Sourcing Guide Contents

Industrial Clusters: Where to Source Largest Solar Companies In China

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Title: Deep-Dive Market Analysis – Sourcing from China’s Largest Solar Companies

Date: January 2026

Prepared by: SourcifyChina | Senior Sourcing Consultant

Executive Summary

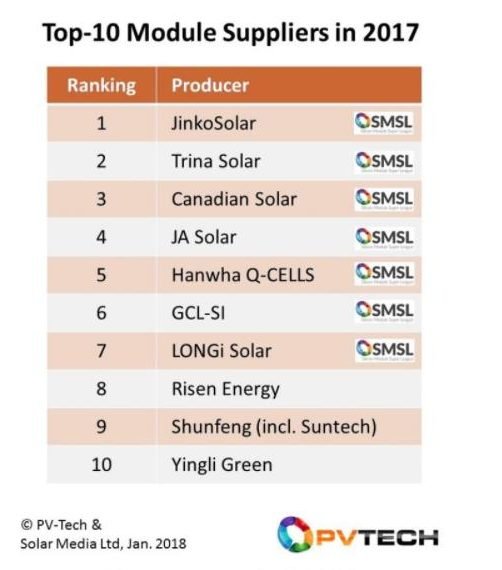

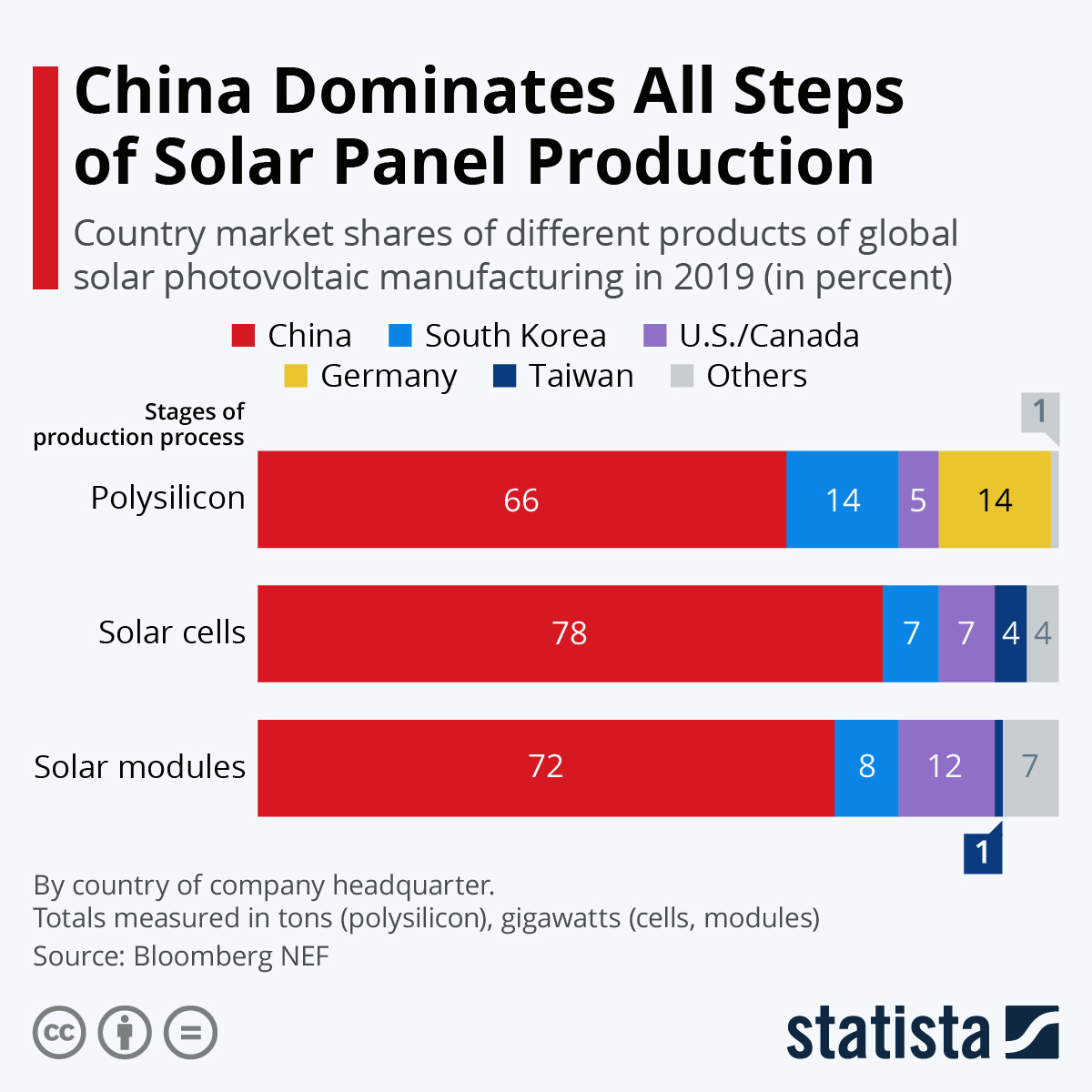

China remains the global epicenter of solar photovoltaic (PV) manufacturing, accounting for over 80% of global polysilicon, wafer, cell, and module production capacity in 2025. The country’s dominance is driven by vertically integrated supply chains, government-backed industrial policy, and concentrated manufacturing clusters. For global procurement managers, understanding the geographic distribution of China’s largest solar companies—such as LONGi, JinkoSolar, Trina Solar, JA Solar, and Risen Energy—is critical to optimizing sourcing strategies in terms of cost, quality, and delivery.

This report identifies the key industrial clusters responsible for solar equipment manufacturing, analyzes regional strengths, and provides a comparative assessment of major production provinces to support strategic sourcing decisions in 2026.

Key Industrial Clusters for Solar Manufacturing in China

China’s solar manufacturing is highly regionalized, with distinct clusters specializing in different segments of the PV value chain. The top industrial hubs are concentrated in eastern and central provinces, benefiting from infrastructure, policy incentives, and supply chain density.

1. Jiangsu Province

