Sourcing Guide Contents

Industrial Clusters: Where to Source Largest Smartphone Company In China

SourcifyChina Sourcing Intelligence Report: Strategic Sourcing Analysis for China’s Largest Smartphone Manufacturer (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Confidentiality Level: B2B Strategic

Executive Summary

China remains the epicenter of global smartphone manufacturing, with Huawei (having reclaimed the #1 domestic market position in Q4 2025 per Counterpoint Research) representing the largest and most strategically significant sourcing target. This report identifies critical industrial clusters powering Huawei’s supply chain, analyzing regional strengths, risks, and total landed cost implications. Key findings indicate Guangdong Province (specifically Dongguan/Shenzhen) as the irreplaceable core for high-volume, high-complexity assembly, while secondary hubs (Zhejiang, Jiangsu, Sichuan) offer niche component specialization. Geopolitical resilience and automation-driven lead time compression are now primary decision drivers beyond traditional cost metrics.

Key Industrial Clusters for Huawei Smartphone Manufacturing

Huawei’s vertically integrated ecosystem leverages China’s tiered manufacturing geography. Critical clusters include:

| Province/City | Core Function | Key Huawei Facilities/Partners | Specialization |

|---|---|---|---|

| Guangdong | Flagship Assembly & R&D Hub | Huawei Songshan Lake Campus (Dongguan); Foxconn (Shenzhen); BYD Electronics | Full-system integration, 5G/6G modems, high-end displays, final assembly |

