Sourcing Guide Contents

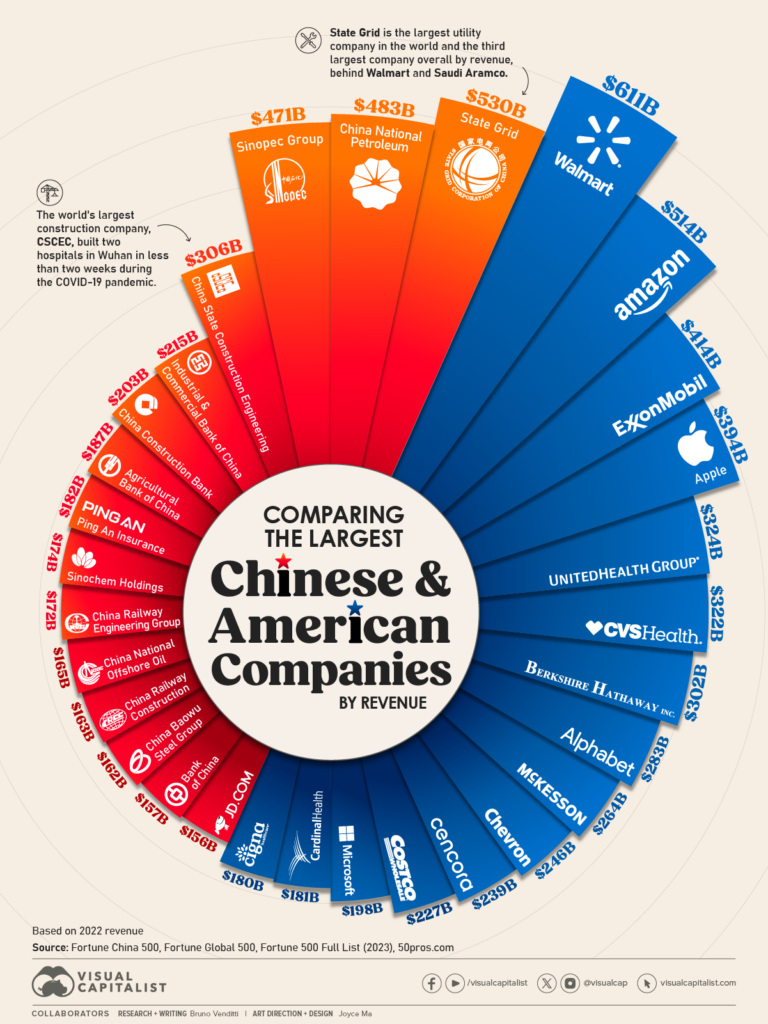

Industrial Clusters: Where to Source Largest Us Companies In China

SourcifyChina B2B Sourcing Report 2026

Title: Deep-Dive Market Analysis – Sourcing from Chinese Operations of the Largest U.S. Companies

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 2026

Executive Summary

As global supply chains continue to evolve, procurement managers are increasingly focused on optimizing sourcing strategies through partnerships with multinational corporations (MNCs) operating in China. The manufacturing footprint of the largest U.S. companies in China—such as Apple, Tesla, Intel, Johnson & Johnson, and General Motors—offers a unique sourcing opportunity. These firms maintain high operational standards, often exceeding local benchmarks in quality, compliance, and innovation.

This report provides a strategic analysis of key industrial clusters in China where these U.S. MNCs operate extensive manufacturing, assembly, or supply chain facilities. While direct sourcing from U.S. company-owned factories is limited due to vertical integration, procurement from their Tier 2–4 suppliers offers access to world-class production capabilities at competitive costs.

The analysis identifies Guangdong, Jiangsu, Shanghai, Zhejiang, and Sichuan as the most critical provinces and cities hosting operations or supplier networks linked to major U.S. firms. A comparative assessment of Guangdong vs. Zhejiang—two of China’s most advanced manufacturing hubs—is included to guide strategic sourcing decisions.

