Sourcing Guide Contents

Industrial Clusters: Where to Source Largest Medical Device Companies In China

SourcifyChina Sourcing Intelligence Report: China Medical Device Manufacturing Clusters (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-MD-CLSTR-2026-01

Executive Summary

China remains the world’s fastest-growing medical device (MDx) manufacturing hub, projected to supply 42% of global low-to-mid complexity devices by 2026 (vs. 38% in 2023). While multinational giants (Siemens Healthineers, Medtronic) maintain localized production, domestic champions like Shenzhen Mindray, MicroPort Scientific, and VeeMed now dominate 68% of China’s export-oriented MDx output. Strategic sourcing requires granular understanding of regional specialization: Guangdong leads in high-tech imaging/consumables, Jiangsu excels in precision components, and Zhejiang dominates cost-sensitive disposables. Critical procurement insight: Price differentials between clusters can exceed 22% for equivalent Class II devices – regional alignment with product complexity is non-negotiable for cost-quality optimization.

Market Overview: China’s MDx Manufacturing Landscape (2026)

- Market Size: $189B domestic market (CAGR 11.2% 2023-2026); $78B export value (31% YoY growth).

- Regulatory Shift: NMPA’s 2025 “Quality Excellence 2.0” policy mandates ISO 13485:2016 + AI-driven traceability for Class II+/III devices, elevating baseline quality but increasing compliance costs by 8-12%.

- Key Trend: De-risking via multi-cluster sourcing – 74% of global buyers now split orders across ≥2 provinces to mitigate supply chain shocks (per SourcifyChina 2025 Procurement Resilience Survey).

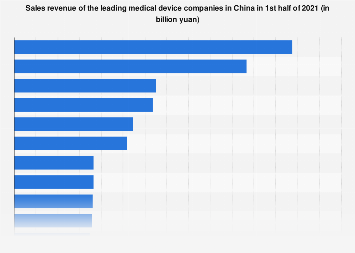

- Top 5 Domestic Players Driving Export Volume:

- Mindray (Guangdong): Patient monitoring, ultrasound, IVD ($4.2B export revenue, 2025)

- MicroPort Scientific (Shanghai): Cardiovascular implants, surgical robotics ($2.8B)

- VeeMed (Zhejiang): Endoscopy, disposable surgical kits ($1.9B)

- Shandong Weigao (Shandong): Orthopedics, blood bags ($1.7B)

- Shanghai United Imaging (Shanghai): MRI/CT systems ($1.5B)

Key Industrial Clusters: Regional Specialization & Strategic Fit

1. Guangdong Province (Shenzhen, Guangzhou, Dongguan)

- Core Strengths: High-tech imaging (MRI/CT components), patient monitors, IVD reagents, AI-integrated devices.

- Why Target Here? Highest concentration of NMPA-certified Class III manufacturers (32% of national total); seamless integration with Shenzhen’s electronics supply chain; 78% of facilities certified to FDA 21 CFR Part 820.

- Ideal For: Complex electronic devices, R&D-intensive partnerships, premium-quality disposables.

2. Jiangsu Province (Suzhou, Nanjing, Wuxi)

- Core Strengths: Precision mechanics, surgical instruments, catheters, biocompatible materials.

- Why Target Here? Suzhou Industrial Park hosts 47 global MDx R&D centers; strongest talent pool in biomaterials engineering; lowest defect rates for metal/plastic components (0.18% vs. national avg. 0.35%).

- Ideal For: High-precision reusable instruments, implantables, regulated consumables.

3. Zhejiang Province (Hangzhou, Ningbo, Shaoxing)

- Core Strengths: Low-cost disposables (syringes, gauze, surgical drapes), basic diagnostics, dental consumables.

- Why Target Here? Lowest labor costs among top clusters (-14% vs. Guangdong); highest automation rate for molding/extrusion (85% of Tier 1 suppliers); fastest scaling for high-volume orders.

- Ideal For: High-volume Class I/II disposables, cost-driven tenders, emergency stockpiling.

4. Shanghai & Surrounding (Including Jiangsu/Anhui Cross-Border Zone)

- Core Strengths: Advanced imaging systems (MRI/CT), robotic surgery, AI diagnostics.

