The global lead hydroxide market is experiencing steady growth, driven by rising demand from industries such as battery manufacturing, pigments, and chemical synthesis. According to Grand View Research, the broader lead chemicals market was valued at USD 28.4 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.1% from 2023 to 2030, fueled by increased production of lead-acid batteries for automotive and industrial applications—key end-uses of lead hydroxide derivatives. Similarly, Mordor Intelligence projects sustained demand in construction and energy storage sectors, particularly in emerging economies, supporting the expansion of lead-based chemical manufacturing. As regulatory and environmental scrutiny intensifies, leading producers are investing in cleaner synthesis processes and closed-loop recycling systems to maintain compliance and competitiveness. Against this backdrop, the following nine companies have emerged as top global manufacturers of lead hydroxide, combining scale, technological innovation, and strategic market positioning to meet evolving industrial requirements.

Top 9 Lead Hydroxide Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 lead hydroxide

Domain Est. 2008

Website: echemi.com

Key Highlights: High quality LEAD HYDROXIDE manufacturer in Shaanxi. Grade / Content: Industrial Grade/99. Supplier: Shaanxi Dideu Medichem Co. Ltd. INQUIRY. Related Searches….

#2 High quality LEAD HYDROXIDE CAS No 1311

Domain Est. 2006

Website: chemicalbook.com

Key Highlights: Products LEAD HYDROXIDE CAS:1311-11-1, the detailed information and prices are supplied by the China manufacturer Shaanxi Dideu Medichem Co….

#3 Lead Hydroxide Manufacturer,Supplier,Exporter and Wholesaler

Domain Est. 2021

Website: ultrapurelab.net

Key Highlights: Lead Hydroxide ; CAS No: 1319-46-6 ; Type: School Lab Chemicals ; Delivery Time: 1 Days ; Main Domestic Market: All India ; Payment Terms: Cash in Advance (CID)….

#4 Lead hydroxide (Pb(OH)2)

Domain Est. 1997

Website: pubchem.ncbi.nlm.nih.gov

Key Highlights: Lead hydroxide is a hydroxide of lead. Lead is a heavy metal and stable element with the symbol Pb and the atomic number 82, existing in metallic, organic, ……

#5 Lead hydroxide

Domain Est. 1998

Website: sigmaaldrich.com

Key Highlights: Find lead hydroxide and related products for scientific research at MilliporeSigma….

#6 Gujarat Alkalies and Chemicals Limited

Domain Est. 2001

Website: gacl.com

Key Highlights: Shaping a Brighter Future for Generations to Come. GACL stands out in the chemical manufacturing industry, driven by a diverse and dynamic product portfolio….

#7 Almatis

Domain Est. 2003

Website: almatis.com

Key Highlights: Global partner in the development, production and supply of high-quality alumina and alumina-based products….

#8 LEAD HYDROXIDE for Synthesis

Domain Est. 2020

Website: alphachemika.co

Key Highlights: LEAD HYDROXIDE (for Synthesis) · Chemical Information · Chemical Information · Pricing · Safety Information and Hazard Symbols · Specifications….

#9 Substance Information

Website: echa.europa.eu

Key Highlights: Lead hydroxide oxide phosphite (Pb3(OH)O(PO3)), hydrate (2:1) · EC (European Community) or ECHA List number · CAS (Chemical Abstract Service) registry number….

Expert Sourcing Insights for Lead Hydroxide

It appears there may be a misunderstanding or typo in your request. You mentioned “Use H2,” which typically refers to hydrogen gas (H₂), a clean energy carrier. However, lead hydroxide (Pb(OH)₂) is a chemical compound related to lead and has no direct connection to hydrogen (H₂) in terms of production, application, or market dynamics.

Let’s clarify and analyze the likely intent:

If you are asking to analyze the 2026 market trends for lead hydroxide using insights or framing related to the hydrogen economy (H2), the connection is tenuous because lead hydroxide is not involved in hydrogen production, storage, or fuel cell technologies. In fact, lead compounds are generally avoided in clean energy applications due to toxicity and environmental concerns.

