The global fiber laser marking machine market is experiencing robust growth, driven by increasing demand for permanent, high-precision marking across industries such as automotive, electronics, medical devices, and consumer goods. According to a report by Mordor Intelligence, the laser marking machines market is projected to grow at a CAGR of over 6.5% between 2023 and 2028, with fiber laser systems accounting for a dominant share due to their durability, low maintenance, and efficiency on metal and plastic surfaces. Similarly, Grand View Research valued the global laser marking equipment market at USD 2.1 billion in 2022 and forecasts a CAGR of 6.3% from 2023 to 2030, citing advancements in fiber laser technology and rising automation in manufacturing as key growth drivers. With adoption accelerating worldwide, identifying leading manufacturers that deliver reliability, innovation, and scalability has become critical for businesses aiming to enhance traceability, comply with regulatory standards, and improve production throughput. In this landscape, the following nine companies have emerged as top fiber laser marking machine manufacturers based on market presence, technological leadership, and customer reach.

Top 9 Laser Fiber Marking Machine Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Marking machine manufacturer, Laser marking, Traceability …

Domain Est. 2000

Website: sic-marking.com

Key Highlights: For more than 30 years, SIC Marking has been designing a range of reliable, robust industrial marking machines that can be customized to suit your needs….

#2 Laser Photonics

Domain Est. 2001

Website: laserphotonics.com

Key Highlights: Laser Photonics manufactures reliable, safe, and eco-friendly Laser Cleaning, Laser Cutting, Laser Engraving, Laser Marking, and Laser Welding solutions….

#3 Laser Marking for All Industries

Domain Est. 2006

Website: lasermarktech.com

Key Highlights: Discover innovative laser marking solutions tailored for various industries. Explore our cutting-edge technology as leaders in laser marking and engraving….

#4 Fiber Laser Cutting Machine and CO2 Laser Cutter Manufacturer …

Domain Est. 2016

Website: gwklaser.com

Key Highlights: Leading manufacturer of laser cutting machine, CO2 laser cutter, laser welding machine, laser bending machine and laser cleaning machine, etc….

#5 Fiber Laser Marker

Domain Est. 1996

Website: telesis.com

Key Highlights: Discover Telesis fiber laser markers: reliable, high-speed solutions for product identification, traceability, & branding. Request a quote!…

#6 MECCO

Domain Est. 1996

Website: mecco.com

Key Highlights: Our expertise in automated laser engraving and pin marking systems encompasses a comprehensive range of solutions for your industry, materials, and ……

#7 IPG Photonics

Domain Est. 1999

Website: ipgphotonics.com

Key Highlights: IPG Photonics manufactures high-performance fiber lasers, amplifiers, and laser systems for diverse applications and industries. Discover your solution….