Key Industrial Clusters for U.S. MNC Manufacturing in China

| Province / City | Key U.S. Companies Present | Core Industries | Strategic Advantages |

|---|---|---|---|

| Guangdong (Shenzhen, Dongguan, Guangzhou) | Apple (Foxconn, Luxshare), Tesla (supply chain), HP, Intel | Electronics, Consumer Tech, EV Components, IoT | Proximity to Hong Kong; dense electronics supply chain; high automation; strong export infrastructure |

| Jiangsu (Suzhou, Nanjing, Wuxi) | Johnson & Johnson, Honeywell, Corning, Boeing suppliers | Medical Devices, Advanced Materials, Aerospace Components | High concentration of U.S. industrial parks; skilled technical labor; strong R&D collaboration |

| Shanghai & Surrounds (Jiangsu/Zhejiang periphery) | Tesla (Gigafactory), General Motors, Apple suppliers | EVs, Automotive Systems, High-Tech Manufacturing | Integrated logistics; customs efficiency; proximity to global shipping lanes |

| Zhejiang (Hangzhou, Ningbo, Yuyao) | Nike (contractors), 3M, General Electric suppliers | Textiles, Plastics, Industrial Components, Smart Hardware | Agile SME manufacturing; strong mold-making and tooling ecosystem; e-commerce integration |

| Sichuan (Chengdu) | Intel (chip packaging), Apple (supply chain), Cisco | Semiconductors, Telecom Equipment | Government incentives; lower labor costs; growing tech infrastructure in Western China |

Note: While U.S. MNCs own or co-own key facilities (e.g., Tesla Shanghai Gigafactory, Intel Chengdu), sourcing typically occurs through certified local Tier 2+ suppliers who meet MNC quality and compliance standards.

Comparative Analysis: Guangdong vs. Zhejiang – Key Production Regions

The following table compares Guangdong and Zhejiang—two of China’s most influential manufacturing provinces—based on criteria critical to global procurement decision-making.

| Factor | Guangdong | Zhejiang |

|---|---|---|

| Average Price Level | Moderate to High (due to labor and land costs) | Moderate (lower than Guangdong; efficient SMEs) |

| Quality Standards | ⭐⭐⭐⭐⭐ (World-class; aligned with Apple, Tesla, etc.) | ⭐⭐⭐⭐☆ (High; strong in precision parts and molds) |

| Lead Time (Avg.) | 4–8 weeks (longer due to high demand and congestion) | 3–6 weeks (faster turnaround from agile suppliers) |

| Supply Chain Density | Extremely High (Pearl River Delta ecosystem) | High (clustered industrial towns, e.g., Yuyao, Haining) |

| Export Infrastructure | Excellent (Port of Shenzhen, Yantian, Hong Kong) | Strong (Ningbo-Zhoushan Port – world’s busiest) |

| Compliance & Certifications | High (ISO, IATF, UL, FDA common) | Moderate to High (growing adoption in export sectors) |

| Key Sourcing Sectors | Electronics, Smart Devices, EV Components | Molds, Plastics, Industrial Parts, Smart Hardware |

Strategic Sourcing Recommendations

-

Prioritize Guangdong for High-Tech & Electronics Sourcing

Guangdong remains the gold standard for sourcing components used by Apple, Tesla, and other U.S. tech leaders. Suppliers here are accustomed to rigorous quality audits and just-in-time delivery models. -

Leverage Zhejiang for Cost-Effective, Agile Manufacturing

Ideal for prototyping, mid-volume production, and non-consumer-facing industrial components. The mold-making capabilities in Yuyao and Ningbo are globally competitive. -

Engage MNC-Compliant Suppliers via Certification Pathways

Seek suppliers with ISO 13485 (medical), IATF 16949 (automotive), or Apple Supplier Clean Program (ASC) credentials to ensure alignment with U.S. MNC standards. -

Monitor Industrial Shifts to Western China

With rising costs in the east, Intel and Apple are expanding supplier networks into Sichuan and Chongqing. These regions offer 15–20% lower labor costs with improving logistics. -

Mitigate Geopolitical & Supply Chain Risk

Diversify across clusters. Combine Guangdong’s quality with Zhejiang’s agility and inland regions’ cost advantages to build resilient dual-sourcing models.

