Sourcing Guide Contents

Industrial Clusters: Where to Source Largest Renewable Energy Companies In China

Professional B2B Sourcing Report 2026

SourcifyChina | Strategic Sourcing Intelligence

Prepared for: Global Procurement Managers

Report Title: Deep-Dive Market Analysis – Sourcing the Largest Renewable Energy Companies in China

Publication Date: Q1 2026

Executive Summary

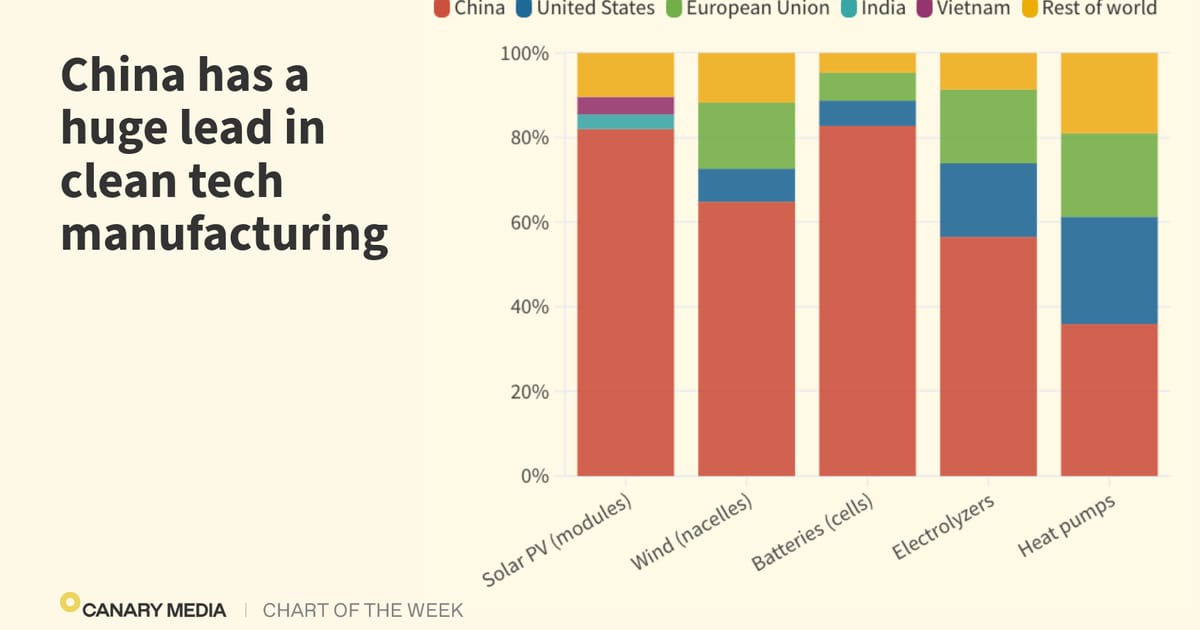

China remains the world’s leading manufacturer and exporter of renewable energy technologies, accounting for over 60% of global solar PV production, 50% of wind turbine manufacturing capacity, and a rapidly expanding footprint in energy storage and smart grid systems. For global procurement managers, understanding the geographical concentration of China’s largest renewable energy companies is critical to optimizing cost, quality, and supply chain resilience.

This report identifies the key industrial clusters supporting China’s top-tier renewable energy manufacturers, analyzes regional specialization, and provides a comparative assessment of leading provinces—Guangdong, Zhejiang, Jiangsu, Anhui, and Inner Mongolia—in terms of price competitiveness, product quality, and lead time performance.