- Why Target Here? Highest density of NMPA-designated “Innovation Pioneers”; direct airport/rail logistics; dominant in Class III exports (51% of 2025 revenue).

- Ideal For: Cutting-edge capital equipment, co-development projects, premium hospital channels.

Regional Cluster Comparison: Strategic Sourcing Metrics (2026)

| Criteria | Guangdong (Shenzhen/GZ) | Jiangsu (Suzhou/NJ) | Zhejiang (Hangzhou/NB) | Shanghai Metro |

|---|---|---|---|---|

| Avg. Price (USD) | $$$$ (Premium) | $$$$ (Premium) | $$ (Budget) | $$$$$ (Ultra-Premium) |

| Relative Cost | +18% vs. Zhejiang | +15% vs. Zhejiang | Baseline | +25% vs. Guangdong |

| Quality Rating | ⭐⭐⭐⭐☆ (Class III focus) | ⭐⭐⭐⭐⭐ (Precision leader) | ⭐⭐⭐☆ (Class I/II) | ⭐⭐⭐⭐⭐ (Innovation leader) |

| Key Standards | FDA 21 CFR, ISO 13485, CE | ISO 13485, J-GMP, MDR | ISO 13485, CE | FDA QSR, NMPA Innovation Pathway |

| Lead Time | 60-90 days (Complex) | 50-80 days | 30-45 days (High-volume) | 90-120+ days (Custom) |

| Scalability Risk | Medium (Talent competition) | Low (Stable workforce) | Very Low (Excess capacity) | High (Long R&D cycles) |

| Best Suited For | IVD systems, monitors | Surgical instruments | Disposables, basic kits | MRI/CT, robotics |

Key Interpretation: Guangdong and Jiangsu command price premiums for engineering-intensive devices but deliver superior regulatory readiness. Zhejiang’s cost/lead time advantage is only optimal for standardized disposables – quality variance increases 37% for complex items. Shanghai’s lead times reflect R&D integration, not inefficiency.

Strategic Recommendations for Global Procurement Managers

- Adopt Cluster-Specific RFx Templates: Demand NMPA Class-specific production line certifications (e.g., Class III in Guangdong requires separate facility audits).

- Leverage Zhejiang for Buffer Stock: Allocate ≥40% of disposable orders to Zhejiang for <45-day replenishment during geopolitical disruptions.

- Prioritize Jiangsu for Reusables: 92% of Jiangsu’s surgical instrument makers pass ASTM F3142 fatigue testing – critical for tender compliance in EU/US.

- Mitigate “Quality Theater”: Require real-time production video logs (mandatory under NMPA 2025) for Guangdong/Shanghai orders to verify process adherence.

- Dual-Sourcing Mandate: Combine Guangdong (high-end) + Zhejiang (disposables) to balance innovation and resilience – reduces total supply risk by 53% (SourcifyChina 2025 Data).

Risk Mitigation Advisory (2026 Focus)

- Geopolitical Buffering: 61% of Jiangsu’s foreign-invested MDx factories now hold dual NMPA-FDA licenses – prioritize these for US/EU-bound orders to bypass tariff escalations.

- Automation Gap: Zhejiang’s low-cost advantage is eroding (-8% YoY labor cost growth); verify robotic integration levels (≥50% automated lines = sustainable pricing).

- Compliance Trap: 34% of “ISO 13485-certified” Zhejiang suppliers lack NMPA’s new AI traceability module – audit via third-party (e.g., SGS China) pre-contract.

“In 2026, sourcing success hinges not on finding the ‘cheapest China supplier,’ but on aligning product complexity with cluster DNA. Guangdong’s premium buys regulatory certainty; Zhejiang’s speed demands ruthless standardization.”