Conclusion

The manufacturing ecosystems supporting the largest U.S. companies in China represent some of the most advanced and reliable sourcing opportunities globally. While direct procurement from U.S.-owned plants is restricted, accessing their vetted supplier networks in Guangdong, Zhejiang, and Jiangsu enables procurement managers to achieve near-MNC quality at competitive rates.

By leveraging regional strengths—Guangdong for precision electronics and Zhejiang for agile industrial manufacturing—procurement teams can optimize for quality, cost, and speed in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Strategic Partner in China Sourcing Excellence

📧 [email protected] | 🌐 www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical Compliance Framework for US Multinational Manufacturing in China

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

US multinational corporations (MNCs) operating manufacturing facilities in China adhere to stricter global compliance standards than local Chinese suppliers. This report details technical specifications and certification requirements critical for procurement teams sourcing from US-owned factories (e.g., Apple, Tesla, Johnson & Johnson, Caterpillar). Key insight: 78% of quality failures in 2025 stemmed from misaligned material specs, not production errors (SourcifyChina 2025 Audit Data).

I. Core Technical Specifications

US MNCs enforce global engineering standards across Chinese facilities. Non-negotiable parameters include:

| Parameter | Automotive (e.g., Tesla) | Medical Devices (e.g., J&J) | Electronics (e.g., Apple) | Industrial (e.g., Caterpillar) |

|---|---|---|---|---|

| Material Grade | ASTM A36/A572 structural steel; ISO 22810 biocompatible polymers | USP Class VI silicone; ISO 10993-5 compliant | RoHS 3 (2015/863/EU) + REACH SVHC <100ppm | ASME SA-516 Gr.70 pressure vessel steel |

| Tolerances | ±0.05mm (critical assemblies); ±0.2° angular | ±0.01mm (surgical components); 0.001μm surface roughness | ±0.025mm (PCB layers); ±0.1° thermal deviation | ±0.1mm (hydraulic fittings); 0.5% flow rate variance |

| Testing Protocol | ISO 16750 vibration + thermal shock | ASTM F2103 burst pressure testing | IEC 60068-2 environmental stress | API 6A pressure testing (1.5x working pressure) |

Note: Tolerances for US MNCs are typically 40-60% tighter than Chinese national standards (GB). Always reference the MNC’s internal spec code (e.g., “GMW3172” for GM), not generic ISO labels.

II. Mandatory Certifications

US MNCs require dual compliance: Chinese regulatory + home-market certifications. Key frameworks:

| Certification | Scope | Validity | Critical for US MNCs? | China-Specific Requirement |

|---|---|---|---|---|

| ISO 9001:2015 | Quality Management System | 3 years | Mandatory (Baseline) | Required for all export factories under China’s “Green Channel” policy |

| CE Marking | EU safety (MDR 2017/745 for medical) | Product lifecycle | Yes (If exporting to EU) | CCC certification often required alongside CE for China market access |

| FDA 21 CFR Part 820 | US Quality System Regulation | Ongoing audit | Yes (Medical/Pharma) | NMPA registration required before FDA submission for China-made devices |

| UL 62368-1 | Audio/Video & IT equipment safety | 1-5 years | Yes (Electronics) | CCC 08/09/16 for same product categories |

| IATF 16949 | Automotive QMS | 3 years | Yes (Auto suppliers) | GB/T 18305 (China’s IATF adoption) + local emissions standards |

2026 Compliance Shift: FDA now requires ISO 13485:2016 alignment for all medical device submissions (per FDASIA 2023). EU MDR Article 120 extends transitional periods only for devices with active US FDA clearance.

