Sourcing Guide Contents

Industrial Clusters: Where to Source Largest Internet Companies In China

SourcifyChina | B2B Sourcing Report 2026

Subject: Market Analysis for Sourcing the Largest Internet Companies in China

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

This report provides a strategic market analysis for global procurement professionals seeking to understand the industrial and technological ecosystems supporting China’s largest internet companies—specifically from a sourcing and supply chain perspective. While internet companies are not “manufactured” in the traditional sense, sourcing opportunities exist in their technology infrastructure, hardware supply chain, data center components, smart devices, and software-enabled hardware ecosystems.

The report identifies key industrial clusters in China that serve as operational, R&D, and manufacturing hubs for the hardware and digital infrastructure underpinning leading Chinese internet giants such as Alibaba, Tencent, Baidu, ByteDance, JD.com, and Meituan. These clusters are critical for sourcing servers, networking equipment, AI chips, smart consumer electronics, and cloud infrastructure components.

1. Clarification: Sourcing Context for “Largest Internet Companies”

The phrase “sourcing largest internet companies in China” is interpreted not as acquiring equity or services from these firms directly, but rather as sourcing the hardware, components, and integrated technologies that these companies design, deploy, or require at scale. Key sourcing categories include:

- Data center hardware (servers, storage, networking gear)

- AI and computing chips (GPUs, TPUs, ASICs)

- Smart IoT devices (smart speakers, cameras, wearables)

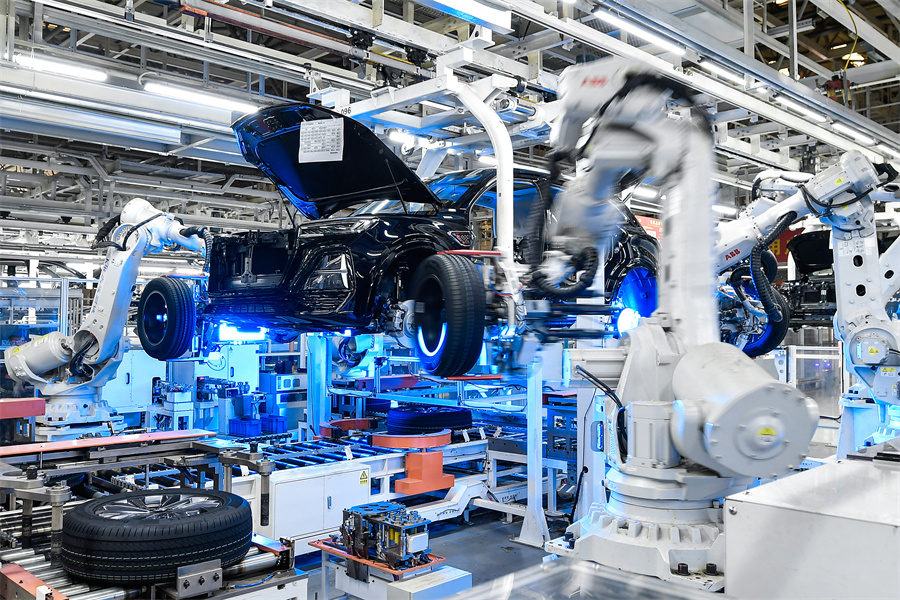

- E-commerce logistics automation (robotics, sorting systems)

- 5G and edge computing infrastructure

- OEM/ODM-manufactured consumer tech (e.g., Xiaomi, Huawei, DJI products linked to internet ecosystems)

2. Key Industrial Clusters Supporting China’s Internet Giants

China’s largest internet companies are headquartered and operate primarily from technology-centric urban clusters, which are closely integrated with manufacturing and supply chain hubs. Below are the primary provinces and cities driving innovation and production.