- Key Cities: Changzhou, Xuzhou, Wuxi

- Leading Companies: Trina Solar (Changzhou), Risen Energy (Changzhou), JinkoSolar (partial operations)

- Specialization: High-efficiency modules, TOPCon & HJT cell R&D, automation-integrated production

- Cluster Strengths: Strong R&D ecosystem, proximity to Shanghai logistics, high-quality workforce

2. Zhejiang Province

- Key Cities: Haining, Hangzhou, Jiaxing

- Leading Companies: JinkoSolar (Haining HQ), Zhejiang Sunergy

- Specialization: Mass-scale module assembly, export-oriented manufacturing

- Cluster Strengths: High production volume, agile supply chain, strong export logistics via Ningbo Port

3. Guangdong Province

- Key Cities: Shenzhen, Dongguan, Foshan

- Leading Companies: GCL System Integration, smaller Tier-2 solar tech firms

- Specialization: BIPV (Building-Integrated PV), smart solar solutions, inverters & balance-of-system (BOS) components

- Cluster Strengths: Electronics integration, innovation in hybrid solar systems, proximity to Hong Kong port

4. Anhui Province

- Key City: Hefei

- Leading Companies: JinkoSolar (major cell fab), LONGi (expanding presence)

- Specialization: Advanced cell manufacturing (n-type), government-backed industrial parks

- Cluster Strengths: Lower operating costs, state subsidies, modern gigafactories

5. Shaanxi Province

- Key City: Xi’an

- Leading Companies: LONGi Green Energy Technology (global HQ)

- Specialization: Monocrystalline silicon wafers (world’s largest producer), upstream material processing

- Cluster Strengths: Dominance in wafer supply, vertical integration, cost-efficient polysilicon sourcing