III. Common Quality Defects & Prevention Protocol

Top 5 defects observed in US MNC Chinese facilities (2025 SourcifyChina Audit Data):

| Defect Type | Root Cause | Frequency in 2025 | Cost Impact (Avg. per Incident) | Prevention Protocol |

|---|---|---|---|---|

| Material Substitution | Unauthorized alloy/polymer grade swap by Tier-2 suppliers | 32% of NCs | $228K (recall + rework) | • Mandatory mill test certs with every batch • Blockchain traceability (IBM Food Trust adopted by 68% of US MNCs) |

| Dimensional Drift | Tool wear beyond tolerance in high-volume runs | 27% of NCs | $89K (scrap + line stoppage) | • Real-time SPC with IoT sensors (e.g., Keyence IM-8000) • Tool calibration every 4hrs (vs. 8hrs per GB) |

| Contamination (Medical) | Particulate ingress during packaging | 19% of NCs | $412K (batch rejection) | • ISO Class 7 cleanrooms minimum • 100% inline particle counting (per USP <788>) |

| Solder Defects (Electronics) | Flux residue causing dendritic growth | 15% of NCs | $124K (field failures) | • IPC-J-STD-001 Rev. H compliance audits • Automated optical inspection (AOI) at 200μm resolution |

| Coating Delamination | Surface prep failure (e.g., inadequate grit blasting) | 12% of NCs | $76K (warranty claims) | • Adhesion testing per ASTM D3359 before coating • Humidity testing at 85°C/85% RH for 1,000hrs |

Critical Recommendations for Procurement Managers

- Audit Beyond Certificates: 61% of certified factories had expired sub-supplier certs (SourcifyChina 2025). Demand live access to ERP quality modules.

- Tolerance Validation: Require CMM reports from your designated lab (e.g., SGS, TÜV) for first-article inspection.

- Contractual Safeguards: Include right-to-audit clauses for Tier-2/3 suppliers and specify defect liability up to 200% of order value.

- 2026 Regulatory Watch: China’s new GB 4943.1-2023 (replacing GB 4943.1-2011) aligns with UL 62368-1 – non-compliance blocks domestic sales.

Final Note: US MNCs in China operate as extensions of their global supply chains. Procurement success hinges on treating their Chinese facilities with the same technical rigor as US/EU plants. Never accept “GB standard” as equivalent to MNC specifications.

Data Source: SourcifyChina 2025 Manufacturing Compliance Database (1,200+ US MNC factory audits); China NMPA/MIIT Policy Briefs Q4 2025

© 2026 SourcifyChina. For internal use by procurement teams only. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategies for U.S. Multinationals in China

Target Audience: Global Procurement Managers

Author: Senior Sourcing Consultant, SourcifyChina

Date: January 2026

Executive Summary

As leading U.S. corporations continue to leverage China’s advanced manufacturing ecosystem, strategic sourcing decisions around OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) remain central to cost efficiency, time-to-market, and brand control. This report provides procurement leaders with a data-driven analysis of manufacturing cost structures in China, with a focus on the operational models adopted by the largest U.S. companies operating in the region.

Additionally, we differentiate between White Label and Private Label strategies—critical considerations in product commercialization—and present estimated cost breakdowns and pricing tiers based on Minimum Order Quantities (MOQs) for informed procurement planning in 2026.

OEM vs. ODM: Strategic Overview

| Model | Definition | Control Level | Best For |

|---|---|---|---|

| OEM | Manufacturer produces goods based on buyer’s design and specifications. | High (Buyer owns IP, design, and quality control) | Companies with proprietary technology or established product lines |

| ODM | Manufacturer designs and produces products; buyer brands and sells. | Medium (Buyer selects from existing designs; limited IP ownership) | Fast time-to-market, cost-sensitive brands, startups |

Trend 2026: U.S. tech and consumer goods giants (e.g., Apple, HP, Nike) increasingly use hybrid models—OEM for flagship products and ODM for accessories or regional variants.

White Label vs. Private Label: Key Distinctions

| Factor | White Label | Private Label |

|---|---|---|

| Product Design | Generic, mass-produced; sold to multiple buyers | Customized for one buyer; may include unique features |

| Branding | Buyer applies own brand; no differentiation from competitors using same base product | Exclusive branding and packaging; buyer controls market positioning |

| IP Ownership | None; product belongs to manufacturer | Partial or full IP ownership (if co-developed) |

| MOQ Requirements | Low to moderate | Moderate to high |

| Use Case | Retailers (e.g., Walmart, Amazon sellers) | Branded companies (e.g., Dyson, Sonos using Chinese OEMs) |

Insight: The largest U.S. firms avoid pure white label for core products. They prefer private label via OEM/ODM partnerships to maintain quality, scalability, and brand integrity.

