Sourcing Guide Contents

Industrial Clusters: Where to Source Largest Phone Company In China

SourcifyChina Sourcing Intelligence Report: Industrial Clusters for China’s Top Mobile Device Brands (2026)

Prepared for Global Procurement Managers | Confidential

Date: October 26, 2025 | Report ID: SC-CHN-PH-2026-001

Executive Summary

China remains the epicenter of global smartphone manufacturing, dominated by four key players: Huawei (largest by revenue in Greater China), Xiaomi (largest by global volume), OPPO, and vivo. Contrary to common misconception, these brands do not manufacture directly but rely on a sophisticated network of Tier-1 ODMs (Original Design Manufacturers) and component suppliers concentrated in specific industrial clusters. This report identifies the core manufacturing hubs, debunks the “single largest company” myth, and provides actionable regional comparisons for strategic sourcing.

Critical Clarification: There is no single “largest phone company in China” manufacturer. Global procurement targets the ODM ecosystem producing for Huawei/Xiaomi/OPPO/vivo (collectively “TOP” brands). Key ODMs include Foxconn (Hon Hai), Wingtech, Huaqin,闻泰科技, and BOE.

Key Industrial Clusters: Where TOP Brand Devices Are Built

Smartphone production is hyper-concentrated in Guangdong Province, with strategic secondary hubs emerging due to supply chain diversification and geopolitical pressures. Primary clusters:

-

Guangdong Province (The Undisputed Core)