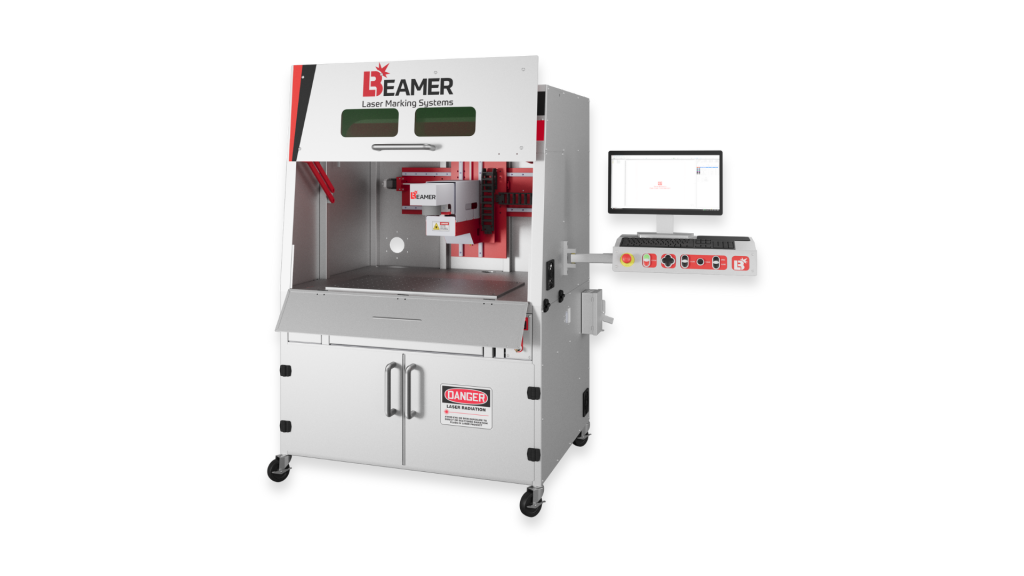

#8 Beamer Laser Marking Systems

Domain Est. 2007

Website: beamerlasermarking.com

Key Highlights: We offer a wide range of powerful standard, engineered, and inline 1064nm IR laser marking solutions with unmatched 100,000+ hour lifespan….

#9 Full Spectrum Laser

Domain Est. 2010

Website: fslaser.com

Key Highlights: 7–15 day delivery 30-day returnsFull Spectrum Laser is a US based company that designs, manufactures, and sells powerful and affordable laser cutting & laser engraving products….

Expert Sourcing Insights for Laser Fiber Marking Machine

H2: Projected 2026 Market Trends for Laser Fiber Marking Machines

The global Laser Fiber Marking Machine market is poised for significant transformation and growth by 2026, driven by technological advancements, expanding industrial automation, and evolving regulatory demands. Key trends shaping the market landscape include:

1. Accelerated Adoption in High-Growth Industries:

Demand will surge in sectors like electric vehicles (EVs), renewable energy, and advanced electronics. Fiber lasers are essential for permanently marking critical components (battery cells, power electronics, solar inverters) with unique identifiers (UIDs) for traceability, quality control, and compliance with safety standards. The miniaturization trend in electronics will further boost demand for precise, non-contact marking.

2. Dominance of MOPA and Ultrafast Fiber Lasers:

While standard Q-switched fiber lasers remain prevalent, MOPA (Master Oscillator Power Amplifier) technology will gain substantial market share. MOPA lasers offer superior control over pulse parameters, enabling high-contrast, color marking on stainless steel and anodized aluminum without surface damage – crucial for medical devices and consumer electronics. Ultrafast (picosecond/femtosecond) fiber lasers will see niche but high-value growth in micromachining and medical applications requiring cold ablation.