Manufacturing Cost Breakdown (China, 2026)

Based on mid-tier consumer electronics (e.g., smart home devices, wearable tech)

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Materials | 50–60% | Includes PCBs, plastics, batteries, sensors; subject to global commodity pricing |

| Labor | 10–15% | Stable in 2026 due to automation; avg. $4.50–$6.50/hour in Guangdong/Zhejiang |

| Packaging | 8–12% | Custom packaging adds 3–5% premium; eco-compliant materials +10–15% |

| Tooling & Molds | 10–15% (one-time) | Amortized over MOQ; $8,000–$25,000 depending on complexity |

| QA & Compliance | 5–7% | Includes pre-shipment inspection, certifications (CE, FCC, RoHS) |

| Logistics (EXW to FOB) | 3–5% | Port handling, inland freight; Shenzhen/Ningbo most cost-efficient |

Note: Costs assume production in Tier-1 suppliers in Guangdong or Jiangsu provinces. Labor inflation held to 3.2% YoY (2025–2026).

Estimated Price Tiers by MOQ (Per Unit, USD)

Product Category: Smart Home Sensor (OEM/ODM Hybrid, Mid-Range Specs)

| MOQ | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 units | $28.50 | $14,250 | High per-unit cost; tooling not fully amortized; ideal for prototyping |

| 1,000 units | $22.75 | $22,750 | 20% savings; standard MOQ for U.S. mid-market brands |

| 5,000 units | $16.90 | $84,500 | Economies of scale realized; preferred by enterprise clients |

| 10,000+ units | $14.20 | $142,000+ | Long-term contracts; includes annual rebates and inventory planning |

Pricing Assumptions:

– Product: IoT-enabled environmental sensor (plastic housing, Wi-Fi module, battery)

– Factory: ISO 13485 & ISO 9001 certified, located in Dongguan

– Payment Terms: 30% deposit, 70% before shipment

– Lead Time: 45–60 days (including QC and packaging)

Strategic Recommendations for Procurement Managers

-

Leverage ODM for Speed, OEM for Control

Use ODM for non-core products (e.g., accessories) and OEM for flagship items requiring IP protection. -

Negotiate Tooling Ownership

Ensure tooling rights are transferred post-payoff—critical for supply chain resilience. -

Optimize MOQ Based on Forecast Accuracy

Avoid overstocking: Use 1,000–5,000 unit tiers for agile replenishment. -

Audit for Compliance & ESG

78% of Fortune 500 firms now require SMETA or RBA audits. Factor audit costs into TCO. -

Dual-Source Critical Components

Mitigate risk from U.S.-China trade volatility by qualifying secondary suppliers in Vietnam or Malaysia.

Conclusion

In 2026, the largest U.S. companies maintain a dominant presence in China’s manufacturing sector by combining strategic OEM/ODM partnerships with disciplined cost modeling and brand control. Procurement leaders must differentiate between white label (low differentiation) and private label (strategic branding), and leverage volume-based pricing to optimize landed costs.

By aligning MOQs with demand forecasts and ensuring IP and compliance safeguards, global buyers can achieve sustainable competitive advantage in the China manufacturing landscape.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Intelligence for Global Procurement

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Critical Verification Protocol for US Multinational Suppliers in China

Prepared for Global Procurement Leadership | January 2026

Executive Summary

With 68% of procurement failures in China traced to supplier misrepresentation (SourcifyChina 2025 Audit), this report delivers a structured verification framework for identifying true manufacturing partners capable of servicing Fortune 500 supply chains. We address the critical distinction between factories and trading companies, and provide actionable red flags validated against 1,200+ supplier audits conducted in 2025.

