The global laser cutting market is experiencing robust growth, driven by increasing demand for precision manufacturing across industries such as automotive, aerospace, electronics, and healthcare. According to a 2023 report by Mordor Intelligence, the market was valued at USD 7.8 billion in 2022 and is projected to grow at a CAGR of over 6.5% from 2023 to 2028. This expansion is fueled by advancements in fiber laser technology, rising adoption of automation, and the need for high-accuracy cutting solutions in complex fabrication processes. As industries shift toward leaner, more efficient production methods, laser cutting has emerged as a cornerstone technology. In this evolving landscape, a select group of manufacturers have distinguished themselves through innovation, scalability, and technical excellence. The following list explores the top 10 laser cutting project manufacturers leveraging this momentum to deliver high-impact engineering and industrial solutions worldwide.

Top 10 Laser Cutting Projects Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Focus on laser

Domain Est. 2005

Website: hanslaser.net

Key Highlights: Laser cutting is the process of cutting material by means of electron discharge as the energy source. The following diagram describe the principle of Laser ……

#2 TRUMPF SE + Co. KG

Domain Est. 1996

Website: trumpf.com

Key Highlights: As a high-tech company, TRUMPF provides manufacturing solutions in the fields of machine tools, laser technology, electronics, and Industry 4.0….

#3 Mazak Leading Laser Machine Manufacturer

Domain Est. 1998

Website: mazak.com

Key Highlights: Mazak provides products and solutions that can support a wide range of parts machining processes, such as high-speed and high-accuracy machines….

#4 Trotec Laser

Domain Est. 2002

Website: troteclaser.com

Key Highlights: Trotec is a leading international laser manufacturer and makes the work of laser users easier, faster and more profitable….

#5 Top 18 Websites for Free Laser Cut & Cutter Files in 2026

Domain Est. 2000

Website: store.creality.com

Key Highlights: Discover the top 18 websites of 2026 offering free laser cut and cutter files. Enhance your projects with premium, easy-to-use laser cut files….

#6 Laser engravers & laser cutters

Domain Est. 2004

Website: gravotech.com

Key Highlights: Our laser tables are designed to engrave, mark and cut on a wide variety of materials (plastic, wood, metal, leather, glass, paper, stone) and shapes….

#7 Full Spectrum Laser

Domain Est. 2010

#8 Laser Cutting, Engraving & Marking Machines

Domain Est. 2010

Website: thunderlaser.com

Key Highlights: Thunder Laser offers high-quality, reliable laser machines to meet the needs of a variety of industries. ThunderLaser has become a well-recognized icon in ……

#9 xTool Gallery

Domain Est. 2013

Website: xtool.com

Key Highlights: xTool laser cutter and engraver project ideas are all listed here. See all the beautiful projects laser made with wood, acrylic, glass, leather, paper, ……

#10 Custom Online Laser Cutting Services

Domain Est. 2015

Website: xometry.com

Key Highlights: Xometry offers an online custom laser cutting service in metal, plastic, rubber, foam, and wood. Xometry’s laser cutting offers a cost-effective, on-demand ……

Expert Sourcing Insights for Laser Cutting Projects

2026 Market Trends for Laser Cutting Projects

The global laser cutting market is poised for significant transformation by 2026, driven by technological advancements, expanding industrial applications, and evolving manufacturing demands. Key trends shaping the landscape include:

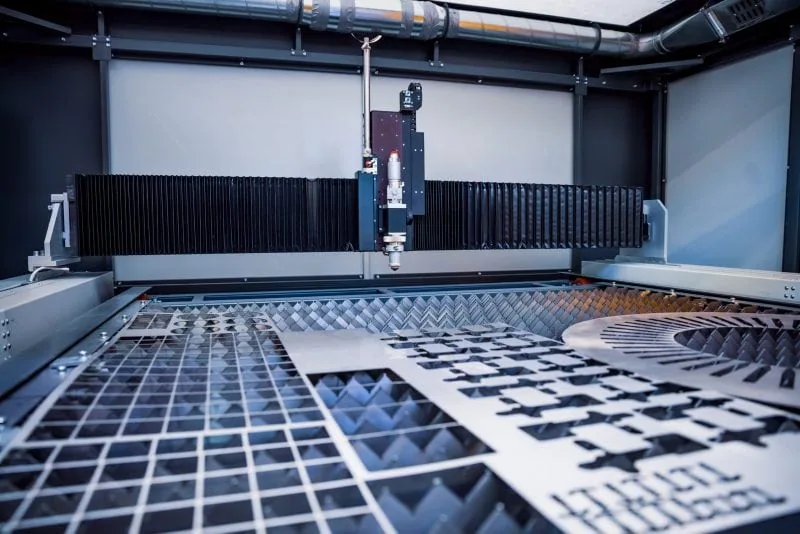

Rising Adoption of High-Power and Ultrafast Lasers

By 2026, high-power fiber lasers (exceeding 10 kW) are expected to dominate industrial applications, enabling faster cutting speeds and the ability to process thicker materials like high-strength steel and aluminum alloys. Concurrently, ultrafast lasers (picosecond and femtosecond) are gaining traction in precision sectors such as medical device manufacturing, electronics, and aerospace. These lasers offer cold ablation, minimizing heat-affected zones and enabling micron-level accuracy—critical for miniaturized components.