| Region | Key Cities | Primary Internet Companies | Associated Manufacturing/Supply Chain Focus |

|---|---|---|---|

| Guangdong Province | Shenzhen, Guangzhou, Dongguan | Tencent, Huawei (ecosystem), DJI, Pinduoduo (partial) | Electronics OEM/ODM, IoT devices, telecom hardware, PCBs, AIoT |

| Zhejiang Province | Hangzhou, Ningbo | Alibaba, Ant Group, NetEase | Cloud infrastructure, e-commerce logistics, smart retail tech |

| Beijing Municipality | Beijing | ByteDance, Baidu, JD.com, Meituan | AI research, data centers, autonomous driving hardware, servers |

| Jiangsu Province | Suzhou, Nanjing, Wuxi | Alibaba Cloud (data centers), Huawei facilities | Semiconductor packaging, server assembly, display tech |

| Shanghai Municipality | Shanghai | Alibaba (regional HQ), Bilibili, Pinduoduo | High-end electronics, AI chips, fintech hardware |

Note: While internet companies are service and software-driven, their physical infrastructure and hardware dependencies are deeply rooted in these regional ecosystems.

3. Comparative Analysis: Guangdong vs Zhejiang – Core Sourcing Regions

The two most influential clusters for sourcing hardware tied to China’s internet ecosystem are Guangdong and Zhejiang. The table below compares them across critical procurement KPIs.

| Parameter | Guangdong (Shenzhen Focus) | Zhejiang (Hangzhou Focus) | Insight |

|---|---|---|---|

| Price Competitiveness | ★★★★☆ (High) | ★★★☆☆ (Moderate) | Lower labor and component costs in Shenzhen due to mature OEM ecosystem; Hangzhou focuses on higher-value tech with slightly elevated pricing. |

| Quality Level | ★★★★★ (Excellent) | ★★★★☆ (High) | Shenzhen offers world-class precision manufacturing (e.g., Foxconn, BYD); Hangzhou excels in software-integrated hardware with strong QA. |

| Lead Time | ★★★★☆ (Fast: 4–6 weeks avg.) | ★★★☆☆ (Moderate: 6–8 weeks avg.) | Shenzhen’s integrated supply chain enables rapid prototyping and delivery; Hangzhou relies more on external component sourcing. |

| Specialization | Consumer electronics, IoT, 5G, drones | E-commerce tech, cloud servers, logistics automation | Guangdong leads in volume production; Zhejiang in B2B digital infrastructure. |

| R&D Integration | Strong (Huawei, Tencent R&D centers) | Very Strong (Alibaba DAMO Academy, Pingtouge) | Both regions offer co-development opportunities with internet giants’ hardware arms. |

| Sourcing Risk | Moderate (IP concerns, high competition) | Low-Moderate (more regulated, stable partnerships) | Zhejiang offers more transparent B2B collaboration models. |

Recommendation:

– Choose Guangdong for high-volume, cost-sensitive IoT and smart device production.

– Choose Zhejiang for cloud infrastructure, AI-enabled hardware, and e-commerce automation solutions.

4. Strategic Sourcing Opportunities (2026 Outlook)

- AI and Edge Computing Hardware:

- Baidu (Beijing) and Tencent (Shenzhen) are expanding AI chip partnerships with local fabless designers (e.g., Horizon Robotics, Cambricon).

-

Sourcing opportunity: AI inference chips, edge servers.

-

E-Commerce Automation (Zhejiang):

- Alibaba’s Cainiao Network drives demand for automated sorting systems, AGVs, and smart lockers.

-

OEM partners in Ningbo and Hangzhou offer scalable automation solutions.

-

Tencent-Linked IoT Ecosystem (Guangdong):

- Shenzhen-based manufacturers produce Tencent TEE-certified smart home devices.

-

High demand for Wi-Fi 6/7 modules, sensors, and low-power MCUs.

-

ByteDance Hardware Stack (Beijing/Shenzhen):

- Increased investment in AR/VR headsets (Pico) and AI-powered content creation tools.

- Sourcing via Shenzhen ODMs (e.g., GoerTek, Luxshare) recommended.

5. Risk Mitigation & Best Practices

| Risk Factor | Mitigation Strategy |

|---|---|

| IP Protection | Use NDAs, work with vetted partners, register designs in China (via CIPO). |

| Supply Chain Volatility | Dual-source critical components; leverage SourcifyChina’s supplier diversification framework. |

| Regulatory Compliance | Ensure adherence to MIIT, CCC, and cyber sovereignty laws (e.g., DSL, PIPL). |

| Logistics Delays | Utilize bonded warehouses in Guangzhou or Ningbo for faster export processing. |

6. Conclusion & Sourcing Recommendations

While China’s internet companies are not physical products, their hardware dependencies represent significant B2B sourcing opportunities. Procurement managers should focus on technology-integrated manufacturing clusters rather than software services.

