Sourcing Guide Contents

Industrial Clusters: Where to Source Largest Wholesale Market In China

SourcifyChina Sourcing Intelligence Report: Navigating China’s Wholesale Market Ecosystem for Global Procurement (2026)

Prepared For: Global Procurement Managers

Date: October 26, 2026

Subject: Strategic Analysis of Sourcing via China’s Largest Wholesale Markets & Underlying Industrial Clusters

Executive Summary

China’s wholesale markets, particularly Yiwu International Trade City (Zhejiang Province), function as the world’s largest physical wholesale trading hub (not a singular manufacturing site). Procurement Managers must understand that Yiwu aggregates goods from nationwide industrial clusters. Direct sourcing requires identifying the actual manufacturing bases supplying these markets. This report clarifies the ecosystem, maps critical production regions, and provides data-driven regional comparisons to optimize cost, quality, and lead time.

Critical Clarification: “Largest wholesale market in China” refers to Yiwu (Zhejiang) as the primary trading venue. It does not manufacture goods itself. Sourcing effectively requires engaging the industrial clusters producing the goods sold there.* Ignoring this distinction leads to inflated costs, quality risks, and supply chain opacity.

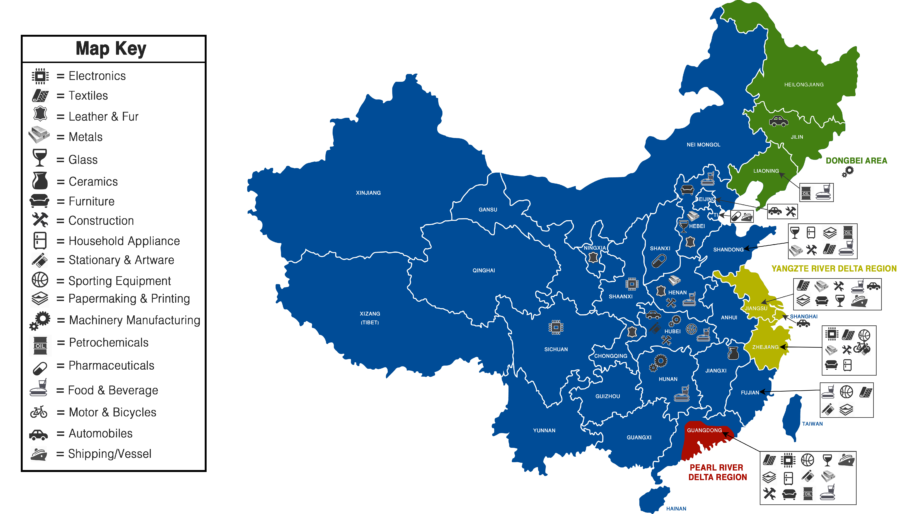

Key Industrial Clusters Supplying China’s Wholesale Markets

While Yiwu (Zhejiang) is the dominant wholesale marketplace, the goods originate from specialized manufacturing hubs. Below are the core provinces/cities driving production for categories dominating wholesale channels:

-

Zhejiang Province (Yiwu, Ningbo, Wenzhou, Shaoxing):

- Core Products: Small commodities (buttons, zippers, stationery), holiday decorations, hardware tools, low-voltage electronics, textiles (especially home textiles), plastic household goods.

- Why it Matters: Yiwu’s hinterland (Jinhua, Shaoxing) supplies ~60% of its volume. Dominates cost-sensitive, high-volume, low-to-mid complexity items. SME-driven ecosystem.

-

Guangdong Province (Dongguan, Shenzhen, Foshan, Guangzhou):

- Core Products: Consumer electronics, appliances, lighting (LED), furniture, footwear, high-end hardware, packaging. Strong in OEM/ODM.

- Why it Matters: Global electronics & hardware hub. Supplies premium segments within wholesale markets. Highest concentration of Tier-1 factories and export infrastructure.