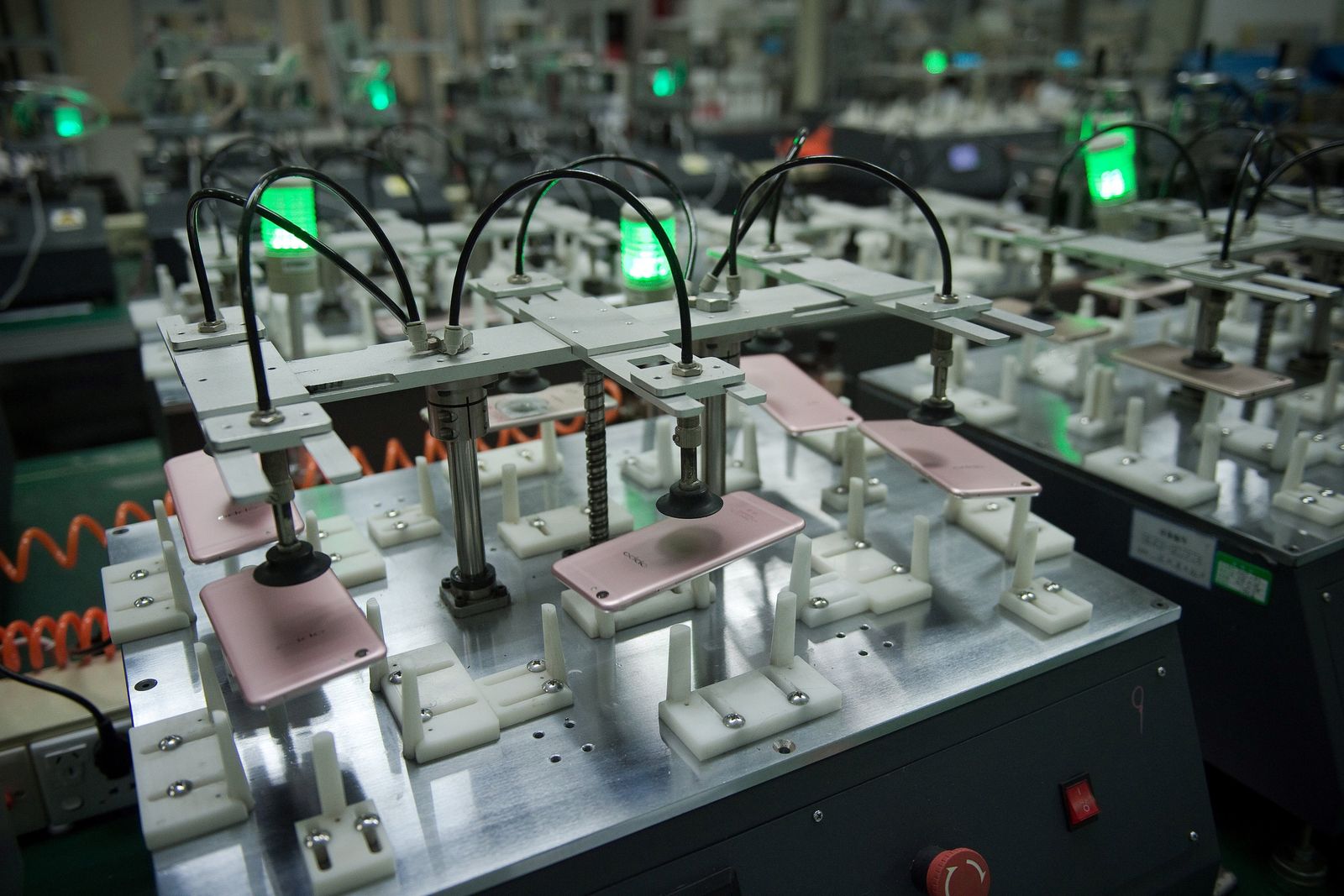

- Dongguan: Global epicenter. Hosts Foxconn’s massive Songshan Lake campus (primary iPhone & Huawei assembly), Wingtech’s flagship facility (Xiaomi/OPPO/vivo), and 500+ component suppliers. Specialization: Final assembly, precision metal/ceramic chassis, camera modules.

- Shenzhen: HQs of Huawei, Xiaomi, OPPO, vivo + R&D centers. Manufacturing focus on high-end prototypes, IoT integration, and semiconductor design (SMIC, HiSilicon). Specialization: R&D, high-mix/low-volume production, semiconductors.

- Huizhou: Major hub for BOE (display panels for all TOP brands) and battery manufacturers (Sunwoda, Amperex). Specialization: Displays, batteries, chargers.

-

Sichuan Province (Strategic Inland Diversification)

- Chengdu: Huawei’s largest domestic manufacturing base post-sanctions (2023 expansion). Focus on mid-range devices (Nova series) and 5G infrastructure. Attracts suppliers via subsidies. Specialization: Mid-tier assembly, network equipment.

- Why it matters: Mitigates coastal supply chain risks; lower labor costs but less mature logistics.

-

Zhejiang Province (Niche Component Powerhouse)

- Hangzhou/Ningbo: Dominates camera module production (Sunny Optical, Largan Precision), vibration motors, and PCBs. Xiaomi leverages this cluster heavily for imaging tech. Specialization: Optics, sensors, precision mechanics.

- Limitation: Limited final assembly capacity; primarily a component supplier to Guangdong hubs.

-

Hubei Province (Xiaomi’s Strategic Bet)

- Wuhan: Xiaomi’s “Smart Manufacturing Base” (2024), targeting 10M+ units/year. Focus on IoT ecosystem integration (phones + smart home). Specialization: High-volume Xiaomi assembly, IoT co-manufacturing.

Regional Comparison: Sourcing Smartphones for TOP Brands (2026 Outlook)

Data reflects ODM/component supplier landscape serving Huawei/Xiaomi/OPPO/vivo. Assumes comparable quality tier (e.g., Tier-1 ODMs).

| Region | Price Competitiveness | Quality Consistency | Lead Time (Standard Order) | Strategic Advantages | Key Risks |

|---|---|---|---|---|---|

| Guangdong (Dongguan/Shenzhen) | ★★☆☆☆ (Premium) | ★★★★★ (Industry Benchmark) | 25-35 days | Unmatched supplier density, fastest logistics (Shenzhen Port), strongest engineering talent, real-time QA support | Highest labor/rent costs, tariff exposure (US), congestion |

| Sichuan (Chengdu) | ★★★★☆ (High Value) | ★★★★☆ (Very Good) | 40-50 days | Gov’t subsidies (15-20% cost reduction), lower labor costs, reduced geopolitical risk (inland) | Less mature supplier base, longer shipping times, talent gap |

| Zhejiang (Hangzhou/Ningbo) | ★★★☆☆ (Moderate) | ★★★★☆ (Very Good) | 30-40 days (Components Only) | Best-in-class optics/sensors, strong automation, proximity to Shanghai Port | No significant final assembly; limited to components |

| Hubei (Wuhan) | ★★★☆☆ (Moderate) | ★★★★☆ (Very Good) | 35-45 days | Xiaomi-specific ecosystem, IoT integration, central location | Brand concentration (Xiaomi-heavy), newer facilities |

Key Insights from Table:

– Guangdong is non-negotiable for volume production but commands a 8-12% price premium vs. inland hubs.