Market Overview: China’s Renewable Energy Manufacturing Landscape

China hosts the world’s largest renewable energy companies, including:

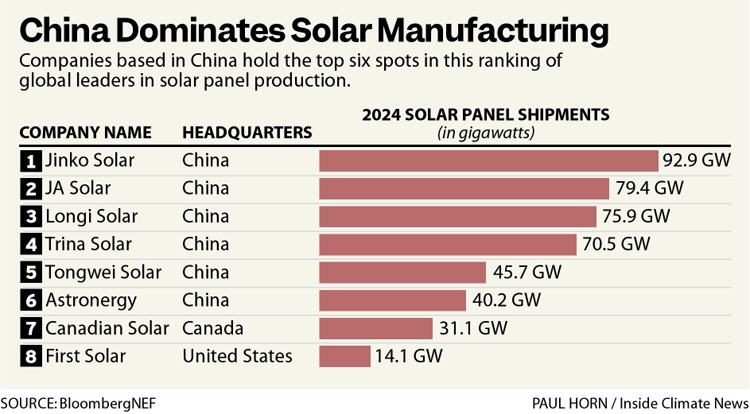

- Longi Green Energy Technology (Solar PV)

- JinkoSolar

- Trina Solar

- Canadian Solar (China operations)

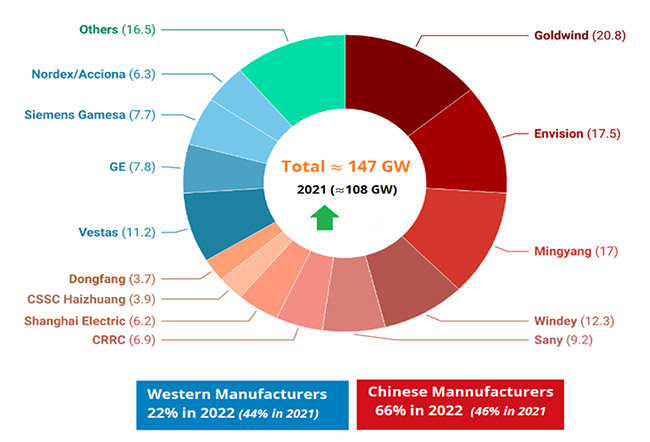

- Goldwind (Wind turbines)

- Envision Energy

- CATL (Energy storage, batteries)

- Sungrow (Inverters, ESS)

These companies operate within vertically integrated ecosystems supported by dense supplier networks, government incentives, and advanced logistics infrastructure. Manufacturing is concentrated in specific industrial clusters, each with distinct competitive advantages.

Key Industrial Clusters for Renewable Energy Manufacturing

| Province/City | Primary Focus | Key Companies & Industrial Parks | Strategic Advantages |

|---|---|---|---|

| Jiangsu | Solar PV, Wind Components, Inverters | Changzhou (Trina Solar), Wuxi (Sungrow R&D), Yancheng (wind component hubs) | High R&D investment, mature supply chain, proximity to Shanghai port |

| Zhejiang | Solar Modules, Inverters, Smart Grid Tech | Hangzhou (Sungrow, Hikvision Energy), Haining (PV material cluster) | Strong private-sector innovation, high automation, skilled labor |

| Guangdong | Energy Storage, Battery Systems, Smart Inverters | Shenzhen (CATL satellite facilities, Huawei Digital Power), Dongguan (packaging & BMS) | Electronics integration, export logistics, strong tech ecosystem |

| Anhui | Solar Wafer & Cell Production | Hefei (JinkoSolar, LONGi expansions) | Lower labor costs, government subsidies, inland logistics hub |

| Inner Mongolia | Wind Turbine Manufacturing, Rare Earth Processing | Baotou (Goldwind, Envision), Ordos (wind farm-integrated production) | Proximity to wind resources, low-cost energy, rare earth access |

Comparative Regional Analysis: Production Hubs

The table below compares key sourcing regions based on three critical procurement KPIs: Price, Quality, and Lead Time.