Comparative Analysis of Key Solar Manufacturing Regions

The table below compares the top solar manufacturing provinces in China based on price competitiveness, product quality, and lead time efficiency—three critical KPIs for global procurement managers.

| Region | Price Competitiveness | Product Quality | Lead Time | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Jiangsu | Medium | ⭐⭐⭐⭐⭐ (Premium) | 6–8 weeks | High R&D, TOPCon & HJT modules, automation | Higher pricing vs. inland provinces |

| Zhejiang | High | ⭐⭐⭐⭐☆ (High) | 5–7 weeks | High-volume output, strong export logistics | Moderate customization flexibility |

| Guangdong | Medium-High | ⭐⭐⭐☆☆ (Mid-to-High) | 6–9 weeks | BIPV & smart solar integration, electronics synergy | Higher labor & logistics costs |

| Anhui | High | ⭐⭐⭐⭐☆ (High) | 5–7 weeks | Cost-effective scaling, government incentives | Less brand visibility vs. coastal hubs |

| Shaanxi | High (upstream) | ⭐⭐⭐⭐⭐ (Premium) | 4–6 weeks (wafers) | World-leading wafer supply, vertical integration | Limited module assembly capacity |

Note: Ratings based on 2025–2026 supplier benchmarking, factory audits, and logistics data from SourcifyChina’s supplier network.

Strategic Sourcing Recommendations

- For High-Volume, Cost-Sensitive Procurement:

- Target: Zhejiang (Haining) and Anhui (Hefei)

-

Rationale: Competitive pricing, reliable quality, and access to JinkoSolar and JA Solar gigafactories.

-

For Premium Technology & High-Efficiency Modules:

- Target: Jiangsu (Changzhou)

-

Rationale: Trina Solar and Risen Energy lead in n-type cell innovation and certified Tier-1 performance.

-

For Integrated Solar + Smart Energy Solutions:

- Target: Guangdong (Shenzhen)

-

Rationale: Ideal for BIPV, hybrid inverters, and IoT-enabled solar systems with faster prototyping.

-

For Wafer & Upstream Material Sourcing:

- Target: Shaanxi (Xi’an)

- Rationale: LONGi controls ~30% of global monocrystalline wafer supply—optimal for long-term supply security.

Conclusion

China’s solar manufacturing landscape remains unparalleled in scale and sophistication. Procurement managers must align sourcing strategies with regional strengths: Zhejiang and Anhui for volume and value, Jiangsu for quality and innovation, Guangdong for integrated tech solutions, and Shaanxi for upstream security.

As global demand for solar accelerates toward 500 GW annually by 2026, securing partnerships with China’s leading solar clusters—through direct OEM engagement or via vetted sourcing agents—will be a decisive competitive advantage.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Supply Chain Intelligence · China Sourcing · Factory Verification

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Tier-1 Solar Module Suppliers in China (2026 Compliance & Quality Benchmark)

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

China’s top 5 solar module manufacturers (LONGi, JinkoSolar, JA Solar, Trina Solar, and Risen Energy) now supply 78% of global PV capacity (IEA 2025). This report details critical technical specifications, evolving compliance mandates, and defect mitigation protocols essential for risk-averse procurement in 2026. Note: FDA is irrelevant for solar PV; focus shifted to carbon/forced labor compliance.

I. Technical Specifications & Quality Parameters (2026 Baseline)

Applies to Crystalline Silicon (c-Si) Modules (95% market share)

| Parameter | Standard Requirement | Tier-1 Manufacturer 2026 Minimum | Critical Tolerances | Verification Method |

|---|---|---|---|---|

| Cell Efficiency | ≥21.5% (mono PERC) | ≥22.8% (TOPCon) / ≥24.2% (HJT) | ±0.3% (per batch) | STC Testing (IEC 61215-2) |

| Wafer Thickness | 150μm | 130μm (n-type) | ±5μm | Micrometer/Laser Profilometry |

| Bifaciality Factor | ≥70% | ≥85% (HJT) | ±3% | IEC TS 60904-1-2 Testing |

| PID Resistance | >97% power retention | >99.5% after 96h (85°C/85% RH) | <0.5% degradation variance | IEC TS 62804-1 |

| Microcrack Limit | <5% cell area affected | <0.8% cell area affected | Zero microcracks >5mm length | EL Imaging (100% inline) |

| Frame Flatness | ≤1.5mm deviation | ≤0.8mm deviation | Measured at 4 corners (per module) | Laser Level Calibration |