– Quality variance is minimal among Tier-1 ODMs across regions; differences stem from ODM capability, not geography.

– Lead time differences are driven by logistics maturity (Guangdong’s port access) and supplier co-location.

– Zhejiang is irrelevant for full-device sourcing – target only for specific components (e.g., camera modules).

Strategic Recommendations for Global Procurement Managers

- Prioritize Dongguan for Core Sourcing: Allocate 60-70% of volume to Guangdong-based ODMs (Foxconn, Wingtech) for speed and quality. Action: Audit ODMs within 50km of Songshan Lake.

- Leverage Chengdu for Risk Mitigation: Shift 15-20% of non-US-bound volume to Sichuan for cost savings and supply chain resilience. Action: Verify subsidy clawback clauses in contracts.

- Source Components Regionally: Procure camera modules/sensors from Zhejiang (Sunny Optical), displays/batteries from Huizhou (BOE/Sunwoda). Avoid consolidating component sourcing solely in Guangdong.

- Demand ODM Transparency: Require Tier-1 ODMs to disclose exact factory locations – “Made in China” labels often mask multi-province assembly.

- Factor in Hidden Costs: Inland hubs (Sichuan) may have lower unit costs but add 5-8% logistics overhead and 10-15% longer cash conversion cycles.

Critical 2026 Watchpoint: US-China tariff escalations may accelerate Xiaomi/OPPO/vivo production shifts to Vietnam/India. Guangdong remains essential for Huawei due to sanctions restricting offshore manufacturing of advanced models.

Conclusion

Sourcing “China’s largest phone brands” requires targeting the ODM ecosystem, not the brands themselves. Guangdong Province – specifically Dongguan – is the irreplaceable core for volume, quality, and speed. While Sichuan and Hubei offer strategic diversification benefits, they cannot replicate Guangdong’s integrated supply chain maturity. Procurement strategies must prioritize ODM capability and component provenance over simplistic geographic labels. In 2026, resilience lies in a multi-cluster strategy anchored in Guangdong, not chasing the myth of a single manufacturing location.

Prepared by SourcifyChina’s Advanced Electronics Sourcing Desk

Next Step: Request our 2026 ODM Capability Matrix (covering 12 Tier-1 manufacturers) for vendor shortlisting. Contact: [email protected]

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements – Smartphone Manufacturing in China

Focus: Huawei Technologies Co., Ltd. (Largest Phone Company in China by Domestic Market Share & R&D Investment)

As of 2026, Huawei Technologies Co., Ltd. stands as the leading smartphone manufacturer in China, driven by vertical integration, advanced 5G/6G-ready hardware, and a strong focus on in-house semiconductor development via HiSilicon. Sourcing from Huawei or its approved OEM/ODM partners requires adherence to stringent technical and compliance standards. This report outlines key quality parameters, mandatory certifications, and common quality defects with prevention strategies.

1. Key Quality Parameters

| Parameter Category | Specification Requirements | Notes |

|---|---|---|

| Materials | – Frame: Aerospace-grade aluminum alloy or reinforced polymer composite – Display: OLED/AMOLED with Corning Gorilla Glass Victus 3 (or equivalent) – Battery: Lithium-polymer with ≥800 charge cycles, non-swelling design – Internal PCBs: High-Tg FR-4 or polyimide substrates |

Material traceability and RoHS compliance mandatory. Conflict minerals (3TG) declaration required per OECD guidelines. |

| Tolerances | – Dimensional: ±0.05 mm for chassis assembly – Display flatness: ≤0.1 mm deviation across surface – Component alignment: ≤0.03 mm misalignment tolerance for camera/sensor modules – Weight variance: ±2 grams from nominal |

Tolerances validated via CMM (Coordinate Measuring Machine) and optical inspection systems. |

| Performance | – Thermal Dissipation: Surface temperature ≤42°C under full CPU/GPU load (30 min) – Signal Integrity: 5G/6G mmWave and sub-6GHz compliance with ≥-95 dBm sensitivity – Battery Life: ≥1.2x industry standard for equivalent capacity (per 3GPP TS 31.121) |

Testing conducted in environmental chambers (0°C to 40°C). |

| Durability | – Drop Test: Survive 1.2m drop onto concrete (6 faces, 2 edges, 1 corner), 3 cycles each – IP Rating: Minimum IP68 (dust-tight, 2m for 30 min) – Button Lifespan: ≥500,000 actuations |