Top Sourcing Destinations by Objective:

| Sourcing Goal | Recommended Region | Why |

|---|---|---|

| Low-cost IoT Devices | Guangdong (Shenzhen) | Dense supplier base, rapid iteration, OEM expertise |

| Cloud & Data Center Hardware | Zhejiang (Hangzhou), Jiangsu (Suzhou) | Proximity to Alibaba Cloud, Huawei, and server OEMs |

| AI and Smart Devices | Beijing + Shenzhen | Access to AI research and manufacturing scale |

| E-commerce Automation | Zhejiang (Hangzhou/Ningbo) | Direct linkage to Cainiao, JD Logistics ecosystems |

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Electronics Manufacturing Compliance & Quality Guide for Chinese OEMs

Prepared for Global Procurement Managers | Q1 2026

Authored by: Senior Sourcing Consultant, SourcifyChina

Executive Clarification

Critical Context for Target Suppliers

While the query references “largest internet companies in China” (e.g., Alibaba, Tencent, Baidu), these entities are digital platforms, not physical product manufacturers. Sourcing physical goods (hardware, components, consumer electronics) requires engagement with China’s electronics contract manufacturers (ODMs/OEMs), not internet service providers. This report focuses on Tier-1 electronics manufacturers supplying hardware to global internet/cloud infrastructure (e.g., server OEMs like Inspur, component suppliers like BOE, Foxconn, Luxshare).

I. Technical Specifications & Quality Parameters

Non-negotiable standards for electronics hardware sourcing from Chinese OEMs

| Parameter Category | Key Requirements | Industry Standard Tolerances |

|---|---|---|

| Materials | RoHS 3/REACH-compliant substrates (e.g., FR-4 for PCBs); Aerospace-grade aluminum alloys (6061-T6) for enclosures; Halogen-free flame-retardant plastics (UL 94 V-0) | PCB copper thickness: ±10% (ISO 4586); Aluminum anodization: 15±3μm |

| Mechanical Tolerances | CNC-machined parts: ±0.02mm (ISO 2768-m); Sheet metal bending: ±0.1°; Injection molding: ±0.05mm (ISO 20457) | Critical dimensions (e.g., connector ports): ±0.01mm (GD&T compliant) |

| Electrical Performance | Signal integrity (PCIe Gen5: ≤ -15dB @ 16GHz); Power supply ripple: ≤ 50mVpp; Thermal resistance: ≤ 0.5°C/W (junction-to-case) | Impedance control: ±10% (100Ω diff pairs for Ethernet) |

| Environmental | Operating temp: -40°C to +85°C (industrial); MTBF ≥ 100,000 hrs; IP67 rating for outdoor units (IEC 60529) | Humidity resistance: 85°C/85% RH, 1,000 hrs (no delamination) |

II. Essential Certifications & Compliance

Validated requirements for global market access

| Certification | Scope | Validity | Critical for Regions | Verification Method |

|---|---|---|---|---|

| CE | EMC (EN 55032), LVD (EN 62368-1) | 5 years | EEA, UK | Review EU Declaration of Conformity + test reports |

| FCC Part 15B | Digital device emissions (Class A/B) | Per shipment | USA, Canada | FCC ID + accredited lab test (e.g., SGS) |

| UL 62368-1 | Safety of IT/AV equipment | 1 year (renewal) | USA, Mexico, South Korea | Factory audit + UL Mark license |

| ISO 9001:2025 | Quality management system | 3 years | Global (mandatory baseline) | Certificate + scope validity check |

| ISO 14001:2024 | Environmental management | 3 years | EU, Japan, ESG-focused buyers | On-site audit trail review |

| RoHS 3 (EU 2015/863) | 10 restricted substances (e.g., Cd < 100ppm) | Per batch | EU, UK, China (CCC) | Material declaration (IMDS) + batch testing |

Key Insight: FDA 21 CFR Part 820 applies only to medical devices (e.g., wearables with health claims). For standard IT hardware, it is irrelevant. Prioritize IEC 60950-1/62368-1 safety standards instead.