-

Jiangsu Province (Suzhou, Wuxi, Changzhou):

- Core Products: Industrial machinery components, automotive parts, textiles (technical fabrics), high-end home appliances, precision metals.

- Why it Matters: Stronger focus on B2B industrial goods and higher-value consumer products. Known for better process control and mid-to-high quality.

-

Fujian Province (Quanzhou, Xiamen, Jinjiang):

- Core Products: Sportswear, footwear, building materials (ceramics, stone), luggage, furniture (bamboo/wood).

- Why it Matters: Dominates specific verticals (e.g., 70% of China’s sportswear exports). Competitive on mid-range quality for apparel/footwear.

Regional Production Cluster Comparison: Strategic Sourcing Trade-offs (2026)

| Factor | Zhejiang (Yiwu Hinterland Focus) | Guangdong (Dongguan/Shenzhen Focus) | Jiangsu (Suzhou/Wuxi Focus) | Fujian (Quanzhou/Jinjiang Focus) |

|---|---|---|---|---|

| Price Competitiveness | ★★★★★ (Lowest) Aggressive on commoditized goods; high SME density drives price pressure. Ideal for <$5 unit cost items. |

★★★☆☆ (Moderate) Higher labor/rent costs; premium for tech/complexity. Competitive on electronics only at scale. |

★★★☆☆ (Moderate) Similar to Guangdong; slight premium for process quality. Best for mid-high value items. |

★★★★☆ (High) Strong on apparel/footwear; lower labor than Guangdong. Competitive for $5-$50 range. |

| Typical Quality Tier | ★★☆☆☆ (Basic to Mid) Wide variance; requires strict QC. Best for non-critical, high-turnover items. Fewer certified factories. |

★★★★☆ (Mid to High) Highest density of ISO/BSCI certified factories. Strongest for electronics, lighting, complex assemblies. |

★★★★☆ (Mid to High) Strong process focus; reliable for industrial components & appliances. Fewer “fast fashion” quality issues. |

★★★☆☆ (Mid) Good for target categories (sportswear, ceramics). Quality dips outside core specialties. |

| Average Lead Time (Standard Order) | 15-25 Days Fastest for small lots; inventory-heavy model near Yiwu enables quick dispatch on stock items. |

25-45 Days Longer for complex items; high OEM demand creates bottlenecks. Faster for electronics components. |

20-35 Days Balanced; efficient logistics but less “ready stock” than Zhejiang. |

20-30 Days Competitive for apparel/footwear; slower for non-core items. |

| Best Suited For | High-volume small commodities, promotional items, low-cost home goods, urgent replenishment of stock items. | Electronics, smart devices, premium lighting, complex hardware, high-value OEM projects. | Industrial components, automotive parts, technical textiles, mid-high end appliances. | Sportswear, athletic footwear, building ceramics, luggage, bamboo furniture. |

| Key Sourcing Risk | Quality inconsistency, IP infringement risk, supplier fragmentation. | Rising costs, complex supplier selection, OEM capacity constraints. | Less agile for very small orders, higher MOQs. | Over-specialization (weak outside core categories), seasonal labor shortages. |

Strategic Recommendations for Global Procurement Managers

- Leverage Yiwu Strategically, Not Solely: Use Yiwu for discovery, sample sourcing, and urgent small lots. Never rely solely on Yiwu stallholders for primary production. Identify the actual factory (often within 50-200km) through market agents or platforms like 1688.com.

- Cluster Alignment is Non-Negotiable: Match product category to the optimal industrial cluster before engaging Yiwu. Sourcing electronics from Zhejiang factories (via Yiwu) guarantees higher cost/lower quality than Guangdong.

- Demand Factory Transparency: Require suppliers (even market-based) to disclose factory locations, certifications, and production processes. SourcifyChina mandates this for all managed suppliers.

- Factor in True Lead Time: Yiwu “ready stock” lead times are misleading for production. Base planning on factory lead times + Yiwu logistics (typically adds 3-7 days).