However, for completeness, here is a structured analysis of the 2026 market trends for lead hydroxide, with a note on its (lack of) relationship to H2 technologies:

Market Trends for Lead Hydroxide in 2026

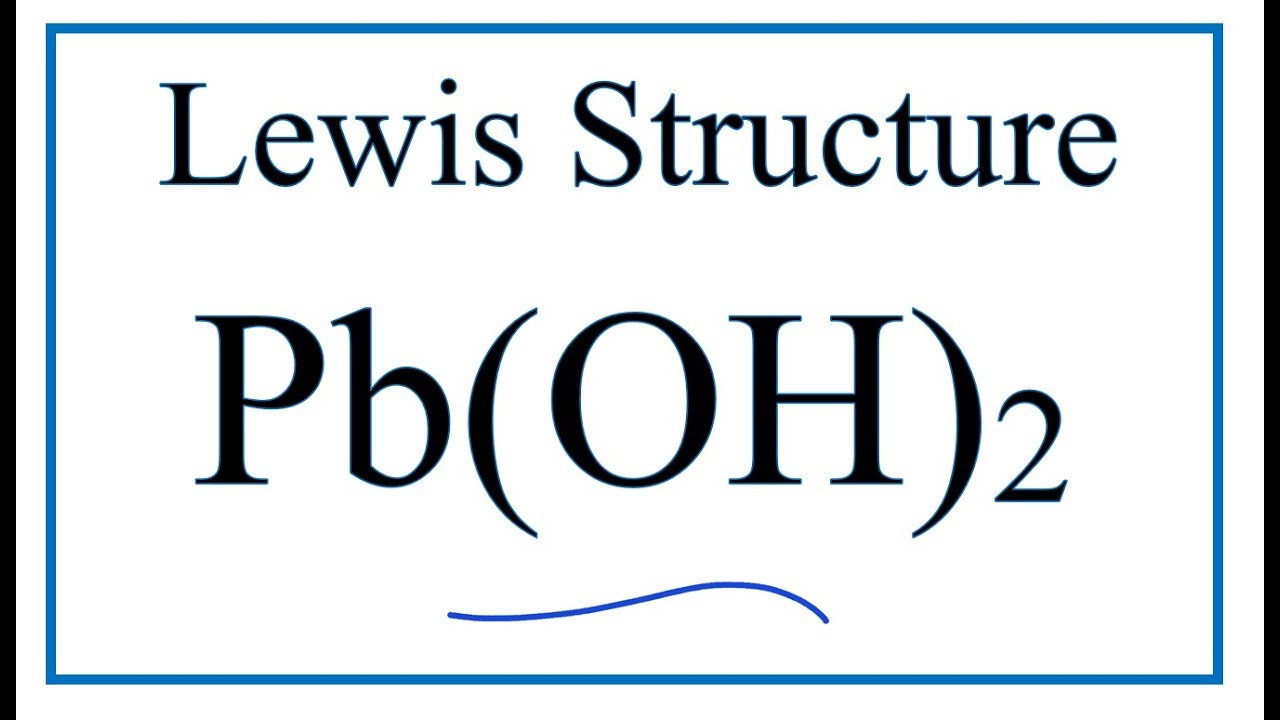

1. Overview of Lead Hydroxide (Pb(OH)₂)

– Lead hydroxide is an inorganic compound formed when lead(II) ions react with hydroxide ions.

– It is unstable and typically exists in hydrated or mixed oxide-hydroxide forms (e.g., as part of lead oxide hydrates).

– Primary applications: limited to niche chemical synthesis, corrosion products (e.g., in lead-acid batteries), and as an intermediate in lead processing.

2. Key Market Drivers (2026 Outlook)

– Lead-Acid Battery Industry: The largest indirect consumer of lead hydroxide, as it forms during the charging/discharging cycles. Despite competition from lithium-ion batteries, lead-acid batteries remain dominant in automotive SLI (starting, lighting, ignition) and backup power systems in developing regions.