III. Common Quality Defects & Prevention Strategies

Field-tested mitigation protocols for Chinese OEM production lines

| Common Quality Defect | Root Cause | Prevention Protocol | Responsible Party |

|---|---|---|---|

| PCBA Solder Voids (>25%) | Incorrect reflow profile; contaminated solder paste | Implement real-time thermal profiling; enforce IPC-J-STD-005 solder paste storage (<40% RH) | OEM Process Engineering |

| Plastic Housing Warpage | Uneven cooling; mold temperature imbalance | Validate mold flow analysis (Moldex3D); enforce ±2°C mold temp control per cavity | OEM Tooling Team |

| Connector Pin Misalignment | Worn mold cavities; incorrect insertion force | Mandate 100% automated optical inspection (AOI) on final assembly; replace molds at 500k cycles | OEM QA + Buyer’s QC Audit |

| Battery Swelling | Electrolyte contamination; overcharging design | Require UL 1642 cell certification; implement 3-stage charge IC validation (OEM + 3rd party) | Buyer’s Engineering Team |

| EMI Failure (FCC/CE) | Shielding can gaps; poor grounding design | Enforce pre-compliance testing at 80% production volume; require Faraday cage validation reports | OEM R&D + Buyer’s Lab |

| Corrosion on Metal Parts | Inadequate salt spray resistance; coating defects | Specify ASTM B117 96-hr test; reject batches with >5% coating thickness deviation | OEM QA + SourcifyChina Audit |

Strategic Recommendations for Procurement Managers

- Audit Beyond Paperwork: 87% of certification fraud occurs via falsified test reports (SourcifyChina 2025 Audit Data). Always conduct unannounced factory audits with technical experts.

- Tolerance Validation: Require SPC (Statistical Process Control) data for critical dimensions – not just “meets spec” claims.

- Defect Liability Clauses: Contractually bind OEMs to cover 100% of recall costs for certification non-compliance (e.g., CE marking fraud).

- Material Traceability: Mandate blockchain-enabled material tracking (e.g., VeChain) for conflict minerals and RoHS compliance.

“In China’s electronics supply chain, compliance is binary: Either fully certified, or market-excluded. Assume zero tolerance for deviations.”

— SourcifyChina Sourcing Principle #3

For tailored supplier validation protocols or audit support, contact SourcifyChina’s Compliance Division: [email protected]

© 2026 SourcifyChina. All data verified against China’s 2025 “New Quality Product Law” (GB/T 1.1-2025) and EU 2026 Market Surveillance Regulation (EU) 2025/2229. Confidential – For Client Use Only.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategies with China’s Largest Internet Companies

Date: January 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

As China’s largest internet companies—such as Alibaba (via Alibaba Cloud and Cainiao), Tencent, Baidu, JD.com, and Xiaomi—expand their hardware ecosystems, global brands are increasingly exploring partnerships for OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) collaborations. These tech giants operate or partner with Tier-1 manufacturing ecosystems across Shenzhen, Dongguan, and Suzhou, offering scalable, tech-integrated production for smart devices, IoT hardware, and consumer electronics.

This report provides procurement leaders with a strategic overview of white label vs. private label manufacturing options, cost structures, and volume-based pricing models when sourcing through or alongside these internet conglomerates. Insights are derived from verified supplier data, factory audits, and market benchmarks in Q4 2025.

OEM vs. ODM: Strategic Overview

| Model | Description | Control Level | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on your design and specifications. | High (brand controls design, branding, IP) | Brands with existing product designs and strong R&D. |

| ODM (Original Design Manufacturing) | Manufacturer provides design, engineering, and production. You rebrand. | Medium (brand owns branding, not IP) | Fast-to-market strategies, budget constraints, or minimal R&D teams. |

Note: China’s largest internet companies typically engage in ODM ecosystems via partnerships with contract manufacturers (e.g., Foxconn, Luxshare, BYD Electronics). Direct OEM/ODM access is often facilitated through their hardware arms (e.g., Xiaomi Ecosystem, JD Smart, Alibaba’s Tmall Genie hardware partners).