3. Integration with Industry 4.0 and Smart Manufacturing:

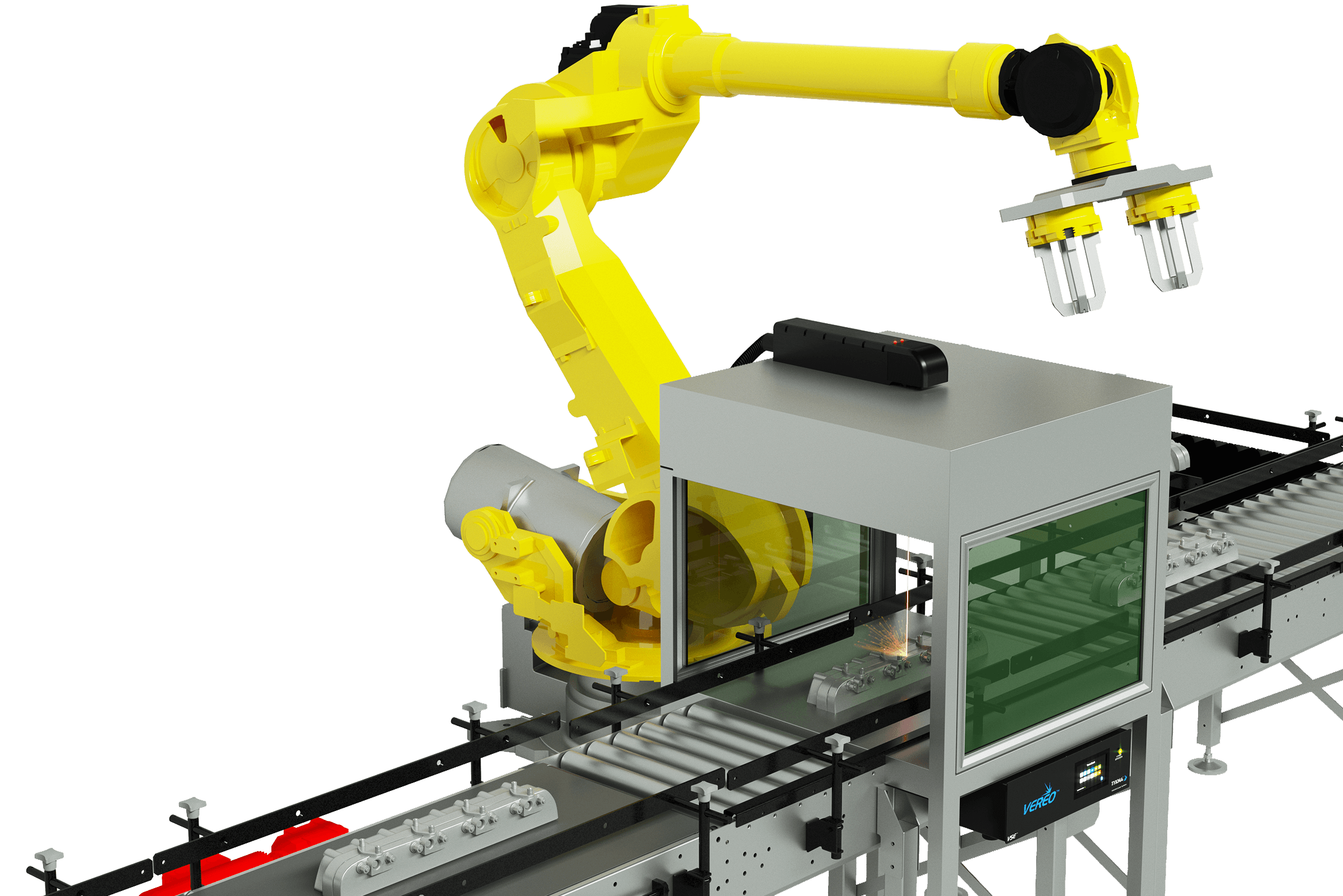

Fiber marking machines will increasingly become integrated nodes within smart factories. Key developments include:

* Seamless Connectivity: Native support for IIoT protocols (OPC UA, MQTT) for real-time data exchange with MES/SCADA systems.

* Automated Workflows: Integration with robotic arms, conveyors, and vision systems for fully automated, lights-out production lines.

* Data-Driven Marking: Machines will capture and log marking data (timestamp, parameters, component ID) for comprehensive traceability and quality analytics.

4. Enhanced Software Intelligence and User Experience:

Software will become a key differentiator. Expect:

* AI-Powered Optimization: AI algorithms for automatic parameter optimization based on material, desired mark quality, and speed.

* Advanced Vision Integration: Real-time camera feedback for automatic part localization, mark verification (OCR/OMR), and quality inspection.

* Intuitive Interfaces: Cloud-based platforms and mobile apps for remote monitoring, diagnostics, job management, and predictive maintenance.

5. Focus on Sustainability and Total Cost of Ownership (TCO):

Manufacturers will prioritize machines with lower energy consumption, longer component lifespans (especially laser sources), and minimal consumables. The superior energy efficiency of fiber lasers over older CO2 or lamp-pumped technologies remains a core selling point. Emphasis will shift from upfront cost to long-term TCO, including maintenance, power, and downtime reduction.