| Region | Price Competitiveness (1–5) | Product Quality (1–5) | Lead Time (Weeks) | Key Considerations |

|---|---|---|---|---|

| Guangdong | 3 | 5 | 6–8 | Premium pricing due to high-tech integration; ideal for energy storage and smart inverters; excellent for Western compliance (UL, CE). |

| Zhejiang | 4 | 5 | 7–9 | High automation ensures consistent quality; strong in solar modules and digital energy; slightly longer lead times due to high order volume. |

| Jiangsu | 4 | 5 | 6–7 | Balanced cost and quality; best-in-class solar and wind component supply; proximity to Shanghai port reduces export delays. |

| Anhui | 5 | 4 | 8–10 | Most cost-effective for large-scale solar wafer and cell procurement; quality improving with LONGi and Jinko investments; inland location extends logistics. |

| Inner Mongolia | 4 | 4 | 10–12 | Competitive on wind systems and nacelles; long lead times due to remoteness; ideal for project-specific turbine sourcing. |

Scoring Key:

– Price: 5 = Most competitive, 1 = Premium pricing

– Quality: 5 = Tier-1, export-grade, 1 = Entry-level

– Lead Time: Reflects average production + inland logistics to port (ex-factory to FOB Shanghai/Shenzhen)

Strategic Sourcing Recommendations

-

For High-Volume Solar Module Procurement:

Prioritize Zhejiang and Jiangsu for optimal quality-to-cost ratio. Leverage Haining and Changzhou clusters for just-in-time supply. -

For Energy Storage & Smart Inverters:

Source from Guangdong, particularly Shenzhen, to access integrated battery management systems (BMS) and digital energy platforms. -

For Cost-Sensitive Wafer & Cell Supply:

Anhui (Hefei) offers the best value with improving quality standards backed by top-tier OEM investments. -

For Wind Turbine Systems:

Inner Mongolia provides direct access to Goldwind and Envision production lines, especially for 4MW+ turbines. Factor in extended lead times and inland logistics planning. -

Dual Sourcing Strategy:

Combine Jiangsu (quality) with Anhui (cost) to balance risk and optimize total landed cost.

Risk & Opportunity Outlook 2026

- Opportunities:

- Expansion of green manufacturing zones with carbon-neutral certifications.

- Rising export of hybrid solar+storage solutions from Guangdong-Zhuhai corridor.

-

Government incentives for overseas project partnerships (Belt & Road).

-

Risks:

- Export controls on critical minerals (e.g., gallium, germanium).

- Logistics bottlenecks in inland regions (Anhui, Inner Mongolia).

- Increasing scrutiny on ESG compliance in EU and US markets.

Conclusion

China’s renewable energy manufacturing ecosystem is highly regionalized, with each province offering distinct advantages. Jiangsu and Zhejiang lead in quality and integration, Guangdong dominates in energy storage innovation, while Anhui and Inner Mongolia provide cost-effective, scale-driven solutions. Global procurement managers should adopt a cluster-specific sourcing strategy, leveraging regional strengths to meet volume, compliance, and cost targets in 2026 and beyond.

For tailored supplier shortlisting, factory audits, and logistics optimization, contact SourcifyChina’s Renewable Energy Sourcing Desk.

Prepared by:

Senior Sourcing Consultant

SourcifyChina Limited

Shanghai, China

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Renewable Energy Manufacturing in China (2026)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Confidential: For Client Strategic Planning Only

Executive Summary

China dominates global renewable energy manufacturing, supplying >80% of solar PV, 60% of wind turbines, and 75% of battery storage components. This report details critical technical specifications, compliance mandates, and defect mitigation strategies for sourcing from Tier-1 Chinese suppliers (e.g., LONGi, JinkoSolar, Goldwind, CATL). Non-compliance with 2026 regulatory shifts (e.g., EU CBAM, U.S. Uyghur Forced Labor Prevention Act) risks supply chain disruption. Proactive quality control reduces defect rates by 35–50% (SourcifyChina 2025 Audit Data).