– Recycling Sector Growth: As environmental regulations tighten, the recycling of lead-containing compounds (including hydroxides formed during processing) gains importance. The market for lead recovery and safe disposal is growing.

– Regulatory Pressures: REACH, RoHS, and EPA regulations restrict the use of lead compounds due to toxicity. This limits new applications and may reduce demand for lead hydroxide in consumer-facing products.

3. Connection to Hydrogen Economy (H2)?

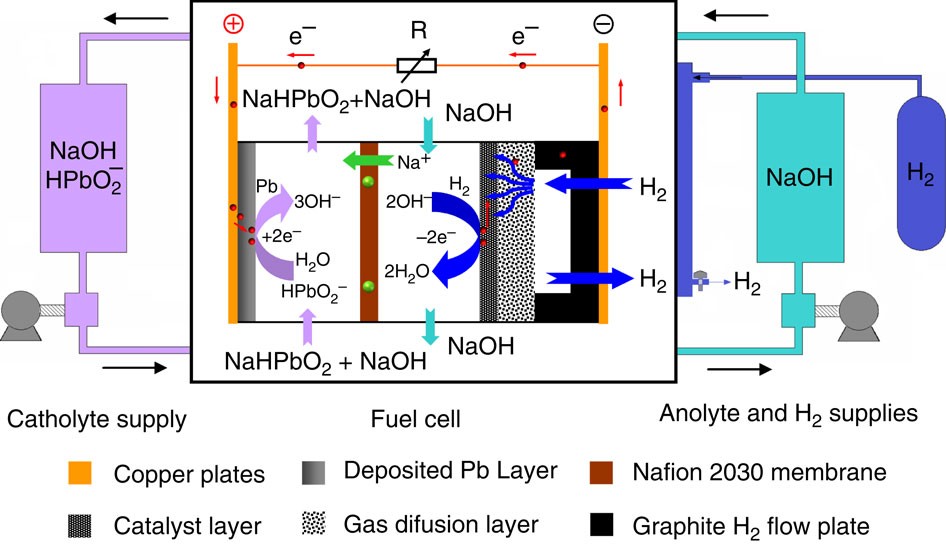

– No Direct Role: Lead hydroxide plays no role in hydrogen production (e.g., electrolysis), storage (e.g., metal hydrides), or fuel cell catalysts.

– Indirect Competition: The rise of H2-based energy systems promotes technologies that displace lead-acid batteries (e.g., hydrogen fuel cell vehicles or grid storage using alternative chemistries), which could reduce long-term demand for lead-based compounds.

– Infrastructure Shifts: Investment in green H2 may redirect capital away from traditional lead-dependent industries.

4. 2026 Market Projections

– The global market for lead compounds (including hydroxides) is expected to grow modestly (~1–2% CAGR) through 2026, driven by:

– Continued use in lead-acid batteries in emerging markets.

– Industrial demand in glass, radiation shielding, and pigments.

– However, lead hydroxide specifically is not traded as a standalone commodity; it is typically generated in situ or as an intermediate.

– Environmental and health concerns will likely suppress expansion into new applications.

5. Regional Trends

– Asia-Pacific (China, India): Largest consumers due to automotive and battery manufacturing.

– Europe and North America: Declining use due to environmental regulations; increased recycling and substitution.

– Africa and South America: Growing demand for backup power solutions supports lead-acid battery use.

6. Sustainability and Substitution

– The push for sustainable and non-toxic materials under the green energy transition (including H2 economy) accelerates substitution away from lead.

– Research into H2 production via electrolysis favors catalysts based on nickel, platinum, or iron — not lead-based materials.

Conclusion

In 2026, the market for lead hydroxide will remain niche and largely tied to the lead-acid battery lifecycle and industrial lead processing. There is no meaningful integration between lead hydroxide and the hydrogen (H2) economy. In fact, the growth of H2 and clean energy technologies may indirectly reduce reliance on lead-based systems over the long term.

If your request intended a different interpretation of “H2” (e.g., a company name, report code, or another chemical), please clarify so I can refine the analysis accordingly.