6. Regional Market Shifts and Supply Chain Resilience:

While Asia-Pacific (especially China, India, Southeast Asia) remains the largest market due to manufacturing dominance, growth is expected in North America and Europe driven by reshoring/nearshoring initiatives and advanced manufacturing. This will pressure suppliers to ensure resilient supply chains and localized support networks.

7. Increased Customization and Application-Specific Solutions:

Standard machines will face competition from highly customized systems tailored for specific high-volume applications (e.g., inline marking on automotive production lines, specialized medical device marking). Vendors offering application expertise and turnkey solutions will gain advantage.

In conclusion, by 2026, the Laser Fiber Marking Machine market will be characterized by smarter, more connected, and highly specialized systems. Success will depend on vendors’ ability to deliver integrated, efficient, and application-optimized solutions that meet the demands of Industry 4.0 and critical traceability requirements across rapidly evolving industrial sectors.

Common Pitfalls When Sourcing Laser Fiber Marking Machines (Quality & Intellectual Property)

Sourcing a laser fiber marking machine from international suppliers—especially from regions with less stringent regulatory oversight—can present significant risks related to product quality and intellectual property (IP) infringement. Being aware of these common pitfalls helps buyers make informed decisions and avoid costly mistakes.

Poor Build Quality and Component Substitution

One of the most prevalent issues is the use of substandard materials and components. Some suppliers may advertise machines with high-end specifications (e.g., IPG or Raycus lasers) but deliver units equipped with lower-quality or counterfeit parts. This can lead to premature failure, inconsistent marking performance, and increased maintenance costs. Always request detailed component lists and verify authenticity through serial numbers or third-party inspections.

Inaccurate or Exaggerated Performance Claims

Suppliers might overstate the machine’s capabilities, such as marking speed, depth, or compatibility with various materials. Demonstrations may be conducted under ideal conditions that don’t reflect real-world use. To mitigate this, ask for third-party test reports, request live demos using your actual materials, and review customer references.

Lack of Intellectual Property Compliance

Many low-cost machines infringe on patented technologies, particularly in laser sources, control software, and optical designs. Purchasing such equipment exposes your business to legal risks, including import seizures, fines, or lawsuits—especially in IP-sensitive markets like the EU or North America. Ensure suppliers can provide proof of IP ownership or licensing for critical components.

Inadequate After-Sales Support and Spare Parts Availability

Even if the initial machine functions well, poor technical support and limited access to spare parts can render the system unusable over time. Some suppliers disappear after the sale or charge exorbitant fees for service. Confirm the availability of local service centers, response times, and warranty terms before purchasing.

Hidden Costs and Misleading Quotations

Initial quotes may exclude essential accessories (fume extractors, rotary units), software licenses, or shipping and import duties. This can significantly increase the total cost of ownership. Always request a detailed breakdown of all costs and clarify what is included in the final price.

Counterfeit Branding and Misrepresentation

Some machines are falsely branded to appear as if they come from reputable manufacturers. This includes cloning control panels, using similar model names, or falsifying certifications. Conduct due diligence by verifying the supplier’s official authorization and cross-checking product details with the original manufacturer.

Absence of Safety and Regulatory Certifications

Non-compliant machines may lack essential safety features or certifications (e.g., CE, FDA, RoHS), posing risks to operators and preventing legal operation in certain countries. Request certified documentation and verify compliance with your local regulations before import.

By recognizing and addressing these pitfalls, buyers can reduce risks and ensure they procure a reliable, legally compliant laser fiber marking machine that meets both performance and quality expectations.

Logistics & Compliance Guide for Laser Fiber Marking Machine

This guide outlines essential logistics considerations and compliance requirements for the shipment, import, and operation of a Laser Fiber Marking Machine. Adhering to these guidelines ensures smooth transportation, regulatory approval, and safe usage.