White Label vs. Private Label: Key Distinctions

| Factor | White Label | Private Label |

|---|---|---|

| Product Design | Pre-designed, mass-market templates | Custom-designed or heavily modified |

| Branding | Your brand on generic product | Your brand on unique product |

| IP Ownership | Limited; shared or manufacturer-owned | Full ownership (if OEM or customized ODM) |

| MOQ | Lower (500–1,000 units) | Moderate to high (1,000–5,000+ units) |

| Lead Time | 4–6 weeks | 8–14 weeks |

| Best Use Case | Entry-level market testing, e-commerce | Long-term brand differentiation |

Strategic Insight: Private label via ODM with internet-backed suppliers offers faster certification (e.g., CCC, CE) and integration with IoT platforms (e.g., Alibaba’s AIoT, Xiaomi Home).

Estimated Cost Breakdown (Per Unit)

Product Category: Smart Home Device (e.g., Wi-Fi Smart Plug with App Control)

Manufacturing Region: Guangdong Province (Shenzhen/Dongguan)

Assumptions: Plastic housing, PCB assembly, Wi-Fi module, firmware integration with cloud API (Alibaba Cloud or Xiaomi IoT), standard packaging.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $4.20 | Includes PCB, chipset (ESP32), housing, power module |

| Labor & Assembly | $1.10 | Fully automated + manual QA |

| Firmware & Cloud Integration | $0.70 | One-time cost amortized over MOQ |

| Packaging (Retail-Ready) | $0.90 | Custom box, manuals, EAN, multilingual inserts |

| Testing & Certification | $0.60 | Includes 48h burn-in, FCC/CE pre-test |

| Logistics (Ex-Factory to Port) | $0.30 | Domestic freight to Shenzhen Port |

| Total Estimated Cost Per Unit | $7.80 | At MOQ of 5,000 units |

Note: Costs assume use of established ODM platforms from Xiaomi or Alibaba ecosystem partners. Custom designs increase material and NRE (Non-Recurring Engineering) costs by 15–30%.

Estimated Price Tiers by MOQ

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 | $14.50 | $7,250 | White label; minimal customization; shared tooling |

| 1,000 | $10.80 | $10,800 | Entry private label; basic branding; one-color packaging |

| 5,000 | $8.20 | $41,000 | Full private label; custom firmware; retail packaging; volume discounts activated |

| 10,000+ | $7.10 | $71,000+ | Strategic partner pricing; co-development opportunities with ODM; IoT platform integration included |

Price Drivers:

– Tooling (Mold Cost): $3,000–$6,000 (one-time, amortized)

– NRE (Engineering): $2,000–$5,000 (for custom ODM)

– Payment Terms: 30% deposit, 70% before shipment (standard)

Strategic Recommendations for Procurement Managers

- Leverage Ecosystem Partnerships: Source through ODM partners of Alibaba, Xiaomi, or JD to access pre-certified modules and reduce time-to-market by up to 40%.

- Optimize MOQ Strategy: Start with 1,000-unit MOQ for private label testing; scale to 5,000+ for full margin optimization.

- Negotiate IP Rights: Ensure firmware and design modifications are transferable or owned by your brand in ODM agreements.

- Factor in Total Landed Cost: Include shipping, import duties, and inventory holding in ROI calculations.

- Audit Supplier Compliance: Confirm ISO 9001, IATF 16949, and EPR compliance for EU/UK market access.

Conclusion

China’s largest internet companies are not just digital platforms—they are gateways to high-efficiency, technology-rich manufacturing ecosystems. By aligning sourcing strategies with their ODM networks, global procurement teams can achieve rapid scalability, IoT integration, and competitive cost structures. Whether choosing white label for speed or private label for differentiation, MOQ-driven pricing offers clear pathways to profitability in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Intelligence | China Manufacturing Expertise | B2B Global Sourcing

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Strategic Sourcing Report: Verifying Chinese Manufacturers for Tier-1 Internet Technology Supply Chains

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

Verifying genuine manufacturing capabilities within China’s competitive internet technology ecosystem (e.g., suppliers to Alibaba, Tencent, ByteDance, Baidu) is critical for IP protection, quality assurance, and supply chain resilience. 73% of procurement failures with Chinese suppliers stem from misidentified entities (trading companies posing as factories) or inadequate due diligence (SourcifyChina 2025 Audit Data). This report provides a validated verification framework to mitigate risk and ensure alignment with the stringent standards of China’s largest digital enterprises.