H2: Common Pitfalls in Sourcing Lead Hydroxide – Quality and Intellectual Property Considerations

Sourcing lead hydroxide (Pb(OH)₂) presents several challenges, particularly concerning product quality and intellectual property (IP) risks. Being aware of these pitfalls is essential for manufacturers, researchers, and procurement teams to ensure regulatory compliance, operational safety, and legal integrity.

1. Quality-Related Pitfalls

a. Impurity Profiles and Contaminants

Lead hydroxide is often produced as an intermediate or specialty chemical, and impurities (such as excess lead oxide, residual acids, or heavy metal contaminants like cadmium or arsenic) can compromise performance and safety.

– Pitfall: Suppliers may provide material that appears chemically correct but contains hazardous trace metals above allowable thresholds.

– Mitigation: Require full Certificate of Analysis (CoA) with ICP-MS data for trace metals. Define purity specifications (e.g., ≥98%) and limit residual solvents or byproducts.

b. Inconsistent Physical Properties

Lead hydroxide can vary in crystallinity, particle size, and moisture content depending on synthesis method and drying conditions.

– Pitfall: Batch-to-batch variability affects reactivity in downstream processes (e.g., in battery materials or pigments).

– Mitigation: Specify physical attributes (e.g., particle size distribution, bulk density) in procurement contracts and conduct incoming quality control (QC) testing.

c. Stability and Decomposition

Lead hydroxide is prone to thermal decomposition into lead oxide (PbO) and water, especially if stored improperly.

– Pitfall: Degraded material may not meet functional requirements.

– Mitigation: Establish storage conditions (cool, dry, sealed) and shelf-life limits. Test for decomposition (e.g., via TGA or XRD) upon receipt.

d. Mislabeling or Misrepresentation

Some suppliers may incorrectly label basic lead carbonates or mixed lead oxides as “lead hydroxide.”

– Pitfall: Chemical substitution leads to failed reactions or unsafe processing.

– Mitigation: Validate identity using analytical methods (FTIR, XRD) and insist on clear nomenclature (CAS 1319-43-3).

2. Intellectual Property (IP) Pitfalls

a. Patented Synthesis Methods

Certain high-purity or nanostructured forms of lead hydroxide may be protected by patents, particularly in advanced applications like lead-acid batteries or catalysis.

– Pitfall: Sourcing material produced via a patented process could expose the buyer to indirect infringement if the supplier is unauthorized.

– Mitigation: Conduct freedom-to-operate (FTO) analysis before procurement, especially for commercial-scale use. Ask suppliers to confirm non-infringement of known patents.

b. Trade Secrets in Formulation

Lead hydroxide used in proprietary formulations (e.g., specialty coatings or battery pastes) may incorporate protected additives or processing techniques.

– Pitfall: Reverse engineering or replicating such formulations without permission risks IP litigation.

– Mitigation: Avoid sourcing from vendors unwilling to disclose material composition transparently. Use confidentiality agreements (NDAs) when sharing specs.

c. Geopolitical and Export Compliance Risks

Some countries restrict export of chemicals involved in battery tech or defense applications due to dual-use concerns.

– Pitfall: Unintentional violation of export control regulations (e.g., EAR, ITAR) when sourcing internationally.

– Mitigation: Verify supplier compliance with export laws and ensure proper documentation (e.g., ECCN classification).

Best Practices Summary

- Quality Assurance: Require detailed CoAs, conduct third-party testing, and audit supplier facilities.

- IP Due Diligence: Perform FTO searches, document supplier warranties on IP, and avoid gray-market sources.

- Regulatory Compliance: Confirm adherence to REACH, RoHS, and OSHA standards, especially given lead’s toxicity.

- Supplier Vetting: Prefer suppliers with ISO certification and transparent traceability.

Conclusion

Sourcing lead hydroxide safely and legally requires a balanced focus on chemical quality and intellectual property integrity. Proactive due diligence mitigates risks related to performance failures, regulatory penalties, and litigation, ensuring reliable and compliant supply chains.