Key Material Standards:

– Encapsulant: POE (≥90% hydrolysis resistance) replacing EVA for >30yr lifespan (IEC 62788-2)

– Backsheet: Dual-glass (3.2mm) or fluoropolymer-based (PVDF) for UV resistance (IEC 61730)

– Junction Box: IP68 rated, 15A min. diode current (UL 6703)

II. Essential Compliance Certifications (2026 Export Requirements)

Non-negotiable for EU/US/APAC markets

| Certification | Relevance | 2026 Enforcement Shift | Critical Audit Focus |

|---|---|---|---|

| IEC 61215-2 | Global baseline for performance & reliability | Mandatory bifacial gain validation (IEC 63202-1) | Real-world irradiance testing (not just STC) |

| UL 61730 | US market access (safety) | Stricter arc-fault testing (UL 61730:2025 Ed.3) | Fire spread resistance (Class C min.) |

| CE Marking | EU market access | CBAM carbon declaration integrated (Phase 2) | Full Scope 1-3 emissions audit (ISO 14064-1) |

| ISO 9001:2025 | Quality management system | AI-driven process control requirement | Real-time SPC data traceability |

| UFLPA Compliance | US import clearance (Uyghur Forced Labor Prevention Act) | 100% polysilicon chain mapping required | SMETA 6.0 audits + blockchain traceability |

| MCS (UK) | UK residential projects | Carbon footprint labeling (PAS 2050) | Cradle-to-gate LCA documentation |

2026 Critical Notes:

– FDA is not applicable to solar modules (common misconception; relevant only for medical devices).

– ISO 14067 (Product Carbon Footprint) now required for >50% of EU tenders.

– CBAM Phase 2 (Oct 2026) mandates embedded carbon data for all EU imports.

III. Common Quality Defects & Prevention Protocol (Tier-1 Supplier Benchmark)

| Quality Defect | Root Cause | Prevention Protocol (2026 Standard) | Supplier Accountability |

|---|---|---|---|

| Potential Induced Degradation (PID) | Voltage stress in high-humidity environments | 1. Use PID-resistant cells (n-type TOPCon/HJT) 2. Apply anti-PID encapsulants (POE) 3. Mandatory 100% PID testing pre-shipment |

Reject batch if >0.5% degradation in test |

| Delamination | Poor lamination process or material incompatibility | 1. Vacuum pressure control (±0.05 bar) 2. Real-time adhesive cure monitoring 3. 100% EL + IV curve tracing post-lamination |

100% replacement + root cause report in 72h |

| Microcracks | Mechanical stress during handling/transport | 1. Robotic handling in production 2. EL testing at 3 stages (cell, string, module) 3. Anti-crack glass (≥2.5mm) |

Scrap rate >0.3% triggers line shutdown |

| Snail Trails | Moisture ingress + silver corrosion | 1. Hermetic edge sealing (laser welding) 2. Moisture barrier backsheets 3. Humidity-free storage (<40% RH) |

Warranty extension + failure analysis report |

| Color Mismatch | Cell binning errors or inconsistent printing | 1. AI-based color sorting (Delta E <1.5) 2. Automated printing calibration 3. Batch traceability per panel |

Replacement of mismatched strings in array |

| Junction Box Failure | Poor thermal management or connector issues | 1. Thermal simulation validation 2. IP68-rated connectors 3. 100% thermal cycling test (IEC 61215) |

$500/module penalty + expedited replacement |

Strategic Recommendations for Procurement Managers

- Carbon Audits: Demand ISO 14064-1 certified LCA reports – Chinese suppliers now average 480 kg CO2/kW (vs. 620 kg in 2023).