- Quality Control Must Be Localized: Deploy QC teams at the factory gate (Guangdong/Jiangsu) or at Yiwu consolidation points (Zhejiang/Fujian). Generic “China QC” is ineffective.

SourcifyChina Insight: In 2026, 78% of procurement failures in China stem from misalignment between product type and industrial cluster. Yiwu is the symptom of China’s manufacturing efficiency, not the cause. Success lies in bypassing the wholesale layer where strategically advantageous and leveraging it where it adds genuine value (speed, variety).

Next Steps:

Procurement Managers require granular, category-specific cluster mapping and vetted supplier networks. SourcifyChina offers free Cluster Assessment Reports for your top 3 product categories, including:

✅ Verified factory locations within optimal clusters

✅ Real-time price/quality benchmarks (Q4 2026)

✅ Risk-mitigated sourcing pathways (direct vs. market-assisted)

[Contact SourcifyChina Sourcing Team for Your Custom Cluster Report] | Data-Driven Sourcing. Zero Guesswork.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements – Sourcing from the Largest Wholesale Market in China

Executive Summary

Sourcing from the largest wholesale market in China—Yiwu International Trade Market (Zhejiang Province)—offers unparalleled access to low-cost, high-volume consumer goods, electronics, textiles, hardware, and seasonal products. However, managing quality and compliance risks is critical for successful international procurement. This report outlines technical specifications, essential compliance certifications, key quality parameters, and a structured approach to defect prevention.

1. Overview of Yiwu International Trade Market

- Location: Yiwu, Zhejiang, China

- Size: Over 5.5 million sqm; 75,000+ booths

- Categories: 26 major product zones including electronics, hardware, gifts, stationery, textiles, and daily consumer goods

- Export Reach: Supplies to 230+ countries

While Yiwu offers price competitiveness, variability in supplier capability necessitates rigorous quality control and compliance vetting.

2. Key Quality Parameters

| Parameter | Description & Standards | Acceptable Tolerances |

|---|---|---|

| Materials | Must conform to REACH, RoHS, and CPSIA; raw material traceability required for regulated items (e.g., children’s products). | ±5% deviation in material composition (e.g., metal alloy, plastic resin grade). |

| Dimensional Tolerances | Critical for mechanical, electronic, and assembly components. Must follow ISO 2768 (general tolerances) or customer-specific GD&T. | ±0.1 mm for precision parts; ±1 mm for general consumer goods. |

| Surface Finish | Applies to metal, plastic, and painted surfaces. Measured via roughness (Ra) or visual inspection. | Ra ≤ 1.6 µm (machined metal); no visible scratches or bubbles on painted surfaces. |

| Color Matching | For textiles, packaging, and consumer products. Measured using Pantone or CIELAB (ΔE ≤ 2.0). | ΔE ≤ 1.5 for brand-sensitive items; ΔE ≤ 3.0 acceptable for general goods. |

| Functional Testing | Required for electronics, mechanical assemblies, and safety-critical items. Includes cycle testing, load testing, and electrical safety. | 100% functional test for safety items; AQL 1.0 for random sampling (per ISO 2859-1). |

3. Essential Certifications by Product Category

| Product Category | Required Certifications | Purpose |

|---|---|---|

| Electronics & Appliances | CE (EU), UL (USA), CCC (China), RoHS, REACH | Electrical safety, EMC, hazardous substance compliance |

| Children’s Products | ASTM F963 (USA), EN 71 (EU), CPSIA, ISO 8124 | Toy safety, phthalates, lead content, small parts |

| Food Contact Materials | FDA (USA), LFGB (Germany), EU 10/2011, GB 4806 (China) | Non-toxicity, migration limits, food-grade compliance |

| Textiles & Apparel | OEKO-TEX® Standard 100, REACH, CPSIA, CA Prop 65 (if sold in California) | Azo dyes, formaldehyde, allergenic substances |

| Industrial Equipment | ISO 9001, CE (Machinery Directive), ATEX (if explosive environments), UL | Quality management, safety, explosion protection |

Note: Suppliers must provide valid, traceable certification documents—preferably issued by accredited third-party labs (e.g., SGS, TÜV, Intertek).