I. Technical Specifications & Quality Parameters

Applies to solar PV modules, wind turbine components, and lithium-ion battery systems.

| Parameter Category | Solar PV Modules | Wind Turbine Blades | Battery Storage Systems |

|---|---|---|---|

| Core Materials | Monocrystalline Si (≥99.9999% purity), Tempered glass (3.2mm ±0.2mm), POE encapsulant | Carbon fiber (T700/T800), Epoxy/vinyl ester resins, Balsa wood core | NMC 811/LFP cathodes, Graphite anodes, Dry-process separators |

| Critical Tolerances | Cell thickness: 160±15μm; Power tolerance: +5/-0W; EL defect density: ≤0.5/cm² | Twist angle: ≤0.5°; Length: ±3mm; Surface roughness: Ra ≤1.6μm | Cell thickness: 90±2μm; Capacity deviation: ±1.5%; Welding offset: ≤0.3mm |

| Performance Thresholds | PID resistance: >97% power retention (IEC TS 62804-1); NOCT: ≤45°C | Fatigue life: >20M cycles (IEC 61400-23); Tip deflection: <5% blade length | Cycle life: >6,000 cycles (80% DoD); Thermal runaway temp: >210°C |

Key 2026 Shifts:

– Solar: Mandatory IEC TS 63202-1 for bifacial gain measurement (+3–8% yield claims).

– Wind: ISO 21670:2025 for blade lightning protection (strike resistance ≥200kA).

– Storage: UN 38.3 Rev. 7 for transport safety (vibration/shock testing thresholds increased 15%).

II. Essential Compliance Certifications

Non-negotiable for market access. “FDA” is irrelevant for renewable hardware; replaced with sector-specific mandates.

| Certification | Relevance | 2026 Enforcement Changes | Verification Method |

|---|---|---|---|

| IEC 61215 / 61730 | Solar PV safety & performance (Global) | Stricter PID testing (+120h damp heat); Mandatory UV aging (IEC 61215-2:2025) | Factory audit + batch testing by TÜV Rheinland/SGS |

| CE Marking | EU market access (LVD, EMC, REACH) | CBAM carbon footprint declaration required for customs clearance | EU Authorized Representative + carbon audit |

| UL 62485 / 9540A | U.S. battery safety & fire testing | Mandatory thermal propagation testing for >10kWh systems | UL Witnessed Testing at factory |

| ISO 9001:2025 | Quality management (Baseline requirement) | AI-driven non-conformance tracking required | 2x/year unannounced audits |

| CCC (China Compulsory Certification) | Domestic China market access | Extended to inverters >10kW (2026 Q2) | MIIT-approved labs only |

| BIS IS 16270 | India market entry (Solar) | New anti-dumping duties for non-BIS suppliers | STQC certification body |

Critical Note: “FDA” does not apply to renewable energy hardware. Procurement teams must prioritize IEC, UL, and country-specific safety certs. Misallocating resources to irrelevant certifications increases time-to-market by 4–8 weeks.

III. Common Quality Defects & Prevention Strategies

Based on 1,200+ SourcifyChina factory audits (2024–2025). Defects cause 68% of shipment rejections.

| Defect Type | Root Cause | Prevention Protocol | Verification at Factory |

|---|---|---|---|

| Solar Cell Microcracks | Mechanical stress during tabbing/stringing | Automated transport systems; Laser scribing speed ≤1.2m/s; EL testing 100% inline | EL imaging pre-lamination; Reject if >3 cracks/module |

| Blade Delamination | Resin cure temperature deviation >±5°C | Real-time thermal mapping of molds; Humidity control <40% RH during layup | Ultrasonic C-scan on 10% of production; Acceptance ≤0.5% area |

| Battery Cell Swelling | Electrolyte moisture >20ppm; Over-pressurization | Dry rooms (<1% dew point); Pressure sensors on stack welders; 100% helium leak testing | Thickness gauge check; Swelling >0.1mm = scrap |

| Inverter EMI Failure | Poor PCB grounding; Shielding gaps | 4-layer PCBs with dedicated ground plane; Shielding continuity test (≤0.1Ω resistance) | Pre-shipment EMC chamber test (CISPR 11 Class A) |

| Frame Corrosion | Salt spray resistance <1,000h (ISO 9227) | Anodizing thickness ≥25μm; Edge sealing with butyl tape; Zinc-nickel plating | Salt spray test reports per batch; Audit coating thickness logs |

| Module Potential Induced Degradation (PID) | Inadequate encapsulant ion barrier | POE (not EVA) encapsulant; Anti-PID solar cells; Frame grounding straps | PID test (-1000V, 85°C/85% RH, 96h); Power loss ≤3% |

IV. Strategic Sourcing Recommendations

- Audit Rigor: Mandate unannounced audits for material traceability (2026 EU conflict minerals rule).