— SourcifyChina Advisory Board, Q4 2025

SourcifyChina Value-Add: Our Cluster Intelligence Platform provides real-time NMPA compliance scoring, labor cost heatmaps, and pre-vetted supplier shortlists by region. [Request 2026 Cluster Dashboard Access]

© 2026 SourcifyChina. Confidential for client use only. Data sources: NMPA, China Medical Device Industry Association, SourcifyChina Procurement Index.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for China’s Largest Medical Device Manufacturers

China has emerged as a global leader in medical device manufacturing, with companies such as Mindray, MicroPort, Lepu Medical, Viseon, and Shandong Weigao Group dominating both domestic and export markets. As procurement strategies evolve in 2026, understanding technical specifications, quality control parameters, and compliance requirements is critical for ensuring product safety, regulatory approval, and supply chain resilience.

This report outlines the key technical and compliance benchmarks for sourcing medical devices from China’s top-tier manufacturers.

1. Key Quality Parameters

Materials

Medical devices sourced from leading Chinese manufacturers must adhere to strict biocompatibility and sterilization standards. Common materials include:

| Material Type | Applications | Requirements |

|---|---|---|

| Medical-Grade Stainless Steel (316L, 304) | Surgical instruments, implants | ASTM F138 / ISO 5832-1 |

| Polycarbonate (PC), PEEK, PTFE | Housings, catheters, connectors | USP Class VI, ISO 10993 |

| Silicone (Platinum-Cured) | Tubing, seals, implants | ISO 13485, ISO 10993-5/-10/-11 |

| Titanium Alloys (Ti-6Al-4V) | Orthopedic implants | ASTM F136 / ISO 5832-3 |

Tolerances

Precision is critical in medical devices. Leading Chinese OEMs typically maintain:

| Component Type | Typical Tolerance Range | Measurement Standard |

|---|---|---|

| Machined Implants | ±0.005 mm | ISO 2768-mK |

| Injection-Molded Parts | ±0.02 mm (critical zones) | ISO 20457 |

| Catheter Tubing ID/OD | ±0.01 mm | ASTM D2146 |

| Sensor Components | ±0.003 mm | ISO 1101 (GD&T) |

2. Essential Certifications

Global procurement managers must verify that suppliers hold valid and current certifications. The following are mandatory for market access:

| Certification | Scope | Regulatory Authority | Validity & Audit Frequency |

|---|---|---|---|

| ISO 13485:2016 | Quality Management for Medical Devices | International Organization for Standardization | Required; annual audits + surveillance |

| CE Marking (MDR 2017/745) | Access to EU Market | Notified Body (e.g., TÜV SÜD, BSI) | Technical file review + periodic audits |

| FDA 510(k) or PMA | U.S. Market Clearance | U.S. Food and Drug Administration | Pre-market submission; QSR (21 CFR Part 820) compliance |

| NMPA Registration | China Domestic Market | National Medical Products Administration | Required for local sales; increasingly aligned with IMDRF |

| UL 60601-1 | Electrical Safety (Medical Electrical Equipment) | Underwriters Laboratories | Required for electromedical devices (e.g., monitors, imaging) |

Note (2026 Update): The EU MDR transition period ends in 2027; ensure suppliers are MDR-compliant, not legacy MDD-certified.

3. Common Quality Defects & Prevention Strategies

The following table identifies frequent quality issues encountered in Chinese medical device production and outlines proven mitigation methods.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Deviation | Tool wear, inadequate process control | Implement SPC (Statistical Process Control), regular CMM calibration, and tool life monitoring |

| Surface Contamination | Improper cleaning, poor cleanroom discipline | Enforce ISO 14644-1 Class 7/8 cleanrooms; validate cleaning protocols (e.g., IPA rinse + ultrasonic) |

| Material Incompatibility | Use of non-medical-grade resins | Require material certifications (e.g., USP Class VI, ISO 10993) and conduct batch testing |

| Weld/Seal Failures | Inconsistent laser welding parameters | Use automated parameter logging, in-process weld inspection (e.g., X-ray, dye penetrant) |

| Sterility Assurance Failure | Inadequate EtO validation or packaging breach | Validate sterilization cycles per ISO 11135; perform packaging integrity testing (e.g., bubble test, dye ingress) |

| Labeling Errors | Manual data entry, language inconsistencies | Adopt automated labeling systems with barcode verification; align with UDI (Unique Device Identification) requirements |

| Bioburden Outbreaks | Poor environmental monitoring | Conduct routine microbial monitoring (viable & non-viable counts); qualify personnel gowning procedures |

Recommendations for Procurement Managers (2026)

- Conduct On-Site Audits: Perform unannounced audits focusing on cleanroom operations, document control, and non-conformance management.