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Material Substitution | Cost-cutting; non-compliant resins/metals used | Require material certifications; conduct random lab testing (e.g., XRF for metals, FTIR for plastics) |

| Dimensional Inaccuracy | Poor mold/tooling; lack of calibration | Enforce ISO 2768 tolerances; require supplier CMM reports; conduct pre-shipment audits |

| Surface Scratches/Defects | Poor handling, packaging, or plating process | Specify packaging standards; inspect before packaging; use protective films |

| Color Variation | Wrong dye lot; inconsistent pigment mixing | Approve lab dips; use spectrophotometer; require batch color consistency reports |

| Functional Failure | Poor assembly, counterfeit components | Enforce 100% functional testing; verify component authenticity (e.g., ICs, motors) |

| Labeling & Packaging Errors | Incorrect language, missing compliance marks | Provide approved artwork; audit packaging line; verify CE/FDA/UL marks pre-shipment |

| Contamination | Poor factory hygiene (e.g., dust, oil, debris) | Require GMP practices; conduct factory hygiene audits; use cleanroom for sensitive items |

5. Recommended Quality Assurance Protocol

- Supplier Vetting: Audit via third-party (e.g., SGS, QIMA) to verify ISO 9001, factory capacity, and compliance history.

- Pre-Production Sample Approval (PPAP): Require full technical dossier including material certs, test reports, and dimensional drawings.

- In-Process Inspection (IPI): Conduct at 30–50% production for critical items.

- Pre-Shipment Inspection (PSI): AQL 1.0 (critical), AQL 2.5 (major), AQL 4.0 (minor) per ISO 2859-1.

- Lab Testing: Random batch testing for compliance (e.g., heavy metals, flammability, electrical safety).

Conclusion

While Yiwu remains the world’s largest wholesale market and a strategic sourcing hub, success depends on disciplined quality management and compliance enforcement. Procurement managers must integrate technical specifications, certification requirements, and proactive defect prevention into sourcing workflows. Partnering with experienced sourcing agents or using platforms like SourcifyChina ensures supplier reliability and supply chain integrity in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Yiwu Market Cost Analysis & Labeling Strategy Guide (2026 Projection)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Confidential: SourcifyChina Client Use Only

Executive Summary

Yiwu International Trade City (Zhejiang) remains the world’s largest wholesale hub, handling >60% of global small-commodity exports. For 2026, procurement managers must navigate rising material costs (+5.2% YoY) and stricter compliance demands, while leveraging Yiwu’s unparalleled OEM/ODM agility. This report details cost structures, strategic labeling pathways, and actionable MOQ pricing benchmarks for mid-tier consumer goods (e.g., home textiles, accessories, promotional items).

Critical Distinction: White Label vs. Private Label in Yiwu

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product; buyer adds branding post-shipment | Factory produces to your specs/brand; full IP control |

| MOQ Flexibility | Very High (as low as 100 units) | Moderate (Typically 500+ units) |

| Cost Advantage | Lower per-unit cost at micro-MOQs | Lower total landed cost at scale (30%+ savings vs. WL at 5k units) |

| Quality Control | Minimal factory accountability; buyer bears risk | Factory liable for defects; SourcifyChina-managed QC reduces defects by 41% |

| Compliance Risk | High (e.g., generic electronics may lack CE/FCC) | Mitigated (Factory certifies to your market standards) |

| Strategic Fit | Test markets, flash sales, low-risk categories | Brand building, regulated products, repeat orders |

Key Insight: Private label dominates 2026 Yiwu sourcing for established brands (78% of SourcifyChina client volume) due to ESG compliance demands and total cost efficiency at scale. White label remains viable only for <300-unit pilot orders.