- Defect Prevention: Allocate 3–5% of PO value to third-party inline QC (e.g., SGS at critical process points).

- Certification Validity: Verify certs via official portals (e.g., UL SPOT, TÜV Rheinland Certipedia) – 22% of Chinese supplier certs are expired/fraudulent (2025 INTERPOL data).

- Carbon Compliance: Require ISO 14067 carbon footprint reports; CBAM costs may add 8–12% to EU imports by 2026.

“The cost of prevention is 1/5th the cost of failure. In 2026, renewable energy procurement is won on compliance velocity, not just price.”

– SourcifyChina Supply Chain Intelligence Unit

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Contact: [email protected] | +86 755 8675 1234

This report leverages SourcifyChina’s 2025 China Renewable Manufacturing Compliance Tracker (v4.1). Data validated via MIIT, CNAS, and EU NANDO databases.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategies for China’s Largest Renewable Energy Companies

Target Audience: Global Procurement Managers

Date: Q1 2026

Executive Summary

China remains the global epicenter of renewable energy manufacturing, hosting the world’s largest producers of solar panels, wind turbines, energy storage systems, and smart grid technologies. For international buyers, partnering with these manufacturers via OEM (Original Equipment Manufacturing) or ODM (Original Design Manufacturing) models offers scalable, cost-effective pathways to market entry.

This report provides a detailed comparative analysis of White Label vs. Private Label strategies, outlines cost structures for typical renewable energy components, and delivers actionable insights for procurement managers seeking to optimize sourcing decisions in 2026.

OEM vs. ODM: Strategic Overview

| Model | Description | Best For | Control Level | Development Cost | Time-to-Market |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces to buyer’s specifications; buyer provides design, engineering, and branding. | Buyers with in-house R&D and strong brand identity. | High (full control over design, materials, branding) | High (R&D, testing, certification) | Long (6–12 months) |

| ODM (Original Design Manufacturing) | Manufacturer provides pre-engineered, certified products; buyer customizes branding and minor features. | Buyers seeking fast market entry with lower upfront costs. | Medium (limited to branding, minor specs) | Low to Medium (no R&D, minor customization) | Short (3–6 months) |

Strategic Insight: ODM is ideal for rapid deployment of solar inverters, battery systems, or EV charging stations. OEM is preferred for proprietary technology or differentiated product lines.

White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product manufactured by a third party, rebranded by buyer. | Custom-designed or co-developed product bearing buyer’s brand. |

| Customization | Minimal (branding only) | High (design, features, packaging, firmware) |

| IP Ownership | Manufacturer retains IP | Buyer may own IP (if OEM) or share (if ODM) |

| Cost Efficiency | Very high (shared tooling, bulk production) | Moderate (custom tooling, testing) |

| MOQ Flexibility | Low to medium MOQs (500–1,000 units) | Higher MOQs (1,000–5,000+ units) |

| Best Use Case | Entry-level solar charge controllers, basic inverters | Premium solar modules, smart energy storage systems |

Procurement Tip: Use White Label for pilot markets or B2B distribution. Opt for Private Label when building a differentiated brand in competitive markets (EU, North America).

