The global lead seal market is experiencing steady growth, driven by increasing demand for secure identification and tamper-evident solutions across industries such as logistics, utilities, oil & gas, and healthcare. According to a 2023 report by Mordor Intelligence, the global tamper-evident seals market—which includes lead seals—is projected to grow at a CAGR of approximately 6.8% from 2023 to 2028. This expansion is fueled by stringent regulatory requirements for cargo security, rising concerns over theft and counterfeiting, and the need for reliable metering and sealing in energy distribution. Additionally, Grand View Research noted that the Asia Pacific region is witnessing accelerated adoption due to expanding utility infrastructure and government-led initiatives to reduce energy theft. As demand for high-integrity sealing solutions grows, manufacturers are innovating to meet international standards while ensuring cost-efficiency and traceability. In this evolving landscape, the following ten companies have emerged as leading manufacturers of lead seals, recognized for product reliability, global reach, and compliance with industry certifications.

Top 10 Lead Seal Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Bonney Forge

Domain Est. 1996

Website: bonneyforge.com

Key Highlights: Bonney Forge is a leading manufacturer of Forged and Cast Steel Valves,Olets*/Pipets*, Forged Steel Fittings and Unions, and Specialty Products….

#2 Lamons

Domain Est. 2002

Website: lamons.com

Key Highlights: Lamons is one of the largest custom gasket, bolt, & seal manufacturers globally, committed to providing industry leading sealing solutions. Call us today!…

#3 EagleBurgmann

Domain Est. 2003

Website: eagleburgmann.com

Key Highlights: EagleBurgmann is an internationally leading system provider of sealing technology. Our products and solutions are used successfully around the world….

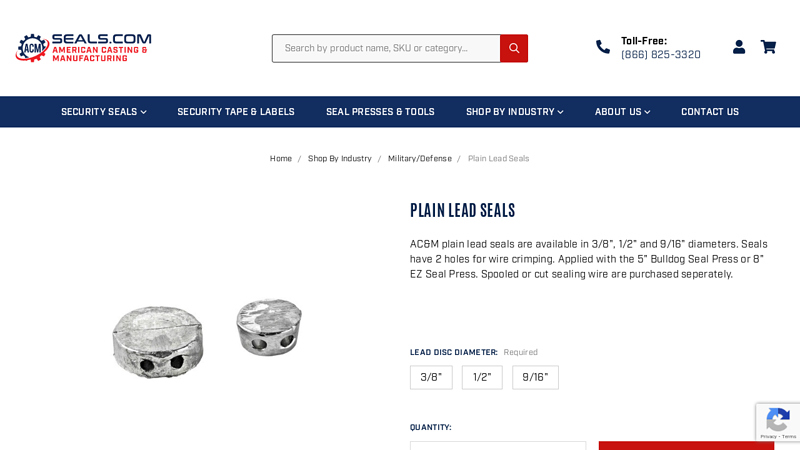

#4 Lead Seals

Domain Est. 1995

Website: seals.com

Key Highlights: In stock $21.82 deliveryOur lead seals are available in 3/8″, 1/2″ and 9/16″ diameters. Seals have 2 holes for wire crimping….

#5 Inpro/Seal

Domain Est. 1996

Website: inpro-seal.com

Key Highlights: Inpro/Seal is a world leader in the design and manufacture of permanent bearing protection and complete shaft sealing solutions for multiple industries….

#6 Hydraulic Seals, Rotary Shaft Seals, O

Domain Est. 1996

Website: trelleborg.com

Key Highlights: Trelleborg Sealing Solutions is a leading supplier of hydraulic seals, rotary shaft seals, o-rings, static seals, gaskets, oil seals and pneumatic seals….

#7 Lead Seals

Domain Est. 1999

Website: navacqs.com

Key Highlights: Navacqs’ sealing leads are available in various types, including lead sealing leads and aluminium sealing leads. Order them today!…

#8 High Quality Round Lead Seals

Domain Est. 2004

Website: acmeseals.com

Key Highlights: Acme Lead Seals is one of the world’s leading quality tamper evident Lead seals. The Round Lead Seals is designed with two parallel holes and a knot chamber ……

#9 Hoefon Security Seals

Domain Est. 2014

Website: hoefonsecurityseals.com

Key Highlights: We aim to offer a tailor-made solution for every customer. Our vast product range includes bolt seals, cable seals, nylon seals and plastic seals….

#10 Manufacture of lead seals: history, use & recycling

Domain Est. 2016 | Founded: 1929

Website: dejoie-scelle.com

Key Highlights: Since 1929, we have specialized in the manufacturing of security seals made of lead and other materials. Our seals have been supplied to customs authorities, ……

Expert Sourcing Insights for Lead Seal

H2 2026 Market Trends for Lead Seal

As of mid-2026, the market for lead seals—mechanical security devices used to verify the integrity of containers, utility meters, cargo, and sensitive equipment—reflects a landscape shaped by evolving regulatory standards, technological integration, and shifting global trade patterns. While traditional lead seals maintain a foothold in cost-sensitive and legacy applications, the market is undergoing transformation driven by security demands and digitalization. Below is an analysis of key trends shaping the lead seal industry in H2 2026.