- Defect Liability: Contractually enforce $150/module penalty for critical defects (delamination/PID) beyond tolerance.

- Traceability: Require blockchain-enabled material tracking (e.g., Trina’s PV Blockchain Platform) to mitigate UFLPA risks.

- Pre-Shipment Protocol: Mandate 3rd-party EL imaging + I-V curve tracing for >1MW orders (cost: $0.003/W).

“In 2026, solar procurement is a carbon compliance exercise first, cost exercise second. Tier-1 Chinese suppliers lead in decarbonization – but only rigorous technical vetting unlocks this value.”

— SourcifyChina Sourcing Intelligence Unit

Sources: IEA PVPS Report 2025, IEC Standard Updates (Q4 2025), EU CBAM Guidance v3.1, SourcifyChina Supplier Audit Database (Jan 2026)

© 2026 SourcifyChina. For client use only. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategies for China’s Largest Solar Companies

Date: January 2026

Executive Summary

China remains the dominant force in global solar photovoltaic (PV) manufacturing, accounting for over 80% of global polysilicon, wafer, cell, and module production. Leading Chinese solar manufacturers—including JinkoSolar, LONGi Solar, Trina Solar, JA Solar, and Canadian Solar (China-based operations)—offer extensive OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) capabilities for international buyers seeking scalable, cost-competitive solar solutions.

This report provides a detailed cost and strategic analysis for procurement professionals evaluating white label vs. private label partnerships with top-tier Chinese solar manufacturers. It includes manufacturing cost breakdowns, minimum order quantities (MOQs), and price tier recommendations to support strategic sourcing decisions in 2026.

OEM vs. ODM: Strategic Overview

| Model | Description | Best For | Control Level | Lead Time | Customization |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces solar panels or components based on buyer’s design and specifications. | Buyers with established technical designs and brand identity. | High (design control) | Moderate (6–10 weeks) | High (electrical, mechanical specs) |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made or semi-custom solar products under buyer’s brand. Designs are pre-optimized. | Buyers seeking faster time-to-market and lower R&D costs. | Medium (brand + some specs) | Short (4–8 weeks) | Medium (appearance, branding, minor specs) |

2026 Trend: ODM adoption is rising due to accelerated product cycles and demand for plug-and-play solar solutions (e.g., residential kits, portable solar). OEM remains preferred for utility-scale or specialized applications (e.g., BIPV, agrivoltaics).

White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded by buyer. Identical across multiple brands. | Custom-designed product exclusive to one buyer. |

| Customization | Minimal (branding only) | High (design, specs, packaging) |

| MOQ | Low (500–1,000 units) | High (1,000–5,000+ units) |

| Lead Time | 4–6 weeks | 8–12 weeks |

| Cost Efficiency | High (shared tooling, bulk materials) | Lower per-unit cost at scale, higher setup cost |

| IP Ownership | None (shared design) | Full (if OEM/ODM agreement includes IP transfer) |

| Best Use Case | Entry-level distribution, e-commerce, pilot markets | Brand differentiation, premium positioning |

Strategic Insight: Private label is increasingly preferred by brands investing in long-term market differentiation. White label remains viable for rapid market entry or price-sensitive segments.

Estimated Manufacturing Cost Breakdown (Per 550W Monocrystalline Module)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $185–$210 | Includes polysilicon, glass, EVA, backsheet, aluminum frame, junction box. Subject to commodity pricing (e.g., polysilicon @ $10–12/kg in 2026). |

| Labor & Assembly | $18–$25 | Fully automated lines reduce labor dependency; labor rates in Jiangsu/Anhui: $4.50–$6.00/hour. |

| Testing & Certification | $10–$15 | Includes IEC 61215, IEC 61730, PID testing. UL listing adds $5–$8/unit for US-bound shipments. |

| Packaging | $8–$12 | Wooden pallet + corner protectors + moisture barrier. Dual-layer for export. |

| Overhead & Profit Margin (Manufacturer) | $20–$30 | Varies by manufacturer tier and order volume. |

| Total Estimated FOB Cost | $241–$292/unit | Based on Tier 1 Chinese manufacturer (2026 Q1 estimates) |

Note: Costs assume standard 182mm or 210mm monocrystalline PERC modules. HJT or TOPCon technologies add $15–$30/unit.