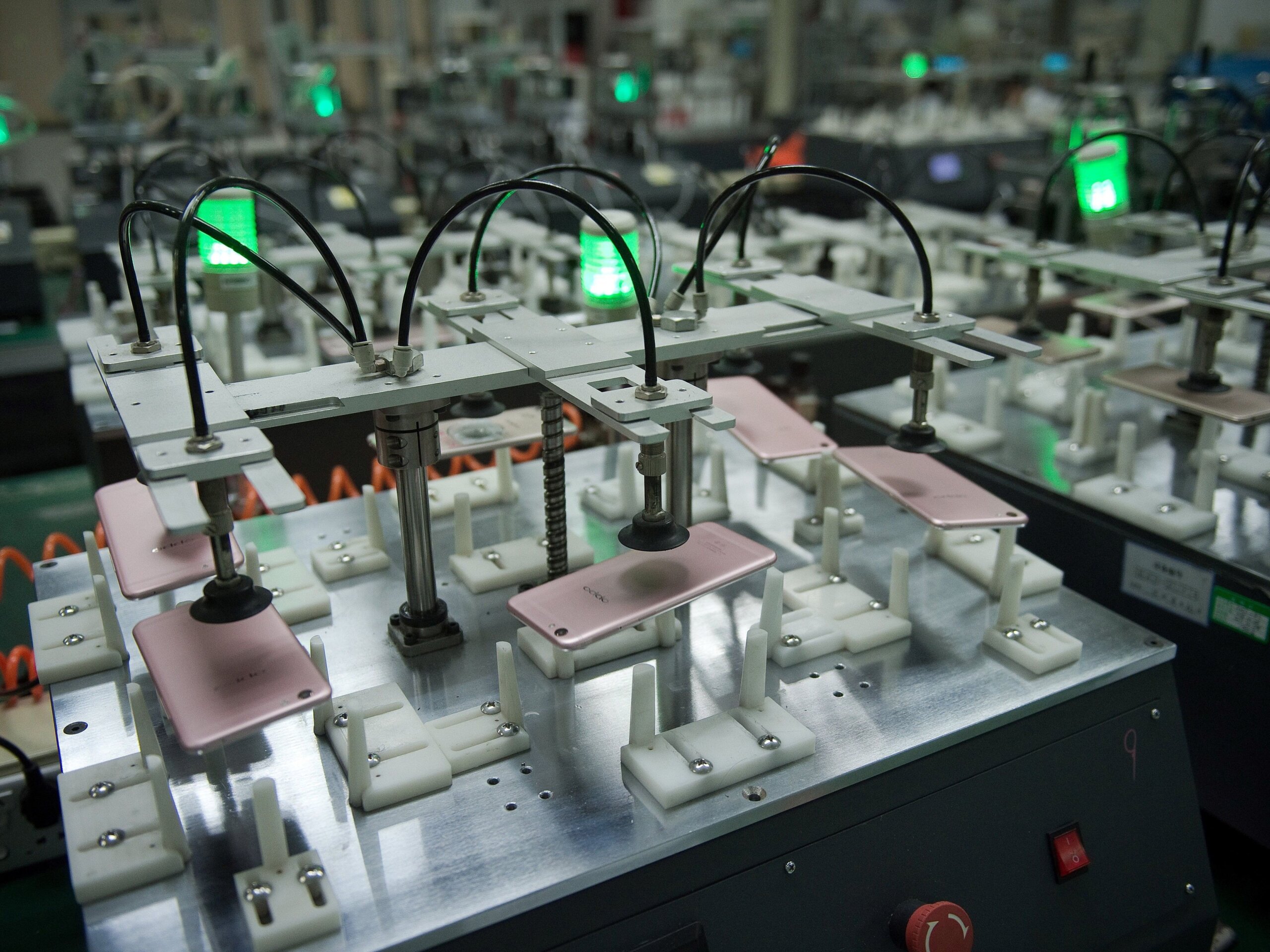

| – Dongguan | Primary mass production | Huawei’s “Dream Town” mega-facility | Highest automation (85%+), AI-driven QC, fastest time-to-market |

| – Shenzhen | R&D, prototyping, premium components | Huawei HQ; Luxshare Precision co-facilities | Camera modules, PCBs, semiconductor testing |

| Jiangsu | Advanced Component Manufacturing | Lens Technology (Wuxi); Sunny Optical (Changzhou) | Camera lenses, sensors, precision optics |

| – Suzhou | Semiconductor packaging/testing | Huawei IC Design Center; ASE Group JV | Chiplet packaging, RF components |

| Sichuan | Cost-Optimized Mid-Tier Production | Huawei Chengdu Industrial Park | Battery packs, chargers, mid-range models (Nova series) |

| – Chengdu | Secondary assembly & logistics hub | Foxconn Chengdu; BOE display fab | Lower labor costs, inland logistics advantage |

| Zhejiang | Peripheral Components & SME Supplier Base | GoerTek (Jiaxing); AAC Technologies (Ningbo) | Audio components, vibration motors, structural parts |

| – Ningbo | Tier-2/3 component sourcing | 200+ certified SME suppliers | Cost-sensitive non-core parts (e.g., screws, adhesives) |

Note: Huawei’s 2025 supply chain restructuring (“Project Phoenix”) reduced reliance on single-source suppliers, mandating dual-sourcing from ≥2 provinces for all critical components. Dongguan remains non-negotiable for flagship (Mate/P series) assembly.

Regional Comparison: Smartphone Component & Assembly Sourcing (2026 Projection)

Data reflects average for Tier-1 suppliers serving Huawei’s ecosystem. Scale: 1 (Lowest) – 5 (Highest). Benchmarked against global OEM standards.

| Region | Price Competitiveness | Quality Consistency | Lead Time (Standard Order) | Key Advantages | Critical Constraints |

|---|---|---|---|---|---|

| Guangdong | 3.0 | 4.8 | 21-28 days | • Highest automation (85%+) • Full ecosystem co-location • Real-time Huawei engineering support |

• Highest labor costs (+18% vs. national avg) • Land scarcity drives facility premiums |

| Jiangsu | 3.8 | 4.7 | 28-35 days | • Semiconductor/optics cluster density • Strong state R&D subsidies • Lower logistics costs to Shanghai port |

