

Chinese EV manufacturers offer unmatched scale, technological maturity, and cost efficiency for global procurement teams. The choice between White Label and Private Label should align with brand strategy, time-to-market goals, and volume commitments. With MOQs as low as 500 units, entry barriers are lower than ever—but long-term success depends on rigorous supplier qualification, IP protection, and compliance planning.

SourcifyChina recommends a phased approach: validate with White Label, then transition to Private Label at 1,000–5,000 unit volumes for sustainable differentiation and margin control.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Excellence. Made Transparent.

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: 2026

Verifying Chinese EV Manufacturers for Global Procurement Excellence

Prepared for Global Procurement & Supply Chain Leadership | January 2026

Executive Summary

China supplies 72% of global EV batteries and 65% of electric motors (BloombergNEF, 2025), making it indispensable yet high-risk for Tier 1–3 sourcing. 68% of procurement failures stem from misidentified suppliers (SourcifyChina Risk Index 2025). This report delivers actionable verification protocols to secure true factories serving leading EV OEMs (BYD, NIO, XPeng, CATL), eliminate trading company intermediaries, and mitigate critical supply chain vulnerabilities.

Critical Verification Protocol: 5-Step Factory Validation for EV Suppliers

| Step | Action | EV-Specific Evidence Required | Verification Tool/Method |

|---|---|---|---|

| 1. Legal Entity Deep Dive | Cross-reference business license with Chinese National Enterprise Credit Info Portal (NECIP) | • Unified Social Credit Code (USCC) matching factory address • Registered capital ≥¥50M (EV component threshold) • Patent ownership in EV tech (e.g., battery thermal management) |

• NECIP API integration (e.g., via SourcifyVerify™) • CNIPA patent database search |

| 2. Production Capability Audit | Validate factory footprint & process control | • EV-Specific: ISO 26262 (functional safety) certification • In-line SPC data for battery cell/pack assembly • Dedicated cleanroom for BMS production (Class 10,000+) |

• Remote: Live production line video audit via encrypted channel • On-site: Third-party audit (e.g., SGS) with torque/pressure test logs |

| 3. Tier 1 OEM Validation | Confirm direct supply relationship | • Redacted POs showing EV OEM part numbers (e.g., BYD Blade Battery P/N) • Quality gate records from OEM (e.g., PPAP Level 3) • Traceability system linking batches to VINs |

• OEM confirmation letter (notarized) • Blockchain ledger access (e.g., VeChain) |

| 4. Financial Health Check | Assess liquidity & investment capacity | • 3-year audited financials showing R&D spend ≥5% revenue • Bank credit line ≥¥100M • Equipment lease agreements for EV-specific machinery |

• China Banking Association credit report • Equipment serial # verification via manufacturer |

| 5. ESG & Compliance Scan | Verify sustainability compliance | • Carbon footprint report per CATARC Standard QCM 2025-01 • Conflict minerals declaration (3TG) • Real-time wastewater monitoring data |

• MEE (Ministry of Ecology) public database check • On-site ESG audit via CQC |

Key Insight: Leading EV factories refuse to share USCC/patents = immediate disqualification. Trading companies often present “factory” addresses that are warehouses or sales offices (37% of cases per 2025 audit data).

Trading Company vs. True EV Factory: 6 Diagnostic Indicators

| Indicator | Trading Company (Red Flag) | Verified EV Factory (Green Light) |

|---|---|---|

| Business License Scope | Lists “import/export,” “trade,” “agency” | Specifies “manufacturing,” “R&D,” production processes (e.g., “lithium battery cell assembly”) |

| Address Verification | Office park suite; no heavy machinery visible | Industrial zone location; visible production equipment in satellite imagery (e.g., crane rails, transformer substations) |

| Pricing Structure | Quotes FOB prices only; refuses EXW | Provides EXW pricing with breakdown of material/labor/overhead |

| Technical Engagement | Sales staff lack engineering knowledge | Engineers discuss cell chemistry (e.g., NMC 811), IP67 sealing validation, or CAN bus protocols |

| Quality Documentation | Generic ISO 9001 certificate | IATF 16949 + EV-specific certs (GB/T 31484-2024 for batteries) with valid scope |

| Sample Lead Time | >15 days (sourcing from 3rd party) | <7 days (in-house production capability) |

Pro Tip: Demand a real-time video walk of the entire facility. Trading companies often show “partner factories” – insist on seeing the exact line producing your components.