Logistics & Compliance Guide for Lead Hydroxide (H₂)

Prepared in accordance with Globally Harmonized System (GHS) and international regulatory standards

Note: The designation “H2” is not a standard chemical identifier for Lead Hydroxide. Lead Hydroxide is typically represented as Pb(OH)₂. This guide assumes “H2” was used informally or in error and proceeds with the correct compound: Lead Hydroxide, Pb(OH)₂.

1. Chemical Identification

| Property | Information |

|——–|————-|

| Chemical Name | Lead Hydroxide |

| Chemical Formula | Pb(OH)₂ |

| CAS Number | 1344-33-0 (commonly associated with lead oxide hydroxide mixtures) |

| UN Number | UN 2291 |

| Hazard Class | 6.1 (Toxic Substances) |

| Packing Group | II (High hazard) |

| GHS Classification | Acute Toxicity (Oral, Inhalation, Dermal), Category 2

Specific Target Organ Toxicity (Repeated Exposure), Category 1

Hazardous to the Aquatic Environment, Chronic, Category 1 |

2. Hazard Statements (H-Statements)

- H300 – Fatal if swallowed

- H330 – Fatal if inhaled

- H373 – May cause damage to organs (nervous system, kidneys, blood) through prolonged or repeated exposure

- H410 – Very toxic to aquatic life with long-lasting effects

- H360D – May damage fertility or the unborn child

3. Precautionary Statements (P-Statements)

- P201 – Obtain special instructions before use

- P260 – Do not breathe dust/fume/gas/mist/vapors/spray

- P264 – Wash hands thoroughly after handling

- P270 – Do not eat, drink, or smoke when using this product

- P271 – Use only outdoors or in a well-ventilated area

- P273 – Avoid release to the environment

- P280 – Wear protective gloves/protective clothing/eye protection/face protection

- P304+P340 – IF INHALED: Remove person to fresh air and keep comfortable for breathing

- P310 – Immediately call a poison center or doctor

- P308+P313 – IF exposed or concerned: Get medical advice/attention

- P405 – Store locked up

- P501 – Dispose of contents/container in accordance with local/regional/national/international regulations

4. Physical and Chemical Properties

| Property | Value |

|——–|——-|

| Appearance | White or pale yellow crystalline powder |

| Odor | Odorless |

| Solubility in Water | Slightly soluble |

| Melting Point | Decomposes before melting (~200°C) |

| Density | ~7.4 g/cm³ |

| pH (1% solution) | Alkaline (~9–10) |

5. Storage Requirements

- Storage Condition: Store in a cool, dry, well-ventilated area.

- Container: Sealed, corrosion-resistant container (e.g., HDPE or glass).

- Segregation: Store away from acids, food, beverages, animal feed, and incompatible materials.

- Labeling: Clearly label with GHS pictograms, hazard statements, and “Toxic” warnings.

- Access Control: Restrict access to authorized personnel only.

6. Handling Procedures

- Use only in enclosed systems or with local exhaust ventilation.

- Prohibit eating, drinking, or smoking in handling areas.

- Use non-sparking tools and grounding during transfer.

- Implement engineering controls to minimize dust generation.

- Conduct routine air monitoring in work areas.

7. Personal Protective Equipment (PPE)

| Protection Type | Requirement |

|—————-|————-|

| Respiratory | NIOSH-approved respirator with P100 filters (or supplied-air for high concentrations) |

| Hand Protection | Nitrile or neoprene gloves (tested for lead permeation) |

| Eye Protection | Chemical splash goggles or full face shield |

| Body Protection | Impervious lab coat or chemical-resistant suit |

| Footwear | Closed-toe, chemical-resistant shoes |

8. Transportation (UN/DOT/ADR/IMDG/IATA)

- Proper Shipping Name: LEAD COMPOUND, TOXIC, N.O.S. (Lead Hydroxide)

- UN Number: UN 2291

- Class: 6.1 (Toxic Substances)

- Packing Group: II

- Labels: Toxic (Skull and Crossbones), Environmental Hazard

- Packaging: Leak-proof, rigid outer packaging with inner containment (combination packaging compliant with 4GV).