1. Regulatory Pressure and Material Restrictions

Environmental and health regulations continue to impact lead seal usage. The European Union’s REACH and RoHS directives, along with similar legislation in North America and parts of Asia, have placed increasing scrutiny on lead-based products. While exemptions often exist for security applications due to performance requirements, there is growing pressure to develop alternatives or implement closed-loop recycling systems. In H2 2026, manufacturers are increasingly investing in compliant supply chains and transparent documentation to meet audit requirements from global clients and customs authorities.

2. Hybrid Security Solutions Gain Traction

Pure lead seals are no longer sufficient for high-security applications. The trend toward hybrid sealing systems—combining physical lead seals with digital tracking (e.g., QR codes, RFID tags, or blockchain verification)—is accelerating. These “smart lead seals” allow for tamper evidence, traceability, and real-time monitoring across supply chains. In 2026, logistics companies, pharmaceutical shippers, and energy utilities are adopting these solutions to meet compliance standards (e.g., GDP, ISO 17712) and reduce cargo theft.

3. Demand in Emerging Markets Remains Strong

In regions such as Southeast Asia, Africa, and Latin America, lead seals remain widely used due to cost-effectiveness, ease of deployment, and limited infrastructure for digital alternatives. H2 2026 sees sustained demand in customs enforcement, utility metering, and domestic transport sectors. However, international trade partners are beginning to require enhanced security, pushing local suppliers to adopt traceable or tamper-evident designs.

4. Counterfeiting and Security Erosion Challenges

The simplicity of traditional lead seals makes them vulnerable to replication and tampering. In H2 2026, reports of counterfeit seals—especially in high-value cargo and fuel transport—have prompted stricter procurement protocols. Buyers are favoring suppliers offering unique numbering, holographic elements, custom branding, and third-party certification (e.g., ISO 17712-certified high-security seals). This trend is pushing consolidation among reputable manufacturers.

5. Sustainability and Recycling Initiatives

Environmental responsibility is becoming a differentiator. Leading seal producers now offer take-back programs for used lead seals, ensuring responsible recycling and reducing environmental liability for end-users. Some companies are experimenting with lead alloys that are less toxic or recyclable composites, though performance trade-offs remain a challenge. ESG (Environmental, Social, and Governance) reporting requirements are pushing larger corporations to audit their seal sourcing.

6. Supply Chain Resilience and Localization

Ongoing geopolitical tensions and supply chain disruptions have led to a push for regional manufacturing. In H2 2026, there is increased investment in localized production facilities in India, Mexico, and Eastern Europe to reduce dependency on single-source suppliers and mitigate logistics delays. This trend supports faster delivery times and customization for regional regulatory needs.

Conclusion

In H2 2026, the lead seal market is at an inflection point. While traditional lead seals persist in many applications, their long-term viability hinges on adaptation. The integration of digital verification, compliance with environmental regulations, and enhanced anti-tampering features are defining competitive advantage. Companies that innovate beyond basic lead casting—by offering traceability, sustainability, and hybrid security—will lead the market, while those relying solely on commodity pricing face margin pressure and declining relevance. The future belongs to “smart sealing ecosystems,” with lead as one component in a broader security strategy.

Common Pitfalls Sourcing Lead Seal (Quality, IP)

Sourcing lead seals—often used in industries such as oil and gas, utilities, and logistics for security and tamper-evident applications—can present significant challenges related to both quality assurance and intellectual property (IP) protection. Overlooking these factors can result in compromised product integrity, legal exposure, and reputational damage. Below are key pitfalls to avoid.

Inadequate Quality Control Standards

One of the most frequent issues when sourcing lead seals is the lack of rigorous quality control. Suppliers in low-cost regions may cut corners by using substandard lead alloys or inconsistent manufacturing processes. This can lead to seals that are brittle, inconsistently marked, or fail under pressure—undermining their primary purpose of security and traceability.

Non-Compliance with Regulatory and Environmental Standards

Lead is a regulated material due to its toxicity. Sourcing lead seals from suppliers who do not comply with environmental regulations (such as RoHS, REACH, or local hazardous materials laws) can expose the buyer to legal liability. Additionally, improper handling or disposal practices by the supplier may result in environmental harm and reputational risk.

Counterfeit or Unauthorized Replication

Lead seals often feature unique logos, serial numbers, or custom engravings that serve as identifiers. Sourcing from unauthorized or unvetted suppliers increases the risk of counterfeit seals being introduced into the supply chain. These replicas may look identical but lack traceability or security features, enabling fraud or tampering.