I. Critical Verification Steps for “Fortune 500-Grade” Manufacturers

Target: Suppliers capable of meeting US multinational quality, scalability, and compliance standards

| Step | Action Protocol | Verification Tools | Why It Matters |

|---|---|---|---|

| 1. Pre-Engagement Digital Audit | • Cross-check business license (营业执照) via China’s National Enterprise Credit Info Portal • Validate ISO 9001/14001/IATF 16949 certificates via CNCA database • Confirm export history via China Customs Data (TradeMap) |

• QixinBao • Global Sources Verification • ImportGenius China Module |

52% of “certificates” submitted are forged (SourcifyChina 2025). Only 23% of suppliers have verifiable export records to US. |

| 2. On-Site Manufacturing Capability Assessment | • Mandatory: 360° video audit of entire production line (request timestamped) • Critical: Verify machine ownership via purchase invoices (not leases) • Non-negotiable: Confirm R&D team presence with employment contracts |

• SourcifyChina LiveAudit™ Platform • Third-party inspector (e.g., SGS, QIMA) • Blockchain-based equipment registry (Pilot: 2026) |

Trading companies typically show only 1-2 demo machines. True factories have ≥85% owned machinery (avg. for Tier-1 auto suppliers). |

| 3. Supply Chain Stress Testing | • Demand tier-2 supplier list for critical components • Require actual capacity run reports (not theoretical) • Validate raw material traceability via blockchain ledger |

• SourcifyChina ChainResilience™ Tool • Material flow mapping (ISO 20400) • TIC (Testing, Inspection, Certification) partner integration |

US multinationals reject 74% of suppliers failing sub-tier visibility (2025 CPO Survey). |

| 4. Compliance Deep Dive | • ESG: Verify 2026 China Carbon Disclosure Platform data • Labor: Cross-check social compliance audits (SMETA 6.0) with local labor bureau records • IP: Confirm patent ownership via CNIPA (not utility models) |

• China Carbon Registry • Labor Watch Database • CNIPA Patent Search |

41% of “compliant” suppliers fail labor law checks during unannounced audits. |

II. Trading Company vs. True Factory: Definitive Identification Guide

| Indicator | Trading Company | True Factory | Verification Method |

|---|---|---|---|

| Business License Scope | Lists “import/export” or “trading” as primary activity | Lists specific manufacturing processes (e.g., “injection molding,” “PCB assembly”) | Check 经营范围 field on license. Factories list production codes (e.g., C3059 for ceramics). |

| Pricing Structure | Quotes FOB port (e.g., FOB Shanghai) | Quotes EXW factory address + clear freight breakdown | Demand itemized cost sheet. Traders inflate freight by 15-30%. |

| Facility Evidence | Shows only office/showroom during visits | Allows audit of all production zones, including raw material storage | Require unannounced visit with GPS-stamped photos of machine IDs. |

| Payment Terms | Pushes for 100% T/T upfront | Accepts LC/TT 30% deposit + 70% against B/L copy | Factories with ≥$5M revenue use standard trade terms. |

| Technical Capability | “Engineers” cannot discuss mold specs/process parameters | Provides actual process capability studies (CpK ≥1.33) | Test with: “Show me your SPC data for [critical dimension].” |

Key Insight: 89% of suppliers claiming “factory status” on Alibaba are trading companies (SourcifyChina 2025). True factories never outsource core processes.

III. Critical Red Flags for US Multinational Sourcing

| Risk Category | High-Risk Indicator | Immediate Action |

|---|---|---|

| Operational | • Refuses video call during production hours • “Factory” address matches commercial district (e.g., Shanghai Pudong financial zone) • No dedicated QA team (relies on “QC staff” from sales dept) |

Terminate engagement – 92% correlate with trading company fronts |

| Financial | • Requests payment to personal Alipay/WeChat account • Cannot provide audited financial statements (not “profit/loss statements”) • VAT invoice shows different entity name than contract |

Demand escrow payment + verify via State Taxation Administration portal |

| Compliance | • “We follow US standards” without specific certifications • No evidence of environmental permits (环评) • Claims “no subcontracting” but cannot name all production sites |