Integration with Automation and Industry 4.0

Laser cutting systems are increasingly embedded within fully automated production lines, featuring robotic loading/unloading, AI-driven process optimization, and real-time monitoring via IoT sensors. By 2026, smart laser cutting cells will leverage predictive maintenance and adaptive control algorithms to reduce downtime and enhance yield. Cloud-based platforms will allow remote monitoring and data analytics, supporting lean manufacturing across distributed facilities.

Growth in Electric Vehicle and Renewable Energy Sectors

The surge in electric vehicle (EV) production is driving demand for laser-cut battery components, electric motor laminations, and lightweight chassis parts. Similarly, the renewable energy sector—especially solar panel frames and wind turbine components—relies on laser cutting for high-precision, high-volume fabrication. These industries will be key growth engines for laser cutting projects through 2026.

Expansion into New Materials and Hybrid Processes

Manufacturers are pushing laser cutting into advanced materials such as carbon fiber composites, ceramics, and high-temperature alloys used in aerospace and defense. Additionally, hybrid manufacturing—combining laser cutting with additive manufacturing or bending in a single workstation—is emerging as a trend to reduce process steps and improve throughput.

Sustainability and Energy Efficiency Focus

Environmental regulations and corporate sustainability goals are pushing manufacturers toward energy-efficient laser systems. Fiber lasers, with higher wall-plug efficiency compared to CO₂ lasers, will continue to capture market share. Closed-loop material handling and recycling of offcuts will become standard in laser cutting operations, aligning with circular economy principles.

Regional Shifts and Market Consolidation

Asia-Pacific, led by China, India, and Southeast Asia, will remain the fastest-growing region due to expanding manufacturing infrastructure and government support for advanced technologies. Meanwhile, North America and Europe will focus on high-value, precision applications. Market consolidation is expected as major players acquire niche technology firms to enhance software capabilities and expand service offerings.

In summary, by 2026, laser cutting projects will be characterized by smarter, faster, and more adaptable systems serving high-growth industries with a strong emphasis on precision, automation, and sustainability.

Common Pitfalls in Sourcing Laser Cutting Projects (Quality, IP)

Sourcing laser cutting services can offer precision and efficiency, but it comes with significant risks if not managed carefully. Two of the most critical areas where issues arise are quality control and intellectual property (IP) protection. Overlooking these can lead to costly delays, legal disputes, or compromised product integrity.

Quality-Related Pitfalls

Inconsistent Material and Tolerance Standards

One of the most frequent quality issues stems from unclear or unverified material specifications and tolerance expectations. Different laser cutting providers may use varying grades of material or interpret technical drawings differently, leading to parts that don’t meet functional or assembly requirements. Without defined quality benchmarks (e.g., ISO 2768 for general tolerances), inconsistencies across production batches are likely.

Lack of Pre-Production Validation

Skipping prototype runs or first-article inspections (FAI) increases the risk of receiving flawed final products. Without verifying cut accuracy, edge quality, and dimensional consistency upfront, errors may only surface during assembly—resulting in rework or scrap.

Poor Edge Quality and Surface Finish

Laser cutting can produce burrs, dross (resolidified slag), or heat-affected zones (HAZ), especially with lower-quality equipment or improper settings. If the supplier lacks process optimization or post-processing (e.g., deburring), the final parts may require additional finishing, increasing costs and lead times.

Inadequate Quality Control Processes

Many suppliers—especially lower-cost or overseas vendors—may lack robust QC protocols such as documented inspection reports, statistical process control (SPC), or in-process checks. Relying solely on final visual inspection is insufficient for precision parts.

Intellectual Property (IP) Risks

Unprotected Design Files

Sharing CAD or DXF files with suppliers without proper agreements exposes your designs to theft or unauthorized replication. Files can be copied, reverse-engineered, or sold to competitors, particularly in regions with weak IP enforcement.

Lack of Confidentiality Agreements (NDAs)

Engaging suppliers without a signed NDA leaves your designs legally unprotected. Even with an NDA, vague language or jurisdictional limitations may render it unenforceable, especially when sourcing internationally.

