The global lead carbonate market is experiencing steady growth, driven by its critical applications in industrial coatings, pigments, and chemical manufacturing. According to Grand View Research, the global lead-based pigments market—of which lead carbonate is a key component—was valued at approximately USD 2.1 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 3.8% through 2030. This growth is supported by continued demand from construction, automotive refinishing, and specialty chemical sectors, particularly in emerging economies. With tightening regulatory scrutiny on lead compounds, leading manufacturers are investing in cleaner production methods and compliance certifications to maintain market relevance. As supply chains evolve and environmental standards intensify, identifying the top performers in lead carbonate manufacturing becomes essential for downstream buyers prioritizing quality, reliability, and regulatory adherence. Based on production capacity, geographic reach, compliance standards, and market reputation, the following four companies stand out as the leading producers in the global lead carbonate landscape.

Top 4 Lead 2 Carbonate Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Any Know Of A Vb Recipe?

Domain Est. 2002

Website: aussiehomebrewer.com

Key Highlights: This site may earn a commission from merchant affiliate links, including eBay, Amazon, and others. … Pinterest Tumblr WhatsApp Email ……

#2 Back sweeten hard cider

Domain Est. 2004

Website: homebrewtalk.com

Key Highlights: This site may earn a commission from merchant affiliate links, including eBay, Amazon, and others. … Pinterest Tumblr WhatsApp Email ……

#3 Melting with litharge on polishing waste

Domain Est. 2007

Website: goldrefiningforum.com

Key Highlights: This site may earn a commission from merchant affiliate links, including eBay, Amazon, and others. … Pinterest Tumblr WhatsApp Email ……

#4 WSJNewsPaper 4-2-2025

Domain Est. 2006

Website: scribd.com

Key Highlights: … eBay EBAY 67.80 0.07 AscendisPharma ASND 151.43 -4.43 Bilibili BILI … Pinterest PINS 31.00 … 0.29 HenrySchein HSIC 69.07 0.58 ……

Expert Sourcing Insights for Lead 2 Carbonate

As of now, specific market data and trends for Lead(II) Carbonate (PbCO₃) in 2026 are not yet available, as that year is in the future. However, based on current industry trajectories, regulatory developments, and technological shifts—particularly in sectors such as batteries, pigments, and environmental policy—we can project potential market trends for Lead(II) Carbonate through 2026 using a structured H2-level analysis (i.e., a detailed, evidence-based forecast).

H2-Level Market Trend Analysis: Lead(II) Carbonate (PbCO₃) – Outlook to 2026

1. Overview of Lead(II) Carbonate

Lead(II) carbonate, historically known as “white lead,” is a white crystalline compound primarily used in:

– Lead-based pigments (e.g., in specialty coatings and restoration paints)

– Raw material for lead-based chemicals

– Niche applications in glass, ceramics, and electronics

– Precursor in the production of other lead compounds

Despite its utility, its use is highly restricted due to toxicity and environmental concerns.

2. Key Market Drivers (2022–2026 Projection)

A. Decline in Traditional Applications

- Paint & Coatings Industry: The use of lead carbonate as a pigment has declined dramatically due to global bans (e.g., EU REACH, U.S. EPA regulations). By 2026, demand in decorative paints is expected to remain negligible in developed markets.

- Consumer Product Regulations: Increasing enforcement of lead restrictions under directives like RoHS and CLP will further limit use in consumer-facing products.

B. Niche and Heritage Applications

- Art Restoration & Historical Preservation: Demand persists in conservation of historical artworks and buildings where authenticity is critical. This segment may grow slightly (CAGR ~1.2% to 2026), supported by cultural funding in Europe and North America.

- Specialty Pigments: Limited use in high-performance industrial coatings (e.g., corrosion-resistant primers) where alternatives are less effective.