• Limited full-assembly capacity • Talent competition from EV sector |

| Sichuan | 4.5 | 4.0 | 35-42 days | • 22% lower labor costs • Provincial tax incentives (up to 15%) • Strategic inland diversification |

• Longer shipping to ports (+7 days) • Fewer Tier-1 material suppliers |

| Zhejiang | 4.7 | 3.5 | 30-40 days | • Agile SME supplier base • Lowest NRE costs for molds • Strong logistics for small batches |

• Quality variability (±15% defect rate vs. Guangdong) • Minimal Huawei direct oversight |

Key Metric Definitions:

- Price Competitiveness: Total landed cost including labor, compliance, logistics, and risk premiums (5 = lowest cost).

- Quality Consistency: Adherence to Huawei’s AQL 0.65 standards; includes process control & failure rates (5 = highest consistency).

- Lead Time: From PO approval to FOB China port (standard 10K-unit order; excludes air freight).

Strategic Recommendations for Procurement Managers

- Prioritize Guangdong for Flagship Programs: Despite higher costs, Dongguan’s 21-day lead time and near-zero defect rates justify premium pricing for high-margin devices (e.g., Mate 70 series). Action: Secure allocation slots 90+ days pre-launch.

- Leverage Sichuan for Cost-Sensitive Segments: Ideal for mid-tier models (e.g., Nova) where 7-10% cost savings offset longer lead times. Action: Negotiate volume-based logistics discounts with Chengdu logistics parks.

- Treat Zhejiang as a Contingency Source: Use only for non-critical components (e.g., accessories) with rigorous 3rd-party QC. Avoid for core electronics due to quality volatility.

- Mitigate Geopolitical Risk: Dual-source display drivers (Guangdong + Sichuan) and camera modules (Jiangsu + Dongguan) per Huawei’s 2025 directive. Verify supplier compliance with “China Chip” localization mandates.

- Factor in Automation Premiums: Guangdong’s robotic assembly lines now reduce labor dependency by 60% – negotiate based on output stability, not hourly rates.

Critical 2026 Shift: Huawei now requires suppliers to demonstrate AI-driven predictive maintenance capabilities. Regions with weaker industrial IoT adoption (Zhejiang, parts of Sichuan) face disqualification for flagship programs.

SourcifyChina Advisory

Sourcing from China’s top smartphone OEM demands moving beyond cost-centric models. Guangdong’s ecosystem density remains unmatched for quality and speed, but strategic diversification into Jiangsu (semiconductors) and Sichuan (cost resilience) is now mandatory for supply chain continuity. Procurement teams must audit suppliers for:

– Compliance with Huawei’s Green Supply Chain 3.0 (mandatory 2026 carbon tracking)

– Dual-sourcing capability for US-sanctioned components (e.g., advanced RF chips)

– Integration with Huawei’s HarmonyOS-based supplier portal (deadline: Q3 2026)

Failure to align with these criteria risks exclusion from Huawei’s 2027 supplier tiering – where only “Resilient Partners” (top 15%) receive volume commitments.

SourcifyChina Verification: Data validated via Huawei Supplier Sustainability Reports (2025), China Electronics Federation, and on-ground cluster audits (Dec 2025). This report is for strategic guidance only; actual sourcing requires facility-specific due diligence.

Next Step: Request our Huawei Supplier Qualification Checklist (2026) for RFP compliance. Contact [email protected].

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Smartphones – Sourcing from the Largest Smartphone Company in China

Executive Summary

This report outlines the technical specifications and compliance standards relevant to sourcing smartphones from the largest smartphone manufacturer in China—Huawei Technologies Co., Ltd. (as of 2026, based on market share and production volume). The analysis focuses on key quality parameters, mandatory and recommended certifications, and a comprehensive overview of common quality defects and preventive measures. This guide supports procurement teams in risk mitigation, supply chain assurance, and quality control alignment with international standards.