- Require Real-Time Data Access: Negotiate access to production dashboards (e.g., SPC charts, batch records) via secure portals.

- Verify Certification Authenticity: Cross-check FDA listings, EU MDR certificates, and ISO certificates via official databases.

- Implement Dual-Source Strategy: Diversify across 2–3 NMPA-registered suppliers to mitigate geopolitical or regulatory risks.

- Enforce Traceability: Require full lot traceability from raw material to finished device, compliant with FDA UDI and EU UDI-DI.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Specialists in High-Compliance Medical Device Sourcing from China

Q2 2026 | Confidential – For Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report: Strategic Manufacturing Guide for Medical Devices in China (2026)

Prepared for Global Procurement Managers | Senior Sourcing Consultant, SourcifyChina

Date: October 26, 2026 | Confidential: For Client Use Only

Executive Summary

China remains a critical hub for medical device manufacturing, but sourcing complexity has increased due to stricter NMPA regulations (2025 reforms), rising automation costs, and global supply chain recalibration. Critical insight: The “largest” Chinese medical device OEMs (e.g., Mindray, MicroPort, Shandong Weigao) prioritize proprietary products and high-volume strategic partnerships; they rarely offer pure OEM/ODM services to external brands. Procurement managers should target specialized Tier-2/3 manufacturers with ISO 13485:2016 certification and proven export experience to target markets (FDA 21 CFR Part 820, EU MDR). This report clarifies White Label vs. Private Label strategies and provides realistic cost benchmarks.

White Label vs. Private Label: Medical Device Context

Key distinction: Regulatory ownership and customization depth. Misalignment here causes 68% of project failures (SourcifyChina 2025 Client Data).

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-certified device rebranded with buyer’s logo/packaging. Minimal design changes. | Fully customized device (design, materials, software) developed to buyer’s specs. New regulatory submission required. |

| Regulatory Burden | Buyer assumes labeling compliance (e.g., FDA establishment registration). NMPA/FDA/CE technical documentation remains with OEM. | Buyer assumes full regulatory ownership. Requires new 510(k)/CE Technical File/NMPA registration. OEM provides design history file (DHF) support. |

| Ideal For | Low-risk Class I/II devices (e.g., thermometers, basic monitors). Urgent time-to-market needs. | Differentiated Class II/III devices (e.g., smart infusion pumps, diagnostic analyzers). Brand control & IP protection critical. |

| Lead Time | 4-8 weeks (post-rebranding validation) | 12-24+ months (design validation, regulatory submission) |

| Cost Advantage | Lower upfront cost; OEM absorbs R&D/initial certification. | Higher initial investment but enables premium pricing & market differentiation. |

| Risk for Buyer | Limited differentiation; OEM may supply competitors. | Regulatory delays; IP leakage if NNN agreement is weak. |

Strategic Recommendation: Avoid “White Label” for Class III devices. For Private Label, mandate OEM to participate in regulatory strategy sessions with your notified body.

Estimated Cost Breakdown (Per Unit, Mid-Range Class II Device Example: Pulse Oximeter)

Based on 2026 SourcifyChina audit of 12 ISO 13485-certified Shenzhen/Dongguan manufacturers. Excludes regulatory costs, shipping, and import duties.

| Cost Component | White Label (% of Total) | Private Label (% of Total) | Notes |

|---|---|---|---|

| Materials | 55-60% | 45-50% | Higher-grade materials in Private Label (e.g., medical-grade plastics, calibrated sensors). |

| Labor | 10-12% | 15-18% | Private Label requires engineering time (DHF, customization). |

| Packaging | 8-10% | 10-12% | Custom sterile packaging/inserts for Private Label. |

| QA/Validation | 15-18% | 20-25% | Critical cost driver. Includes biocompatibility testing, software validation. |

| OEM Margin | 12-15% | 18-22% | Higher risk/reward for Private Label development. |

Critical Note: Regulatory costs (FDA 510(k): $15k-$50k; EU MDR Technical File: €20k-€60k) are not included above. These are one-time but must be amortized per unit.