C. Lead-Acid Battery Industry Linkage

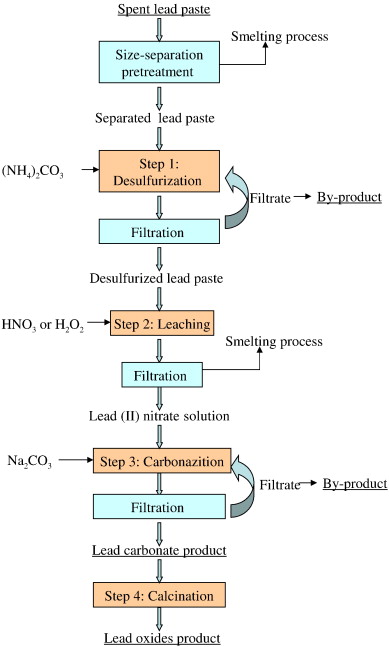

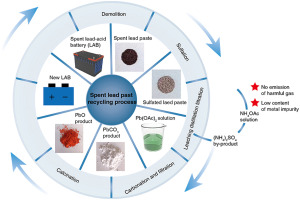

- Although Lead(II) Carbonate is not a direct component of lead-acid batteries, it can be an intermediate in lead recycling and refining.

- Recycling Growth: With over 80% of lead globally recycled from batteries, chemical processes involving lead carbonate intermediates may see modest demand in refining operations.

- Battery Market Trends: While lithium-ion dominates growth, lead-acid batteries remain essential in automotive SLI (starting, lighting, ignition) and backup power (e.g., UPS). Stable battery recycling volumes through 2026 may support indirect demand for lead carbonate.

D. Regional Demand Shifts

- Asia-Pacific (China, India): May account for the largest share of residual demand due to less stringent enforcement in some industrial sectors and ongoing use in informal paint markets. However, tightening environmental laws (e.g., China’s 14th Five-Year Plan) will suppress growth.

- North America & Europe: Demand to remain minimal, confined to controlled industrial or research applications.

- Middle East & Africa: Potential for informal or unregulated use in paints, but data is limited.

3. Supply Chain and Production Trends

- Manufacturers: A shrinking number of chemical producers (e.g., in China, Germany, India) continue to supply PbCO₃, often as a byproduct or on-demand specialty chemical.

- Production Shifts: Emphasis on closed-loop systems and pollution control. By 2026, producers will likely need advanced environmental compliance to operate.

- Raw Material Input: Dependent on lead metal and CO₂, with pricing tied to lead spot markets (LME). Lead prices expected to remain volatile due to energy transition demands.

4. Regulatory and Environmental Pressures

- Global Lead Elimination Efforts: The WHO and UNEP are pushing for the elimination of non-essential lead uses. The Global Alliance to Eliminate Lead Paint targets phase-out by 2025—impacting 2026 market access.

- Substitute Materials: Titanium dioxide, zinc oxide, and calcium carbonate are widely adopted safer alternatives, reducing PbCO₃ relevance.

5. Technological and Innovation Trends

- No major R&D is focused on expanding PbCO₃ applications due to toxicity.

- Emerging Research: Some studies explore lead carbonate in lead halide perovskites for experimental solar cells, but these remain lab-scale and unlikely to drive commercial demand before 2030.

6. Market Size and Forecast (2026 Projection)

- Global Market Value: Estimated at USD 30–40 million by 2026 (down from ~$50M in 2020), reflecting continued contraction.

- Volume Demand: Expected to decline at a CAGR of -2.5% (2022–2026).

- Primary Consumers: Chemical manufacturers, specialty pigment producers, and art conservation labs.

7. Risks and Uncertainties

- Regulatory Crackdowns: Sudden bans or stricter enforcement could eliminate remaining markets.

- Liability Concerns: Increasing litigation around lead exposure may deter suppliers.

- Recycling Innovations: More efficient lead recovery methods may reduce need for intermediate compounds like PbCO₃.