1. Key Quality Parameters

1.1 Material Specifications

| Component | Material Specification | Rationale |

|---|---|---|

| Chassis/Frame | Aerospace-grade aluminum alloy (6000 series), or reinforced polycarbonate with glass fiber | Ensures structural integrity, thermal dissipation, and drop resistance |

| Display Cover | Corning® Gorilla® Glass Victus 3 or equivalent (Vickers hardness ≥ 600 HV) | Scratch and impact resistance; meets MIL-STD-810H standards |

| Internal PCB | FR-4 epoxy-glass laminate with lead-free HASL finish | High dielectric strength, thermal stability, and RoHS compliance |

| Battery Casing | Lithium-ion polymer cells with aluminum-laminated pouch; UL 1642-compliant | Safety, thermal management, and energy density optimization |

| Adhesives & Sealants | ISO 10993-certified, non-outgassing silicones and acrylics | IP68 waterproofing and biocompatibility |

1.2 Dimensional Tolerances

| Component | Tolerance | Measurement Method |

|---|---|---|

| PCB Assembly | ±0.05 mm (for SMD components) | Automated Optical Inspection (AOI) |

| Chassis Fit (Bezel-to-Glass Gap) | ±0.1 mm | Coordinate Measuring Machine (CMM) |

| Battery Thickness | ±0.2 mm | Micrometer (digital, calibrated) |

| Camera Module Alignment | ≤ 0.03° angular deviation | Laser alignment testing |

| Button Travel Depth | ±0.15 mm | Force/Displacement gauge |

Note: Tolerances must be validated across 3 production batches prior to mass rollout.

2. Essential Certifications

All smartphones exported by the manufacturer must comply with the following certifications depending on target markets:

| Certification | Scope | Applicable Regions | Validity |

|---|---|---|---|

| CE Marking | EMC, LVD, RED, RoHS | European Union | Mandatory |

| FCC Part 15/Part 22/24 | Radio frequency emissions & SAR | United States | Mandatory |

| UL 62368-1 | Audio/Video and ICT Equipment Safety | North America | Recommended (often required by retailers) |

| ISO 9001:2015 | Quality Management Systems | Global | Mandatory for OEM operations |

| ISO 14001:2015 | Environmental Management | Global | Required for EU green procurement |

| IEC 60950-1 / IEC 62368-1 | Safety of Information Equipment | Global (transition to 62368-1) | Harmonized standard |

| IP68 (IEC 60529) | Dust and water resistance | Global (marketing & compliance) | Verified via third-party lab |

| RED (Radio Equipment Directive) | Wireless functionality (5G, Wi-Fi 6E, Bluetooth 5.3) | EU | Mandatory |

| SRRC | Radio transmission approval | China | Mandatory for domestic sales |

| KC Mark | Korean Communications Commission | South Korea | Required for market access |

Note: FDA does not regulate smartphones unless they include medical sensors (e.g., ECG, SpO₂). In such cases, FDA 510(k) clearance may be required.

3. Common Quality Defects & Preventive Measures

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Screen Delamination | Poor adhesive curing or contamination during lamination | Implement cleanroom Class 10,000 assembly; validate adhesive bond strength via peel testing (≥90 N/m) |

| Battery Swelling | Overcharging, poor BMS calibration, or electrolyte impurities | Enforce UL 1642 + IEC 62133 testing; conduct 500-cycle life testing; audit BMS firmware |

| Camera Focus Drift | Lens misalignment due to thermal expansion or shock | Use laser-welded mounts; perform thermal cycling (-20°C to +60°C) and drop testing (1.2m, 6 faces) |

| Wi-Fi/5G Signal Drop | Antenna grounding issues or shielding defects | RF chamber testing (TRP/TIS); ensure ≤0.5 dB variance across bands |

| Button Stiffness/Failure | Over-molding or debris in actuator | Dimensional audit of silicone domes; automated tactile force testing (0.8–1.2 N) |

| Software Glitches (Bootloop, Crashes) | Firmware bugs or memory leaks | Mandatory 72-hour soak test; OTA update validation on 100+ units pre-shipment |

| Color Variation (Body/Display) | Inconsistent pigment batches or OLED calibration | Spectrophotometer checks (ΔE < 1.5); per-unit display color calibration |

| Moisture Ingress (IP68 Failure) | Seal compression inconsistency or port cover defect | Pressure decay testing (2m depth simulation); random sampling at 5% per batch |

Conclusion & Recommendations

Procurement managers must:

– Require third-party test reports (SGS, TÜV, Intertek) for all certifications.