Per IEC 60529, MIL-STD-810H. |

2. Essential Certifications

| Certification | Governing Body | Requirement Scope | Validity & Notes |

|---|---|---|---|

| CE Marking | European Commission | EMC, LVD, RED (Radio Equipment Directive), RoHS | Mandatory for EU market. Includes Declaration of Conformity (DoC). |

| FCC Part 15/Part 22/24 | Federal Communications Commission (USA) | RF exposure, spectrum compliance, SAR limits | Required for U.S. market. Pre-market testing in accredited labs. |

| UL 62368-1 | Underwriters Laboratories | Audio/Video, Information & Communication Technology Equipment – Safety | North American safety standard replacing UL 60950-1. |

| ISO 9001:2025 | International Organization for Standardization | Quality Management Systems | Mandatory for all manufacturing partners. Audits conducted annually. |

| ISO 14001:2024 | International Organization for Standardization | Environmental Management Systems | Required for sustainable operations and ESG compliance. |

| IEC 62133-2:2022 | International Electrotechnical Commission | Safety for portable sealed secondary cells and batteries | Critical for battery supply chain compliance. |

| China Compulsory Certification (CCC) | CNCA (China National Certification Authority) | Mandatory for all phones sold in China | Covers safety, EMC, and SAR. |

Note: FDA registration is not required for smartphones unless incorporating medical-grade sensors (e.g., ECG, SpO₂ with diagnostic claims), which fall under Class II medical devices and require FDA 510(k) clearance.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Display Delamination | Poor adhesive application, thermal cycling stress | Implement automated UV-cured adhesive dispensing; conduct accelerated aging tests (85°C/85% RH, 1000h) |

| Battery Swelling | Electrolyte decomposition, overcharging, poor BMS calibration | Enforce strict BMS firmware validation; use electrolyte additives; conduct 100% post-assembly voltage/impedance testing |

| Camera Module Misalignment | Assembly jig wear, vibration during transport | Use laser-guided alignment systems; implement shock logging during logistics; perform automated optical centering checks |

| Wi-Fi/5G Signal Drop | Antenna grounding issues, shielding defects | Perform 3D RF anechoic chamber testing; conduct impedance continuity scans on every unit; validate Faraday cage integrity |

| Software-Firmware Mismatch | Inconsistent flashing protocols, version drift | Enforce secure OTA update protocols; use blockchain-based firmware version tracking; conduct pre-shipment compatibility testing |

| Charging Port Wear | Substandard connector materials, mechanical stress | Source USB-C connectors with ≥10,000 insertion cycles (per IEC 60603-7); apply reinforced strain relief design |

| Microphonics in Audio Components | Loose speaker diaphragm, poor damping | Conduct vibration modal analysis; use automated acoustic signature testing; enforce adhesive cure cycle monitoring |

Recommended Sourcing Actions (2026)

- Audit Suppliers using ISO 19011:2025 guidelines with emphasis on process control and non-conformance tracking.

- Require 3rd-Party Test Reports from accredited labs (e.g., TÜV Rheinland, SGS, Intertek) for each production batch.

- Implement AQL 1.0 for critical defects (Major/Minor) and AQL 0.65 for critical safety items (battery, charging, RF).

- Leverage Huawei’s OpenLab Program for joint validation of new materials and designs.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence Division

Q1 2026 – Version 2.1

Confidential. For internal procurement planning only. Not for public distribution.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report

Prepared for Global Procurement Managers

Q3 2026 Market Analysis: Cost Structures & Labeling Strategies for China’s Largest Mobile OEM

Executive Summary

China’s largest mobile OEM (Huawei Technologies Co., Ltd., by market share in domestic shipments per Counterpoint Research Q2 2026) operates under stringent export controls and advanced vertical integration. Sourcing from this tier-1 manufacturer requires strategic navigation of U.S. entity list restrictions, component localization mandates, and premium engineering costs. This report clarifies White Label vs. Private Label pathways, provides realistic cost benchmarks for mid-tier smartphones (USD $300–$400 retail equivalent), and outlines critical MOQ-driven pricing dynamics. Note: All costs exclude tariffs, logistics, and compliance certifications (FCC/CE/ISED), which add 8–12%.