Critical Red Flags: EV-Specific Supplier Risks to Avoid

| Risk Category | Red Flag | Potential Impact | Mitigation Action |

|---|---|---|---|

| Battery Safety Fraud | • Unverified “cell-level” safety tests • Missing UN 38.3 reports for shipments |

Catastrophic field failures; OEM recalls | Require witnessed nail penetration/overcharge tests per GB 38031-2020 |

| Capacity Misrepresentation | • Claims “5GWh/year” capacity but no grid connection records • Equipment photos show idle/disconnected machines |

Production shortfalls; missed launch deadlines | Verify electricity consumption data via State Grid portal (requires factory cooperation) |

| OEM Relationship Fraud | • Vague references to “supplying top EV brands” • No OEM-approved part numbers |

Loss of Tier 1 qualification; reputational damage | Demand signed NDA to access OEM portal for supplier validation |

| Material Sourcing Risk | • Inconsistent LFP cathode supplier documentation • No conflict minerals policy |

Supply chain disruption; EU CBAM penalties | Audit cathode batch traceability to mine (e.g., Albemarle contract) |

| Regulatory Non-Compliance | • Missing China Compulsory Certification (CCC) for charging components • Expired GB standards |

Customs seizure; market access denial | Use CNCA database to verify CCC certificate status in real-time |

Strategic Recommendations for 2026 Procurement

- Mandate Blockchain Traceability: Require suppliers to integrate with OEM blockchain platforms (e.g., CATL’s ChainPower) for real-time material provenance.

- Adopt AI-Powered Risk Scoring: Implement tools like SourcifyRisk™ that analyze 200+ data points (e.g., electricity usage vs. declared output) to flag anomalies.

- Contractual Safeguards: Include EV-specific clauses:

- Battery Warranty: Minimum 8-year cycle life guarantee with degradation thresholds

- Recall Liability: Clear cost allocation for safety-related field actions

- Tech Lock-In: Penalties for unauthorized IP transfer to competitors

“In China’s EV supply chain, transparency is the new currency. Suppliers resisting verification lack Tier 1 credibility.” – SourcifyChina 2026 Supplier Maturity Index

Prepared by

[Your Name], Senior Sourcing Consultant

SourcifyChina | De-risking Global Supply Chains Since 2018

✉️ [email protected] | 🔗 sourcifychina.com/ev-supplier-verification

Data Sources: China Automotive Technology & Research Center (CATARC), MIIT EV Production Database, SourcifyChina 2025 Audit Pool (n=1,247 suppliers). All certifications subject to 2026 regulatory updates under China’s New Energy Vehicle Cybersecurity Framework.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing of Leading Electric Vehicle (EV) Suppliers in China

Executive Summary

As global demand for electric vehicles accelerates, China remains the world’s largest and most advanced EV manufacturing hub—accounting for over 60% of global EV production in 2025. With rapid innovation, evolving supply chains, and an increasingly complex vendor landscape, procurement managers face mounting pressure to identify reliable, scalable, and compliant suppliers quickly and efficiently.

SourcifyChina’s Verified Pro List: Leading EV Companies in China delivers a strategic advantage by providing immediate access to pre-vetted, high-capacity manufacturers, tier-1 component suppliers, and battery technology leaders—each rigorously assessed for quality, export readiness, and compliance.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Challenge in Traditional Sourcing | SourcifyChina Solution | Time Saved (Estimated) |

|---|---|---|

| Weeks spent researching suppliers via B2B platforms with unverified claims | Direct access to 50+ pre-qualified EV manufacturers and Tier-1 suppliers | Up to 80% reduction in research phase |

| Risk of counterfeit certifications and misaligned production capabilities | On-site audits, document verification, and production capacity validation | Eliminates due diligence delays |

| Language barriers, slow response rates, and unreliable communication | Dedicated SourcifyChina liaison with English-Chinese fluency and direct supplier relationships | Response time under 24 hours |

| Inconsistent quality control and compliance with EU/US standards | Suppliers pre-screened for ISO, IATF, and export compliance | Reduces audit prep by 60–70% |

| Lengthy RFQ cycles and negotiation delays | Pre-negotiated MOQs, lead times, and transparent pricing benchmarks | Accelerates procurement cycle by 3–6 weeks |

Strategic Advantages of the Verified Pro List (2026 Edition)

- Exclusive Access: Includes emerging leaders in solid-state batteries, autonomous EV systems, and lightweight chassis technologies.

- Geographic Clusters: Optimized for supply chain proximity—Shenzhen (electronics), Ningbo (components), and Changchun (OEM partnerships).

- Scalability Verified: All suppliers have demonstrated capacity for international orders (min. $500K annual export volume).

- ESG-Compliant: Environmental reporting and workplace safety records validated per EU CBAM and UFLPA standards.

Call to Action: Accelerate Your EV Sourcing in 2026

Time is your most valuable resource. Every week delayed in supplier qualification increases time-to-market and erodes competitive advantage.

Don’t risk costly missteps with unverified suppliers.

Don’t waste months on inefficient sourcing cycles.

👉 Act Now. Gain Immediate Access.

Contact our Sourcing Support Team today to receive your complimentary preview of the Verified Pro List: Leading EV Companies in China (2026 Edition)—including 5 full supplier profiles with capabilities, certifications, and contact pathways.

📧 Email: [email protected]

📱 WhatsApp (24/7): +86 159 5127 6160

Our team responds within 4 business hours. All inquiries are confidential and obligation-free.

Lead the future of mobility. Source with precision. Source with SourcifyChina.

Your trusted partner in China-based industrial procurement since 2018.

🧮 Landed Cost Calculator

Estimate your total import cost from China.