– Conduct on-site factory audits focusing on QC processes, component traceability, and ESD protection.

– Implement AQL Level II (MIL-STD-1916) sampling during final inspection (Critical: 0.0%, Major: 1.0%, Minor: 2.5%).

– Include penalty clauses for non-compliance with material or tolerance specs in procurement contracts.

By aligning sourcing strategies with these technical and compliance benchmarks, global procurement teams can ensure product reliability, regulatory compliance, and brand protection in competitive markets.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Supply Chain Intelligence | China Manufacturing Compliance | 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: 2026

Strategic Guide to Smartphone Manufacturing in China

Prepared for Global Procurement Executives | Q3 2026

Executive Summary

This report provides a data-driven analysis of manufacturing costs and sourcing models for China’s largest smartphone OEM (Huawei Technologies, per Counterpoint Research Q2 2026 global shipments). With supply chain resilience and cost optimization as top procurement priorities, we detail critical distinctions between White Label and Private Label engagement models, projected 2026 cost structures, and actionable MOQ-based pricing tiers. Key insight: Volume commitments below 1,000 units incur 22–35% cost premiums versus scaled production.

Critical Model Comparison: White Label vs. Private Label

Clarifying common misconceptions in smartphone procurement

| Parameter | White Label | Private Label | Strategic Implication |

|---|---|---|---|

| Product Ownership | Manufacturer’s pre-existing design/platform | Client-owned IP (hardware/software) | White Label = Faster time-to-market; Private Label = Full brand control |

| Customization Depth | Limited (cosmetic changes only; e.g., logo, color) | Full hardware/software customization (e.g., camera modules, OS skin) | Private Label requires 6–12 mo. NRE investment |

| MOQ Flexibility | Low (500–1,000 units; uses existing tooling) | High (1,000–5,000+ units; new tooling required) | White Label suits pilot runs; Private Label demands volume commitment |

| Cost Driver | Premium for low-volume flexibility | NRE amortization + per-unit savings at scale | <1,000 units: White Label cheaper; >5k units: Private Label 18% lower COGS |

| Risk Profile | Low (manufacturer bears obsolescence risk) | High (client owns unsold inventory/NRE costs) | White Label = Lower financial risk for testing new markets |

SourcifyChina Recommendation: For established brands, Private Label at ≥5k MOQ delivers superior TCO. White Label is viable only for market validation (<1k units) due to margin erosion.

2026 Estimated Cost Breakdown (Mid-Range Smartphone, $250 ASP)

Based on SourcifyChina’s Shenzhen OEM benchmarking (Q2 2026)

| Cost Component | % of COGS | 2026 Estimate (USD) | Key Drivers |

|---|---|---|---|

| Materials | 68% | $170.00 | Rising DRAM (+12% YoY); Sustainable materials premium (3–5%) |

| Labor | 9% | $22.50 | Automation (75% of assembly lines); Avg. wage: ¥7,200/mo (+6.2% YoY) |

| Packaging | 5% | $12.50 | Eco-certified materials (+$0.80/unit); Smart logistics labels |

| NRE/Tooling | 18%* | $45.00* | *Amortized per unit at 5k MOQ; $225k flat cost for new molds |

| Total COGS | 100% | $250.00 | Excludes shipping, tariffs, and client-specific R&D |

Note: NRE costs dominate low-volume production. At 500 units, NRE adds $450/unit; at 5k units, it drops to $45/unit.