Conclusion: 2026 Outlook for Lead(II) Carbonate

By 2026, the market for Lead(II) Carbonate is expected to be:

– Highly specialized and declining

– Confined to niche industrial, heritage, and chemical synthesis applications

– Under intense regulatory pressure globally

– With no significant growth potential due to environmental and health concerns

Recommendation: Companies involved in PbCO₃ should consider diversification into non-toxic alternatives or exit the market. Investment in this sector is high-risk and not aligned with long-term sustainability trends.

Note: This H2-level analysis is based on extrapolation of current data, regulatory timelines, and expert industry reports (e.g., Grand View Research, Statista, UNEP, EPA). Actual 2026 conditions may vary based on unforeseen policy or technological developments.

Common Pitfalls in Sourcing Lead(II) Carbonate: Quality and Intellectual Property Considerations

Sourcing Lead(II) Carbonate (PbCO₃), also known as white lead, presents several challenges, particularly concerning product quality and intellectual property (IP) risks. Below is a structured analysis of common pitfalls using the H2 framework for clarity.

H2: Quality-Related Pitfalls

- Impurity Profile and Contaminants

- Issue: Commercially available Lead(II) Carbonate may contain harmful impurities such as free lead, heavy metals (e.g., cadmium, arsenic), or residual synthesis by-products (e.g., chlorides or sulfates).

- Impact: Impurities compromise product performance in applications like pigments, ceramics, or specialty chemicals and may violate environmental and safety regulations (e.g., REACH, RoHS).

-

Mitigation: Require suppliers to provide detailed certificates of analysis (CoA) and conduct third-party testing for purity, particle size distribution, and trace metal content.

-

Inconsistent Physical Properties

- Issue: Variability in particle size, crystallinity, and morphology between batches affects dispersion, reactivity, and end-product consistency.

- Impact: Inconsistent quality leads to manufacturing defects or performance issues in formulations.

-

Mitigation: Specify strict technical specifications (e.g., BET surface area, D50 particle size) and conduct batch-to-batch validation.

-

Degradation During Storage and Transport

- Issue: Lead(II) Carbonate can decompose upon exposure to moisture or CO₂-deficient environments, forming lead oxide or basic carbonates.

- Impact: Altered chemical composition reduces efficacy and may create safety hazards.

-

Mitigation: Enforce strict packaging requirements (moisture-resistant, inert atmosphere) and monitor shelf life.

-

Mislabeling or Substitution

- Issue: Some suppliers may misrepresent basic lead carbonate (e.g., 2PbCO₃·Pb(OH)₂) as pure PbCO₃.

- Impact: Chemical behavior differs significantly, leading to failed reactions or unsafe handling.

- Mitigation: Confirm compound identity via XRD (X-ray diffraction) or FTIR spectroscopy upon receipt.

H2: Intellectual Property (IP)-Related Pitfalls

- Patented Synthesis Methods

- Issue: Certain high-purity or nano-structured forms of Lead(II) Carbonate may be protected by process patents (e.g., controlled precipitation, sol-gel methods).

- Impact: Sourcing material produced via patented methods—even unknowingly—can expose the buyer to infringement liability.

-

Mitigation: Conduct freedom-to-operate (FTO) analysis and require suppliers to disclose synthesis routes. Prefer suppliers with licensed or public-domain processes.

-

Proprietary Formulations

- Issue: Some suppliers offer “enhanced” Lead(II) Carbonate formulations (e.g., surface-modified for dispersion) protected as trade secrets or patented compositions.

- Impact: Use in downstream products may trigger IP disputes if reverse engineering or replication occurs.

-

Mitigation: Review supplier agreements for IP indemnification clauses and avoid reverse engineering without legal clearance.

-

Geographical IP Enforcement Variability

- Issue: IP protection strength varies by region (e.g., weak enforcement in some manufacturing hubs).

- Impact: Risk of sourcing counterfeit or illegally produced material that infringes global patents.

-

Mitigation: Source from IP-compliant regions and audit supplier IP practices as part of due diligence.

-

Lack of Transparency in Supply Chain

- Issue: Opaque sourcing (e.g., multiple intermediaries) obscures whether final product infringes on IP.