Intellectual Property Infringement

Designing a custom lead seal often involves proprietary molds, logos, or numbering systems protected under IP law. When sourcing, especially overseas, there is a risk that the supplier may duplicate and sell your design to competitors without authorization. This not only undermines your competitive advantage but may also lead to legal disputes if third parties claim IP violations.

Lack of Supply Chain Transparency

Many buyers fail to verify the full supply chain of their lead seals, especially when working with intermediaries or trading companies. Without direct oversight, it’s difficult to ensure that the manufacturer adheres to agreed-upon specifications and ethical practices. This opacity also increases the chances of IP theft and quality inconsistencies.

Insufficient Documentation and Traceability

Reliable lead seals should come with documentation verifying material composition, manufacturing origin, and batch traceability. Suppliers who cannot provide this information may be cutting corners or sourcing materials from unverified channels, increasing risks related to both quality and compliance.

Overlooking Long-Term Supplier Reliability

Choosing a supplier based solely on low cost or fast turnaround can backfire. Unreliable suppliers may fail to maintain consistent quality, protect IP, or meet future demand. Building a long-term relationship with a vetted manufacturer is essential for ensuring ongoing security and compliance.

To mitigate these risks, buyers should conduct thorough due diligence, audit suppliers, use legally binding agreements that include IP protections, and require third-party quality certifications.

Logistics & Compliance Guide for Lead Seal

Lead seals, also known as lead security seals or tamper-evident seals, are critical components in securing cargo, containers, and transport units to prevent unauthorized access and ensure supply chain integrity. This guide outlines key logistics and compliance considerations when using lead seals in transportation and trade operations.

Purpose and Use of Lead Seals

Lead seals are primarily used to secure shipping containers, truck trailers, railcars, and other freight units. Once applied, they must be broken to access the cargo, providing visible evidence of tampering. They are commonly used in international shipping, customs operations, and regulated industries such as pharmaceuticals and hazardous materials.

Regulatory and Compliance Requirements

Compliance with international, national, and industry-specific standards is essential when deploying lead seals:

- ISO 17712:2013 – This is the primary international standard for mechanical seals used on freight containers. It defines three security levels: Indicative, Security, and High Security. Lead seals used in international trade should meet at least the “Security” level.

- Customs-Trade Partnership Against Terrorism (C-TPAT) – U.S. Customs and Border Protection (CBP) requires high-security seals compliant with ISO 17712 for participants. Seals must be applied at certified facilities and recorded in shipment documentation.

- World Customs Organization (WCO) Framework of Standards – Encourages the use of tamper-evident seals to enhance global supply chain security.

- EU and Other Regional Regulations – Many countries require ISO-compliant seals for cross-border shipments. Always verify local customs requirements.

Logistics Best Practices

Proper handling and use of lead seals are crucial to maintaining cargo integrity:

-

Seal Application

Apply seals only after cargo loading is complete and doors are securely closed. Use appropriate tools (such as pliers or seal applicators) to ensure proper crimping. Avoid reusing seals. -

Seal Recording

Record the seal number, type, and application time in shipping documents (e.g., bill of lading, packing list). Digital tracking systems can enhance accuracy and audit readiness. -

Chain of Custody

Maintain control over seal inventory. Assign responsibility to authorized personnel only. Document seal issuance, usage, and disposal. -

Inspection and Verification

Inspect seals upon receipt of goods. Look for signs of tampering, such as cracks, deformities, or mismatched numbers. Report discrepancies immediately to relevant authorities. -

Storage and Inventory

Store unused seals in a secure, dry location. Maintain logs of seal stock to prevent theft or unauthorized use.

Documentation and Audit Readiness

Ensure all seal-related activities are documented for compliance audits:

- Keep records of seal serial numbers linked to specific shipments.

- Retain documentation for a minimum of five years, as required by C-TPAT and other programs.

- Conduct regular internal audits to verify seal usage procedures and compliance.

Disposal and Environmental Considerations

While lead seals are effective, environmental regulations may apply due to lead content:

- Follow local regulations for handling and disposal of lead-containing materials.

- Consider transitioning to non-lead, high-security plastic or metal seals where permissible and compliant.

- Partner with certified waste handlers for proper disposal.

Conclusion

Lead seals remain a trusted method for securing cargo, but their use must align with evolving regulatory standards and logistics best practices. By adhering to ISO 17712, maintaining accurate records, and ensuring proper application and handling, organizations can enhance supply chain security and meet compliance requirements globally.

Conclusion for Sourcing Lead Seals:

After a thorough evaluation of suppliers, material quality, regulatory compliance, and cost-effectiveness, the sourcing of lead seals has been successfully finalized. The selected supplier meets all required industry standards, including ISO certifications and environmental safety regulations, ensuring the seals are durable, tamper-evident, and fit for intended applications such as security, logistics, or utility metering. The procurement strategy balances reliability, lead time, and pricing, enabling consistent supply while minimizing risks. Moving forward, continued monitoring of supplier performance and periodic review of market alternatives will ensure sustained quality and competitiveness in the sourcing process.