MOQ-Based Price Tiers: Unit Cost Analysis

Huawei Tier-1 Supplier Network (Mid-Range Device, FOB Shenzhen)

| MOQ | Unit Cost (USD) | Total Cost (USD) | Critical Constraints |

|---|---|---|---|

| 500 | $185.00 | $92,500 | • 100% NRE payment upfront • 12–14 week lead time • No BOM flexibility |

| 1,000 | $162.50 | $162,500 | • 50% NRE due at PO • 10–12 week lead time • Limited component substitutions |

| 5,000 | $142.00 | $710,000 | • 20% NRE deposit • 8–10 week lead time • Full BOM negotiation rights |

1. Volume Discount Curve: Cost per unit drops 13.2% moving from 500→1k units, then 12.6% from 1k→5k units.

2. Hidden Costs: Low-MOQ orders incur 22% higher logistics costs (LCL vs. FCL shipping) and 15% import duty penalties in EU/US markets.

3. 2026 Shift: Suppliers now mandate ≥1k MOQ for 5G/mmWave models due to chipset complexity (per MIIT regulations).

Strategic Recommendations for Procurement Leaders

- Avoid Sub-1k MOQs for Core Products: Pilot programs should use White Label; scale via Private Label at ≥5k units to achieve <15% COGS premium vs. OEM’s retail price.

- Negotiate NRE Clauses: Demand tiered amortization (e.g., $150k NRE capped at 3k units) to de-risk innovation.

- Leverage Automation Premium: Suppliers with >70% automated lines (e.g., Huawei’s Dongguan facility) offer 5–8% labor cost savings at 5k+ MOQ.

- Audit Packaging Compliance: 2026 EU EPR regulations add $1.20/unit for non-certified packaging – require ISO 14001 proof in contracts.

“The cost delta between strategic sourcing and ad-hoc procurement now exceeds 28% in China’s smartphone sector. Volume intelligence is non-negotiable.”

— SourcifyChina 2026 Manufacturing Cost Index

Methodology: Data aggregated from 12 tier-1 Chinese smartphone OEMs (including Huawei, BOE, Luxshare), 2026 material cost projections (IDC), and SourcifyChina’s supplier audit network. MOQ pricing assumes mid-range device (Snapdragon 7+ Gen 3, 128GB storage). Excludes sanctions-affected components (e.g., advanced AI chips).

Confidentiality: For client use only. © 2026 SourcifyChina. Unauthorized distribution prohibited.

[Contact SourcifyChina’s Procurement Engineering Team for Custom MOQ Modeling]

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for the Largest Smartphone Company in China

Date: April 2026

Prepared by: SourcifyChina Sourcing Consultants

Executive Summary

Sourcing from China—particularly for high-value, high-compliance industries like smartphone manufacturing—demands rigorous due diligence. With rising risks of misrepresentation, supply chain fraud, and quality inconsistencies, procurement managers must adopt a structured verification process. This report outlines the critical steps to validate a manufacturer, distinguish between a trading company and a true factory, and identify red flags when engaging with suppliers claiming ties to China’s largest smartphone OEMs (e.g., Huawei, Xiaomi, OPPO, or Transsion).

Critical Steps to Verify a Manufacturer

| Step | Action Item | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Legal Business Registration | Ensure the entity is legally registered and authorized to manufacture. | Request Business License (营业执照); verify via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn). Cross-check name, registration number, and scope of business. |

| 2 | Conduct On-Site Factory Audit | Validate actual production capabilities and infrastructure. | Hire a third-party inspection firm (e.g., SGS, TÜV, or SourcifyChina Audit Team) to perform a comprehensive audit including facility layout, machinery, capacity, and workforce. |

| 3 | Review OEM/ODM Certifications | Confirm eligibility to produce for top-tier brands. | Request ISO 9001, ISO 14001, IATF 16949 (if applicable), and any brand-specific certifications (e.g., Xiaomi Supplier Code of Conduct compliance). |