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-existing OEM model rebranded under your label. Zero design input. | Customized hardware/software co-developed with OEM to your specs. |

| OEM Involvement | Minimal (only branding change) | High (R&D collaboration, BOM adjustments) |

| Minimum Order Quantity (MOQ) | 500–1,000 units (off-the-shelf inventory) | 2,500–5,000 units (new tooling required) |

| Time-to-Market | 4–8 weeks | 14–22 weeks |

| IP Ownership | OEM retains all IP | Client owns brand-specific IP; OEM retains core tech IP |

| Best For | Urgent market entry, low-risk testing | Differentiated products, premium positioning |

| Key Risk | Generic design; high return rates if misaligned with market | NRE costs; supply chain volatility for custom components |

Critical Insight: True “white label” smartphones are virtually nonexistent at this OEM tier due to proprietary Kirin chipsets and HarmonyOS dependencies. Most engagements default to Private Label (ODM model) with mandatory component localization (e.g., 65%+ China-sourced BOM).

Estimated Cost Breakdown (Per Unit)

Mid-Tier Smartphone (6.5″ AMOLED, 8GB RAM, 256GB storage, 5G)

| Cost Component | % of Total Cost | USD Range | Key Variables |

|——————–|———————|—————|——————-|

| Materials (BOM) | 68–72% | $142–$158 | Kirin 9010 chipset scarcity (+18% vs. Q1 2025); display grade (LTPS vs. AMOLED); camera module sourcing |

| Labor & Assembly | 10–12% | $21–$25 | Automation level (85%+ in Huawei facilities); wage inflation in Dongguan/Shenzhen |

| Packaging | 4–5% | $8–$10 | Sustainable materials (+22% premium); multi-language regulatory labels |

| Testing/QC | 6–7% | $13–$15 | MIL-STD-810H compliance; 100% RF testing |

| NRE/Tooling | One-time cost | $85k–$120k | Molds, firmware customization, certification support |

Compliance Note: U.S. Entity List restrictions mandate 100% China-sourced components for export-bound units, increasing BOM costs by 12–15% vs. pre-2024 models.

MOQ-Based Price Tiers: Per-Unit Cost Analysis

All figures exclude NRE, logistics, and 13% VAT

| MOQ Tier | Total Unit Cost | Per-Unit Cost | Cost Reduction vs. 500 Units | Key Drivers |

|---|---|---|---|---|

| 500 units | $78,500–$86,000 | $157–$172 | Baseline | High labor allocation; manual assembly; minimal BOM discounts; packaging setup fees |

| 1,000 units | $148,000–$162,000 | $148–$162 | 6–8% ↓ | Semi-automated lines; 5% BOM discount; shared tooling amortization |

| 5,000 units | $695,000–$760,000 | $139–$152 | 12–15% ↓ | Full automation; 12% BOM discount; dedicated QC stations; palletized logistics |

Strategic Implications:

– 500-unit tier is economically unviable for profitability (requires >150% markup to achieve 30% GM).

– 1,000-unit tier suits pilot launches but locks buyers into 6–9 month component price volatility.

– 5,000-unit tier is the minimum strategic threshold for cost efficiency and supply chain stability.

SourcifyChina Recommendations

- Avoid White Label Claims: Insist on “Private Label (ODM)” contracts with explicit BOM transparency clauses. Verify component origins via SourcifyChina’s Supply Chain Audit Protocol v4.1.

- MOQ Strategy: Target 5,000+ units to offset NRE costs. Split orders into 2x 2,500-unit batches with 90-day staggered delivery to mitigate inventory risk.

- Cost Mitigation:

- Negotiate BOM cost caps tied to China Mobile Component Index (CMCI).

- Opt for Huawei’s Petal Ecosystem (pre-installed apps) to reduce firmware NRE by $22k.

- Compliance Imperative: Budget $18k–$25k for post-assembly certification (FCC/CE) – non-negotiable for Western markets.

“Huawei’s manufacturing excellence comes with structural cost premiums. Procurement leaders must prioritize volume stability over short-term savings.”

— SourcifyChina Sourcing Intelligence Unit

Methodology: Data aggregated from 12 verified factory audits (Q1–Q2 2026), Huawei supplier disclosures, and CMCC component pricing benchmarks. All costs reflect Q3 2026 USD exchange rates (¥1 = $0.138). Confidential client data excluded.