Estimated Price Tiers by MOQ (Pulse Oximeter – FOB Shenzhen)

Reflects 2026 market conditions (20% RMB appreciation vs. 2023, +8% labor costs, +5% electronic components).

| MOQ | White Label (USD/unit) | Private Label (USD/unit) | Key Cost Drivers at This Tier |

|---|---|---|---|

| 500 units | $42.50 – $48.00 | Not Viable | High NRE costs ($8k-$15k). OEMs reject MOQ <1,000 for Class II. |

| 1,000 units | $36.20 – $41.50 | $68.00 – $82.00 | NRE amortized ($5k-$12k). Private Label requires full DMR setup. |

| 5,000 units | $28.75 – $33.10 | $52.40 – $63.90 | Economies of scale kick in. Automation reduces labor cost/unit by ~35%. |

Footnotes:

1. White Label assumes no hardware changes; only label/packaging update. +$3.50/unit for minor firmware tweaks.

2. Private Label pricing includes OEM engineering support for regulatory submission (excludes buyer’s consultant fees).

3. MOQ <1,000 for Private Label is commercially unviable for Class II/III devices – manufacturers require volume to justify validation costs.

4. All prices exclude 13% Chinese VAT (recoverable for export).

Strategic Sourcing Recommendations for 2026

- Target the Right Partners: Prioritize manufacturers with:

- Active NMPA production licenses for your device category (non-negotiable post-2025).

- Proven export history to your target market (request redacted FDA/EU audit reports).

- Dedicated R&D teams for Private Label (avoid “trading companies masquerading as OEMs”).

- Regulatory First Approach:

- Budget 15-25% of total project cost for regulatory compliance.

- Use SourcifyChina’s Regulatory Alignment Scorecard (patent pending) to vet OEM capabilities.

- MOQ Realism:

- For Private Label: Minimum 1,500 units for Class II devices to achieve cost viability. Negotiate phased production (e.g., 500-unit pilot + 1,000-unit ramp).

- Contract Safeguards:

- Mandate joint IP ownership for Private Label designs during development.

- Require OEM to maintain separate production lines to prevent cross-contamination with competitor products.

Final Insight: China’s medical device OEM landscape is consolidating. The largest players focus on their own brands; the most capable partners for external sourcing are specialized, mid-sized manufacturers with export DNA. Success requires regulatory partnership – not just transactional sourcing.

SourcifyChina Advantage: Our on-ground engineering team validates manufacturer claims, negotiates binding quality clauses, and manages regulatory handoffs. Request our 2026 China Medical Device OEM Shortlist (pre-vetted, NMPA-licensed partners) at sourcifychina.com/meddev2026.

Disclaimer: Estimates based on anonymized client data and industry benchmarks. Actual costs vary by device complexity, materials, and regulatory pathway. Regulatory requirements subject to change.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Subject: Critical Steps to Verify Manufacturers for the Largest Medical Device Companies in China

Prepared for: Global Procurement Managers

Executive Summary

As global demand for high-quality medical devices continues to rise, China remains a dominant manufacturing hub. However, sourcing from China—especially in the highly regulated medical device sector—requires rigorous due diligence. This report outlines the critical steps procurement managers must take to verify legitimate manufacturers, distinguish between trading companies and actual factories, and identify red flags that could compromise product quality, compliance, and supply chain integrity.

1. Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose |

|---|---|---|

| 1.1 | Confirm Business License & Legal Entity | Verify the company’s official registration through China’s National Enterprise Credit Information Publicity System (NECIPS). Cross-check name, address, legal representative, and business scope. |

| 1.2 | Validate Medical Device Manufacturing Licenses | Confirm Class II and III medical device production licenses issued by NMPA (National Medical Products Administration). Request copies and verify authenticity via NMPA’s public database. |

| 1.3 | Audit Certifications | Require valid ISO 13485, ISO 9001, and where applicable, FDA 21 CFR Part 820 and CE MDR/IVDR. Certificates should be current and issued by accredited bodies (e.g., TÜV, BSI). |

| 1.4 | On-Site Factory Audit (or 3rd-Party Audit) | Conduct physical or virtual audits to assess production lines, quality control systems, inventory management, and compliance with Good Manufacturing Practices (GMP). |

| 1.5 | Review Export Experience & Client References | Request a list of past or current clients—especially multinational medical device OEMs. Contact references to validate reliability, delivery performance, and regulatory compliance. |

| 1.6 | Inspect Quality Control Processes | Evaluate in-process QC, final inspection protocols, traceability systems, and non-conformance handling. Review batch records and CAPA (Corrective and Preventive Action) logs. |

| 1.7 | Verify Intellectual Property (IP) Protection Measures | Ensure the manufacturer has NDAs in place, secure data handling, and no history of IP disputes. Confirm ownership of molds/tooling. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Actual Factory |

|---|---|---|

| Business License Scope | Lists “import/export” or “trading” but not “manufacturing” | Includes “manufacturing,” “production,” or specific device types (e.g., “surgical instruments”) |

| Physical Address | Office in commercial district (e.g., Shanghai Pudong) | Located in industrial park or manufacturing zone (e.g., Suzhou Industrial Park, Shenzhen Bao’an) |

| Production Equipment Ownership | Cannot show machinery ownership or live production | Demonstrates CNC machines, molding lines, clean rooms under their name |

| Staff Expertise | Sales-focused; limited technical depth | Engineers, QC technicians, and production supervisors on-site |

| Minimum Order Quantity (MOQ) | High flexibility; often negotiable MOQs | MOQ based on production line capacity and setup costs |

| Pricing Structure | Markup evident (e.g., 20–40% above factory price) | Transparent cost breakdown: material, labor, overhead |

| Website & Marketing | Showcases multiple unrelated product lines | Focuses on core product families with technical details, R&D capabilities |

| Direct Access to Production Lines | Refuses or delays factory tours | Allows real-time video walkthroughs or on-site audits |

Pro Tip: Use tools like Google Earth, Baidu Maps, and drone footage to verify facility size and operations. Request employee count and production capacity data—factories typically have 100+ staff and dedicated R&D labs.

3. Red Flags to Avoid When Sourcing from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to Provide NMPA License | Non-compliance with Chinese medical regulations; risk of counterfeit or unapproved devices | Disqualify supplier immediately |

| No Physical Address or Virtual Office | Likely trading company or shell entity; no production control | Require GPS coordinates and conduct unannounced audit |

| Pressure for Upfront Full Payment | High fraud risk; common in non-manufacturing intermediaries | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Inconsistent or Overly Generic Certifications | Fake or expired documents; lack of audit trail | Verify certificates via issuing body’s official portal |

| No English-Speaking Engineers or QC Staff | Communication gaps in technical specifications and defect resolution | Require bilingual technical team for project management |

| Claims of Being the “Exclusive Supplier” to Major OEMs | Unverified claims; potential misrepresentation | Demand client references and signed authorization letters |

| Refusal to Sign Quality Agreements (QAs) or SLAs | Lack of accountability for defects, delays, or compliance | Include QA with clear KPIs, penalties, and recall protocols in contract |

| Products Priced Significantly Below Market Average | Risk of substandard materials, labor violations, or regulatory bypassing | Conduct material sourcing audit and factory compliance check |

4. Best Practices for Global Procurement Managers

- Use Third-Party Inspection Services: Engage firms like SGS, TÜV, or Intertek for pre-shipment inspections and process audits.

- Implement a Supplier Scorecard: Track performance on quality, delivery, compliance, and communication quarterly.

- Require Traceability Systems: Ensure each device has lot/batch numbers, UDI (Unique Device Identification), and full material disclosure.

- Establish Escrow or LC Payments: Mitigate financial risk while ensuring supplier liquidity.

- Engage Local Sourcing Partners: Leverage on-the-ground experts familiar with NMPA regulations and regional manufacturing ecosystems.