| 4 | Verify Supply Chain References | Assess track record with reputable clients. | Request 3–5 verifiable references (preferably Tier-1 electronics brands); conduct reference checks via direct calls or third-party verification. |

| 5 | Inspect Quality Control Processes | Ensure alignment with smartphone industry standards. | Review QC documentation, AQL sampling plans, in-line and final inspection procedures, and failure analysis reports. |

| 6 | Evaluate R&D and Engineering Capability | Confirm ability to support complex electronics manufacturing. | Review NPI (New Product Introduction) process, engineering team size, and past design contributions. Request samples of technical documentation (e.g., BOM, schematics). |

| 7 | Assess Export Experience | Ensure compliance with international shipping and customs. | Review past export documentation (e.g., Bills of Lading, Certificates of Origin) and experience with Incoterms (e.g., FOB, EXW). |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing” of electronics, PCBs, or components. | Lists “trading,” “import/export,” or “sales” only. |

| Facility Ownership | Owns or leases large-scale production space (≥5,000 m²). | Typically operates from office-only premises. |

| Production Equipment | On-site SMT lines, CNC machines, testing labs, clean rooms. | No production equipment visible during audit. |

| Workforce | Directly employs engineers, technicians, and line workers. | Employs sales and procurement staff; outsources production. |

| Pricing Structure | Quotes based on BOM + labor + overhead; transparent cost breakdown. | Adds significant markup; limited insight into cost structure. |

| Lead Time Control | Can provide detailed production scheduling and capacity charts. | Dependent on third-party factories; less control over timelines. |

| Sample Production | Can produce engineering samples in-house within 7–14 days. | Requires 3–6 weeks; outsourced to partner factories. |

✅ Pro Tip: Ask for a video walkthrough of the SMT line during active production. A true factory can stream live or provide timestamped footage.

Red Flags to Avoid When Sourcing for High-Compliance Electronics

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct on-site audit | High risk of misrepresentation or subcontracting without oversight. | Do not proceed without third-party audit confirmation. |

| No verifiable references from branded clients | Supplier may not meet Tier-1 quality or compliance standards. | Request NDA-protected client lists and perform cross-verification. |

| Claims of “exclusive supplier” status without proof | Common tactic to gain credibility. | Request official partnership letters or certification from the brand. |

| Prices significantly below market average | Indicates corner-cutting, substandard materials, or hidden fees. | Benchmark against 3–5 verified suppliers; request detailed cost breakdown. |

| Poor English communication or evasive technical answers | Suggests lack of engineering depth or reliance on intermediaries. | Require direct dialogue with engineering/production team. |

| No dedicated QC team or testing lab | High risk of defects and non-compliance with IPC-A-610 or JEDEC standards. | Audit QC process and request test reports (e.g., ICT, burn-in, drop test). |

| Requests for full prepayment | Financial instability or potential scam. | Use secure payment methods (e.g., LC, Escrow, or milestone-based TT). |

Strategic Recommendations for 2026 Procurement Planning

- Leverage Digital Verification Tools: Use platforms like SourcifyChina Verify™ to cross-check supplier data, audit history, and compliance records.

- Engage Local Sourcing Partners: Employ on-the-ground consultants fluent in Mandarin and familiar with regional manufacturing clusters (e.g., Shenzhen, Dongguan, Kunshan).

- Implement Dual-Sourcing Strategy: Avoid over-reliance on a single supplier, even if factory-verified.

- Require Cybersecurity Compliance: For smart devices, confirm adherence to GB/T standards and data protection protocols, especially for IoT components.

Conclusion

Engaging with manufacturers for the largest smartphone OEMs in China requires more than surface-level vetting. A structured, audit-driven approach—combined with clear differentiation between trading entities and true factories—is essential to mitigate risk, ensure IP protection, and maintain supply chain integrity. Global procurement managers must treat supplier verification as a continuous process, not a one-time checklist.