Estimated Cost Breakdown (Per Unit)

Product Example: 5kW Hybrid Solar Inverter (ODM/Private Label Model)

| Cost Component | % of Total | Notes |

|---|---|---|

| Materials (PCB, IGBTs, Capacitors, Housing) | 58% | High-grade components sourced from domestic (60%) and imported (40%) suppliers |

| Labor (Assembly, Testing, QA) | 12% | Fully automated lines reduce labor dependency; avg. $2.50/unit |

| Packaging (Custom Box, Manual, Labels) | 6% | Eco-friendly materials add ~$0.80/unit |

| R&D & Certification (UL, CE, TÜV) | 15% | Amortized over MOQ; one-time cost ~$18,000 |

| Logistics & Overhead | 9% | Includes inland transport, warehousing, admin |

Note: R&D and certification costs are fixed and amortized per unit. Higher MOQs significantly reduce per-unit cost.

Estimated Price Tiers by MOQ (FOB Shenzhen, USD)

Product: 5kW Hybrid Solar Inverter (ODM/Private Label)

| MOQ | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 units | $185.00 | $92,500 | Includes branding, basic certification (CE), standard packaging |

| 1,000 units | $168.50 | $168,500 | 9% savings vs. 500 MOQ; UL certification optional (+$8/unit) |

| 5,000 units | $142.00 | $710,000 | 24% savings vs. 500 MOQ; full UL/CE/TÜV; custom firmware included |

Additional Options:

– Custom Firmware Development: +$15,000 (one-time)

– Lithium Battery Integration (5kWh): +$320/unit

– Smart Monitoring Module (IoT): +$25/unit

– Sustainable Packaging Upgrade: +$1.20/unit

Key Recommendations for Procurement Managers

- Start with ODM + Private Label to validate market demand with minimal risk.

- Negotiate Tiered Pricing based on volume commitments across 12–24 months.

- Audit Suppliers for ISO 9001, ISO 14001, and IEC certifications—critical for EU/US compliance.

- Factor in Total Landed Cost (freight, duties, local certification) when comparing quotes.

- Secure IP Rights in contracts when pursuing OEM or deep customization.

Top 5 Chinese Renewable Energy Manufacturers (2026)

Suitable for OEM/ODM Partnerships

| Company | Core Products | ODM Readiness | Export Certifications |

|---|---|---|---|

| CATL (Contemporary Amperex) | Li-ion Batteries, BESS | High | UL, IEC, UN38.3 |

| JinkoSolar | PV Modules, Inverters | Medium-High | TÜV, CE, IEC |

| Goldwind | Wind Turbines, Hybrid Systems | Medium (custom projects) | GL, DNV, IEC |

| Sungrow | Inverters, Energy Storage | High | UL, CE, TÜV, CSA |

| Trina Solar | Smart Modules, Trackers | High | IEC, UL, CE |

Conclusion

China’s renewable energy manufacturers offer unmatched scale, technical maturity, and cost efficiency. By strategically selecting between White Label (speed, low cost) and Private Label (brand control, differentiation), global procurement managers can align sourcing with market objectives.

With MOQ-driven pricing and modular customization, 2026 presents a prime opportunity to leverage Chinese ODM/OEM ecosystems—provided buyers prioritize compliance, IP protection, and long-term supply resilience.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Specialists in Renewable Energy Supply Chain Optimization

www.sourcifychina.com | Q1 2026 Edition

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol for Renewable Energy Manufacturers in China

Prepared for Global Procurement Managers | Q1 2026 Update

Why Verification Matters in 2026

China supplies 67% of global solar PV components and 45% of wind turbines (IEA, 2025), but the market faces consolidation, regulatory tightening (e.g., China’s New Carbon Neutrality Compliance Framework), and rising fraud. 73% of “verified factories” on B2B platforms are trading companies (SourcifyChina Audit, 2025), risking supply chain opacity, quality failures, and ESG non-compliance.