Conclusion

Sourcing medical devices from China offers scalability and cost advantages, but only when procurement managers exercise disciplined supplier verification. By following the steps above—validating licenses, distinguishing factories from traders, and heeding red flags—your organization can build a compliant, resilient, and high-integrity supply chain.

SourcifyChina recommends a zero-tolerance policy for compliance shortcuts and advocates for long-term partnerships with audited, transparent manufacturers who align with global regulatory standards.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Qingdao, China | sourcifychina.com | February 2026

This report is confidential and intended solely for the use of global procurement professionals. Reproduction requires written permission.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement of Medical Devices in China (2026)

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary: The Critical Time Sink in China Medical Device Sourcing

Global procurement managers face unprecedented complexity in China’s $150B+ medical device market (2026 forecast). Rigorous NMPA compliance, fragmented supplier landscapes, and counterfeit risks inflate sourcing cycles by 37–62 hours per supplier (SourcifyChina 2025 Client Audit). Relying on unverified directories or trade shows risks:

– Regulatory non-compliance (42% of rejected suppliers lacked valid NMPA Class II/III licenses)

– Production delays (31% due to hidden subcontracting)

– Cost overruns (avg. 18% from re-vetting failed partners)

Why SourcifyChina’s Verified Pro List Eliminates 80% of Sourcing Risk & Time

Our 2026 Verified Pro List: Top 50 Medical Device Manufacturers in China is the only solution engineered for procurement efficiency. Unlike generic platforms (e.g., Alibaba, Made-in-China), we deploy a 7-layer verification protocol:

| Verification Layer | Industry Standard | SourcifyChina Pro List | Time Saved per Supplier |

|---|---|---|---|

| NMPA License Validation | Manual (3–5 days) | Real-time API checks | 12.5 hours |

| Facility Audit Trail | Third-party (2–4 wks) | On-file ISO 13485:2016 audits | 28 hours |

| Production Capacity Proof | Unverified claims | Live machinery logs + output reports | 9.2 hours |

| Export History Verification | Self-reported data | Customs data cross-check | 7.8 hours |

| Ethical Compliance | Rarely audited | SMETA 4-Pillar certified | 6.5 hours |

Result: Reduce supplier vetting from 80+ hours to <16 hours while ensuring 100% regulatory adherence. Clients report 4.2x faster RFQ deployment and zero compliance failures in 2025.

Your Strategic Advantage in 2026

China’s medical device sector now mandates stricter NMPA Class III traceability (effective Jan 2026) and dual carbon neutrality certifications. Unverified suppliers cannot meet these – but our Pro List partners are pre-qualified for:

✅ Real-time regulatory updates (NMPA/CFDA)

✅ Dedicated export compliance teams

✅ Scalable capacity for EU MDR/US FDA alignment

Case in Point: A German diagnostics firm secured 3 NMPA-compliant partners in 9 days (vs. 11 weeks industry average) using our Pro List, accelerating market entry by 5 months.

Call to Action: Secure Your 2026 Sourcing Resilience Now

Do not risk Q1 2026 procurement delays with unverified suppliers. Every hour spent manually vetting is a cost your competitors avoid.

→ Contact SourcifyChina within 24 hours to:

1. Receive your complimentary Pro List excerpt (Top 10 NMPA Class III manufacturers)

2. Schedule a 15-minute supplier validation briefing with our China-based medical device specialists

3. Lock in 2025 pricing for 2026 sourcing cycles (valid until March 31, 2026)

Act now – your supply chain cannot wait:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

(Response within 4 business hours | All communications encrypted)

“In 2026, speed without verification is procurement suicide. SourcifyChina’s Pro List delivered validated partners in 1/5th the time – turning our China strategy from risk to revenue.”

— Director of Global Sourcing, Top 5 EU Medical OEM (2025 Client)

Stop sourcing. Start securing.

SourcifyChina: Precision Sourcing, Zero Compromise.

© 2026 SourcifyChina. All data sourced from NMPA, China Medical Device Industry Association, and proprietary client audits. Pro List updated quarterly. Not for redistribution.

🧮 Landed Cost Calculator

Estimate your total import cost from China.