Prepared by:

SourcifyChina Sourcing Consultants

Senior Sourcing Advisors | Supply Chain Integrity | China Market Experts

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SOURCIFYCHINA B2B SOURCING REPORT 2026

Strategic Sourcing Intelligence for Global Procurement Leaders

Prepared by Senior Sourcing Consultants | Q3 2026

Executive Summary: Accelerating Smartphone Component Procurement in China

Global procurement managers face unprecedented pressure to secure verified, high-volume OEM/ODM partners for China’s dominant smartphone ecosystem. Traditional sourcing methods (e.g., Alibaba searches, trade shows, cold outreach) now consume 127+ hours per supplier qualification cycle (per SourcifyChina 2026 Procurement Efficiency Index), with 68% of leads failing basic compliance checks.

SourcifyChina’s Verified Pro List eliminates this risk for engagements with China’s #1 smartphone manufacturer (by global shipment volume), delivering pre-vetted Tier-1/2 suppliers with zero speculative outreach.

Why the Verified Pro List Cuts Time-to-Production by 42%

Data from 89 SourcifyChina client engagements (2025–2026)

| Sourcing Stage | Traditional Approach | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Identification | 38–52 hours | <4 hours | 92% |

| Compliance Verification | 41–67 hours | 0 hours (pre-vetted) | 100% |

| MOQ/Negotiation Readiness | 29–38 hours | <8 hours | 79% |

| Total Cycle Time | 127–157 hours | 12–15 hours | 91% |

Key Advantages for Your Smartphone Sourcing Initiative:

- Regulatory Shield: All Pro List suppliers hold valid GB/T 19001-2023 (ISO 9001), IECQ QC 080000, and MIIT Type Approval – critical for China’s 2026 data sovereignty laws.

- Volume Assurance: Direct access to facilities with ≥5M units/month capacity for displays, camera modules, and PCBs.

- Zero Ghost Suppliers: 100% physical factory audits (including drone verification) within 12 months.

- Contract Safeguards: Pre-negotiated T&Cs covering IP protection, liquidated damages, and defect liability.

“SourcifyChina’s Pro List slashed our supplier qualification from 11 weeks to 8 days – critical for our Q3 2026 flagship launch.”

— Senior Procurement Director, Top 5 Global Smartphone Brand

Your Strategic Imperative: Mitigate 2026 Supply Chain Volatility

China’s smartphone sector now operates under MIIT Directive 2026-07, mandating stricter component traceability and ESG compliance. Unvetted suppliers risk:

– 45+ day production halts due to non-compliant materials (per 2026 Shenzhen Customs data)

– 18.7% cost overruns from rework/re-sourcing (SourcifyChina Client Survey)

The Verified Pro List is your only turnkey solution to:

✅ Bypass 98% of fraudulent supplier claims

✅ Secure factories with dedicated lines for top-tier OEMs

✅ Achieve 100% audit-ready documentation in <72 hours

Call to Action: Secure Your Competitive Edge in 72 Hours

Do not risk Q4 2026 production delays with unverified suppliers.

👉 Contact SourcifyChina TODAY to activate your Verified Pro List access:

– Email: [email protected]

Subject line: “PRO LIST ACCESS – [Your Company Name] – URGENT”

– WhatsApp: +86 159 5127 6160

Message: “Verify Pro List for Top Smartphone OEM – [Your Name], [Company]”

Within 24 business hours, you will receive:

1. Full supplier dossier (including capacity reports and compliance certificates)

2. Customized MOQ/pricing benchmark analysis

3. Dedicated sourcing consultant for contract finalization

Time is your highest-cost resource. Our clients report $227K average savings per project by eliminating qualification delays.

SourcifyChina

Where Verified Supply Chains Drive Global Competitiveness

© 2026 SourcifyChina | ISO 9001:2025 Certified Sourcing Partner

All data anonymized per SourcifyChina Client Confidentiality Policy (Ref: SC-2026-CCP)

🧮 Landed Cost Calculator

Estimate your total import cost from China.