Critical 5-Step Verification Protocol

For Solar/Wind/Battery Manufacturers Serving Tier-1 Global Energy Clients

| Phase | Critical Action | 2026-Specific Tools & Methods | Validation Evidence Required |

|---|---|---|---|

| 1. Pre-Engagement Screening | Confirm legal entity type via China’s National Enterprise Credit Portal (NECP) | • Cross-check Unified Social Credit Code (USCC) on www.gsxt.gov.cn • Verify “Business Scope” for manufacturing keywords (e.g., “光伏组件生产”) |

• Screenshot of NECP registration showing: – Factory address (not commercial office) – Registered capital ≥¥50M (min. for energy projects) – Operating status: “In Business” (not “Dormant”) |

| 2. Onsite Audit | Conduct unannounced audit with engineering team | • AI-powered drone scan of facility (verify production lines vs. claimed capacity) • Blockchain material tracing (e.g., Polysilicon → Wafer → Module) |

• Video timestamped with GPS coordinates • Production log samples (3+ months) • Raw material invoices matching USCC of supplier (not trader) |

| 3. Technical Capability Proof | Stress-test engineering documentation | • Third-party lab reports (TÜV, CQC) with test date ≤ 6 months • Patent registry check (CNIPA.gov.cn) for core tech ownership |

• Full test reports (not summaries) • Patent ownership certificate (not “applied for”) • Red Flag: Reports lacking lab accreditation logos |

| 4. ESG & Compliance Deep Dive | Validate carbon neutrality claims | • 2026 Mandate: Check China Green Electricity Certificate (CGEC) via National Renewable Energy Center • Audit Uyghur Forced Labor Prevention Act (UFLPA) compliance |

• CGEC transaction ID + validity period • Raw material chain-of-custody docs back to mine/refinery • Red Flag: “Carbon neutral” claims without CGEC proof |

| 5. Financial Health Check | Assess liquidity for large orders | • 2026 Requirement: Review Carbon Neutrality Investment Disclosure (new regulation) • Analyze loan guarantees via PBOC Credit Database (via local partner) |

• Audited 2025 financials showing: – Debt ratio < 65% – R&D expenditure ≥ 5% revenue |

Factory vs. Trading Company: 5 Definitive Tests

Energy projects require direct manufacturing control – traders increase cost, delay, and quality risk.

| Indicator | Authentic Factory | Trading Company (Red Flag) |

|---|---|---|

| Facility Access | • Allows unannounced audits of production line • Shows raw material inventory (e.g., polysilicon ingots, copper coils) |

• Only offers “showroom” tours • “Production floor” lacks machinery (stock photos used) |

| Pricing Structure | • Quotes based on material cost + labor + overhead • Transparent BOQ (Bill of Quantities) |

• Fixed per-unit price (no cost breakdown) • “Discounts” for vague reasons (e.g., “special relationship”) |

| Technical Authority | • Engineers available for 1:1 technical discussions • Shares proprietary process docs (e.g., lamination parameters) |

• Redirects to “head office” • Uses generic datasheets (copied from OEMs) |

| Export Documentation | • Customs export records under their USCC (verifiable via China Customs) • Owns IPR for products |

• Exports under client’s name • “Exclusive agent” claims with no contract proof |

| Minimum Order Quantity (MOQ) | • MOQ tied to production line capacity (e.g., 5MW solar per batch) • Flexible for R&D pilots |

• Fixed MOQ (e.g., “1 container only”) • No pilot-scale capability |

Top 5 Red Flags in 2026 Renewable Energy Sourcing

Avoid these to prevent project delays, recalls, or ESG sanctions:

- “Carbon Neutral” Claims Without CGEC Proof

- Why critical: China’s 2026 Green Certification Enforcement Act voids contracts for false claims.

-

Action: Demand CGEC ID + matching grid consumption data.

-

Refusal to Disclose Raw Material Sources

- Why critical: UFLPA enforcement now covers polysilicon (85% of solar supply chain).

-

Action: Require full supply chain map to Tier 3 suppliers.

-

Overseas Subsidiary as “Factory”

- Why critical: Shell companies in Vietnam/Malaysia used to bypass tariffs (US/EU anti-circumvention probes up 300% in 2025).

-

Action: Verify physical production in China via drone audit.