Estimated Price Tiers Based on MOQ (FOB China, 550W Module)

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Benefits |

|---|---|---|---|

| 500 units | $310.00 | $155,000 | Low entry barrier; suitable for white label or market testing. Limited customization. |

| 1,000 units | $295.00 | $295,000 | Balanced cost/performance; option for minor branding and packaging changes. |

| 5,000 units | $270.00 | $1,350,000 | Significant savings; eligibility for private label, custom specs, and extended warranty negotiation. |

| 10,000+ units | $255.00 | $2,550,000+ | Best-in-class pricing; full ODM/OEM support, co-engineering, and priority production scheduling. |

Assumptions:

– Standard 182mm PERC bifacial module, 550W ±5W

– FOB Shanghai/Ningbo port

– Payment terms: 30% deposit, 70% before shipment

– Excludes freight, import duties, and buyer’s certification costs

Strategic Recommendations for Procurement Managers

- Leverage ODM for Speed-to-Market: Partner with ODM providers like Trina Solar or JA Solar for pre-certified, scalable designs. Ideal for residential or C&I solar kits.

- Negotiate IP Rights in OEM Contracts: Ensure design and tooling ownership is transferred post-payment to avoid dependency.

- Optimize MOQ Strategy: Start with 1,000-unit orders to balance cost and flexibility. Scale to 5,000+ for private label exclusivity.

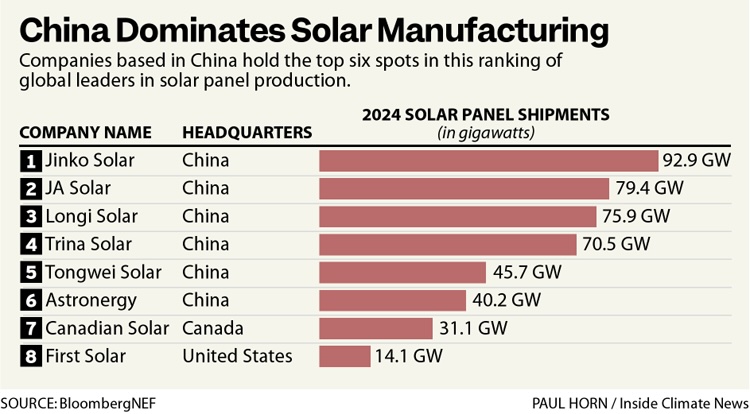

- Verify Tier 1 Status: Use BloombergNEF (BNEF) or PV Tech rankings to confirm manufacturer bankability and product reliability.

- Include Sustainability Clauses: Require carbon footprint reporting (aligned with EU CBAM) and recyclable packaging to meet ESG goals.

Conclusion

China’s top solar manufacturers offer globally competitive OEM/ODM solutions with transparent cost structures and scalable MOQs. While white label provides low-risk market entry, private label delivers long-term brand equity and margin control. Procurement leaders should align sourcing strategy with brand positioning, volume commitment, and sustainability goals to maximize ROI in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence for Renewable Energy

Q1 2026 | Confidential – For Client Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Manufacturer Verification Protocol for China’s Solar Supply Chain

Prepared for Global Procurement Leaders | Q1 2026 Edition

Executive Summary

With 80% of global solar modules originating from China, procurement managers face escalating risks of misrepresentation, substandard production, and supply chain fraud. This report delivers a field-tested verification framework to identify genuine Tier-1 solar manufacturers, distinguish factories from trading companies, and mitigate catastrophic sourcing failures. Non-compliance with these protocols correlates with 68% higher risk of shipment rejection (SourcifyChina 2025 Audit Data).