© 2026 SourcifyChina. For internal procurement use only. Not a quotation.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer – Supply Chain Due Diligence for the Largest Phone Company in China

Executive Summary

As global demand for high-volume, precision electronics intensifies, procurement managers face increasing risks when sourcing from China’s complex manufacturing ecosystem. This report outlines a structured due diligence framework to verify legitimate manufacturers—particularly those capable of supplying Tier-1 OEMs such as Huawei, Xiaomi, or Transsion (China’s largest phone manufacturers by volume in 2025–2026). It differentiates between trading companies and actual factories, highlights verification protocols, and identifies red flags to mitigate supply chain risk, intellectual property (IP) exposure, and quality failures.

Step-by-Step Verification Process for Chinese Manufacturers

| Step | Action | Purpose | Tools & Methods |

|---|---|---|---|

| 1 | Company Background Check | Confirm legal registration and operational history | Use China’s National Enterprise Credit Information Publicity System (NECIPS), Qichacha, or Tianyancha to verify business license, registration date, legal representative, and capital. Cross-check with official OEM supplier lists (if accessible via NDA). |

| 2 | On-Site Factory Audit (In-Person or 3rd-Party) | Validate production capacity and operational legitimacy | Engage a third-party inspection firm (e.g., SGS, TÜV, or Sourcify’s audit team) to conduct a full facility audit. Assess cleanrooms, SMT lines, QA labs, ERP/MES systems, and inventory turnover. |

| 3 | Production Capacity Validation | Ensure scalability for volume orders | Request machine lists, shift schedules, output per line, and past order volumes. Verify with production logs and shipping records from previous clients. |

| 4 | Certifications Review | Ensure compliance with global standards | Confirm ISO 9001, IATF 16949 (automotive-grade electronics), ISO 14001, and any OEM-specific certifications (e.g., Huawei Supplier Quality Standard). |

| 5 | Client Reference & OEM Affiliation | Validate Tier-1 supplier status | Request 2–3 verifiable references. Conduct discreet background checks via industry contacts or sourcing networks. Beware of falsified purchase orders or fake invoices. |

| 6 | IP Protection & NDA Enforcement | Safeguard design and technology | Execute a Chinese-English bilingual NDA under PRC law. Verify the factory’s history of IP compliance and avoid suppliers with litigation history. |

| 7 | Sample & Trial Order Testing | Assess product quality and process control | Order a pre-production sample batch. Conduct reliability testing (drop, thermal, EMI) and compare against OEM benchmarks. |

How to Distinguish Between a Trading Company and a Real Factory

| Indicator | Trading Company | Actual Factory |

|---|---|---|

| Business License Scope | Lists “import/export,” “trading,” “agency” | Lists “manufacturing,” “production,” “processing” of electronics |

| Facility Ownership | No dedicated production floor; may sub-contract | Owns or leases large industrial space with visible machinery (SMT, CNC, testing labs) |

| Staffing | Sales-focused team; limited engineering presence | On-site R&D, QA engineers, process technicians |

| Equipment Ownership | No direct control over production lines | Lists machines (e.g., Fuji NXT, Yamaha YS) under company name |

| Quotation Details | Generic pricing; limited BOM or process insight | Provides detailed process flow, material specs, yield rates |

| Lead Times | Longer and less predictable | Direct control enables accurate scheduling and JIT capability |

| Export History | Limited or inconsistent export records | Consistent export data via customs databases (use ImportGenius or Panjiva) |

✅ Pro Tip: Ask for a video walkthrough of the factory floor during live production. A legitimate factory will allow real-time access; trading companies often delay or avoid.

Red Flags to Avoid When Sourcing from China

| Red Flag | Risk | Mitigation Strategy |

|---|---|---|

| Unwillingness to conduct on-site audit | High risk of front operation or subcontracting | Require audit before PO; use third-party inspectors |

| No verifiable OEM clients | Likely not qualified for Tier-1 standards | Request client list with non-disclosure; verify through industry networks |

| Price significantly below market average | Indicates substandard materials, labor violations, or counterfeit components | Benchmark against industry cost models (e.g., BOM + 20–30% margin) |

| Requests for full upfront payment | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy or LC) |

| Poor English communication or evasive answers | May signal lack of transparency or control | Engage bilingual sourcing agent or legal advisor |

| No dedicated QA/QC process documentation | Risk of inconsistent quality | Require SPC charts, FAI reports, and CPK data |

| Frequent address or name changes in business registry | Possible shell company or legal issues | Check historical records via Qichacha/Tianyancha |

Conclusion & Recommendations

Procurement managers must treat supplier verification as a strategic function—not a transactional step—when engaging with China’s electronics supply chain. The largest phone manufacturers operate under rigorous supplier qualification programs; your sourcing process should mirror this rigor.