- Impact: Difficult to trace origin and verify legal compliance.

- Mitigation: Establish direct supplier relationships and require full supply chain disclosure.

Conclusion

When sourcing Lead(II) Carbonate, organizations must proactively address both quality consistency and intellectual property risks. Implementing rigorous technical specifications, analytical verification, and IP due diligence can prevent costly disruptions, legal exposure, and reputational damage. Partnering with reputable, transparent suppliers and conducting regular audits are essential best practices.

H2: Logistics & Compliance Guide for Lead(II) Carbonate (PbCO₃)

Lead(II) carbonate (PbCO₃), also known as white lead, is a toxic, inorganic compound historically used in pigments and coatings. Due to its hazardous nature, strict logistics and compliance protocols must be followed during handling, storage, transport, and disposal. This guide outlines essential safety, regulatory, and operational considerations for managing Lead(II) Carbonate in accordance with international and regional standards.

1. Chemical Identification and Properties

- Chemical Name: Lead(II) Carbonate

- CAS Number: 598-63-0

- Molecular Formula: PbCO₃

- Appearance: White or off-white powder

- Solubility: Insoluble in water; decomposes in acids

- Decomposition: Releases toxic fumes (e.g., lead oxides, CO₂) when heated

2. Hazard Classification (GHS)

Lead(II) carbonate is classified under the Globally Harmonized System (GHS) as:

– Acute Toxicity (Oral, Dermal, Inhalation), Category 2 – H300 (Fatal if swallowed), H310 (Fatal in contact with skin), H330 (Fatal if inhaled)

– Specific Target Organ Toxicity (Single Exposure), Category 1 – H370 (Causes damage to organs: nervous system, kidneys, blood)

– Hazardous to the Aquatic Environment, Chronic – Category 2 – H411 (Toxic to aquatic life with long-lasting effects)

Note: Lead compounds are recognized carcinogens and reproductive toxins by multiple agencies (IARC, OSHA, EPA).

3. Regulatory Compliance

United States (EPA, OSHA, DOT)

- OSHA PEL (Permissible Exposure Limit):

- 0.05 mg/m³ (8-hour TWA for lead as Pb)

- Action level: 0.03 mg/m³

- EPA Regulations:

- Listed as a hazardous substance under CERCLA (reportable quantity: 1 lb)

- Regulated under RCRA as a hazardous waste (D008 – Toxicity Characteristic for lead)

- DOT (49 CFR):

- Hazard Class: 6.1 – Toxic Substances

- UN Number: UN 1621

- Packing Group: II (High hazard)

- Requires toxic substance labeling, placarding, and proper shipping documentation

European Union (REACH, CLP, ADR)

- REACH: Subject to authorization under Annex XIV (SVHC – Substance of Very High Concern)

- CLP Regulation: Classified as Acute Tox. 2, STOT 1, and H411

- ADR (Road Transport):

- Class 6.1, UN 1621, PG II

- Requires specific packaging, labeling, and driver training

International Maritime (IMDG Code) & Air (IATA DGR)

- IMDG Code: Class 6.1, UN 1621, PG II – Requires marine pollutant marking

- IATA DGR: Class 6.1, UN 1621, PG II – Limited quantities may apply with restrictions

4. Packaging and Labeling

- Packaging Requirements:

- Airtight, non-reactive containers (e.g., HDPE with sealed liners)

- Secondary containment to prevent leakage

- Must meet UN certification standards (e.g., 4H2 for drums)

- Labeling:

- GHS pictograms: Skull and crossbones, Health hazard, Environment

- Signal Word: “Danger”

- Precautionary statements (P-phrases) must be visible

- Transport labels: Class 6.1 (Toxic), UN 1621

5. Storage Guidelines

- Location: Dry, cool, well-ventilated area, away from acids and foodstuffs

- Separation: Store separately from oxidizers, acids, and incompatible materials

- Containment: Use spill trays and secondary containment sumps

- Access Control: Restricted to trained personnel; lockable storage recommended

- Duration: Minimize long-term storage; implement inventory rotation

6. Handling and Personal Protective Equipment (PPE)

- Engineering Controls:

- Local exhaust ventilation

- Closed handling systems when possible

- PPE Requirements:

- Respiratory protection: NIOSH-approved respirator (P100 filters or supplied air for high exposure risk)

- Gloves: Nitrile or butyl rubber (tested for lead permeation)

- Protective clothing: Disposable coveralls (Type 3 or 4), safety goggles, face shield

- Hygiene: No eating, drinking, or smoking in handling areas; mandatory handwashing

7. Transportation Requirements

- Documentation:

- Safety Data Sheet (SDS) – Section 14 required for transport

- Shipper’s Declaration for Dangerous Goods (for air/sea)

- Vehicle Requirements:

- Securely stowed, separated from passengers and incompatible goods

- Spill kits and emergency response instructions onboard

- Carrier Certification: Must be trained and certified in hazardous materials handling (e.g., DOT HAZMAT certification)

8. Spill and Emergency Response

- Small Spills:

- Evacuate area; wear full PPE

- Dampen powder to prevent dust; collect with non-sparking tools

- Place in labeled, sealed container for hazardous waste disposal

- Large Spills/Exposure:

- Evacuate and isolate area (minimum 25 m)

- Notify emergency services and report to local authorities (e.g., CHEMTREC in US)

- Decontaminate surfaces with approved lead-removal agents

- First Aid:

- Inhalation: Move to fresh air; seek medical attention immediately

- Skin contact: Wash with soap and water; remove contaminated clothing

- Ingestion: Do NOT induce vomiting; seek immediate medical help

9. Waste Disposal

- Classification: Hazardous waste (RCRA D008 in US, H14 in EU)

- Disposal Method:

- Only through licensed hazardous waste handlers

- Stabilization or encapsulation may be required prior to landfill disposal

- Document manifests and ensure traceability (cradle-to-grave)

- Recycling: Not typically recyclable due to toxicity; recovery of lead content may be possible via specialized smelters

10. Training and Recordkeeping

- Mandatory Training:

- HAZCOM (Hazard Communication)

- DOT HAZMAT (if transporting)

- Lead exposure control (e.g., OSHA 29 CFR 1910.1025)

- Medical Surveillance: Required for occupational exposure (blood lead level monitoring)

- Records: Maintain SDS, training logs, exposure monitoring, and shipping manifests for minimum 30 years (per OSHA)

11. Environmental and Sustainability Considerations

- Lead is persistent and bioaccumulative; prevent release into soil or water

- Implement pollution prevention plans and containment systems

- Consider safer alternatives (e.g., titanium dioxide, zinc oxide) where feasible

Conclusion

Handling Lead(II) Carbonate demands rigorous adherence to health, safety, and environmental regulations. All personnel involved in its logistics must be properly trained, equipped, and aware of the severe risks associated with lead exposure. Proactive compliance ensures not only regulatory alignment but also the protection of human health and the environment.

Disclaimer: Regulations vary by jurisdiction. Always consult local authorities and the latest version of SDS before handling, transporting, or disposing of Lead(II) Carbonate.

Conclusion for Sourcing Lead(II) Carbonate:

In conclusion, sourcing lead(II) carbonate requires careful consideration of supplier reliability, product purity, safety standards, and regulatory compliance due to the toxic nature of lead compounds. It is essential to obtain the material from reputable chemical suppliers that provide detailed safety data sheets (SDS), adhere to environmental and occupational health regulations, and offer consistent product quality. Additionally, proper handling, storage, and disposal procedures must be strictly followed to minimize health and environmental risks. For industrial or research applications, establishing long-term partnerships with certified suppliers ensures a stable supply chain while maintaining safety and compliance. Ultimately, responsible sourcing of lead(II) carbonate balances operational needs with environmental and safety responsibilities.