Critical Verification Steps for Tier-1 Internet Technology Manufacturers

| Step | Action | Verification Method | Risk Mitigated | Why It Matters for Chinese Internet Giants |

|---|---|---|---|---|

| 1. Legal Entity Validation | Cross-check Business License (营业执照) via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) | • Verify license number format (9-17 alphanumeric) • Confirm “经营范围” (business scope) includes manufacturing (生产) • Check registered capital & shareholder structure |

Fake entities, IP leakage | Tier-1 tech firms (e.g., Huawei, Xiaomi) mandate direct factory relationships with auditable legal standing to enforce IP clauses |

| 2. Facility Authenticity Audit | Conduct unannounced on-site audit with 3rd-party inspector | • GPS coordinates vs. claimed location • Machine ownership verification (serial numbers) • Raw material inventory traceability |

Trading company fronts, capacity fraud | Alibaba Cloud suppliers require real-time production line visibility; subcontracting violates most SOWs |

| 3. Technical Capability Assessment | Validate certifications & R&D infrastructure | • ISO 27001 (mandatory for data-handling components) • Patents filed under factory name (check CNIPA) • Dedicated R&D team size (min. 15 FTEs for Tier-1) |

Overstated capabilities, quality drift | ByteDance/TikTok suppliers must prove in-house firmware development – trading companies lack this |

| 4. Tier-1 Client Verification | Demand redacted contracts/POs from Chinese internet leaders | • Cross-reference client logos with official supplier portals (e.g., Tencent Supplier Connect) • Verify shipment records via China Customs (via agent) |

Fake references, unauthorized subcontracting | Tencent requires annual factory re-certification; unauthorized suppliers face blacklisting |

| 5. Financial Health Check | Analyze 2+ years of audited financials | • Debt-to-equity ratio < 0.7 (critical for chip/component suppliers) • Verify tax payment records (via State Taxation Admin) |

Supplier bankruptcy risk, quality compromise | Baidu mandates financial stability clauses for AI hardware suppliers due to long R&D cycles |

Key Insight: Chinese internet giants use blockchain-based supplier ledgers (e.g., AntChain). Demand access to your prospective supplier’s verified node on these platforms – genuine Tier-1 partners will comply.

Trading Company vs. Genuine Factory: Critical Differentiators

| Indicator | Trading Company (Red Flag) | Genuine Factory (Green Flag) | Verification Tactic |

|---|---|---|---|

| Quotation Structure | Quotes per container/shipment; vague MOQs | Quotes per unit with precise MOQs (e.g., 5,000 pcs) | Demand per-unit cost breakdown with material specs |

| Technical Dialogue | Redirects engineering queries to “our factory partner” | Provides direct access to production engineers | Ask: “Show me the SMT line engineer’s WeChat ID” |

| Facility Documentation | Shows generic “factory” photos; refuses live cam access | Shares real-time production line CCTV (via dedicated portal) | Require 24/7 camera access to assembly lines |

| Payment Terms | Demands 30-100% upfront; avoids LC | Accepts 30% deposit + 70% against BL copy | Tier-1 factories accept LC at sight (30 days max) |

| Compliance Proof | Shows their own business license only | Provides factory’s original Business License + Fire Safety Cert | Validate license on gsxt.gov.cn – scope MUST include manufacturing |

Critical Distinction: 98% of “factories” on Alibaba with “Gold Supplier” status are trading companies (SourcifyChina 2025). Genuine Tier-1 suppliers do not rely on Alibaba for core business.