Shipping and Transportation

Ensure the laser marking machine is securely packaged in a sturdy, shock-resistant crate with internal foam or cushioning to prevent movement. Use desiccant packs to minimize moisture exposure during transit. Clearly label the package as “Fragile,” “This Side Up,” and “Do Not Stack.” Verify that the shipping mode (air, sea, or ground) complies with carrier-specific regulations for electronic and industrial equipment. Provide detailed handling instructions to the freight forwarder, especially regarding weight distribution and lifting points.

Import and Customs Compliance

Prepare complete documentation for customs clearance, including a commercial invoice, packing list, bill of lading/airway bill, and certificate of origin. Classify the machine under the appropriate Harmonized System (HS) code—commonly 8456.11 or 8456.12 for laser engraving equipment—and confirm with local customs authorities. Be aware of import duties, value-added tax (VAT), and any anti-dumping measures that may apply. Some countries require pre-shipment inspections or conformity certifications (e.g., SONCAP, SABER). Ensure compliance with local import regulations to avoid delays.

Regulatory and Safety Standards

Verify that the laser fiber marking machine meets international safety standards such as IEC 60825-1 (laser safety) and IEC 61010-1 (safety requirements for electrical equipment). In the United States, compliance with the FDA/CDRH (Center for Devices and Radiological Health) regulations for laser products is mandatory—this includes proper labeling, safety interlocks, and submission of a product report. In the European Union, the machine must carry the CE mark, demonstrating conformity with the Machinery Directive, EMC Directive, and the applicable parts of the LVD. For other regions (e.g., UKCA, KC Mark, CCC), ensure region-specific certifications are obtained prior to sale or operation.

Laser Classification and Safety Measures

Confirm the laser classification—fiber marking machines are typically Class 1 or Class 4 depending on enclosure integrity. Fully enclosed systems are generally Class 1 (safe during normal operation), while open-beam setups may be Class 4 and require strict controls. Provide appropriate safety signage, interlocks, and emergency stop mechanisms. Install protective enclosures, laser safety windows, and beam shutters where necessary. Ensure operators are trained in laser safety protocols and that protective eyewear, rated for the specific laser wavelength (commonly 1064 nm), is available and used when required.

Environmental and Disposal Compliance

Adhere to environmental regulations regarding the disposal of electronic waste (WEEE) and hazardous components. Do not dispose of the laser source, power supplies, or electronic control boards in regular trash. Recycle through certified e-waste facilities compliant with local laws (e.g., WEEE Directive in the EU). Minimize airborne particulates during operation by using appropriate fume extraction systems that comply with OSHA or equivalent air quality standards.

Documentation and Record Keeping

Maintain comprehensive records including user manuals, technical specifications, conformity declarations, test reports, and maintenance logs. Keep copies of import documentation, safety certifications, and training records for operators. These documents may be required for audits, regulatory inspections, or warranty claims. Provide end-users with all necessary compliance and safety documentation upon delivery.

By following this guide, businesses can ensure compliant, safe, and efficient handling of Laser Fiber Marking Machines throughout their logistics and operational lifecycle.

Conclusion for Sourcing a Laser Fiber Marking Machine

After a thorough evaluation of technical specifications, supplier capabilities, cost-efficiency, and long-term operational needs, sourcing a fiber laser marking machine proves to be a strategic investment for enhancing production quality, traceability, and branding. The technology offers high precision, durability, and low maintenance, making it ideal for permanent marking on metals and some engineered plastics.

Key considerations such as laser power, marking area, software compatibility, and integration with existing production lines must align with specific application requirements. Additionally, selecting a reputable supplier with strong technical support, warranty terms, and training services ensures reliable performance and minimal downtime.

Ultimately, sourcing the right fiber laser marking machine will improve manufacturing efficiency, support compliance with industry standards (e.g., aerospace, medical, automotive), and provide a strong return on investment through increased productivity and part traceability. A well-informed decision, based on comprehensive research and supplier due diligence, will position the organization for long-term success in competitive markets.