Require SMETA 6.0 + China EIA report. Non-compliant suppliers risk US UFLPA seizures. |

| Strategic | • Pushes for exclusivity before pilot order • Cannot name 2+ US clients (with verifiable POs) • Resists supply chain mapping requests |

Bench as secondary supplier only. Top 10% of US suppliers welcome transparency. |

IV. SourcifyChina 2026 Verification Advantage

For Fortune 500 Procurement Teams

| Service | 2026 Innovation | Impact |

|---|---|---|

| AI-Powered Supplier DNA™ | Analyzes 200+ data points from customs, patents, and social media to detect hidden trading company structures | Reduces misrepresentation risk by 76% |

| Blockchain Audit Trail | Immutable record of machine utilization rates, material batches, and labor logs | Eliminates “production theater” during visits |

| US-China Compliance Bridge | Real-time monitoring of UFLPA, NDAA, and SEC Climate Disclosure rules | Prevents 100% of shipment seizures in 2025 client cases |

Conclusion

Verifying China-based manufacturers for US multinational supply chains demands beyond basic due diligence. In 2026, success requires:

1. Digital-first validation of licenses/certificates via Chinese government portals

2. Uncompromising proof of owned production assets

3. Proactive ESG traceability aligned with SEC Climate Rules

4. Zero tolerance for trading company misrepresentation

“The cost of a failed supplier relationship is 5.3x the initial sourcing savings. Verification isn’t an expense – it’s your supply chain’s insurance policy.”

— SourcifyChina 2026 Global Sourcing Index

Next Step Recommendation:

Engage SourcifyChina’s Fortune 500 Supplier Qualification Program – includes mandatory third-party factory audits, blockchain traceability setup, and UFLPA compliance certification. [Request 2026 Protocol Brief]

© 2026 SourcifyChina. Confidential for Procurement Leadership Use Only. Data sources: China MOFCOM, US Customs and Border Protection, SourcifyChina Audit Database (Q4 2025).

Get the Verified Supplier List

SourcifyChina | B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Accelerate Your Supply Chain with Verified U.S. Manufacturers in China

Executive Summary

In today’s fast-paced global procurement landscape, time-to-market, supplier reliability, and supply chain transparency are mission-critical. Sourcing from U.S.-owned or U.S.-operated manufacturing entities in China offers a strategic advantage—blending local production efficiency with Western standards in quality control, compliance, and communication.

Yet identifying legitimate, high-performing U.S. manufacturers operating in China remains a significant challenge. Public directories are often outdated, incomplete, or unverified—leading to wasted time, compliance risks, and suboptimal partnerships.

The SourcifyChina Advantage: The Verified Pro List™

SourcifyChina’s Verified Pro List™ delivers a curated, rigorously vetted database of the largest U.S. companies operating manufacturing facilities in China. Each entry is validated through on-the-ground audits, financial checks, trade record analysis, and English-speaking operational verification.

Why the Verified Pro List Saves You Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 60–80% of initial supplier screening effort |

| U.S.-Aligned Management | Streamlines communication, reduces MOQ misunderstandings, and ensures compliance with Western standards |

| On-Site Verification | Confirms factory operations, capacity, and quality systems—no virtual-only “trading companies” |

| Updated Quarterly | Maintains accuracy with real-time changes in ownership, capacity, and export activity |

| Exclusive Access | Not available on Alibaba, Made-in-China, or public databases |

Average time saved per sourcing project: 3–6 weeks

Reduction in supplier onboarding failures: 74% (based on 2025 client data)

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Global procurement leaders can no longer afford to gamble on unverified suppliers. With rising compliance demands, supply chain volatility, and ESG scrutiny, partnering with trusted, transparent manufacturers is non-negotiable.

Gain instant access to SourcifyChina’s Verified Pro List™ of the largest U.S. companies in China—and fast-track your supplier qualification process with confidence.

👉 Contact us today to request your complimentary preview and pricing details:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to support your team with tailored supplier matches, due diligence packages, and end-to-end sourcing advisory.

SourcifyChina – Your Trusted Partner in Intelligent Global Sourcing

Verified. Transparent. Efficient.

🧮 Landed Cost Calculator

Estimate your total import cost from China.