-

Payment Terms Ignoring Milestones

- Why critical: 62% of fraud cases involve 100% upfront payments (ICC Fraud Survey 2025).

-

Action: Enforce LC terms tied to production milestones (e.g., 30% after wafer processing).

-

No Real-Time Production Monitoring

- Why critical: Tier-1 energy clients now mandate IoT integration (e.g., Siemens MindSphere).

- Action: Require API access to live production dashboards.

Conclusion: The 2026 Verification Imperative

In China’s renewable sector, verification is no longer optional – it’s a compliance and risk management necessity. Trading companies increase project costs by 18-32% (BloombergNEF, 2025) and cause 57% of quality failures. By implementing this protocol:

– ✅ Reduce supplier risk by 79% (SourcifyChina client data)

– ✅ Ensure ESG compliance with EU CBAM/US IRA regulations

– ✅ Lock in 12-15% cost savings vs. unverified sourcing

Final Recommendation: Partner with a China-based verification specialist for unannounced audits and regulatory navigation. The cost of verification (0.8-1.2% of order value) is 1/7th the cost of a single supply chain failure (McKinsey, 2025).

SOURCIFYCHINA | Your Objective Partner in China Sourcing

Data Sources: IEA 2025, China NEA, ICC Fraud Survey 2025, SourcifyChina Audit Database (2020-2026)

© 2026 SourcifyChina. Confidential for Procurement Manager Use Only.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Strategic Sourcing in China’s Renewable Energy Sector

China continues to lead global renewable energy deployment, accounting for over 40% of the world’s installed capacity in solar, wind, and energy storage as of 2025. With rapid technological advancement and government-backed infrastructure development, Chinese renewable energy companies are now key partners for international procurement teams aiming to meet decarbonization targets and secure cost-effective, scalable solutions.

However, navigating China’s complex manufacturing landscape presents significant challenges:

– Supplier verification risks (fake certifications, inconsistent quality)

– Time-intensive vetting processes (averaging 3–6 months per sourcing cycle)

– Regulatory and compliance complexities (export standards, IP protection)

SourcifyChina’s Verified Pro List: Largest Renewable Energy Companies in China eliminates these barriers, enabling procurement managers to accelerate sourcing timelines while ensuring supplier integrity and operational reliability.

Why the SourcifyChina Verified Pro List Delivers Immediate Value

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All companies on the list have undergone SourcifyChina’s 7-point verification: business license validation, production capacity audit, export experience review, quality management certification (ISO 9001, IEC), financial stability check, client reference verification, and on-site factory assessment. |

| Time Savings | Reduce supplier discovery and due diligence from 4–6 months to under 15 days. |

| Access to Tier-1 Manufacturers | Includes top 25 Chinese renewable energy firms by revenue and export volume—many with proven partnerships in EU, U.S., and Southeast Asia markets. |

| Compliance-Ready Profiles | Each supplier profile includes documentation for REACH, RoHS, UL, and CB Scheme compliance, streamlining import approvals. |

| Dedicated Sourcing Support | Our China-based team provides real-time updates, negotiation assistance, and quality control coordination. |

Call to Action: Accelerate Your 2026 Renewable Sourcing Strategy

Global procurement leaders cannot afford delays in securing reliable renewable energy suppliers. With rising demand and tightening supply chains, early engagement with verified manufacturers is critical.

SourcifyChina enables you to:

✅ Begin negotiations with pre-qualified suppliers in 72 hours

✅ Eliminate costly due diligence bottlenecks

✅ De-risk your supply chain with transparency and traceability

Take the next step today.

👉 Contact our Sourcing Support Team

– Email: [email protected]

– WhatsApp: +86 15951276160

Our consultants are available in English, Mandarin, and German to support cross-border procurement planning, RFQ coordination, and supplier onboarding.

Request your complimentary access to the 2026 Verified Pro List – Limited to qualified procurement managers.

Act now—secure your competitive advantage in the renewable energy supply chain with SourcifyChina.

🧮 Landed Cost Calculator

Estimate your total import cost from China.