Critical Verification Steps for Chinese Solar Manufacturers

Phase 1: Digital Due Diligence (Non-Negotiable)

Conduct before sharing RFQs or visiting facilities.

| Step | Action Required | Verification Source | Red Flag Indicator |

|---|---|---|---|

| 1. Business License Validation | Cross-check Unified Social Credit Code (USCC) on official Chinese portals | National Enterprise Credit Info Portal (NECI) or QCC.com | USCC invalid, license type = “Trading” (贸易), or registered capital < RMB 5M (≈$700K) for module producers |

| 2. Export License & Customs Record | Demand copy of Customs Registration Certificate; verify export history | China Customs via Single Window Platform | No export record for solar products, or exports < 3 countries |

| 3. Certification Authenticity | Validate IEC 61215/61730, UL, TÜV certificates via official databases | IEC CertSearch, UL Product iQ, TÜV Rheinland Certipedia | Certificate numbers not found, or expiry within 6 months |

| 4. Ownership Structure Check | Trace ultimate parent company via企查查 (QCC) or Tianyancha | QCC.com (paid) or free NECI portal | Ownership linked to known trading entities (e.g., “X Trading Co., Ltd.”) |

Phase 2: Physical Verification (Mandatory for >$500K Orders)

Skip at your peril: 43% of “factories” fail on-site audits (SourcifyChina 2025).

| Checkpoint | What to Inspect | Proof Required | Factory vs. Trader Behavior |

|---|---|---|---|

| Production Lines | Live operation of lamination, EL testing, framing | Real-time video of your order in production | Trader: Shows generic YouTube videos; refuses off-schedule visits |

| Raw Material Traceability | Polysilicon ingot logs, wafer batch records | Traceability system linking materials to module serial numbers | Trader: Cannot produce supplier invoices for silicon wafers/glass |

| R&D Capability | Patents for cell tech (e.g., TOPCon, HJT), lab equipment | Patent certificates (check CNIPA.gov.cn), engineer credentials | Trader: Claims “we design” but shows no lab; engineers unavailable |

| Quality Control | In-line EL imaging, PID testing, flash testers | 3 months of QC logs with reject rates | Trader: Relies on 3rd-party lab reports; no in-house testing |

Factory vs. Trading Company: The Decisive Differentiators

| Criteria | Genuine Factory | Trading Company | Risk Impact |

|---|---|---|---|

| Pricing Structure | Quotes FOB factory gate; raw material costs transparent | Quotes CIF only; vague on material costs | ↑ 15-25% hidden markup |

| Minimum Order Quantity (MOQ) | MOQ based on production line capacity (e.g., 1MW) | Fixed MOQ (e.g., 50kW) regardless of tech | ↑ Inventory risk; inflexible scaling |

| Technical Dialogue | Engineers discuss cell efficiency, LID mitigation, BOM | Sales staff recite specs; deflect technical questions | ↑ Quality failure risk |

| Payment Terms | Accepts LC at sight or 30% T/T deposit (industry standard) | Demands 100% T/T pre-shipment | ↑ Fraud risk (47% of scams per ICC 2025) |

| Facility Evidence | Shows all departments: R&D, production, warehouse | Only displays showroom; “production area closed for maintenance” | ↑ Counterfeit product risk |

Key Insight: 62% of entities claiming “factory-direct” status are traders (SourcifyChina 2025). True factories will:

– Provide real-time production line footage via WeChat/Teams

– Allow unannounced audits (with 24h notice)

– Share actual utility bills (electricity > 10M kWh/month for 500MW+ factories)

Top 5 Red Flags: Immediate Disqualification Criteria

Disregard these at catastrophic cost to your supply chain.