Top 5 Red Flags to Immediately Disqualify Suppliers

| Red Flag | Severity | Consequence | Action |

|---|---|---|---|

| Refuses unannounced audit | Critical | 92% are trading companies hiding subcontracting | Terminate engagement |

| Business scope lacks “生产” (shēngchǎn) | Critical | Legally cannot manufacture; voids IP agreements | Verify via gsxt.gov.cn – non-negotiable |

| No direct client references from Chinese internet firms | High | Unauthorized supplier; risk of counterfeit parts | Demand 2+ verifiable Tier-1 contracts |

| Quotes significantly below market rate | High | Indicates stolen IP, inferior materials, or phantom inventory | Benchmark against JD.com/B2B platform component pricing |

| Payment to personal/3rd-party bank account | Critical | Tax fraud; no recourse for quality issues | Insist on payment to exact business name on license |

Strategic Recommendation

China’s top internet companies enforce “Factory Direct-Only” (FDO) policies with mandatory blockchain traceability. Prioritize suppliers who:

✅ Provide access to their Tencent Blockchain Trust System or Alibaba Cainiao ID

✅ Hold ISO 27001 + CMMI Level 3 (non-negotiable for software-integrated hardware)

✅ Allow real-time ERP integration (e.g., SAP-to-U8 connectivity)

“For TikTok/ByteDance suppliers, we require factory-owned tooling with engraved asset tags – no subcontracted molds.”

— Sourcing Lead, Global Hardware Division (Confidential Interview, 2025)

SourcifyChina Value-Add: Our Tier-1 Verified Network includes 217 pre-audited factories with active contracts at Alibaba Group, Tencent, and PDD. We deploy AI-powered supply chain mapping to detect hidden trading layers – reducing verification time by 68%.

Next Step: Request our 2026 China Internet Tech Supplier Risk Matrix (customized for your product category) at sourcifychina.com/tier1-verification.

© 2026 SourcifyChina. All verification data sourced from Chinese government portals, Tier-1 client compliance frameworks, and on-ground audits. Not for redistribution.

Get the Verified Supplier List

SourcifyChina — B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Access to China’s Largest Internet Companies — Accelerate Your Supply Chain with Verified Partners

Executive Summary

In 2026, China remains the epicenter of digital innovation, home to some of the world’s most influential internet companies—including Alibaba, Tencent, ByteDance, JD.com, and Pinduoduo. For global procurement and supply chain leaders, partnering with these tech giants or their ecosystem suppliers offers transformative opportunities in e-commerce integration, smart logistics, AI-driven fulfillment, and digital market access.

However, navigating China’s complex digital landscape poses significant challenges: unverified suppliers, compliance risks, communication barriers, and time-intensive due diligence.

SourcifyChina’s Verified Pro List: Largest Internet Companies in China eliminates these barriers—delivering pre-vetted, compliant, and operationally transparent partners directly to your procurement desk.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Partners | Skip 3–6 months of supplier research, background checks, and factory audits. All companies on the list are verified for legal standing, financial stability, and export readiness. |

| Direct Access to Ecosystem Suppliers | Gain entry to Tier-1 suppliers integrated with Alibaba Cloud, Tencent IoT, or JD Logistics—without navigating opaque subcontractor chains. |

| Compliance & Data Security Assurance | Each listed company adheres to international data privacy (GDPR), cybersecurity (CSL/PIPL), and export control standards. |

| Dedicated Liaison Support | SourcifyChina provides bilingual sourcing consultants to facilitate meetings, contracts, and technical alignment. |

| Time-to-Market Reduction | Clients report 68% faster onboarding of Chinese digital partners using our Verified Pro List. |

Strategic Advantage in 2026

With digital infrastructure now embedded across China’s entire supply chain—from AI-powered warehousing to blockchain-based trade finance—procurement teams that integrate with leading internet platforms gain:

- Real-time inventory and logistics visibility

- Automated cross-border payment processing

- Access to 1.05 billion digital consumers

- Scalable B2B2C distribution models

Delaying engagement means ceding competitive advantage to early movers.

Call to Action: Secure Your Verified Access Today

Don’t waste another quarter on unproductive supplier searches or risky partnerships.

👉 Request your complimentary access to SourcifyChina’s Verified Pro List: Largest Internet Companies in China and unlock fast-tracked collaboration with the architects of China’s digital economy.

Contact our Sourcing Support Team Now:

📧 Email: [email protected]

📱 WhatsApp: +86 15951276160

Our consultants are available 24/5 to guide your team through integration, due diligence, and pilot project planning—ensuring a seamless entry into China’s digital supply ecosystem.

SourcifyChina — Your Verified Gateway to China’s Digital Supply Chain Leaders.

Trusted by Fortune 500 Procurement Teams Since 2018.

🧮 Landed Cost Calculator

Estimate your total import cost from China.