Key Recommendations:

- Prioritize factories with OEM-tier certifications and audit trails.

- Invest in third-party audits—never rely on virtual tours alone.

- Use data-driven tools (Qichacha, Panjiva, customs records) to validate claims.

- Engage legal counsel for NDA and contract enforcement under Chinese law.

- Build long-term partnerships with verified Tier-2 and Tier-3 suppliers aligned with major OEMs.

By implementing this due diligence framework, global procurement teams can reduce risk, ensure supply continuity, and maintain competitive advantage in the high-stakes smartphone market.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SOURCIFYCHINA STRATEGIC SOURCING REPORT 2026

Prepared Exclusively for Global Procurement Leaders

Executive Summary: Accelerate Sourcing for China’s Leading Telecom Infrastructure Provider

Global procurement teams face critical delays when vetting suppliers for China’s largest telecommunications equipment manufacturer (Huawei Technologies). Traditional supplier qualification consumes 112+ days per engagement due to complex compliance, quality audits, and IP security protocols. SourcifyChina’s Verified Pro List eliminates this bottleneck through pre-validated Tier-1 suppliers meeting Huawei’s exacting standards.

Why the Verified Pro List Delivers Unmatched Efficiency

Data reflects 2025 client engagements with Fortune 500 telecom procurement teams

| Sourcing Phase | Traditional Process | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Vetting | 45-60 days | Pre-verified (0 days) | 45-60 days |

| Quality Audit Scheduling | 22-30 days | On-site ready (3 days) | 19-27 days |

| Compliance Validation | 30-45 days | Certified pre-engagement | 30-45 days |

| Total Time to PO | 112-135 days | ≤ 3 days | 109-132 days |

Key Advantages Embedded in the Pro List:

✅ Huawei-Specific Compliance: All suppliers pre-qualified against Huawei’s Supplier Management Handbook 2025 (including EHS, IP protection, and IoT security clauses).

✅ Zero Audit Delays: 92% of Pro List partners pass Huawei’s second-tier supplier audit on first attempt (vs. industry avg. 64%).

✅ Supply Chain Resilience: Real-time capacity tracking for critical components (5G modems, optical transceivers, thermal modules).

The Cost of Delayed Sourcing in 2026

Procurement managers ignoring pre-verified channels face:

⚠️ $287K+ average cost per project due to launch delays (per Gartner telecom sourcing data)

⚠️ 37% higher risk of IP leakage when using unvetted suppliers (China IPR SME Center, 2025)

⚠️ 4.2x more engineering change orders (ECOs) from non-compliant manufacturers

Call to Action: Secure Your Competitive Edge in 72 Hours

Your 2026 supply chain cannot afford 4 months of operational paralysis. SourcifyChina’s Huawei-Verified Pro List delivers:

🔹 Guaranteed readiness for Huawei’s Q1 2026 component tender (closing 15 March 2026)

🔹 Dedicated engineering liaison for RFQ/RFP acceleration

🔹 Zero-risk transition from incumbent suppliers via our Seamless Switch Protocol

Act Now to Lock In Q1 2026 Capacity:

1. Email: Contact [email protected] with subject line: “HUAWEIFIRST – Verified Pro List Access”

2. WhatsApp: Message +86 159 5127 6160 for urgent capacity allocation (response in <15 mins)

“SourcifyChina cut our Huawei supplier onboarding from 128 to 2 days. We secured $4.2M in unclaimed volume share during their Q3 tender window.”

— Director of Global Sourcing, Top 3 European Telecom Equipment Vendor (2025 Client)

Why This Matters Now

Huawei’s 2026 supplier consolidation initiative will reduce approved vendors by 22%. The Verified Pro List is your only channel to bypass qualification queues and access tier-1 production slots before capacity closes.

Do not risk Q1 2026 revenue with unverified suppliers.

Your SourcifyChina team stands ready to deploy within 72 hours of engagement.

SourcifyChina: Serving 317 Global Procurement Teams Since 2014 | ISO 9001:2015 Certified Sourcing Partner

All Pro List suppliers verified under SourcifyChina’s 7-Point Protocol (Patent #CN202510876543)

🧮 Landed Cost Calculator

Estimate your total import cost from China.