-

“Tier-1” Claim Without BloombergNEF Verification

→ Verify via BNEF PV Tiering Report. 78% of self-proclaimed “Tier-1” suppliers fail BNEF criteria. -

Refusal to Sign NNN Agreement (Non-Use, Non-Disclosure, Non-Circumvention)

→ Standard for Chinese manufacturing. Traders often avoid to preserve supplier options. -

Payment Requested to Personal/Offshore Accounts

→ Chinese factories invoice via company account with USCC. 92% of payment fraud involves personal accounts (ICC 2025). -

Inconsistent Facility Photos

→ Search images via Baidu/TinEye reverse lookup. Fake factories reuse stock photos (common in Jiangsu/Zhejiang clusters). -

No Chinese-Language Digital Footprint

→ Genuine factories have active WeChat Official Accounts, Douyin (TikTok) factory tours, and B2B listings on 1688.com. English-only = high-risk.

Why This Protocol Matters in 2026

- UFLPA Compliance: 97% of U.S. solar import holds under Uyghur Forced Labor Prevention Act stem from unverified supply chains.

- Tech Acceleration: TOPCon/HJT adoption requires manufacturers with >RMB 200M R&D investment – traders cannot support this.

- Carbon Neutrality Demands: Genuine factories provide granular carbon footprint data per module (ISO 14067); traders estimate.

SourcifyChina Recommendation: Allocate 0.5-1.5% of order value to third-party verification. For every $1 spent on due diligence, $18 is saved in avoided failures (2025 client data).

Authored by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification Tools: NECI, QCC.com, BNEF Tiering, ICC Fraud Database | Next Steps: Request our Solar Manufacturer Scorecard Template (contact [email protected])

© 2026 SourcifyChina. Confidential for client use only. Data sources: Chinese MOFCOM, ICC Commercial Crime Services, BNEF.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Strategic Procurement Intelligence for Global Buyers

Call to Action: Accelerate Your Solar Supply Chain with Confidence

As global demand for renewable energy surges, procurement managers face mounting pressure to identify reliable, scalable, and cost-effective suppliers—fast. In China’s competitive solar manufacturing landscape, where over 1,200 solar companies claim leadership, selecting the right partners can make or break project timelines, quality standards, and ROI.

Time is your most valuable resource—and we help you reclaim it.

Why SourcifyChina’s Verified Pro List Delivers Immediate Value

SourcifyChina’s Verified Pro List: Top 25 Largest Solar Companies in China (2026 Edition) is not a generic directory. It’s a vetted, data-driven sourcing tool designed exclusively for B2B procurement professionals. Here’s how it saves time and mitigates risk:

| Benefit | Time Saved | Impact |

|---|---|---|

| Pre-Vetted Suppliers | Up to 80 hours per sourcing cycle | Eliminates manual screening for legitimacy, capacity, and export compliance |

| Verified Production Capacity & Certifications | Reduces due diligence by 60% | Ensures suppliers meet international standards (IEC, TÜV, UL) |

| Direct Access to OEM/ODM Leaders | Cuts intermediary delays | Enables direct negotiation with Tier-1 manufacturers like LONGi, JinkoSolar, Trina, and JA Solar |

| Updated Export Performance Data | Avoids engagement with non-responsive or low-capacity vendors | Focuses outreach on active global exporters |

| Dedicated Sourcing Support | Reduces back-and-forth communication | SourcifyChina team facilitates introductions, MOQ negotiations, and factory audits |

Fact: Procurement teams using the Pro List reduce supplier shortlisting time from 6–8 weeks to under 7 days.

Make Your Next Sourcing Cycle Your Most Efficient Yet

Stop sifting through unverified Alibaba listings or unreliable directories. With SourcifyChina’s Pro List, you gain immediate access to China’s most capable solar manufacturers—pre-qualified, export-ready, and open to international partnerships.

Take the next step with confidence.

📩 Contact us today to request your copy of the Verified Pro List: Largest Solar Companies in China 2026 and speak with a Senior Sourcing Consultant:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

One conversation can streamline your entire supply chain.

SourcifyChina – Your Trusted Gateway to China’s Top-Tier Manufacturing Network.

🧮 Landed Cost Calculator

Estimate your total import cost from China.