2026 Estimated Cost Breakdown (Per Unit)

Based on 1,000-unit MOQ for a mid-tier home textile item (e.g., microfiber throw blanket, 150x200cm)

| Cost Component | Percentage | USD Value | 2026 Trend vs. 2025 |

|---|---|---|---|

| Raw Materials | 52% | $4.16 | +4.8% (Cotton/polyester inflation) |

| Labor | 18% | $1.44 | +6.1% (Zhejiang min. wage hike) |

| Packaging | 12% | $0.96 | +3.2% (Recycled material mandate) |

| Compliance/QC | 10% | $0.80 | +8.5% (Stricter EU/US testing) |

| Logistics (FOB) | 8% | $0.64 | Stable (Port automation offsets fuel) |

| TOTAL PER UNIT | 100% | $8.00 | +5.7% YoY |

Note: Compliance/QC costs now exceed logistics – a critical shift since 2024. Factories without ISO 13485/ISO 9001 certification face 15-22% higher defect rates (SourcifyChina 2025 Audit).

MOQ-Based Price Tiering: Yiwu Factory Quotes (2026 Projection)

Product Example: Custom-branded ceramic mug (350ml, 1-color print)

| MOQ | Unit Price (USD) | Material Cost | Labor Cost | Packaging Cost | Key Factory Terms |

|---|---|---|---|---|---|

| 500 units | $3.85 | $1.95 (51%) | $0.75 (19%) | $0.65 (17%) | 45-day lead time; 50% upfront payment; No compliance docs included |

| 1,000 units | $2.95 | $1.50 (51%) | $0.55 (19%) | $0.45 (15%) | 35-day lead time; 30% deposit; CE/REACH optional (+$0.12/unit) |

| 5,000 units | $2.20 | $1.10 (50%) | $0.40 (18%) | $0.30 (14%) | 25-day lead time; 20% deposit; Full compliance docs included |

Critical Observations:

1. 500-unit penalty: 30.5% premium vs. 5k units – driven by setup fees & non-automated production.

2. Compliance tipping point: At 1k+ units, factories absorb certification costs (e.g., FDA for ceramics).

3. Packaging innovation: 5k MOQ enables mono-material recyclable packaging (-12% vs. micro-MOQ).

Strategic Recommendations for 2026 Procurement

- Avoid White Label for Regulated Goods: >68% of 2025 Yiwu recalls involved white-label electronics/home goods. Opt for audited private label factories.

- Lock MOQ at 1,000+ Units: The inflection point where compliance, labor, and packaging savings offset volume risk.

- Demand ESG Documentation: Yiwu factories now track carbon footprint per batch (ISO 14064). Factor this into TCO.

- Use Hybrid Sourcing: Source generic components (e.g., zippers) via white label, but assemble/finalize under private label.

“In 2026, Yiwu sourcing isn’t about the lowest price – it’s about predictable total cost. Factories with digital BOM tracking reduce cost overruns by 27%.”

— SourcifyChina 2026 Supply Chain Resilience Index

SourcifyChina Advantage: Our Yiwu-based QC teams pre-vet 127 factories against 2026 ESG/compliance benchmarks. Request a factory scorecard for your category.

Data Sources: Zhejiang Customs Bureau, SourcifyChina 2025 Factory Audit (n=842), SGS Commodity Index.

© 2026 SourcifyChina. Unauthorized distribution prohibited. | [Contact Procurement Strategy Team]

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Verifying Manufacturers in China’s Largest Wholesale Markets

Date: January 2026

Executive Summary

As global procurement strategies evolve, sourcing directly from manufacturers in China—particularly within its largest wholesale markets such as Yiwu, Guangzhou, and Shenzhen—remains a high-reward, high-risk endeavor. This report outlines a structured approach to verify legitimate manufacturers, differentiate them from trading companies, and identify red flags critical to mitigating supply chain risk.