- Documentation: Safety Data Sheet (SDS) required. Shipper must provide transport emergency card (TREM card if applicable).

- IATA/IMDG: Comply with current air/sea regulations; quantity limits apply.

9. Spill Response

- Immediate Action: Evacuate non-essential personnel. Avoid dust formation.

- Containment: Use clean, dry materials to contain spill. Do not use water.

- Cleanup: Carefully collect spilled material using HEPA vacuum or wet method. Place in sealed, labeled container.

- Decontamination: Clean surfaces with lead-specific detergents or chelating agents.

- Disposal: Treat as hazardous waste. Document all spill cleanup activities.

- Reporting: Report significant spills to local environmental and occupational safety agencies.

10. Waste Disposal

- Classification: Hazardous waste (EPA Waste Code D008 for lead)

- Method: Dispose via licensed hazardous waste contractor.

- Landfill: Only in hazardous waste landfills with leachate controls.

- Recycling: Not recommended due to toxicity; may be processed in lead recovery facilities.

- Documentation: Maintain manifests and disposal records per RCRA (US) or equivalent regulations.

11. Regulatory Compliance (Key Jurisdictions)

| Region | Regulation | Requirement |

|——-|————|————-|

| USA (EPA) | RCRA (40 CFR) | Report releases > 1 lb (0.45 kg) under CERCLA |

| USA (OSHA) | 29 CFR 1910.1025 | Lead exposure standard: PEL = 50 µg/m³ (8-hr TWA) |

| EU | REACH & CLP | SVHC candidate; labeling per CLP Regulation (EC) No 1272/2008 |

| UK | COSHH | Risk assessment and control measures required |

| Globally | Basel Convention | Transboundary movement restricted; requires prior informed consent |

12. Emergency Medical Response

- Inhalation: Move to fresh air, administer oxygen if needed, seek immediate medical attention.

- Ingestion: Do NOT induce vomiting. Rinse mouth. Call poison control.

- Skin Contact: Remove contaminated clothing. Wash with soap and water.

- Eye Contact: Flush with water for at least 15 minutes. Seek medical help.

Note: Chelation therapy (e.g., EDTA, DMSA) may be required in cases of lead poisoning.

13. Safety Data Sheet (SDS)

Ensure a current, GHS-compliant SDS is accessible to all handlers, emergency responders, and transport personnel.

14. Training & Documentation

- Train staff on hazards, PPE, emergency procedures, and HAZWOPER (if applicable).

- Maintain records of exposure monitoring, medical surveillance, and training.

15. Environmental Precautions

- Prevent discharge into sewers, waterways, or soil.

- Use secondary containment for storage.

- Monitor for lead leaching in disposal sites.

Disclaimer: This guide is for informational purposes only. Always consult local, national, and international regulations and the most current SDS before handling, transporting, or disposing of Lead Hydroxide.

Prepared by: [Your Organization] – EHS Department

Revision Date: April 2025

Reference Standards: GHS Rev. 9, OSHA 29 CFR 1910.1200, UN Model Regulations, IATA DGR 2024, ADR 2023

Lead hydroxide is a hazardous chemical compound that poses significant health and environmental risks, including toxicity upon ingestion, inhalation, or skin contact, and potential environmental contamination. Due to these concerns, sourcing lead hydroxide is highly regulated in many countries and should only be pursued for legitimate industrial, research, or specialized applications under strict compliance with local, national, and international safety and environmental regulations.

When considering sourcing lead hydroxide, it is essential to:

- Verify legal requirements and obtain necessary permits or licenses.

- Source from reputable and certified chemical suppliers who adhere to safety and regulatory standards.

- Implement stringent safety protocols for handling, storage, and disposal.

- Explore safer alternatives where possible to minimize risk.

In conclusion, while lead hydroxide may be sourced for specific purposes, it must be done responsibly, with full awareness of its dangers and a commitment to regulatory compliance, workplace safety, and environmental protection.