Unauthorized Production or Overruns

Some suppliers may produce more parts than ordered and sell the excess to third parties. Without strict contractual terms and audit rights, detecting such violations is difficult, leading to market dilution or counterfeit products.

Tooling and Fixture Ownership Ambiguity

Custom jigs, fixtures, or cutting programs developed for your project may be retained or reused by the vendor unless ownership is clearly defined in the contract. This can restrict your ability to switch suppliers or scale production efficiently.

Mitigation Strategies

To avoid these pitfalls, establish clear technical specifications, require sample approvals, and conduct factory audits when possible. Legally, always use robust NDAs, define IP ownership in contracts, and consider watermarking or encrypting design files. Regular communication and ongoing supplier evaluation are essential to maintaining both quality and IP security.

Logistics & Compliance Guide for Laser Cutting Projects

Project Planning and Design Compliance

Ensure all laser cutting designs adhere to material-specific guidelines and safety standards. Use CAD software compatible with your laser cutter (e.g., AutoCAD, SolidWorks, or Adobe Illustrator) and confirm file formats (typically DXF, SVG, or PDF) are accepted by the machine. Verify design dimensions, tolerances, and kerf allowances to prevent fitment issues. Conduct a design review to eliminate sharp internal corners, unsupported sections, and overly intricate features that may compromise structural integrity or increase processing time.

Material Selection and Safety Regulations

Choose materials appropriate for laser cutting and compliant with fire, fume, and toxicity regulations. Avoid materials containing chlorine (e.g., PVC, vinyl) or halogenated flame retardants, as they release hazardous gases (e.g., hydrochloric acid) when laser-cut. Use only laser-safe materials such as acrylic (PMMA), wood (plywood, MDF), leather, fabric, and select metals (with appropriate laser systems). Confirm material certifications (e.g., RoHS, REACH) if required for end-use applications, especially in consumer products or medical devices.

Workplace Safety and Equipment Standards

Comply with OSHA (or local equivalent) safety regulations for laser operation. Ensure laser cutters are installed in well-ventilated areas with proper fume extraction systems certified to capture particulates and volatile organic compounds (VOCs). Install protective enclosures, emergency stop buttons, and interlocks. Operators must wear appropriate PPE, including laser safety goggles rated for the specific laser wavelength (e.g., 10.6 µm for CO₂ lasers). Maintain up-to-date machine maintenance logs and safety training records for all personnel.

Documentation and Regulatory Compliance

Maintain detailed project documentation, including cutting parameters (power, speed, frequency), material batch numbers, and safety data sheets (SDS). For commercial or export projects, ensure compliance with international standards such as CE (Europe), FCC (USA), or ISO 9073 (for laser safety). If producing regulated items (e.g., medical, aerospace), follow industry-specific quality management systems (e.g., ISO 13485, AS9100) and maintain traceability throughout production.

Shipping and Handling Logistics

Package laser-cut components to prevent scratches, warping, or contamination during transit. Use anti-static materials for electronics-related parts and moisture barriers for hygroscopic materials like wood. Clearly label packages with handling instructions (e.g., “Fragile,” “This Side Up”) and include a packing slip with project ID, part numbers, and quantity. For international shipments, prepare accurate customs documentation and verify compliance with import regulations regarding material origin and treatment (e.g., ISPM 15 for wood packaging).

Environmental and Disposal Compliance

Manage waste materials according to local environmental regulations. Collect and dispose of cutting residue (e.g., acrylic dust, wood chaff) in sealed containers to prevent airborne contamination. Recycle scrap materials whenever possible. For hazardous waste (e.g., from coated or treated metals), use licensed disposal services and maintain disposal records. Regularly inspect and service exhaust filtration systems to ensure emissions remain below permissible levels.

Quality Control and Traceability

Implement a quality assurance process including pre-cut inspection, in-process monitoring, and post-cut verification. Use measurement tools (calipers, micrometers) and inspection checklists to confirm dimensional accuracy and edge quality. Tag or label parts with batch identifiers to ensure traceability. Document any non-conformances and corrective actions taken, especially for projects requiring audit trails or certification.

In conclusion, sourcing laser cutting projects requires a strategic approach that balances cost, quality, precision, and turnaround time. By clearly defining project specifications, researching and vetting reliable suppliers, and leveraging both local and global manufacturing capabilities, businesses can achieve efficient and high-quality results. Evaluating factors such as material compatibility, machine capabilities, lead times, and communication effectiveness ensures smoother collaboration and successful project outcomes. Additionally, building strong relationships with trusted service providers enables long-term scalability and adaptability in dynamic markets. With the right sourcing strategy, laser cutting can be a powerful tool for prototyping, small-batch production, and custom fabrication across diverse industries.