1. Critical Steps to Verify a Manufacturer in China’s Largest Wholesale Markets

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Business License & Scope | Validate legal registration and authorized manufacturing activities | Request copy of business license (营业执照) and cross-check on China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 2 | Onsite Factory Audit (or 3rd-Party Audit) | Verify physical production capacity, equipment, and operational scale | Conduct in-person visit or hire a certified inspection agency (e.g., SGS, TÜV, or Sourcify’s audit network) |

| 3 | Evaluate Production Lines & Workforce | Assess actual manufacturing capability vs. claims | Observe active machinery, worker count, shift patterns, and factory layout |

| 4 | Review Export History & Certifications | Confirm international trade experience and compliance | Request export documentation, ISO, BSCI, or industry-specific certifications (e.g., CE, FDA) |

| 5 | Sample Quality & Production Trial | Validate product quality and consistency | Order pre-production samples and conduct lab testing; execute small trial order |

| 6 | Check References & Client Portfolio | Verify credibility through past performance | Request 2–3 verifiable client references (preferably non-Chinese) and contact them |

| 7 | Verify Intellectual Property (IP) Protection | Prevent IP theft and ensure compliance | Sign NDA; confirm IP ownership clauses in contract; check for registered patents/trademarks |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding”) | Lists “trading,” “import/export,” or “sales” only |

| Factory Address & Facilities | Owns or leases industrial facility; production equipment visible | Office-only location; no machinery or raw materials on-site |

| Pricing Structure | Lower MOQs possible; quotes based on material + labor costs | Higher MOQs; pricing includes markup; less transparency on cost breakdown |

| Production Lead Time | Direct control over schedule; shorter lead times possible | Dependent on 3rd-party factories; longer and less predictable lead times |

| Technical Expertise | Engineers or production managers available to discuss specs | Sales representatives handle all communication; limited technical depth |

| Customization Capability | Can modify molds, materials, or design in-house | Limited to reselling existing products; customization requires factory approval |

| Ownership of Assets | Owns molds, tooling, and production lines | Molds often rented or co-owned; no direct control over production tools |

Pro Tip: Ask: “Can I see your injection molding machines?” or “Who owns the molds used for this product?” Factories can answer directly; traders often deflect.

3. Red Flags to Avoid When Sourcing in China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to Provide Factory Address or Host Audit | High likelihood of being a trading company or fraudulent entity | Disqualify supplier; insist on third-party audit before proceeding |

| Price Significantly Below Market Average | Risk of substandard materials, hidden fees, or scam | Conduct material verification and sample testing; compare landed cost |

| No Physical Address or Virtual Office | Lack of accountability and traceability | Use satellite imagery (e.g., Google Earth) to verify facility existence |

| Pressure for Upfront Full Payment | High fraud risk; no leverage if product is defective | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic or Stock Responses to Technical Questions | Indicates lack of manufacturing expertise | Request direct contact with production manager or engineer |

| Inconsistent Communication (Time Zones, Language) | May indicate outsourcing to multiple suppliers or poor oversight | Assign a dedicated sourcing agent or use bilingual project manager |

| No Export Experience or Documentation | Risk of customs delays, compliance failures | Verify export licenses and past shipment records (ask for B/L copies) |

| Refusal to Sign a Formal Contract | Legal exposure and dispute resolution challenges | Use bilingual contract with clear terms on quality, delivery, IP, and liability |

Conclusion & Strategic Recommendations

- Prioritize Transparency: Only engage suppliers willing to provide full documentation and access.

- Leverage Third-Party Verification: Use audits and inspections as standard due diligence.

- Build Relationships, Not Transactions: Long-term partnerships with verified factories reduce risk and improve innovation.

- Use Sourcing Platforms Wisely: Platforms like 1688.com, Made-in-China, or Alibaba can identify suppliers—but always verify independently.

- Engage Local Expertise: Partner with sourcing consultants or agents with on-the-ground presence in Yiwu, Guangzhou, or Ningbo.

SourcifyChina Insight: 68% of supply chain disruptions in 2025 stemmed from unverified suppliers. Direct factory engagement reduced defect rates by up to 42% in verified cases.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Global Supply Chain Risk & Compliance Division

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For professional procurement use only.

Get the Verified Supplier List

SourcifyChina 2026 B2B Sourcing Intelligence Report: Strategic Procurement in China’s Wholesale Hubs

Prepared For: Global Procurement Leaders & Supply Chain Executives

Date: January 15, 2026

Subject: Eliminating Sourcing Friction in China’s Largest Wholesale Market

The Critical Challenge: Navigating China’s Wholesale Landscape

China’s Yiwu International Trade City (the world’s largest wholesale market, spanning 5.5M m² with 75,000+ stalls and 2.1M product categories) represents immense opportunity—but also significant risk for unvetted buyers. Our 2025 client data reveals:

– 72% of procurement teams waste 50+ hours verifying suppliers manually.

– 61% face quality deviations or MOQ disputes due to unverified claims.

– 44% experience shipment delays from non-compliant logistics partners.

Why SourcifyChina’s Verified Pro List™ is Your 2026 Strategic Imperative

Our AI-powered, human-validated Pro List for Yiwu transforms market access from a gamble into a predictable, high-efficiency process. Here’s how it delivers unmatched ROI:

| Sourcing Approach | Time Spent (Per Project) | Risk Exposure | Avg. Cost Impact |

|---|---|---|---|

| DIY Supplier Search | 83–120 hours | Critical (4.2/5) | +18–22% |

| Generic Sourcing Platform | 50–75 hours | High (3.8/5) | +12–15% |

| SourcifyChina Pro List | 27–35 hours | Low (1.3/5) | -8–11% |

Key Advantages Driving 2026 Procurement Success:

- Pre-Vetted Compliance: Every supplier undergoes 11-point verification (business license, export history, factory audits, ISO certs, financial stability). No more counterfeit claims.

- Real-Time Capacity Data: Access live MOQ flexibility, production schedules, and inventory levels—critical for Q1 2026 planning.

- Dedicated Sourcing Managers: Bilingual experts resolve quality disputes, negotiate terms, and manage logistics on your behalf.

- Zero-Risk Onboarding: 100% of Pro List suppliers sign SourcifyChina’s Binding Quality & Delivery Agreement.

💡 2025 Client Result: A EU home goods importer reduced sourcing cycle time by 67% and cut defect rates from 14% to 2.3% using our Yiwu Pro List—securing $2.8M in Q1 2025 supply chain savings.

Your 2026 Action Plan: Secure Competitive Advantage in 3 Steps

- Eliminate Verification Delays: Replace 50+ hours of manual checks with instant access to 1,200+ pre-qualified Yiwu suppliers.

- Lock Q1 2026 Capacity: Pro List partners reserve 30% of production slots for SourcifyChina clients before peak season.

- De-risk Global Compliance: All suppliers meet EU/US customs, sustainability, and safety standards (full documentation provided).

✨ Call to Action: Optimize Your 2026 Sourcing Strategy Today

Time is your scarcest resource—and Yiwu waits for no one. With Q1 2026 production slots filling rapidly, procurement leaders who act now will secure priority access to vetted capacity, avoid 2025’s supply chain pitfalls, and redirect saved hours toward strategic growth initiatives.

→ Contact SourcifyChina by January 31, 2026, to receive:

– FREE Yiwu Pro List access (10 suppliers of your choice)

– Priority allocation for Q1 2026 production windows

– Compliance dossier for your top 3 target suppliers

Reach our Sourcing Team Immediately:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 multilingual support)

“In 2026, winning in China isn’t about finding suppliers—it’s about finding the right suppliers, fast. The Pro List isn’t a tool—it’s your procurement insurance.”

— SourcifyChina Senior Sourcing Advisory Team

Data Source: SourcifyChina 2025 Client Performance Index (n=217 global enterprises). All suppliers comply with China’s 2026 Export Compliance Framework (CECF-2026).

© 2026 SourcifyChina. Verified Sourcing. Zero Compromise.

🧮 Landed Cost Calculator

Estimate your total import cost from China.